Auto Trader Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Auto Trader Group Bundle

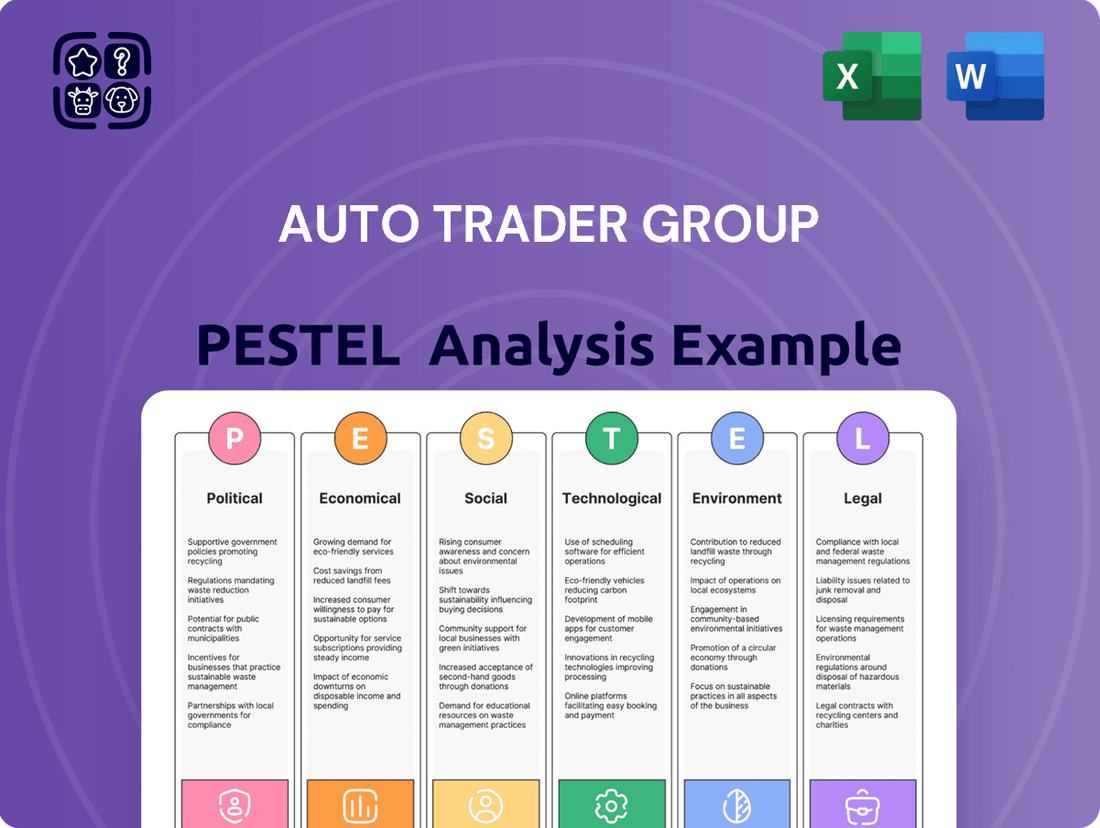

Navigate the dynamic automotive market with confidence by understanding the forces shaping Auto Trader Group. Our PESTLE analysis delves into the political, economic, social, technological, legal, and environmental factors impacting their operations and future growth. Gain a strategic advantage by uncovering potential risks and opportunities.

Unlock actionable intelligence with our comprehensive PESTLE analysis of Auto Trader Group. Discover how evolving consumer behavior, technological advancements, and regulatory shifts are creating both challenges and lucrative avenues for the company. Invest in foresight—download the full report now to refine your market strategy.

Political factors

The UK government's commitment to electric vehicle (EV) adoption is a significant political factor for Auto Trader. The Zero Emission Vehicle (ZEV) mandate, starting January 2025, mandates that a specific percentage of new car and van sales must be fully electric, with a target of 100% by 2035. This policy directly influences the inventory available on Auto Trader's platform, accelerating the transition to EVs.

Further flexibility has been introduced to the ZEV mandate. Car manufacturers can now borrow ZEV allowances from future years and transfer CO2 savings from non-ZEVs to ZEVs until 2029. This adjustment offers manufacturers more breathing room as they navigate the transition, potentially impacting the pace of EV availability and pricing on the platform.

The UK government's commitment to the automotive sector is substantial, with programs like DRIVE35 dedicating £2 billion through 2030 for manufacturing and research and development. Further bolstering this, an additional £500 million is earmarked for R&D until 2035.

