AutoNation Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AutoNation Bundle

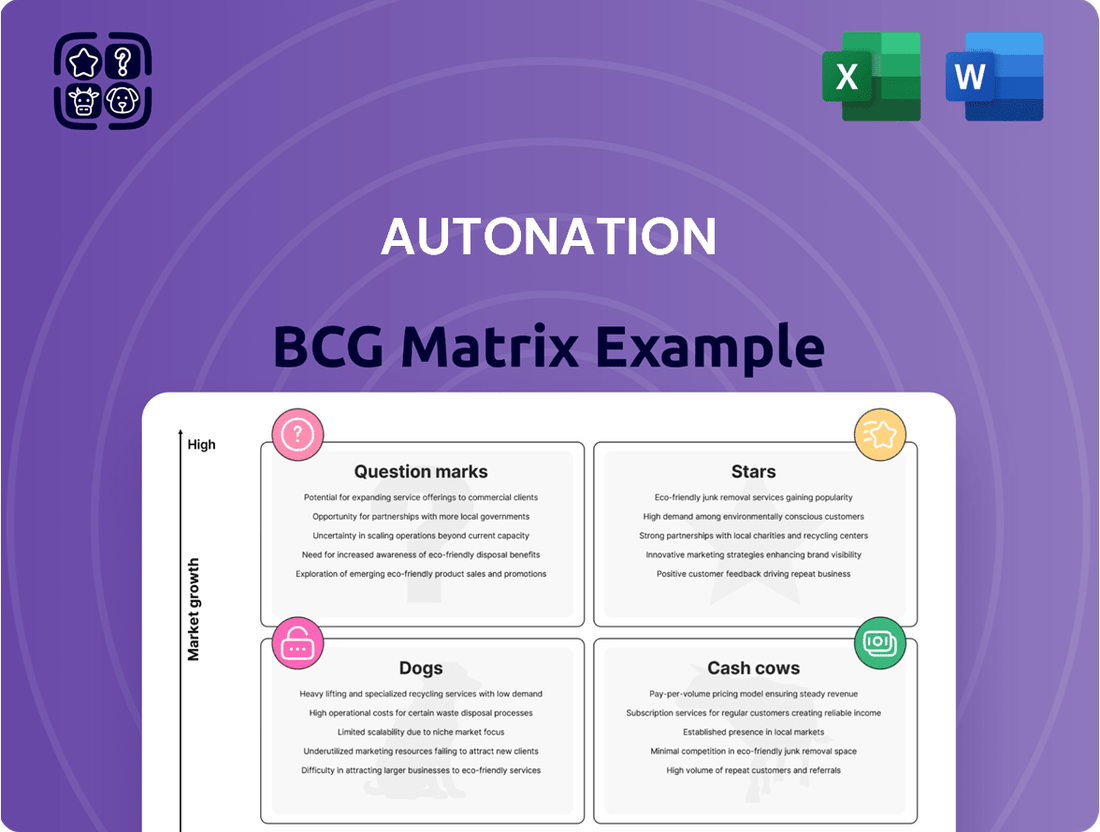

Curious about AutoNation's product portfolio performance? This glimpse into their BCG Matrix reveals potential Stars, Cash Cows, Dogs, and Question Marks, offering a strategic overview. To truly understand their market position and unlock actionable insights for growth, dive into the complete BCG Matrix report.

Gain a comprehensive understanding of AutoNation's product strategy by purchasing the full BCG Matrix. This detailed analysis will provide the clarity needed to make informed decisions about resource allocation and future investments, transforming your strategic planning.

Stars

AutoNation's Premium Luxury Vehicle Sales segment is a star performer, showcasing robust growth. In Q4 2024, this segment saw a healthy 6% increase in income, and for the first half of 2025, revenue climbed by an impressive 7%.

This success is driven by sought-after brands such as Mercedes-Benz, BMW, and Lexus. These marques are known for their consistent profitability and a dedicated customer following, making them cornerstones of AutoNation's portfolio.

