Auto Trader Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Auto Trader Group Bundle

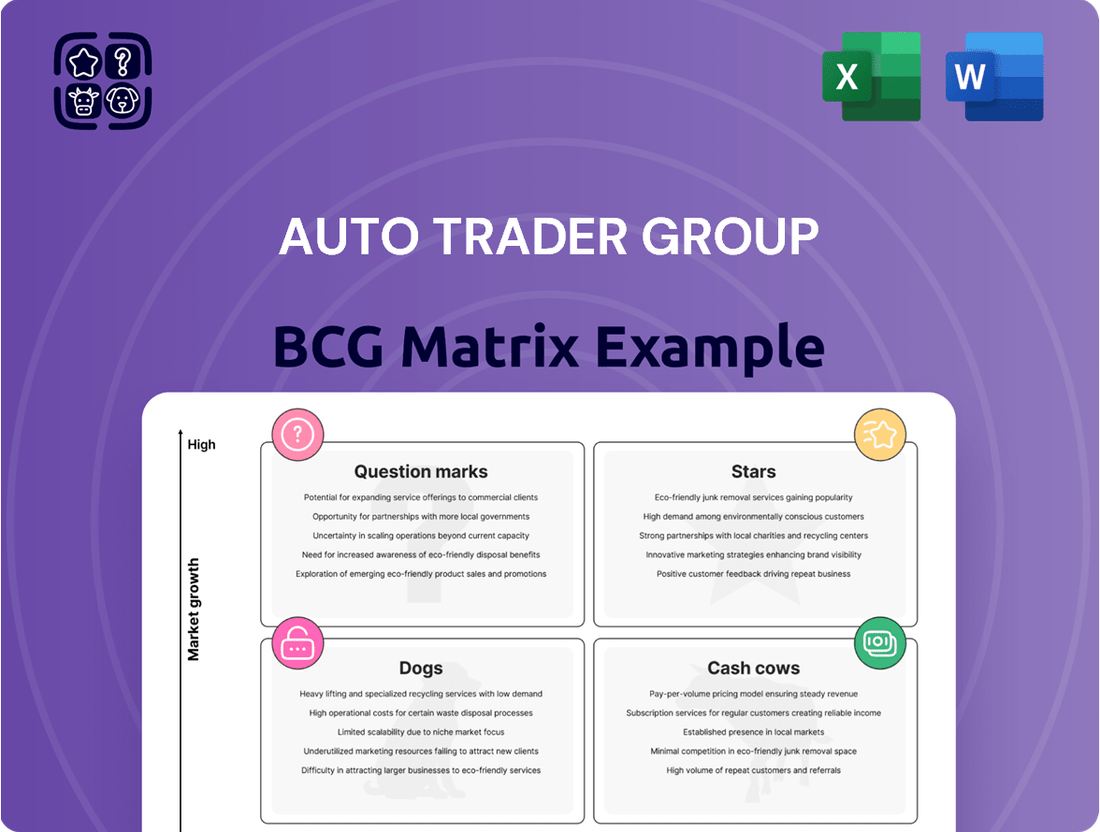

The Auto Trader Group's BCG Matrix offers a powerful lens to understand its diverse portfolio. Are its online marketplaces Stars, generating high growth and market share, or Cash Cows, providing stable revenue? This preview hints at the strategic positioning, but to truly unlock actionable insights and confidently navigate the competitive automotive digital landscape, you need the full picture.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

AutoTrader.co.uk, the group's flagship digital marketplace, is firmly positioned as a Star in the BCG Matrix. Its dominance in the UK automotive classifieds market is undeniable, capturing over 75% of all user engagement time on such platforms.

This substantial market share, significantly outperforming its closest rival by more than tenfold, underscores its strong leadership in a growing digital sector. The platform's continued growth and high user stickiness solidify its Star status, indicating strong future potential.

The AI-driven Co-Driver suite from Auto Trader Group is positioned as a Star in the BCG Matrix. This innovative product significantly streamlines the listing process for retailers, enabling them to produce superior quality vehicle advertisements with greater efficiency. Its ability to enhance the buyer journey through AI-curated features is a key differentiator.

Early performance indicators for the Co-Driver suite are exceptionally strong, showcasing high levels of user engagement. This robust adoption rate, coupled with the growing market demand for AI-powered solutions in the automotive sector, points towards substantial future growth potential for this product. For instance, initial pilot programs in late 2023 saw a reported 20% reduction in listing creation time for participating dealerships.

