AutoNation Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AutoNation Bundle

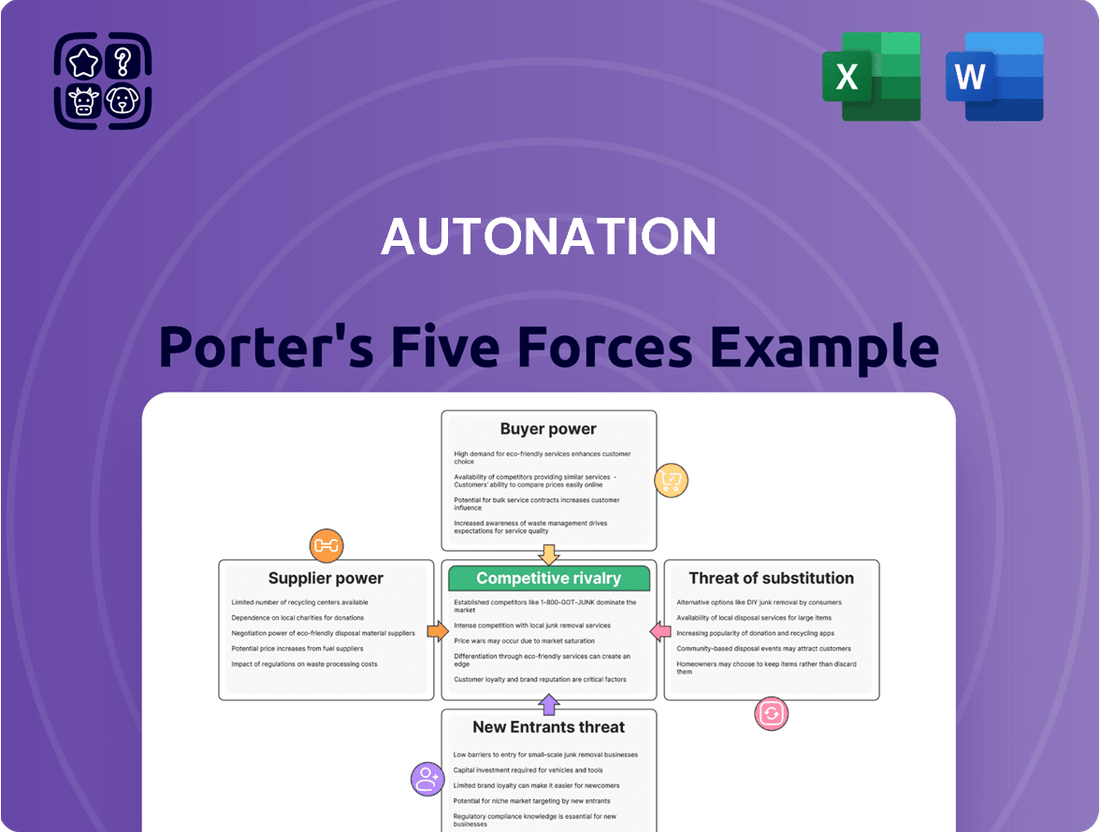

AutoNation faces significant competitive pressures, with intense rivalry among dealerships and the growing influence of online car retailers. The threat of new entrants is moderate, while the bargaining power of buyers is high due to readily available information and financing options. Understanding these dynamics is crucial for any automotive industry stakeholder.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore AutoNation’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Automakers wield substantial bargaining power over retailers like AutoNation. This stems from the inherent desirability of their brands and their absolute control over vehicle allocation. The franchise system further solidifies this, making it difficult for dealerships to pivot to different manufacturers.

While AutoNation’s extensive network, representing 31 distinct new vehicle brands as of early 2024, offers some diversification, the company remains heavily reliant on major manufacturers such as Toyota, Honda, Ford, and General Motors. This dependence means automakers can dictate terms, impacting inventory, pricing, and model availability for AutoNation.

Parts and components suppliers hold significant bargaining power, especially when providing specialized or proprietary parts crucial for AutoNation's after-sales and repair operations. While AutoNation benefits from the standardization of many common automotive parts and the availability of multiple aftermarket suppliers, this power diminishes for OEM-specific components where manufacturers often have greater control.

