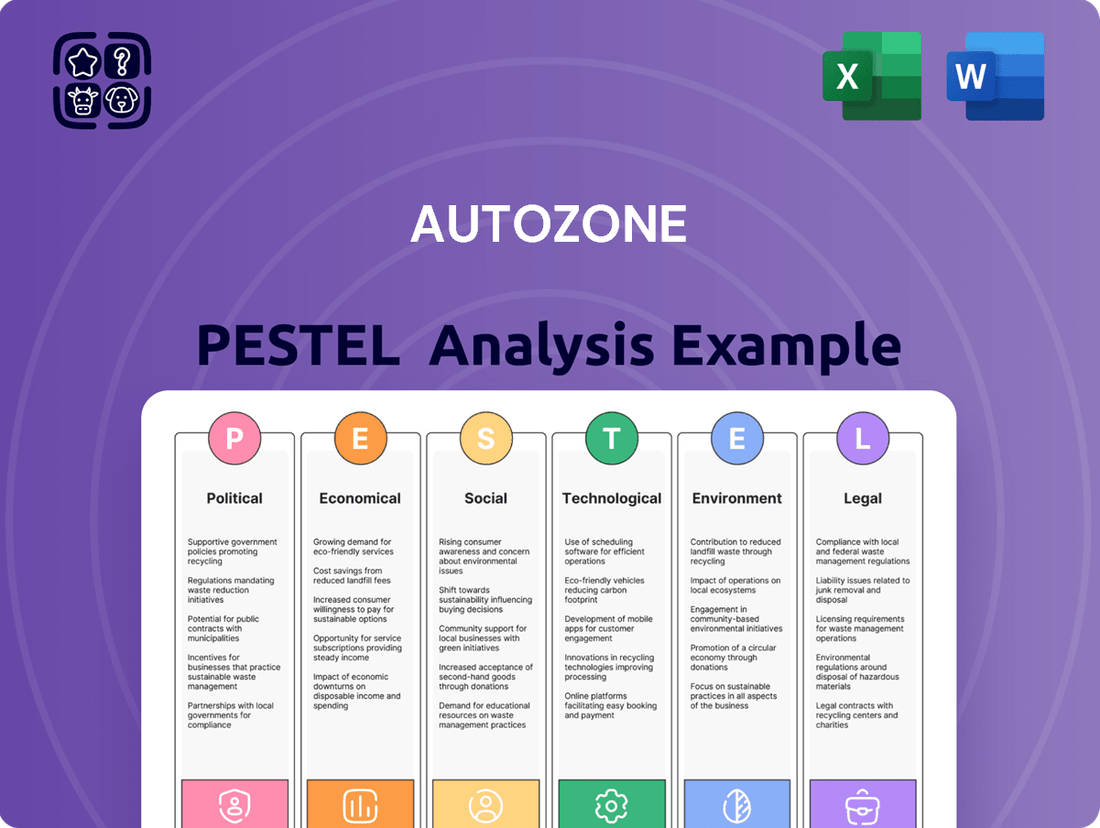

AutoZone PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AutoZone Bundle

Unlock the critical external factors shaping AutoZone's trajectory with our comprehensive PESTLE analysis. From evolving consumer behaviors to technological advancements, understand the forces driving change in the automotive aftermarket. Gain a strategic advantage by downloading the full report and making informed decisions for your business.

Political factors

Government regulations significantly shape AutoZone's operations, particularly concerning vehicle safety and emissions standards. For instance, evolving emissions mandates, such as those pushed by the EPA in 2024 and expected to be further refined through 2025, directly impact the demand for specific catalytic converters and exhaust system components that AutoZone must stock. Changes in these standards can either boost sales of compliance-related parts or necessitate adjustments in inventory to phase out non-compliant items.

Stricter safety regulations, like updated requirements for airbag systems or advanced driver-assistance systems (ADAS) components, could increase the need for specialized parts and trained technicians. Conversely, any relaxation in these rules might shift market demand towards more basic maintenance items. AutoZone's proactive monitoring of legislative proposals, such as potential updates to OBD-II diagnostic requirements anticipated in the 2025 model year, is essential for strategic inventory management and service offering alignment.

AutoZone's reliance on a global supply chain makes it particularly sensitive to international trade policies and tariffs on automotive parts. Changes in these agreements, such as potential adjustments to existing free trade pacts or the imposition of new import duties, can directly increase the cost of goods sold. For instance, in 2024, ongoing discussions around trade relations between major automotive manufacturing regions could introduce new tariff structures, impacting the landed cost of components AutoZone sources internationally.

