AutoZone Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AutoZone Bundle

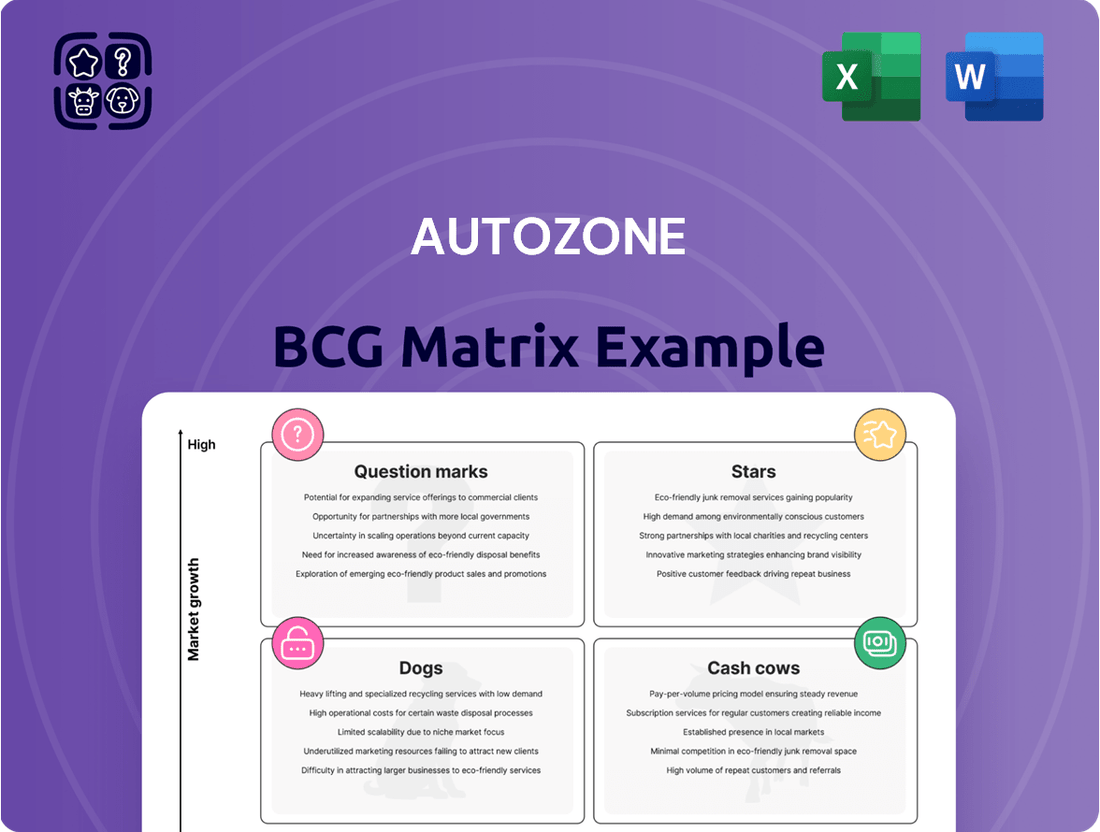

Explore AutoZone's strategic positioning with our insightful BCG Matrix preview. See how their product portfolio stacks up as Stars, Cash Cows, Dogs, or Question Marks, offering a glimpse into their market performance. Purchase the full BCG Matrix for a comprehensive breakdown and actionable insights to drive your own business strategy forward.

Stars

AutoZone's commercial segment, catering to professional mechanics and repair shops, is a key driver of growth. This "Dogs" segment in the BCG Matrix is experiencing robust expansion, a strategic focus for the company.

Domestic commercial sales saw a healthy 3.2% increase in the first quarter of fiscal year 2025 and a stronger 7.3% in the second quarter. Management has explicitly prioritized aggressive growth in this area for fiscal year 2025.

To fuel this commercial expansion, AutoZone is strategically increasing its Mega-Hub network. These hubs are crucial for improving parts availability and significantly shortening delivery times for their professional clientele.

AutoZone's international ventures, especially in Mexico and Brazil, are showing impressive momentum. These markets represent key growth areas, with the company strategically increasing its footprint.

In the first quarter of fiscal year 2025, international same-store sales surged by almost 14% when adjusted for currency fluctuations. This robust performance continued into the second quarter, with a 9.5% increase on a constant currency basis, significantly outpacing domestic sales growth.

Looking ahead, AutoZone is set to open 100 new international stores in fiscal year 2025, with a strong focus on Mexico and Brazil. This expansion underscores the high growth potential and increasing market penetration AutoZone is pursuing in these regions.

