AvalonBay Communities Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AvalonBay Communities Bundle

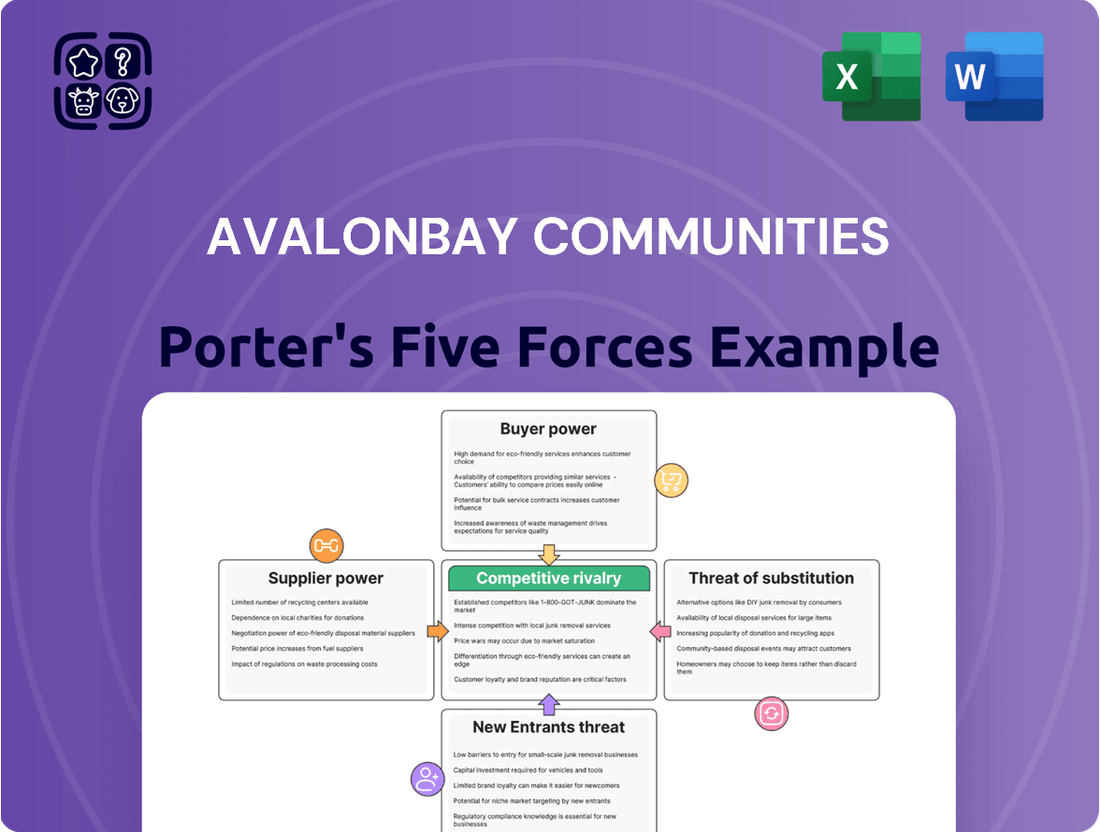

AvalonBay Communities operates in a dynamic real estate market, facing significant competitive pressures. Understanding the interplay of buyer power, supplier leverage, and the threat of new entrants is crucial for strategic planning.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore AvalonBay Communities’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The rising cost of building materials and overall construction expenses significantly impacts multifamily development projects like those undertaken by AvalonBay Communities. This trend, driven by inflation and supply chain issues, strengthens the bargaining power of material suppliers and construction firms.

For instance, lumber prices in 2024 have experienced volatility, with futures contracts fluctuating based on housing market demand and supply chain stability. This increased cost of inputs directly translates to higher project expenses for developers, giving suppliers more leverage in price negotiations.

Persistent labor shortages in the construction sector, especially for skilled trades, are a significant factor. Estimates suggest hundreds of thousands of additional workers are needed to meet demand through 2024 and into 2025.

This scarcity of qualified labor grants construction workers and specialized contractors increased bargaining power, enabling them to demand higher wages and more favorable contract terms.

Consequently, these increased labor costs directly translate to higher development expenses for companies like AvalonBay Communities, impacting their overall project profitability and budget.