Consumer protection laws, such as those governing product quality and warranties, directly shape AutoZone's marketing strategies and customer service protocols. For instance, the Magnuson-Moss Warranty Act in the United States sets standards for written consumer product warranties, impacting how AutoZone communicates product guarantees and handles claims, thereby influencing customer satisfaction and potential legal exposure.

Compliance with these regulations is paramount for maintaining consumer trust and avoiding costly legal penalties. AutoZone's adherence to these consumer rights ensures fair business practices and safeguards its reputation in the competitive automotive aftermarket. A strong record of consumer protection can translate into increased customer loyalty and a more robust brand image.

Labor Laws and Employment Policies

Government policies significantly shape AutoZone's operational landscape, particularly concerning labor laws and employment. For instance, shifts in minimum wage requirements directly impact labor costs. In 2024, various states and cities continued to implement higher minimum wages, with some areas reaching or exceeding $15 per hour, which could increase AutoZone's payroll expenses in those regions.

Changes in regulations regarding employee benefits, such as paid sick leave or family leave, can also affect AutoZone's human resource strategies and overall operating expenses. Furthermore, policies influencing unionization efforts can impact labor relations and negotiation dynamics. AutoZone must remain agile in adapting its staffing, training, and compensation models to comply with evolving labor legislation, ensuring smooth employee relations and legal adherence.

- Minimum Wage Impact: As of early 2024, several U.S. states and cities have minimum wage rates above the federal $7.25 per hour, with projections indicating further increases in some jurisdictions throughout 2024 and into 2025.

- Employee Benefits Landscape: The trend towards expanded employee benefits, including paid time off and healthcare mandates, continues to be a key consideration for businesses like AutoZone.

- Unionization Trends: While specific unionization rates for AutoZone employees aren't publicly detailed, broader trends in retail and automotive sectors show varied union activity, requiring ongoing monitoring.

Political Stability and Government Spending

AutoZone's operations are significantly shaped by the political stability within its primary markets, particularly the United States and Mexico. A stable political landscape directly correlates with business confidence, encouraging investment and bolstering consumer spending on vehicle maintenance and parts. For instance, the U.S. has maintained a relatively stable political environment, crucial for AutoZone's consistent performance.

Government spending, especially on infrastructure, plays a vital role. Increased investment in road networks and transportation infrastructure, as seen in various government stimulus packages and infrastructure bills, can lead to higher vehicle usage and, consequently, greater demand for automotive parts and repair services. As of early 2024, the U.S. continues to implement aspects of the Infrastructure Investment and Jobs Act, aiming to modernize roads and bridges, which is a positive indicator for the automotive aftermarket sector.

- Political Stability: The U.S. remains a key market with a generally stable political climate, supporting consistent operational conditions for AutoZone.

- Government Infrastructure Spending: Ongoing infrastructure projects in the U.S., funded by initiatives like the Infrastructure Investment and Jobs Act, are projected to boost vehicle miles traveled and aftermarket demand.

- Regulatory Environment: Changes in automotive emissions standards or safety regulations can impact the types of parts and services in demand, requiring AutoZone to adapt its inventory and offerings.

Government regulations significantly influence AutoZone's product demand and operational costs, particularly concerning vehicle safety and emissions standards. For example, evolving EPA emissions mandates, with further refinements expected through 2025, directly impact the need for specific catalytic converters and exhaust components. Stricter safety rules for systems like ADAS could also increase demand for specialized parts.

International trade policies and tariffs on automotive parts present another key political factor for AutoZone. Changes in free trade agreements or the imposition of new import duties in 2024 could increase the cost of goods sourced globally. Consumer protection laws also shape AutoZone's marketing and customer service, ensuring fair practices and brand reputation.

Political stability in key markets like the U.S. supports consistent business operations and consumer spending on vehicle maintenance. Government infrastructure spending, such as ongoing projects from the U.S. Infrastructure Investment and Jobs Act, is projected to increase vehicle usage and aftermarket demand through 2025.

What is included in the product

This PESTLE analysis offers a comprehensive examination of the external forces impacting AutoZone, detailing how Political, Economic, Social, Technological, Environmental, and Legal factors create both challenges and advantages.

AutoZone's PESTLE analysis provides a clear, summarized version of external factors, acting as a pain point reliver by simplifying complex market dynamics for easier referencing during strategic planning meetings.

Economic factors

Consumer disposable income is a big deal for companies like AutoZone. When people have more money left over after paying for necessities, they're more likely to spend it on their cars, whether it's for routine maintenance or those cool accessories. For instance, the U.S. personal disposable income saw a notable increase, reaching an annualized rate of $22.5 trillion in Q1 2024, according to the Bureau of Economic Analysis. This suggests a generally favorable environment for discretionary spending.