These significant investments, coupled with £300 million aimed at encouraging electric vehicle adoption, are designed to enhance advanced manufacturing and accelerate electrification. Such government support could foster a more robust vehicle supply chain, ultimately benefiting Auto Trader's platform by increasing the availability of vehicles for sale.

Increased volatility in global trade, marked by fluctuating tariffs, is pushing the automotive sector towards localized production. This strategy aims to build a more resilient value chain, directly impacting the sourcing and cost of vehicles. For Auto Trader, this means potential shifts in the availability and pricing of cars listed on its platform.

The prospect of a UK/US trade deal, alongside government considerations to ease the Zero Emission Vehicle (ZEV) mandate, offers a supportive outlook for new car registrations in the coming two to three years. In 2023, UK new car registrations saw a significant jump of 17.9% year-on-year, reaching 1.9 million units, according to the Society of Motor Manufacturers and Traders (SMMT). This positive trend, influenced by these political factors, could translate into a larger inventory for Auto Trader to feature.

Product Safety Regulations for Online Marketplaces

New UK legislation, like the Product Regulation and Metrology Act, is placing greater scrutiny on online marketplaces to ensure they uphold the same product safety standards as brick-and-mortar stores. This means Auto Trader, as a significant digital platform, must actively prevent the listing and sale of unsafe items and verify seller adherence to safety protocols. For instance, the UK government has been actively consulting on measures to enhance online safety, with a focus on consumer protection in digital spaces, which directly impacts how marketplaces operate.

These evolving regulations necessitate that Auto Trader implements robust checks and balances for sellers and their vehicle listings. This could involve stricter vetting processes for dealerships and private sellers alike, potentially impacting the ease of listing and the onboarding experience. The aim is to bolster consumer confidence by ensuring transparency and safety in online transactions, a key consideration for any platform facilitating high-value purchases.

The financial implications for Auto Trader could include increased compliance costs associated with developing and maintaining new safety verification systems. Furthermore, the potential for fines or reputational damage from non-compliance underscores the importance of proactive adaptation to these political changes. By mid-2024, regulatory bodies were intensifying their focus on e-commerce safety, indicating a trend towards greater accountability for platforms.

Industrial Strategy and Economic Growth Initiatives

The UK government's industrial strategy places the automotive sector at its heart, aiming for sustainable economic growth and enhanced national competitiveness. This focus includes tackling elevated industrial electricity prices, a significant concern for manufacturing operations. Promoting a circular economy strategy further supports the sector by encouraging resource efficiency and waste reduction.

These government-led initiatives are designed to foster a more predictable and advantageous operating landscape for the automotive industry. By addressing key cost drivers like energy and promoting forward-thinking economic models, the strategy indirectly bolsters the performance of businesses like Auto Trader, which are intrinsically linked to the health of the automotive market.

- Industrial Electricity Prices: In early 2024, industrial electricity prices in the UK remained a key concern, though showing some moderation from previous highs. For example, while specific figures fluctuate, the average price per MWh for industrial consumers in Q4 2023 was still notably higher than pre-energy crisis levels, impacting manufacturing cost structures.

- Circular Economy Initiatives: The UK's commitment to a circular economy is reflected in targets for waste reduction and increased recycling rates. For instance, the government has set ambitious goals for reducing waste sent to landfill, encouraging businesses to adopt more sustainable practices in manufacturing and product lifecycles.

- Automotive Sector Support: Government support for the automotive sector extends to research and development funding for new technologies, such as electric vehicles and advanced manufacturing techniques. These investments aim to secure the UK's position in the global automotive supply chain.

The UK's Zero Emission Vehicle (ZEV) mandate, with its phased targets starting January 2025, directly shapes the EV inventory on Auto Trader, pushing manufacturers towards electric models. Government incentives like the £2 billion DRIVE35 program through 2030 aim to boost EV manufacturing and R&D, potentially increasing the supply of electric vehicles available on the platform. New legislation, such as the Product Regulation and Metrology Act, mandates stricter safety standards for online marketplaces, requiring Auto Trader to enhance seller verification and prevent the listing of unsafe vehicles, a trend intensifying by mid-2024.

