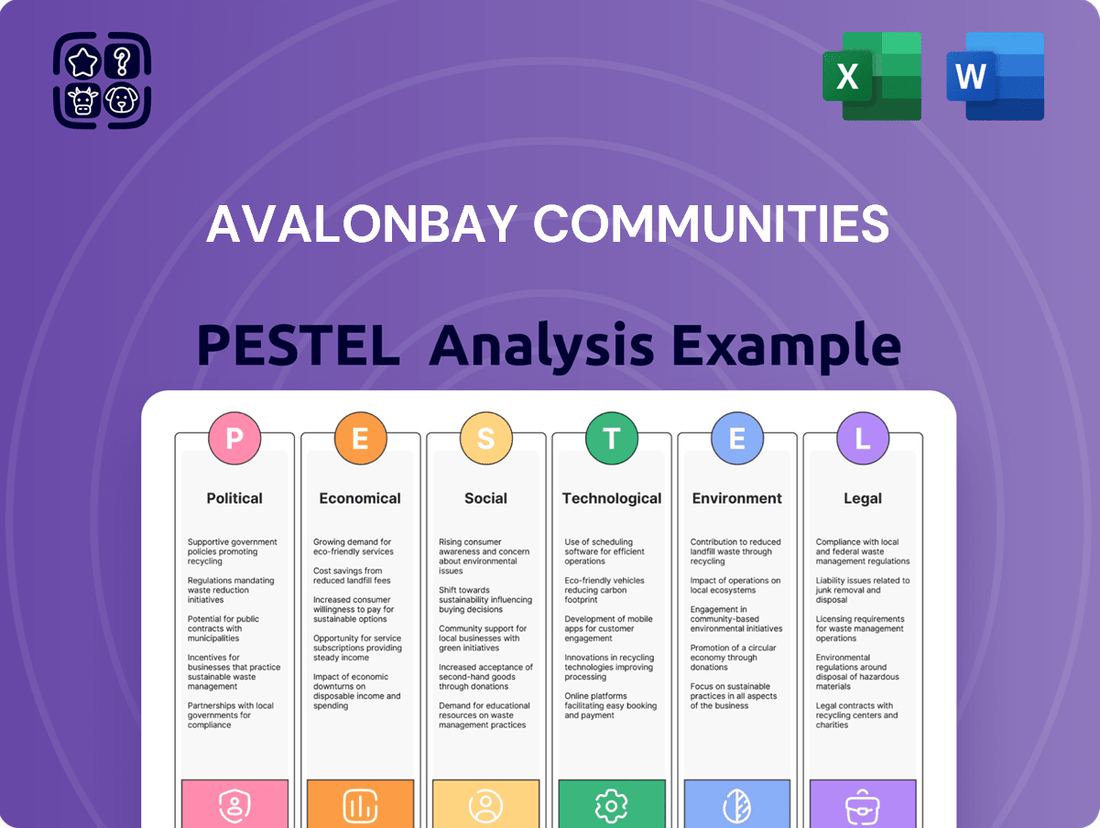

AvalonBay Communities PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AvalonBay Communities Bundle

Unlock the forces shaping AvalonBay Communities's future with our comprehensive PESTLE analysis. Understand how political stability, economic shifts, and evolving social trends are impacting their operations and strategic decisions. Gain a competitive edge by leveraging these critical insights to inform your own market approach. Download the full PESTLE analysis now for actionable intelligence.

Political factors

Government policies, especially at the state and local levels, profoundly shape the multifamily real estate sector. These can range from incentives for affordable housing projects, such as tax credits, to zoning regulations that might limit density or impose specific design requirements, directly impacting supply and development costs. For instance, in 2024, many states are exploring or implementing new tenant protection laws, which could affect rental income and operational expenses for companies like AvalonBay.

AvalonBay actively navigates these complex regulatory environments, which dictate the feasibility and parameters of their development and property management activities. Changes in local zoning ordinances, for example, can either open new opportunities for expansion or create significant hurdles, influencing where and how the company can invest capital. The ongoing debate around rent control in various urban centers in 2024-2025 presents a key policy area to monitor for its potential impact on AvalonBay's revenue streams and investment strategies.

The increasing adoption of rent control and rent stabilization policies in key urban centers directly impacts the revenue potential for real estate investment trusts (REITs) like AvalonBay. Cities such as New York, Los Angeles, and San Francisco already have such regulations in place, and the trend is expanding, potentially limiting annual rent increases to a mere 2-5% in some areas, which can significantly affect a REIT's ability to grow rental income and influence property valuations.

Taxation is a critical political factor for AvalonBay Communities. For instance, changes in corporate tax rates directly impact net income. In 2024, the U.S. federal corporate tax rate remains at 21%, but discussions around potential adjustments could influence future profitability. State and local tax policies also vary significantly, affecting operational costs across AvalonBay's diverse portfolio.