AutoZone's Mega-Hub store network represents a significant investment in its "Question Mark" or potentially "Star" segment, depending on market growth and its own performance. These expanded locations, stocking three to four times the inventory of standard stores, are designed to function as localized distribution points. This strategy facilitates quicker stock replenishment for surrounding AutoZone locations and enables rapid delivery services for commercial clients.

The company's aggressive expansion plans underscore the importance of this initiative. AutoZone intends to launch 19 new Mega-Hubs during the latter half of fiscal year 2025. The overarching goal is to grow the Mega-Hub fleet to a substantial 300 locations, effectively tripling the current number of these larger format stores.

Digital Transformation and E-commerce

AutoZone is actively enhancing its digital presence and e-commerce operations to cater to modern consumer demands. This strategic push involves improving online platforms, offering convenient services like next-day delivery and in-store pickup, and upgrading IT infrastructure for better customer service and inventory control.

The automotive aftermarket e-commerce sector is experiencing significant expansion, with projections indicating a market value of $113.3 billion by 2025. This robust growth underscores the importance of AutoZone's digital transformation efforts.

- Digital Investment: AutoZone is channeling resources into its online shopping experience and delivery services.

- E-commerce Growth: The global automotive aftermarket e-commerce market is set to reach $113.3 billion in 2025.

- Customer Convenience: Services like next-day delivery and same-day store pickup are key components of their digital strategy.

Aging Vehicle Fleet and Increased Miles Driven

The average age of vehicles in operation in the U.S. reached a record 12.6 years in 2023, signaling a sustained demand for AutoZone's products. This aging fleet necessitates more frequent repairs and maintenance, directly benefiting the automotive aftermarket sector. With consumers holding onto their vehicles longer, the need for replacement parts and accessories remains robust, creating a stable and growing market for AutoZone.

- Aging Fleet: The average age of vehicles on U.S. roads surpassed 12.6 years in 2023.

- Increased Maintenance: Older vehicles typically require more frequent repairs, boosting demand for parts.

- Market Growth: This trend supports AutoZone's position in a high-demand segment of the automotive industry.

AutoZone's digital initiatives and the growing e-commerce market position it strongly. The company is investing in its online platforms and delivery services to meet evolving customer needs. This strategic focus on digital transformation aligns with the significant expansion of the automotive aftermarket e-commerce sector.

The global automotive aftermarket e-commerce market is projected to reach $113.3 billion by 2025, highlighting the substantial opportunity. AutoZone's commitment to enhancing its online presence, offering services like next-day delivery, and improving in-store pickup options are key to capturing this growth.

This segment is a potential Star due to the high growth in online sales and AutoZone's proactive investments. The company's efforts to digitize its operations and improve customer convenience are crucial for solidifying its market position in this rapidly expanding area.

The aging U.S. vehicle fleet, averaging 12.6 years in 2023, also fuels demand for parts and services, supporting AutoZone's overall market strength. This trend, combined with digital advancements, creates a favorable environment for AutoZone's growth, particularly in its e-commerce and digitally-enabled services.

| Initiative | Market Trend | AutoZone's Action | Fiscal Year 2025 Focus | Projected Impact |

|---|---|---|---|---|

| E-commerce Growth | Market to reach $113.3B by 2025 | Digital platform enhancement, next-day delivery | Improving online experience | Increased market share in online sales |

| Customer Convenience | Demand for seamless shopping | In-store pickup, upgraded IT | Streamlining digital services | Enhanced customer loyalty |

| Vehicle Maintenance | Average U.S. vehicle age 12.6 years (2023) | Robust parts availability | Supporting aging fleet needs | Sustained demand for parts |

What is included in the product

AutoZone's BCG Matrix analysis categorizes its offerings into Stars, Cash Cows, Question Marks, and Dogs.

This framework guides strategic decisions on resource allocation for AutoZone's product portfolio.

A clear AutoZone BCG Matrix overview, visually placing each business unit, alleviates the pain of strategic uncertainty.

Cash Cows

AutoZone's DIY core business is a true cash cow, consistently delivering strong performance. Historically, this segment has driven around 70% of its U.S. sales, underscoring its immense importance to the company's financial health.

Despite a minor dip of 1.8% in DIY transactions in the first quarter of 2025, the DIY market remains a bedrock of AutoZone's revenue. Consumers increasingly opt for DIY maintenance to manage costs, ensuring this segment's continued stability and profitability.

AutoZone's vast network of over 7,387 stores across the U.S., Mexico, and Brazil as of Q1 2025 solidifies its position as a leader in the automotive aftermarket. This extensive physical presence, coupled with strong brand recognition, translates into a significant market share.