The increasing complexity of modern vehicles, particularly with the surge in electric vehicles (EVs) and software-defined vehicles (SDVs), significantly enhances the bargaining power of technology and software providers. These companies are indispensable for developing and supplying essential in-car systems, advanced diagnostic tools, and the digital retail platforms that are becoming standard in the automotive industry.

AutoNation's strategic commitment to digital transformation, including substantial investments in AI-driven customer engagement and operational efficiency tools, underscores its growing dependence on these specialized technology suppliers. For instance, AutoNation reported significant investments in technology in its 2023 and 2024 financial reports, aiming to streamline operations and enhance the customer experience. This reliance can translate into increased leverage for these providers when negotiating contracts and pricing, as their proprietary software and expertise are crucial for AutoNation to maintain its competitive edge.

Labor Market and Skilled Technicians

The availability of skilled labor, especially certified technicians capable of handling complex vehicle repairs and the growing demand for Electric Vehicle (EV) servicing, acts as a significant supplier power for AutoNation. A scarcity of these specialized workers can escalate labor expenses and constrain service throughput, directly impacting the company's lucrative after-sales operations.

This difficulty is a well-documented and ongoing challenge within the automotive sector. For instance, in 2024, industry reports highlighted a substantial deficit in qualified EV technicians, with some estimates suggesting a need for hundreds of thousands more by the end of the decade to meet projected demand.

- Technician Shortage Impact: A lack of certified technicians can lead to longer wait times for customers, potentially reducing service revenue and customer satisfaction for AutoNation.

- Rising Labor Costs: Increased demand for skilled labor drives up wages, directly impacting AutoNation's cost of goods sold and overall profitability in its service departments.

- EV Servicing Demand: The transition to EVs necessitates specialized training and tools, creating a concentrated pool of suppliers (technicians) with significant bargaining power.

Financing and Insurance Product Providers

The bargaining power of financing and insurance product providers is a key consideration for AutoNation. While AutoNation operates its own captive finance company, AutoNation Finance, it also relies on partnerships with external financial institutions and insurance providers to offer a comprehensive suite of products to its customers.

The leverage these external providers hold is influenced by the overall competitiveness of the financial services market. AutoNation's ability to negotiate favorable terms is also bolstered by the growing strength and success of its own financing arm, as evidenced by its recent successful securitization. This internal capability provides a degree of counter-bargaining power.

- External Partnerships: AutoNation collaborates with various external financial institutions and insurance companies.

- Market Competitiveness: The bargaining power of these external providers is directly tied to the intensity of competition within the financial services sector.

- Internal Financing Strength: AutoNation Finance's recent successful securitization highlights its increasing capacity to secure its own funding and potentially reduce reliance on external partners, thereby enhancing its negotiation leverage.

Suppliers to AutoNation, particularly those providing specialized parts or technology, wield considerable bargaining power. This is amplified by the increasing complexity of vehicles and the demand for specialized services like EV maintenance, where a shortage of qualified technicians exists. AutoNation's reliance on proprietary components and advanced software from specific tech firms further strengthens these suppliers' negotiating positions.

| Supplier Type | Bargaining Power Factors | Impact on AutoNation |

|---|---|---|

| Automakers (OEMs) | Brand desirability, vehicle allocation control, franchise system | Dictate terms on inventory, pricing, and model availability |

| Parts & Components (Specialized/Proprietary) | Uniqueness of parts, OEM control | Higher costs for after-sales and repair operations |

| Technology & Software Providers | Vehicle complexity (EVs, SDVs), proprietary systems, digital platforms | Increased leverage in contract negotiations due to essential nature of services |

| Skilled Labor (Certified Technicians) | Scarcity of specialized skills (e.g., EV technicians), demand for services | Escalated labor costs, potential constraint on service throughput |

What is included in the product

This analysis dissects the competitive forces impacting AutoNation, revealing the intensity of rivalry, bargaining power of buyers and suppliers, threat of new entrants, and the impact of substitutes on its market position and profitability.

Effortlessly identify and mitigate competitive threats by visualizing AutoNation's buyer power and supplier leverage with intuitive interactive charts.