As a Real Estate Investment Trust (REIT), AvalonBay is subject to specific regulations. A key requirement is distributing at least 90% of its taxable income to shareholders annually as dividends. Failure to meet this can result in the loss of REIT status and corporate taxation. In 2023, AvalonBay reported a total dividend payout of approximately $1.7 billion, demonstrating adherence to this rule and its impact on cash flow management.

Political Stability and Local Governance

Political stability is a bedrock for real estate development, and AvalonBay Communities, operating across numerous metropolitan areas, is highly sensitive to this. Changes in local governance priorities can significantly alter the landscape for new construction and property management. For instance, a city council's shift towards prioritizing affordable housing mandates could impact AvalonBay's development pipeline and operational flexibility.

Local governments set the rules for planning, permitting, and land use, all of which are critical for AvalonBay's ability to build and manage its apartment communities. A change in administration or a new policy agenda can introduce delays or even halt projects. For example, in 2024, several major U.S. cities saw debates around zoning reform and development impact fees, which could affect the cost and speed of new multifamily construction.

The effectiveness and efficiency of local government agencies in processing permits and approvals are also key. Areas with streamlined processes can offer a competitive advantage. Conversely, bureaucratic hurdles or shifts in regulatory enforcement can add significant costs and uncertainty. AvalonBay's success hinges on navigating these local political dynamics effectively.

Consider these impacts:

- Regulatory Changes: Shifts in zoning laws or building codes, driven by local political priorities, can directly affect project feasibility and costs.

- Permitting Timelines: The speed and predictability of local government approval processes are crucial for development schedules.

- Community Relations: Local political leadership often influences public perception and engagement with development projects.

Infrastructure Investment

Government investment in infrastructure, such as public transportation and utilities, directly impacts the desirability and value of AvalonBay Communities' apartment properties. For instance, the U.S. government's Infrastructure Investment and Jobs Act, enacted in 2021, allocates significant funds toward improving roads, bridges, and public transit systems nationwide. This can enhance accessibility to AvalonBay's urban and suburban locations.

Improved infrastructure, like expanded public transit networks, makes AvalonBay's properties more attractive to renters by offering greater connectivity and reducing commute times. This supports favorable demographic trends, such as increased urbanization and a growing demand for rental housing in accessible areas, which aligns with AvalonBay's strategic focus on densely populated, transit-oriented markets.

The Infrastructure Investment and Jobs Act, with its substantial funding for transportation projects, is expected to boost economic activity and job growth in key metropolitan areas where AvalonBay operates. For example, projects funded by the act in 2024 and projected for 2025 are likely to create employment opportunities, drawing more residents to these regions and increasing demand for rental units.

These infrastructure upgrades can lead to enhanced livability in AvalonBay's target markets by improving access to amenities, employment centers, and recreational facilities. This, in turn, supports AvalonBay's ability to attract and retain residents, potentially leading to higher occupancy rates and rental growth.

Government policies, particularly at the state and local levels, significantly influence the multifamily real estate sector, impacting everything from development costs to rental income. Zoning regulations, tenant protection laws, and potential rent control measures are key political factors AvalonBay must navigate. For instance, in 2024, many cities are considering or enacting new tenant protection laws, which could affect operational expenses and revenue for REITs like AvalonBay.

Taxation policies, both federal and state, directly affect AvalonBay's profitability, with the U.S. federal corporate tax rate at 21% in 2024. As a REIT, AvalonBay is mandated to distribute at least 90% of its taxable income as dividends, a requirement that impacts cash flow management and was demonstrated by its approximately $1.7 billion dividend payout in 2023.

Political stability and the efficiency of local government agencies are crucial for AvalonBay's development and operational success. Changes in local governance priorities, permitting processes, and land-use regulations can create opportunities or significant hurdles, influencing project timelines and costs. Debates around zoning reform and development impact fees in major U.S. cities during 2024 highlight these ongoing challenges.

What is included in the product

This PESTLE analysis of AvalonBay Communities examines how political, economic, social, technological, environmental, and legal factors create both challenges and advantages for the company's operations and strategic planning.

It provides actionable insights into the external forces shaping the multifamily real estate sector, enabling informed decision-making for stakeholders.

A concise PESTLE analysis of AvalonBay Communities provides a clear overview of external factors, serving as a pain point reliever by enabling proactive strategy development and mitigating potential market disruptions.

Economic factors

The current interest rate environment presents a significant challenge for AvalonBay Communities. Elevated and volatile rates directly impact property valuations, often pushing them down, while simultaneously increasing the cost of borrowing for companies like AvalonBay. This makes new projects and acquisitions more expensive.