AvalonBay Communities operates in major metropolitan areas, which naturally have high barriers to entry. This scarcity of available land directly translates into elevated land acquisition costs for developers like AvalonBay.

In these desirable urban locations, sellers of prime development sites wield considerable bargaining power. The limited supply and strategic importance of these parcels allow them to command premium prices, impacting AvalonBay's development expenses.

For instance, in 2024, average land costs for multifamily development in core urban markets like San Francisco and New York City continued to be exceptionally high, often exceeding $500 per buildable square foot in prime submarkets. This trend underscores the supplier power stemming from high land costs.

Specialized Equipment and Technology Providers

AvalonBay Communities, like many modern apartment operators, increasingly integrates advanced technology for smart living, energy efficiency, and streamlined operations. This reliance on specialized equipment and technology providers can grant these suppliers significant bargaining power, especially when their solutions are unique or critical to AvalonBay's competitive edge.

The demand for sophisticated building management systems, smart home features, and data analytics platforms is growing. For instance, in 2024, the smart home technology market within the real estate sector saw continued expansion, with providers offering proprietary software and hardware solutions that are not easily replicated. If AvalonBay finds itself dependent on a limited number of suppliers for these essential technological components, those suppliers can command higher prices or more favorable terms.

- Supplier Dependence: AvalonBay's need for cutting-edge smart technology for its apartment communities creates a dependence on specialized providers.

- Limited Alternatives: The uniqueness of certain technological solutions means few, if any, viable alternatives exist for AvalonBay.

- Pricing Power: This limited substitutability allows specialized equipment and technology providers to exert considerable pricing power.

Limited Number of High-Quality Contractors

AvalonBay Communities, like many large real estate developers, faces a concentrated market for high-quality general contractors experienced in complex, large-scale apartment projects. This scarcity means a few select firms often dominate the landscape, giving them significant leverage.

This limited pool of specialized contractors can translate into higher bidding prices and less flexibility on project schedules. For instance, in 2024, the construction industry continued to grapple with labor shortages, particularly for skilled trades, which further amplified the bargaining power of established, reputable contractors.

- Limited Contractor Pool: The number of general contractors capable of handling AvalonBay's extensive development pipeline is restricted.

- Increased Demand: High demand for these specialized services from multiple developers intensifies contractor influence.

- Pricing Power: Contractors can command higher prices due to their expertise and limited competition.

- Timeline Control: Developers may have less control over project timelines as contractors prioritize their most profitable or convenient engagements.

Suppliers of building materials and skilled labor hold significant bargaining power over AvalonBay Communities due to rising costs and scarcity. For instance, lumber prices in 2024 remained volatile, and the construction sector faced a deficit of hundreds of thousands of skilled workers, driving up wages and contract terms.

The limited availability of prime development land in desirable urban markets, such as San Francisco and New York City, also empowers land sellers. In 2024, these locations saw land costs exceeding $500 per buildable square foot in prime submarkets, directly increasing AvalonBay's acquisition expenses.

AvalonBay's increasing reliance on specialized smart home technology and building management systems grants these providers leverage, especially when solutions are proprietary. The smart home market's expansion in 2024 highlighted the demand for unique tech, allowing key suppliers to dictate terms.

A concentrated market for experienced general contractors further amplifies supplier power. In 2024, ongoing labor shortages in construction bolstered the influence of established contractors, enabling them to negotiate higher prices and potentially less flexible schedules.

| Supplier Type | 2024 Cost Impact | Bargaining Power Driver |

|---|---|---|

| Building Materials (e.g., Lumber) | Volatile pricing, increased overall cost | Supply chain issues, housing market demand |

| Skilled Construction Labor | Higher wages, increased contract demands | Significant labor shortages (hundreds of thousands needed) |

| Prime Urban Land | Costs > $500/sq ft in prime submarkets | Scarcity of desirable locations |

| Specialized Technology Providers | Potential for higher prices on unique solutions | Dependence on proprietary software/hardware |

| Experienced General Contractors | Higher bidding prices, less schedule flexibility | Limited pool of qualified firms, labor shortages |

What is included in the product

This analysis unpacks the competitive forces impacting AvalonBay Communities, detailing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes on the multifamily real estate sector.

