AutoZone Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AutoZone Bundle

Discover the core strategies driving AutoZone's success with our comprehensive Business Model Canvas. This detailed breakdown reveals how they connect with customers, manage key resources, and generate revenue in the automotive aftermarket.

Unlock the full strategic blueprint behind AutoZone's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

AutoZone partners with numerous automotive parts suppliers and manufacturers, ensuring a broad selection of new, remanufactured, and maintenance items. These relationships are fundamental to their ability to stock a comprehensive inventory, from basic filters to specialized components, catering to a wide array of customer needs. For instance, in fiscal year 2023, AutoZone's cost of sales was $10.4 billion, highlighting the significant volume of goods sourced from these key partners.

AutoZone's reliance on technology partners is crucial for streamlining operations. For example, their collaboration with software providers enables advanced inventory management systems, ensuring parts are available when and where customers need them. This focus on technology underpins their ability to maintain efficient logistics and supply chains.

The company leverages artificial intelligence through partnerships to enhance demand forecasting accuracy and optimize delivery routes, directly impacting cost savings and customer satisfaction. Furthermore, AutoZone's acquisition of ALLDATA highlights a strategic partnership in providing essential diagnostic and shop management software to automotive repair businesses, a key segment of their customer base.

AutoZone relies on a robust network of logistics and distribution partners to ensure its parts reach customers efficiently. These collaborations are crucial for maintaining timely deliveries to AutoZone's extensive store base and its commercial clients.

In 2024, AutoZone continued to invest in expanding its distribution capabilities. The company has new distribution centers in various stages of completion, designed to bolster its network and increase overall capacity to meet growing demand.

Professional Service Providers (Commercial Accounts)

AutoZone cultivates vital alliances with a broad network of professional service providers, encompassing local and regional repair garages, dealerships, service stations, and fleet operators. These commercial accounts are the backbone of AutoZone's Do-It-For-Me (DIFM) business, driving significant revenue through dedicated service and product offerings.

These partnerships are fueled by AutoZone's commitment to providing these commercial clients with essential support, including rapid parts delivery and accessible commercial credit lines. This focus on the DIFM segment is a strategic imperative, allowing AutoZone to capture a substantial share of the professional automotive repair market.

For instance, in fiscal year 2023, AutoZone's commercial sales represented a significant portion of its overall revenue, demonstrating the critical role these professional service providers play in the company's success. The company continues to invest in services and programs tailored to meet the unique demands of these business customers.

- Key Commercial Partners: Repair garages, dealerships, service stations, fleet owners.

- Value Proposition for Partners: Prompt parts delivery, commercial credit.

- Strategic Importance: Crucial for the 'Do-It-For-Me' (DIFM) segment.

- Fiscal Year 2023 Impact: Commercial sales formed a substantial revenue stream.

Strategic Acquisition Targets

AutoZone has a history of strategic acquisitions to broaden its product lines and geographic presence. A prime example is the acquisition of ALLDATA, a leading provider of automotive diagnostic and repair information. This move significantly enhanced AutoZone's digital capabilities and service offerings to professional technicians.

Identifying and integrating businesses that align with and enhance AutoZone's core operations remains a key partnership strategy for sustained growth. This approach allows AutoZone to leverage external expertise and technology to accelerate its market penetration and service innovation.

AutoZone's acquisition strategy is not just about size, but about strategic fit. For instance, in 2023, AutoZone continued to explore opportunities that could bolster its DIY and DIFM (Do It For Me) customer segments, aiming to capture a larger share of the aftermarket. The company's robust financial position, evidenced by its strong free cash flow generation, provides the capital necessary for such strategic moves.

- ALLDATA Acquisition: Enhanced digital offerings and professional technician services.

- Continuous Evaluation: Ongoing identification of complementary businesses for integration.

- Strategic Growth: Acquisitions are a core component of AutoZone's expansion strategy.

- Financial Capacity: Strong free cash flow supports potential future acquisitions.

AutoZone's key partnerships are primarily with a vast network of automotive parts suppliers and manufacturers, ensuring a comprehensive inventory. They also rely on technology partners for advanced inventory management and AI-driven demand forecasting, which is critical for efficient operations. Furthermore, strategic acquisitions, like ALLDATA, bolster their digital capabilities and service offerings to professional technicians.

These alliances are vital for AutoZone's business model, enabling them to maintain a wide selection of parts and streamline their supply chain. The company's fiscal year 2023 cost of sales, standing at $10.4 billion, underscores the scale of these supplier relationships.

| Partner Type | Examples/Focus | Strategic Importance |

| Parts Suppliers & Manufacturers | Broad selection of new and remanufactured parts | Inventory depth and breadth |

| Technology Providers | Inventory management software, AI for forecasting | Operational efficiency, demand accuracy |

| Strategic Acquisitions | ALLDATA (diagnostic and repair info) | Enhanced digital capabilities, professional services |

What is included in the product

AutoZone's business model focuses on serving DIY and professional auto repair customers with a wide selection of parts and accessories, leveraging its extensive retail store network and online presence as key channels to deliver value through product availability and expert advice.

AutoZone's Business Model Canvas acts as a pain reliever by providing a clear, one-page snapshot that demystifies complex operations, making it easier for stakeholders to understand and address inefficiencies.

It streamlines the identification of key value propositions and customer segments, offering a structured approach to resolving operational challenges and improving customer satisfaction.

Activities

AutoZone's product sourcing involves securing a vast array of automotive parts and accessories from a global supplier base. This ensures they have the right parts for a wide range of vehicles.

Sophisticated inventory management is crucial, utilizing AI for demand forecasting. This helps maintain optimal stock levels across their many stores and distribution centers, reducing waste and ensuring parts are available when customers need them.

