Austevoll Seafood Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Austevoll Seafood Bundle

Austevoll Seafood operates in a dynamic industry shaped by moderate buyer power and intense rivalry among existing players. Understanding the nuances of supplier relationships and the threat of substitutes is crucial for navigating this competitive landscape.

The complete report reveals the real forces shaping Austevoll Seafood’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Austevoll Seafood's reliance on pelagic fish, whitefish, and salmon as core raw materials means that the concentration of these sources significantly impacts supplier bargaining power. If a few dominant entities control the supply of these vital resources, they can exert considerable influence over pricing and availability.

For example, disruptions in salmon farming, such as those experienced in key production areas like Chile in 2024, can tighten supply. This scarcity naturally elevates the leverage of unaffected or resilient suppliers, allowing them to command higher prices or impose more favorable terms on buyers like Austevoll Seafood.

Suppliers providing highly specialized or certified sustainable seafood, such as Marine Stewardship Council (MSC) or Aquaculture Stewardship Council (ASC) certified products, hold significant bargaining power. Austevoll Seafood's commitment to sustainable harvesting practices means these specialized suppliers are crucial. For instance, in 2023, the global market for certified sustainable seafood continued its upward trajectory, with growing consumer demand driving higher prices for compliant products.

Switching suppliers in the seafood industry often incurs substantial costs. These can range from setting up new logistics and adjusting quality assurance protocols to the expense and time involved in negotiating fresh contracts. For a company like Austevoll Seafood, which manages a comprehensive value chain from catching fish to delivering products, altering raw material sources can significantly disrupt its carefully calibrated processing and distribution systems, thereby enhancing supplier leverage.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers for Austevoll Seafood is a nuanced consideration. If suppliers of raw fish, particularly larger aquaculture operations or fishing cooperatives, develop the capabilities and resources to process and distribute their catch themselves, they could directly compete with Austevoll. This would reduce Austevoll's access to essential raw materials and significantly enhance the suppliers' bargaining power.

While individual small-scale fishers are unlikely to integrate forward into complex processing and distribution chains, the consolidation of fishing power or the growth of large, vertically integrated aquaculture farms presents a more tangible risk. For instance, a substantial increase in the market share of large salmon farming groups that also operate their own processing facilities could limit the supply of independently processed fish available to companies like Austevoll.

Consider the potential impact on Austevoll's sourcing. If major suppliers, such as large Norwegian salmon farmers, were to expand their processing capacity, they could retain more of their high-value product for their own branded sales, leaving less available for third-party processors. This scenario would directly increase their leverage over buyers like Austevoll, potentially driving up raw material costs or reducing supply availability.

- Potential for Supplier Forward Integration: Larger fishing cooperatives or aquaculture firms could move into processing, directly impacting Austevoll's supply chain.

- Impact on Bargaining Power: Successful forward integration by suppliers would diminish Austevoll's access to raw materials and bolster supplier negotiation strength.

- Industry Trends: Monitoring the growth and vertical integration strategies of major raw fish producers is crucial for assessing this threat.

Impact of Regulations and Environmental Factors on Supply

The seafood industry, including companies like Austevoll Seafood, operates under a complex web of regulations. Environmental conditions, fishing quotas, and sustainability mandates significantly shape supply availability. These factors can empower suppliers who consistently meet or exceed compliance standards, as they become more reliable sources in a constrained market.

Overfishing concerns and the escalating impacts of climate change are directly contributing to reduced fish stocks globally. This scarcity inherently increases the value of the remaining available supply. Consequently, suppliers who can demonstrate sustainable fishing practices and offer traceability gain considerable bargaining power, as they are essential for meeting market demand responsibly.

- Regulatory Compliance: Adherence to quotas and sustainability certifications strengthens supplier position.

- Environmental Scarcity: Climate change and overfishing reduce fish populations, making compliant supply more valuable.

- Market Demand for Sustainability: Growing consumer preference for sustainably sourced seafood further enhances the bargaining power of compliant suppliers.

The bargaining power of suppliers for Austevoll Seafood is influenced by the concentration of raw material sources and the specialized nature of their offerings. For instance, disruptions in key aquaculture regions, such as the 2024 challenges faced by salmon producers in Chile, can tighten supply and empower remaining suppliers. Furthermore, the increasing demand for sustainably certified seafood, like MSC or ASC products, grants significant leverage to suppliers meeting these stringent standards, a trend evident in the continued growth of the certified sustainable seafood market in 2023.

