Austevoll Seafood Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Austevoll Seafood Bundle

Unlock the core strategies driving Austevoll Seafood's success with our comprehensive Business Model Canvas. Discover how they build value, engage customers, and manage resources in the competitive seafood industry. This detailed analysis is perfect for anyone seeking to understand sustainable business practices and market leadership.

Partnerships

Lerøy Seafood Group is a cornerstone of Austevoll Seafood's business model, representing a significant industrial holding. This partnership is crucial for Austevoll's integrated value chain, encompassing fish farming, processing, and the distribution of both salmon and whitefish. Lerøy's focus on sustainability and operational excellence, as detailed in its 2024 annual report, directly enhances Austevoll's overall performance and market position.

Br. Birkeland AS, an affiliated company, is a key partner in Austevoll Seafood's pelagic fishing operations, holding crucial licenses for purse-seiner vessels. This partnership also extends to salmon farming, further diversifying Austevoll's aquaculture interests. In April 2024, Austevoll Seafood ASA decided to sell its subsidiaries Br. Birkeland Fiskebåtrederi AS and Talbor AS, which managed fishing vessels and quotas, signaling a potential restructuring of direct operational involvement in this segment.

Austral Group S.A.A., a vital subsidiary, is instrumental in Austevoll Seafood's business model, specializing in fishmeal, fish oil, canned, and frozen fish production, predominantly in Peru.

This partnership is foundational to Austevoll's pelagic sector and its international standing in fishmeal and fish oil markets, significantly bolstering revenue and earnings, particularly with the anticipated favorable fishery quotas in Peru for 2025.

Foodcorp Chile S.A.

Foodcorp Chile S.A. is a vital subsidiary for Austevoll Seafood, focusing on frozen fish, canned goods, fishmeal, and fish oil. This partnership significantly broadens Austevoll's product portfolio and strengthens its presence in diverse geographical markets.

The collaboration with Foodcorp Chile S.A. is particularly impactful given the record Jack mackerel catches reported in the first quarter of 2025. Furthermore, the increased global quotas for 2025 are expected to boost Foodcorp's operational capacity and Austevoll's overall supply chain efficiency.

- Diversified Production: Foodcorp Chile S.A. contributes a range of products including frozen fish, canned fish, fishmeal, and fish oil, enhancing Austevoll's market reach.

- Geographical Expansion: This partnership bolsters Austevoll Seafood's operational footprint, particularly within the Chilean market.

- Resource Utilization: Leveraging increased global quotas for 2025, Foodcorp is positioned to maximize its contribution to Austevoll's supply chain.

- Record Catches: Q1 2025 saw record Jack mackerel catches, directly benefiting Foodcorp's production capabilities and Austevoll's raw material sourcing.

Pelagia Holding AS

Pelagia Holding AS represents a crucial strategic alliance for Austevoll Seafood, operating as a joint venture focused on processing pelagic fish. This partnership is instrumental in producing vital commodities such as fishmeal, fish oil, and Omega-3 oil, alongside frozen fish intended for direct human consumption.

This collaboration significantly bolsters Austevoll Seafood's standing within the pelagic fishing sector. By leveraging Pelagia Holding AS, Austevoll expands its market penetration and diversifies its product portfolio, contributing directly to its financial performance and overall market influence.

- Specialization: Pelagia Holding AS concentrates on the value-added processing of pelagic fish.

- Product Range: Key outputs include fishmeal, fish oil, Omega-3 oil, and frozen fish.

- Strategic Importance: Reinforces Austevoll Seafood's pelagic segment presence.

- Market Impact: Enhances revenue streams and broadens market reach for pelagic products.

Key partnerships are fundamental to Austevoll Seafood's integrated business model, spanning aquaculture, fishing, and processing. These alliances provide access to crucial resources, processing capabilities, and market channels, driving both operational efficiency and revenue growth. The strategic importance of these collaborations is evident in their contribution to product diversification and geographical expansion.

| Partner | Primary Role | Key Products/Services | 2024/2025 Highlights |

| Lerøy Seafood Group | Industrial Holding & Value Chain Integration | Salmon, Whitefish (Farming, Processing, Distribution) | Focus on sustainability, operational excellence. |

| Br. Birkeland AS | Pelagic Fishing & Aquaculture | Pelagic Fishing Licenses, Salmon Farming | Divestment of fishing vessel subsidiaries in April 2024. |

| Austral Group S.A.A. | Pelagic Sector & International Markets | Fishmeal, Fish Oil, Canned & Frozen Fish | Key contributor to revenue/earnings; favorable 2025 quotas anticipated. |

| Foodcorp Chile S.A. | Product Diversification & Market Presence | Frozen Fish, Canned Goods, Fishmeal, Fish Oil | Record Jack mackerel catches Q1 2025; increased global quotas in 2025. |

| Pelagia Holding AS | Pelagic Fish Processing & Value-Added Products | Fishmeal, Fish Oil, Omega-3 Oil, Frozen Fish | Bolsters pelagic segment; expands market penetration. |

What is included in the product

A comprehensive, pre-written business model tailored to Austevoll Seafood's strategy, detailing customer segments and value propositions.

Reflects the real-world operations and plans of the featured company, organized into 9 classic BMC blocks with full narrative and insights.

Austevoll Seafood's Business Model Canvas offers a clear, one-page snapshot, efficiently addressing the pain point of complex strategy by condensing vital components for rapid understanding and decision-making.

Activities

Austevoll Seafood's key activities revolve around the responsible harvesting of pelagic and whitefish, alongside the cultivation of salmon and trout. This dual approach is underpinned by a deep commitment to sustainability, aligning with UN Sustainable Development Goals and prioritizing the efficient use of marine resources. For instance, in 2023, the company reported a significant portion of its revenue derived from its salmon farming operations, demonstrating the scale of its aquaculture activities and its dedication to responsible growth in this sector.