Customers Bargaining Power

Customers today wield significant power due to readily available information. Digital platforms and online reviews provide instant access to pricing, vehicle inventory, and competitor offerings, allowing buyers to thoroughly research and compare options. This transparency directly enhances their ability to negotiate favorable terms.

In 2024, the automotive retail landscape continued to be shaped by digital advancements. AutoNation, for instance, has been actively investing in its digital infrastructure, including online sales tools and virtual showrooms. This strategy is a direct response to the empowered consumer who expects seamless digital experiences and the ability to compare AutoNation's offerings against a vast array of competitors online.

Following periods of supply shortages, new vehicle inventory levels are notably increasing. For instance, by the end of Q1 2024, many major automotive manufacturers reported significant month-supply increases compared to the previous year, with some segments seeing over 60 days of supply. This abundance of vehicles translates directly into more choices for consumers.

This increased inventory intensifies competition among dealerships. As dealers aim to move their stock, they become more willing to offer discounts and incentives. This dynamic significantly enhances buyer bargaining power, as consumers can leverage the wider selection and competitive pricing to secure more favorable deals.

Consumers are increasingly feeling the pinch from high interest rates, which directly impacts their ability to afford new vehicles. This economic pressure means buyers have more sway, as they can push for better pricing or simply postpone their purchase, knowing that their budget is stretched thin.

In 2024, the average interest rate for a new car loan hovered around 7.5%, a significant jump from previous years, making affordability a major hurdle for many shoppers. This situation amplifies customer bargaining power, as dealerships face pressure to offer incentives to move inventory when buyers are more hesitant due to financing costs.

Growth of Used Vehicle Market

The burgeoning used vehicle market significantly enhances customer bargaining power. With a wider selection and increasingly competitive pricing, particularly for certified pre-owned options, buyers have compelling alternatives to new car purchases. This shift reduces their dependence on dealerships for new inventory, giving them more leverage in negotiations.

For instance, in 2024, the used car market continued its strong performance, with sales volume remaining robust. Data from industry analysts indicated that the average price of used vehicles, while fluctuating, offered a substantial cost saving compared to new models, further empowering consumers to demand better terms.

- Increased Availability: The sheer volume of used cars available provides buyers with a broader range of choices, from budget-friendly options to nearly-new vehicles.

- Price Sensitivity: Customers are highly aware of used car pricing trends, readily comparing options across different dealerships and online platforms.

- Certified Pre-Owned (CPO) Programs: Dealership CPO programs offer warranties and inspections, making used vehicles a more attractive and less risky purchase, thereby increasing customer confidence and bargaining power.

Shifting Preferences Towards Hybrids and EVs

Consumer preferences are indeed shifting towards hybrid and electric vehicles, a trend that significantly impacts the bargaining power of customers. While the initial surge in EV adoption growth has moderated, the increasing variety of powertrain options available means buyers have more leverage. For instance, in 2024, the number of new EV models available in the U.S. market continued to expand, offering consumers a wider selection than ever before.

This expanded choice directly translates to enhanced customer bargaining power. As manufacturers and dealerships vie for sales in a growing, albeit more competitive, EV segment, customers can often negotiate better pricing or favorable terms. The sheer volume of new EV models entering the market in 2024, from established automakers and new entrants alike, creates a buyer's market for those prioritizing electric or hybrid technology.

- Growing EV Model Availability: The U.S. market saw a substantial increase in the number of available EV models in 2024, providing consumers with more choices.

- Increased Negotiation Leverage: With more diverse powertrain options, customers gain greater bargaining power as manufacturers and dealers compete for their business.

- Market Saturation Potential: As more manufacturers introduce new EV and hybrid models, the potential for market saturation in certain segments could further empower consumers.

The bargaining power of customers is significantly amplified by the increasing availability of information and the growing number of vehicle choices. This, combined with economic pressures like higher interest rates, forces dealerships to be more accommodating to secure sales.