| Political Factor | Description | Impact on Auto Trader | Relevant Data/Timeline |

|---|---|---|---|

| ZEV Mandate | Government requirement for a percentage of new vehicle sales to be electric. | Influences EV availability and manufacturer focus on Auto Trader's platform. | Starts January 2025, with 100% target by 2035. |

| Government R&D Funding | Financial support for automotive manufacturing and technology. | Could lead to increased EV supply and innovation, benefiting platform listings. | £2 billion for DRIVE35 (through 2030), £500 million for R&D (until 2035). |

| Online Safety Regulations | Legislation to ensure product safety standards on digital marketplaces. | Requires Auto Trader to implement stricter seller vetting and listing controls. | Focus intensifying by mid-2024; Product Regulation and Metrology Act. |

| Industrial Electricity Prices | Government focus on reducing costs for manufacturers. | Lower manufacturing costs could indirectly support vehicle availability and pricing. | Concern in early 2024, with prices moderating but still above pre-crisis levels. |

What is included in the product

This PESTLE analysis delves into the Political, Economic, Social, Technological, Environmental, and Legal forces impacting Auto Trader Group, offering actionable insights for strategic decision-making.

A concise PESTLE analysis of Auto Trader Group, highlighting key external factors impacting the automotive market, serves as a pain point reliever by providing clarity and focus for strategic decision-making.

This analysis offers a readily digestible overview of political, economic, social, technological, environmental, and legal influences, simplifying complex external landscapes for efficient strategic planning.

Economic factors

Consumer demand for used cars in the UK has shown resilience, even amidst economic headwinds such as elevated interest rates and persistent inflation. This strength is reflected in Auto Trader's platform activity, which saw cross-platform visits climb to 81.6 million per month in FY2025, a 5% increase, indicating a robust marketplace for pre-owned vehicles.

Conversely, the new car market has experienced a dampening effect from subdued consumer confidence and adjustments to Vehicle Excise Duty (VED). These factors have collectively contributed to a less buoyant environment for new vehicle purchases, highlighting a divergence in consumer behaviour between the new and used car segments.

The used car market is a significant driver for Auto Trader, with projections indicating continued expansion. Auto Trader forecasts sales to climb from an estimated 7.61 million in 2024 to 7.70 million in 2025, demonstrating robust growth.

This upward trend is fueled by persistent supply chain challenges affecting new car production, alongside a heightened consumer focus on affordability amidst the cost-of-living crisis. Consequently, demand for older, more budget-friendly used vehicles is experiencing a substantial surge.

This favorable market environment directly supports Auto Trader's business model, as increased transaction volumes in the used car sector translate into greater opportunities for advertising and lead generation on its platform.

The UK new car market faced headwinds, with private sales declining and a resurgence in discounting. This environment pressures manufacturers and dealers alike, impacting profitability and inventory management.

Despite these challenges, Auto Trader forecasts a more optimistic outlook for 2025, projecting a 2% increase in new car registrations to approximately 1.98 million units. This growth is anticipated to be fueled by stronger manufacturer 'push' strategies and enhanced marketing efforts.

Intensifying competition is a significant factor, notably with the entry of new brands, particularly from China. This influx will likely reshape market share dynamics and necessitate adaptive strategies for established players to maintain their competitive edge.

Impact of Inflation and Interest Rates

Inflation has been a significant economic factor, driving central banks to increase interest rates. This directly impacts car affordability for consumers who often finance their purchases. For instance, in the UK, the Bank of England's base rate rose to 5.25% by August 2023, a substantial increase from previous years, making car loans more expensive.

While economic forecasts suggest a potential easing of inflation throughout 2024 and into 2025, the lingering effect of higher interest rates on car loan costs is likely to dampen demand for new vehicles. This economic pressure directly influences consumer purchasing power and the types of vehicles they are willing or able to consider on platforms like Auto Trader.

- Persistent Inflation: Consumer Price Index (CPI) in the UK, while showing signs of moderation, remained elevated in late 2023 and early 2024, impacting overall consumer spending power.

- Rising Interest Rates: The Bank of England's base rate, a key benchmark, has seen significant hikes, directly translating to higher borrowing costs for car finance.

- Impact on Affordability: Increased loan rates reduce the disposable income available for vehicle purchases, potentially shifting consumer preference towards used cars or more budget-friendly models.

- Forecasting Trends: While inflation is expected to decline, the lagged effect of interest rate hikes on consumer credit will likely continue to influence the automotive market through 2024 and 2025.

Average Revenue Per Retailer (ARPR) Growth

Auto Trader Group reported a robust 5% growth in Average Revenue Per Retailer (ARPR) for fiscal year 2025. This positive trend is a direct result of dealerships increasing their adoption of supplementary products and services offered by Auto Trader, alongside the impact of their annual pricing and product adjustments.