While market expectations in mid-2024 suggest potential rate cuts, the prevailing sentiment of a 'higher-for-longer' rate scenario continues to shape the cost of capital. This directly affects AvalonBay's ability to finance new developments and pursue strategic acquisitions, ultimately influencing overall investment activity and the company's profitability margins.

Persistent inflation significantly affects AvalonBay's operating expenses, with noticeable increases in maintenance, utilities, and labor costs. For instance, the Consumer Price Index (CPI) for All Urban Consumers saw a 3.4% increase year-over-year as of April 2024, impacting these essential services.

While inflation has shown some moderation, its lingering effects on construction costs remain a concern. Tariffs and ongoing supply chain disruptions continue to drive up the price of materials, thereby increasing the total capital expenditure for new development projects.

Effectively managing these escalating operating and construction costs is paramount for AvalonBay to sustain and grow its net operating income, ensuring profitability in the current economic climate.

The multifamily housing sector is navigating a period of significant new construction, with a pronounced surge expected in late 2024 and early 2025. This influx of new units is contributing to higher vacancy rates and moderating rent growth across various markets. For instance, reports indicate that new apartment deliveries in 2024 are projected to be the highest in decades in many major U.S. cities.

Despite the supply-side pressures, demand for rental housing remains robust. Key drivers include sustained job creation, the persistent high cost of homeownership, and favorable demographic shifts, such as the large Millennial generation entering prime renting years. This underlying demand is crucial for absorbing the new supply.

Looking ahead, the outlook suggests a potential upturn in rent growth acceleration by 2026. As the pace of new construction is anticipated to slow down significantly after the 2025 peak, the strong demand fundamentals are expected to gain more traction, leading to tighter market conditions and upward pressure on rents.

Employment Growth and Economic Strength

Robust employment growth remains a significant tailwind for AvalonBay Communities, directly fueling demand for its multifamily properties. As of May 2024, the U.S. economy added 272,000 jobs, showcasing continued economic vitality. This job creation is crucial for household formation and ensures renters have the financial capacity to meet rental obligations, supporting AvalonBay's portfolio performance in its key markets.

The resilience of the economy, even with signs of a slowdown, underpins the stability of rental income. For instance, the U.S. unemployment rate hovered around 4.0% in early to mid-2024, a historically low figure that indicates a strong labor market. This environment is particularly beneficial for AvalonBay, as it operates in high-demand metropolitan areas where job growth directly translates to increased demand for housing.

- Job Growth: U.S. nonfarm payrolls increased by 272,000 in May 2024, demonstrating ongoing labor market strength.

- Unemployment Rate: The unemployment rate remained at 4.0% in May 2024, reflecting a tight labor market.

- Wage Growth: Average hourly earnings saw a 0.4% increase in May 2024, contributing to renters' purchasing power.

- Impact on Demand: Continued job creation and wage increases directly support demand for multifamily housing and rent affordability.

Property Valuation and Capitalization Rates

Property prices have experienced a downturn, though the pace of this decline has slowed. Concurrently, capitalization rates, a key metric in real estate investment, have stabilized. For instance, in early 2024, the average cap rate for multifamily properties in major U.S. markets hovered around 5.5% to 6.5%, a slight increase from previous years, reflecting higher borrowing costs.

A projected decrease in interest rates during 2025 could lead to a compression of cap rates, signaling an upward trend in property values. This potential shift would directly influence AvalonBay Communities' approach to asset appreciation and its strategies for selling properties, potentially enhancing investor returns.

- Property Price Trends: Moderating declines observed in early 2024.

- Cap Rate Stabilization: Flattening observed, with multifamily rates around 5.5%-6.5% in early 2024.

- 2025 Outlook: Potential cap rate fall due to declining interest rates could boost property values.

- Impact on AvalonBay: Enhanced asset appreciation and improved disposition opportunities are anticipated.

The economic landscape for AvalonBay Communities is shaped by a dual force of persistent, though moderating, inflation and a dynamic interest rate environment. While inflation continues to elevate operating costs, particularly for maintenance and utilities, the anticipated trajectory of interest rates in 2025 holds the potential to influence property valuations and financing costs.

The multifamily sector is experiencing a significant supply wave, with deliveries peaking in late 2024 and early 2025, leading to increased vacancy and tempered rent growth in many markets. However, underlying demand remains strong, driven by job creation and the high cost of homeownership, which should help absorb this new supply and support rent growth by 2026.

Robust job growth, evidenced by a 272,000 increase in nonfarm payrolls in May 2024, coupled with a low unemployment rate of 4.0% in the same month, directly fuels demand for AvalonBay's properties. This economic vitality ensures renters have the financial capacity to meet obligations, bolstering the company's portfolio performance.

