Auto Trader Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Auto Trader Group Bundle

Auto Trader Group navigates a competitive landscape shaped by moderate buyer power from dealerships and intense rivalry among online automotive marketplaces. The threat of new entrants is somewhat mitigated by established brand recognition and network effects, but the digital nature of the industry allows for agile disruption.

The full analysis reveals the strength and intensity of each market force affecting Auto Trader Group, complete with visuals and summaries for fast, clear interpretation. Unlock key insights into Auto Trader Group’s industry forces—from buyer power to substitute threats—and use this knowledge to inform strategy or investment decisions.

Suppliers Bargaining Power

Auto Trader's reliance on technology and data providers is significant, as these entities underpin its platform's core operations and market intelligence. While a broad range of general technology providers exist, the market for specialized automotive data is more concentrated. This concentration can grant certain data providers a degree of bargaining power.

However, Auto Trader's substantial investment in its own data infrastructure and its dominant market position as the UK's leading digital automotive marketplace significantly counterbalances this supplier power. For instance, Auto Trader's revenue for the year ending March 31, 2024, was £520.4 million, demonstrating its scale and ability to negotiate favorable terms.

Automotive retailers, the dealerships, are key suppliers of the vehicles Auto Trader lists on its digital marketplace. While Auto Trader dominates the UK market, dealerships retain some leverage. They can opt to list their inventory on alternative platforms or even promote directly through their own websites and physical locations, potentially reducing their reliance on Auto Trader.

To counter this, Auto Trader actively works to enhance its value proposition for retailers. Initiatives like the Deal Builder tool and AI-powered features such as Co-Driver are designed to deepen these relationships. By offering advanced tools and demonstrable value, Auto Trader seeks to minimize any inclination for dealerships to seek out other listing services, thereby reinforcing its position as an indispensable partner in their sales process.

Private sellers are a crucial part of the used car market, contributing a substantial volume of listings. For instance, in 2024, Auto Trader continued to see a significant percentage of its inventory come from private individuals, underscoring their importance to the platform's breadth.

The bargaining power of these private sellers with Auto Trader is typically low. This is largely due to the highly fragmented nature of this seller group, with each individual having limited leverage. Their reliance on Auto Trader's extensive reach and established customer base to find buyers for their vehicles significantly diminishes their ability to negotiate terms or fees.

Auto Trader's dominant market position means it offers the most efficient and effective channel for private sellers to market their cars. This creates a dependency for private sellers, further concentrating bargaining power with the platform rather than the individual seller.

Finance and Insurance Providers

Finance and insurance providers act as suppliers to Auto Trader Group, contributing essential services to its integrated car buying platform. The bargaining power of these suppliers is influenced by the overall competitiveness within the financial services sector and the distinctiveness of their product offerings. For instance, in 2024, the UK’s motor finance market saw continued growth, with new business volumes reaching significant figures, indicating a robust supplier base.

Auto Trader's strength lies in its ability to integrate these financial and insurance solutions directly into the consumer’s car search experience, thereby enhancing the value proposition for both buyers and sellers. This integration can mitigate the suppliers' bargaining power by creating a captive audience and a streamlined distribution channel. The group’s extensive reach, with millions of monthly visitors to its platform, makes it an attractive partner for financial institutions seeking to access the automotive market.

- Supplier Dependence: Auto Trader's reliance on finance and insurance partners for its integrated offerings.

- Market Competitiveness: The degree of competition among financial service providers influences their bargaining power.

- Integration Value: Auto Trader's platform adds value by seamlessly embedding these services into the car buying journey.

- Market Reach: Auto Trader's substantial audience provides leverage against individual financial suppliers.

Marketing and Advertising Agencies

While Auto Trader Group operates as an advertising platform, it may still engage external marketing and advertising agencies for its own brand promotion and digital campaigns. The bargaining power of these suppliers is typically moderate. This is largely due to the significant number of marketing and advertising agencies available in the market, offering a competitive landscape.

Auto Trader's own internal marketing expertise and its robust data-driven approach likely temper the bargaining power of external agencies. By possessing strong in-house capabilities, Auto Trader can be more selective and negotiate more effectively, reducing its reliance on any single external provider. For instance, in 2023, the global digital advertising market was valued at approximately $600 billion, indicating a vast pool of agencies available to service companies like Auto Trader.