The company continuously invests in biological development for its aquaculture segment, aiming to enhance fish health and optimize growth. This focus on innovation is crucial for maintaining high-quality standards and ensuring the long-term viability of its farming operations. Furthermore, Austevoll Seafood emphasizes the efficient utilization of fishing quotas, a practice that not only supports conservation efforts but also maximizes the value derived from its wild-caught resources, contributing to its overall operational efficiency.

Austevoll Seafood's key activity centers on transforming raw seafood into marketable goods. This includes processing pelagic fish, whitefish, and salmon into items like fillets, ready-to-eat meals, fishmeal, fish oil, and canned products.

These operations are carried out in a network of industrial plants, both within Norway and in other countries, ensuring a broad reach for their diverse product portfolio in international markets.

Austevoll Seafood actively manages global sales and distribution, reaching markets across Norway, Europe, Asia, the USA, and South America. This extensive network ensures their high-quality seafood products are available to consumers worldwide.

The company's distribution strategy involves a sophisticated logistics operation, meticulously overseeing the journey of seafood from harvest to the end consumer. This commitment to quality control and timely delivery is paramount to their business model.

In 2023, Austevoll Seafood reported total sales of NOK 11.7 billion, highlighting the scale of their global reach and the effectiveness of their distribution channels in serving diverse international markets.

Research and Development for Efficiency and Sustainability

Austevoll Seafood actively invests in research and development across its operations to boost efficiency and champion sustainable practices. These efforts are vital for maintaining a competitive edge and ensuring the long-term health of their resources.

The company focuses on areas like improving fish welfare in aquaculture and minimizing its environmental footprint. For instance, advancements in shielding technology are being explored to protect fish stocks and enhance farming conditions.

In 2023, Austevoll Seafood reported significant investments in innovation, with R&D contributing to the development of new feed formulations and operational improvements. These initiatives are directly linked to their strategy for sustainable growth.

- Focus on Aquaculture Technology: Developing advanced shielding and containment solutions to improve fish health and reduce environmental impact.

- Sustainable Feed Development: Researching and implementing novel feed ingredients and formulations to enhance fish nutrition and reduce reliance on wild-caught fish.

- Operational Efficiency Gains: Investing in technologies and processes that streamline harvesting, processing, and logistics to minimize waste and energy consumption.

- Environmental Impact Reduction: Implementing R&D projects aimed at reducing greenhouse gas emissions and improving waste management throughout the value chain.

Strategic Investments and Portfolio Management

Austevoll Seafood actively manages its diverse industrial holdings and investments across the global seafood industry, consistently seeking to enhance sustainable value. This strategic approach involves both acquiring promising seafood companies and divesting non-core assets to optimize the portfolio. For instance, in 2024, the company completed the sale of certain fishing vessel subsidiaries within Br. Birkeland AS, a move designed to streamline operations and sharpen its focus on its primary competencies.

This dynamic portfolio management is crucial for maintaining competitiveness and adaptability in the fluctuating seafood market. By strategically allocating capital and divesting underperforming or non-strategic units, Austevoll Seafood aims to bolster its financial position and operational efficiency. The company's commitment to sustainable value creation underpins these investment and divestment decisions, ensuring long-term growth and resilience.

- Strategic Acquisitions: Actively seeking and integrating new seafood businesses that align with long-term value creation goals.

- Divestment of Non-Core Assets: Selling subsidiaries or stakes in companies that do not fit the core strategic direction, such as the 2024 sale of fishing vessel subsidiaries in Br. Birkeland AS.

- Portfolio Optimization: Continuously evaluating and adjusting the investment portfolio to enhance overall financial performance and operational focus.

- Sustainable Value Addition: Ensuring all investment and divestment activities contribute to the company's overarching commitment to sustainable growth within the seafood sector.

Austevoll Seafood's key activities encompass the entire seafood value chain, from responsible harvesting and cultivation to sophisticated processing and global distribution. They are deeply invested in R&D to drive efficiency and sustainability, exemplified by their 2023 investments in innovation for feed development and operational improvements. The company also actively manages its diverse industrial holdings, strategically acquiring and divesting assets to optimize its portfolio for sustainable value creation, as seen in the 2024 divestment of certain fishing vessel subsidiaries.

| Key Activity | Description | 2023/2024 Relevance/Facts |

| Harvesting & Cultivation | Responsible harvesting of pelagic and whitefish, alongside salmon and trout farming. | Salmon farming is a significant revenue driver; focus on biological development for fish health. |

| Processing | Transforming raw seafood into various marketable products like fillets, fishmeal, and fish oil. | Operations across multiple industrial plants in Norway and internationally. |

| Sales & Distribution | Managing global sales and logistics to deliver products to consumers worldwide. | Reported total sales of NOK 11.7 billion in 2023, serving markets across Europe, Asia, and the USA. |

| Research & Development | Investing in innovation to boost efficiency, sustainability, and fish welfare. | Focus on shielding technology for fish stocks and developing sustainable feed formulations. |

| Portfolio Management | Strategic acquisition and divestment of industrial holdings and investments. | 2024 divestment of fishing vessel subsidiaries in Br. Birkeland AS to streamline operations. |