The sustained strong performance and high market demand for these premium brands solidify their status as stars within AutoNation's business. Their ongoing desirability ensures continued strong contributions to the company's overall financial health.

AutoNation's After-Sales segment, which includes parts, maintenance, and repair services, is a powerhouse for the company, consistently delivering robust gross profit and impressive growth. This segment is vital for AutoNation's financial health, acting as a stable income stream that complements vehicle sales.

In the second quarter of 2025, AutoNation reported a significant 12% year-over-year increase in After-Sales revenue. Even more impressively, gross profit within this segment saw a 13% rise on a same-store basis, highlighting its strong performance and increasing profitability.

The resilience of the After-Sales business is a key strategic advantage for AutoNation. Even when new and used vehicle sales experience fluctuations, this segment continues to contribute substantially to overall gross profit, demonstrating its dependable nature and importance to the company's bottom line.

Customer Financial Services (CFS) at AutoNation is a strong performer, showing a 13% revenue and gross profit increase in Q2 2025. This growth is driven by their vehicle financing and insurance offerings.

The company recently completed a $700 million asset-backed securitization with an attractive coupon rate, underscoring the financial health and appeal of their captive finance operations.

This segment is crucial for AutoNation, not only boosting overall profitability but also fostering deeper customer relationships and encouraging repeat business.

Used Electric Vehicle (EV) Sales

The market for used electric vehicles (EVs) is experiencing significant expansion. In 2024, used EVs emerged as the fastest-selling fuel type, indicating strong consumer demand and market maturation. This surge is further supported by stabilizing and recovering price trends for pre-owned EVs.

AutoNation has capitalized on this burgeoning sector. The company reported a notable 14% increase in same-store gross profit from used vehicle sales during the fourth quarter of 2024. This growth was partly fueled by AutoNation's strategic decision to broaden its inventory of used EVs, aligning with market demand.

- Fastest-Selling Fuel Type: Used EVs led sales growth in 2024.

- Price Stabilization: Pre-owned EV prices are showing signs of recovery.

- AutoNation's Profitability: A 14% rise in Q4 2024 same-store gross profit from used vehicles.

- Strategic Inventory Expansion: Increased availability of used EVs contributed to AutoNation's performance.

New Hybrid Vehicle Sales

New Hybrid Vehicle Sales represent a significant growth opportunity for AutoNation, fitting squarely into the Stars category of the BCG Matrix. The company saw a remarkable surge in hybrid new vehicle unit sales, with a year-over-year increase exceeding 40% in the second quarter of 2025. This upward trend is fueled by a combination of increasing consumer interest in fuel-efficient vehicles and attractive incentives offered by original equipment manufacturers (OEMs). AutoNation's proactive strategy to bolster its hybrid inventory directly addresses this burgeoning market demand, positioning these vehicles as a crucial component of its future growth.

Key highlights for AutoNation's hybrid sales:

- Hybrid new vehicle unit sales up over 40% year-over-year in Q2 2025.

- Consumer preference and OEM incentives are driving demand.

- AutoNation is strategically increasing hybrid inventory to meet market trends.

AutoNation's Premium Luxury Vehicle Sales, After-Sales services, and Customer Financial Services are all strong stars. The used EV market is also a star, with AutoNation seeing a 14% increase in same-store gross profit from used vehicles in Q4 2024. New Hybrid Vehicle Sales are also a star, with unit sales up over 40% year-over-year in Q2 2025.

| Business Segment | Growth Indicator | Performance Metric | Time Period |

|---|---|---|---|

| Premium Luxury Vehicles | Revenue Increase | 7% | H1 2025 |

| After-Sales | Revenue Increase | 12% YoY | Q2 2025 |

| Customer Financial Services | Revenue & Profit Increase | 13% | Q2 2025 |

| Used EVs | Same-Store Gross Profit | 14% | Q4 2024 |

| New Hybrid Vehicles | Unit Sales Increase | >40% YoY | Q2 2025 |

What is included in the product

This BCG Matrix overview provides strategic insights for AutoNation's business units, highlighting which to invest in, hold, or divest.