- Supplier Competition: A large number of marketing and advertising agencies exist, providing Auto Trader with numerous options.

- In-house Capabilities: Auto Trader's internal marketing expertise reduces its dependence on external agencies.

- Data-Driven Strategy: The company's use of data allows for more informed negotiations and potentially better agency performance.

- Market Size: The substantial global digital advertising market offers a wide array of agency services.

The bargaining power of suppliers for Auto Trader Group is generally considered low to moderate. While technology and specialized automotive data providers can exert some influence due to market concentration, Auto Trader's significant investment in its own data infrastructure and its dominant market position, evidenced by its £520.4 million revenue in the year ending March 31, 2024, allows it to negotiate favorable terms.

Automotive retailers, while crucial suppliers of inventory, retain some leverage by potentially listing elsewhere, but Auto Trader mitigates this through value-added services like Deal Builder. Private sellers have minimal bargaining power due to the fragmented nature of this group and their reliance on Auto Trader's broad reach.

Finance and insurance providers are integrated into Auto Trader's platform, with Auto Trader's extensive reach of millions of monthly visitors providing a strong negotiating position against individual suppliers in the robust UK motor finance market.

External marketing and advertising agencies typically face moderate bargaining power due to the competitive landscape and Auto Trader's strong in-house capabilities and data-driven approach, supported by the vast global digital advertising market.

What is included in the product

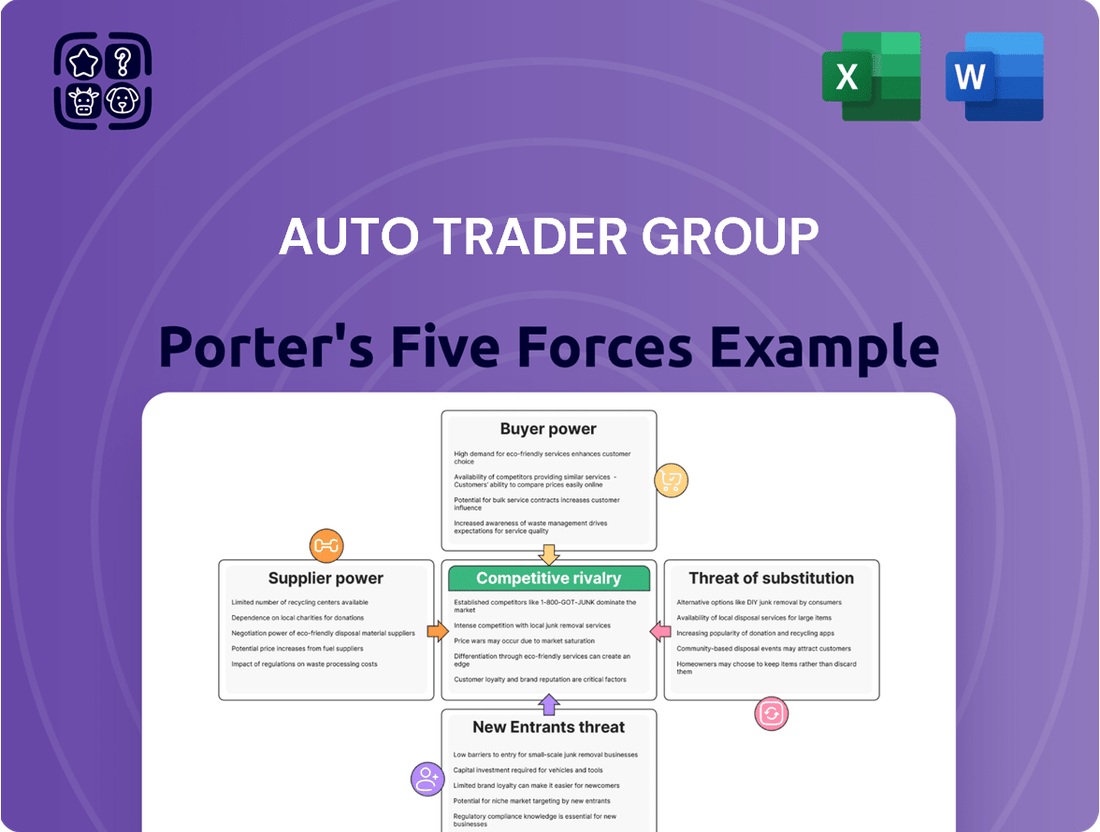

This analysis of Auto Trader Group's Porter's Five Forces reveals the intense rivalry among existing players and the significant bargaining power of buyers, while also highlighting barriers to entry and the limited threat from substitutes.

