AutoNation PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AutoNation Bundle

Navigate the complex external landscape affecting AutoNation with our expert PESTLE analysis. Understand how political shifts, economic fluctuations, and technological advancements are reshaping the automotive retail sector. Equip yourself with actionable intelligence to anticipate challenges and capitalize on emerging opportunities. Download the full PESTLE analysis now and gain a critical competitive advantage.

Political factors

Government regulations, especially concerning vehicle emissions and safety, significantly shape AutoNation's inventory and operational costs. The ongoing shift towards electric vehicles (EVs) and increasingly stringent emissions mandates are compelling strategic adjustments in vehicle offerings and compliance management.

While the FTC's CARS Rule was overturned, AutoNation still navigates a complex landscape of state-specific consumer protection laws and the FTC's overarching regulatory powers. This necessitates ongoing vigilance and adaptation to diverse compliance requirements across different markets, impacting sales practices and advertising.

Changes in trade policies, particularly tariffs on imported vehicles and parts, directly impact AutoNation's cost of goods sold and vehicle pricing. For instance, a hypothetical 25% tariff on imported vehicles could drive up new car prices by an estimated 10-15%, potentially dampening consumer demand.

AutoNation's diverse inventory, featuring both domestic and import brands, necessitates careful navigation of these evolving trade landscapes. The company must strategize to mitigate potential cost escalations and supply chain interruptions to preserve its competitive edge in the market.

Government incentives and subsidies for electric vehicle (EV) purchases are a significant driver of consumer demand. Despite a notable slowdown in U.S. EV sales growth during 2024, federal incentives, such as the $7,500 tax credit, remain a critical factor in stimulating consumer interest.

AutoNation's strategic focus on increasing its EV inventory and expanding charging infrastructure makes these government incentives particularly important. These programs directly support AutoNation's EV adoption strategy and influence the overall sales mix of the company.

Political Stability and Election Cycles

Political stability and the outcomes of elections significantly impact the automotive sector by influencing consumer confidence and purchasing behaviors. For instance, the anticipation surrounding the 2024 US election led to considerable market uncertainty, with a substantial majority of consumers, around 75%, anticipating changes in vehicle pricing post-November. This suggests that election cycles can directly affect demand and AutoNation's sales projections for the upcoming year.

A new administration's policy decisions, particularly concerning electric vehicle (EV) incentives or trade tariffs, can profoundly shape AutoNation's strategic planning and market outlook for 2025. For example, shifts in government support for EVs could alter consumer adoption rates, impacting inventory management and future product mix. Similarly, changes in tariffs on imported vehicles or parts would necessitate adjustments to pricing strategies and supply chain operations.

- Election Uncertainty Impact: Approximately 75% of consumers expected vehicle prices to change following the 2024 US election, highlighting the market's sensitivity to political outcomes.

- Policy Influence on EVs: Potential changes to EV tax credits or mandates by a new administration could significantly affect AutoNation's EV sales targets for 2025.

- Trade Policy Ramifications: New tariffs on imported vehicles or automotive components could lead to increased costs for AutoNation and influence its pricing and sourcing strategies.

State-Level Regulations and Consumer Protection Laws

Beyond federal oversight, individual states enact distinct regulations impacting automotive retail, including measures against "junk fees" and mandates for cooling-off periods on used vehicle purchases. California, a key market, has recently implemented new rules concerning subscriptions and pricing transparency, with ongoing discussions around a potential 10-day cooling-off period for pre-owned car transactions.

AutoNation, with its extensive presence across multiple states, faces the complex challenge of aligning its sales strategies and compliance protocols with these diverse and dynamic state-specific legal frameworks. This requires continuous monitoring and adaptation to ensure adherence to varying consumer protection mandates.

- State-Specific Fee Regulations: Many states are scrutinizing dealer fees, with some, like California, enacting stricter disclosure and limitation rules.

- Used Vehicle Cooling-Off Periods: Proposals for mandatory cooling-off periods, such as California's potential 10-day rule for used cars, could impact sales velocity and inventory management.

- Subscription Service Rules: New regulations, like those in California, are increasing transparency requirements for automotive subscription services, affecting how AutoNation structures and markets these offerings.

- Varying State Compliance Burden: AutoNation must navigate a patchwork of state laws, necessitating robust compliance programs to manage differences in advertising standards, financing disclosures, and warranty regulations.

Government policies, particularly those concerning environmental standards like emissions and fuel efficiency, directly influence AutoNation's product mix and operational costs. The ongoing push for electrification, supported by federal incentives such as the $7,500 EV tax credit, continues to shape consumer demand and AutoNation's strategic inventory planning for 2024 and 2025, despite a general slowdown in EV sales growth observed in 2024.