This market dominance allows AutoZone to generate substantial and consistent cash flow from its established, mature markets. The sheer scale of its operations acts as a significant barrier to entry for competitors, further reinforcing its Cash Cow status.

AutoZone's robust supply chain and inventory management are key to its cash cow status. The company's focus on efficiency, including improvements in merchandise margins, directly fuels its strong gross profit margins.

Investments in distribution centers and technology are crucial for optimizing operations and ensuring product availability. This strategic approach solidifies AutoZone's ability to generate consistent cash flow.

Strong Brand Reputation and Customer Loyalty

AutoZone's unwavering dedication to exceptional customer service, epitomized by its 'Trustworthy Advice' philosophy, has cultivated a deeply loyal customer base. This strong brand equity within the mature automotive aftermarket sector translates into predictable repeat business and a steady flow of revenue, solidifying its competitive edge.

This customer loyalty is a significant driver for AutoZone's Cash Cow status. For instance, in fiscal year 2023, AutoZone reported net sales of $16.3 billion, a testament to its consistent performance and customer retention. The company's focus on providing expert advice and quality parts ensures customers return for their automotive needs.

Key aspects contributing to AutoZone's Cash Cow position include:

- Established Brand Recognition: Decades of consistent service have built strong brand awareness and trust among DIY and professional mechanics.

- Customer Retention: The 'Trustworthy Advice' program directly fosters repeat purchases by building confidence in AutoZone's expertise.

- Stable Market Dynamics: The automotive aftermarket is generally less volatile than other retail sectors, providing a reliable revenue base.

- Consistent Profitability: AutoZone has a history of strong financial performance, with operating margins often exceeding industry averages, reflecting its ability to generate sustained profits from its loyal customer base.

Share Repurchase Programs and Shareholder Value

AutoZone, a classic Cash Cow, demonstrates a strong commitment to returning capital to its shareholders. This is primarily achieved through substantial share repurchase programs, a strategy that directly enhances shareholder value by reducing the number of outstanding shares.

The company's financial performance in early 2025 and throughout fiscal year 2024 underscores this commitment. In the first quarter of fiscal year 2025, AutoZone invested a notable $505.2 million in stock buybacks. This followed a significant outlay of $3.2 billion in common stock repurchases during the entirety of fiscal year 2024.

These aggressive buyback initiatives are a clear indicator of AutoZone's robust cash flow generation. It also signals a strategic focus on maximizing shareholder returns within its mature market segment. Such actions are typical for established companies that generate consistent profits and seek to reward investors.

- Q1 2025 Share Repurchases: $505.2 million

- Fiscal Year 2024 Share Repurchases: $3.2 billion

- Strategy: Capital return to shareholders via buybacks

- Market Position: Mature, strong cash flow generation

AutoZone's DIY segment is its undisputed Cash Cow, consistently generating substantial profits due to its market leadership and customer loyalty. This segment benefits from a stable market and AutoZone's extensive store network, which currently stands at over 7,387 locations across the U.S., Mexico, and Brazil as of Q1 2025.

The company's commitment to customer service and efficient operations, including strong inventory management, ensures high gross profit margins. This allows AutoZone to return significant capital to shareholders, as evidenced by its aggressive share repurchase programs. For instance, AutoZone repurchased $3.2 billion in common stock during fiscal year 2024 and an additional $505.2 million in the first quarter of fiscal year 2025.

| Metric | Value (Q1 2025) | Value (FY 2024) |

|---|---|---|

| DIY Sales Contribution | ~70% of U.S. Sales | ~70% of U.S. Sales |

| Store Count | 7,387+ | 7,387+ |

| Share Repurchases | $505.2 million | $3.2 billion |

What You See Is What You Get

AutoZone BCG Matrix

The AutoZone BCG Matrix preview you are currently viewing is the identical, fully formatted document you will receive immediately after your purchase. This means no watermarks, no demo content, and no alterations; just the complete, analysis-ready strategic report for your business planning needs.

Dogs

Certain geographic regions within AutoZone's domestic market have demonstrated underperformance when compared to other areas. For example, the Northeast, Mid-Atlantic, and Rust Belt markets experienced a notable 1.8% decline in sales during the first quarter of 2025. This trend suggests these regions are exhibiting lower growth rates and potentially represent areas where AutoZone holds a smaller market share.

Within AutoZone's DIY segment, discretionary sales, making up roughly 17% of the total, have shown signs of weakness. Transactions in this area decreased by 1.8% in the first quarter of 2025.

This underperformance suggests that consumers are pulling back on non-essential auto parts purchases, likely due to economic uncertainty and a focus on essential repairs. This trend could indicate a slight erosion of market share in this specific niche.