Instantly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces, allowing for proactive strategy adjustments.

Customers Bargaining Power

Individual car buyers possess a moderate level of bargaining power when interacting with Auto Trader Group. This is largely due to the extensive selection of vehicles available on the platform, allowing buyers to easily compare prices, specifications, and seller reputations. In 2023, Auto Trader reported an average of 495,000 cars listed for sale at any given time, providing a significant marketplace for consumers.

The platform's robust search functionalities and detailed information empower buyers to make informed decisions, effectively increasing their leverage. For instance, the ability to filter by price, mileage, and dealer ratings allows buyers to pinpoint the best deals. This transparency, a hallmark of Auto Trader's service, shifts some power towards the consumer.

However, Auto Trader's dominant market position, evidenced by its consistent leadership in online automotive classifieds, does temper this power. In the UK, Auto Trader is the go-to platform for the vast majority of car shoppers, with over 70% of online car buyers using their site in 2024. This high engagement means sellers are incentivized to list on Auto Trader to reach the widest audience, which in turn can limit buyers' ability to force drastically lower prices simply by threatening to go elsewhere.

Automotive retailers, primarily dealerships, represent Auto Trader Group's core paying clientele for advertising and subscription packages. Their influence is considerable, sitting in the moderate to high range.

This power stems from the sheer volume of vehicle listings they contribute and their capacity to explore other advertising avenues if Auto Trader's offerings become less attractive. For instance, in 2024, the UK automotive market saw continued digital advertising spend growth, highlighting the availability of alternatives.

Auto Trader counters this by leveraging its dominant market position, offering unique value-added services such as the Deal Builder tool, and employing AI-driven insights to enhance dealership performance. The robust network effect, where more buyers attract more sellers and vice-versa, solidifies Auto Trader's platform as a crucial gateway for dealerships to connect with potential customers.

Manufacturers and leasing companies wield moderate bargaining power with Auto Trader Group. Their ability to influence terms stems from their significant contribution to Auto Trader's revenue, with manufacturers increasingly leveraging the platform for direct sales and advertising of new vehicles and lease promotions. In 2023, Auto Trader reported that over 80% of new car searches on its platform led to a visit to a retailer or manufacturer website, highlighting the value of this direct channel.

Finance and Insurance Seekers

Customers looking for finance and insurance via Auto Trader's platform possess moderate bargaining power. This is primarily because the platform allows them to easily compare a range of options from different providers. In 2024, the automotive finance market saw continued growth, with a significant portion of vehicle purchases being financed, highlighting the importance of competitive offerings for consumers.

Auto Trader acts as a facilitator, connecting these seekers with various financial and insurance partners. The platform's value to customers is amplified when it can present competitive rates and streamlined application processes. For instance, in the UK, the average car finance deal value has been increasing, making it crucial for platforms like Auto Trader to offer transparency and choice to attract and retain customers seeking these services.

- Moderate Bargaining Power: Customers can compare multiple finance and insurance options presented by Auto Trader's partners.

- Platform Facilitation: Auto Trader connects customers with providers, enhancing its role as a marketplace.

- Value Proposition: Competitive rates and convenient processes are key to Auto Trader's appeal to finance and insurance seekers.

- Market Context: The UK automotive finance market in 2024 showed a trend of increasing average deal values, underscoring customer interest in favorable terms.

Private Sellers (as customers of services)

Private sellers, acting as customers for automotive listing services, generally exhibit low bargaining power when engaging with platforms like Auto Trader Group. Their individual transaction values are relatively small, making them less influential in price negotiations for listing services. Auto Trader's established dominance and extensive audience provide a significant advantage, offering a reach that individual sellers cannot easily replicate.