Political stability and election outcomes create market anticipation, impacting consumer confidence and purchasing decisions, as seen with the 2024 US election where approximately 75% of consumers expected price changes post-election. This suggests that AutoNation must remain agile in adapting its sales forecasts and inventory strategies to potential shifts in economic policy and consumer sentiment driven by electoral cycles.

Trade policies, including potential tariffs on imported vehicles and parts, pose a direct risk to AutoNation's cost structure and pricing strategies. For example, a hypothetical 25% tariff could increase vehicle costs by 10-15%, necessitating careful navigation of global supply chains to maintain competitive pricing and mitigate disruptions.

| Political Factor | Impact on AutoNation | Data/Example |

| Environmental Regulations & EV Incentives | Drives EV adoption, influences inventory mix and sales strategy. | $7,500 federal EV tax credit remains a key consumer driver; 2024 saw a slowdown in EV sales growth. |

| Election Uncertainty | Affects consumer confidence and purchasing behavior, leading to demand fluctuations. | ~75% of consumers anticipated vehicle price changes post-2024 US election. |

| Trade Policies & Tariffs | Impacts cost of goods sold, vehicle pricing, and supply chain stability. | Hypothetical 25% tariff could increase vehicle prices by 10-15%. |

What is included in the product

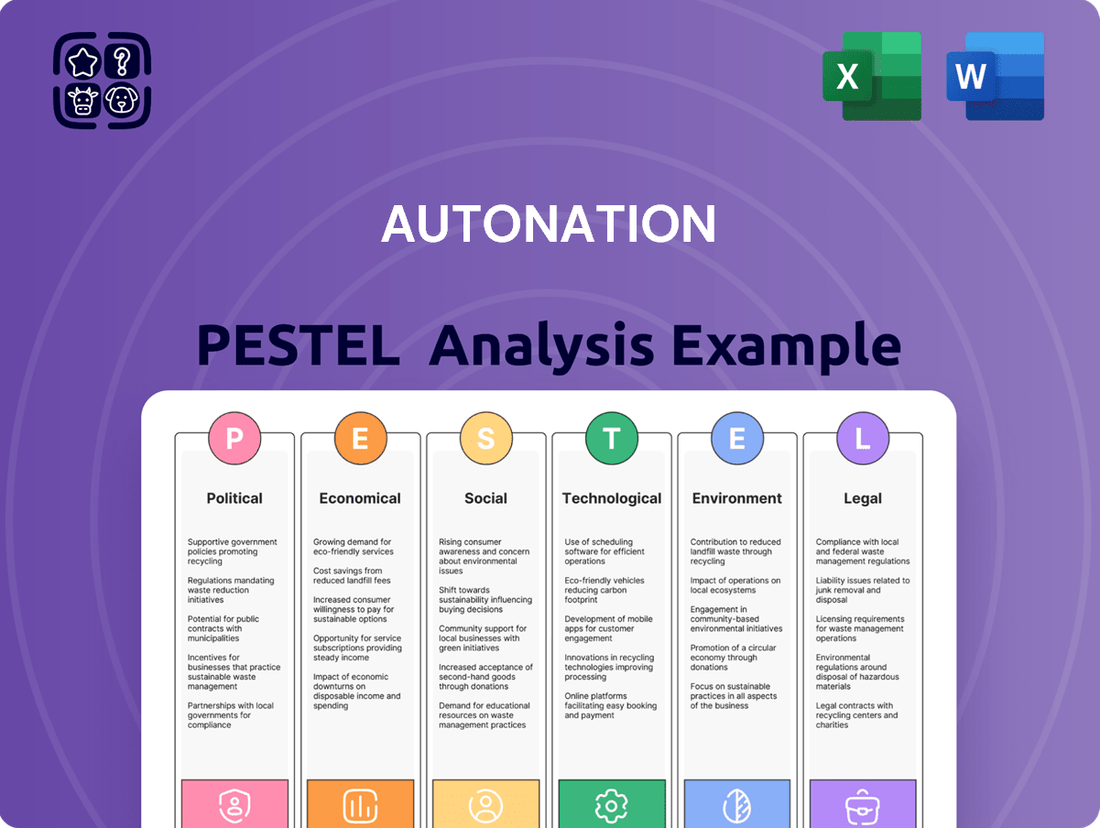

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting AutoNation, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers forward-looking insights to aid in scenario planning and proactive strategy design, helping stakeholders navigate industry challenges and opportunities.