Effortlessly identify and mitigate competitive threats with a dynamic visualization of AvalonBay's Porter's Five Forces, enabling proactive strategy adjustments.

Customers Bargaining Power

The bargaining power of customers is significantly influenced by the increased multifamily supply. Many markets, especially in the Sun Belt, are seeing a historically high number of new apartment units being delivered in 2024 and 2025. For instance, markets like Austin, Texas, and Phoenix, Arizona, are projected to have substantial deliveries, potentially increasing vacancy rates.

This surge in new inventory gives renters more choices, which can lead to landlords offering more concessions, such as a month or two free rent. Consequently, rent growth is likely to moderate, shifting the advantage towards tenants and thereby increasing their bargaining power.

After experiencing significant increases, national rent growth is projected to stabilize and become more moderate in 2025, with some forecasts indicating it will fall below long-term averages. For instance, Moody's Analytics projected effective rent growth for multifamily properties to be around 2.8% in 2024 and a similar figure for 2025, a notable slowdown from prior years.

This moderation in rental price increases directly impacts the bargaining power of customers. With less upward pressure on rents, potential residents gain more leverage to negotiate lease terms or select properties that offer better value, thereby diminishing the pricing power of landlords like AvalonBay Communities.

Affordability constraints significantly amplify the bargaining power of AvalonBay's customers. With elevated interest rates and persistently high home prices, many individuals who might otherwise purchase a home are remaining renters. This demographic, however, is also grappling with their own affordability challenges, making them more sensitive to rent hikes and more inclined to search for properties with competitive pricing, thereby strengthening their collective negotiating leverage.

Access to Information and Digital Tools

Prospective renters in 2024 have unprecedented access to information, allowing them to easily compare AvalonBay Communities' offerings against competitors. Online platforms like Zillow and Apartment List provide detailed data on pricing, amenities, and resident reviews, significantly increasing customer power. For instance, a 2023 National Multifamily Housing Council survey indicated that 70% of renters used online listing sites during their apartment search.

This transparency empowers renters to negotiate more effectively, pushing AvalonBay to maintain competitive pricing and high service standards. The ease of access to information means that any perceived disadvantage in price or amenities for AvalonBay can quickly translate into lost leasing opportunities. This digital accessibility directly impacts the bargaining power of customers by reducing information asymmetry.

- Increased Transparency: Online platforms offer detailed comparisons of rental properties, including pricing, amenities, and user reviews.

- Informed Decision-Making: Renters can thoroughly research options, leading to more informed choices and stronger negotiation positions.

- Competitive Pressure: AvalonBay Communities faces pressure to offer competitive rates and superior amenities to attract and retain tenants in a well-informed market.

- Digital Influence: The prevalence of online reviews and comparison tools amplifies the voice of individual renters, influencing the decisions of many others.

Evolving Tenant Protections and Regulations

The bargaining power of customers, specifically tenants, is growing due to a wave of new tenant protection laws. For instance, in 2024, several major U.S. cities saw increased legislative action aimed at capping rent increases and providing more security against evictions. These regulations directly impact AvalonBay Communities by limiting their ability to adjust lease terms and rental income based on market demand.

These evolving tenant protections can significantly shift the balance of power. Stricter eviction rules mean landlords have less leverage to remove tenants who may be paying below-market rates. Rent control policies, where implemented, cap potential revenue growth, making it harder for companies like AvalonBay to maximize profits from their properties.

- Increased Regulatory Landscape: As of mid-2024, over 20 states and numerous municipalities have enacted or are considering new tenant protection legislation.

- Rent Control Impact: Cities with rent control, such as New York City and San Francisco, already demonstrate how these policies can limit rental income growth for property owners.

- Eviction Moratoriums and Restrictions: While widespread pandemic-era moratoriums have largely ended, localized or more targeted eviction restrictions continue to emerge, adding complexity to tenant management.

The bargaining power of AvalonBay's customers, primarily renters, is notably heightened by an expanding multifamily housing supply. Markets across the U.S., particularly in the Sun Belt, are experiencing a significant influx of new apartment units throughout 2024 and into 2025, leading to increased tenant choice and a greater likelihood of concessions like free rent. This dynamic is projected to moderate rent growth, shifting leverage towards renters and away from property owners.