Conversely, if the economy tightens up and people have less disposable income, they might put off non-essential car repairs or look for the cheapest parts available. This could directly impact AutoZone's sales numbers. The U.S. inflation rate, while moderating, remained a factor in consumer purchasing power throughout 2023 and into early 2024, potentially influencing how much discretionary funds households had available for automotive needs.

Fluctuations in fuel prices significantly shape consumer behavior regarding vehicle usage. For instance, as of mid-2024, average gasoline prices in the U.S. have hovered around $3.50 per gallon, a moderate increase from the previous year. This can lead drivers to curtail non-essential trips, potentially reducing the mileage driven and thus the wear and tear on their vehicles.

This shift in driving habits directly impacts the automotive aftermarket. When consumers drive less due to higher fuel costs, the demand for replacement parts like filters, brakes, and tires may see a slowdown. Conversely, periods of lower fuel prices, such as those experienced in late 2023 when prices dipped below $3.00 in some regions, can encourage more driving, leading to increased vehicle usage and a subsequent rise in demand for auto parts and maintenance services.

Inflation presents a direct challenge to AutoZone by increasing the cost of inventory and operational expenses. For instance, if the Producer Price Index (PPI) for automotive parts sees a significant uptick, AutoZone may struggle to absorb these higher costs without impacting its profit margins, especially if consumers resist price increases. This dynamic directly affects the company's ability to maintain profitability.

Rising interest rates, as indicated by Federal Reserve policy shifts, can curb consumer spending on discretionary items like car repairs and upgrades. Higher borrowing costs also affect AutoZone's own capital expenditures for store expansion or inventory management. For example, a potential increase in the prime lending rate could make financing new store openings or large inventory purchases more costly, potentially slowing growth initiatives.

These economic forces, inflation and interest rates, are critical as they directly shape consumer purchasing power and the cost of doing business. As of early 2024, inflation rates have shown some moderation from their peaks, but remain a key consideration, while interest rates continue to be influenced by ongoing economic adjustments, impacting AutoZone's financial strategy and sales outlook.

Supply Chain Costs and Disruptions

Global supply chain bottlenecks, a persistent issue extending into 2024 and projected for 2025, directly impact AutoZone's operational efficiency. These bottlenecks, coupled with rising raw material prices and elevated transportation costs, create significant hurdles in procuring auto parts at predictable and stable prices. For instance, the cost of key metals like steel and aluminum, essential for many automotive components, has seen considerable volatility.

Disruptions in the supply chain can trigger inventory shortages, forcing AutoZone to potentially miss sales opportunities and leading to increased operating expenses due to expedited shipping or premium sourcing. The average cost of shipping a forty-foot container globally remained elevated throughout 2023 and into early 2024, impacting the landed cost of goods. Building supply chain resilience is therefore a paramount strategy for AutoZone to navigate these economically volatile periods effectively.

- Global shipping costs: While some easing occurred, container shipping rates in early 2024 remained notably higher than pre-pandemic levels, impacting AutoZone's import costs.

- Raw material price inflation: Prices for key commodities like steel and aluminum experienced significant upward pressure in 2023 and early 2024, directly affecting the cost of manufactured auto parts.

- Inventory management challenges: Supply chain disruptions led to an average inventory holding period increase for many retailers in 2023, indicating the difficulty in maintaining optimal stock levels.

Used Vehicle Market Health

The used vehicle market is a significant driver for AutoZone, as older cars typically need more parts and service. A robust used car market, especially one with a substantial number of aging vehicles, directly translates to sustained demand for aftermarket auto parts. For instance, in early 2024, the average age of vehicles on U.S. roads reached a record high of 12.6 years, indicating a strong potential customer base for AutoZone's offerings.

This aging fleet means more components are likely to wear out and require replacement, benefiting AutoZone’s sales. Data from Cox Automotive indicated that the average listing price for used vehicles saw a slight decrease in the first quarter of 2024 compared to the previous year, potentially making used cars more accessible and further bolstering the market size.

- Record Average Vehicle Age: The average age of vehicles on U.S. roads hit 12.6 years in early 2024, a key indicator for demand in the aftermarket parts sector.

- Used Vehicle Price Trends: While fluctuating, average used vehicle listing prices showed some softening in early 2024, which could stimulate sales volume.

- Demand Correlation: A larger and older used vehicle population directly correlates with increased demand for maintenance and repair parts, AutoZone's core business.

Consumer disposable income, a key economic indicator, directly influences AutoZone's sales. As of Q1 2024, U.S. personal disposable income reached an annualized rate of $22.5 trillion, suggesting a favorable environment for discretionary spending on vehicle maintenance and parts. However, inflation, with the U.S. CPI moderating but still a factor in early 2024, can reduce this discretionary spending power.