AutoZone, like any major auto parts retailer, faces the challenge of outdated or slow-moving inventory, which would fall into the 'dog' category of the BCG matrix. While the company is known for its effective inventory systems, any parts that aren't selling can tie up valuable capital and incur storage costs without contributing to revenue.

For instance, if AutoZone had $100 million in inventory and 5% of it was considered slow-moving or obsolete, that's $5 million in assets not generating returns. To address this, strategies like targeted sales or clearance events would be employed to clear out these items and free up resources.

Products with Declining Demand due to Vehicle Technology Shifts

As the automotive industry pivots towards electric vehicles (EVs), traditional parts for internal combustion engine (ICE) vehicles are facing declining demand. This shift directly impacts product lines heavily dependent on older technologies.

For AutoZone, product categories like exhaust systems and certain engine components for older ICE models could be classified as dogs. For instance, while sales of EV-specific parts are growing, the market share for catalytic converters, a key component in ICE exhaust systems, is projected to see a compound annual growth rate (CAGR) of around 2.5% globally through 2028, indicating a slower pace compared to emerging EV technologies.

- Exhaust Systems: Demand is decreasing as EVs eliminate the need for mufflers, catalytic converters, and tailpipes.

- Fuel System Components: As gasoline engines are phased out, demand for fuel pumps, injectors, and filters for these vehicles will naturally decline.

- Traditional Engine Parts: Items like spark plugs, oil filters, and certain belts for older ICE engines will see reduced demand over time.

Less Efficient Smaller Stores in Saturated Markets

While AutoZone actively pursues store expansion, certain smaller, less efficient locations within highly saturated domestic markets might be categorized as dogs. These stores, particularly those not integrated into the Mega-Hub network or exhibiting limited future growth prospects, often show lower sales per square foot. For instance, in fiscal year 2024, AutoZone reported a total of 7,103 stores globally. A portion of these, especially older formats in mature retail environments, could fall into this underperforming category.

These underperforming stores might struggle to achieve the same sales volumes or profit margins as their larger, more strategically located counterparts. Their contribution to AutoZone's overall profitability could be marginal, making them candidates for review and potential optimization or closure. The company's focus on larger format stores and distribution hubs aims to consolidate resources and improve efficiency, indirectly highlighting the challenges faced by smaller, less adaptable units.

- Underperforming Locations: Smaller stores in saturated markets lacking Mega-Hub support.

- Sales Efficiency: Exhibit lower sales per square foot compared to optimal store performance.

- Profitability Impact: Contribute less to overall company profitability due to lower sales and potential higher operating costs per unit of sales.

- Strategic Review: These stores may be subject to evaluation for potential consolidation, relocation, or closure to improve resource allocation.

Certain AutoZone product lines, particularly those tied to older internal combustion engine (ICE) vehicle technology, can be classified as dogs. For example, demand for exhaust systems and traditional fuel system components is declining as the automotive industry shifts towards electric vehicles. While AutoZone's overall sales for fiscal year 2024 reached $16.3 billion, the specific contribution of these declining product segments may be minimal and represent a drag on resources.

Slow-moving or obsolete inventory also falls into the dog category. If 5% of AutoZone's $100 million inventory is considered slow-moving, that's $5 million tied up without generating returns. This highlights the need for proactive inventory management to mitigate losses.

Additionally, some of AutoZone's smaller, less efficient domestic stores in saturated markets might be considered dogs. These locations, often not part of the Mega-Hub network, can exhibit lower sales per square foot, impacting overall profitability. With 7,103 stores globally as of fiscal year 2024, optimizing or potentially divesting these underperforming units is a strategic consideration.

Question Marks

The burgeoning electric vehicle (EV) sector represents a significant growth opportunity, yet traditional auto parts retailers like AutoZone currently hold a small slice of this emerging market. Despite EVs making up only about 1.7% of the U.S. vehicle fleet in 2024, the demand for specialized components such as batteries, electric motor repairs, and charging station upkeep is poised for rapid expansion.

AutoZone is actively positioning itself for this transition, but its market penetration in the EV parts and services segment remains in its early stages. This segment is characterized by high potential but requires investment in new inventory and technician training to capture future market share.

AutoZone's ALLDATA software offers diagnostic and shop management tools, which are increasingly vital for the growing EV repair sector. While ALLDATA is established, its specific capabilities for the complex electronic systems in EVs are still developing within the broader aftermarket, positioning it as a high-growth, low-penetration segment.