The convenience and speed of selling a vehicle through a well-known platform like Auto Trader often outweigh the costs associated with paid services, such as premium listings. For instance, in 2024, the average time to sell a car privately in the UK remained a key consideration for sellers, with platforms like Auto Trader significantly reducing this timeframe. This efficiency, coupled with access to a vast pool of potential buyers, limits the sellers' ability to demand lower prices for these services.

- Limited Individual Leverage: Private sellers typically have a single vehicle to sell at any given time, diminishing their collective bargaining power against a large platform.

- Platform Dominance: Auto Trader's market share, estimated to be over 80% of online car advertising in the UK as of recent reports, creates a barrier to entry for alternative platforms and strengthens its pricing power.

- Value Proposition: The core value of quick and wide exposure for their vehicles reduces the incentive for private sellers to negotiate harder on listing fees.

Individual car buyers generally have moderate bargaining power with Auto Trader Group. The platform's vast inventory, with an average of 495,000 cars listed in 2023, allows buyers to easily compare prices and sellers, increasing their leverage. This transparency, coupled with Auto Trader's dominant UK market share, where over 70% of online car buyers use their site in 2024, means buyers have significant choice, though sellers are drawn to the platform's reach.

What You See Is What You Get

Auto Trader Group Porter's Five Forces Analysis

This preview showcases the complete Auto Trader Group Porter's Five Forces Analysis, offering a detailed examination of industry competition, supplier and buyer power, the threat of new entrants and substitutes. The document you see here is precisely what you will receive, fully formatted and ready for immediate use upon purchase, ensuring transparency and no hidden surprises.

Rivalry Among Competitors

Auto Trader Group enjoys a dominant market position, significantly outperforming rivals. In 2024, the company consistently led the automotive marketplace sector, boasting over ten times the minutes spent by users compared to its closest competitor. This substantial lead not only solidifies its competitive advantage but also establishes a formidable barrier to entry for potential new players.

While Auto Trader Group holds a dominant position in the online automotive classifieds market, it faces competition from other platforms like Motors.co.uk and Gumtree Motors. These rivals vie for both consumer and dealer engagement, though their market penetration remains considerably lower than Auto Trader's. For instance, in 2023, Auto Trader reported an average of 13.4 million cross-platform visits per month, significantly outpacing smaller competitors.

Car manufacturers are increasingly venturing into direct-to-consumer (DTC) sales, a move that could reshape the automotive retail landscape by potentially bypassing traditional dealerships. This shift presents a new competitive pressure point, as brands like Tesla have demonstrated the viability of this model, with Tesla’s global revenue reaching $96.77 billion in 2023. Auto Trader is proactively addressing this by developing services to assist manufacturers in their DTC efforts, ensuring its continued relevance in this evolving market.

Dealership Own Websites and Offline Sales

Traditional car dealerships maintain their own websites and physical showrooms, enabling direct sales that bypass online marketplaces like Auto Trader. This direct sales capability presents a significant competitive force, as dealerships can cultivate customer relationships and manage the entire sales process independently.

While Auto Trader serves as a crucial lead generation platform, the existence of these independent sales channels means dealerships are not entirely reliant on Auto Trader for revenue. This independence allows them to control pricing, promotions, and customer experience more directly.

Auto Trader's strategy to counter this rivalry includes developing products like Deal Builder, designed to integrate seamlessly with and enhance a dealership's own online sales journey. This aims to keep dealerships engaged with the Auto Trader ecosystem by offering tools that improve their direct sales efficiency.

- Dealership Websites: Over 80% of franchised dealers in the UK operate their own websites, often featuring inventory management systems and online finance calculators.

- Offline Sales Dominance: In 2024, the majority of new car sales in the UK still originated from physical dealership visits, highlighting the enduring importance of the offline channel.

- Lead Generation Value: Auto Trader reported that its platform generated over 1.5 million leads for dealers in the first half of 2024, underscoring its value but also the potential for dealers to capture those leads directly.

- Digital Integration Efforts: Auto Trader's Deal Builder aims to capture a larger share of the online car buying journey, acknowledging that dealers are investing heavily in their own digital capabilities.