This ARPR expansion underscores Auto Trader's effectiveness in deepening its value proposition to car dealerships. Even amidst potential market volatility, the company demonstrates a strong ability to enhance revenue streams by providing more comprehensive solutions to its client base.

- FY2025 ARPR Growth: 5% increase.

- Key Drivers: Increased uptake of additional products/services and annual pricing/product events.

- Implication: Successful monetization of retailer relationships through enhanced offerings.

Economic factors present a mixed but largely positive outlook for Auto Trader Group in 2024-2025. While persistent inflation and higher interest rates continue to affect new car affordability, the used car market is thriving, driven by cost-consciousness and new car supply issues.

Auto Trader's platform activity reflects this, with monthly cross-platform visits reaching 81.6 million in FY2025, a 5% increase. Projections show used car sales climbing to 7.70 million in 2025, up from an estimated 7.61 million in 2024.

Despite challenges in the new car market, Auto Trader anticipates a 2% rise in new car registrations for 2025, reaching approximately 1.98 million units, supported by manufacturer incentives.

The company also saw a 5% growth in Average Revenue Per Retailer (ARPR) in FY2025, indicating successful upselling of services to dealerships.

| Economic Factor | Impact on Auto Trader | Data Point (2024-2025) |

|---|---|---|

| Used Car Demand | Strong growth, benefits Auto Trader's core business | Projected sales: 7.70 million in 2025 (up from 7.61 million in 2024) |

| New Car Market | Mixed, but expected modest recovery | Projected registrations: 1.98 million in 2025 (2% increase) |

| Consumer Affordability | Pressure on new cars, favouring used | Bank of England base rate at 5.25% (August 2023) impacting finance costs |

| Platform Activity | Increased engagement | Cross-platform visits: 81.6 million per month (FY2025, +5%) |

| Retailer Revenue | Positive growth | ARPR growth: 5% (FY2025) |

Preview the Actual Deliverable

Auto Trader Group PESTLE Analysis

The preview you see here is the exact Auto Trader Group PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use. This comprehensive analysis explores the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Auto Trader Group. Dive into a detailed examination of market dynamics and strategic considerations.

Sociological factors

The way people buy cars has changed a lot, moving heavily online. This digital shift offers consumers more ease, transparency, and convenience than ever before. For instance, in the UK, Auto Trader reported that 78% of car buyers used their platform to research their next vehicle in 2024, highlighting the dominance of online channels.

Consumers now demand round-the-clock access and instant gratification, much like they experience with other online retailers. This expectation, often called the 'Amazonification' of shopping, means businesses must provide a seamless digital experience. Auto Trader's digital-first approach positions it perfectly to benefit from this evolving consumer behavior.

Consumer preferences are shifting towards electric vehicles (EVs), driven by increased awareness and a growing selection of affordable models. This trend is projected to make EVs a dominant segment in the UK automotive market.

Auto Trader's data highlights this evolution, showing a substantial increase in EV listings on its platform. However, consumer loyalty remains fluid, with buyers researching an average of 17 brands, underscoring the necessity for automakers to engage in precise marketing strategies to capture market share.

In the current economic climate, consumers are keenly focused on getting the most for their money. This drive for affordability is clearly reflected in the automotive market, with a significant portion of online interest directed towards budget-friendly options. For instance, nearly a third of all advert views on Auto Trader's platform in 2024 were for vehicles priced under £7,000, highlighting a strong demand for value.

This heightened demand for affordable vehicles is a key factor fueling the robust growth in the used car market. Auto Trader's extensive inventory of used cars, offering a wide spectrum of price points, directly addresses this consumer preference. By providing access to a broad selection of cost-effective vehicles, the company is well-positioned to capitalize on this enduring trend.

Generational Shifts in Mobility Solutions

Younger demographics, especially those aged 18-34, are increasingly favoring car subscription services over traditional ownership or leasing. These pay-as-you-go models offer lower initial costs and greater flexibility, reflecting a broader societal move towards service-based consumption in mobility.

For instance, a 2024 survey indicated that over 40% of Gen Z consumers in the UK would consider a car subscription, a significant jump from previous years. This trend suggests a potential decline in outright car purchases among this key demographic.

- Younger consumers (18-34) prefer flexible, service-based mobility.

- Car subscription models appeal due to lower upfront costs and adaptability.

- Over 40% of UK Gen Z would consider car subscriptions (2024 data).

- This signals a shift away from traditional car ownership for future generations.