A clear AutoNation BCG Matrix visual instantly clarifies which business units are cash cows and which need investment, relieving the pain of strategic uncertainty.

Cash Cows

Traditional new vehicle sales, encompassing both domestic and import brands, remain a cornerstone of AutoNation's business. Despite a moderating growth environment, these segments command a significant market share, reflecting AutoNation's established presence and customer base.

In the fourth quarter of 2024, AutoNation reported a robust 12% increase in new vehicle same-store unit sales. This momentum carried into the second quarter of 2025, with new vehicle revenue climbing by 9%. These figures underscore the continued financial strength and market leadership of AutoNation in the new vehicle sector, even within a more mature market.

The market for used internal combustion engine (ICE) vehicles continues to be a bedrock for AutoNation, even as the electric vehicle (EV) sector captures headlines. This segment, while not experiencing the explosive growth of EVs, still represents a substantial and reliable stream of both revenue and profit for the company.

For the entirety of 2024, AutoNation observed a modest dip in its overall used vehicle revenue. However, a key indicator of underlying strength is the gross profit generated per used vehicle, which demonstrated stability through the second quarter of 2025, underscoring the efficiency of their operations in this segment.

AutoNation's extensive footprint, comprising numerous dedicated used vehicle locations, coupled with their seasoned expertise in remarketing vehicles, firmly anchors their competitive standing. This infrastructure and know-how are crucial for navigating and succeeding within this established, albeit mature, market landscape.

AutoNation's collision repair services, a cornerstone of its operations, function as a classic Cash Cow within the BCG Matrix. The company boasts a significant network of branded collision centers, offering vital services that cater to a consistent demand.

Despite a reported dip in collision revenue during Q2 2025, the inherent nature of collision repair as a necessity for vehicle owners ensures a stable and predictable income. This mature market segment benefits from AutoNation's established infrastructure, solidifying its role as a reliable cash generator for the company.

Parts Distribution Centers

AutoNation's parts distribution centers are crucial for its service operations, supplying components for both new and pre-owned vehicles. This segment leverages the vast number of vehicles requiring ongoing maintenance and repairs, positioning it as a stable, low-growth, high-market share business within the company's portfolio.

The demand for automotive parts remains consistently strong, driven by the necessity of vehicle upkeep. This stability translates into a reliable source of cash flow for AutoNation. For instance, in 2023, AutoNation reported that its Aftermarket segment, which includes parts and service, generated substantial revenue, underscoring the consistent contribution of parts distribution. The company's focus on efficiency in its distribution network further solidifies this segment's role as a cash cow.

- Steady Demand: The large installed base of vehicles ensures consistent demand for maintenance and repair parts.

- High Market Share: AutoNation's extensive network provides a significant advantage in parts distribution.

- Cash Flow Generation: This segment reliably contributes to the company's overall cash flow due to its stable nature.

- Operational Efficiency: Investments in optimizing distribution logistics enhance profitability and cash generation.

Vehicle Financing for Established Brands

Vehicle financing for established domestic and import brands is a cornerstone of AutoNation's financial services, driving substantial revenue. This segment captures a large market share due to the widespread appeal and sales volume of mainstream vehicles.

- High Market Share: AutoNation's established brand relationships and broad customer reach ensure a dominant position in financing mainstream vehicles.

- Significant Revenue Driver: Financing for new and used vehicles from popular brands forms a large portion of AutoNation's financial services income.

- Strong Cash Flow: The consistent profitability from these financing operations significantly bolsters AutoNation's overall cash flow generation.

AutoNation's collision repair centers and parts distribution are classic cash cows. These segments benefit from a mature market with consistent demand, where AutoNation holds a high market share due to its extensive infrastructure and operational expertise.