A concise AutoNation PESTLE analysis that highlights key external factors impacting the automotive industry, serving as a pain point reliever by enabling proactive strategic adjustments and mitigating potential risks.

Economic factors

Interest rates significantly impact car affordability. For instance, in early 2024, average auto loan rates hovered around 7-8% for new cars with good credit, a noticeable increase from previous years. This directly affects consumer purchasing power, potentially slowing down sales for AutoNation.

When credit availability tightens or interest rates climb, consumers may delay purchases or opt for less expensive vehicles. AutoNation's finance arm plays a vital role here, needing to offer competitive financing to offset these economic headwinds and maintain demand.

Consumer spending habits and disposable income are fundamental to AutoNation's performance, directly influencing automotive demand. In 2024, a projected 3.1% GDP growth in the US, while positive, is accompanied by persistent inflation concerns, potentially squeezing real disposable income for many households.

Economic uncertainties, such as the lingering threat of recession and elevated unemployment figures, often prompt consumers to delay large purchases like new vehicles, favoring affordability and value. This shift can impact AutoNation’s new car sales but also potentially boost demand for their used vehicle inventory and aftermarket services, which often represent lower price points or essential maintenance.

AutoNation's strategic diversification across new and used vehicle sales, alongside a robust after-sales service and parts division, positions it to navigate these consumer spending fluctuations. For instance, the company reported a 10% increase in service and parts revenue for Q1 2024, demonstrating resilience in this segment even as new vehicle sales faced headwinds.

The health of both new and used vehicle markets significantly influences AutoNation's financial performance. New vehicle inventory showed signs of recovery throughout 2024, culminating in strong sales figures by year-end. Simultaneously, the used car market experienced an upswing, with certified pre-owned vehicles demonstrating particularly robust sales growth.

AutoNation is strategically addressing these market dynamics by increasing its inventory of used electric vehicles (EVs). The company is also enhancing its use of digital pricing tools, aiming to secure a greater market share in this rapidly changing automotive landscape.

Inflation and Vehicle Pricing

Inflationary pressures directly influence vehicle pricing, potentially affecting how affordable cars are for consumers and consequently influencing demand. While new vehicle prices saw an increase compared to pre-pandemic levels, the rate of price inflation was relatively subdued in 2024, suggesting a stabilizing market. AutoNation's strategic approach to managing its extensive inventory, capitalizing on its broad range of vehicle offerings, and implementing competitive, transparent pricing models are crucial for navigating these economic conditions effectively.

Key considerations for AutoNation in this inflationary environment include:

- Inventory Management: Efficiently managing stock levels to align with demand and avoid excessive carrying costs.

- Product Mix: Leveraging a diverse portfolio of new and used vehicles across various price points to cater to a wider customer base.

- Pricing Strategies: Employing transparent and competitive pricing to maintain customer trust and market share amidst fluctuating costs.

Supply Chain Stability and Inventory Levels

Supply chain disruptions, notably the semiconductor shortage, significantly impacted vehicle production and AutoNation's inventory throughout 2023 and into early 2024. While new vehicle inventory saw a substantial recovery in 2024, reaching an average of approximately 2.5 million units by mid-year according to industry analysts, ongoing challenges persist. These include the lingering effects of chip scarcity and the strategic imperative for automakers to establish more resilient, decentralized manufacturing networks to buffer against future shocks.

AutoNation is positioned to navigate these complexities due to its proactive strategies. The company has benefited from the broader improvement in vehicle inventory levels throughout 2024. Furthermore, AutoNation's commitment to diversifying its supplier base and fostering stronger relationships with manufacturers helps to mitigate the risks associated with potential supply chain disruptions, ensuring a more stable flow of vehicles to meet consumer demand.

Key factors influencing AutoNation's supply chain stability include:

- Semiconductor Availability: While improving, the global semiconductor market remains a critical factor influencing vehicle production volumes.

- Inventory Recovery: The significant rebound in new vehicle inventory in 2024 has eased previous constraints, allowing for more consistent sales.

- Supplier Diversification: AutoNation's efforts to broaden its supplier network reduce reliance on single sources, enhancing resilience.

- Manufacturing Decentralization: The automotive industry's push towards distributed manufacturing hubs aims to create more robust and adaptable supply chains.

Economic factors significantly shape AutoNation's operating environment, with interest rates and consumer spending being paramount. As of early 2024, auto loan rates around 7-8% for new cars with good credit impacted affordability, while a projected 3.1% US GDP growth in 2024 was tempered by inflation concerns, potentially squeezing disposable income.