In 2024, AutoNation faces customers who are well-informed and have numerous alternatives, both new and used. The competitive landscape, further fueled by a robust used car market and expanding EV options, means customers can demand better pricing and terms.

| Factor | Impact on Customer Bargaining Power | 2024 Data/Trend |

|---|---|---|

| Information Availability | High | Digital platforms provide instant access to pricing, inventory, and reviews. |

| Vehicle Inventory Levels | Increased | Month-supply for new vehicles rose significantly by end of Q1 2024, exceeding 60 days in some segments. |

| Financing Costs | Increased Leverage for Buyers | Average new car loan interest rates around 7.5% in 2024, making affordability a key negotiation point. |

| Used Vehicle Market | Enhanced Alternatives | Robust sales volume and competitive pricing offer significant cost savings compared to new models. |

| EV/Hybrid Options | Greater Choice & Negotiation Potential | Expanding number of EV models available in 2024, increasing competition and buyer leverage. |

Preview Before You Purchase

AutoNation Porter's Five Forces Analysis

This preview shows the exact AutoNation Porter's Five Forces Analysis you'll receive immediately after purchase, detailing the competitive landscape within the automotive retail industry. You'll gain insights into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry among existing competitors. This comprehensive document is ready for your immediate use upon completion of your purchase, offering a clear understanding of the strategic forces shaping AutoNation's market position.

Rivalry Among Competitors

The U.S. automotive retail sector is characterized by its fragmentation, featuring a vast number of independent dealerships alongside large consolidators like AutoNation. Despite this, the industry is experiencing a noticeable trend of consolidation as mergers and acquisitions become more prevalent, thereby heightening competitive pressures, particularly among the larger entities.

AutoNation, holding the position as the largest automotive retailer in the United States, is a significant participant in this ongoing consolidation. This strategic involvement means AutoNation is not only a major player but also actively shaping the competitive landscape by acquiring smaller dealerships and groups, aiming to expand its market share and operational efficiencies.

The automotive retail landscape is marked by fierce price competition as dealerships grapple with rising inventory levels and consumer affordability challenges. This intense rivalry directly squeezes gross profit margins, especially on new vehicle sales.

AutoNation's financial performance in Q1 2025 illustrates this trend, with a notable decline in gross profit per new vehicle unit. This data point underscores the significant pressure dealerships are facing to maintain profitability amidst a highly competitive market.

Competitive rivalry in the auto industry is intensifying, heavily influenced by digital advancements and the demand for seamless omnichannel customer experiences. Dealerships are making substantial investments in online sales platforms, AI-powered tools for personalized customer engagement, and digital marketing to attract and retain buyers in 2024. AutoNation's proactive digital transformation strategy is therefore essential for its continued competitive advantage.

After-Sales and Service Competition

Beyond the initial sale, fierce competition thrives in the after-sales market, encompassing maintenance, repairs, and parts. This segment is crucial as consumers are holding onto vehicles longer, and the shift towards electric vehicles (EVs) is reshaping traditional service demands.

Dealerships are actively working to diversify and expand their service revenue. AutoNation, for instance, has demonstrated robust performance in after-sales gross profit, underscoring the significance of this competitive battleground. In the first quarter of 2024, AutoNation reported after-sales gross profit of $400 million, a 5% increase year-over-year, reflecting successful strategies in this area.

- Focus on Customer Retention: Dealerships compete on building loyalty through reliable service and transparent pricing.

- EV Service Specialization: As EV adoption grows, dealerships are investing in training and equipment to service these vehicles, creating a new competitive frontier.

- Parts and Accessories Sales: Offering genuine parts and a wide range of accessories is another key area of competition, driving additional revenue.

- Service Department Efficiency: Streamlining operations and appointment scheduling enhances customer experience and competitiveness.

Brand Diversity and Geographic Reach

AutoNation's competitive rivalry is significantly shaped by its extensive brand diversity and broad geographic reach. Operating a vast network of new vehicle franchises across numerous states, the company offers a wide selection of automotive brands, which serves as a major competitive advantage.

This extensive geographic footprint and diverse brand portfolio enable AutoNation to appeal to a wide spectrum of consumers. For instance, in 2023, AutoNation reported revenue of $22.7 billion, underscoring its substantial market presence and ability to serve a large customer base. This scale also allows for significant economies of scale in marketing and operational efficiencies, positioning AutoNation as a formidable competitor in the automotive retail sector.

- Extensive Franchise Network: AutoNation operates hundreds of dealerships across the United States, providing broad market coverage.