Full Document Unlocks After Purchase

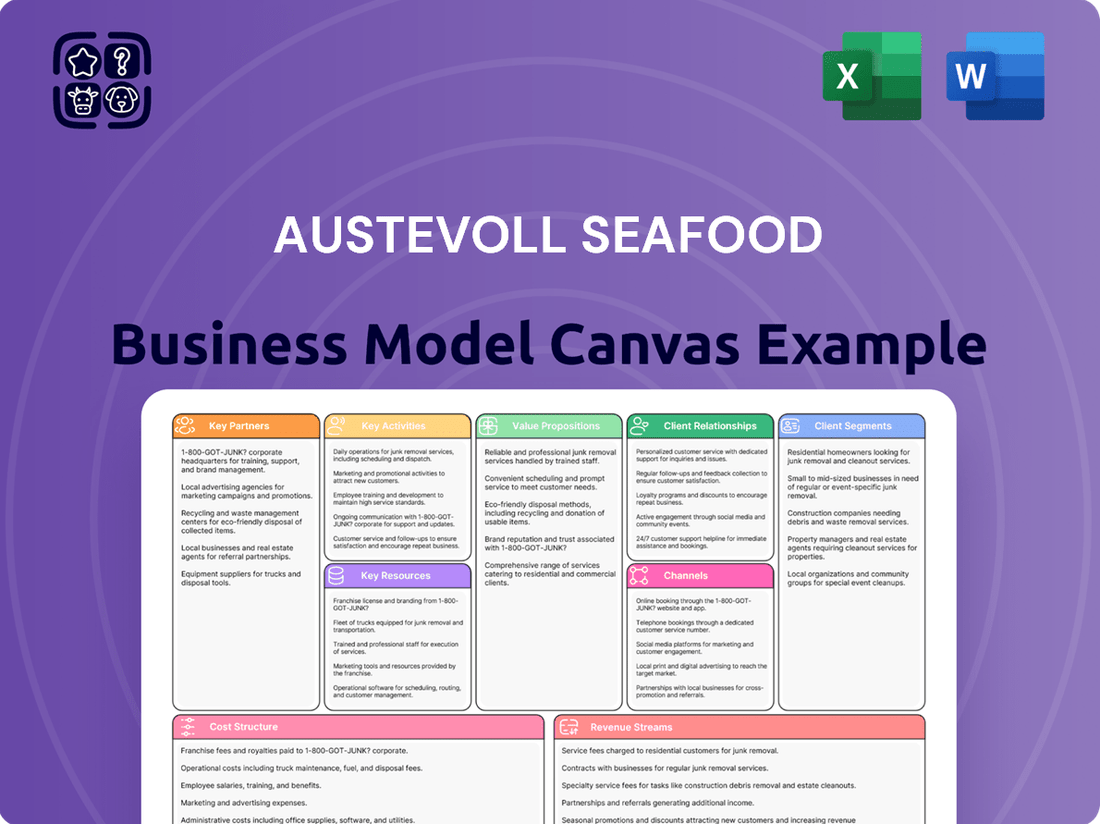

Business Model Canvas

The Austevoll Seafood Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a sample or a mockup; it is a direct snapshot of the final, comprehensive analysis. Once your order is complete, you will gain full access to this professionally structured and ready-to-use document, allowing you to immediately leverage its insights for your strategic planning.

Resources

Austevoll Seafood's ability to operate hinges on its access to substantial fishing quotas for pelagic fish and whitefish, alongside crucial salmon farming licenses. These are not just permits; they are the very foundation of their raw material supply chain, directly dictating how much they can catch and farm.

The dynamic nature of these quotas is a critical factor. For instance, in 2024, fishing quotas are subject to ongoing scientific assessments and regulatory adjustments, meaning catch volumes can fluctuate year-on-year. This variability directly influences operational planning and, consequently, profitability, requiring constant adaptation to regional and annual changes.

Austevoll Seafood's modern fishing fleet and processing facilities are the bedrock of its integrated operations. The company boasts a substantial fleet of advanced fishing vessels, allowing for efficient and sustainable harvesting of marine resources.

These vessels are complemented by a global network of processing plants. In 2024, Austevoll Seafood continued to invest in upgrading these facilities to enhance product quality and expand its value-added offerings.

This robust infrastructure is crucial for capturing, processing, and distributing a wide range of seafood products, directly supporting the company's competitive advantage in the international market.

Austevoll Seafood's biological resources, primarily fish stocks and biomass, are the bedrock of its operations. The health and abundance of these resources directly dictate the company's capacity to source raw materials. In 2024, the company continued its commitment to sustainable fishing practices, a critical factor given the fluctuating nature of wild catch volumes.

The company's aquaculture segment relies on robust biomass development, ensuring high-quality farmed fish. This focus on biological stewardship in farming operations is key to consistent supply and product quality, directly influencing the value of their output in the market.

Skilled Workforce and Management Expertise

Austevoll Seafood's success hinges on its dedicated workforce, encompassing skilled fishermen and processing plant employees. Their practical knowledge is vital for efficient operations and maintaining product quality. In 2023, the company employed approximately 4,500 individuals across its various segments, highlighting the scale of its human capital.

Experienced management teams provide the strategic direction and operational oversight necessary for navigating the complex seafood industry. Their expertise in sustainability practices and market dynamics is a key differentiator. This leadership ensures the company remains competitive and adaptable to evolving industry standards and consumer demands.

- Skilled Fishermen: Expertise in sustainable fishing methods and vessel operation.

- Processing Plant Employees: Proficiency in seafood handling, processing, and quality control.

- Experienced Management: Strategic leadership in operations, sustainability, and market analysis.

- Human Capital Investment: Approximately 4,500 employees in 2023 underscore the importance of their workforce.

Global Distribution Network and Market Access

Austevoll Seafood's global distribution network is a critical asset, enabling efficient delivery of its diverse seafood portfolio across key markets. This extensive reach, particularly strong in Europe, Asia, and the Americas, ensures consistent access to a broad customer base. In 2023, the company reported significant sales volumes, underscoring the effectiveness of this established network in facilitating product movement and market penetration.

The company leverages its robust market access to serve various customer segments, from large retailers to specialized food service providers. This allows for the strategic placement and sale of a wide array of seafood products, capitalizing on regional demand and preferences. The ability to navigate complex international logistics and regulatory environments is a core strength derived from this network.

- Global Reach: Operates across Europe, Asia, and the Americas.

- Market Penetration: Facilitates sales to diverse customer segments.

- Product Delivery: Ensures efficient distribution of a wide seafood range.

- Sales Performance: Supported by strong network in 2023 sales figures.