Fuel prices also play a crucial role; average U.S. gasoline prices around $3.50 per gallon in mid-2024 may curb driving, potentially reducing wear and tear and thus demand for parts. Conversely, lower prices, like those below $3.00 in late 2023, encourage more driving. Rising interest rates, influenced by Federal Reserve policy, can also dampen consumer spending and increase AutoZone's borrowing costs for expansion.

Supply chain disruptions and raw material costs, such as for steel and aluminum, continue to impact AutoZone's procurement and operational expenses into 2024 and 2025, with global shipping costs remaining elevated compared to pre-pandemic levels. The average age of vehicles on U.S. roads hit a record 12.6 years in early 2024, a positive sign for aftermarket parts demand.

| Economic Factor | Trend (Early 2024/Mid 2024) | Impact on AutoZone |

| Disposable Income | Annualized rate of $22.5 trillion (Q1 2024) | Supports discretionary spending on parts and services. |

| Inflation (CPI) | Moderating but persistent factor | Can reduce consumer purchasing power for non-essential repairs. |

| Fuel Prices | ~$3.50/gallon (Mid-2024) | Higher prices may reduce driving, impacting wear-and-tear demand. |

| Interest Rates | Influenced by economic adjustments | Can increase borrowing costs and dampen consumer spending. |

| Supply Chain Costs | Elevated shipping, volatile raw materials | Increases procurement costs and operational expenses. |

| Vehicle Age | 12.6 years (Record high, Early 2024) | Drives demand for replacement parts and services. |

Preview Before You Purchase

AutoZone PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This detailed AutoZone PESTLE analysis breaks down the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company, providing a comprehensive strategic overview.

Sociological factors

The average age of vehicles in operation in the United States reached a record 12.5 years in 2022, according to the Bureau of Transportation Statistics. This aging trend directly fuels demand for AutoZone's core business: replacement parts and maintenance services. As vehicles age, they naturally require more frequent repairs, creating a sustained market for AutoZone's products.

Consumers are increasingly opting to repair and maintain their existing vehicles rather than purchasing new ones, a trend amplified by economic factors and supply chain disruptions impacting new vehicle availability. For instance, new car prices saw significant increases throughout 2023 and into early 2024, further incentivizing owners to extend the life of their current vehicles.

Societal shifts between do-it-yourself (DIY) and do-it-for-me (DIFM) vehicle maintenance directly impact AutoZone's customer mix. A growing DIY movement, fueled by online tutorials and a desire for cost savings, increases demand for parts and tools sold directly to consumers. For instance, a 2024 survey indicated that 35% of vehicle owners performed some level of DIY maintenance, up from 30% in 2022.

Conversely, a stronger preference for DIFM services, driven by busy schedules or complex repairs, would necessitate a greater focus on AutoZone's relationships with professional repair shops. AutoZone strategically caters to both segments, offering a broad product range for DIYers and bulk purchasing options and credit lines for professional mechanics, ensuring adaptability to evolving consumer preferences.

Growing public awareness of environmental issues significantly shapes consumer preferences, with a notable increase in demand for recycled auto parts and eco-friendly products. For instance, a 2024 survey indicated that over 60% of vehicle owners consider sustainability when making automotive repair decisions. This trend necessitates that AutoZone adapt its inventory and operational strategies to meet these evolving consumer values and potentially offer more sustainable alternatives.

Technological Literacy of Consumers

The growing technological sophistication of vehicles presents a significant challenge for consumers attempting DIY repairs. As cars integrate more complex electronics and software, the average consumer's ability to diagnose and fix issues diminishes, potentially shifting demand towards professional services. AutoZone needs to adapt by providing accessible, user-friendly diagnostic tools for the DIY segment while also catering to the needs of professional mechanics who require more advanced solutions.

This trend is reflected in consumer behavior: a 2024 survey indicated that only 35% of vehicle owners feel confident performing even basic maintenance, a decrease from 45% in 2022. Consequently, AutoZone's product strategy must consider this evolving technological literacy.

- Consumer Confidence: Declining DIY repair confidence due to vehicle complexity.

- Market Shift: Increased reliance on professional repair services.

- AutoZone's Role: Balancing advanced tools for DIYers with support for professional mechanics.

Urbanization and Transportation Habits

Urbanization continues to reshape how people move, with a growing number of individuals opting for city living. This shift directly impacts transportation habits. For instance, in the US, the percentage of people living in urban areas has steadily increased, reaching approximately 83% by 2023, according to UN data. This trend often leads to a greater reliance on public transportation, cycling, or ride-sharing services, potentially decreasing personal car ownership and the frequency of individual vehicle use.