Switching costs for Austevoll Seafood are considerable, encompassing new logistics, quality assurance adjustments, and contract negotiations, which reinforces supplier leverage. The threat of forward integration by major suppliers, particularly large aquaculture operations or fishing cooperatives, could limit Austevoll's access to raw materials and increase supplier negotiation strength. For example, if major Norwegian salmon farmers expand their processing capacity, they might retain more product for their own brands, reducing availability for third-party processors and thus increasing their power over buyers like Austevoll.

Regulatory compliance and environmental factors also play a crucial role. Suppliers who consistently meet fishing quotas and sustainability mandates become more valuable in a market constrained by overfishing and climate change impacts, which are reducing fish stocks globally. This scarcity elevates the bargaining power of suppliers offering traceable and sustainably sourced products.

| Factor | Impact on Supplier Bargaining Power | Example/Data Point |

|---|---|---|

| Supplier Concentration | High if few dominant suppliers control key raw materials. | Disruptions in Chilean salmon farming in 2024 tightened supply. |

| Product Differentiation/Specialization | High for certified sustainable or specialized products. | Global market for certified sustainable seafood grew in 2023 due to consumer demand. |

| Switching Costs | High for Austevoll due to logistical and contractual complexities. | Significant investment required to change raw material sources. |

| Threat of Forward Integration | Moderate to High for large aquaculture or fishing cooperatives. | Potential for major salmon farmers to expand processing, limiting supply for competitors. |

| Regulatory & Environmental Factors | High for compliant suppliers in a scarce resource environment. | Overfishing and climate change reduce fish stocks, increasing value of sustainable supply. |

What is included in the product

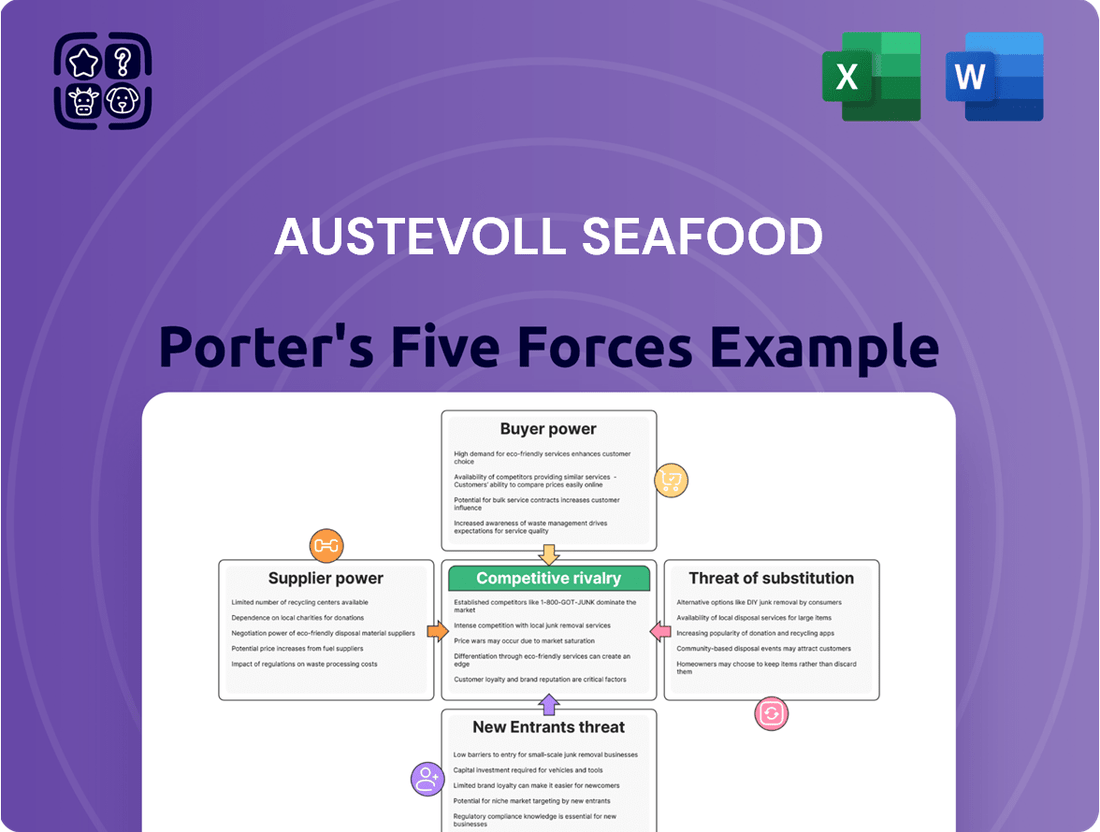

This Porter's Five Forces analysis for Austevoll Seafood dissects the competitive intensity, buyer and supplier power, threat of new entrants and substitutes, providing strategic insights into its market position.