In 2023, AutoZone reported net sales of $16.5 billion, reflecting the scale of their operations and the effectiveness of their sourcing and inventory strategies in meeting customer demand.

AutoZone's core functions revolve around its extensive retail and commercial sales operations. The company operates thousands of physical stores, catering to do-it-yourself (DIY) customers seeking automotive parts and accessories. This in-store experience is complemented by a strong online presence through autozone.com.

Beyond the DIY segment, AutoZone actively manages a robust commercial sales program. This initiative targets professional mechanics and repair shops, offering them specialized services and products. A key aspect of this program is providing prompt delivery services to ensure these businesses can maintain their operational efficiency.

In fiscal year 2023, AutoZone reported total sales of $17.5 billion, with its commercial sales segment showing significant growth, accounting for approximately 20% of its total revenue. This highlights the dual focus on both individual consumers and professional clientele as a critical driver of its business model.

AutoZone's supply chain and logistics optimization is a crucial key activity. This includes managing its network of distribution centers and strategically expanding its 'mega hub' locations. These mega hubs are designed to significantly enhance inventory availability and speed up delivery times to stores across the country.

The company leverages technology to ensure efficient product flow throughout its supply chain. For instance, in fiscal year 2024, AutoZone continued investing in its distribution network, aiming to improve the speed and accuracy of getting parts to customers.

Customer Service and Support

AutoZone places a significant emphasis on customer service, aiming to provide a superior experience for all patrons. This includes offering expert advice and diagnostic testing to DIY customers, ensuring they have the right parts and knowledge for their vehicle repairs. For their commercial clients, AutoZone provides dedicated support and reliable parts delivery, understanding the critical nature of minimizing downtime.

The company’s commitment to exceptional service is further reinforced through its tool rental program, allowing customers to access specialized equipment needed for specific repairs. This initiative not only aids customers but also fosters loyalty by providing value-added services. AutoZone actively invests in training its employees, known as AutoZoners, to ensure they possess the technical expertise and customer-facing skills necessary to deliver on this promise.

In fiscal year 2024, AutoZone's dedication to service is reflected in its continued growth and customer retention. While specific customer service metrics are not publicly detailed, the company’s consistent revenue growth, reaching approximately $16.5 billion in the first three quarters of fiscal year 2024, indicates strong customer satisfaction and repeat business. This success is built upon the foundation of knowledgeable staff and accessible support channels.

- DIY Customer Support: Offering diagnostic tools and expert advice for individual car owners.

- Commercial Client Services: Providing dedicated support and timely parts delivery for professional mechanics and businesses.

- Tool Rental Program: Enabling customers to access specialized tools for repairs, enhancing convenience and affordability.

- Employee Training: Continuously developing AutoZoners' skills to ensure high-quality customer interactions and technical assistance.

Strategic Expansion and Market Penetration

AutoZone's strategic expansion is a cornerstone of its business model, focusing on increasing its physical footprint and enhancing digital capabilities. The company is actively opening new retail locations across the United States, Mexico, and Brazil, aiming to capture greater market share and bring its products closer to customers.

This physical expansion is complemented by a strategic push into 'mega hub' locations. These larger format stores are designed to improve product accessibility and availability, serving as critical distribution points for a wider range of automotive parts and accessories.

Simultaneously, AutoZone is making significant investments in its e-commerce platform. This digital enhancement is crucial for meeting evolving customer expectations and expanding reach beyond traditional brick-and-mortar sales channels. Targeted marketing campaigns are also employed to drive traffic to both online and in-store locations.

- New Store Openings: AutoZone continues its aggressive new store opening strategy in the U.S., Mexico, and Brazil.

- Mega Hub Expansion: Growth in 'mega hub' locations enhances inventory depth and distribution efficiency.

- E-commerce Investment: Ongoing development of the online platform supports omnichannel sales and customer engagement.

- Targeted Marketing: Campaigns are designed to boost brand awareness and drive sales across all channels.

AutoZone's key activities center on its extensive retail and commercial sales operations, serving both DIY customers and professional mechanics. This dual focus is supported by efficient supply chain management and a strong commitment to customer service, including expert advice and tool rentals.

The company actively pursues strategic expansion through new store openings and the development of 'mega hub' locations, while simultaneously investing in its e-commerce platform to enhance digital capabilities and customer engagement.

In fiscal year 2023, AutoZone reported total sales of $17.5 billion, with commercial sales contributing approximately 20% of revenue, underscoring the importance of its diverse customer base and operational strategies.

| Key Activity | Description | Fiscal Year 2023 Impact |

|---|---|---|

| Retail & Commercial Sales | Operating thousands of stores and a robust commercial sales program for professional mechanics. | $17.5 billion in total sales. Commercial sales approximately 20% of revenue. |

| Supply Chain & Logistics | Managing distribution centers and expanding 'mega hub' locations for enhanced inventory availability and faster delivery. | Continued investment in distribution network to improve speed and accuracy. |

| Customer Service | Providing expert advice, diagnostic testing, and a tool rental program for DIY customers; dedicated support for commercial clients. | Indicated by consistent revenue growth, reflecting strong customer satisfaction and repeat business. |

| Strategic Expansion | Opening new stores in the U.S., Mexico, and Brazil, and investing in e-commerce capabilities. | Aggressive new store opening strategy and ongoing development of online platform. |