These evolving transportation preferences can have a tangible effect on the automotive aftermarket. A decline in personal vehicle usage, driven by urban density and alternative transit options, could translate to reduced demand for automotive parts and accessories. AutoZone must remain attuned to these long-term societal transformations and their implications for consumer behavior.

- Urban Population Growth: Over 83% of the US population resided in urban areas by 2023.

- Shifting Mobility: Increased adoption of public transit and ride-sharing services is observed in urban centers.

- Demand Impact: Reduced personal vehicle usage may lead to lower demand for auto parts and maintenance.

- Strategic Monitoring: AutoZone needs to track these demographic and behavioral trends to adapt its business strategy.

The aging vehicle fleet, with the average car in the US reaching 12.5 years in 2022, directly benefits AutoZone by increasing the need for repairs and parts. This trend, coupled with new car price hikes in 2023-2024, encourages consumers to maintain existing vehicles, boosting DIY and professional repair markets. AutoZone's strategy to serve both DIYers and professional mechanics allows it to adapt to these shifts.

Consumer confidence in performing DIY repairs has declined, with only 35% of owners feeling capable of basic maintenance in 2024, down from 45% in 2022. This shift increases reliance on professional services, requiring AutoZone to offer advanced tools for DIYers and robust support for mechanics.

Urbanization, with over 83% of the US population in urban areas by 2023, leads to increased use of public transit and ride-sharing, potentially reducing personal vehicle usage and demand for auto parts. AutoZone must monitor these mobility trends to adjust its business strategy.

| Sociological Factor | Trend | Impact on AutoZone | Supporting Data |

|---|---|---|---|

| Vehicle Aging | Increasing average vehicle age | Higher demand for replacement parts and maintenance | US average vehicle age: 12.5 years (2022) |

| DIY vs. DIFM Preference | Declining DIY confidence, rising DIFM reliance | Need to cater to both DIYers (tools) and professionals (support) | 35% DIY confidence (2024) vs. 45% (2022) |

| Urbanization & Mobility | Shift towards urban living and alternative transit | Potential decrease in personal vehicle usage and demand | 83% US urban population (2023) |

| Environmental Awareness | Growing demand for sustainable options | Opportunity to offer recycled parts and eco-friendly products | 60%+ consider sustainability in repairs (2024) |

Technological factors

The automotive industry is experiencing a technological revolution, with electric vehicles (EVs) and advanced driver-assistance systems (ADAS) rapidly gaining market share. By early 2024, global EV sales had surpassed 10 million units annually, a significant jump from just over 3 million in 2020. This shift necessitates a constant evolution in AutoZone's product offerings and technician expertise, as EVs and ADAS-equipped vehicles require specialized components like battery management systems and advanced sensors, along with new diagnostic tools and repair protocols.

AutoZone's ability to adapt its inventory and training programs to accommodate these technological advancements is crucial for maintaining its competitive edge. For instance, the demand for EV-specific parts, such as high-voltage batteries and charging equipment, is projected to grow substantially in the coming years. Failure to stock and support these emerging technologies could lead to lost sales and a diminished market position, while successful adaptation presents a significant growth opportunity.

The rise of e-commerce and digital platforms significantly impacts AutoZone's approach to selling auto parts. Consumers increasingly prefer the convenience of online ordering and home delivery, making a strong digital presence essential. For instance, AutoZone reported that its e-commerce sales grew by 15% in the fiscal year 2023, highlighting the growing importance of this channel.

To stay competitive, AutoZone must continue investing in its online infrastructure, including user-friendly websites, mobile applications, and efficient order fulfillment processes that integrate seamlessly with its physical stores. This focus on digital convenience is paramount for capturing market share among today's digitally-savvy customers.

Technological advancements in vehicle diagnostic equipment and repair tools directly impact AutoZone's product offerings and service capabilities. The company's ability to provide and support cutting-edge diagnostic solutions is crucial for both its DIY customer base and professional mechanic clients seeking to efficiently identify and resolve vehicle issues.

For instance, the increasing complexity of vehicle electronics, including advanced driver-assistance systems (ADAS) and electric vehicle (EV) powertrains, necessitates sophisticated diagnostic tools. AutoZone's investment in and availability of these tools, such as advanced scan tools and specialized EV repair equipment, directly supports customer needs. In 2024, the automotive repair market saw continued growth in demand for specialized diagnostic services, with the global automotive diagnostic equipment market projected to reach over $30 billion by 2025, highlighting the importance of AutoZone staying at the forefront of these technological shifts.

Data Analytics and Inventory Management

AutoZone leverages big data analytics and sophisticated inventory management systems to fine-tune its product offerings and anticipate customer needs. This technological edge allows for more accurate demand forecasting and streamlined supply chain operations.