The automotive market saw inventory recovery in 2024, with new vehicle sales and used car markets showing strength, particularly in certified pre-owned vehicles. AutoNation's strategic focus on used EVs and digital pricing aims to capture market share amidst these shifts.

Inflationary pressures, while stabilizing in 2024, continued to influence vehicle pricing. AutoNation's diverse product mix and transparent pricing strategies are crucial for navigating these economic conditions effectively.

| Economic Factor | 2024 Data/Trend | Impact on AutoNation |

|---|---|---|

| Interest Rates (Auto Loans) | ~7-8% (New Cars, Good Credit) | Reduced affordability, potential sales slowdown |

| US GDP Growth | Projected 3.1% | Supports overall economic activity, but inflation is a concern |

| Inflation | Subdued rate increase on new vehicles | Influences pricing, impacts consumer purchasing power |

| New Vehicle Inventory | Recovered significantly in 2024 | Improved sales opportunities |

| Used Vehicle Market | Robust growth, especially CPO | Increased demand for pre-owned vehicles |

Preview the Actual Deliverable

AutoNation PESTLE Analysis

The preview shown here is the exact AutoNation PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This comprehensive analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting AutoNation. You'll gain valuable insights into market dynamics and strategic considerations.

What you’re previewing here is the actual file—fully formatted and professionally structured, providing a complete understanding of AutoNation's external environment.

Sociological factors

Consumer preferences are in constant flux, with a noticeable surge in demand for fuel-efficient vehicles like hybrids and a strong appetite for advanced automotive technology. For instance, by the end of 2024, hybrid vehicle sales are projected to continue their upward trajectory, capturing a larger market share than previous years, driven by both environmental concerns and rising fuel costs.

AutoNation must proactively adjust its inventory and marketing strategies to align with these evolving tastes, particularly the growing interest in safety features such as collision avoidance systems and adaptive cruise control, which are becoming increasingly standard expectations for new car buyers.

The company is also adapting to changing customer journeys by integrating online ease with the essential element of in-store trust, recognizing that many consumers begin their research online but still value a tangible, personal experience before making a significant purchase.

Demographic shifts are significantly reshaping how people think about cars. Younger generations, particularly Gen Z and Millennials, are showing a growing preference for mobility-as-a-service (MaaS) options like ride-sharing and car subscriptions over the traditional model of outright vehicle ownership. This trend is particularly pronounced in urban areas, where 55% of Gen Z adults in the US express interest in MaaS.

While overall vehicle usage remains robust, with the average American driving an estimated 13,500 miles annually in 2024, AutoNation must adapt to these evolving consumer preferences. The company's strategic focus on personalized transportation services, including its DriveWise program and emphasis on flexible ownership options, positions it to capitalize on this demand for tailored mobility solutions.

AutoNation is acutely aware that brand loyalty is becoming harder to secure, with a noticeable global trend of customers switching vehicle brands. To counter this, the company prioritizes a customer-centric approach, aiming for a superior customer experience. This focus has led to recognition for its service quality, reinforcing its brand image.

The company's marketing efforts are designed to build trust and encourage repeat business. By concentrating on brand awareness, actively engaging with customers, and offering transparent pricing, AutoNation seeks to cultivate lasting loyalty. This strategy is vital in a market where customer defection is an increasing concern.

Public Perception of the Automotive Industry

Public perception significantly shapes the automotive industry's trajectory. Growing environmental concerns, particularly around emissions and the transition to electric vehicles (EVs), are a major driver of consumer choice. For instance, a 2024 study indicated that over 60% of potential car buyers consider fuel efficiency and environmental impact when making a purchase. AutoNation's emphasis on sustainability, including its efforts to promote EV sales and service, directly addresses these public sentiments, aiming to build trust and align with evolving consumer values.

Safety remains a paramount concern for consumers, influencing brand loyalty and purchasing decisions. AutoNation's commitment to safety-focused innovations and transparent vehicle history reporting can bolster its public image. The industry's ongoing advancements in driver-assistance technologies and crash safety standards are closely watched by the public, with safety ratings often being a deciding factor. For example, J.D. Power’s 2024 U.S. Vehicle Dependability Study highlighted that perceived reliability and safety features are key drivers of customer satisfaction.

Technological advancements, from autonomous driving to advanced infotainment systems, also play a crucial role in public perception. Consumers are increasingly looking for seamless integration of technology into their vehicles. AutoNation's embrace of digital retailing and its focus on offering vehicles equipped with the latest technological features can enhance its appeal. The company's 'DRV PNK' initiative, which supports breast cancer research and awareness, further contributes to its positive social impact and strengthens brand affinity by demonstrating corporate social responsibility.