The company's financing services for established domestic and import brands also function as cash cows, consistently generating significant revenue and strong cash flow. This is driven by AutoNation's dominant market share in financing popular vehicle models.

| Segment | Market Growth | Market Share | Cash Flow Generation |

|---|---|---|---|

| Collision Repair | Low | High | High |

| Parts Distribution | Low | High | High |

| Vehicle Financing (Mainstream Brands) | Low | High | High |

What You See Is What You Get

AutoNation BCG Matrix

The AutoNation BCG Matrix preview you are currently viewing is the identical, fully formatted document you will receive immediately after completing your purchase. This means no watermarks, no placeholder text, and no altered content—just the comprehensive strategic analysis ready for your immediate use. You can trust that the insights and recommendations presented here are precisely what will be delivered, allowing you to seamlessly integrate this powerful business tool into your strategic planning and decision-making processes without any further modifications or delays.

Dogs

Older, less popular used vehicles, often with higher mileage, can be categorized as Dogs in AutoNation's BCG Matrix. These vehicles typically experience slower sales and generate lower profit margins, making them less attractive inventory.

AutoNation's strategy involves optimizing its used car stock, but some older models may necessitate substantial price reductions or extended selling periods. This ties up valuable capital with limited returns on investment.

The ongoing difficulty in acquiring high-quality used cars and maintaining efficient inventory management practices can contribute to the presence of these less desirable units on the lot.

Within AutoNation's portfolio, even strong domestic and import segments can house individual franchises that are underperforming. These might be specific dealerships experiencing declining sales or holding a low market share in their local area. For instance, a domestic franchise in a region dominated by import brands might face significant headwinds.

These struggling locations often find it difficult to draw in customers or sustain profitability. Factors such as intense local competition, unfavorable economic conditions in their specific market, or internal operational issues can all contribute to their poor performance. In 2023, AutoNation reported that while overall revenue was robust, certain dealerships required a disproportionate amount of management attention and capital for minimal returns, highlighting the challenge of these underperforming units.

Certain niche or discontinued vehicle models, such as a limited run of a classic muscle car or an early generation of an electric vehicle that has since been superseded, could represent AutoNation's Dogs. These vehicles often have a smaller, more specialized buyer pool, making sales cycles longer and potentially requiring significant price reductions to move.

For instance, a 2020 model year specialty sports car with low production numbers might sit on the lot for over a year, tying up capital and incurring storage costs. In 2024, the average cost to carry inventory for a dealership can range from 15-25% of the vehicle's value annually, highlighting the financial drag these slow-moving assets can create.

The absence of ongoing manufacturer support, like updated software or readily available parts for discontinued models, further diminishes their appeal and resale value. This can transform these vehicles from potential assets into liabilities, draining resources without generating commensurate returns.

Non-Core, Low-Volume Ancillary Services

Non-core, low-volume ancillary services within AutoNation's BCG Matrix represent offerings that struggle with efficient scaling or experience minimal customer uptake. These could encompass highly specialized or infrequently utilized services that demand considerable investment yet yield negligible revenue or profit. Such services risk diverting valuable resources, hindering overall business performance due to their limited contribution.

For instance, AutoNation might offer niche detailing packages or specialized accessory installations that, while potentially valuable to a small segment, don't achieve widespread adoption. In 2024, the automotive aftermarket services sector saw continued growth, but many smaller, specialized services struggled to gain traction against more mainstream offerings. AutoNation's focus remains on high-volume, profitable services like routine maintenance and repairs, which drive significant customer traffic and revenue.

- Low Customer Adoption: Services with limited customer interest or demand.

- Inefficient Scaling: Offerings that cannot be easily or profitably expanded.

- Resource Diversion: Potential drain on capital and operational focus without significant return.

- Minimal Revenue Contribution: Services generating little to no meaningful profit.

Legacy Sub-prime Finance Portfolio

AutoNation's legacy sub-prime finance portfolio represents a segment of their business that has been strategically managed for divestment. This approach acknowledges the inherent risks associated with sub-prime lending, which can impact profitability and capital allocation.