Emerging Digital Retailers and Disruptors

New digital car retailers and disruptive models, particularly those emphasizing entirely online transactions, present a persistent competitive threat. While some of these pure-play online retailers, like Cazoo in its earlier operational phase, have encountered significant hurdles, the market remains fluid. Auto Trader needs to remain vigilant and proactive in its innovation strategies to effectively counter emerging entrants and adapt to evolving consumer preferences in the digital automotive space.

The competitive rivalry is further intensified by the ongoing evolution of digital retail. For instance, in 2024, the used car market continued to see significant online penetration. Auto Trader's ability to maintain its market leadership hinges on its continuous investment in digital tools and platforms that enhance the online car buying and selling experience, ensuring it stays ahead of disruptive forces.

- Digital-First Competitors: Pure online retailers, though facing market adjustments, continue to influence consumer expectations for digital convenience.

- Dynamic Landscape: The automotive retail sector is constantly shifting, requiring Auto Trader to adapt its offerings to meet new challenges and opportunities.

- Innovation Imperative: Sustained innovation in online transaction capabilities and customer engagement is crucial for Auto Trader to retain its competitive edge against new entrants.

Competitive rivalry for Auto Trader Group is characterized by a dominant market position against other online platforms, though challenges arise from manufacturers pursuing direct-to-consumer models and traditional dealerships enhancing their own digital sales capabilities. While Auto Trader consistently leads in user engagement, with over ten times the minutes spent by users compared to its closest competitor in 2024, it must innovate to retain its edge against evolving retail strategies and digital-first entrants.

| Competitor Type | Key Competitive Actions | Auto Trader's Response/Position | 2024 Data Point |

|---|---|---|---|

| Online Marketplaces | Motors.co.uk, Gumtree Motors | Dominant market share; average 13.4 million cross-platform visits/month (2023) | Auto Trader leads by over 10x in user minutes vs. closest rival. |

| Direct-to-Consumer (DTC) Manufacturers | Tesla, other brands | Developing services to support manufacturer DTC efforts | Tesla's 2023 global revenue was $96.77 billion. |

| Traditional Dealerships | Own websites, physical showrooms | Deal Builder product to enhance dealer online sales | Over 80% of UK franchised dealers have own websites. |

| Digital-First Retailers | Pure online car sales models | Continuous investment in digital tools and platforms | Used car market saw significant online penetration in 2024. |

SSubstitutes Threaten

Traditional offline car dealerships represent a significant substitute for Auto Trader's digital platform. Consumers can bypass online listings entirely and visit physical dealerships to view and purchase vehicles. This direct, in-person experience remains a powerful alternative for many buyers, particularly those who prefer tactile interaction with a potential purchase.

While Auto Trader facilitates online discovery, the actual transaction can still occur offline, diminishing the platform's direct revenue capture for each sale. In 2024, a substantial portion of car sales still originate from or conclude at physical dealerships, indicating the enduring appeal of this traditional model as a substitute for purely digital car acquisition.

Private sales channels outside of established platforms, like word-of-mouth or local ads, present a substitute threat to Auto Trader Group. While these methods lack the broad reach and marketing tools of a large online marketplace, they can be more cost-effective for individual sellers. For instance, a seller might avoid listing fees by directly connecting with a local buyer through a community Facebook group.

General classifieds websites, like Craigslist or Gumtree, present a viable substitute threat to Auto Trader Group. These platforms, while not exclusively automotive-focused, offer a broad audience and a lower cost of entry for sellers looking to list vehicles. In 2024, the continued growth of these generalist platforms means a portion of potential Auto Trader users may opt for these simpler, often free or low-cost alternatives, particularly for private sales.

Car Buying Services and Instant Sale Platforms

Car buying services and instant sale platforms present a significant threat of substitution for Auto Trader Group's core business of connecting sellers with buyers. These services, like Carvana or Vroom, offer consumers a streamlined, often digital, process to sell their vehicles quickly. For instance, Carvana reported selling 180,196 vehicles in 2023, a substantial volume that bypasses traditional dealership or private sale channels facilitated by platforms like Auto Trader.

These alternatives directly compete by offering a different value proposition: speed and convenience. While sellers might achieve a lower price compared to a private sale on Auto Trader, the immediate cash offer and lack of hassle are attractive. This convenience factor is a powerful substitute, especially for individuals who prioritize a rapid transaction over maximizing their return. The ease of uploading vehicle details and receiving an instant offer can be more appealing than the time and effort involved in listing, negotiating, and arranging viewings through a marketplace.