Instantly identify and mitigate competitive threats with a visual representation of each of Porter's Five Forces impacting Austevoll Seafood.

Customers Bargaining Power

Austevoll Seafood's diverse global reach, encompassing both retail and foodservice sectors, means customer concentration is a key factor. If a few major retail chains or foodservice distributors account for a large chunk of their sales, these significant buyers gain considerable leverage due to their substantial purchase volumes. For instance, in 2023, the top 10 customers for similar seafood companies often represented over 40% of revenue, highlighting the potential power of concentrated buyers.

Customers in the seafood market, especially for frozen and ready-to-eat items, often exhibit significant price sensitivity. This becomes even more pronounced during economic downturns, as seen in the general consumer spending trends of 2024. For instance, reports from early 2024 indicated a noticeable shift towards value-oriented grocery options across many Western economies, directly impacting demand for premium seafood products.

Austevoll Seafood's ability to differentiate its offerings through value-added processing plays a crucial role in counteracting this customer power. However, the extent to which these processed products are perceived as unique and superior compared to competitors' offerings directly influences how much customers are willing to pay. If differentiation is weak, customers can more easily switch to lower-priced alternatives, increasing their bargaining leverage.

Building strong brand loyalty is a key strategy to mitigate customer price sensitivity. While specific loyalty program data for Austevoll in 2024 is proprietary, industry-wide trends show that companies with established reputations for quality and reliability can command higher prices and retain customers even when facing price competition. This loyalty acts as a buffer, reducing the direct impact of customer bargaining power.

The increasing availability of alternative proteins, such as plant-based seafood, chicken, and beef, directly enhances customer bargaining power. For instance, the global plant-based food market, including seafood alternatives, was valued at approximately USD 40.2 billion in 2023 and is projected to grow substantially, indicating a significant shift in consumer choices. This expansion offers consumers readily accessible and often competitively priced options, diminishing their reliance on traditional seafood providers like Austevoll Seafood.

Customers' Threat of Backward Integration

The threat of backward integration by customers, particularly large retail chains and foodservice operators, poses a significant consideration for Austevoll Seafood. These entities might explore sourcing directly from fisheries or developing their own processing capabilities if they perceive Austevoll's profit margins as unusually high or if they desire enhanced control over their supply chain's consistency and sustainability practices.

This potential customer action is amplified when customers seek to guarantee the quality, traceability, and ethical sourcing of seafood products. For instance, major supermarket groups in Europe, which represent a substantial portion of the seafood market, have increasingly invested in supply chain transparency initiatives, sometimes leading them to explore direct partnerships or vertical integration to meet consumer demands for verifiable sustainability. In 2024, many of these retailers reported increased consumer spending on sustainably sourced products, suggesting a continued trend towards greater supply chain oversight.

- Customer Backward Integration: Large retailers and foodservice companies may consider direct sourcing or in-house processing.

- Motivations: High perceived profit margins at Austevoll or a desire for greater supply chain control (consistency, sustainability).

- Market Trends: Growing consumer demand for traceable and sustainably sourced seafood in 2024 influences retailer strategies.

Information Availability and Transparency Demands

Consumers increasingly demand transparency regarding seafood sourcing, particularly for sustainably certified products. This growing awareness allows customers to readily compare suppliers based on ethical and environmental practices. For instance, in 2023, over 60% of consumers surveyed by the Marine Stewardship Council indicated that they actively sought out seafood with sustainability certifications, directly pressuring companies like Austevoll Seafood to demonstrate responsible sourcing.

This enhanced information availability significantly strengthens the bargaining power of customers. They can leverage their knowledge to negotiate better terms or choose alternatives that align with their values, pushing Austevoll to meet specific ethical or environmental standards. This can influence both pricing and the company's sourcing strategies, as demonstrated by the growing market share of certified sustainable seafood, which saw a 15% increase in global sales in 2024 compared to the previous year.