- Brand Portfolio: The company represents a wide array of automotive manufacturers, catering to diverse customer preferences and price points.

- Economies of Scale: A large operational footprint facilitates cost savings in areas like advertising, inventory management, and administrative functions.

- Market Penetration: This combination of reach and variety allows AutoNation to capture market share effectively against smaller, more localized competitors.

The competitive rivalry within the automotive retail sector is intense, driven by both large consolidators like AutoNation and numerous independent dealerships. This fragmented yet consolidating market sees significant price competition, particularly on new vehicles, squeezing profit margins. Dealerships are increasingly investing in digital platforms and omnichannel experiences to attract and retain customers in 2024, a trend AutoNation is actively pursuing.

The after-sales market, including maintenance and repairs, is another critical battleground where competition is fierce. AutoNation's strong performance in after-sales gross profit, reaching $400 million in Q1 2024, a 5% year-over-year increase, highlights its success in this area. This segment is vital as consumers hold onto vehicles longer and the shift to EVs reshapes service needs.

| Metric | Q1 2024 | Year-over-Year Change |

|---|---|---|

| After-Sales Gross Profit | $400 million | +5% |

| New Vehicle Gross Profit Per Unit | Declined | N/A |

SSubstitutes Threaten

Public transportation and ride-sharing services present a nuanced threat. While not direct replacements for owning a car, they offer viable alternatives for personal mobility, especially in densely populated urban centers. For instance, in 2024, ride-sharing services like Uber and Lyft saw continued strong adoption, with millions of daily rides completed globally, providing a convenient option for those who might otherwise consider a second vehicle.

The growing convenience and accessibility of these services can indeed dampen the demand for personal vehicle ownership, particularly impacting multi-car households where one vehicle might be replaced by ride-sharing for certain trips. This trend is supported by data showing a slight decrease in average vehicle miles traveled per household in some major metropolitan areas, as individuals opt for these on-demand services.

However, the fundamental appeal of personal vehicle ownership—unparalleled freedom, convenience for longer distances, and the ability to transport goods or family without scheduling constraints—remains a significant counter-force. For many consumers, especially in suburban and rural areas, these substitutes are not yet a practical or preferred alternative to the utility of owning a car.

Vehicle subscription services and flexible leasing are emerging as significant substitutes for traditional car ownership. These models allow consumers to access vehicles for a monthly fee, often including insurance and maintenance, reducing the upfront cost and long-term commitment associated with buying a car. For instance, subscription services like Flex by Enterprise or Porsche Drive offer varying tiers of vehicle access, directly competing with the outright purchase model.

The increasing average age of vehicles on U.S. roads, reaching an estimated 12.5 years in 2023, directly impacts new car sales by signaling that consumers are holding onto their vehicles for longer periods. This trend reduces the overall demand for new automobiles, as fewer replacement purchases are needed.

Furthermore, a thriving used car market acts as a potent substitute for new vehicle purchases. In 2023, the used car market continued to show strong activity, with prices stabilizing after previous volatility, offering consumers more affordable alternatives. This robust market provides a viable and often more budget-friendly option for many buyers.

AutoNation's strategic focus on its used vehicle sales segment is a key mitigating factor against this threat. In the first quarter of 2024, AutoNation reported that used vehicle sales constituted a significant portion of its revenue, demonstrating its ability to capture demand within the substitute market and offset potential declines in new vehicle sales.

Bicycles, E-bikes, and Micromobility Solutions

For short-distance urban travel, bicycles, e-bikes, and micromobility options like electric scooters are becoming increasingly viable substitutes for traditional vehicles. This trend, while currently niche, could gradually affect demand for smaller, city-oriented cars. For instance, in 2023, the global e-bike market was valued at approximately $25 billion and is projected to grow significantly, indicating a growing consumer preference for these alternatives.

The increasing adoption of these alternatives is a growing threat, particularly for AutoNation's smaller, urban-focused vehicle segments. As more consumers opt for these eco-friendly and often more affordable modes of transport for their daily commutes, the need for a personal car for short trips diminishes. This can lead to a subtle but persistent erosion of potential sales in specific vehicle categories.