The Deal Builder functionality within Auto Trader Group's BCG Matrix is a prime example of a Star. It directly addresses the growing consumer demand for online car purchasing, allowing customers to handle crucial steps like part-exchange valuations and finance applications digitally. This innovation is rapidly gaining traction, with a notable rise in retailer adoption and a substantial increase in the number of deals facilitated through the platform.

Data and Technology Platform

Auto Trader Group's data and technology platform is a clear Star in its BCG Matrix. This foundational asset is not just internally robust but is becoming a critical tool for the broader automotive sector, offering distinct data and tech advantages that solidify Auto Trader's market position. For example, in the fiscal year ending June 30, 2024, Auto Trader reported a 10% increase in revenue, largely driven by the enhanced capabilities of its digital platforms and data services.

The platform's ongoing evolution and integration into new offerings like Co-Driver and Deal Builder highlight its significant potential for future growth and innovation. These advancements are designed to streamline the car buying and selling process, further embedding Auto Trader's technology into industry workflows. The company's investment in these areas underscores its commitment to maintaining a leading edge in a rapidly digitizing market.

- Industry-Leading Technology: Auto Trader's platform provides unique data and technology capabilities.

- Broad Industry Utilization: Increasingly adopted across the automotive industry for its competitive advantage.

- High Growth Potential: Continuous development fuels new products like Co-Driver and Deal Builder, indicating future innovation.

- Revenue Driver: Contributed to a 10% revenue increase in FY24, demonstrating its commercial success.

Used Car Classifieds

The used car classifieds segment of Auto Trader Group is a clear Star in the BCG Matrix. This is driven by sustained high demand in the used car market, which remains a resilient sector. Auto Trader's platform is experiencing significant user engagement, with record cross-platform visits and minutes spent by consumers actively searching for vehicles.

This strong performance translates into tangible business results. In the fiscal year ending February 2024, Auto Trader reported that its advertising revenue grew by 10% to £424 million, largely fueled by the robust used car market. The platform facilitated a substantial volume of used car transactions, underscoring its dominant market position and ability to connect buyers and sellers efficiently.

- High Market Share: Auto Trader holds a leading position in the UK used car classifieds market.

- Growing Demand: The used car market continues to show strong consumer interest and transaction volumes.

- Platform Engagement: Record cross-platform visits and time spent on Auto Trader indicate high user activity.

- Revenue Growth: The segment contributes significantly to Auto Trader's overall financial performance, with advertising revenue seeing a notable increase.

The Auto Trader Group's data and technology platform is a significant Star. It provides crucial data and tech advantages, solidifying the company's market dominance and is increasingly adopted across the automotive industry. This platform is a key revenue driver, contributing to a 10% revenue increase in FY24.

| Platform Component | BCG Category | Key Performance Indicators | Financial Impact (FY24) | Strategic Outlook |

| Data & Technology Platform | Star | Industry-leading capabilities, broad industry adoption | 10% revenue growth contribution | Continued innovation and integration into new products |

What is included in the product

This BCG Matrix overview provides a tailored analysis of Auto Trader Group's business units, highlighting which to invest in, hold, or divest.

The Auto Trader Group BCG Matrix provides a clear, one-page overview of each business unit's market share and growth, alleviating the pain of strategic uncertainty.

Cash Cows

Auto Trader Group's core subscription and advertising services for car dealerships represent a significant Cash Cow. This segment benefits from the company's dominant market share and deep-rooted relationships with a vast network of retailers, consistently delivering robust revenue and impressive profit margins.

In the fiscal year ending March 2024, Auto Trader reported that its average revenue per retailer saw a healthy increase, underscoring the stability and strength of this cash-generating business. This sustained performance highlights the ongoing demand for their services within the automotive retail sector.

Auto Trader's vehicle valuation services, such as Trended Valuations and enhanced Retail Check, function as cash cows within their BCG matrix. These offerings are typically integrated into broader advertising packages for retailers, generating steady revenue with minimal incremental cost.

This consistent revenue generation is a hallmark of cash cows. For instance, Auto Trader's valuation tools provide retailers with crucial data for pricing, which is essential in a dynamic market. In 2024, the automotive retail sector continued to rely heavily on accurate valuation data to manage inventory and optimize pricing strategies, underscoring the ongoing demand for these services.

Auto Trader's robust brand recognition and deep-seated consumer trust in the UK automotive market firmly position it as a Cash Cow. This established reputation significantly lowers the barrier to entry for new users, meaning less capital is needed for aggressive marketing campaigns to attract buyers and sellers. As the dominant platform for vehicle transactions, Auto Trader consistently benefits from a reliable influx of engaged participants, underpinning its stable revenue generation.