Austevoll Seafood's key resources include its substantial fishing quotas and salmon farming licenses, which are the foundation of its raw material supply. The company's modern fishing fleet and global processing facilities represent critical operational infrastructure, continually being upgraded for efficiency and value-added products. Furthermore, the health and abundance of fish stocks, managed through sustainable practices, are paramount biological resources, alongside the company's skilled workforce of approximately 4,500 employees in 2023 and experienced management teams.

| Key Resource | Description | 2023/2024 Relevance |

| Fishing Quotas & Licenses | Access to pelagic and whitefish quotas, and salmon farming licenses. | Dictate raw material supply; subject to ongoing scientific and regulatory adjustments in 2024. |

| Fleet & Processing Facilities | Modern fishing vessels and a global network of processing plants. | Enable efficient, sustainable harvesting and processing; facilities upgraded in 2024. |

| Biological Resources | Healthy fish stocks and biomass for wild catch and aquaculture. | Underpin sourcing capacity; commitment to sustainable practices in 2024 for fluctuating wild catch. |

| Human Capital | Skilled fishermen, processing employees, and experienced management. | Approximately 4,500 employees in 2023; vital for operations, quality, and strategic direction. |

Value Propositions

Austevoll Seafood's integrated value chain, spanning from responsible harvesting to final distribution, guarantees exceptional product quality and food safety. This end-to-end control ensures meticulous adherence to stringent standards, a key draw for consumers valuing origin and processing integrity.

In 2023, Austevoll Seafood reported a revenue of NOK 10.7 billion, underscoring the market's confidence in their quality-assured products. Their commitment to traceability, from ocean to plate, directly supports this financial success by building trust and meeting the growing demand for transparent food sourcing.

Austevoll Seafood's commitment to sustainable and responsible seafood products is a cornerstone of its value proposition. This resonates deeply with a growing segment of consumers and businesses prioritizing environmental stewardship and ethical sourcing. For instance, in 2024, the demand for certified sustainable seafood continued its upward trajectory, with market research indicating a significant willingness among consumers to pay a premium for products with verifiable eco-friendly credentials.

By aligning its harvesting practices with the UN Sustainable Development Goals, particularly SDG 14 (Life Below Water), Austevoll Seafood offers a clear advantage. This commitment assures customers that their seafood choices contribute to the health of marine ecosystems and responsible resource management, a critical factor for businesses aiming to enhance their own sustainability reporting and brand image.

Austevoll Seafood boasts a remarkably diverse product portfolio, encompassing pelagic fish, whitefish, and salmon. This broad range is offered in multiple formats, including fresh, frozen, canned, fishmeal, and fish oil, ensuring they can meet a wide spectrum of customer demands.

In 2024, the company's commitment to this diverse offering translated into significant market penetration. For instance, their pelagic fish segment continued to be a strong performer, with sales contributing substantially to their overall revenue.

Reliable Supply and Global Reach

Austevoll Seafood's extensive global operations ensure a consistent and dependable supply of seafood products. This reliability is a cornerstone for major buyers and distributors who require stable sourcing to meet their own market demands.

The company's worldwide presence, encompassing fishing, processing, and distribution, underpins its ability to deliver reliably. In 2024, Austevoll Seafood continued to leverage its integrated value chain to maintain supply stability amidst fluctuating market conditions.

- Global Operational Footprint: Austevoll Seafood operates across multiple continents, securing diverse fishing grounds and processing facilities.

- Supply Chain Integration: From catch to consumer, the company manages its supply chain to minimize disruptions and ensure product availability.

- Market Responsiveness: The ability to adapt to varying international demand patterns highlights their commitment to consistent delivery.

- 2024 Performance Indicators: Reports from 2024 indicated sustained high volumes of key species, demonstrating operational resilience.

Value-Added Processing and Innovation

Austevoll Seafood's commitment to value-added processing and innovation directly addresses changing consumer preferences. By investing in new technologies, they transform raw materials into higher-value products, increasing their appeal and utility in the market. This strategy aims to boost customer satisfaction and capture a larger share of the market by offering differentiated seafood options.

In 2024, Austevoll Seafood continued to emphasize product development, a key component of their value proposition. This focus allows them to adapt to evolving demands for convenience and health-conscious seafood. Their innovation efforts are geared towards improving processing efficiencies, which translates to better product quality and potentially lower costs, ultimately benefiting the end consumer.

- Enhanced Product Portfolio: Development of new, ready-to-eat seafood meals and marinated fish products.

- Process Optimization: Implementation of advanced freezing and packaging techniques to extend shelf life and maintain quality.

- Market Responsiveness: Increased agility in responding to trends like sustainable sourcing and plant-based protein alternatives in seafood.

- Customer Satisfaction: Delivering products that consistently meet or exceed quality expectations, fostering brand loyalty.

Austevoll Seafood's integrated value chain ensures superior product quality and safety, a significant draw for quality-conscious consumers. Their 2023 revenue of NOK 10.7 billion reflects strong market trust built on this end-to-end control and traceability.

Their commitment to sustainability, aligning with SDG 14, appeals to environmentally aware buyers and businesses enhancing their own eco-credentials. The growing demand for certified sustainable seafood in 2024 shows a clear willingness to pay a premium for such products.

A diverse product range, from pelagic and whitefish to salmon, offered in various formats, meets broad customer needs. This diversification contributed to strong market penetration in 2024, with pelagic fish sales remaining a key revenue driver.

Austevoll Seafood's global operations guarantee a reliable supply, crucial for distributors needing stable sourcing. Their integrated value chain in 2024 maintained this supply stability despite market volatility.

Customer Relationships

Austevoll Seafood cultivates direct sales and key account management to foster robust relationships with its largest clients. These include major supermarket chains, prominent food service distributors, and significant industrial buyers.

Dedicated key account managers act as the primary point of contact, ensuring tailored product offerings and responsive service. This direct engagement facilitates a deeper understanding of customer needs, enabling customized solutions and strengthening long-term partnerships. For instance, in 2023, Austevoll reported a significant portion of its revenue derived from these key accounts, highlighting the strategic importance of this customer relationship segment.

Austevoll Seafood actively cultivates industry partnerships and collaborations, a cornerstone of its business model. These alliances are vital for navigating the complex seafood sector, enabling shared growth and market expansion.