- Growing Micromobility Market: The global market for e-bikes and scooters is expanding rapidly, with significant growth expected in urban centers.

- Shift in Consumer Preferences: There's a noticeable shift towards sustainable and convenient transportation for short distances, especially in congested cities.

- Impact on Entry-Level Vehicles: This trend poses a threat to sales of smaller, fuel-efficient, and city-focused cars, which are often considered by first-time buyers or those with shorter commutes.

- 2023 E-bike Market Value: The e-bike market alone was valued at around $25 billion in 2023, highlighting the scale of this alternative.

Shifting Consumer Priorities and Environmental Concerns

A growing segment of consumers, particularly younger demographics, are increasingly prioritizing environmental sustainability and minimalist lifestyles. This evolving consumer sentiment could lead to a reduced demand for traditional car ownership, as individuals explore alternatives like car-sharing services, enhanced public transportation, or even opting out of vehicle ownership altogether. For instance, in 2024, ride-sharing services continued to see robust user adoption, with global revenue projected to reach over $200 billion, indicating a tangible shift in transportation preferences for some.

This trend represents a long-term, albeit gradual, substitution threat to traditional automotive retail. As these preferences solidify, they could erode the market share of new and used vehicle sales. The increasing availability and convenience of mobility-as-a-service platforms further amplify this substitution pressure.

The impact of these shifting priorities is becoming more pronounced:

- Growing interest in electric vehicles (EVs): While still a form of car ownership, the shift towards EVs signifies a change in consumer preference away from internal combustion engine vehicles, potentially impacting the resale value and demand for traditional used cars. In 2024, EV sales continued their upward trajectory, capturing a significant portion of new vehicle registrations in many developed markets.

- Increased adoption of public transit and micro-mobility: Urban areas are seeing greater investment and usage of public transit and micro-mobility options like e-scooters and bikes, offering viable alternatives for short-distance travel.

- Subscription-based vehicle models: Some automakers are experimenting with vehicle subscription services, which offer flexibility and may appeal to consumers hesitant about long-term ownership commitments.

The threat of substitutes for AutoNation is multifaceted, encompassing alternatives to traditional car ownership and even car usage itself. Ride-sharing and public transportation offer mobility without ownership, particularly in urban settings. For example, in 2024, ride-sharing services remained a popular choice for millions of daily commuters, providing a convenient alternative to personal vehicle use.

Furthermore, the used car market presents a significant substitute for new vehicle purchases. In 2023, the used car market remained robust, offering more affordable options that appeal to a broad range of buyers. AutoNation's strong performance in used vehicle sales, which constituted a significant portion of its revenue in Q1 2024, demonstrates its ability to capitalize on this substitute market.

Emerging trends like vehicle subscription services and micromobility options such as e-bikes and scooters also represent growing threats. The global e-bike market, valued at approximately $25 billion in 2023, highlights the increasing consumer adoption of these alternatives for short-distance travel.

| Substitute Category | Examples | 2023/2024 Relevance | Impact on AutoNation |

|---|---|---|---|

| Mobility Services | Ride-sharing (Uber, Lyft), Public Transit | Millions of daily rides; strong urban adoption in 2024 | Reduces demand for second vehicle ownership in urban areas |

| Used Vehicle Market | Pre-owned cars and trucks | Robust activity and stabilizing prices in 2023 | Direct competition for new vehicle sales; AutoNation leverages its used car segment |

| Alternative Ownership Models | Vehicle Subscriptions, Leasing | Growing availability from manufacturers and third parties | Appeals to consumers avoiding long-term ownership commitment |

| Micromobility | E-bikes, E-scooters | Global e-bike market ~$25 billion in 2023; growing urban use | Threatens sales of smaller, city-focused vehicles |

Entrants Threaten

The automotive retail sector, particularly for new vehicle sales, presents a formidable barrier to entry due to immense capital requirements. A new dealership typically needs millions of dollars for prime real estate, state-of-the-art facilities, extensive vehicle inventory, and robust operational systems. For instance, establishing a new dealership in a competitive market could easily necessitate an investment upwards of $10 million, making it prohibitive for many aspiring entrepreneurs.