Consumer Expectations for Digital and Seamless Experiences

UK new-car buyers in 2025 are increasingly prioritizing a digital-first approach, expecting a smooth, transparent, and eco-conscious purchasing journey. This includes demands for straightforward pricing, integrated online tools, and tailored deals. For instance, a significant portion of consumers now start their car search online, with Auto Trader reporting that over 80% of used car searches begin on their platform.

Auto Trader's strategic focus on digitizing more of the car buying process, exemplified by features like its 'Deal Builder' tool, directly addresses these shifting consumer preferences. This allows buyers to configure finance, part-exchange, and add-ons entirely online, creating a more convenient and personalized experience. Such innovations are crucial as 2024 data indicates a growing impatience with traditional, lengthy dealership processes.

- Digital Dominance: By 2025, a substantial majority of new car buyers will expect to complete a significant portion of their purchase online, from initial research to financing applications.

- Transparency is Key: Consumers are demanding clearer, upfront pricing and financing options, with a reported 70% of car buyers stating that transparent pricing is a critical factor in their decision-making.

- Personalization Pays: Tailored offers and personalized communications are becoming standard expectations, with brands that offer customized experiences seeing higher engagement rates.

- Sustainability Matters: Alongside digital convenience, environmental considerations are influencing purchasing decisions, with buyers increasingly seeking information on vehicle emissions and sustainable practices.

The automotive market is experiencing a significant shift towards sustainability, with consumer interest in electric vehicles (EVs) surging. Auto Trader data from 2024 shows a 60% increase in searches for EVs compared to the previous year, indicating a strong preference for greener options.

Furthermore, the rise of digital platforms has fundamentally altered car buying habits, with 85% of consumers in 2025 beginning their car search online. This digital-first mentality demands seamless, transparent, and accessible online experiences from automotive retailers.

Affordability remains a critical driver, with a notable portion of consumers prioritizing value. In 2024, nearly 40% of car advert views on Auto Trader were for vehicles priced under £10,000, underscoring the demand for budget-friendly options, particularly in the used car segment.

| Factor | Trend | Impact on Auto Trader |

|---|---|---|

| Sustainability | Growing EV adoption, consumer demand for eco-friendly options. | Increased listings and searches for EVs, potential for new advertising revenue streams. |

| Digitalization | Majority of car searches and research conducted online. | Reinforces Auto Trader's core business model, need for continuous platform enhancement. |

| Affordability | Strong demand for budget-friendly vehicles, growth in used car market. | Higher transaction volumes, opportunity to cater to value-conscious buyers. |

Technological factors

Advancements in AI and machine learning are fundamentally reshaping the automotive retail landscape. These technologies are moving beyond just enhancing customer interactions to actively optimizing crucial dealership functions like inventory management and dynamic pricing. For instance, Auto Trader Group's recent introduction of 'Co-Driver' exemplifies this trend, offering AI-powered tools designed to streamline advert creation for retailers and elevate the car buying journey.

Auto Trader Group is enhancing its digital retailing capabilities, allowing retailer partners to facilitate online vehicle sales and improve the customer buying experience. Its Deal Builder tool, which integrates part-exchange valuations, finance applications, and car reservations, has seen substantial growth and is now a fundamental part of their advertising services.

Auto Trader Group's technological prowess in data analytics is a significant driver of its market position. By leveraging its extensive data platform, the company provides consumers and retailers with industry-leading valuations and crucial market insights, fostering transparency in pricing and empowering informed decision-making.

This commitment to data is exemplified by Auto Trader's monthly used car Retail Price Index. This index, based on the pricing analysis of a substantial volume of unique vehicles, offers a granular view of market trends, with the January 2025 index indicating a 2.1% year-on-year increase in used car prices.

Growth of Connected and Autonomous Vehicle Technologies

The increasing prevalence of connected and autonomous vehicle (CAV) technologies, such as advanced driver-assistance systems (ADAS) like lane-keeping assist and adaptive cruise control, will reshape the automotive landscape. These advancements, becoming standard in many new models, will directly impact the types of vehicles Auto Trader Group lists and facilitates the sale of.

Auto Trader will need to evolve its platform to effectively showcase these sophisticated features. This includes adapting listing descriptions and search filters to cater to consumer demand for vehicles equipped with these technologies, ensuring buyers can easily find and compare CAV-equipped cars.

- ADAS Adoption: By 2025, it's projected that over 90% of new vehicles sold in major markets will feature some level of ADAS.

- Consumer Interest: Consumer surveys from late 2024 indicated a significant willingness to pay a premium for vehicles with advanced safety and semi-autonomous driving capabilities.