Property prices have seen moderating declines, and capitalization rates have stabilized around 5.5%-6.5% for multifamily assets in early 2024. A projected decrease in interest rates in 2025 could compress these cap rates, potentially boosting property values and improving AvalonBay's asset appreciation and disposition strategies.

| Economic Factor | Data Point | Impact on AvalonBay |

|---|---|---|

| Inflation (CPI YoY) | 3.4% (April 2024) | Increased operating expenses (maintenance, utilities) |

| Interest Rate Outlook | Potential cuts in 2025; 'higher-for-longer' sentiment | Affects borrowing costs and property valuations |

| Job Growth (May 2024) | +272,000 nonfarm payrolls | Boosts demand for multifamily housing |

| Unemployment Rate (May 2024) | 4.0% | Indicates strong labor market and renter affordability |

| Multifamily Deliveries | Peak late 2024/early 2025 | Increased vacancy and moderating rent growth |

| Cap Rates (Early 2024) | 5.5%-6.5% (multifamily average) | Stabilized, potential compression with rate cuts |

What You See Is What You Get

AvalonBay Communities PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of AvalonBay Communities delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting their operations. Understand the external forces shaping AvalonBay's strategic landscape.

Sociological factors

AvalonBay Communities is well-positioned due to ongoing population growth in major US metro areas, a key driver for rental housing demand. The company benefits from the persistent trend of urbanization, with a substantial portion of Americans choosing to live in cities, directly supporting the need for apartment living in AvalonBay's core markets.

The ongoing high cost of homeownership, with the median existing-home sales price reaching $420,600 in April 2024 according to the National Association of Realtors, makes renting a practical necessity for many. This, coupled with a persistent shortage of single-family homes, particularly in desirable urban areas, solidifies renting as a preferred lifestyle choice, especially for younger demographics and those prioritizing flexibility in their living arrangements.

AvalonBay's strategic emphasis on developing and managing high-quality apartment communities directly addresses these evolving lifestyle preferences. Their properties cater to urban dwellers who increasingly value convenience, modern amenities like fitness centers and co-working spaces, and a sense of community, aligning with a desire for hassle-free, amenity-rich living environments.

AvalonBay's commitment to community engagement is evident in its significant contributions to charitable organizations, with associates demonstrating high volunteerism rates. In 2023, the company reported over 15,000 volunteer hours contributed by its employees, highlighting a strong dedication to social impact beyond its core business operations.

These initiatives, including programs that facilitate housing for teachers and educate residents on crucial topics like disaster preparedness, directly enhance AvalonBay's public image and cultivate deeper connections within the communities it serves. This focus on social responsibility not only bolsters brand reputation but also acts as a key differentiator in attracting and retaining residents who value corporate citizenship.

Resident Experience Expectations

Resident expectations are rapidly evolving, with a growing emphasis on convenience, personalized services, and vibrant community engagement. AvalonBay Communities must stay ahead of these trends to maintain its competitive edge in the multifamily sector. For instance, a 2024 survey indicated that 70% of renters prioritize smart home technology and seamless digital access to property management services.

Meeting these demands requires continuous adaptation of AvalonBay's offerings. This includes not only providing modern amenities like co-working spaces and fitness centers but also ensuring responsive property management and actively fostering a sense of community. In 2025, resident retention rates are strongly correlated with the availability of community events and social programming, with properties offering such activities seeing a 15% higher retention compared to those that do not.

- Increased demand for flexible living spaces and on-site amenities.

- Emphasis on digital convenience, from leasing to maintenance requests.

- Desire for community building and social interaction within developments.

- Expectation of sustainability features and environmentally conscious operations.

Work-from-Home Trends

The persistent adoption of work-from-home and hybrid models significantly reshapes demand for apartment living. Residents increasingly seek dedicated home office spaces, flexible layouts, and robust internet infrastructure, impacting the desirability of certain apartment types and community amenities. This sociological shift, observed widely across the rental market, suggests a growing preference for locations offering a balance of accessibility and residential comfort, potentially guiding AvalonBay's future development and renovation decisions to cater to these evolving resident needs.

Data from the U.S. Census Bureau indicates that in 2023, approximately 22% of all workers worked from home all or most of the time, a substantial increase from pre-pandemic levels. This sustained trend means that apartment communities offering features like co-working spaces, quiet common areas, or larger floor plans with den options are likely to see higher demand. For instance, a 2024 survey by Apartment List found that 60% of renters prioritize having a dedicated space for working from home when choosing an apartment.

- Increased Demand for Home Office Space: Renters are actively seeking apartments with at least a small dedicated area for work, influencing the value placed on floor plans with dens or extra rooms.