Full Document Unlocks After Purchase

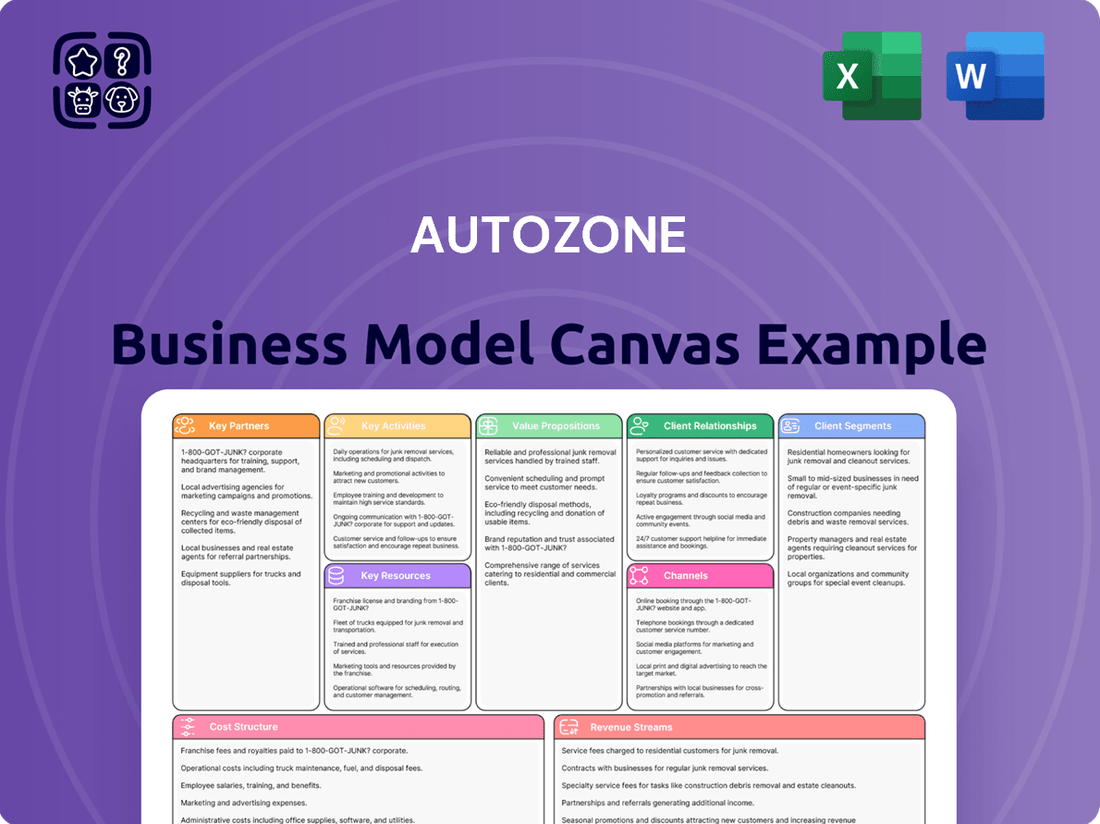

Business Model Canvas

The AutoZone Business Model Canvas you see previewed is the exact document you will receive upon purchase. This isn't a sample or a mockup; it's a direct representation of the comprehensive analysis you'll gain access to. Upon completing your order, you'll download this complete, professionally structured Business Model Canvas, ready for your strategic planning.

Resources

AutoZone's extensive store network, with thousands of retail locations across the U.S., Mexico, and Brazil, forms a critical backbone of its operations. This vast physical presence ensures widespread accessibility for customers seeking automotive parts and accessories.

The company's strategic investment in 'mega hub' stores represents a significant enhancement to its resource base. These larger facilities boast significantly expanded inventory, directly contributing to improved product availability and enabling quicker fulfillment for AutoZone's entire network.

By leveraging these mega hubs, AutoZone can more efficiently distribute products to its surrounding stores, a key factor in reducing delivery times and enhancing customer satisfaction. This logistical advantage is crucial in a market where timely access to parts is paramount.

AutoZone's extensive product inventory, encompassing new and remanufactured hard parts, maintenance essentials, and accessories, is a cornerstone of its business. This vast selection ensures they can meet the demands of a wide array of vehicle makes and models, serving both individual car owners and professional mechanics.

In 2024, AutoZone continued to leverage this comprehensive inventory to maintain its market leadership. The company’s ability to stock a broad range of parts, from common filters to specialized engine components, directly supports its value proposition of being a one-stop shop for automotive needs.

AutoZone's approximately 126,000 AutoZoners are a cornerstone of its business model, representing critical human capital. Their deep product knowledge and dedication to customer service directly support AutoZone's promise of providing helpful advice and quality parts.

The ongoing training and development programs for these employees ensure they remain adept at assisting customers, a key differentiator in the automotive aftermarket. This commitment to a skilled workforce is fundamental to delivering AutoZone's value proposition of expert assistance and a positive shopping experience.

Robust Supply Chain and Distribution Infrastructure

AutoZone's robust supply chain and distribution infrastructure is a cornerstone of its business model, ensuring customers get the right parts quickly. This network includes strategically located distribution centers designed for efficient product flow. For instance, as of fiscal year 2023, AutoZone operated 17 domestic distribution centers, supporting its vast retail footprint.

The company continuously invests in enhancing its supply chain, recognizing its critical role in maintaining product availability and customer satisfaction. These investments focus on both physical expansion and technological upgrades to optimize inventory management and delivery times. This commitment ensures that AutoZone can meet the diverse needs of its customer base across various locations.

- Distribution Network: Operates a significant number of distribution centers across the United States, facilitating efficient product replenishment for its retail stores.

- Supply Chain Technology: Leverages sophisticated management systems to track inventory, forecast demand, and optimize logistics, ensuring timely delivery of automotive parts.

- Infrastructure Investment: Regularly invests in expanding and modernizing its distribution centers and implementing new technologies to improve operational efficiency and product availability.

Proprietary Technology and Data Systems

AutoZone's proprietary technology and data systems are foundational to its business. These advanced systems include sophisticated inventory management, logistics optimization software, and AI-powered forecasting tools. These are not just operational tools but drivers of competitive advantage, enabling AutoZone to maintain optimal stock levels and efficient distribution across its vast network.