- Increased Consumer Demand for Transparency: A significant portion of consumers actively seeks information on seafood origin and sustainability practices.

- Empowerment Through Information: Access to data allows customers to compare suppliers and make informed purchasing decisions.

- Influence on Sourcing and Pricing: Customer pressure can drive companies to adopt higher ethical and environmental standards, impacting costs and market positioning.

- Market Trends: The growing market for certified sustainable seafood highlights the tangible impact of informed consumer choices on industry practices.

The bargaining power of customers for Austevoll Seafood is significant, driven by factors like price sensitivity and the availability of alternatives. In 2024, economic conditions amplified consumer focus on value, making price a critical negotiation point. Furthermore, the expanding market for plant-based and other protein alternatives directly diminishes customer reliance on traditional seafood. This creates a dynamic where customers can readily switch suppliers or demand more favorable terms, impacting Austevoll's pricing power and market share.

Preview the Actual Deliverable

Austevoll Seafood Porter's Five Forces Analysis

This preview displays the comprehensive Austevoll Seafood Porter's Five Forces Analysis, providing a detailed examination of industry competition and profitability. You are looking at the actual document; once your purchase is complete, you’ll gain instant access to this exact, professionally formatted file. This means you'll receive the complete, ready-to-use analysis, offering valuable insights into Austevoll Seafood's strategic positioning without any surprises.

Rivalry Among Competitors

The global seafood market is set for robust expansion, with an anticipated 7% compound annual growth rate from 2024 to 2025, projecting a market value of $270.43 billion. This overall market uplift can help temper intense rivalry, as a growing pie benefits all participants.

While the broader market offers breathing room, specific product categories may face heightened competition. For instance, the whitefish segment is expected to experience supply reductions in 2025, which could consequently intensify competitive pressures among those focusing on these particular species.

The seafood industry is incredibly fragmented, featuring a mix of small, local players and massive global companies. Austevoll Seafood, for instance, operates alongside its subsidiary Lerøy Seafood Group, highlighting this diverse competitive landscape.

This fragmentation means competition is fierce across various segments, including pelagic fish, whitefish, and salmon. Companies are constantly battling for market share, whether they are fully integrated operations or specialists in a particular niche.

For example, in 2023, global seafood production reached approximately 220 million tonnes, with a significant portion coming from aquaculture. This vast market naturally attracts a wide array of competitors, from individual fishing vessels to large processing plants, all vying for a piece of this substantial industry.

While seafood can be seen as a commodity, companies like Austevoll Seafood actively pursue differentiation. They achieve this through value-added processing, emphasizing sustainable fishing practices, and building strong brand recognition. For instance, Austevoll's subsidiary, Lerøy, has developed well-regarded salmon brands.

The extent to which Austevoll's offerings, such as Lerøy's salmon, are perceived as distinct or of higher quality directly impacts the intensity of competitive rivalry. Robust brands can command higher prices and cultivate lasting customer loyalty, thereby lessening the pressure of direct price-based competition.

Exit Barriers in the Seafood Industry

The seafood industry presents considerable exit barriers, largely due to the significant capital tied up in specialized assets. Companies often face high fixed costs associated with maintaining fishing fleets, extensive aquaculture infrastructure, and sophisticated processing plants. These substantial investments can make it economically challenging to divest or cease operations, even when market conditions are unfavorable.

These high exit barriers mean that companies may continue operating at a loss, prolonging competitive intensity as they strive to recoup their investments. This can lead to a market where firms are reluctant to leave, even if profitability is low, thereby sustaining a more aggressive competitive environment. For instance, the capital expenditure for a modern fishing vessel can easily run into millions of dollars, and establishing a large-scale salmon farm requires hundreds of millions in investment.

- High Fixed Costs: Investments in fishing fleets, aquaculture facilities, and processing plants represent substantial capital outlays.

- Asset Specificity: Seafood industry assets are highly specialized and often lack alternative uses, making them difficult to sell or redeploy.

- Operational Commitments: Long-term contracts, labor agreements, and regulatory compliance can further complicate exiting the market.

- Market Conditions: In periods of low profitability, the inability to easily exit can force companies to continue operations, intensifying rivalry.

