AvalonBay Communities Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AvalonBay Communities Bundle

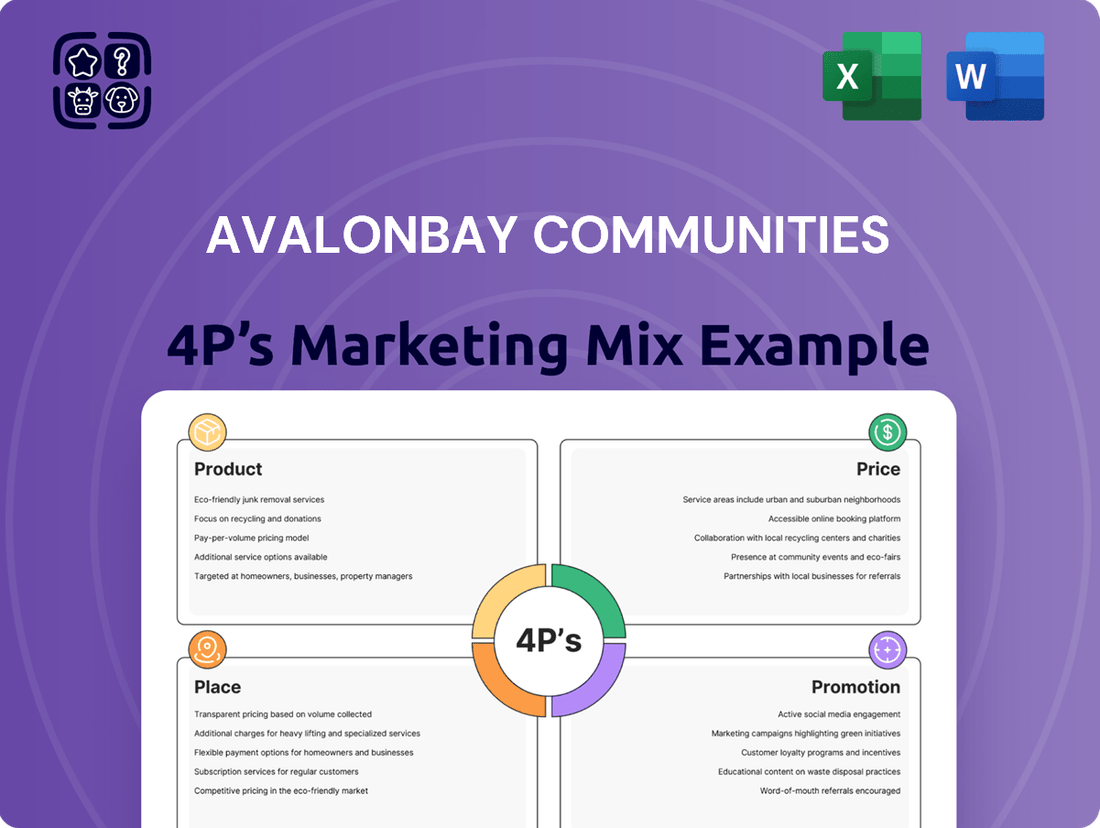

AvalonBay Communities masterfully blends premium living experiences (Product) with competitive rental rates (Price), strategically locating properties in high-demand urban and suburban areas (Place). Their promotional efforts, from digital marketing to community engagement, create a strong brand presence.

Want to understand the specific tactics behind their success? Dive deeper into AvalonBay's 4Ps with our comprehensive analysis, perfect for business professionals and students seeking strategic insights.

Get instant access to a professionally written, editable report that breaks down AvalonBay's product, price, place, and promotion strategies. Elevate your understanding of real estate marketing today!

Product

AvalonBay Communities excels in creating and managing top-tier apartment complexes. Their focus is on delivering an exceptional living experience through contemporary amenities, thoughtful design, and overall resident comfort, catering to specific lifestyle preferences.

The company's strategy centers on offering a premium residential product that stands out in busy urban markets. This commitment to quality is evident in their portfolio; as of December 31, 2024, AvalonBay managed 306 apartment communities, totaling 93,518 homes across 12 states and Washington D.C.