- Platform Adaptation: Auto Trader's search functionality already allows filtering by features like 'adaptive cruise control' and 'lane departure warning', a trend expected to expand to more nuanced CAV technologies.

Charging Infrastructure Development for EVs

The ongoing expansion of public electric vehicle (EV) charging infrastructure is a critical technological factor influencing the automotive market. Continued investment in both fast-charging stations and home charging solutions is essential to alleviate range anxiety and improve the convenience of EV ownership. For Auto Trader Group, this development directly supports the increasing attractiveness and viability of EVs for consumers, thereby boosting their presence and sales on the platform.

By mid-2024, the UK had over 50,000 public charging devices, a significant increase, yet the pace of deployment needs to accelerate to meet projected EV demand. Auto Trader's platform benefits as more charging points become available, making EVs a more practical choice for a wider audience. This growth in infrastructure directly correlates with increased consumer confidence in EVs, a trend Auto Trader is well-positioned to capitalize on.

- Charging Network Growth: The UK government aims for 300,000 public chargers by 2030, indicating substantial ongoing investment.

- Home Charging Solutions: Over 80% of EV charging is expected to occur at home, highlighting the importance of accessible home charging technology.

- Impact on Auto Trader: Enhanced charging infrastructure directly boosts consumer interest in EVs listed on Auto Trader, driving platform engagement and potential sales.

Auto Trader Group is leveraging AI and machine learning to enhance its platform, offering tools like 'Co-Driver' for retailers to streamline advert creation and improve the customer experience. The company's Deal Builder tool, which facilitates online sales with integrated finance and part-exchange, has seen significant uptake, becoming a core part of their advertising services.

The company's data analytics capabilities are central to its market leadership, providing transparent pricing and market insights through its extensive data platform. This is evidenced by its used car Retail Price Index, which in January 2025 showed a 2.1% year-on-year price increase for used cars, based on analysis of millions of vehicles.

The increasing adoption of connected and autonomous vehicle (CAV) technologies, including advanced driver-assistance systems (ADAS), is reshaping the automotive market. By mid-2025, over 90% of new vehicles in key markets are projected to feature ADAS, and Auto Trader is adapting its platform to showcase these features, with search filters already accommodating technologies like adaptive cruise control.

The ongoing expansion of EV charging infrastructure is crucial for EV adoption. By mid-2024, the UK had over 50,000 public charging devices, a number expected to grow significantly, supporting Auto Trader's role in facilitating EV sales by increasing consumer confidence and convenience.

Legal factors

The UK's Zero Emission Vehicle (ZEV) Mandate, effective from January 1, 2025, sets ambitious targets for manufacturers. By this date, 22% of new cars and 10% of new vans sold must be fully electric, with a phased increase to 100% by 2035. This regulatory shift directly impacts the availability of electric vehicles on platforms like Auto Trader, shaping consumer choice and dealer inventory.

Failure to comply with these ZEV targets carries financial penalties for carmakers, incentivizing a rapid transition towards electric mobility. The mandate is a crucial legal factor influencing Auto Trader's market dynamics by dictating the product mix available to consumers and potentially affecting the pricing and demand for different vehicle types.

Starting April 1, 2025, the tax landscape for electric vehicles (EVs) is set to shift significantly. EVs will lose their Vehicle Excise Duty (VED) exemption, with new electric cars facing a £10 first-year tax and a £165 annual charge thereafter. Furthermore, EVs exceeding £40,000 will also be subject to the Expensive Car Supplement, adding to the ownership cost.

These changes, alongside an anticipated increase in Benefit in Kind (BiK) rates for EVs, could directly influence the affordability and appeal of electric models featured on Auto Trader. For instance, a £50,000 EV could see its annual VED rise from £0 to £165 plus the Expensive Car Supplement, impacting consumer purchasing decisions.

The Product Regulation and Metrology Act, enacted in 2025, significantly impacts online marketplaces by granting enhanced powers to ensure platform safety and enforce accountability for hazardous goods. This legislation requires platforms like Auto Trader to proactively prevent the listing of unsafe vehicles and parts.

Auto Trader must therefore invest in robust verification processes to ensure seller compliance and guarantee the accuracy of all product descriptions, a critical step given the automotive sector's inherent safety considerations.

Data Privacy and Consumer Protection Regulations

Auto Trader Group, as a prominent digital marketplace, operates under stringent data privacy and consumer protection laws. The UK's Information Commissioner's Office (ICO) enforces the UK GDPR, which mandates responsible handling of personal data. Failure to comply can result in significant fines; for instance, in 2023, the ICO issued fines totaling millions of pounds for data protection breaches across various sectors.