The company's investment in technology extends to customer-facing solutions. The ALLDATA diagnostic and shop management software, for instance, is a critical resource for professional repair shops. This software provides technicians with comprehensive vehicle repair information, enhancing their ability to service vehicles accurately and efficiently, thereby strengthening AutoZone's relationships with its commercial clients.

These technological assets empower AutoZone with several key capabilities:

- Efficient Operations: Streamlined inventory and logistics reduce costs and improve product availability.

- Personalized Marketing: Data analytics allow for targeted promotions and customer engagement.

- Enhanced Customer Experience: Tools like ALLDATA improve service delivery for professional customers.

- Data-Driven Forecasting: AI tools enable more accurate demand prediction, minimizing stockouts and overstocking.

AutoZone's key resources are its extensive physical store network, strategically located distribution centers, a vast product inventory, its dedicated workforce of AutoZoners, and proprietary technology. These elements collectively enable efficient operations, strong customer relationships, and market leadership in the automotive aftermarket.

The company's commitment to its physical footprint and sophisticated supply chain infrastructure, supported by ongoing investments in technology and employee development, ensures its ability to meet customer demands effectively. This integrated approach to resources is fundamental to AutoZone's sustained success.

In fiscal year 2023, AutoZone operated over 6,000 locations globally, supported by a robust distribution network. Its workforce of approximately 126,000 employees is crucial for delivering expert customer service and product knowledge.

The company's investment in technology, including AI-powered forecasting and diagnostic software like ALLDATA, enhances operational efficiency and customer value, positioning AutoZone strongly for future growth.

| Resource Category | Description | Key Data Point (as of FY23/2024) | Impact on Business Model |

|---|---|---|---|

| Physical Network | Retail Stores & Distribution Centers | Over 6,000 locations globally; 17 domestic distribution centers | Widespread customer accessibility; efficient product replenishment |

| Inventory | New and remanufactured hard parts, maintenance items, accessories | Comprehensive range for diverse vehicle makes/models | One-stop shop value proposition; meeting broad customer needs |

| Human Capital | AutoZoners (Employees) | Approximately 126,000 | Expert product knowledge; customer service; operational execution |

| Technology & Data Systems | Inventory management, logistics optimization, AI forecasting, ALLDATA | Proprietary systems driving efficiency and customer solutions | Streamlined operations; data-driven decision making; enhanced customer experience |

Value Propositions

AutoZone's extensive product availability is a cornerstone of its business. They boast a massive inventory of automotive replacement parts and accessories, catering to a wide spectrum of vehicle makes and models. This ensures that whether a customer needs a common filter or a more specialized component, they are likely to find it at AutoZone.

The company's strategic expansion of mega hubs plays a crucial role in this value proposition. These larger distribution centers significantly improve the accessibility of even hard-to-find parts. For instance, in fiscal year 2023, AutoZone continued to invest in its supply chain, with approximately 70% of its stores being within a one-day drive of a distribution center, enhancing parts availability and reducing customer wait times.

AutoZone's extensive network of over 6,000 stores across the U.S., Mexico, and Brazil ensures customers can easily find what they need, whether in person or online. This widespread physical presence, combined with robust e-commerce platforms like autozone.com and autozonepro.com, makes accessing automotive parts and services exceptionally convenient.

Further enhancing accessibility, AutoZone offers services like in-store pickup for online orders, allowing customers to quickly retrieve their purchases. For professional clients, prompt commercial delivery directly to their businesses streamlines operations and minimizes downtime, underscoring a commitment to customer convenience.

AutoZone is a strong partner for DIY car owners, offering essential services like free battery testing and loaner tools to help them tackle repairs themselves. This commitment to support was evident in their 2023 fiscal year, where they reported over $15 billion in sales, indicating a significant demand for their DIY-focused offerings.

Speed and Efficiency for Professional Mechanics

AutoZone prioritizes speed and efficiency for professional mechanics by offering rapid parts delivery and flexible commercial credit options. This ensures their operations run smoothly and minimizes costly vehicle downtime.

The company's mega hub strategy is a key driver of this efficiency. These strategically located distribution centers are designed to significantly cut down delivery times for commercial clients, a critical factor for busy repair shops.

- Prompt Delivery: AutoZone's commitment to quick delivery directly supports mechanics' need to get vehicles back on the road fast.

- Commercial Credit: Access to credit streamlines purchasing for repair businesses, aiding cash flow management.

- Mega Hubs: This initiative enhances delivery speed for commercial accounts, a crucial value proposition.

Competitive Pricing and Value

AutoZone is committed to offering customers the best merchandise at the right price, a core tenet of its value proposition. This focus on value is a key driver for attracting and retaining a broad customer base, from DIY enthusiasts to professional mechanics.

The company leverages efficient supply chain management and optimized inventory levels to keep its pricing competitive. For instance, AutoZone's ability to manage stock effectively means they can pass on cost savings to consumers, reinforcing their commitment to affordability.

- Competitive Pricing: AutoZone consistently aims to be a price leader in the automotive aftermarket.

- Value Proposition: The company's motto, "Get in the Zone," reflects a commitment to providing comprehensive value beyond just price, including product availability and knowledgeable staff.

- Operational Efficiency: Streamlined logistics and inventory control are critical enablers of AutoZone's ability to offer competitive pricing.

AutoZone provides a vast selection of automotive parts and accessories, ensuring customers can find what they need for various vehicle makes and models. Their investment in mega hubs, with approximately 70% of stores within a one-day drive of a distribution center in fiscal year 2023, significantly boosts parts accessibility.