AvalonBay Communities effectively employs product differentiation through its diverse apartment brands: AVA, Avalon, eaves by Avalon, and Kanso. This strategy allows them to appeal to a wide range of renters, from those seeking a high-energy, urban lifestyle with AVA to those preferring a more streamlined, value-oriented experience with Kanso.

This segmentation is crucial for capturing market share across different demographics and psychographics. For instance, Avalon offers a more traditional, upscale apartment living experience, while eaves by Avalon targets a slightly more budget-conscious segment without sacrificing quality. This multi-brand approach ensures AvalonBay can meet varied resident needs and preferences, a key factor in maintaining high occupancy rates, which stood at 95.6% for their same-store apartment portfolio as of Q1 2024.

AvalonBay Communities strategically places its apartment developments in desirable metropolitan areas, often those with high barriers to entry. This approach targets regions with strong demographic tailwinds and significant job creation, ensuring a consistent demand for housing.

The company's focus spans key markets like New England, the New York/New Jersey Metro, Mid-Atlantic, Pacific Northwest, and both Northern and Southern California. For instance, in 2024, Southern California's rental market continued to show resilience, with average rents in major cities like Los Angeles and San Diego remaining strong, reflecting sustained demand.

Sustainable and Energy-Efficient Features

AvalonBay Communities is actively enhancing its product by integrating sustainable and energy-efficient features, a strategy detailed in its 2024 Corporate Responsibility Report. This commitment is demonstrated through an expanding solar program, which currently boasts 69 installations and has plans for 15 additional resident solar projects.

Beyond solar, AvalonBay is implementing robust energy efficiency measures across its portfolio. The company is also employing life cycle assessments for new developments, a process that guides the selection of materials with demonstrably lower embodied carbon footprints.

- Solar Expansion: 69 installations completed with 15 more resident solar projects planned.

- Energy Efficiency: Implementation of various energy-saving measures in properties.

- Low Carbon Materials: Use of life cycle assessments to select materials with reduced embodied carbon.

- Value Proposition: These features boost product value, lower operating expenses, and attract environmentally aware residents.

Ancillary Services and Community Amenities

Beyond the apartment itself, AvalonBay Communities enhances its product offering with a suite of ancillary services and community amenities. These additions are crucial for elevating the resident experience and building loyalty. For instance, the company saw a robust 15% growth in ancillary rental revenue during 2024, demonstrating the market's appetite for these value-added offerings.

Looking ahead, AvalonBay anticipates a further 9% increase in ancillary revenue for 2025, driven by strategic expansions in its service portfolio. This focus on ancillary services and amenities directly contributes to the overall value proposition, fostering higher resident satisfaction and retention rates.

- Ancillary Revenue Growth: AvalonBay reported 15% growth in ancillary rental revenue in 2024.

- Projected Ancillary Growth: A 9% increase in ancillary revenue is projected for 2025.

- Service Expansion: Growth is attributed to the expansion of ancillary services and community amenities.

- Resident Value: These offerings are key to enhancing the resident experience and overall value proposition.

AvalonBay Communities' product strategy focuses on delivering high-quality, differentiated apartment living experiences across various urban markets. Their commitment to contemporary design, resident comfort, and sustainable features enhances the overall value proposition. The company's multi-brand approach, including AVA, Avalon, eaves by Avalon, and Kanso, effectively targets diverse renter demographics and preferences, contributing to strong occupancy rates.

| Product Aspect | Description | Key Data/Initiatives (2024/2025) |

|---|---|---|

| Apartment Portfolio | Diverse, contemporary apartment complexes | 93,518 homes across 306 communities (as of Dec 31, 2024) |

| Brand Segmentation | Multiple brands catering to different lifestyles | AVA (urban), Avalon (upscale), eaves (value-oriented), Kanso (streamlined) |

| Sustainability | Energy efficiency and low-carbon materials | 69 solar installations completed, 15 more planned; use of life cycle assessments for materials |

| Ancillary Services | Value-added services and community amenities | 15% growth in ancillary revenue (2024), 9% projected growth (2025) |

What is included in the product

This analysis delves into AvalonBay Communities' marketing mix, examining their high-quality apartment offerings (Product), competitive rental rates (Price), strategically located properties in desirable urban and suburban areas (Place), and targeted digital and community-focused promotional efforts (Promotion).