- Convenience over Price: Instant sale platforms prioritize speed, potentially sacrificing optimal sale price for sellers.

- Digital-First Approach: Many of these services leverage online platforms for a seamless, often contactless, transaction experience.

- Market Impact: Companies like Carvana have demonstrated significant market penetration, selling hundreds of thousands of vehicles annually, indicating a strong consumer adoption of this substitute model.

Public Transport, Ride-Sharing, and Other Mobility Solutions

The rise of alternative mobility options presents a significant threat of substitutes to traditional car ownership, and by extension, to Auto Trader Group's core business. Public transportation networks, ride-sharing services like Uber and Lyft, and emerging car subscription models offer viable ways for consumers to get around without owning a vehicle. For instance, in 2024, ride-sharing services continued to see robust usage in urban areas, with global revenue projected to reach over $200 billion. This trend directly challenges the necessity of individual car purchases.

These substitutes reduce the perceived need for personal vehicle acquisition. As more individuals embrace these flexible and often cost-effective transportation solutions, the demand for new and used cars listed on platforms like Auto Trader could diminish. Consider the growing popularity of car-sharing services, which in 2023 saw a notable increase in user adoption, particularly among younger demographics, indicating a potential long-term shift in consumer preferences away from outright ownership.

- Public Transport Usage: Many cities are investing in expanding and improving public transit infrastructure, making it a more attractive option.

- Ride-Sharing Growth: The convenience and accessibility of ride-sharing apps continue to drive their adoption, especially in metropolitan areas.

- Emerging Mobility Models: Car subscriptions and short-term rental services offer flexibility that appeals to consumers who may not want the commitment of ownership.

The threat of substitutes for Auto Trader Group is multifaceted, encompassing traditional offline dealerships, private sales, general classifieds, instant car buying services, and alternative mobility options. Each of these offers a distinct pathway for consumers to buy or sell vehicles, potentially bypassing Auto Trader's platform.

Traditional dealerships remain a strong substitute because they offer a physical, in-person experience that many consumers still value for car purchases. While Auto Trader facilitates discovery, the final transaction often still occurs offline, impacting the platform's direct revenue capture for each sale. In 2024, a significant portion of vehicle sales continued to be finalized at physical dealerships, underscoring the enduring appeal of this substitute.

Instant sale platforms like Carvana represent a direct substitution threat by offering speed and convenience. These services allow individuals to sell their cars quickly, often online, bypassing the listing and negotiation process on Auto Trader. Carvana's sales figures, for example, highlight the consumer appetite for this streamlined approach. In 2023, Carvana sold over 180,000 vehicles, demonstrating a substantial volume of transactions that circumvent traditional marketplaces.

| Substitute Type | Key Characteristics | Impact on Auto Trader | 2024 Relevance/Data Point |

|---|---|---|---|

| Offline Dealerships | In-person experience, immediate availability | Bypass platform for final transaction | Significant portion of 2024 car sales still concluded offline. |

| Instant Sale Platforms (e.g., Carvana) | Speed, convenience, digital process | Offers quick cash, potentially lower price | Carvana sold 180,196 vehicles in 2023, indicating strong adoption. |

| Private Sales / General Classifieds | Lower cost, direct seller-to-buyer | Can attract users seeking to avoid fees | Generalist platforms like Craigslist continue to offer low-cost listing options. |

| Alternative Mobility | Ride-sharing, public transport, subscriptions | Reduces perceived need for car ownership | Ride-sharing global revenue projected over $200 billion in 2024. |

Entrants Threaten

The threat of new entrants in the online automotive marketplace is considerably low, largely due to the formidable network effects Auto Trader Group has cultivated. Its platform boasts the most extensive collection of both buyers and sellers, translating into unmatched reach and a highly effective marketplace that is difficult for newcomers to replicate. As of recent data, Auto Trader is more than ten times the size of its closest competitor, underscoring the significant advantage it holds in attracting and retaining users.