Private Seller Listings

Private seller listings on Auto Trader Group function as a classic Cash Cow. This segment, while potentially smaller in absolute revenue compared to dealer partnerships, provides a steady and highly profitable income. The platform's inherent strength – its massive audience and consistent high traffic – ensures these listings attract buyers with minimal incremental marketing spend from Auto Trader.

The low operational cost associated with private seller listings is a key differentiator. Unlike managing dealer relationships, which involves sales teams and dedicated account management, private sellers are largely self-service. This translates to a high-margin revenue stream that requires very little ongoing investment to maintain its productivity.

In 2024, Auto Trader Group continued to see strong engagement from private sellers. While specific figures for this segment are often bundled within broader revenue reports, the company's overall revenue growth in the year, reaching £503.1 million, indicates the sustained health of all its revenue streams, including private listings.

- Consistent Revenue: Private seller listings offer a reliable income source due to the platform's established user base.

- Low Investment: Minimal ongoing operational costs are required to sustain this revenue stream, maximizing profitability.

- Platform Leverage: Benefits directly from Auto Trader's high traffic and brand recognition, attracting a large pool of potential buyers.

- Profitability Driver: Contributes significantly to the company's overall financial health due to its high-margin nature.

Existing Retailer Network

Auto Trader Group's extensive network of over 14,000 retailer forecourts actively advertising on its platform firmly positions this as a Cash Cow. This substantial and long-standing customer base is the bedrock of the company's predictable, recurring revenue streams. These revenues are generated through consistent subscription fees and ongoing advertising investments from these retailers.

The platform's proven effectiveness in connecting buyers and sellers results in remarkably low customer churn. In 2024, Auto Trader reported that approximately 80% of UK car dealerships utilize their services, underscoring the loyalty and reliance of this segment. This stability ensures a consistent cash flow, allowing Auto Trader to invest in other growth areas.

- Established Market Dominance: Over 14,000 retailer forecourts actively advertising.

- Predictable Revenue: Driven by recurring subscriptions and advertising spend.

- Low Churn Rate: Indicative of platform value and customer retention.

- Significant Market Share: Around 80% of UK car dealerships are customers in 2024.

Auto Trader Group's core subscription and advertising services for car dealerships represent a significant Cash Cow. This segment benefits from the company's dominant market share and deep-rooted relationships with a vast network of retailers, consistently delivering robust revenue and impressive profit margins.

In the fiscal year ending March 2024, Auto Trader reported that its average revenue per retailer saw a healthy increase, underscoring the stability and strength of this cash-generating business. This sustained performance highlights the ongoing demand for their services within the automotive retail sector.

Auto Trader's vehicle valuation services, such as Trended Valuations and enhanced Retail Check, function as cash cows within their BCG matrix. These offerings are typically integrated into broader advertising packages for retailers, generating steady revenue with minimal incremental cost.

This consistent revenue generation is a hallmark of cash cows. For instance, Auto Trader's valuation tools provide retailers with crucial data for pricing, which is essential in a dynamic market. In 2024, the automotive retail sector continued to rely heavily on accurate valuation data to manage inventory and optimize pricing strategies, underscoring the ongoing demand for these services.

Auto Trader's robust brand recognition and deep-seated consumer trust in the UK automotive market firmly position it as a Cash Cow. This established reputation significantly lowers the barrier to entry for new users, meaning less capital is needed for aggressive marketing campaigns to attract buyers and sellers. As the dominant platform for vehicle transactions, Auto Trader consistently benefits from a reliable influx of engaged participants, underpinning its stable revenue generation.

Private seller listings on Auto Trader Group function as a classic Cash Cow. This segment, while potentially smaller in absolute revenue compared to dealer partnerships, provides a steady and highly profitable income. The platform's inherent strength – its massive audience and consistent high traffic – ensures these listings attract buyers with minimal incremental marketing spend from Auto Trader.

The low operational cost associated with private seller listings is a key differentiator. Unlike managing dealer relationships, which involves sales teams and dedicated account management, private sellers are largely self-service. This translates to a high-margin revenue stream that requires very little ongoing investment to maintain its productivity.

In 2024, Auto Trader Group continued to see strong engagement from private sellers. While specific figures for this segment are often bundled within broader revenue reports, the company's overall revenue growth in the year, reaching £503.1 million, indicates the sustained health of all its revenue streams, including private listings.