Strategic Objectives and Competitive Tactics

Competitive rivalry within the seafood industry is intense, with players like Austevoll Seafood constantly navigating various strategic maneuvers. Competitors may engage in price wars, ramp up marketing efforts, or innovate with new product offerings, such as advanced flavored seafood dishes, to capture market share.

The strategic objectives of major seafood companies significantly shape the competitive environment. For instance, a focus on achieving economies of scale can lead to aggressive expansion and consolidation, while a commitment to sustainability might drive different investment and operational strategies. These differing objectives directly influence Austevoll's need for adaptive strategic responses.

- Price Competition: Competitors may lower prices to gain market share, impacting Austevoll's profitability.

- Product Innovation: Development of new, value-added products, like flavored seafood, can differentiate offerings.

- Market Consolidation: Mergers and acquisitions by rivals can alter the competitive landscape, potentially increasing Austevoll's challenges.

- Strategic Focus: Whether competitors prioritize scale or sustainability dictates their approach and Austevoll's counter-strategies.

The seafood industry is characterized by intense rivalry, fueled by a fragmented market structure with numerous players, from small local operators to global giants like Austevoll Seafood and its subsidiary Lerøy Seafood Group.

Companies compete across various segments such as pelagic fish, whitefish, and salmon, employing strategies like price wars, enhanced marketing, and product innovation, including value-added items like flavored seafood, to gain market share.

While the overall global seafood market is projected for significant growth, with an estimated 7% CAGR from 2024 to 2025 reaching $270.43 billion, specific product categories like whitefish may see intensified competition due to anticipated supply reductions in 2025.

High exit barriers, stemming from substantial capital investments in specialized assets like fishing fleets and processing plants, mean companies often remain in the market even during periods of low profitability, sustaining competitive pressures.

| Competitive Factor | Description | Impact on Austevoll Seafood |

|---|---|---|

| Market Fragmentation | Numerous small and large players compete globally. | Requires constant adaptation to diverse competitive strategies. |

| Product Segment Competition | Rivalry is fierce in pelagic, whitefish, and salmon markets. | Drives need for differentiation and cost efficiency in specific areas. |

| Differentiation Strategies | Focus on value-added processing and sustainability. | Brand strength, like Lerøy's salmon, can mitigate price competition. |

| Exit Barriers | High fixed costs and asset specificity deter market exits. | Contributes to sustained competitive intensity and potential oversupply. |

SSubstitutes Threaten

The most direct substitutes for seafood are other animal proteins like chicken, beef, and pork. In 2024, global meat consumption continues to rise, with chicken often being the most affordable option, directly impacting seafood demand.

Consumers are demonstrating significant price sensitivity. For instance, during periods of heightened inflation in late 2023 and early 2024, reports indicated a noticeable shift in consumer purchasing habits, with many opting for less expensive meats like chicken and pork over pricier seafood options.

This broad availability and consumer willingness to switch to more economical alternatives significantly limits Austevoll Seafood's ability to dictate prices. The competitive landscape is further intensified by the sheer volume and variety of protein sources available to consumers.

The rise of plant-based and lab-cultivated seafood alternatives presents a significant and growing threat to traditional seafood producers like Austevoll Seafood. This burgeoning market is attracting consumers concerned with health, ethics, and environmental sustainability. For instance, the global plant-based seafood market is anticipated to reach $1.3 billion by 2027, demonstrating a robust compound annual growth rate of 28%.

The attractiveness of substitutes for Austevoll Seafood's products hinges on their price-performance trade-off. Consumers weigh the cost of seafood against alternatives like plant-based proteins or other animal proteins, considering factors like taste, nutritional value, and convenience.

While premium, fresh seafood often commands a higher price due to its perceived quality and taste, more accessible options like frozen seafood, canned fish, or even processed seafood products can offer a compelling value proposition. These alternatives can often be purchased at a lower price point, making them attractive to budget-conscious consumers.

The threat of substitutes escalates significantly if these alternatives can deliver comparable sensory experiences, nutritional benefits, or preparation ease at a more competitive cost. For instance, the growing market for plant-based seafood alternatives, which are increasingly mimicking the texture and flavor of fish, presents a direct challenge if their pricing becomes more aggressive relative to traditional seafood offerings.

Changing Consumer Preferences and Health Trends

The growing consumer focus on health and wellness significantly impacts the threat of substitutes for seafood. As people become more health-conscious, they actively seek out nutritious food options. While seafood, like that from Austevoll Seafood, is recognized for its omega-3 fatty acids and lean protein content, the surge in plant-based diets presents a compelling alternative.