Simplifies AvalonBay's complex marketing strategy into actionable 4Ps, alleviating the pain of overwhelming data for clear decision-making.

Provides a concise overview of AvalonBay's 4Ps, relieving the burden of sifting through extensive research for quick, strategic understanding.

Place

AvalonBay Communities strategically concentrates its 'place' in major, high-growth metropolitan areas across the U.S. This includes key markets like New England, the New York/New Jersey Metro, Mid-Atlantic, Pacific Northwest, and both Northern and Southern California.

This deliberate geographic focus allows AvalonBay to tap into regions with robust economic activity and consistently high demand for quality rental housing. For instance, as of Q1 2024, AvalonBay reported a portfolio of 297 communities with approximately 87,000 apartment homes, with a significant portion situated in these prime locations.

By concentrating in these leading metropolitan areas, AvalonBay benefits from strong employment centers and a large renter pool, contributing to high occupancy rates. In 2023, the company saw average same-store occupancy rates around 96%, a testament to the desirability of its chosen locations.

AvalonBay Communities is strategically broadening its portfolio beyond traditional coastal hubs, focusing on high-growth Sunbelt markets. This expansion is a direct response to robust population influx and job creation in these areas. For instance, in 2024, markets like Raleigh-Durham and Charlotte, North Carolina, along with Dallas and Austin, Texas, are experiencing significant demand for multifamily housing.

This geographical diversification targets regions with more favorable demographic tailwinds and often less stringent regulatory environments compared to some established coastal markets. Southeast Florida and Denver, Colorado, are also key components of this Sunbelt strategy, reflecting AvalonBay's commitment to capturing value in dynamic, expanding economies.

AvalonBay's 'place' strategy centers on expanding its physical presence through both acquiring existing apartment communities and developing new ones. This approach ensures a consistent supply of modern living spaces in desirable locations.

In 2024, AvalonBay demonstrated robust growth by acquiring six wholly-owned communities, adding 1,441 apartment homes to its portfolio. Concurrently, the company completed the development of nine new communities, contributing an additional 2,981 apartment homes. This dual strategy highlights their commitment to strategic expansion.

Looking ahead to 2025, AvalonBay plans to accelerate its growth trajectory by increasing development starts to an estimated $1.6 billion. This significant investment signals their intent to further broaden their geographic reach and enhance their market position by adding more high-quality apartment inventory.

Suburban Portfolio Optimization

AvalonBay Communities is actively rebalancing its portfolio towards suburban locations, aiming for 80% of its holdings to be in these areas. By the end of 2024, the company expects to reach 73% suburban exposure, demonstrating a clear strategic pivot. This move is driven by changing renter preferences and a favorable supply dynamic in these markets, with limited new construction expected.

The company's suburban strategy emphasizes lower-density development. A prime example is their planned townhome community in Austin, Texas, which reflects this focus. This approach capitalizes on the demand for more space and a different lifestyle often sought by renters in suburban settings.

- Target Suburban Exposure: 80%

- 2024 Suburban Exposure: 73%

- Strategy: Prioritize low-density developments in suburban markets

- Example: Planned townhome community in Austin

Digital Presence and Online Accessibility

AvalonBay Communities' digital presence, centered on www.avalonbay.com, acts as a vital virtual "place" for customer engagement and transactions. This website is more than just an information hub; it's a primary distribution channel where prospective residents explore available apartments, view community amenities, and initiate the leasing process, streamlining convenience and boosting sales opportunities.

In 2024, AvalonBay's digital strategy is crucial for reaching a broad audience. The company reported that a significant portion of its leasing traffic originates online, underscoring the website's role in driving occupancy. This digital accessibility allows for 24/7 interaction, catering to the modern consumer's preference for self-service and immediate information, thereby enhancing the overall customer experience and operational efficiency.

- Website as Primary Leasing Channel: www.avalonbay.com facilitates apartment searches, virtual tours, and lease applications, directly impacting occupancy rates.

- Enhanced Customer Convenience: Online accessibility allows prospective and current residents to engage with AvalonBay at their own pace, anytime, anywhere.