The increasing transparency afforded by digital platforms empowers renters, allowing for easy comparison of pricing and amenities across AvalonBay's portfolio and competitors. With approximately 70% of renters utilizing online listing sites in 2023, this information asymmetry reduction compels AvalonBay to maintain competitive pricing and service levels to attract and retain tenants.

Furthermore, the growing landscape of tenant protection laws, with over 20 states and numerous municipalities considering new legislation in 2024, directly impacts AvalonBay's operational flexibility. These regulations, including potential rent caps and stricter eviction rules, limit revenue growth and tenant management leverage, thereby strengthening customer bargaining power.

| Factor | Impact on Customer Bargaining Power | Supporting Data/Trend |

|---|---|---|

| Multifamily Supply Increase | Increases | Historically high new unit deliveries projected for 2024-2025 in key markets. |

| Online Information Access | Increases | 70% of renters used online listing sites in 2023; enables easy competitor comparison. |

| Tenant Protection Laws | Increases | Over 20 states considering new tenant protection legislation in 2024; rent control policies in effect in major cities. |

Preview Before You Purchase

AvalonBay Communities Porter's Five Forces Analysis

The document you see is your deliverable. It’s ready for immediate use—no customization or setup required. This comprehensive Porter's Five Forces analysis of AvalonBay Communities details the competitive landscape, including the bargaining power of buyers and suppliers, the threat of new entrants and substitute products, and the intensity of rivalry within the apartment REIT sector. Understanding these forces is crucial for strategic decision-making and assessing AvalonBay's competitive position.

Rivalry Among Competitors

AvalonBay Communities faces significant competitive rivalry from large, established Real Estate Investment Trusts (REITs). Major players like Equity Residential, Camden Property Trust, and Essex Property Trust operate in the same high-demand, dense urban markets. These competitors share similar financial muscle, operational scale, and strategic acumen, making the competition for prime development sites and attracting top-tier residents fierce.

AvalonBay Communities faces heightened competitive rivalry due to record-breaking levels of new apartment supply entering key markets. In 2024, several major metropolitan areas experienced significant deliveries of new apartment units, putting pressure on existing properties to attract and retain residents. This influx of new supply often translates into increased marketing spend and a greater willingness to offer concessions, such as rent discounts or waived fees, to maintain occupancy rates.

AvalonBay Communities faces intense rivalry as many competitors actively pursue the same affluent renter demographic in similar urban and suburban markets. This overlap means companies like Equity Residential and UDR, Inc. are often vying for the same high-quality apartment units and the same tenant base.

The similarity in property types, typically Class A multifamily apartments, and the focus on similar target renters means that competitive advantages are often derived from nuanced factors. AvalonBay, for instance, might differentiate through superior amenity packages, prime locations within desirable neighborhoods, or exceptional customer service, as seen in its focus on resident experience.

In 2024, the multifamily sector continues to see strong demand, particularly in Sun Belt cities where AvalonBay has a significant presence. However, this demand also attracts substantial new supply, increasing the pressure on existing operators to maintain occupancy and rental rates. For example, markets like Austin and Denver, key AvalonBay locations, experienced significant apartment deliveries in early 2024, intensifying competition.

Aggressive Development and Acquisition Strategies

Competitors in the multifamily real estate sector are aggressively pursuing growth through both new construction and property acquisitions. This intense activity leads to a more crowded market, intensifying the competition for prime locations and desirable tenant demographics. AvalonBay must therefore continuously invest in its own development pipeline and pursue strategic acquisitions to keep pace and maintain its market standing.

The landscape is characterized by a constant influx of new supply, with major players like Equity Residential and UDR also actively developing and acquiring properties. For instance, in 2024, AvalonBay reported commencing development on approximately 3,000 new apartment homes, while also completing 2,500 homes. This level of activity mirrors the broader industry trend where significant capital is being deployed to expand portfolios.

- Market Saturation: Competitors’ aggressive development and acquisition strategies are increasing the supply of rental units, leading to heightened competition for tenants.

- Strategic Imperative: AvalonBay must maintain a strong development pipeline and execute strategic acquisitions to counter rivals' expansion and secure market share.

- Industry Activity: In 2024, major REITs like AvalonBay, Equity Residential, and UDR were actively engaged in significant development and acquisition projects, reflecting robust industry growth and competition.