This shift is driven by perceptions of health benefits associated with plant-based foods. For instance, the global plant-based food market was valued at approximately USD 29.7 billion in 2023 and is projected to grow substantially, indicating a strong consumer preference for these alternatives. This trend suggests a potential decline in traditional seafood consumption as consumers increasingly choose plant-based options for their perceived health advantages.

The threat of substitutes is amplified by several factors:

- Rising Health Consciousness: Consumers are increasingly prioritizing diets that promote well-being, influencing their protein source choices.

- Plant-Based Food Growth: The expanding market for plant-based alternatives, driven by health and ethical considerations, offers direct competition to seafood.

- Nutritional Perceptions: While seafood offers distinct nutritional benefits, plant-based foods are also being marketed effectively for their health properties, creating a perception of parity or superiority for some consumers.

Convenience and Accessibility of Substitutes

The increasing availability of convenient and ready-to-eat meal options poses a significant threat to seafood. Consumers seeking quick meal solutions may opt for processed or pre-prepared meat products, or even plant-based alternatives, that offer greater ease of preparation compared to fresh or frozen seafood. This trend is amplified by busy lifestyles and a growing demand for convenience in food choices.

For instance, the global ready-to-eat meal market was valued at approximately USD 176.5 billion in 2023 and is projected to grow significantly. This expansion directly competes with traditional seafood preparation methods, especially for households where time is a primary consideration. Austevoll Seafood must consider how to adapt its offerings or marketing to address this shift.

- Convenience Factor: Ready-to-eat meals and pre-marinated meats offer immediate meal solutions, bypassing the preparation time often associated with seafood.

- Plant-Based Alternatives: The rise of plant-based proteins, often marketed for their convenience and health benefits, provides a direct substitute for animal protein, including seafood.

- Consumer Lifestyle: Evolving consumer lifestyles, characterized by increased demand for speed and simplicity in meal preparation, favor substitutes that require minimal effort.

- Market Growth: The robust growth of the convenience food sector, including ready-to-eat and plant-based segments, indicates a substantial and expanding competitive landscape for seafood.

The threat of substitutes for Austevoll Seafood is substantial, driven by the availability of other animal proteins and a growing market for plant-based alternatives. Consumers are increasingly price-sensitive, often opting for more economical options like chicken and pork, especially during inflationary periods seen in late 2023 and early 2024. This price competition directly impacts seafood's market share.

The plant-based seafood market is a significant disruptor, projected to reach $1.3 billion by 2027 with a 28% CAGR, appealing to health and sustainability-conscious consumers. Furthermore, the convenience food market, valued at approximately $176.5 billion in 2023, offers ready-to-eat meals that bypass the preparation time associated with seafood, catering to busy lifestyles.

| Substitute Category | Key Drivers | Market Data/Projections (2023-2027) |

|---|---|---|

| Other Animal Proteins (Chicken, Beef, Pork) | Price sensitivity, affordability, availability | Global meat consumption rising; chicken often most affordable. |

| Plant-Based Seafood | Health, ethics, environmental sustainability, taste mimicry | Global market projected to reach $1.3 billion by 2027, 28% CAGR. |

| Convenience Foods (Ready-to-Eat Meals) | Busy lifestyles, demand for speed and simplicity | Global market valued at ~$176.5 billion in 2023, with significant growth expected. |

Entrants Threaten

The integrated seafood industry, encompassing everything from fishing and farming to processing and distribution, demands a massive upfront capital investment. Think about the cost of acquiring and maintaining fishing fleets, establishing and managing aquaculture operations, and building state-of-the-art processing plants. These aren't small expenses; they represent significant financial hurdles for any potential new player.

Starting even a modest retail seafood business can easily cost between $50,000 and $200,000. This figure doesn't even include the essential, and often costly, refrigerated transport needed to maintain product quality and safety. These substantial financial requirements act as a strong deterrent, effectively blocking many aspiring companies from entering the market.

The seafood industry is heavily regulated, with strict rules on fishing quotas, environmental protection, and food safety. These regulations act as a significant deterrent for newcomers.

Securing the required permits for fishing or aquaculture operations can be a complex and expensive undertaking. For instance, permits for fishermen can reach as high as $300,000, creating a substantial financial barrier to entry.