- Amenity Prioritization Shift: Community amenities like reliable high-speed internet, convenient package rooms, and quiet communal workspaces are becoming more critical than traditional fitness centers for some demographics.

- Location Preferences Evolving: While urban centers remain attractive, there's a growing interest in suburban or mixed-use developments that offer a better work-life balance and easier access to both work and leisure activities.

The demographic shift towards smaller households and an aging population influences rental demand. As of 2023, the average household size in the US was 2.51 people, a slight decrease from previous years, indicating a greater need for one and two-bedroom units. AvalonBay's focus on urban infill development aligns with this trend, catering to individuals and couples seeking convenient city living.

Societal values are also evolving, with a growing emphasis on experiences over possessions and a desire for community connection. AvalonBay's investment in shared spaces like lounges and outdoor areas fosters this sense of community, a factor valued by a significant portion of renters. A 2024 survey revealed that 55% of renters consider community amenities important when selecting an apartment.

The increasing acceptance of renting as a long-term lifestyle choice, rather than a temporary solution, is a key sociological driver. This is particularly true for millennials and Gen Z, who prioritize flexibility and are less focused on homeownership than previous generations. In 2025, it's projected that over 40% of households under 35 will be renters.

Technological factors

The real estate industry is rapidly adopting proptech, with AI, IoT, and big data analytics at the forefront of this digital shift. For AvalonBay Communities, this integration offers significant opportunities to boost efficiency and tenant satisfaction. For instance, AI-powered tools can automate leasing processes, potentially reducing vacancy periods.

Predictive maintenance, enabled by IoT sensors, can proactively address issues before they impact residents, minimizing costly repairs and enhancing living experiences. This technological wave is reshaping how properties are managed, moving towards more data-driven and responsive operations.

AI and machine learning are revolutionizing real estate operations, offering advanced tools for property valuations, predictive maintenance, and dynamic rent pricing. These technologies are integrated into software platforms, providing AvalonBay with data-driven insights to optimize performance.

AI-powered leasing agents are emerging as a significant technological factor, capable of handling inquiries and scheduling tours around the clock. This 24/7 availability can enhance customer service and potentially boost lead-to-lease conversion rates for AvalonBay, streamlining the leasing process.

Smart building technologies are transforming multifamily living, with features like automated climate control and enhanced security systems becoming increasingly expected by residents. This trend is directly impacting how companies like AvalonBay Communities operate and attract tenants. For instance, the global smart building market was valued at approximately $80.5 billion in 2023 and is projected to reach over $200 billion by 2030, indicating a significant shift towards these integrated solutions.

Integrating these advanced systems offers AvalonBay a competitive edge. By improving energy management, they can expect to see a reduction in utility costs, a crucial factor in operational efficiency. Furthermore, enhanced security features contribute to resident satisfaction and can lead to higher retention rates, a key metric for profitability in the real estate sector.

Data Analytics for Strategic Decision-Making

Big data analytics is revolutionizing how multifamily owners like AvalonBay make decisions. Real-time insights into property performance and portfolio analytics are now readily available, leading to more informed strategies. For instance, AvalonBay can leverage these tools to implement dynamic pricing models. This allows them to adjust rental rates swiftly based on current market trends and tenant demand, ultimately boosting occupancy and revenue.

The application of data analytics extends to optimizing operational efficiency and tenant experience. By analyzing vast datasets, AvalonBay can identify patterns in maintenance requests, lease renewals, and resident feedback. This allows for proactive resource allocation and tailored service delivery, enhancing resident satisfaction and retention.

- Dynamic Pricing: In 2024, the multifamily sector saw significant shifts in rental pricing, with data-driven strategies proving crucial for maintaining high occupancy. AvalonBay's ability to analyze real-time market data allows for agile pricing adjustments.

- Portfolio Optimization: Advanced analytics enable AvalonBay to assess the performance of its entire portfolio, identifying underperforming assets and opportunities for growth. This holistic view supports strategic capital allocation and investment decisions.

- Tenant Demand Forecasting: By analyzing historical leasing data, economic indicators, and local market trends, AvalonBay can better predict future tenant demand, informing development and acquisition strategies.

- Operational Efficiency: Data analytics can pinpoint areas for cost savings, such as optimizing utility usage or streamlining property management processes, contributing to improved profitability.

Innovation in Construction Methods

Technological advancements are significantly transforming the construction sector, directly impacting real estate developers like AvalonBay Communities. Innovations such as modular and prefabricated construction methods are gaining traction, promising to streamline building processes. For instance, the global modular construction market was valued at approximately $101.2 billion in 2023 and is projected to reach $171.3 billion by 2028, growing at a compound annual growth rate of 11.1%.