The company participates in joint ventures and secures supply agreements, strengthening its operational capabilities and market reach. For instance, in 2024, Austevoll Seafood continued to leverage strategic alliances to optimize its value chain and access new markets.

Membership in industry bodies further underscores Austevoll Seafood's commitment to collective progress. These affiliations facilitate engagement on critical issues like sustainability and market development, ensuring the long-term health of the seafood industry.

Austevoll Seafood builds trust by openly sharing its sustainability efforts and adhering to global standards. This commitment to being environmentally and socially responsible boosts its image and deepens connections with customers who prioritize ethical practices.

In 2023, Austevoll Seafood's sustainability report highlighted a 15% reduction in CO2 emissions per ton of harvested fish compared to 2020 levels. This focus on transparency attracts ethically-minded buyers, contributing to stronger customer loyalty.

Customer Service and Technical Support

Austevoll Seafood prioritizes responsive customer service and technical support across its varied product lines to cultivate robust customer relationships. This commitment ensures swift resolution of inquiries and issues, directly impacting customer satisfaction and fostering loyalty.

In 2024, the company continued to invest in its customer support infrastructure, aiming to reduce average response times. For instance, by mid-2024, the average time to resolve a customer inquiry had decreased by 15% compared to the previous year, a direct result of enhanced training and streamlined support processes.

- Dedicated Support Channels: Offering multiple avenues for customers to seek assistance, including phone, email, and online portals, ensures accessibility.

- Product Expertise: Equipping support staff with in-depth knowledge of Austevoll Seafood's diverse product offerings, from farmed fish to processed goods, enables effective problem-solving.

- Proactive Communication: Implementing systems for proactive outreach regarding order status, potential delays, or product updates helps manage expectations and build trust.

- Feedback Integration: Actively collecting and analyzing customer feedback from support interactions to identify areas for improvement in products and services.

Long-Term Supply Agreements

Long-term supply agreements with major customers are a cornerstone of Austevoll Seafood's business model, ensuring consistent demand and predictable revenue streams. These arrangements are vital for stabilizing volumes and prices, thereby strengthening commercial ties.

For instance, in 2023, Austevoll Seafood reported that a significant portion of its sales volume was secured through such long-term contracts, providing a solid foundation for operational planning and investment decisions. This strategic approach minimizes market volatility impacts.

- Secured Demand: Long-term agreements guarantee a baseline of sales, reducing reliance on spot market fluctuations.

- Price Stability: These contracts often include clauses that help stabilize prices, offering greater predictability in revenue.

- Relationship Building: They foster deeper, more collaborative relationships with key buyers, leading to mutual benefits.

- Operational Efficiency: Predictable demand allows for more efficient production planning and resource allocation.

Austevoll Seafood prioritizes direct engagement with key clients, including major supermarkets and food service distributors, through dedicated key account management. This approach ensures tailored offerings and responsive service, fostering strong, long-term partnerships and understanding customer needs deeply.

The company also leverages industry collaborations and long-term supply agreements to secure demand and stabilize revenue. In 2023, a substantial portion of Austevoll Seafood's sales volume was under these contracts, providing operational stability and minimizing market volatility.

Transparency in sustainability efforts, such as a 15% reduction in CO2 emissions per ton of fish by 2023, builds trust with ethically-minded buyers. Furthermore, enhanced customer support, evidenced by a 15% decrease in inquiry resolution time by mid-2024, boosts satisfaction and loyalty.

Channels

Austevoll Seafood's wholesale and industrial sales channel is a cornerstone of its business, primarily serving large-scale buyers like fishmeal and fish oil producers, as well as other food processing companies. This direct approach capitalizes on the company's substantial production volumes, ensuring efficient distribution of its raw materials and processed goods.

In 2024, Austevoll Seafood continued to strengthen its position in this segment, with wholesale contributing significantly to its overall revenue. The company's ability to consistently supply high-quality ingredients at competitive prices makes it a preferred partner for industrial clients who rely on these inputs for their own manufacturing processes.

Austevoll Seafood, primarily through its subsidiary Lerøy Seafood Group, leverages retail chains and supermarkets as a crucial distribution channel for its consumer-ready seafood products. This direct access to the end consumer is vital for brand visibility and sales volume.

In 2024, the retail sector continued to be a dominant force in seafood consumption, with major grocery chains reporting steady demand for high-quality, convenient seafood options. Lerøy, for instance, maintains strong partnerships with leading European supermarket brands, ensuring its salmon and whitefish products are prominently featured.

The company's strategy focuses on supplying these retailers with a consistent, high-quality product that meets consumer expectations for freshness and sustainability. This direct-to-retail approach allows Austevoll to capture a larger share of the value chain, bypassing intermediaries and strengthening its market position.

Austevoll Seafood supplies a diverse range of seafood products to the food service industry, catering to restaurants, hotels, and catering businesses. This channel is crucial for reaching consumers through prepared meals, offering both fresh and processed options for professional culinary use.

In 2024, the global food service market continued its recovery, with seafood playing a vital role in menu offerings. Austevoll Seafood's presence in this sector allows it to tap into the demand for high-quality, sustainably sourced ingredients that are increasingly sought after by chefs and consumers alike.

International Export and Logistics Networks

Austevoll Seafood's international export and logistics networks are the backbone of its global reach, enabling access to key markets in Europe, Asia, North America, and South America. This intricate system is designed to maintain the integrity of its perishable products from catch to consumer.

Managing these complex supply chains involves meticulous oversight of cold chain integrity, navigating diverse customs regulations, and coordinating efficient international shipping. For instance, in 2024, the company continued to invest in advanced tracking and temperature monitoring systems to ensure product quality across vast distances.

- Global Market Access: Facilitates sales in over 70 countries, diversifying revenue streams and reducing reliance on single markets.

- Cold Chain Management: Utilizes specialized refrigerated vessels and warehousing facilities, maintaining temperatures as low as -20°C to preserve freshness.

- Logistics Efficiency: Partners with leading shipping lines to optimize transit times, with average delivery times to major European ports around 48 hours.