The company's extensive network of over 6,000 stores and strong online presence, autozone.com and autozonepro.com, offers unparalleled convenience. Services like in-store pickup and prompt commercial delivery further enhance this accessibility for both DIY customers and professional mechanics.

AutoZone supports DIY customers with services like free battery testing and loaner tools, contributing to their over $15 billion in sales in fiscal year 2023. For professionals, rapid delivery and flexible commercial credit options minimize vehicle downtime and streamline operations.

Competitive pricing is a key value, supported by efficient supply chain management and inventory control. AutoZone's commitment extends beyond price, aiming to deliver overall value through product availability and customer support.

| Value Proposition | Description | Supporting Data/Facts |

| Extensive Product Availability | Wide range of automotive replacement parts and accessories for diverse vehicle needs. | Caters to a broad spectrum of vehicle makes and models. |

| Enhanced Accessibility | Convenient access through a large store network and robust online platforms. | Over 6,000 stores across the U.S., Mexico, and Brazil; strong e-commerce presence. |

| Speed and Efficiency for Professionals | Rapid parts delivery and flexible commercial credit to minimize downtime. | Mega hub strategy reduces delivery times for commercial clients. |

| Support for DIY Customers | Essential services like free battery testing and loaner tools. | Significant demand reflected in fiscal year 2023 sales exceeding $15 billion. |

| Competitive Pricing and Value | Offering quality merchandise at favorable prices through operational efficiency. | Leverages efficient supply chain and inventory management for cost savings. |

Customer Relationships

AutoZone's customer relationships are built on a foundation of a customer-first mindset, aiming for an exceptional 'Wow!' experience. This is actively reinforced through employee training, ensuring they are knowledgeable and ready to assist every customer.

Their fiscal year 2025 operating theme, 'Great People, Great Service,' underscores this commitment. This focus on service is a key differentiator, driving loyalty and repeat business in the competitive auto parts market.

For DIY customers, AutoZone cultivates strong relationships through direct, in-store assistance from knowledgeable employees, often called AutoZoners. This personalized guidance extends to helping customers select the right parts, offering diagnostic testing services, and facilitating tool rentals, all of which build trust and encourage repeat business.

AutoZone fosters robust connections with automotive repair professionals and commercial clients through tailored sales initiatives. These programs offer vital support, including flexible commercial credit options and efficient, on-time delivery services, ensuring mechanics have the parts they need when they need them.

Access to specialized online platforms like autozonepro.com further strengthens these relationships. This digital hub provides commercial customers with detailed product information, inventory visibility, and streamlined ordering processes, enhancing the overall customer experience and operational efficiency for businesses relying on AutoZone's extensive inventory.

Digital Engagement and Support

AutoZone leverages its online platforms, including AutoZone.com and AutoZonePro.com, to offer customers a seamless digital experience. These sites provide easy access to product information, order placement, and convenient self-service options, meeting the needs of digitally inclined consumers. For professional mechanics, AutoZonePro.com is a key resource.

The company is also integrating AI-driven marketing strategies to enhance customer engagement. This approach focuses on delivering personalized experiences and tailored communications, aiming to build stronger relationships by understanding individual customer preferences and purchase histories.

- Digital Self-Service: AutoZone.com and AutoZonePro.com facilitate online browsing, product research, and order fulfillment, enabling customers to manage their needs digitally.

- Professional Resources: AutoZonePro.com specifically caters to automotive professionals, offering specialized tools and information.

- AI-Powered Personalization: The company utilizes artificial intelligence to personalize marketing efforts, aiming for more relevant customer interactions.

- Convenience: Digital channels provide 24/7 access to AutoZone's offerings, enhancing overall customer convenience.

Loyalty Programs and Promotions

AutoZone, like many successful retailers, likely leverages loyalty programs and targeted promotions to foster customer retention and increase lifetime value. These initiatives are crucial for encouraging repeat purchases and building a dedicated customer base.

While specific AutoZone loyalty program details aren't publicly disclosed, common industry practices include points-based systems, exclusive discounts, early access to sales, and personalized offers based on purchase history. For instance, in 2023, the retail sector saw significant investment in customer loyalty, with many companies reporting increased engagement through these programs.

- Loyalty Programs: Typically reward repeat customers with points or discounts, driving consistent sales.

- Targeted Promotions: Utilize customer data to offer relevant deals, enhancing purchase likelihood.

- Customer Retention: These strategies are vital for keeping customers engaged and choosing AutoZone over competitors.

- Increased Lifetime Value: By encouraging repeat business, loyalty programs directly contribute to a higher overall value derived from each customer relationship.

AutoZone's customer relationships are a cornerstone of its business, focusing on exceptional service for both DIY and professional customers. This is supported by knowledgeable staff, digital platforms like AutoZone.com and AutoZonePro.com, and increasingly, AI-driven personalization efforts. The company's fiscal year 2025 theme, 'Great People, Great Service,' highlights this commitment to building strong, lasting connections.

For fiscal year 2024, AutoZone reported net sales of $14.7 billion, indicating a strong market presence and customer engagement. The company's strategy emphasizes providing convenience and expertise, whether in-store or online, to foster loyalty and repeat business across its diverse customer base.

Channels

AutoZone's core channel is its vast network of over 7,300 physical retail stores, strategically located across the United States, Mexico, and Brazil as of August 2024. These brick-and-mortar locations are the primary touchpoint for both individual do-it-yourself (DIY) customers and professional commercial clients, facilitating direct sales and immediate product availability.

AutoZone's e-commerce website, autozone.com, is a crucial channel for reaching a wide array of customers. It allows DIY enthusiasts to easily find and purchase auto parts and accessories, offering convenient options like in-store pickup or direct delivery. This digital presence significantly expands their market reach beyond physical store locations.