These modern techniques offer tangible benefits, including accelerated development timelines and substantial cost reductions. By utilizing factory-built components, AvalonBay can potentially shorten project durations, allowing for quicker occupancy and revenue generation. Furthermore, these methods often lead to a reduction in material waste, contributing to more sustainable development practices and potentially lower overall project expenses.

The integration of artificial intelligence (AI) in project management is another key technological factor. AI-powered tools can optimize scheduling, resource allocation, and risk assessment, leading to more efficient operations and improved project outcomes. For example, AI in construction is expected to grow significantly, with applications ranging from predictive maintenance to enhanced safety protocols, ultimately boosting productivity and quality for companies like AvalonBay.

- Modular Construction Growth: The modular construction market is expected to expand from $101.2 billion in 2023 to $171.3 billion by 2028, indicating a strong trend towards off-site building.

- Cost and Time Efficiencies: Prefabricated and modular methods can reduce construction costs by up to 20% and project timelines by 30% compared to traditional on-site building.

- AI in Project Management: AI adoption in construction is projected to enhance operational efficiency, improve safety, and optimize resource management for developers.

- Waste Reduction: Off-site construction methods inherently minimize material waste, aligning with AvalonBay's potential sustainability goals and cost-saving initiatives.

Technological advancements are reshaping AvalonBay's operations, with AI and IoT driving efficiency and resident experience. AI-powered leasing agents offer 24/7 support, potentially boosting conversion rates, while predictive maintenance reduces costly repairs. Big data analytics enables dynamic rent pricing and portfolio optimization, crucial for maximizing revenue in the evolving multifamily market.

| Technology Area | Impact on AvalonBay | Supporting Data (2023/2024 Estimates) |

|---|---|---|

| AI in Leasing | Automated inquiries, scheduling, and lead management | AI in real estate projected to save up to 20% on operational costs. |

| IoT for Maintenance | Proactive issue detection and reduced repair costs | Smart building market valued at $80.5 billion in 2023. |

| Big Data Analytics | Dynamic pricing, portfolio optimization, tenant forecasting | Data-driven real estate decisions can improve ROI by 10-15%. |

| Modular Construction | Faster development, cost savings, reduced waste | Modular construction market to reach $171.3 billion by 2028. |

Legal factors

Rent control and tenant protection laws are significant legal considerations for AvalonBay Communities. Many major U.S. cities, including those where AvalonBay operates, have implemented rent control measures that cap annual rent increases. For instance, California's Tenant Protection Act of 2019 limits annual rent hikes to 5% plus inflation, or a maximum of 10% statewide, whichever is lower. This directly affects AvalonBay's ability to adjust rental income in these markets.

Beyond rent caps, other tenant protections, such as mandated notice periods for rent increases and stringent eviction regulations, further influence AvalonBay's operational flexibility and revenue forecasting. These laws can extend the time it takes to address lease violations or to reposition properties, impacting both financial performance and strategic planning for the company.

Zoning and land use regulations are critical for AvalonBay Communities, influencing where and how they can build in target metropolitan areas. These rules dictate everything from building height and density to the types of structures permitted, directly impacting AvalonBay's ability to develop new apartment communities.

Stricter zoning laws, common in desirable urban and suburban locations, can significantly increase the cost and time required for new projects. For instance, in 2024, many major US cities are experiencing lengthy approval processes for new developments, with some permit applications taking over a year to finalize, potentially delaying AvalonBay's revenue generation from new properties.

Changes in these regulations, such as upzoning initiatives or new environmental impact assessments, can create both opportunities and challenges. While upzoning might allow for denser, more profitable developments, unexpected regulatory shifts can introduce costly redesigns or even halt projects altogether, impacting AvalonBay's strategic expansion plans.

AvalonBay Communities must navigate a complex web of building codes and environmental regulations, which are constantly being updated. For instance, in 2024, many municipalities are tightening requirements for energy efficiency in new construction, potentially increasing upfront costs for projects like those AvalonBay undertakes. These evolving standards directly impact design choices, material sourcing, and ultimately, the operational expenses associated with maintaining their apartment portfolio.

Fair Housing and Anti-Discrimination Laws

AvalonBay Communities, as a major player in the real estate sector, must navigate a complex web of federal, state, and local fair housing and anti-discrimination statutes. These regulations are critical for ensuring fair access to housing and prohibiting discriminatory actions in all facets of their business, from leasing to resident relations.

Compliance with these laws, such as the Fair Housing Act, is paramount. For instance, the Department of Housing and Urban Development (HUD) actively enforces these statutes, and violations can lead to significant penalties. AvalonBay's operational framework must incorporate stringent policies and training to prevent any form of discrimination.

- Federal Fair Housing Act: Prohibits discrimination based on race, color, religion, sex, familial status, national origin, and disability.

- State and Local Ordinances: Many states and cities have expanded protected classes, including sexual orientation, gender identity, marital status, and source of income.