Workforce Demographics and Skilled Labor Availability

The availability of skilled technicians is a critical concern for AutoNation, especially as vehicles become more technologically advanced and the industry transitions to electric vehicles (EVs). The shortage of these specialized workers directly impacts service efficiency.

This scarcity means longer wait times for customers needing maintenance or repair, potentially affecting AutoNation's service revenue and customer satisfaction. For instance, a 2024 industry report indicated a shortage of over 100,000 automotive technicians in the US, a figure projected to grow.

To address this, AutoNation might need to significantly invest in robust training and development programs. These initiatives would focus on equipping technicians with the necessary expertise to safely and effectively service high-voltage EV systems and the complex electronics in modern gasoline-powered cars.

- Skilled Technician Shortage: Approximately 20% of the current automotive technician workforce is nearing retirement age, exacerbating the existing skills gap.

- EV Complexity: Servicing EVs requires specialized knowledge in high-voltage systems, battery diagnostics, and software integration, skills not universally held by traditional technicians.

- Impact on Service: Longer repair times due to technician shortages can lead to reduced service bay utilization and a decrease in customer loyalty for AutoNation's service centers.

- Training Investment: Companies like AutoNation are exploring partnerships with vocational schools and developing in-house apprenticeship programs to cultivate a new generation of EV-certified technicians.

Societal attitudes toward vehicle ownership are evolving, with a notable uptick in interest for mobility-as-a-service (MaaS) options, particularly among younger demographics. This shift, especially in urban centers where 55% of Gen Z adults in the US are exploring MaaS, indicates a potential move away from traditional car buying. AutoNation's strategic focus on flexible ownership models and personalized transportation services aims to address this changing consumer landscape.

Brand loyalty is becoming more fluid, with consumers more willing to switch brands than in previous years. AutoNation is counteracting this by prioritizing an exceptional customer experience, which has garnered recognition for its service quality and aims to foster repeat business through transparency and engagement.

Public perception strongly favors environmental consciousness, with over 60% of potential car buyers in 2024 considering fuel efficiency and environmental impact. AutoNation's emphasis on promoting EV sales and sustainable practices directly aligns with these public sentiments, building trust and brand affinity.

Technological factors

The shift towards electric vehicles (EVs) and hybrids is profoundly reshaping the automotive landscape, directly impacting AutoNation. The company has been actively expanding its EV inventory and installing charging infrastructure to meet this growing demand.

While the pace of EV adoption saw some moderation in the U.S. during 2024, hybrid vehicles have experienced a significant comeback. This resurgence necessitates AutoNation's strategic adaptation of its product mix and sales approaches to cater to evolving consumer preferences.

The automotive retail landscape is rapidly evolving due to digital transformation and the growth of omnichannel strategies. AutoNation is actively embracing this shift by integrating advanced technologies. For instance, their use of AI-powered chatbots helps manage customer inquiries more efficiently, and predictive analytics are employed to personalize the car buying experience. This approach aims to bridge the gap between the convenience of online browsing and the trust built through in-person interactions.

Consumers today heavily rely on digital channels for vehicle research, with a significant portion expecting to complete most, if not all, purchase steps online. Data from 2024 indicates that over 80% of car buyers begin their journey online, researching models, pricing, and dealership reviews. AutoNation's investment in digital platforms and tools is a direct response to this trend, ensuring they meet customer expectations for a seamless, integrated buying process that offers both digital ease and physical dealership assurance.

The automotive retail sector is seeing significant transformation driven by data analytics and artificial intelligence. These technologies are not just buzzwords; they're actively improving how companies like AutoNation operate and connect with customers.

AutoNation has been integrating AI-powered tools, such as chatbots for customer service and predictive analytics for inventory management. This has demonstrably boosted their operational efficiency. For instance, by analyzing vast datasets, AI can forecast demand more accurately, reducing excess stock and improving vehicle turnover rates.

Furthermore, AI plays a critical role in marketing. By sifting through customer data, AI can identify trends and preferences, allowing for highly personalized marketing campaigns. This data-driven approach is vital for generating qualified leads and nurturing them through the sales funnel, ultimately enhancing customer acquisition and retention.

In-Car Technology and Connectivity

The automotive industry is seeing a significant shift towards advanced in-car technology, directly impacting consumer choices. Features like automated driving capabilities and connected car services are no longer niche; they are becoming primary drivers for new vehicle purchases. For instance, a 2024 consumer survey indicated that over 60% of potential car buyers consider advanced driver-assistance systems (ADAS) a critical factor in their decision-making process.