In fiscal year 2023, AutoZone reported that its e-commerce sales represented a growing portion of its overall business, demonstrating the platform's increasing importance. The website provides detailed product information, inventory availability at local stores, and a seamless checkout process, enhancing the customer experience and driving sales volume.

AutoZone's autozonepro.com serves as a critical commercial online platform, offering professional auto parts buyers a streamlined experience for product selection, ordering, and account management. This dedicated channel allows mechanics and businesses to quickly find the parts they need, access their pricing, and track their purchases, significantly boosting operational efficiency.

In 2024, AutoZone continued to emphasize its digital capabilities, with its commercial segment showing robust performance. While specific revenue figures for autozonepro.com are not broken out, the overall commercial sales, which this platform directly supports, have been a key growth driver for the company, reflecting strong adoption by professional customers.

ALLDATA Software and Services

ALLDATA operates as a crucial channel for AutoZone, offering specialized software and services that cater directly to professional automotive repair shops. This segment provides essential diagnostic, repair, collision, and shop management tools, empowering mechanics with the data and solutions they need to operate efficiently.

The ALLDATA brand is a significant revenue driver, extending AutoZone's reach beyond direct-to-consumer parts sales into the professional service sector. In fiscal year 2023, AutoZone reported total revenue of $17.4 billion, with its ALLDATA segment contributing a substantial portion by serving a vast network of automotive businesses.

- Target Audience: Professional automotive repair technicians, collision centers, and shop owners.

- Value Proposition: Provides comprehensive repair information, diagnostic tools, and shop management software to enhance productivity and accuracy.

- Key Offerings: ALLDATA Repair, ALLDATA Collision, and ALLDATA Manage are flagship products.

- Market Reach: Serves thousands of repair facilities across North America and internationally.

Direct Delivery for Commercial Accounts

Direct delivery is a cornerstone for AutoZone's commercial accounts, ensuring vital auto parts reach repair shops, dealerships, and fleet operators precisely when needed. This critical service leverages their extensive distribution network to guarantee speed and reliability.

In 2024, AutoZone's commitment to its commercial segment, often referred to as AutoZoner's Commercial Program, continued to be a significant growth driver. This program focuses on providing dedicated service and delivery solutions tailored to the unique demands of business customers.

- Dedicated Delivery Fleet: AutoZone utilizes a specialized fleet to ensure timely and accurate delivery of parts directly to commercial customer locations, minimizing downtime for their operations.

- Robust Distribution Network: The company's strategically located distribution centers are key to facilitating this direct delivery, enabling rapid replenishment of inventory for businesses.

- Commercial Account Focus: This channel is specifically designed to cater to the needs of professional repair businesses, offering credit accounts, specialized product availability, and dedicated sales support.

- Sales Growth Contribution: While specific figures for direct delivery are not isolated, AutoZone's commercial sales have consistently shown strong performance, underscoring the channel's importance. For example, their commercial sales have been a key component of their overall revenue growth in recent fiscal periods.

AutoZone's channels are multifaceted, encompassing a vast physical retail presence, robust e-commerce platforms, and specialized services for professional clients. This integrated approach ensures accessibility and convenience for a diverse customer base, from DIY enthusiasts to large commercial operations.

The company's commitment to digital expansion, particularly through autozone.com and autozonepro.com, has been a significant driver of growth, complementing its extensive network of over 7,300 physical stores as of August 2024. These digital channels offer enhanced product visibility, streamlined ordering, and convenient fulfillment options.

Furthermore, the ALLDATA segment provides essential software and data solutions to professional repair shops, solidifying AutoZone's position as a comprehensive partner in the automotive aftermarket. Direct delivery services for commercial accounts underscore the company's focus on operational efficiency and customer support.

| Channel | Primary Focus | Key Features | Customer Segment |

|---|---|---|---|

| Physical Retail Stores | Direct Sales & Immediate Availability | 7,300+ locations (US, Mexico, Brazil as of Aug 2024), In-store pickup | DIY, Commercial |

| E-commerce (autozone.com) | Online Sales & Expanded Reach | Product information, inventory check, home delivery, in-store pickup | DIY |

| Commercial E-commerce (autozonepro.com) | Streamlined B2B Ordering | Account management, specialized pricing, order tracking | Professional Repair Shops, Fleets |

| ALLDATA | Professional Repair Solutions | Diagnostic tools, repair data, shop management software | Professional Repair Shops |

| Direct Delivery | Timely Parts Fulfillment | Dedicated fleet, robust distribution network, commercial account support | Commercial Customers |

Customer Segments

DIY customers are individual car owners who enjoy tackling their own vehicle maintenance and repairs. They are looking for a reliable source for parts, the right tools for the job, and often need a bit of guidance or diagnostic help. AutoZone caters to this segment by offering a wide selection of auto parts and accessories, along with helpful resources like their "How-To" guides and in-store expertise.

In 2024, the DIY auto repair market continued to be a significant driver for auto parts retailers. Many consumers, facing rising labor costs for professional repairs, opted to perform simpler maintenance tasks themselves. This trend is supported by data showing a consistent interest in learning basic car care, with online searches for DIY auto repair guides remaining high throughout the year.

AutoZone serves professional mechanics and repair shops, including independent garages, car dealerships, service stations, and fleet owners. These businesses rely on AutoZone for a comprehensive selection of automotive parts, often needing them with rapid delivery to minimize vehicle downtime. In 2024, the automotive repair industry continued to see strong demand, with independent repair shops accounting for a significant portion of the aftermarket service revenue.

A key need for this customer segment is access to commercial credit accounts, allowing them to manage their inventory and cash flow effectively. Furthermore, these professionals require specialized diagnostic tools and software to efficiently identify and resolve vehicle issues, a service AutoZone aims to provide to support their operations and customer satisfaction.