The company's focus on its growing finance segment, which likely includes more prime or near-prime lending, highlights a shift towards less volatile revenue streams. By actively selling off these older, higher-risk assets, AutoNation aims to streamline its financial operations and reduce potential exposure to defaults.

- Divestment Strategy AutoNation has been actively working to reduce its exposure to legacy sub-prime loan portfolios.

- Resource Drain Holding onto high-risk loans can tie up capital and administrative resources that could be better utilized elsewhere.

- Financial Health Impact These legacy portfolios were likely not contributing positively to the company's overall financial performance.

- Strategic Realignment The move signals a strategic decision to focus on more stable and profitable areas of the finance business.

Dogs within AutoNation's BCG Matrix represent underperforming assets with low market share and low growth potential. These could be older, less popular used vehicles, niche vehicle models, or even specific dealerships that are struggling to gain traction. In 2023, AutoNation reported challenges with certain dealerships requiring significant capital for minimal returns, illustrating the impact of these 'Dog' assets.

These units often tie up valuable capital and resources, generating minimal profits. For instance, a slow-moving specialty car model might incur significant carrying costs, estimated at 15-25% of its value annually in 2024, further diminishing returns.

AutoNation's strategy often involves optimizing inventory and focusing on core, high-volume services, which means these 'Dog' assets may be candidates for price reductions, divestment, or strategic neglect to free up resources for more promising areas of the business.

Question Marks

AutoNation's commitment to electric vehicles is evident, with EVs making up 18% of its revenue in 2025 and new battery electric vehicle (BEV) sales climbing nearly 20% year-over-year in the second quarter of 2025. This surge aligns with the broader market trend, which anticipates electric vehicles to represent one in four new vehicle sales globally by 2025.

While the EV market is a high-growth area, AutoNation's position within this dynamic segment is still solidifying. The company is actively investing in critical areas such as charging infrastructure, inventory, and digital customer education to ensure its EV offerings can transition into sustained Stars within the BCG matrix.

AutoNation's aggressive expansion plan for at least 20 new stand-alone used vehicle stores signals a strong belief in the used car market's continued strength. This strategic move aims to capture a larger share of this lucrative segment, building on their existing national presence. The company is betting big on its ability to replicate its successful used vehicle sales model in new territories.

However, this expansion isn't without its challenges. Building new, dedicated used vehicle stores demands significant upfront capital investment and a considerable amount of time to gain traction and achieve profitability in each new market. AutoNation will need to navigate the complexities of establishing brand awareness and operational efficiency in these new locations.

The ultimate success of these new AutoNation USA stores remains a key question mark for the company. Their performance hinges on AutoNation's ability to effectively penetrate new markets, manage operational costs, and deliver a compelling customer experience. For instance, in 2023, AutoNation's used vehicle segment revenue was approximately $23.4 billion, demonstrating the importance of this business line to their overall financial health.

AutoNation's commitment to digital retail, including AI-powered chatbots and predictive analytics, positions it in a high-growth technological sector. These advancements aim to boost customer interaction and streamline operations, reflecting a strategic move towards future-proofing its business model.

While these AI initiatives show promise for significant returns, their ultimate impact on AutoNation's market share and profitability is still unfolding. The company is essentially investing in a category with high potential, but the realization of that potential is contingent on successful execution and customer adoption.

The true long-term value of these digital tools will be determined by their effective implementation and widespread integration across AutoNation's extensive dealership network. For instance, by mid-2024, AutoNation reported a significant increase in online lead generation, partly attributed to its enhanced digital customer journey, underscoring the early traction of these investments.

Acquisition of New Franchises and Dealerships

AutoNation's strategy includes acquiring new franchises and dealerships to expand its reach and efficiency. In the first half of 2025, they successfully integrated two franchise stores through one transaction, demonstrating an ongoing commitment to M&A. This approach is particularly relevant in the auto industry, which is experiencing consolidation.