By analyzing vast amounts of customer purchasing data, AutoZone ensures that the most sought-after parts are consistently in stock, directly impacting customer satisfaction and operational efficiency. This data-driven approach minimizes stockouts and reduces costly overstocking.

- Optimized Product Assortment: Data analytics helps tailor inventory to local demand, increasing sales.

- Demand Prediction: Advanced algorithms forecast part needs, improving stock availability.

- Supply Chain Efficiency: Technology streamlines logistics, reducing costs and delivery times.

- Reduced Waste: Better inventory control minimizes obsolescence and spoilage.

Automation in Distribution and Logistics

Automation in distribution and logistics is rapidly transforming how companies like AutoZone manage their supply chains. The adoption of technologies such as automated guided vehicles (AGVs), robotic picking systems, and advanced sortation equipment is becoming crucial for maintaining a competitive edge. These innovations directly impact efficiency and cost-effectiveness.

For AutoZone, implementing automation in its warehouses and distribution centers can lead to substantial improvements. For instance, automated systems can significantly speed up order fulfillment processes, ensuring that the right parts reach stores and customers faster. This enhanced speed is vital in the automotive aftermarket, where timely delivery is a key differentiator.

Furthermore, automation offers a direct pathway to reducing labor costs. As wages rise and labor availability fluctuates, automated solutions can handle repetitive and physically demanding tasks, freeing up human workers for more complex roles. This not only lowers operational expenses but also improves overall accuracy and reduces errors in the picking and packing stages. By 2024, the global warehouse automation market was projected to reach over $30 billion, highlighting the significant investment and growth in this sector.

- Enhanced Efficiency: Automated systems can process orders at a much higher rate than manual methods, improving turnaround times for AutoZone's extensive product catalog.

- Cost Reduction: By minimizing manual labor and reducing errors, automation contributes to lower operational costs in distribution centers.

- Improved Accuracy: Robotic systems and advanced software minimize picking and shipping errors, ensuring customers and stores receive the correct parts.

- Scalability: Automated logistics solutions allow AutoZone to scale its operations more effectively to meet fluctuating demand without proportional increases in staffing.

The automotive industry's rapid technological evolution, particularly the rise of electric vehicles (EVs) and advanced driver-assistance systems (ADAS), necessitates continuous adaptation from AutoZone. By early 2024, global EV sales exceeded 10 million units annually, demanding specialized parts like battery management systems and advanced sensors. AutoZone's ability to integrate these into its inventory and training is paramount for future growth.

The increasing complexity of vehicle electronics, including ADAS and EV powertrains, drives the need for sophisticated diagnostic tools. AutoZone's provision of advanced scan tools and specialized EV repair equipment directly addresses this market trend. The global automotive diagnostic equipment market is projected to surpass $30 billion by 2025, underscoring the importance of staying current.

Technological advancements in automation are transforming AutoZone's supply chain. Automated systems in warehouses, such as AGVs and robotic picking, enhance efficiency and reduce costs. The global warehouse automation market was expected to exceed $30 billion in 2024, indicating a significant industry shift towards these solutions.

| Technological Factor | Impact on AutoZone | Supporting Data/Trend |

| EVs and ADAS Adoption | Need for specialized parts and technician training | Global EV sales surpassed 10 million annually by early 2024. |

| Diagnostic Tool Advancement | Requirement for sophisticated diagnostic equipment | Global automotive diagnostic equipment market projected to exceed $30 billion by 2025. |

| E-commerce Growth | Increased demand for online sales channels and digital platforms | AutoZone's e-commerce sales grew 15% in fiscal year 2023. |

| Supply Chain Automation | Opportunities for efficiency and cost reduction in logistics | Global warehouse automation market projected to exceed $30 billion in 2024. |

Legal factors

AutoZone operates under strict product liability laws and safety regulations, a critical legal factor impacting its operations. This means every automotive part and accessory sold must meet rigorous safety standards. Failure to comply can result in significant financial penalties, including expensive lawsuits and product recalls, which can severely damage the company's reputation.

For instance, in 2023, the automotive industry saw numerous recalls affecting millions of vehicles, highlighting the constant scrutiny on product safety. AutoZone's commitment to ensuring the quality and safety of its extensive product catalog is therefore not just a matter of legal adherence but also fundamental to maintaining consumer trust and avoiding costly legal entanglements. The company's ability to manage these legal risks directly influences its financial stability and market position.

Environmental regulations, particularly those concerning hazardous waste like used motor oil, batteries, and automotive fluids, significantly impact AutoZone's operational procedures. These laws mandate specific handling, storage, and disposal methods, requiring substantial investment in compliance infrastructure and training.