Commercial fleet operators represent a distinct segment within AutoZone's customer base, focusing on businesses that manage multiple vehicles, such as delivery services, construction companies, or taxi operations. These customers rely on AutoZone for the consistent supply of parts and maintenance services essential for keeping their fleets operational and minimizing downtime. In 2024, the commercial automotive aftermarket, which includes fleet maintenance, continued to show resilience, with major players reporting steady demand for parts and services.

Fleet operators often engage in contractual agreements, seeking reliable suppliers who can meet their specific inventory requirements and provide rapid service to reduce vehicle downtime. This can involve specialized parts, bulk purchasing options, and dedicated account management. The efficiency and cost-effectiveness of fleet maintenance directly impact the profitability of these businesses, making AutoZone's ability to provide timely and accurate solutions a critical factor in their purchasing decisions.

International Customers (Mexico and Brazil)

AutoZone's international presence extends to Mexico and Brazil, tapping into significant and expanding markets for automotive parts. These regions are crucial for AutoZone's growth strategy, as evidenced by their ongoing store network expansion in these countries.

The demand for automotive parts and accessories in both Mexico and Brazil is robust, driven by factors like an aging vehicle fleet and increasing vehicle ownership. This creates a fertile ground for AutoZone's retail model.

- Mexico: AutoZone has a substantial and growing store base in Mexico, catering to a large automotive aftermarket.

- Brazil: While a newer market for AutoZone compared to Mexico, Brazil represents a significant opportunity with a large population and a developing automotive service sector.

- Growth Focus: The company's strategic investments in these international markets underscore their commitment to capturing market share and serving a diverse customer base beyond the United States.

Online Shoppers

Online shoppers represent a key customer segment for AutoZone, prioritizing the ease of researching and purchasing automotive parts and accessories via their digital platforms. This group values detailed product information readily available online, alongside flexible fulfillment choices that cater to their busy lifestyles.

- Convenience is paramount: These customers seek to avoid physical store visits, opting for the efficiency of online browsing and purchasing.

- Information-driven decisions: They rely on comprehensive product descriptions, customer reviews, and compatibility checkers to make informed choices.

- Flexible fulfillment needs: Options like ship-to-home, in-store pickup, or curbside pickup are highly valued to suit individual schedules.

- Digital engagement: This segment is likely to interact with AutoZone's website and mobile app for their automotive needs, reflecting a growing trend in retail.

AutoZone's customer base is broadly segmented into DIY car owners, professional repair shops, and commercial fleet operators, each with distinct needs and purchasing behaviors. The company also serves international markets, particularly in Mexico and Brazil, and a growing segment of online shoppers. In 2024, the DIY segment continued to be strong due to rising labor costs, while professional segments relied on timely parts delivery and diagnostic support.

Cost Structure

The most substantial expense for AutoZone is the cost of procuring the automotive parts and accessories it offers. This encompasses the purchase price from their extensive network of suppliers and manufacturers, alongside the associated inbound freight and handling expenses. For fiscal year 2023, AutoZone reported a Cost of Goods Sold of $12.5 billion, representing a significant portion of their overall operational expenditure.

Operating AutoZone's extensive network of thousands of retail locations involves significant expenditures. These costs encompass essential store operations like rent for prime retail spaces, utilities to keep stores running, ongoing maintenance, and importantly, payroll for its vast workforce. In 2023, AutoZone employed over 120,000 individuals, referred to as AutoZoners, making payroll a substantial component of its cost structure.

The company has acknowledged that higher payroll expenses have indeed contributed to an increase in its overall operating costs. This is a common challenge for large retailers, balancing competitive wages with the need to manage expenses effectively across a widespread physical footprint.

AutoZone incurs substantial expenses managing its extensive distribution network. These costs encompass operating its numerous distribution centers, the fuel and labor involved in transporting parts to over 6,000 stores and commercial clients, and ongoing investments in logistics technology to optimize efficiency.

For fiscal year 2023, AutoZone reported selling, general, and administrative (SG&A) expenses of $3.7 billion. While not solely attributable to supply chain, this figure reflects the significant operational overhead associated with distribution and store support.

Marketing and Advertising Expenses

Marketing and advertising expenses are a significant part of AutoZone's cost structure, covering efforts to reach both do-it-yourself (DIY) customers and commercial clients. These costs are incurred across various channels, including digital platforms and more traditional advertising methods.

In fiscal year 2023, AutoZone reported selling, general, and administrative (SG&A) expenses of $5.4 billion. While this figure encompasses a broad range of operational costs, a notable portion is allocated to marketing and advertising initiatives designed to drive sales and brand awareness.

- Digital Marketing: Investments in online advertising, social media campaigns, and search engine optimization to attract and engage customers.

- Traditional Advertising: Spending on television, radio, print, and in-store promotions to maintain brand visibility.

- Promotional Programs: Costs associated with customer loyalty programs and special offers aimed at increasing sales volume.

- Brand Building: Expenditures on maintaining and enhancing AutoZone's brand reputation and market presence.

Technology and Capital Expenditures

AutoZone's cost structure is significantly shaped by its ongoing investments in technology and capital expenditures. These include substantial outlays for advanced inventory management systems, robust e-commerce platforms, and sophisticated diagnostic software essential for their automotive repair services.

The company also allocates considerable capital to new store openings and the expansion of existing locations, notably their larger 'mega hub' stores. These capital expenditures are critical for maintaining operational efficiency and supporting future growth.

- Technology Investments: AutoZone consistently invests in its digital infrastructure, including e-commerce capabilities and in-store technology, to enhance customer experience and streamline operations.