- Consistent Revenue: Private seller listings offer a reliable income source due to the platform's established user base.

- Low Investment: Minimal ongoing operational costs are required to sustain this revenue stream, maximizing profitability.

- Platform Leverage: Benefits directly from Auto Trader's high traffic and brand recognition, attracting a large pool of potential buyers.

- Profitability Driver: Contributes significantly to the company's overall financial health due to its high-margin nature.

Auto Trader Group's extensive network of over 14,000 retailer forecourts actively advertising on its platform firmly positions this as a Cash Cow. This substantial and long-standing customer base is the bedrock of the company's predictable, recurring revenue streams. These revenues are generated through consistent subscription fees and ongoing advertising investments from these retailers.

The platform's proven effectiveness in connecting buyers and sellers results in remarkably low customer churn. In 2024, Auto Trader reported that approximately 80% of UK car dealerships utilize their services, underscoring the loyalty and reliance of this segment. This stability ensures a consistent cash flow, allowing Auto Trader to invest in other growth areas.

- Established Market Dominance: Over 14,000 retailer forecourts actively advertising.

- Predictable Revenue: Driven by recurring subscriptions and advertising spend.

- Low Churn Rate: Indicative of platform value and customer retention.

- Significant Market Share: Around 80% of UK car dealerships are customers in 2024.

| Segment | BCG Classification | Key Characteristics | 2024 Relevance |

|---|---|---|---|

| Core Dealer Subscriptions & Advertising | Cash Cow | Dominant market share, deep retailer relationships, high profit margins. | Increased average revenue per retailer, stable demand. |

| Vehicle Valuation Services | Cash Cow | Integrated into packages, low incremental cost, steady revenue. | Essential for retailer inventory and pricing strategies. |

| Private Seller Listings | Cash Cow | High traffic attraction, minimal marketing spend, high-margin. | Contributes to overall revenue growth (£503.1m FY24). |

| Retailer Forecourt Advertising | Cash Cow | Large customer base (>14,000), recurring revenue, low churn. | ~80% of UK dealerships as customers, stable cash flow. |

What You’re Viewing Is Included

Auto Trader Group BCG Matrix

The preview you are currently viewing represents the complete Auto Trader Group BCG Matrix report that you will receive immediately after purchase. This ensures that you are fully aware of the quality, detail, and professional formatting of the analysis before committing to a purchase, offering complete transparency.

Rest assured, the Auto Trader Group BCG Matrix document you see here is the identical, final version you will download upon completing your purchase. It is a fully realized strategic tool, devoid of any watermarks or placeholder content, ready for immediate application in your business planning.

What you are previewing is the actual, unedited Auto Trader Group BCG Matrix report that will be delivered to you after your transaction. This means you'll receive a comprehensive and professionally structured document, perfect for in-depth strategic discussions and decision-making.

This preview showcases the exact Auto Trader Group BCG Matrix report you will own once purchased. It is a complete and professionally designed analysis, ready for immediate download and integration into your strategic frameworks or presentations.

Dogs

Autorama, Auto Trader's leasing arm, is currently positioned as a Dog in the BCG matrix. Its revenue saw a decline of 12% in the fiscal year 2025, and while operating losses have narrowed, they persist.

This underperformance is linked to a reduced volume of new lease vehicles delivered, a situation exacerbated by ongoing supply chain challenges impacting the new car market. These factors collectively point to a low market share and stagnant growth within a difficult sector.

Auto Trader Group's legacy features or older product offerings that haven't been updated or integrated into the main platform are likely candidates for the Dogs quadrant. These products typically experience declining usage and hold a low market share within their specific niches. For instance, if a particular classified ad format from years ago is still available but rarely used, it would fit this description.

These underperforming assets contribute minimally to Auto Trader's overall revenue and growth. They might even tie up valuable resources, such as development or maintenance time, without yielding significant returns. In 2024, the company's focus on digital innovation and platform consolidation means such legacy elements are increasingly being phased out or re-evaluated for their continued viability.

Early, less successful iterations of digital retailing initiatives that were not widely adopted by retailers before the strategic pivot to integrate Deal Builder into the core advertising package could be viewed as Dogs in the Auto Trader Group BCG Matrix. These initiatives likely had low market share and consumed resources without achieving desired growth or profitability. For instance, in 2023, Auto Trader Group noted that while digital retailing was a growing area, early standalone tools struggled for traction, with adoption rates below 15% among a test group of dealerships before the integration strategy was refined.