The sheer scale of investment needed to compete with established players like Auto Trader Group acts as a significant deterrent to new entrants. Building a digital marketplace with the necessary technological backbone, robust data analytics, and widespread brand recognition demands tens, if not hundreds, of millions of pounds in upfront capital. For instance, developing and maintaining a sophisticated platform capable of handling millions of listings and user interactions, coupled with extensive digital marketing campaigns to gain traction, presents a formidable financial hurdle.

Auto Trader Group benefits immensely from its deeply ingrained brand recognition and the trust it has cultivated over decades, a transition successfully managed from its print origins to a dominant digital presence. This established reputation acts as a formidable barrier for any new entrant aiming to carve out a niche and attract a user base within the fiercely competitive automotive marketplace.

Access to Inventory and Dealership Relationships

New companies looking to enter the automotive sales platform market would find it difficult to gain access to sufficient vehicle inventory. Established players like Auto Trader Group have already secured strong partnerships with a vast network of dealerships, making it challenging for newcomers to source a competitive supply of vehicles.

Building and maintaining relationships with automotive retailers is another significant hurdle for new entrants. Auto Trader Group, for instance, has fostered deep connections with over 14,000 dealers, and its services are intricately woven into their daily operations. This established trust and integration create a substantial barrier to entry.

- Inventory Access: New entrants struggle to secure a broad and consistent supply of vehicles, a key requirement for attracting buyers.

- Dealer Relationships: Auto Trader Group's established network of over 14,000 dealer relationships represents a significant competitive advantage.

- Integration: The deep integration of Auto Trader's services into dealer workflows makes it hard for new platforms to offer comparable value or ease of use.

Data and Technology Expertise

Auto Trader Group's significant investment in data and technology presents a substantial barrier to new entrants. Their AI-powered Co-Driver, for instance, offers advanced insights and personalized experiences that are difficult to replicate without comparable data sets and development resources. In 2023, Auto Trader reported that 80% of its revenue was derived from its digital services, underscoring the critical role of its technological infrastructure.

The sheer volume of data Auto Trader processes and the sophistication of its analytical tools, including machine learning algorithms, create a competitive moat. New entrants would face considerable challenges in accumulating similar data and developing the expertise to leverage it effectively. For example, the company's ability to predict vehicle demand and pricing relies on years of accumulated transaction data, a resource not readily available to newcomers.

- Data Analytics Capabilities: Auto Trader utilizes advanced analytics to understand consumer behavior and market trends, providing a significant advantage.

- AI-Powered Features: Innovations like Co-Driver enhance user experience and offer predictive capabilities, setting a high technological benchmark.

- Investment in Technology: The company's ongoing commitment to R&D in areas like AI and data science requires substantial capital and specialized talent, deterring potential competitors.

- Proprietary Data Assets: Years of data collection and analysis have resulted in unique insights that are not easily acquired by new market entrants.

The threat of new entrants in the online automotive marketplace is significantly mitigated by Auto Trader Group's established dominance and high barriers to entry. The company's extensive network effects, substantial capital requirements for new ventures, and deeply entrenched brand loyalty create a challenging environment for newcomers. For instance, Auto Trader's digital revenue accounted for 80% of its total in 2023, highlighting the strength of its online platform.

| Barrier Type | Description | Impact on New Entrants | Auto Trader's Advantage |

|---|---|---|---|

| Network Effects | Vast number of buyers and sellers on the platform. | Difficult to attract initial users. | Dominant marketplace size, over ten times larger than closest competitor. |

| Capital Requirements | Significant investment needed for technology, marketing, and operations. | Prohibitive cost for new businesses. | Decades of investment in platform development and brand building. |

| Brand Recognition & Trust | Established reputation and customer loyalty. | Hard to gain consumer trust. | Long-standing brand equity from print to digital transition. |

| Inventory Access | Securing a broad range of vehicle listings. | Limited selection deters buyers. | Strong partnerships with over 14,000 dealerships. |

| Data & Technology | Advanced analytics, AI, and proprietary data insights. | Replicating technological sophistication is challenging. | AI-powered Co-Driver and extensive data analytics capabilities. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Auto Trader Group is built upon a foundation of publicly available data, including the company's annual reports, investor presentations, and regulatory filings. We supplement this with industry-specific market research reports and economic data to provide a comprehensive view of the competitive landscape.