- Capital Expenditures for Growth: Significant capital is deployed for opening new stores and expanding existing ones, particularly the development of mega hubs, which are larger format stores designed to carry a broader inventory and offer enhanced services.

- Diagnostic Software: Ongoing expenditure on diagnostic software is crucial for supporting the automotive repair services offered and ensuring technicians have access to the latest tools.

- Fiscal Year 2023 Capital Spending: In fiscal year 2023, AutoZone reported capital expenditures of $1.1 billion, reflecting substantial investments in store growth and technology upgrades.

AutoZone's cost structure is heavily influenced by the cost of goods sold, which includes the purchase of parts and accessories from suppliers and associated freight costs. For fiscal year 2023, the Cost of Goods Sold was $12.5 billion. Operating expenses, including rent, utilities, maintenance, and payroll for over 120,000 employees in 2023, also represent a significant outlay. Selling, General, and Administrative (SG&A) expenses totaled $5.4 billion in FY2023, encompassing marketing, advertising, and distribution network costs.

| Cost Category | FY2023 (in billions) |

| Cost of Goods Sold | $12.5 |

| Selling, General, and Administrative (SG&A) Expenses | $5.4 |

| Capital Expenditures | $1.1 |

Revenue Streams

AutoZone's main income source is selling new and rebuilt auto parts, upkeep supplies, and add-ons directly to customers who fix their own cars. This happens both in their physical stores and on their website.

For the fiscal year 2023, AutoZone reported net sales of $16.5 billion, with a significant portion driven by these DIY sales. The company's consistent growth in this segment highlights the strong demand for automotive parts and maintenance items among individual consumers.

Commercial sales to professional mechanics represent a substantial and expanding revenue source for AutoZone. This segment includes sales to repair garages, dealerships, service stations, and fleet owners, who rely on AutoZone for their parts and supplies.

AutoZone actively supports these professional customers through various channels, including dedicated commercial sales teams and online portals. The company offers commercial credit accounts, allowing businesses to purchase on account, and emphasizes prompt delivery services to minimize downtime for their repair operations.

In fiscal year 2023, AutoZone reported that its commercial segment, often referred to as the DIFM (Do It For Me) segment, continued to be a significant driver of growth. While specific percentage breakdowns vary, this segment consistently outperforms the DIY (Do It Yourself) segment in terms of growth rate, reflecting the increasing demand from professional service providers.

AutoZone's tool rental program generates revenue through fees charged to customers for borrowing specialized automotive tools. This service allows DIY mechanics to access equipment they might not own, facilitating more complex repairs and maintenance tasks.

While specific rental fee revenue isn't broken out in their primary financial statements, AutoZone's commitment to supporting customer repairs, including offering loaner tools, is a key part of their customer service strategy. This ancillary revenue stream complements their core product sales.

ALLDATA Software Subscriptions/Sales

AutoZone generates revenue through the sales and subscriptions of its ALLDATA brand. This software suite is a key offering, providing essential diagnostic, repair, collision, and shop management tools for automotive professionals.

For the fiscal year 2024, AutoZone's performance in its ALLDATA segment is a significant contributor. While specific segment reporting may vary, the overall growth in the automotive aftermarket and the increasing reliance on digital solutions for repair shops underscore the importance of this revenue stream. The demand for up-to-date technical information and efficient shop management systems continues to drive adoption.

- ALLDATA's role: Provides critical diagnostic, repair, and shop management software.

- Revenue driver: Sales and subscriptions for the ALLDATA brand contribute directly to AutoZone's top line.

- Market relevance: Growing demand for digital solutions in the automotive aftermarket supports this revenue stream.

Other Services and Non-Automotive Products

AutoZone's revenue streams extend beyond just automotive parts. They also generate income from diagnostic testing services provided in their stores. This helps customers identify vehicle issues, creating an additional touchpoint for sales.

Furthermore, AutoZone offers a selection of non-automotive products. These can range from tools and accessories not directly related to car repair to general household items, broadening their appeal and sales potential.

For the fiscal year 2023, AutoZone reported total revenue of $17.5 billion. While specific breakdowns for these "Other Services and Non-Automotive Products" are not typically isolated in top-line reports, they contribute to the overall sales mix and customer engagement.

- Diagnostic Testing Services: Offered in-store to identify vehicle problems.

- Non-Automotive Products: Includes tools, accessories, and general merchandise.

- Revenue Contribution: These services and products supplement core automotive parts sales.

AutoZone's revenue is primarily driven by the sale of new and rebuilt auto parts, maintenance supplies, and accessories through its extensive retail network and online presence. The company also generates significant income from its commercial segment, supplying parts to professional repair businesses, which has shown a strong growth trajectory.

Additional revenue streams include fees from its tool rental program, sales and subscriptions of its ALLDATA diagnostic and repair software, and the sale of non-automotive products. Diagnostic testing services offered in-store also contribute to their overall sales mix.

| Revenue Stream | Description | Fiscal Year 2023 Contribution (Approximate) |

|---|---|---|

| DIY Sales | Sales of parts and supplies to individual car owners. | Majority of $16.5 billion net sales. |

| Commercial Sales (DIFM) | Sales to professional repair shops and fleets. | Significant and growing segment, outperforming DIY growth. |

| ALLDATA | Software sales and subscriptions for automotive repair professionals. | Key contributor to overall revenue. |

| Tool Rental | Fees for customers borrowing specialized automotive tools. | Ancillary revenue supporting core sales. |

| Other Services & Non-Automotive | Diagnostic testing and sales of related merchandise. | Contributes to overall sales mix. |

Business Model Canvas Data Sources

The AutoZone Business Model Canvas is informed by a combination of internal financial reports, customer transaction data, and extensive market research. These sources provide a comprehensive view of AutoZone's operations and its competitive landscape.