Niche or Specialized Advertising Products with Low Uptake

Within Auto Trader Group's portfolio, niche or specialized advertising products with consistently low uptake would be classified as Dogs. These are offerings that retailers rarely select, leading to minimal revenue generation and a negligible impact on the overall market. Think of them as specialized add-ons that haven't resonated with the dealership base.

These "Dog" products typically exist in a slow-growth segment of the advertising market, meaning there's not much expansion potential to begin with. Their low adoption rate further solidifies their position, indicating a low market share within this stagnant niche. For instance, a highly specialized digital banner placement for a very specific vehicle type that only a handful of dealers might ever consider would fit this description.

- Low Retailer Adoption: Products with less than 1% of retailers utilizing them annually.

- Minimal Revenue Contribution: Generating less than £50,000 in annual revenue for the company.

- Limited Market Share: Representing a tiny fraction of the total advertising solutions purchased by dealerships.

- Slow or Stagnant Market Segment: Operating in an area of the automotive advertising market that shows little to no year-over-year growth.

Non-core, Divested or Phased-Out Ventures

Non-core, divested, or phased-out ventures within Auto Trader Group's BCG Matrix represent past initiatives that no longer align with the company's strategic direction or have demonstrated insufficient market traction. These are typically businesses or services that Auto Trader Group has either sold off or significantly reduced investment in because they were not performing well or did not fit the overall growth strategy. For instance, if Auto Trader Group had a venture into a niche automotive data analytics service that failed to gain significant market share or revenue, it would likely be categorized here.

These ventures are characterized by their low market share and low growth potential, making them candidates for divestment or phasing out to reallocate resources to more promising areas. Auto Trader Group's strategic focus in recent years has been on enhancing its digital platforms and core marketplace offerings. Any past ventures that did not contribute to this core strategy, such as a short-lived attempt at a physical car sales portal or a specialized leasing platform that didn't gain traction, would fall into this category. By divesting or phasing out these less successful ventures, the company can concentrate its efforts and capital on areas with higher potential for growth and profitability.

- Divested Ventures: Past services or products that were sold to another company, freeing up capital and management focus.

- Phased-Out Services: Initiatives that were gradually withdrawn from the market due to poor performance or lack of strategic fit.

- Low Market Share & Growth: Ventures that failed to capture significant customer interest or revenue, indicating a weak competitive position.

Dogs in Auto Trader Group's portfolio represent offerings with low market share and low growth prospects. These are typically legacy products or ventures that haven't gained significant traction or have been superseded by newer, more successful initiatives. For instance, specific niche advertising packages that see minimal retailer uptake, contributing less than £50,000 annually, would fit this description.

These underperforming assets may consume resources without delivering substantial returns, often existing within stagnant market segments. In 2024, Auto Trader Group's strategic focus on digital innovation and platform consolidation means such legacy elements are increasingly being phased out or re-evaluated for their continued viability.

Autorama, the leasing arm, exemplifies a Dog, with revenue declining 12% in fiscal year 2025 and persistent operating losses, exacerbated by supply chain issues affecting new vehicle deliveries.

Early, less successful digital retailing initiatives also fall into this category, with adoption rates below 15% in test groups before strategic pivots, highlighting low market share and resource consumption without desired growth.

| Category | Characteristics | Example |

|---|---|---|

| Dogs | Low Market Share, Low Growth | Autorama (leasing arm), legacy classified ad formats, early unadopted digital tools, niche advertising products with minimal retailer adoption (<1% annually). |

| Financial Impact | Minimal Revenue Contribution (<£50,000 annually) | Specialized digital banner placements for specific vehicle types. |

| Strategic Action | Divestment or Phasing Out | Past ventures like niche data analytics services or short-lived physical car sales portals. |

Question Marks

Auto Trader is prioritizing the new car market, recognizing its high-growth potential. This focus is driven by increasing consumer interest and lead generation for new vehicles, signaling a significant opportunity for the platform to expand its reach beyond used car sales.

While the new car segment represents a growth area, Auto Trader is still building its market share against established new car dealership channels. Investment in this area is essential to solidify its position and capture a larger portion of this expanding market.

For instance, in the fiscal year ending March 2024, Auto Trader reported that new car leads grew by 20%, demonstrating the increasing consumer engagement in this segment. This strategic push aims to make Auto Trader the go-to destination for both new and used vehicle purchases.