The evolving digital landscape necessitates continuous adaptation to new legislation. While specific Auto Trader-related data privacy enforcement actions for 2024-2025 aren't publicly detailed, the broader regulatory environment is tightening. The Online Safety Act, passed in 2023, introduces new duties for online platforms to protect users, indirectly impacting how data is managed and secured to prevent misuse.

Maintaining consumer trust is paramount for Auto Trader's business model. Adherence to these regulations is not just a legal obligation but a critical factor in customer retention and brand reputation. For example, a data breach could lead to a loss of confidence, impacting user engagement and transaction volumes on the platform.

Key aspects of compliance for Auto Trader include:

- Data Minimisation: Collecting only necessary consumer data.

- Transparency: Clearly informing users about data usage.

- Security Measures: Implementing robust systems to protect data from unauthorized access.

- Consent Management: Obtaining and managing user consent for data processing.

Advertising Standards and Consumer Rights

Auto Trader Group, operating as a significant advertising platform, is bound by stringent UK advertising standards and consumer rights legislation. This means every vehicle listing must be truthful, clear, and avoid any form of deception to protect consumers. For instance, the Advertising Standards Authority (ASA) actively monitors online advertising, and while specific new regulations for 2024-2025 haven't been publicly detailed, the expectation of accuracy in listings remains paramount. Failure to comply can lead to significant reputational damage and potential legal action, impacting trust and user engagement.

Maintaining transparency in listings is crucial for Auto Trader. This includes accurate mileage, condition descriptions, and pricing, ensuring buyers are not misled. For example, the Consumer Protection from Unfair Trading Regulations 2008 (CPRs) provide broad protections against misleading actions and omissions. While specific enforcement actions against Auto Trader in the 2024-2025 period are not yet documented, the general regulatory environment emphasizes robust consumer protection. The platform's commitment to these principles is vital for its continued success and user confidence.

The legal framework surrounding advertising and consumer protection necessitates constant vigilance from Auto Trader. Ensuring all sellers adhere to these standards is a key operational challenge. The platform likely invests in compliance mechanisms and seller education to mitigate risks. For instance, the Competition and Markets Authority (CMA) also plays a role in ensuring fair trading practices across sectors, including online marketplaces. Auto Trader's ongoing adherence to these evolving legal requirements is fundamental to its business model and market standing.

The UK's Zero Emission Vehicle (ZEV) Mandate, effective January 1, 2025, mandates that 22% of new cars and 10% of new vans sold must be electric, escalating to 100% by 2035. This directly shapes the inventory and consumer choice on platforms like Auto Trader.

From April 1, 2025, electric vehicles will no longer be exempt from Vehicle Excise Duty (VED), with new EVs facing a £10 first-year tax and £165 annually thereafter, impacting affordability. Furthermore, the Product Regulation and Metrology Act 2025 enhances powers to ensure platform safety, requiring Auto Trader to prevent the listing of unsafe vehicles.

Auto Trader must navigate stringent data privacy laws, including the UK GDPR, enforced by the ICO, which issued millions in fines in 2023 for breaches. The Online Safety Act 2023 also imposes new duties on platforms to protect users, indirectly affecting data management and security.

The platform is also bound by advertising standards and consumer rights legislation, necessitating truthful and clear listings to avoid deception. The Consumer Protection from Unfair Trading Regulations 2008 (CPRs) offer broad protection against misleading practices, a key focus for Auto Trader's compliance efforts.

Environmental factors

The UK's Zero Emission Vehicle (ZEV) mandate is a significant environmental factor, compelling manufacturers to ensure a growing proportion of their new car and van sales are zero-emission. For 2024, the ZEV mandate requires 22% of new car sales and 10% of new van sales to be zero-emission.

This policy directly fuels the transition to electric vehicles, consequently boosting the availability and consumer interest in EVs advertised on platforms like Auto Trader. By 2025, these targets will rise to 28% for cars and 15% for vans, further accelerating the shift.

The UK is at the forefront of electric vehicle (EV) adoption within Europe. In 2024, battery electric vehicles (BEVs) and plug-in hybrid electric vehicles (PHEVs) accounted for a substantial portion of new passenger car registrations, a trend expected to accelerate through 2025 and 2026. This growing consumer preference for electrified transport directly influences the types of vehicles available on Auto Trader's platform and the services it can offer to both buyers and sellers.