Consumers are actively seeking out specific safety and convenience technologies. This includes a strong preference for collision avoidance systems, adaptive cruise control, and blind-spot monitoring. AutoNation must ensure its inventory prominently features vehicles equipped with these sought-after technologies to meet evolving customer expectations. Furthermore, the dealership's sales team needs comprehensive training to effectively communicate the benefits and functionalities of these advanced systems, bridging the gap between technological innovation and consumer understanding.

- Consumer Demand: Growing preference for automated driving and connected car features.

- Key Features: Prioritization of collision avoidance, adaptive cruise control, and blind-spot monitoring.

- AutoNation Strategy: Aligning vehicle offerings and sales staff expertise with technological trends.

Cybersecurity and Data Privacy

The increasing reliance on digital platforms and the growing prevalence of connected vehicles place cybersecurity and data privacy at the forefront of technological concerns for automotive retailers like AutoNation. Protecting sensitive customer information is paramount in maintaining trust and operational integrity.

A significant cyberattack that disrupted dealership operations in early summer 2024 underscored the inherent vulnerabilities within the automotive retail sector's digital infrastructure. This event serves as a stark reminder of the constant threat landscape.

To mitigate these risks, AutoNation is compelled to make substantial investments in advanced cybersecurity measures. These investments are crucial for safeguarding customer data against breaches and ensuring the continued reliability and security of its digital customer-facing platforms.

- Data Breach Costs: The average cost of a data breach in the automotive industry reached $5.16 million in 2023, according to IBM's Cost of a Data Breach Report, highlighting the financial implications of inadequate security.

- Connected Vehicle Security: By 2025, it's projected that over 70% of new vehicles will have some form of connectivity, increasing the attack surface for cyber threats targeting vehicle systems and associated data.

- Regulatory Scrutiny: Evolving data privacy regulations, such as GDPR and CCPA, impose strict requirements on how customer data is handled, with non-compliance leading to significant fines.

Technological advancements are fundamentally altering how AutoNation operates and interacts with customers. The company's strategic focus on digital integration, including AI-powered tools and robust online platforms, directly addresses the modern consumer's preference for seamless, data-driven purchasing experiences. This commitment ensures AutoNation remains competitive in an increasingly digitized automotive market.

The surge in hybrid vehicle popularity in 2024, alongside the ongoing transition to EVs, necessitates a dynamic product strategy. AutoNation's proactive expansion of its EV inventory and charging infrastructure, coupled with its adaptation to hybrid demand, positions it to capitalize on these evolving powertrain preferences.

The integration of AI and data analytics is enhancing AutoNation's operational efficiency and customer engagement. Predictive analytics for inventory management and personalized marketing campaigns, driven by AI, are key to optimizing stock levels and improving customer acquisition, as seen in their data-driven lead generation efforts.

Advanced in-car technologies, such as driver-assistance systems, are now critical purchase motivators, with over 60% of car buyers in 2024 considering them essential. AutoNation's strategy to highlight vehicles with these features and train its sales staff on their benefits is crucial for meeting customer demand and driving sales.

Legal factors

The Federal Trade Commission's (FTC) Combating Auto Retail Scams (CARS) Rule, initially set to take effect July 30, 2024, aimed to overhaul vehicle sales and financing by banning deceptive practices and requiring explicit consumer consent for added charges. While this specific rule faced a court challenge and was overturned, the FTC retains broad authority to police unfair and deceptive practices in the automotive sector.

Even without the CARS Rule, AutoNation must navigate a robust landscape of consumer protection laws at both the federal and state levels. These existing regulations mandate transparency in advertising, pricing, and financing terms, ensuring fair dealing and preventing misrepresentation to consumers. For instance, state attorneys general frequently enforce laws against deceptive advertising and predatory lending in auto sales.

AutoNation's extensive network of new vehicle franchises means it navigates a complex web of state-specific franchise laws. These regulations are crucial as they dictate the dynamics between manufacturers and dealerships, influencing everything from expansion strategies to operational procedures and even the process of selling off stores.

These franchise laws directly affect AutoNation's strategic flexibility. For instance, the company's decision to divest a significant portion of its domestic and import stores in Q3 2024 was undoubtedly shaped by these legal frameworks, which can impose conditions on such transactions and impact the ease with which AutoNation can adjust its portfolio.

AutoNation's operations, particularly through its AutoNation Finance division, are significantly influenced by financing and lending regulations. These rules govern everything from the interest rates AutoNation can charge to the disclosures it must provide to consumers regarding credit terms. Compliance is paramount to avoid penalties and maintain customer trust.