Acquisitions offer a pathway to significant growth, but their ultimate success hinges on effective integration processes and the ability to realize anticipated synergies. The performance of these newly acquired dealerships is a key factor in determining the long-term value of these strategic moves.

- Expansion Strategy: AutoNation actively pursues mergers and acquisitions to enhance its market presence and operational scale.

- 2025 Activity: One acquisition in the first half of 2025 added two franchise stores to its portfolio.

- Industry Context: The automotive sector's consolidation makes acquisitions a potentially high-growth strategy.

- Integration Risks: Success depends on seamless integration, synergy realization, and the performance of acquired dealerships, with future profitability and market share gains remaining uncertain.

Mobile Automotive Repair and Maintenance Business

AutoNation's mobile automotive repair and maintenance business fits into the Stars or Question Marks category of the BCG Matrix, depending on its current market share and growth trajectory within the burgeoning mobile service sector. This segment taps into the increasing consumer demand for convenience, a trend that saw the automotive aftermarket projected to reach $435 billion by 2025.

The mobile model offers AutoNation a pathway for rapid scaling, capitalizing on a high-growth market. However, as a relatively new offering for the company, its market share and profitability are still in formative stages, necessitating substantial investment to achieve significant scale and market dominance.

- Market Growth: The automotive aftermarket is expanding, with projections indicating a value of $435 billion by 2025, highlighting the potential for mobile services.

- Scalability: Mobile repair units allow for quicker expansion compared to traditional brick-and-mortar locations.

- Investment Needs: Significant capital is required to build out the mobile fleet and support infrastructure, impacting current profitability.

- Competitive Landscape: While growing, the mobile repair market is becoming more competitive, requiring strategic positioning for AutoNation.

The success of AutoNation's new stand-alone used vehicle stores is a key area of uncertainty. While the company's used vehicle revenue reached approximately $23.4 billion in 2023, the profitability of these new, capital-intensive locations is yet to be fully established. Penetrating new markets and managing operational costs effectively will be crucial for these ventures to transition from question marks to stars.

AutoNation's investment in digital retail, particularly AI-powered tools, represents a high-potential but unproven segment. While early indicators like increased online lead generation by mid-2024 are positive, the ultimate impact on market share and profitability remains to be seen. The company is betting on these technologies to drive future growth, but widespread customer adoption and seamless integration are critical for success.

The mobile automotive repair and maintenance business is another segment where AutoNation's position is still developing. The automotive aftermarket is projected to reach $435 billion by 2025, indicating strong market growth. However, AutoNation's mobile service, while scalable, requires significant investment and faces increasing competition, making its long-term market share and profitability uncertain.

The effectiveness of AutoNation's franchise acquisition strategy is also a question mark. While the company successfully integrated two franchise stores in the first half of 2025, the long-term value of these acquisitions depends on seamless integration and the realization of synergies. The performance of these new dealerships will determine if they contribute positively to AutoNation's overall market position.

| Business Segment | BCG Category | Key Uncertainties | Relevant Data Point |

|---|---|---|---|

| New Stand-Alone Used Vehicle Stores | Question Mark | Market penetration, operational cost management, profitability in new markets | Used vehicle revenue: $23.4 billion (2023) |

| Digital Retail (AI Tools) | Question Mark | Customer adoption, impact on market share and profitability, integration success | Increased online lead generation (mid-2024) |

| Mobile Automotive Repair | Question Mark | Market share, profitability, competitive positioning | Automotive aftermarket projected value: $435 billion (2025) |

| Franchise Acquisitions | Question Mark | Integration success, synergy realization, performance of acquired dealerships | 2 franchise stores integrated (H1 2025) |

BCG Matrix Data Sources

Our AutoNation BCG Matrix is constructed using a blend of AutoNation's official financial disclosures, comprehensive market research reports, and detailed industry trend analyses to provide a robust strategic overview.