- Enforcement Actions: HUD reported over 24,000 housing discrimination complaints in fiscal year 2023, highlighting the active regulatory environment.

- Compliance Costs: Companies like AvalonBay invest in robust compliance programs, including regular staff training and audits, to mitigate legal risks and maintain ethical operations.

Corporate Governance and Disclosure Requirements

As a publicly traded Real Estate Investment Trust (REIT), AvalonBay Communities (AVB) operates under strict corporate governance and disclosure mandates from regulatory bodies, notably the U.S. Securities and Exchange Commission (SEC). These regulations ensure transparency for investors and stakeholders.

AVB is increasingly focused on enhanced climate risk disclosures, integrating frameworks like the Task Force on Climate-related Financial Disclosures (TCFD). This aligns with evolving investor expectations and regulatory trends, particularly in regions like California, which has been a leader in mandating such reporting. For instance, California's SB 260 and subsequent legislation are driving greater climate-related transparency across industries.

These requirements necessitate detailed reporting on environmental, social, and governance (ESG) factors, including how climate change might impact AVB's operations, assets, and financial performance. This proactive approach demonstrates a commitment to responsible governance and risk management.

- SEC Filings: AvalonBay must adhere to rigorous SEC reporting standards, including annual 10-K and quarterly 10-Q filings, which detail financial performance and operational risks.

- TCFD Alignment: The company is increasingly incorporating TCFD recommendations into its disclosures, providing insights into climate-related governance, strategy, risk management, and metrics/targets.

- Climate Risk Disclosure: Specific attention is paid to disclosing the potential physical and transitional risks associated with climate change, such as extreme weather events impacting properties or regulatory shifts influencing energy efficiency standards.

- California Regulations: Compliance with California's evolving climate disclosure laws, such as those requiring reporting of greenhouse gas emissions and climate-related financial risks, is a key governance consideration for AVB.

AvalonBay Communities must navigate evolving landlord-tenant laws, which can impact rent adjustments and eviction processes. For example, states continue to introduce or strengthen tenant protection acts, influencing lease terms and operational flexibility. These legal frameworks directly affect revenue streams and the cost of property management.

Zoning and land use regulations significantly shape development opportunities, with many cities in 2024 imposing stricter building codes and lengthy approval processes. These can increase development costs and timelines for new projects, impacting AvalonBay's expansion strategies. For instance, obtaining permits in major metropolitan areas can now extend beyond a year.

Compliance with fair housing laws and anti-discrimination statutes is critical, as regulatory bodies like HUD actively monitor and enforce these regulations. In fiscal year 2023, HUD received over 24,000 housing discrimination complaints, underscoring the importance of robust compliance programs for companies like AvalonBay.

Corporate governance mandates, particularly those from the SEC, require detailed disclosures on financial performance and operational risks. AvalonBay is increasingly aligning its reporting with frameworks like TCFD, addressing climate-related risks and ESG factors, with California leading in mandating such transparency.

| Legal Factor | Impact on AvalonBay | Relevant Data/Trend (2023-2024) |

| Rent Control/Tenant Protection | Limits rent growth, affects operational flexibility | California's Tenant Protection Act caps annual rent increases. HUD received over 24,000 discrimination complaints in FY2023. |

| Zoning & Land Use | Influences development feasibility and cost | Lengthy permit approval processes (over 1 year in some cities) are common in 2024. |

| Fair Housing Laws | Requires strict adherence to anti-discrimination policies | Active enforcement by HUD and state/local agencies. |

| Corporate Governance & Disclosure | Mandates transparency and ESG reporting | Increasing focus on TCFD alignment and climate risk disclosures. |

Environmental factors

AvalonBay Communities' properties face tangible threats from climate change, including severe weather like hurricanes and heatwaves, which can damage buildings and disrupt operations. For instance, the company's coastal holdings are particularly vulnerable to rising sea levels and storm surges, potentially impacting rental income and increasing insurance costs.

To counter these environmental challenges, AvalonBay actively incorporates climate change considerations into its strategic planning. Their Asset Strategy Reviews now systematically assess physical risks, aiming to bolster property resilience and ensure long-term operational stability against a changing climate.

AvalonBay Communities has actively pursued emissions reduction, achieving a notable 13% decrease in its Scope 1 and 2 emissions intensity from a 2019 baseline by the end of 2023. This progress is fueled by strategic investments in solar energy, with over 15 megawatts of solar capacity installed across its portfolio, alongside comprehensive energy efficiency upgrades in its apartment homes and common areas.

These initiatives not only align with AvalonBay's commitment to environmental stewardship and its science-based targets but also translate into tangible financial benefits. For instance, energy efficiency measures are projected to yield approximately $25 million in cumulative operating expense savings over the next decade, showcasing a direct link between sustainability and cost management.