- Digital Marketing Integration: The website serves as the landing point for digital marketing campaigns, converting online interest into tangible leads and leases.

- Data-Driven Insights: Website analytics provide valuable data on user behavior, informing marketing strategies and service improvements for better online accessibility.

AvalonBay Communities strategically places its properties in high-demand, growing metropolitan areas and expanding suburban markets. This dual focus allows them to capture diverse renter bases and leverage economic growth. By the end of 2024, AvalonBay anticipates 73% of its portfolio will be in suburban locations, a significant increase from previous years, with a target of 80%.

This strategic positioning is supported by active portfolio expansion through acquisitions and development. In 2024 alone, AvalonBay acquired six communities totaling 1,441 homes and completed nine new developments adding 2,981 homes. Their 2025 development pipeline is projected to reach $1.6 billion, indicating a strong commitment to increasing their presence in desirable locations.

The company's digital platform, www.avalonbay.com, serves as a crucial virtual "place" for customer engagement, streamlining the leasing process and driving occupancy. This online accessibility is vital for reaching a broad audience and catering to modern consumer preferences for self-service and immediate information.

| Market Focus | 2024 Suburban Exposure Target | 2025 Development Investment | Key 2024 Activity |

|---|---|---|---|

| Major Metro Areas | 73% (by end of 2024) | $1.6 Billion (projected) | Acquired 6 communities (1,441 homes) |

| Expanding Suburban Markets | 80% (long-term target) | Focus on low-density development | Completed 9 new developments (2,981 homes) |

| Sunbelt Growth Markets | Targeting Raleigh-Durham, Charlotte, Dallas, Austin | Leveraging population and job growth | Website (www.avalonbay.com) as primary leasing channel |

Full Version Awaits

AvalonBay Communities 4P's Marketing Mix Analysis

The preview you see here is the actual, complete AvalonBay Communities 4P's Marketing Mix Analysis that you will receive instantly after purchase. There are no hidden surprises or missing sections; what you view is exactly what you get. This ensures you can begin leveraging this valuable marketing insight immediately.

Promotion

AvalonBay Communities prioritizes investor relations and financial communications to clearly articulate its business performance and strategic direction. The company regularly disseminates key information, such as earnings reports and dividend announcements, through press releases and investor presentations. For instance, in the first quarter of 2024, AvalonBay reported a net income of $265.1 million, demonstrating its financial health to stakeholders.

AvalonBay Communities actively showcases its dedication to corporate responsibility and ESG principles through its annual Corporate Responsibility Report. This report details advancements in areas such as climate targets, the expansion of renewable energy access for residents, impactful community partnerships, and the achievement of diversity objectives.

For instance, in their 2023 report, AvalonBay highlighted a reduction in Scope 1 and 2 greenhouse gas emissions intensity by 23% compared to their 2018 baseline, exceeding their initial 20% target. They also reported that 75% of their apartment homes now have access to renewable energy options, a significant increase from 50% in 2021.

This transparent reporting not only bolsters AvalonBay's brand image as a responsible corporate citizen but also appeals to a growing segment of investors prioritizing ESG performance. By demonstrating tangible progress in sustainability and social impact, AvalonBay positions itself as a leader in responsible real estate development and management.

AvalonBay Communities actively manages its public image through strategic public relations and media engagement. The company regularly issues press releases to share significant company milestones, such as new property acquisitions or the progress of development projects. For instance, in early 2024, AvalonBay announced the acquisition of a new multifamily property in a key growth market, further expanding its portfolio.

Participation in industry conferences and events is another cornerstone of AvalonBay's PR strategy, allowing for direct communication with stakeholders and the dissemination of company news. This proactive approach helps build brand awareness and reinforces its position within the real estate sector. The company also leverages media recognition, such as being named a Top Workplace by USA Today, to enhance its reputation and attract talent.

Online Presence and Digital Marketing

AvalonBay Communities leverages its official website as a central digital platform to showcase its apartment communities, amenities, and resident services, effectively attracting prospective renters. This online presence is a cornerstone of their promotional strategy, providing detailed property information and facilitating initial engagement. While specific campaign metrics aren't public, the website's role in lead generation and brand visibility is undeniable.