Focus on Sustainability and ESG

The competitive rivalry within the multifamily real estate sector is intensifying as companies increasingly emphasize sustainability and Environmental, Social, and Governance (ESG) factors. This trend is driven by growing demand from both investors and residents who prioritize environmentally responsible practices and strong corporate governance.

AvalonBay Communities, recognized for its robust ESG reporting, faces pressure to continuously innovate in sustainability to retain its competitive advantage. Attracting and retaining environmentally conscious residents and investors requires ongoing commitment to green building practices, energy efficiency, and community engagement initiatives.

In 2023, AvalonBay reported significant progress in its ESG efforts, including a reduction in greenhouse gas emissions intensity by 15% compared to its 2019 baseline. This focus on sustainability is crucial as competitors also ramp up their own ESG programs, making it a key differentiator in the market.

- Investor Demand: A 2024 survey indicated that over 70% of institutional investors consider ESG factors when making real estate investment decisions.

- Resident Preferences: Data from 2024 shows that 60% of renters are willing to pay a premium for apartments with strong sustainability features.

- Competitive Landscape: Major competitors like Equity Residential and Greystar have also launched ambitious sustainability targets, including net-zero carbon goals for their portfolios by 2050.

Competitive rivalry in the multifamily sector is intense, with major players like AvalonBay Communities, Equity Residential, and Camden Property Trust vying for prime locations and renters. This competition is amplified by significant new apartment deliveries across key markets in 2024, forcing companies to offer concessions to maintain occupancy.

The pursuit of affluent renters in similar urban and suburban areas means direct competition for both properties and tenants. Differentiators like superior amenities and resident experience are crucial, as seen in AvalonBay's focus on resident satisfaction.

Industry-wide, companies are aggressively expanding through development and acquisitions. For example, AvalonBay commenced development on approximately 3,000 new homes in 2024, a pace mirrored by competitors, highlighting the constant need for strategic growth to maintain market share.

Sustainability is also a growing battleground, with 70% of institutional investors considering ESG factors in 2024. AvalonBay's 15% reduction in greenhouse gas emissions intensity (vs. 2019) is a key differentiator, as competitors like Equity Residential also set ambitious net-zero targets.

| Competitor | 2024 Development Starts (Approx.) | Key Markets | ESG Focus |

|---|---|---|---|

| AvalonBay Communities | 3,000 homes | Dense Urban, Suburban | 15% GHG reduction (vs. 2019) |

| Equity Residential | Significant | Major Metro Areas | Net-zero carbon goals |

| Camden Property Trust | Significant | Sun Belt, Urban | Increasing focus |

SSubstitutes Threaten

The rising appeal of single-family rentals (SFRs) presents a growing threat of substitutes for apartment operators like AvalonBay Communities. Demand for SFRs surged, with the sector seeing significant investment and growth, especially in 2023 and early 2024. This trend is fueled by factors like elevated homeownership costs, a desire for more space and privacy, and the continued flexibility afforded by remote work arrangements, making SFRs an attractive alternative to traditional apartment living.

The threat of substitutes for AvalonBay Communities, specifically concerning homeownership, hinges on future market conditions. While high mortgage rates in 2024 have made buying less appealing, a substantial drop in interest rates or a significant cooling of home prices could dramatically shift consumer preference towards purchasing a home. For instance, if mortgage rates were to fall to 5% from their current levels around 7%, it would significantly lower monthly payments, making homeownership a more viable and attractive alternative to renting.

A market where buying becomes more affordable and desirable directly substitutes for renting apartment units. This could lead to increased demand for single-family homes and condominiums, thereby reducing the pool of potential renters for communities like those managed by AvalonBay. Such a shift would represent a considerable threat, as it directly impacts the core customer base for apartment REITs.

Condominiums and townhouses offer a compelling alternative for those desiring ownership and more personal space than a rental unit. In 2024, the median existing condo price reached approximately $330,000, while townhouses averaged around $430,000, according to the National Association of Realtors. This makes them attractive substitutes for individuals and families looking to build equity and establish long-term residency in areas where AvalonBay Communities has a presence.