Auto Trader Group's expansion into electric vehicle (EV) market services is a classic Question Mark in the BCG matrix. The EV market is experiencing explosive growth, with new EV registrations in the UK reaching over 100,000 in the first quarter of 2024, a significant jump from previous years. Auto Trader is seeing a corresponding surge in EV-related searches on its platform, indicating strong consumer interest and a potential for market leadership in used EV sales.

However, the specific services Auto Trader can offer to cater to the unique needs of EV buyers and sellers are still in their nascent stages of development. While enquiries for EVs are up, the infrastructure and specialized support required for this segment are complex. This necessitates substantial investment in technology, data analytics, and potentially new partnerships to build out a comprehensive EV service offering.

The challenge lies in converting this growing interest into a dominant market position. Auto Trader needs to strategically invest in areas like battery health diagnostics, charging infrastructure information, and tailored financing options for EVs. Failure to adequately address these evolving needs could see competitors gain an early advantage in this high-potential, yet currently uncertain, segment of the automotive market.

Future, more advanced AI-powered tools beyond Auto Trader's initial Co-Driver suite are positioned as question marks within the BCG matrix. Auto Trader has demonstrated a commitment to AI, investing heavily in the technology, recognizing its transformative potential for the car buying and selling experience.

These sophisticated AI tools reside in a rapidly expanding technological frontier. While the potential for improved customer engagement and operational efficiency is high, the precise trajectory of market adoption and the ultimate revenue streams remain subjects of ongoing evaluation, necessitating sustained research and development investment to clarify their future market position.

Enhanced Finance and Insurance Integration

Deepening the integration of finance and insurance offerings within Auto Trader Group's digital buying journey is a classic Question Mark. While the platform currently facilitates these services, achieving seamless online completion and boosting their penetration in digital transactions presents a significant growth avenue.

The key to unlocking this potential lies in driving broader consumer acceptance of completing financing and insurance arrangements entirely online. In 2024, the automotive finance sector saw continued digital evolution, with a growing percentage of consumers expressing comfort in completing loan applications remotely. For instance, reports from early 2024 indicated that over 60% of car buyers were open to finalizing financing digitally, a trend expected to accelerate.

- Increased Digital Penetration: Auto Trader aims to capture a larger share of the automotive finance and insurance market by making these processes more user-friendly and integrated into the core online car search experience.

- Consumer Adoption as a Key Driver: Success is directly tied to how readily consumers embrace completing these financial steps digitally, a trend that has been steadily growing, especially post-pandemic.

- Revenue Diversification: Enhancing finance and insurance integration offers a substantial opportunity for Auto Trader to diversify its revenue streams beyond advertising by capturing a greater share of the ancillary services purchased alongside vehicles.

- Competitive Advantage: A more integrated and frictionless digital finance and insurance offering can differentiate Auto Trader from competitors, providing a more comprehensive end-to-end solution for car buyers.

Further International Expansion or Strategic Partnerships

Auto Trader Group's potential international expansion or strategic partnerships would likely be categorized as Question Marks in a BCG Matrix. These ventures would target high-growth markets where Auto Trader currently has minimal or no presence, demanding significant capital outlay and presenting considerable risk. For example, entering the burgeoning automotive classifieds market in Southeast Asia, a region projected for strong economic growth, would require substantial investment in localized platforms and marketing efforts.

- High Growth, Low Market Share: International markets offer significant growth potential but require Auto Trader to build brand recognition and user adoption from scratch, similar to a new product launch.

- Substantial Investment Required: Establishing a foothold in new geographic territories necessitates significant investment in technology, marketing, and local operations, potentially impacting profitability in the short to medium term.

- High Risk Profile: Success is not guaranteed, as competition from established local players and differing consumer behaviors can pose significant challenges, making these ventures inherently risky.

- Potential for Future Stars: If successful, these international ventures could evolve into Stars, generating substantial revenue and market share in their respective regions.

Auto Trader's foray into advanced AI-driven tools beyond its current offerings represents a Question Mark. The company is actively investing in AI, recognizing its potential to reshape the car buying and selling experience, with significant R&D allocated to these future capabilities.

These sophisticated AI tools are entering a rapidly evolving technological landscape. While the promise of enhanced customer engagement and operational efficiency is substantial, the exact market reception and eventual revenue generation remain under assessment, necessitating ongoing development and strategic evaluation to define their future market standing.

The company's strategic focus on the new car market, while showing promise with a 20% increase in new car leads in FY24, still positions it as a Question Mark relative to established dealership channels. Auto Trader is actively building its presence in this segment, aiming to become a comprehensive platform for both new and used vehicles.

BCG Matrix Data Sources

Our Auto Trader Group BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.