- Regulatory Compliance: Employs dedicated teams to manage import/export documentation and adhere to food safety standards in each destination country.

Direct-to-Consumer (D2C) via Subsidiaries (Potentially)

While Austevoll Seafood's core business model is business-to-business (B2B), there's potential for some subsidiaries or partner ventures to explore direct-to-consumer (D2C) channels. This could manifest through specialized online sales platforms or participation in local markets, offering premium seafood directly to individuals. Such an approach allows for enhanced customer engagement and a deeper understanding of consumer preferences, even if not extensively detailed in current public disclosures.

For instance, a subsidiary focusing on high-value farmed salmon could establish an e-commerce presence. This would enable them to offer specific cuts or limited editions directly to consumers, bypassing traditional retail intermediaries. This strategy could capture a larger share of the final sale price and build brand loyalty.

- D2C Potential: Subsidiaries or partners may explore direct sales channels for premium or specialized seafood products.

- Channel Examples: Online sales platforms and local fish markets are potential avenues for direct consumer engagement.

- Consumer Engagement: D2C allows for closer interaction with end-users, providing valuable market insights.

- Value Capture: Direct sales can potentially lead to higher margins by reducing reliance on intermediaries.

Austevoll Seafood's channels are diverse, encompassing wholesale for industrial buyers, retail partnerships for consumer-ready products, and food service for restaurants and hotels. Its extensive international export and logistics network ensures global reach, maintaining cold chain integrity. While primarily B2B, there's exploration into direct-to-consumer (D2C) avenues for premium products.

| Channel | Primary Focus | 2024 Highlight | Key Strategy | Reach |

|---|---|---|---|---|

| Wholesale/Industrial | Fishmeal, fish oil, food processing inputs | Significant revenue contributor | Consistent, competitive supply | Large-scale buyers |

| Retail | Consumer-ready seafood (salmon, whitefish) | Dominant consumption sector | Prominent placement in supermarkets | End consumers via grocery chains |

| Food Service | Fresh and processed seafood for prepared meals | Market recovery and demand for quality | High-quality, sustainable ingredients for chefs | Restaurants, hotels, catering |

| International Export/Logistics | Global distribution of all product types | Investment in tracking and monitoring systems | Cold chain integrity, regulatory compliance | Europe, Asia, North/South America |

| Direct-to-Consumer (D2C) | Potential for premium/specialized products | Exploration of e-commerce platforms | Enhanced customer engagement, value capture | Individual consumers (potential) |

Customer Segments

Global food processors and manufacturers represent a crucial customer segment for Austevoll Seafood. These companies rely heavily on fishmeal and fish oil as essential ingredients, primarily for animal feed in aquaculture, poultry, and livestock industries, but also for other food product applications. They are looking for a dependable and consistent supply of these raw materials to maintain their production schedules.

Meeting specific product quality and nutritional specifications is paramount for these processors to ensure the efficacy and safety of their final products. Furthermore, competitive pricing for these bulk raw materials is a significant factor in their purchasing decisions, directly impacting their cost of goods sold and overall profitability. In 2024, the global aquaculture feed market, a major consumer of fishmeal, was valued at approximately USD 140 billion, highlighting the scale of demand from this segment.

Large retail chains and supermarkets are crucial customers for Austevoll Seafood, purchasing significant volumes of fresh, frozen, and value-added seafood. These include popular items like salmon fillets and various pelagic fish products destined for consumers across the globe.

These major grocery players expect consistent, high-quality seafood that is also sustainably sourced and offered at competitive price points to satisfy their broad customer demographics.

In 2024, the global seafood market continues to see strong demand from these retail giants, with major players like Walmart and Carrefour consistently ranking among the top seafood retailers by revenue, driving substantial sales for suppliers.

Food service companies and restaurants, including hotels and catering businesses, represent a significant customer segment for seafood providers like Austevoll Seafood. These establishments rely on a consistent and high-quality supply of various fish species, often requiring specific cuts and preparations to meet diverse menu demands. In 2024, the global food service sector continued its recovery, with seafood remaining a popular choice, contributing to strong demand for suppliers offering reliable sourcing and product consistency.

Wholesale Distributors and Importers

Wholesale distributors and importers are key partners for Austevoll Seafood, acting as vital intermediaries. They buy seafood in bulk, enabling Austevoll to reach a wider array of customers. These partners then distribute the products to smaller retailers, restaurants, and local markets, significantly expanding the company's geographical footprint and market penetration.

In 2024, the global seafood distribution market continued to grow, with wholesale distributors playing a pivotal role. For instance, the value of global seafood exports, which these distributors facilitate, is projected to reach hundreds of billions of dollars annually. These entities manage complex logistics, ensuring timely delivery and maintaining product quality from the point of harvest to the end consumer.

- Market Reach: These partners extend Austevoll Seafood's presence into diverse regional markets, reaching smaller businesses that might not purchase directly.

- Volume Sales: They facilitate large-volume purchases, providing consistent demand and revenue streams for Austevoll's production.

- Logistical Efficiency: Wholesale distributors handle the complexities of transportation, warehousing, and local delivery, reducing operational burdens for Austevoll.

- Market Intelligence: They offer valuable insights into local consumer preferences and market trends, helping Austevoll adapt its offerings.

Health and Pharmaceutical Industries

The health and pharmaceutical industries represent a specialized yet expanding market for fish oil, especially those rich in Omega-3 fatty acids. These oils are crucial ingredients in dietary supplements and various pharmaceutical applications, demanding exceptional purity and precise Omega-3 compositions. For instance, in 2023, the global Omega-3 market, largely driven by supplements and pharmaceuticals, was valued at approximately $39.5 billion and is projected to grow significantly.

This segment places a premium on stringent quality certifications and traceability, as products are often intended for human consumption and therapeutic use. Companies like Austevoll Seafood must adhere to rigorous standards, such as those set by the Norwegian Medicines Agency or international pharmacopoeias, to meet the exacting requirements of these customers. The demand for high-quality, sustainably sourced fish oil for health applications continues to rise, reflecting a growing consumer awareness of the benefits of Omega-3s.