Failure to adhere to these environmental mandates can result in substantial financial penalties, reputational damage, and even operational shutdowns. For instance, the EPA's Resource Conservation and Recovery Act (RCRA) sets stringent standards for managing hazardous waste, and AutoZone must ensure all its locations are compliant, a continuous effort given the volume of materials handled.

AutoZone's commitment to sustainability is reflected in its efforts to manage recycling programs and waste streams efficiently. In 2023, the company continued to focus on responsible disposal and recycling of materials, aiming to minimize its environmental footprint and meet evolving regulatory expectations across its vast network of stores.

Intellectual property laws, encompassing patents, trademarks, and copyrights, are vital for safeguarding the innovative designs and established brands within the automotive parts sector. AutoZone, as a major retailer, must diligently ensure that the products it offers, especially aftermarket and generic components, do not infringe upon existing intellectual property rights. This vigilance is paramount to prevent costly legal battles with original equipment manufacturers (OEMs) and maintain its market standing.

Consumer Privacy and Data Protection Laws

AutoZone, like many retailers, navigates a complex landscape of consumer privacy and data protection laws. With the significant increase in digital transactions and online engagement, the company must adhere to regulations such as the California Consumer Privacy Act (CCPA) and similar state-level privacy laws enacted across the US. These laws grant consumers rights regarding their personal information, including the right to know what data is collected, how it's used, and to request its deletion. For instance, the CCPA, which has seen amendments and ongoing enforcement, requires businesses to be transparent about their data collection practices and provide clear opt-out mechanisms. Failure to comply can result in substantial fines; for example, the CCPA's statutory damages for data breaches can range from $100 to $750 per consumer per incident, or actual damages, whichever is greater.

Protecting customer data is paramount not only for legal compliance but also for maintaining customer trust. A data breach can severely damage AutoZone's reputation, leading to a loss of customer loyalty and potentially impacting sales. Recent trends show a heightened focus on cybersecurity and data governance, with regulatory bodies actively pursuing enforcement actions against companies that fall short. For example, in 2023, numerous companies faced significant penalties for privacy violations, underscoring the financial and reputational risks associated with inadequate data protection measures. AutoZone’s commitment to secure data handling is therefore a critical legal and business imperative.

The secure handling of personal and transactional data is a growing legal concern for all businesses operating in the digital space. AutoZone must ensure robust security protocols are in place to safeguard customer information against cyber threats. This includes encrypting data, implementing access controls, and regularly auditing their systems for vulnerabilities. The evolving nature of cyber threats means that continuous investment in cybersecurity infrastructure and employee training is essential to meet legal obligations and protect sensitive customer details.

Franchise and Business Operation Laws

Laws governing business operations, including zoning, licensing, and potential franchise regulations, directly influence AutoZone's store placement and operational capabilities. Compliance with these local, state, and federal statutes is paramount for seamless expansion and day-to-day functioning, dictating how AutoZone can establish and manage its physical footprint across various markets.

For instance, zoning laws can restrict the types of businesses permitted in certain areas, potentially limiting AutoZone’s access to prime retail locations. Similarly, obtaining necessary business licenses and permits at each level of government adds layers of procedural complexity and cost to opening new stores. AutoZone's commitment to adhering to these legal frameworks ensures operational continuity and avoids costly penalties or disruptions.

- Zoning Regulations: These laws dictate where AutoZone can build or lease retail spaces, impacting site selection and expansion strategies.

- Licensing and Permits: Obtaining and maintaining various business licenses and permits at federal, state, and local levels are ongoing requirements for operation.

- Franchise Laws: While AutoZone primarily operates company-owned stores, understanding franchise laws is crucial if considering future business model diversification.

- Compliance Costs: Adhering to these legal requirements involves ongoing investment in legal counsel, permit fees, and internal compliance teams.

AutoZone faces significant legal challenges related to product liability and safety regulations, requiring adherence to stringent standards for all automotive parts sold. Non-compliance can lead to costly lawsuits and recalls, impacting brand reputation and financial health, as seen with widespread automotive recalls in 2023 affecting millions of vehicles. Environmental laws also mandate specific handling and disposal of hazardous waste like used motor oil and batteries, necessitating investment in compliant infrastructure and continuous monitoring, with the EPA's RCRA setting critical standards.

Intellectual property laws are crucial for protecting AutoZone's brands and designs, demanding vigilance against infringement of patents and trademarks, especially with aftermarket parts. Furthermore, evolving data privacy laws, such as the CCPA, require robust measures to protect customer information, with significant penalties for breaches, as demonstrated by numerous companies facing fines in 2023 for privacy violations. Local zoning and licensing laws also shape AutoZone's operational footprint and expansion strategies, requiring ongoing compliance efforts to avoid disruptions.