Securing new vehicle franchises from established automakers is another significant hurdle. These franchises are not readily available and often require prospective dealers to demonstrate substantial financial capacity, proven management expertise, and adherence to stringent brand standards and customer service protocols. In 2024, automakers continue to favor established, well-capitalized dealer groups, further limiting opportunities for new entrants without a strong financial foundation and a track record of success.

Established players like AutoNation leverage extensive, well-developed dealer networks and significant brand loyalty, making it difficult for newcomers to gain traction. Building comparable trust and customer relationships takes considerable time and investment, posing a substantial barrier. For instance, AutoNation's 2024 first-quarter report highlighted their continued focus on customer satisfaction, a key component of their established brand strength.

The automotive retail sector faces substantial regulatory and licensing barriers that deter new entrants. These include stringent state and federal requirements for dealership licenses, consumer protection laws governing sales practices, and evolving environmental standards for vehicle sales and service. For instance, in 2024, many states continue to enforce complex franchise laws that protect existing dealerships, making it difficult for independent startups to establish themselves without significant legal and financial investment.

Supply Chain Relationships and Inventory Access

New entrants face significant hurdles in securing reliable access to new vehicle inventory from major automakers. Established dealerships, like AutoNation, benefit from long-standing relationships and preferential allocation agreements, creating a barrier to entry for newcomers.

This preferential access means new players struggle to compete on vehicle availability and the breadth of models offered. For instance, in 2024, the automotive industry continued to grapple with supply chain disruptions, making inventory acquisition even more critical for market penetration.

- Limited Allocation: New dealerships often receive smaller initial allocations compared to established counterparts.

- Relationship Leverage: Automakers prioritize partners with proven sales records and loyalty.

- Inventory Costs: Securing inventory without established credit lines or bulk purchasing power can lead to higher acquisition costs for new entrants.

Technological Investment and Digital Infrastructure

The automotive retail landscape demands significant upfront technological investment, making it a formidable barrier for new entrants. To even begin competing with established players like AutoNation, newcomers must commit substantial capital to digital transformation, including advanced data analytics and robust online platforms. For instance, in 2024, the average dealership invested millions in upgrading their digital infrastructure to support online sales and customer engagement, a cost that can deter smaller or less capitalized entrants.

New entrants face the challenge of matching the sophisticated omnichannel capabilities that established retailers have cultivated. This necessitates not only financial resources but also specialized expertise in areas like customer relationship management (CRM) systems and digital marketing. Without these, a new entrant would struggle to offer the seamless online-to-offline customer journey that consumers now expect.

- High Capital Outlay: New entrants require significant investment in digital infrastructure, data analytics, and online sales platforms to compete effectively.

- Expertise Gap: Acquiring the necessary specialized knowledge in digital marketing and CRM systems is crucial and can be a hurdle for new businesses.

- Omnichannel Expectations: Meeting consumer demand for seamless online and offline experiences necessitates advanced technological integration, which is costly to develop.

- Competitive Digital Offerings: Established retailers like AutoNation have already made substantial investments, creating a high bar for new entrants to overcome in terms of digital presence and functionality.

The threat of new entrants in automotive retail remains moderate, primarily due to the substantial capital requirements and established brand loyalty that favor incumbents like AutoNation. While the digital shift offers some avenues for disruption, the core barriers of franchise agreements and physical infrastructure investment are significant deterrents.

In 2024, the automotive retail sector continues to demand significant upfront investment, with new dealerships requiring millions for real estate, inventory, and technology. Securing new vehicle franchises from automakers is also a major hurdle, as these are typically awarded to well-capitalized entities with proven track records, limiting opportunities for newcomers without substantial financial backing and management expertise.

Established players like AutoNation benefit from extensive networks and brand recognition, which are difficult for new entrants to replicate. Furthermore, regulatory and licensing requirements, coupled with the need for advanced digital capabilities and seamless omnichannel experiences, add layers of complexity and cost that deter new market participants.

Porter's Five Forces Analysis Data Sources

Our AutoNation Porter's Five Forces analysis is built upon a foundation of publicly available financial statements, investor relations reports, and industry-specific market research data. We also incorporate insights from automotive trade publications and regulatory filings to ensure a comprehensive understanding of the competitive landscape.