The company's digital marketing likely extends to search engine optimization (SEO) and potentially paid search campaigns to ensure high visibility when individuals search for rental properties. Their online strategy aims to capture demand by making it easy for potential residents to find and learn about AvalonBay properties. As of early 2024, the digital real estate market continues to be highly competitive, making a strong, informative online presence critical for tenant acquisition.

- Website as Primary Hub: AvalonBay's official website acts as the main digital storefront, offering comprehensive details on properties and services.

- Digital Marketing Focus: While specific campaigns are private, the strategy likely includes SEO and paid search to capture online rental demand.

- 2024 Digital Landscape: The competitive online rental market emphasizes the importance of a robust and user-friendly digital presence for attracting residents.

Community Engagement and Partnerships

AvalonBay Communities actively invests in its operating communities through targeted engagement and partnership programs. In 2024, the company continued its commitment to social impact by supporting various charitable organizations, including initiatives focused on affordable housing solutions for essential workers like teachers. This approach not only addresses community needs but also cultivates positive brand perception.

The company also champions associate volunteerism, encouraging employees to contribute their time and skills to local causes. This fosters a sense of shared purpose and reinforces AvalonBay's commitment to being a responsible corporate citizen. These efforts build significant goodwill, enhancing brand loyalty and association within the markets they serve.

AvalonBay's community engagement strategy is designed to create mutually beneficial relationships. For instance, their partnerships often involve local non-profits to maximize impact. These initiatives are not merely philanthropic; they serve as a powerful, albeit indirect, promotional tool, strengthening AvalonBay's reputation and community ties.

AvalonBay Communities utilizes a multi-faceted promotion strategy, emphasizing investor relations, corporate responsibility, and digital presence. Their transparent financial reporting, exemplified by Q1 2024 net income of $265.1 million, builds stakeholder trust. Furthermore, their commitment to ESG, including a 23% reduction in GHG emissions intensity by 2023, resonates with socially conscious investors.

The company actively engages in public relations through press releases, such as announcing new property acquisitions in early 2024, and participation in industry events to enhance brand awareness. Their digital strategy centers on a robust website for property showcases and likely incorporates SEO and paid search to capture rental demand in the competitive 2024 online market.

Community engagement and partnerships, including support for affordable housing initiatives in 2024, bolster AvalonBay's reputation as a responsible corporate citizen. These efforts foster positive brand perception and community ties, acting as indirect promotional tools.

| Promotional Tactic | Key Actions/Examples | Impact/Goal | Relevant Data Point (2023/2024) |

|---|---|---|---|

| Investor Relations & Financial Communications | Earnings reports, dividend announcements, investor presentations | Build stakeholder trust, articulate financial health | Q1 2024 Net Income: $265.1 million |

| Corporate Responsibility & ESG Reporting | Annual Corporate Responsibility Report | Enhance brand image, attract ESG-focused investors | 23% reduction in GHG emissions intensity (vs. 2018 baseline) by 2023 |

| Public Relations & Media Engagement | Press releases, industry conferences, media recognition | Increase brand awareness, reinforce market position | Announced new multifamily property acquisition (early 2024) |

| Digital Marketing | Website, SEO, potential paid search | Attract prospective renters, generate leads | Competitive online rental market (early 2024) |

| Community Engagement | Charitable support, associate volunteerism, local partnerships | Cultivate positive brand perception, build community ties | Support for affordable housing initiatives (2024) |

Price

AvalonBay Communities' rental pricing is deeply rooted in market forces, particularly in the competitive, high-demand metropolitan areas it serves. The company actively monitors rental rate trends and adjusts its pricing to align with current market conditions, aiming to capture strong rental growth. For instance, in the first quarter of 2024, AvalonBay reported a 5.7% increase in same-store revenue, reflecting this dynamic pricing approach.

The company's strategy anticipates sustained demand, especially within its coastal portfolio, and sees potential upside from the ongoing return-to-office initiatives in major tech hubs. Leases are typically short-term, often one year or less, which provides AvalonBay with the flexibility to frequently recalibrate rental rates in response to evolving market supply and demand dynamics. This agility is crucial for maximizing revenue in a fluctuating rental landscape.