Established players like Austevoll Seafood leverage significant economies of scale in their operations, from harvesting and processing to global distribution. This scale allows them to achieve lower per-unit costs, a crucial advantage in the competitive seafood market.

New entrants would face a steep challenge in matching these cost efficiencies. Without substantial initial volume, they would be unable to benefit from the experience curve, which rewards accumulated knowledge and optimized processes, placing them at a considerable competitive disadvantage.

Brand Loyalty and Established Distribution Channels

Austevoll Seafood, through its significant holdings like the Lerøy Seafood Group, boasts deeply entrenched brand loyalty and a vast, sophisticated global distribution network. This established presence makes it exceptionally difficult for newcomers to gain traction.

New entrants face a formidable barrier in replicating Austevoll's extensive reach, which includes access to major retail and foodservice clients worldwide. For instance, in 2023, the global seafood market was valued at approximately USD 250 billion, with established players like Austevoll holding significant market share due to their distribution capabilities.

- Brand Recognition: Austevoll's brands are well-known and trusted by consumers and businesses alike, a reputation built over years of consistent quality and marketing investment.

- Distribution Network: The company's logistical infrastructure spans continents, ensuring efficient delivery and market access that is costly and time-consuming to replicate.

- Marketing and Sales Investment: Overcoming established brand loyalty requires substantial capital for marketing campaigns and building sales teams, a significant hurdle for any new competitor.

- Economies of Scale: Austevoll's size allows for greater purchasing power and operational efficiencies, further disadvantaging smaller, new entrants.

Access to Raw Materials and Sustainable Sourcing

New entrants in the seafood industry face significant hurdles in securing consistent access to high-quality, sustainably sourced raw materials. This is particularly true for fish, where limited stocks, often exacerbated by overfishing, create a competitive environment for procurement. For instance, the global wild capture fish production has seen fluctuations, with some reports indicating a plateau or slight decline in certain key species in recent years, making prime fishing grounds and quotas highly contested assets.

The increasing global demand for certified sustainable seafood, such as those bearing MSC (Marine Stewardship Council) or ASC (Aquaculture Stewardship Council) labels, adds another layer of complexity. New companies must invest heavily in ensuring their supply chains meet these stringent standards, which can be a substantial barrier. In 2024, the market share for certified sustainable seafood continued to grow, with consumers increasingly prioritizing ethical and environmentally friendly sourcing, putting pressure on new entrants to demonstrate compliance from day one.

- Supply Chain Investment: New entrants need substantial capital to establish or acquire fishing quotas, vessels, and processing facilities that meet sustainability certifications.

- Supplier Relationships: Building trust and securing reliable supply agreements with established, sustainable fishing operations or aquaculture farms is critical and time-consuming.

- Regulatory Compliance: Navigating complex international and national fishing regulations, including catch limits and environmental impact assessments, requires expertise and resources.

- Market Access: Retailers and food service providers often prefer suppliers with a proven track record of sustainability and consistent quality, which new entrants lack.

The threat of new entrants for Austevoll Seafood is moderate, primarily due to the substantial capital requirements and established brand loyalty in the seafood industry. Significant investments are needed for fleets, processing, and distribution, with permits alone costing hundreds of thousands of dollars. Furthermore, new players must overcome the economies of scale and entrenched distribution networks of incumbents like Austevoll, which boasts extensive global reach and strong supplier relationships. In 2023, the global seafood market, valued at approximately USD 250 billion, demonstrated the scale of operations required to compete effectively.

| Barrier | Estimated Cost/Impact | Relevance to New Entrants |

| Capital Investment (Vessels, Processing) | Millions to Billions USD | Very High; significant hurdle for new players. |

| Permits and Licenses | Up to $300,000+ | High; creates a substantial financial barrier. |

| Economies of Scale | Lower per-unit costs for established players | High; difficult for new entrants to match cost efficiencies. |

| Brand Recognition & Distribution Network | Years to build, costly to replicate | Very High; requires significant marketing and logistical investment. |

| Sustainable Sourcing Compliance | Investment in certifications and supply chains | High; growing consumer demand necessitates compliance. |

Porter's Five Forces Analysis Data Sources

Our Austevoll Seafood Porter's Five Forces analysis is built upon a foundation of reliable data, including the company's annual reports, industry-specific trade publications, and government regulatory filings. We also incorporate macroeconomic data to provide a comprehensive understanding of the competitive landscape.