The company's commitment to robust compliance is evidenced by the improving quality of its loan portfolio. For instance, in 2023, AutoNation reported a strong performance in its financing segment, with a significant portion of its revenue derived from these services, underscoring the importance of adhering to these financial regulations.

Furthermore, AutoNation's successful asset-backed securitization activities, a common practice in the auto finance industry, also demonstrate a well-established compliance framework. These securitizations involve packaging loans and selling them to investors, a process heavily scrutinized by regulatory bodies to ensure consumer protection and market stability.

Data Security and Privacy Regulations (e.g., CCPA, GDPR)

AutoNation, as a major automotive retailer managing extensive customer information, must adhere to stringent data security and privacy laws such as the California Consumer Privacy Act (CCPA). These regulations mandate strong data protection protocols and clear communication about data usage to prevent significant fines and preserve customer confidence. Failure to comply can lead to substantial penalties; for instance, the CCPA can impose fines of up to $7,500 per intentional violation.

Compliance with these evolving legal frameworks requires AutoNation to invest in advanced cybersecurity measures and conduct regular audits of its data handling procedures. The company's commitment to privacy is crucial for maintaining brand reputation and customer loyalty in an era where data breaches are a constant concern. For example, in 2023, data privacy settlements often reached millions of dollars, underscoring the financial risks associated with non-compliance.

- CCPA Fines: Up to $7,500 per intentional violation.

- GDPR Fines: Up to €20 million or 4% of annual global turnover, whichever is higher.

- Customer Trust: Data privacy is a key driver of customer loyalty.

- Data Handling: Requires transparent policies and robust security infrastructure.

Environmental Regulations and Emissions Standards

Beyond federal emissions standards, state-level environmental regulations, like California's 2035 ban on new gasoline-powered car sales, significantly influence AutoNation's inventory and sales mix in key markets. This shift necessitates a strategic adaptation to prominently feature environmentally friendly vehicles, including electric vehicles (EVs) and hybrids, to meet evolving consumer demand and regulatory requirements.

For instance, in 2023, California alone accounted for over 16% of all EV sales in the United States, highlighting the substantial market impact of such state-specific mandates. AutoNation's ability to navigate these diverse and sometimes politically contested regulations will be crucial for its continued success and market share, especially as other states consider similar measures.

AutoNation must navigate a complex web of consumer protection laws, including those governing advertising, pricing, and financing, to ensure fair dealing and prevent misrepresentation. State franchise laws also heavily influence dealership operations and strategic decisions, impacting everything from expansion to store divestitures.

Financing and lending regulations are critical for AutoNation Finance, dictating interest rates and disclosure requirements, with compliance vital for avoiding penalties. Furthermore, data privacy laws like the CCPA, which can impose fines of up to $7,500 per intentional violation, necessitate robust data security measures to maintain customer trust.

State-specific environmental regulations, such as California's ban on new gasoline car sales by 2035, are reshaping AutoNation's inventory strategy to prioritize EVs and hybrids, reflecting significant market shifts. In 2023, California represented over 16% of US EV sales, demonstrating the impact of these mandates.

| Legal Factor | Impact on AutoNation | Relevant Data/Examples |

| Consumer Protection Laws | Mandates transparency in advertising, pricing, and financing; prevents deceptive practices. | State Attorneys General enforce laws against deceptive advertising and predatory lending. |

| Franchise Laws | Governs manufacturer-dealership relationships, influencing expansion and divestiture strategies. | Q3 2024 divestiture of domestic and import stores was shaped by these legal frameworks. |

| Financing & Lending Regulations | Dictates interest rates, disclosures, and credit terms for AutoNation Finance. | Strong performance in financing segment in 2023 highlights importance of compliance. |

| Data Privacy Laws (e.g., CCPA) | Requires strong data protection and transparent usage policies; penalties for non-compliance. | Fines up to $7,500 per intentional CCPA violation; data privacy settlements can reach millions. |

| Environmental Regulations | Influences inventory mix towards EVs and hybrids due to state-level bans on gasoline car sales. | California's 2035 ban; over 16% of US EV sales in 2023 were in California. |

Environmental factors

The accelerating adoption of electric vehicles (EVs), fueled by growing environmental awareness and supportive government policies, presents a significant dynamic for AutoNation. By the end of 2024, projections indicate global EV sales could surpass 17 million units, a substantial increase from previous years.

In response, AutoNation is strategically enhancing its EV offerings and developing charging capabilities across its dealership network. This proactive approach acknowledges the shift in consumer demand and the necessity of adapting to emerging automotive technologies.