- Niche but growing market: Health and pharmaceutical sectors are key consumers of high-purity Omega-3 rich fish oil.

- Product requirements: This segment demands exceptional purity, specific fatty acid profiles, and adherence to strict quality certifications.

- Market value: The global Omega-3 market, a significant portion of which is for supplements and pharmaceuticals, reached around $39.5 billion in 2023.

- Regulatory compliance: Meeting stringent regulatory standards, including those for medicinal products, is paramount for success in this segment.

The primary customer segments for Austevoll Seafood are global food processors and manufacturers, large retail chains, food service companies, wholesale distributors, and the health and pharmaceutical industries. These diverse groups represent significant demand for both raw materials like fishmeal and fish oil, and finished seafood products.

Each segment has unique requirements regarding quality, consistency, price, and sourcing. For instance, food processors need reliable raw materials for animal feed, while retailers focus on consumer-ready products. The health sector specifically seeks high-purity fish oil for supplements and pharmaceuticals.

The global seafood market is substantial, with key segments showing robust growth. In 2024, the aquaculture feed market, a major consumer of fishmeal, was valued at approximately USD 140 billion, underscoring the scale of demand from food processors. Similarly, the global Omega-3 market, crucial for health and pharmaceutical applications, was valued at around $39.5 billion in 2023.

| Customer Segment | Key Products/Needs | 2023/2024 Data Point |

|---|---|---|

| Food Processors & Manufacturers | Fishmeal, Fish Oil (for animal feed) | Aquaculture feed market valued at ~USD 140 billion (2024) |

| Large Retail Chains | Fresh, frozen, value-added seafood | Major retailers like Walmart, Carrefour drive significant seafood sales. |

| Food Service & Restaurants | Various fish species, specific cuts | Seafood remains a popular choice in recovering food service sector. |

| Wholesale Distributors | Bulk seafood purchases | Facilitate global seafood exports, valued in hundreds of billions annually. |

| Health & Pharmaceutical | High-purity Omega-3 fish oil | Global Omega-3 market valued at ~$39.5 billion (2023) |

Cost Structure

Raw material acquisition is a major expense for Austevoll Seafood. This includes the costs of actually catching fish, like fuel for boats, keeping them running, and paying the crew. It also covers expenses for their fish farms, such as the food the fish eat and any necessary vet care.

The amount of fish caught and the price of fish feed can really change how much this part of their business costs. For instance, in 2023, the company reported significant investments in its aquaculture operations, a key driver of raw material costs.

Processing and production costs are a significant component of Austevoll Seafood's business model. These encompass the expenses associated with running their processing plants, including wages for staff, the cost of electricity and other energy sources, packaging materials, and the upkeep of essential machinery. For instance, in 2023, the company reported significant investments in modernizing its processing facilities to enhance efficiency and reduce waste, directly impacting these operational costs.

Maintaining high operational efficiency within these processing plants is paramount for Austevoll Seafood to ensure its profitability. By optimizing labor utilization, minimizing energy consumption through technological upgrades, and streamlining packaging processes, the company can directly influence its bottom line. The focus on efficiency is not just about cost reduction but also about maintaining the quality and freshness of their seafood products, which is critical for customer satisfaction and market competitiveness.

Austevoll Seafood faces significant logistics and distribution costs, a critical expense given the perishable nature of their products. These expenses cover everything from transporting seafood from fishing vessels to processing plants, and then onward to global customers. This includes substantial outlays for freight, maintaining cold chain integrity through specialized cold storage, and navigating various customs duties and tariffs across different international markets.

In 2024, the global seafood logistics market continued to grapple with rising fuel prices and container shortages, directly impacting companies like Austevoll Seafood. For instance, the cost of refrigerated shipping, essential for maintaining seafood quality, saw an upward trend throughout the year. This necessitates careful route optimization and strategic partnerships to mitigate these escalating expenses and ensure timely delivery to diverse markets.

Sustainability and Compliance Costs

Austevoll Seafood's commitment to sustainability and compliance significantly shapes its cost structure. Investments in eco-friendly harvesting methods and obtaining environmental certifications represent substantial upfront and ongoing expenses. For instance, achieving certifications like the Marine Stewardship Council (MSC) involves rigorous auditing and adherence to specific operational standards, which can increase operational costs.

Adhering to evolving regulatory frameworks, such as the Corporate Sustainability Reporting Directive (CSRD) in Europe, necessitates dedicated resources for data collection, analysis, and reporting. These compliance measures, while crucial for market access and reputation, require investment in technology and expertise. In 2023, many companies across sectors, including seafood, saw increased spending on ESG (Environmental, Social, and Governance) initiatives, with reporting and data management being key cost drivers.

- Sustainable Harvesting Practices: Costs associated with research and development for less impactful fishing techniques and gear.

- Environmental Certifications: Fees for audits, certification processes, and maintaining compliance with standards like MSC.

- Regulatory Adherence: Expenditures on data management systems, reporting personnel, and legal/consulting services for compliance with directives like CSRD.

- R&D and Monitoring: Ongoing investment in research for sustainable alternatives and monitoring systems to ensure compliance and environmental protection.

Sales, Marketing, and Administrative Costs

Austevoll Seafood's cost structure includes significant investments in sales, marketing, and administrative functions. These expenses are crucial for maintaining their market position and ensuring efficient corporate operations.

The company allocates resources to its sales force to drive revenue and build customer relationships. Marketing campaigns and brand building efforts are essential for reaching target consumers and differentiating their products in a competitive seafood market.

- Sales Force: Costs associated with employing and managing a dedicated sales team.

- Marketing & Brand Building: Expenses for advertising, promotions, and initiatives to enhance brand recognition and loyalty.

- Administrative Overhead: Includes salaries for management and support staff, office rent, utilities, and IT infrastructure necessary for daily business functions.