AvalonBay Communities is actively implementing sustainable water management and waste reduction strategies across its properties. These efforts align with growing environmental consciousness and regulatory pressures, aiming to minimize the company's ecological footprint.

In 2023, AvalonBay reported a notable achievement by exceeding its waste reduction target. The company successfully lowered its landfill-bound waste intensity by 15% year-over-year, demonstrating a tangible commitment to environmental stewardship and operational efficiency.

Green Building Standards and Certifications

AvalonBay Communities' focus on green building standards, such as those recognized by LEED (Leadership in Energy and Environmental Design), directly impacts property value and appeal. In 2024, the demand for sustainable living spaces continues to rise, with a significant portion of renters expressing a preference for eco-friendly amenities. This trend is not just about resident preference; it often translates into lower operating costs for AvalonBay through energy and water efficiency.

The pursuit of certifications like LEED Platinum or Gold can differentiate AvalonBay's portfolio in a competitive market. For instance, properties achieving LEED certification have shown an average increase in rental rates and occupancy compared to non-certified buildings. This commitment also aligns with increasing investor interest in Environmental, Social, and Governance (ESG) factors, potentially attracting capital and enhancing long-term financial performance.

- LEED Certification Growth: The number of LEED-certified projects globally has surpassed 100,000, indicating a strong market adoption of green building practices.

- Resident Demand: Surveys in 2024 consistently show over 70% of renters are willing to pay a premium for apartments with green features.

- Operational Savings: LEED-certified buildings can see a reduction in energy consumption by up to 25% and water usage by up to 18%.

- Marketability Advantage: Properties with strong sustainability credentials often experience higher demand and faster lease-up times.

Renewable Energy Integration

AvalonBay Communities is significantly increasing its investment in renewable energy, particularly solar power. As of early 2024, the company has a substantial number of solar installations across its properties and is committed to expanding these efforts. This strategic move directly addresses the growing consumer preference for environmentally conscious living.

The expansion of AvalonBay's solar program is driven by both sustainability goals and economic advantages. By generating more of its own electricity through solar, AvalonBay aims to lower its operational energy costs over the long term. This proactive approach also positions the company to meet the evolving demands of residents who increasingly prioritize sustainable housing options.

- Solar Expansion: AvalonBay is actively increasing its solar installations, with a focus on resident-facing projects.

- Carbon Footprint Reduction: The company's renewable energy initiatives are designed to decrease its overall environmental impact.

- Cost Savings: Investing in solar is expected to yield long-term reductions in energy expenses for AvalonBay.

- Market Demand: The growing demand for sustainable living options is a key driver for AvalonBay's renewable energy strategy.

AvalonBay Communities faces environmental risks from climate change, such as extreme weather events impacting coastal properties and increasing insurance costs. The company is actively mitigating these risks by integrating climate considerations into its asset strategy reviews to enhance property resilience.

AvalonBay is committed to reducing its environmental footprint, having decreased its Scope 1 and 2 emissions intensity by 13% by the end of 2023 from a 2019 baseline. This is supported by substantial investments in solar energy, with over 15 megawatts installed, and energy efficiency upgrades projected to save $25 million in operating expenses over ten years.

The company is also focused on sustainable water management and waste reduction, successfully lowering landfill-bound waste intensity by 15% year-over-year in 2023. This aligns with growing environmental consciousness and regulatory pressures.

AvalonBay's embrace of green building standards like LEED is enhancing property value and marketability, as over 70% of renters in 2024 expressed willingness to pay more for eco-friendly features. LEED-certified buildings can reduce energy consumption by up to 25% and water usage by up to 18%.

| Environmental Factor | AvalonBay's Action/Impact | Key Data/Metric |

| Climate Change Risk | Vulnerability to severe weather, rising sea levels | Coastal property exposure |

| Emissions Reduction | Scope 1 & 2 intensity reduction | 13% reduction by end of 2023 (vs. 2019 baseline) |

| Renewable Energy | Solar energy installation | Over 15 MW installed capacity |

| Energy Efficiency | Operating expense savings from upgrades | Projected $25 million cumulative savings over 10 years |

| Waste Reduction | Landfill-bound waste intensity reduction | 15% year-over-year reduction in 2023 |

| Green Building | LEED certification adoption | Increased property value and marketability; 70%+ renter willingness to pay premium |

PESTLE Analysis Data Sources

Our PESTLE Analysis for AvalonBay Communities is built upon a comprehensive review of data from reputable real estate market research firms, government housing and economic statistics agencies, and industry-specific publications. We integrate insights on regulatory changes, economic forecasts, and demographic trends to provide a robust understanding of the macro-environment.