Co-Living and Alternative Housing Models

Emerging co-living and alternative housing models present a potential substitute threat to traditional apartment rentals. These options, like purpose-built shared housing, offer greater flexibility and often lower costs, appealing particularly to younger renters prioritizing community and affordability. For instance, in 2024, the co-living market continued its expansion, with reports indicating a steady increase in occupancy rates for established providers in major urban centers.

While these models remain a niche, their growth suggests a long-term substitution possibility. They cater to a segment of the market that may prioritize shared amenities and social interaction over private space. The affordability aspect is a key driver, especially as rental prices in many markets remain elevated.

- Co-living growth: While specific global market size figures for 2024 are still being finalized, industry analysts projected continued double-digit percentage growth in the co-living sector in key North American and European cities.

- Affordability driver: Studies from late 2023 and early 2024 consistently show that a significant percentage of renters, particularly those aged 18-34, cite cost as a primary factor in their housing decisions.

- Demographic appeal: Co-living's emphasis on community and shared resources directly addresses the preferences of younger demographics who may be less focused on traditional homeownership and more on flexible, experience-driven living.

Economic Downturn Leading to Doubling Up

During significant economic downturns, a notable shift in consumer behavior can emerge where individuals opt to share living spaces with family or friends to cut down on individual housing expenses. This trend directly impacts the demand for traditional rental apartments, as people prioritize cost savings over independent living arrangements.

This "doubling up" phenomenon, while not a direct substitute product in the traditional sense, acts as a powerful substitute force by diminishing the overall pool of potential renters. For instance, in 2023, reports indicated an increase in multi-generational households as a cost-saving measure. This behavioral adaptation directly reduces the addressable market for apartment communities.

- Reduced Demand: Economic hardship encourages sharing living spaces, decreasing the need for individual rental units.

- Cost-Saving Behavior: Consumers prioritize affordability, leading to a preference for cohabitation over solo renting.

- Market Impact: This trend directly shrinks the customer base for apartment operators like AvalonBay Communities.

The threat of substitutes for AvalonBay Communities remains a dynamic factor, influenced by evolving housing preferences and economic conditions. Single-family rentals (SFRs) continue to gain traction, driven by a desire for space and the flexibility of remote work, with the SFR sector experiencing robust investment in 2023 and early 2024. Furthermore, shifts in homeownership affordability, particularly the impact of mortgage rates, can significantly alter the rental market landscape. For example, a notable decrease in mortgage rates, such as a drop from approximately 7% to 5%, would make home buying considerably more attractive, directly impacting demand for apartments.

| Substitute Type | Key Drivers | 2024 Data/Trends |

|---|---|---|

| Single-Family Rentals (SFRs) | Desire for space, privacy, remote work flexibility | Continued investment and growth, appealing to those seeking ownership-like benefits without the commitment. |

| Homeownership (Condos/Townhouses) | Building equity, long-term residency, personal space | Median existing condo price around $330,000; townhouses around $430,000. Affordability hinges on mortgage rates. |

| Co-living/Alternative Housing | Affordability, community, flexibility | Projected double-digit percentage growth in key cities; appeals to younger demographics prioritizing cost and social interaction. |

| "Doubling Up" (Cohabitation) | Cost-saving during economic downturns | Observed increase in multi-generational households in 2023 as a cost-reduction strategy, directly shrinking the renter pool. |

Entrants Threaten

Developing high-quality apartment communities in major metropolitan areas, which is AvalonBay's core business, demands significant capital. We're talking about substantial investments for acquiring prime land, covering construction costs, and putting in necessary infrastructure. For example, in 2024, the average cost to build a new multifamily unit in a major U.S. city can easily exceed $300,000, with some projects running into the hundreds of millions.

These massive upfront financial requirements act as a formidable barrier to entry. It effectively deters many smaller or less capitalized companies from even attempting to compete with established players like AvalonBay, thus protecting its market position.

The real estate development sector, particularly in bustling urban centers, is characterized by a labyrinth of zoning regulations, extensive environmental impact assessments, and multifaceted permitting requirements. These complex processes demand specialized knowledge and considerable time investment, effectively deterring nascent competitors from entering the market.

The scarcity of desirable land acts as a significant barrier to entry for new apartment developers. AvalonBay Communities, for instance, focuses its strategy on markets where prime development sites are exceptionally hard to find and command premium prices. This limited availability means that new players face immense difficulty in securing the necessary land to even begin operations.