AvalonBay Communities employs value-based pricing across its diverse apartment brands, including AVA, Avalon, eaves, and Kanso. This strategy aligns pricing with the distinct features, amenities, and lifestyle experiences each brand provides, ensuring that customers perceive fair value for their investment.

By segmenting its offerings, AvalonBay effectively addresses a broad spectrum of price sensitivities within its target demographic. For instance, while specific 2024 rental rate data for each brand isn't publicly disclosed in a way that allows direct comparison for this analysis, the tiered approach allows the company to capture different market segments, from those seeking premium living experiences to those prioritizing affordability without compromising quality.

AvalonBay Communities strategically aligns its pricing to enhance Net Operating Income (NOI). For its Same Store Residential properties, NOI experienced a healthy 2.7% rise in 2024, underscoring the effectiveness of their revenue management strategies.

Looking ahead to 2025, AvalonBay anticipates a 3% growth in same-store revenue. This projection is primarily fueled by successful rent adjustments and an increase in ancillary rental income, demonstrating a commitment to maximizing profitability from each leased unit.

Impact of Development and Acquisitions on Value

AvalonBay's pricing strategy is deeply intertwined with its growth through development and acquisitions. The company's commitment to expanding its portfolio, with a projected $1.6 billion in development starts for 2025, is a key driver. These new projects are expected to significantly boost net operating income (NOI) from residential properties, thereby supporting and justifying current pricing structures.

Strategic acquisitions further bolster AvalonBay's market position and, consequently, its pricing power. By adding well-located and high-performing assets to its portfolio, the company enhances its overall value proposition. This expansion not only diversifies revenue streams but also allows for premium pricing based on the quality and desirability of its expanded offerings.

- Development Pipeline: AvalonBay plans approximately $1.6 billion in new development starts for 2025, aiming to increase its residential NOI.

- Acquisition Strategy: The company actively pursues strategic acquisitions to enhance its portfolio's overall value and market appeal.

- Value Justification: Both development and acquisitions contribute to a stronger asset base, enabling competitive pricing and justifying rental rates.

Financial Performance and Shareholder Returns

AvalonBay's pricing strategy is a key driver of its financial health and, consequently, its shareholder returns. The company’s ability to set competitive yet profitable rental rates directly impacts its revenue and funds from operations (FFO). This financial strength underpins its commitment to delivering consistent dividends and fostering long-term shareholder value.

The company’s financial performance in the recent period highlights this connection. For 2024, AvalonBay reported revenue growth of 3.4%. Furthermore, core FFO saw a healthy increase of 3.6%. Looking ahead, the outlook for 2025 remains positive, with projections indicating a 3.5% growth in core FFO per share.

- Revenue Growth: 3.4% in 2024, demonstrating effective rental income generation.

- Core FFO Growth: 3.6% in 2024, reflecting strong operational profitability.

- Projected Core FFO Per Share Growth: 3.5% for 2025, indicating continued financial expansion.

- Dividend Support: This robust financial performance enables consistent dividend payments to shareholders.

AvalonBay's pricing is dynamic, reflecting market conditions and aiming for strong rental growth, evidenced by a 5.7% increase in same-store revenue in Q1 2024. The company anticipates continued demand, especially in tech hubs, and uses short-term leases to adjust rates flexibly. This strategy supports a projected 3% same-store revenue growth for 2025, driven by rent adjustments and ancillary income.

| Metric | 2024 (Actual) | 2025 (Projected) |

|---|---|---|

| Same-Store Revenue Growth | N/A (Q1 2024: 5.7%) | 3% |

| Same Store Residential NOI Growth | 2.7% | N/A |

| Core FFO Growth | 3.6% | N/A |

| Core FFO Per Share Growth | N/A | 3.5% |

4P's Marketing Mix Analysis Data Sources

Our AvalonBay Communities 4P's Marketing Mix Analysis is grounded in comprehensive data, including official company reports, investor relations materials, and property listings. We also incorporate insights from industry publications and market research to ensure a thorough understanding of their product offerings, pricing strategies, community placement, and promotional activities.