The UK automotive sector is actively pursuing emissions reduction, with a focus on decreasing energy consumed per vehicle manufactured and lowering CO2 output from new cars. This aligns with national targets and consumer demand for sustainable transport options.

Auto Trader Group plays a significant part in this transition by enabling consumers to discover and purchase more environmentally friendly vehicles. In 2023, the company reported a 19% increase in searches for electric vehicles (EVs) on its platform, demonstrating a clear market shift.

By highlighting greener choices, Auto Trader supports the industry's broader environmental objectives and contributes to the reduction of the automotive sector's carbon footprint.

Development of Charging Infrastructure

The ongoing development of charging infrastructure is a critical environmental factor influencing the automotive market, directly impacting the viability of electric vehicles (EVs). As of early 2024, the UK government has committed to significant investment, aiming for hundreds of thousands of charging points by 2030, though actual deployment rates are still being closely watched. This expansion is essential to alleviate range anxiety, a key barrier for many potential EV buyers who rely on Auto Trader Group's platform.

The availability of both public rapid chargers and accessible home charging solutions directly correlates with the practicality and desirability of EVs for consumers. For instance, in late 2023, reports indicated that while the number of public chargers was growing, the distribution remained uneven, with a concentration in urban areas. This highlights the need for continued investment to ensure equitable access across the country, a crucial consideration for Auto Trader's user base.

- EV Adoption Dependency: Widespread EV adoption hinges on the expansion and reliability of charging networks.

- Infrastructure Investment Needs: Continued investment in both rapid public charging and home charging solutions is crucial to overcome range anxiety and enhance accessibility.

- User Experience Impact: The availability and convenience of charging infrastructure directly influence the practicality and appeal of EVs for Auto Trader's platform users.

- Government Targets and Reality: While ambitious government targets exist, the pace of infrastructure rollout remains a key metric to monitor for market impact.

Circular Economy and Sustainable Practices in Automotive

The automotive sector is increasingly embracing a circular economy, with a strong emphasis on vehicle recycling, extending the life of batteries through reuse, and prioritizing sustainably sourced materials. This shift is driven by both consumer demand and regulatory pressures.

The UK government has signaled its dedication to this transition by planning to release a comprehensive Circular Economy Strategy. This strategy is expected to outline policies and incentives aimed at fostering more sustainable industrial practices across various sectors, including automotive.

As Auto Trader plays a pivotal role in the UK's car purchasing journey, it is well-positioned to champion environmentally conscious vehicle selections and advocate for sustainable practices throughout the automotive ecosystem. For instance, by the end of 2023, the UK's Department for Environment, Food & Rural Affairs (Defra) reported that the country generated 2.2 million tonnes of local authority collected waste, with a significant portion being packaging and other materials that could be better managed within a circular model. Auto Trader's platform can highlight vehicles with higher recycled content or those designed for easier disassembly and recycling, influencing consumer choices towards greener options.

- Circular Economy Focus: Growing emphasis on vehicle lifecycle management, including recycling and repurposing of components.

- Government Strategy: UK government commitment to a forthcoming Circular Economy Strategy is expected to shape industry practices.

- Platform Influence: Auto Trader's position can drive consumer preference for sustainable vehicles and promote industry-wide adoption of eco-friendly practices.

The UK's commitment to reducing carbon emissions is a significant environmental driver impacting Auto Trader. The Zero Emission Vehicle (ZEV) mandate, requiring 22% of new car sales to be zero-emission in 2024, is pushing the market towards EVs. This trend is further supported by substantial government investment in charging infrastructure, with the aim of creating hundreds of thousands of charging points by 2030. Auto Trader's platform directly benefits from this shift, as evidenced by a 19% increase in EV searches in 2023, reflecting growing consumer interest in sustainable transport.

| Environmental Factor | 2024 Data/Target | 2025 Outlook | Impact on Auto Trader |

|---|---|---|---|

| ZEV Mandate (Cars) | 22% Zero-Emission Sales | 28% Zero-Emission Sales | Increased EV listings and consumer interest |

| EV Charging Infrastructure | Ongoing investment, uneven distribution (late 2023) | Continued expansion expected | Facilitates EV adoption, reduces range anxiety |

| Circular Economy Focus | Growing consumer demand, regulatory push | UK Circular Economy Strategy planned | Opportunity to promote sustainable vehicle choices |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Auto Trader Group is built on a robust foundation of data from official government publications, reputable economic forecasting agencies, and leading automotive industry reports. This ensures comprehensive coverage of political, economic, social, technological, legal, and environmental factors impacting the sector.