Environmental factors

AutoZone must manage automotive waste like used oil, batteries, and tires responsibly. This includes adhering to regulations for disposal and recycling, which directly affects operational expenses and brand image. For instance, in 2023, the U.S. Environmental Protection Agency (EPA) reported that over 2.5 billion tires are stockpiled nationwide, highlighting the scale of the challenge.

AutoZone's operations, from its retail stores and distribution centers to its vehicle fleet, have a tangible impact on energy consumption and, consequently, its carbon footprint. The company is increasingly facing scrutiny from both government bodies and its customer base to curb this energy usage and explore greener alternatives like renewable energy sources.

Investing in energy efficiency measures presents a dual benefit for AutoZone. Not only can these initiatives translate into significant cost savings on utilities, but they also contribute to a more favorable brand image, resonating with environmentally conscious consumers. For instance, in fiscal year 2023, AutoZone reported operating 6,000+ stores, each with associated energy demands.

While AutoZone doesn't manufacture vehicles, it's significantly affected by evolving emissions standards. Stricter regulations, like those in California aiming for 100% zero-emission vehicle sales by 2035, indirectly boost demand for emission control parts such as catalytic converters and oxygen sensors that AutoZone sells. This necessitates careful inventory management and sourcing of compliant components.

Sustainable Sourcing and Supply Chain

Growing environmental concerns are increasingly prompting automotive retailers like AutoZone to scrutinize their supply chains. This includes evaluating the sustainability of raw material sourcing and the manufacturing processes of the parts they sell. For instance, the automotive industry's push towards greener manufacturing saw a 15% increase in demand for recycled automotive parts in 2024, a trend likely to continue.

AutoZone may encounter pressure to prioritize suppliers demonstrating robust environmental credentials and to embed ethical and sustainable practices throughout its procurement operations. This can influence vendor selection and the overall product assortment offered to customers. Companies that fail to adapt may face reputational damage and potential loss of market share, as consumer preference for eco-conscious brands grows.

- Supply Chain Scrutiny: Increased focus on the environmental impact of sourcing and manufacturing automotive parts.

- Supplier Standards: Pressure to partner with suppliers adhering to strong environmental and ethical records.

- Product Selection Impact: Vendor relationships and the choice of products are directly affected by sustainability criteria.

- Consumer Preference: Growing consumer demand for products from environmentally responsible companies influences purchasing decisions.

Climate Change Impact on Operations

Climate change poses significant operational risks for AutoZone. Extreme weather events, like the severe hailstorms and flooding experienced in parts of the US in early 2024, can directly impact physical stores, leading to temporary closures and inventory damage. These events also strain AutoZone's extensive supply chain, potentially delaying the delivery of critical auto parts and accessories to over 6,000 locations across North America.

The company must increasingly focus on building resilience into its logistics and disaster preparedness strategies. For instance, assessing the vulnerability of distribution centers and retail locations to rising sea levels or increased hurricane activity is crucial for long-term business continuity. AutoZone's 2024 sustainability report highlighted investments in supply chain optimization, which implicitly includes mitigating the impact of climate-related disruptions.

- Supply Chain Vulnerability: Extreme weather events in 2024 caused disruptions to transportation networks, impacting delivery times for AutoZone's inventory.

- Infrastructure Risk: Damage to retail stores and distribution centers from severe weather necessitates robust insurance and repair protocols.

- Operational Continuity: Implementing advanced weather forecasting and contingency plans is vital to minimize downtime and maintain service levels.

AutoZone faces increasing pressure to manage automotive waste, including used oil and batteries, in an environmentally sound manner, adhering to strict disposal and recycling regulations. The company's energy consumption across its vast network of over 6,000 stores in fiscal year 2023 directly impacts its carbon footprint, leading to a growing demand for greener energy alternatives.

Stricter emissions standards, such as California's goal for 100% zero-emission vehicle sales by 2035, indirectly benefit AutoZone by increasing demand for emission control parts. This trend is further amplified by a 15% rise in demand for recycled automotive parts observed in 2024, signaling a shift towards sustainability in the automotive aftermarket.

Climate change presents tangible risks, with extreme weather events in early 2024 causing supply chain disruptions and potential damage to AutoZone's infrastructure, necessitating enhanced disaster preparedness and supply chain resilience strategies.

PESTLE Analysis Data Sources

Our AutoZone PESTLE Analysis is built on a robust foundation of data from official government sources, reputable industry research firms, and leading economic indicators. We meticulously gather information on political stability, economic forecasts, technological advancements, environmental regulations, and social trends to provide a comprehensive view.