The demand for specialized EV diagnostic software is projected to surge as the electric vehicle fleet expands. By 2024, the global automotive diagnostic software market was valued at over $6 billion, with EV-specific solutions representing a significant and rapidly growing niche within that figure.

AutoZone's e-commerce strategy for complex parts, often requiring professional installation, sits in a developing segment. While DIY online sales are established, the direct-to-consumer (DTC) model for these more intricate components is still evolving. The question is how effectively AutoZone can pivot to capture the 'do-it-for-me' customer who values online convenience for these specialized items.

New Geographic Markets with Untapped Potential (Beyond Current International Focus)

While AutoZone has established a presence in Mexico and is exploring Brazil, new geographic markets with untapped potential represent significant question marks in its BCG Matrix. These markets, characterized by high growth prospects but also substantial investment needs and inherent risks due to low initial market share, could offer future avenues for expansion.

Exploring these nascent markets requires a careful evaluation of their economic indicators and competitive landscapes. For instance, consider the automotive aftermarket growth in Southeast Asia. Countries like Vietnam and the Philippines are experiencing rising disposable incomes and an increasing vehicle parc, presenting long-term opportunities. In 2024, Vietnam's automotive market was projected to grow, driven by increasing domestic demand and government support for the industry.

- Emerging Markets in Southeast Asia: Countries like Vietnam and the Philippines show strong potential due to rising middle classes and growing vehicle ownership.

- African Automotive Growth: North African nations, such as Morocco, are also developing their automotive sectors, with increasing vehicle imports and a need for aftermarket services. Morocco’s automotive industry has seen significant investment in recent years, positioning it as a potential growth area.

- Investment and Risk Assessment: Entering these markets necessitates substantial capital for infrastructure, marketing, and localization, alongside navigating regulatory complexities and understanding local consumer behavior.

Strategic Partnerships for Emerging Automotive Technologies

AutoZone's strategic partnerships for emerging automotive technologies, like autonomous driving components and advanced driver-assistance systems (ADAS) parts, place it in a question mark position within the BCG matrix. These sectors represent high growth potential but currently have a low market share for AutoZone, necessitating careful consideration of investment and expertise. For instance, the global ADAS market was valued at approximately $30 billion in 2023 and is projected to grow at a CAGR of over 15% through 2030.

Entering these nascent but rapidly expanding markets requires significant capital outlay and specialized knowledge, which AutoZone may not currently possess in-house. Strategic alliances or acquisitions could provide the necessary technological capabilities and market access.

- High Growth Potential: The market for autonomous driving sensors and ADAS hardware is expanding rapidly, driven by consumer demand for safety and convenience features.

- Low Current Market Share: AutoZone's existing footprint in these highly specialized technology segments is minimal, indicating a need for strategic entry.

- Investment & Expertise Required: Developing or distributing advanced automotive tech demands substantial R&D investment and deep technical understanding.

- Partnership/Acquisition Strategy: Collaborating with or acquiring tech firms is a viable path to gain market share and expertise in these emerging areas.

The burgeoning electric vehicle (EV) sector represents a significant growth opportunity, yet traditional auto parts retailers like AutoZone currently hold a small slice of this emerging market. Despite EVs making up only about 1.7% of the U.S. vehicle fleet in 2024, the demand for specialized components such as batteries, electric motor repairs, and charging station upkeep is poised for rapid expansion.

AutoZone is actively positioning itself for this transition, but its market penetration in the EV parts and services segment remains in its early stages. This segment is characterized by high potential but requires investment in new inventory and technician training to capture future market share.

The demand for specialized EV diagnostic software is projected to surge as the electric vehicle fleet expands. By 2024, the global automotive diagnostic software market was valued at over $6 billion, with EV-specific solutions representing a significant and rapidly growing niche within that figure.

AutoZone's strategic partnerships for emerging automotive technologies, like autonomous driving components and advanced driver-assistance systems (ADAS) parts, place it in a question mark position within the BCG matrix. These sectors represent high growth potential but currently have a low market share for AutoZone, necessitating careful consideration of investment and expertise. For instance, the global ADAS market was valued at approximately $30 billion in 2023 and is projected to grow at a CAGR of over 15% through 2030.

| Category | Market Growth | AutoZone Market Share | Strategic Consideration |

| EV Parts & Services | High | Low | Invest in inventory & training |

| EV Diagnostic Software | High | Developing | Enhance ALLDATA capabilities |

| Emerging Geographies (e.g., SE Asia) | High | Low | Market entry assessment |

| ADAS & Autonomous Tech | High | Low | Strategic partnerships/acquisitions |

BCG Matrix Data Sources

Our AutoZone BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official company reports to ensure reliable, high-impact insights.