Acquiring these sought-after parcels requires substantial capital, deep understanding of local real estate dynamics, and established connections within the industry. For example, in 2024, the average cost per acre for developable land in many of AvalonBay's target coastal markets continued to rise, often exceeding millions of dollars, making it prohibitive for less capitalized entrants.

Established Brand Reputation and Development Expertise

AvalonBay Communities boasts a formidable brand reputation cultivated over years of developing and managing premium apartment properties. This established recognition, coupled with extensive development expertise, presents a significant barrier for newcomers. Replicating AvalonBay's operational efficiency and nuanced understanding of market dynamics would require substantial time and investment.

New entrants face the challenge of building a comparable level of trust and brand loyalty. For instance, in 2024, AvalonBay reported a strong occupancy rate across its portfolio, underscoring the continued demand for its well-managed communities. This consistent performance reinforces its market position and makes it difficult for less experienced competitors to gain traction.

- Brand Equity: AvalonBay's established name signifies quality and reliability, a difficult asset for new entrants to quickly acquire.

- Development Expertise: Years of experience in site selection, construction, and project management provide a competitive edge.

- Operational Efficiency: Proven systems for property management and tenant relations contribute to higher profitability and customer satisfaction.

- Market Insight: Deep understanding of local housing trends and resident needs allows for more effective product development and pricing strategies.

Economies of Scale and Operational Efficiencies

Economies of scale significantly deter new entrants in the multifamily REIT sector, with established players like AvalonBay Communities leveraging their size. In 2024, AvalonBay's substantial portfolio, spanning numerous markets, allows for bulk purchasing of supplies and services, driving down per-unit operating costs. This scale also translates to more favorable terms with lenders, reducing their cost of capital compared to emerging competitors.

Operational efficiencies gained through years of experience in property management and leasing are another barrier. AvalonBay's sophisticated management systems and trained personnel optimize occupancy rates and tenant retention, contributing to consistent revenue streams. For instance, their ability to implement advanced technology for property maintenance and tenant communication can create cost savings that smaller entities struggle to match.

These advantages create a challenging landscape for new entrants:

- Lower Cost Structure: Established REITs benefit from economies of scale, reducing per-unit operating expenses.

- Superior Access to Capital: Larger entities secure more favorable financing terms, lowering their overall cost of capital.

- Operational Expertise: Years of experience lead to optimized management practices and improved efficiency.

The threat of new entrants for AvalonBay Communities is generally low, primarily due to the substantial capital requirements and regulatory hurdles inherent in developing large-scale apartment communities in desirable urban areas. These barriers significantly limit the number of companies that can realistically enter the market and compete effectively.

The sheer cost of land acquisition and construction in major metropolitan areas presents a formidable obstacle. For example, in 2024, the average cost per unit for new multifamily construction in gateway cities often surpassed $350,000, with some projects reaching well over $500,000 per unit, making it difficult for less capitalized firms to enter.

Furthermore, established players like AvalonBay benefit from strong brand recognition and operational expertise, which are difficult and time-consuming for new entrants to replicate. This includes efficient property management, tenant relations, and a deep understanding of local market dynamics, all of which contribute to their sustained competitive advantage.

| Barrier to Entry | Impact on New Entrants | Example Data (2024) |

|---|---|---|

| Capital Requirements | High; significant investment needed for land and construction. | Average multifamily construction cost per unit: $350,000+ in major U.S. cities. |

| Regulatory Hurdles | Moderate to High; complex zoning, permitting, and environmental reviews. | Permitting processes can add 6-18 months to development timelines. |

| Brand Reputation & Expertise | High; established firms have trust and operational efficiency. | AvalonBay's portfolio occupancy rates consistently above 95% indicate strong market demand and management. |

| Land Scarcity | High; prime locations are limited and expensive. | Land costs in prime urban markets can represent 20-30% of total project development costs. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for AvalonBay Communities is built upon a foundation of verified data, including AvalonBay's annual reports, SEC filings, and industry-specific market research from firms like IBISWorld and Marcus & Millichap. This blend of company disclosures and expert industry analysis provides a comprehensive view of the competitive landscape.