This transition necessitates considerable operational evolution, including the crucial upskilling of service technicians to proficiently handle the complexities of high-voltage EV powertrains and battery systems.

AutoNation is actively pursuing sustainability by integrating green building practices into its new facilities and upgrades. These efforts focus on tangible environmental improvements, such as reducing water usage and incorporating energy-efficient lighting systems. For instance, in 2023, AutoNation reported a 5% reduction in water consumption across its dealerships compared to 2022.

The company's commitment extends to utilizing locally sourced materials, which helps lower transportation-related emissions and supports regional economies. By prioritizing these initiatives, AutoNation aims to significantly decrease its overall carbon footprint and demonstrate a strong commitment to environmental responsibility. This aligns with a growing consumer and investor demand for corporate environmental stewardship.

AutoNation's commitment to sustainability heavily features robust waste management and recycling programs. These initiatives are central to their environmental strategy, covering a wide array of materials from automotive fluids like used oil and coolant to physical components such as tire rubber and scrap metal. The company also processes materials like paper and car batteries for recycling.

Beyond material recycling, AutoNation prioritizes extending the lifespan of vehicles through refurbishment and resale of used cars. This circular economy approach significantly reduces the environmental footprint associated with manufacturing new vehicles and disposes of fewer vehicles prematurely. This focus on refurbishment and recycling is a key component of their waste reduction and resource conservation efforts.

Emissions Reduction and Air Quality Standards

AutoNation, as a major automotive retailer, is indirectly influenced by evolving emissions reduction targets and air quality regulations. While the company doesn't manufacture vehicles, its sales strategy and inventory choices significantly impact the fleet turnover towards more environmentally friendly options. For instance, the growing consumer demand for electric vehicles (EVs) and hybrids, which AutoNation actively promotes, directly contributes to lowering overall tailpipe emissions in the markets it serves.

The push for cleaner air is a significant environmental factor affecting AutoNation's operations and product offerings. As governments worldwide, including the United States, implement stricter emissions standards, the demand for internal combustion engine (ICE) vehicles may face headwinds, while demand for EVs and plug-in hybrids is expected to surge. This shift necessitates AutoNation adapting its inventory and marketing to align with these environmental imperatives.

- Sales Mix Shift: AutoNation's sales of new and used EVs and hybrids are a key indicator of its contribution to emissions reduction. In 2023, the U.S. EV market share reached approximately 7.6% of all new vehicle sales, a notable increase from previous years, reflecting a trend AutoNation is capitalizing on.

- Regulatory Compliance: While primarily impacting manufacturers, stricter emissions standards can indirectly influence vehicle availability and pricing, affecting AutoNation's inventory and customer purchasing decisions.

- Facility Improvements: AutoNation is also focused on improving air quality within its own operational footprint, potentially through energy efficiency measures and responsible waste management at its dealerships.

Climate Change and Extreme Weather Events

Climate change presents a significant environmental challenge, with potential increases in extreme weather events posing risks to AutoNation's physical infrastructure and supply chain operations. These events can disrupt vehicle delivery, service operations, and damage dealership properties.

While AutoNation's direct disclosures on climate change impacts are limited, the company's emphasis on operational resilience and environmental responsibility suggests an awareness of these broader concerns. This proactive stance is crucial for mitigating potential disruptions and ensuring business continuity in the face of a changing climate.

For instance, the automotive industry globally is increasingly focusing on sustainability. In 2024, the automotive sector saw a continued push towards electric vehicles, with global EV sales projected to reach over 15 million units, highlighting a shift that indirectly addresses climate concerns by reducing tailpipe emissions.

- Supply Chain Vulnerability: Extreme weather can impact manufacturing plants and transportation routes, affecting vehicle availability.

- Physical Asset Risk: Dealerships and service centers located in vulnerable areas face potential damage from floods, hurricanes, or wildfires.

- Operational Disruption: Severe weather can lead to temporary closures, impacting sales and service revenue.

- Customer Impact: Service disruptions and vehicle availability issues can affect customer satisfaction and loyalty.

The increasing focus on electric vehicles (EVs) is a major environmental shift, with global EV sales expected to exceed 17 million units by the end of 2024. AutoNation is actively expanding its EV inventory and charging infrastructure to meet this demand. This transition also requires significant investment in retraining service technicians to handle EV-specific maintenance, with a growing emphasis on sustainable business practices across its operations.

PESTLE Analysis Data Sources

Our AutoNation PESTLE Analysis draws data from automotive industry-specific market research reports, government automotive regulations and policies, and economic indicators from reputable financial institutions. This ensures a comprehensive understanding of the external factors influencing the automotive retail sector.