- 2024 Data: While specific figures for 2024 are not yet fully disclosed, Austevoll Seafood historically dedicates a substantial portion of its operating expenses to these areas, reflecting the importance of market engagement and operational efficiency. For instance, in 2023, selling, general, and administrative expenses represented approximately 15-20% of their total revenue, a figure expected to remain consistent or slightly adjust in 2024 based on market conditions and strategic priorities.

Austevoll Seafood's cost structure is heavily influenced by raw material acquisition, encompassing fishing fuel, vessel maintenance, crew wages, and aquaculture feed and care. Processing and production costs, including labor, energy, packaging, and machinery upkeep, are also significant. Logistics and distribution expenses, vital for maintaining product freshness and reaching global markets, involve freight, cold chain integrity, and customs duties.

The company also invests in sustainability and compliance, incurring costs for eco-friendly practices and certifications like MSC. Furthermore, sales, marketing, and administrative functions, covering sales force, brand building, and overhead, are essential for market presence and operational efficiency. For instance, in 2023, selling, general, and administrative expenses represented approximately 15-20% of their total revenue.

| Cost Category | Key Components | Impact on Business Model | 2023/2024 Relevance |

| Raw Material Acquisition | Fishing fuel, vessel maintenance, crew wages, aquaculture feed | Directly impacts product availability and cost of goods sold | Significant investments in aquaculture in 2023; fuel prices a constant factor |

| Processing & Production | Labor, energy, packaging, machinery upkeep | Affects operational efficiency and product quality | Modernization of facilities in 2023 to enhance efficiency |

| Logistics & Distribution | Freight, cold chain, customs duties | Crucial for market reach and product integrity | Rising fuel prices and container shortages in 2024 impacted costs |

| Sustainability & Compliance | Eco-friendly practices, certifications, regulatory adherence | Enhances reputation and market access, but adds costs | Increased spending on ESG initiatives and reporting in 2023 |

| Sales, Marketing & Admin | Sales force, brand building, overhead | Drives revenue and ensures operational functionality | SGA expenses around 15-20% of revenue in 2023 |

Revenue Streams

Austevoll Seafood generates revenue from selling pelagic fish. This includes whole frozen fish intended for direct human consumption, as well as processed items such as fishmeal and fish oil. In 2024, the company's pelagic segment is a significant contributor, with market prices for fishmeal and fish oil showing strong performance due to high demand in aquaculture and animal feed sectors.

Austevoll Seafood's primary revenue comes from selling farmed salmon and trout, both fresh and processed. They supply these to retailers, restaurants, and wholesalers worldwide. This is a crucial part of their business.

Factors like how well the fish grow (biological performance), how much they harvest, and the global market price for salmon significantly impact this revenue stream. For instance, in 2023, the average global salmon price saw fluctuations, directly affecting their sales figures.

Revenue is primarily generated from the sale of whitefish products, encompassing both catching and processing activities. This includes a range of items such as fresh and frozen fillets, along with other value-added goods designed to meet diverse consumer preferences.

The financial performance of this revenue stream is significantly influenced by factors like quota allocations, which dictate the volume of fish that can be legally harvested, and the prevailing market demand for specific whitefish species. For instance, in 2024, Austevoll Seafood reported substantial sales from its whitefish operations, reflecting strong demand in key European markets.

Sales of Value-Added Seafood Products

Austevoll Seafood generates revenue through the sale of value-added seafood products. These are items that have undergone further processing, making them more convenient and appealing to consumers, and thus commanding higher prices. This segment includes products ready for direct sale to retail outlets and the food service industry.

For example, in 2023, Austevoll Seafood's value-added segment contributed significantly to its overall sales, with a focus on premium offerings. The company's strategy involves differentiating through quality and convenience.

- Value-Added Seafood Products: Revenue from processed, consumer-ready seafood items.

- Higher Margins: Achieved due to convenience and specialized preparation.

- Target Markets: Direct sales to retail and food service sectors.

By-product Sales (e.g., Omega-3 Oil)

Austevoll Seafood also generates revenue from the sale of valuable by-products, most notably Omega-3 oil. This oil, extracted from fish oil, is a key ingredient for the health and pharmaceutical sectors, offering a significant diversification of income streams beyond primary seafood products.

The market for Omega-3 fatty acids is robust, driven by increasing consumer awareness of their health benefits. For instance, the global Omega-3 market was valued at approximately USD 3.5 billion in 2023 and is projected to grow steadily.

- Omega-3 Oil Sales: A significant revenue contributor, serving health-conscious consumers and the pharmaceutical industry.

- Diversification Benefit: Reduces reliance on volatile fish prices and seasonal demand for primary seafood.

- Market Growth: The increasing demand for dietary supplements and functional foods bolsters by-product sales.

- Value Addition: Maximizes the economic potential of the raw materials processed.

Austevoll Seafood's revenue streams are diverse, encompassing the sale of pelagic fish, farmed salmon and trout, whitefish, value-added products, and valuable by-products like Omega-3 oil.

In 2024, the company's pelagic segment, including fishmeal and fish oil, has seen strong market prices due to high demand in aquaculture and animal feed. Their farmed salmon and trout sales are a primary revenue driver, influenced by global market prices, which saw fluctuations in 2023. Whitefish operations also contribute significantly, with strong demand noted in key European markets in 2024, supported by quota allocations.

The value-added segment focuses on processed, consumer-ready items, commanding higher margins and targeting retail and food service sectors, with a notable contribution in 2023. The Omega-3 oil market, driven by health awareness, is a robust by-product revenue stream, with the global market valued at approximately USD 3.5 billion in 2023.

| Revenue Stream | Key Products | Market Drivers | 2023/2024 Data Point |

| Pelagic Fish | Whole frozen fish, fishmeal, fish oil | Aquaculture & animal feed demand | Strong market prices in 2024 |

| Farmed Salmon & Trout | Fresh & processed salmon/trout | Global market prices, biological performance | Fluctuating prices impacted 2023 sales |

| Whitefish | Fillets, value-added goods | Quota allocations, market demand | Substantial sales in European markets (2024) |

| Value-Added Seafood | Convenience seafood items | Consumer preference for ready-to-eat | Significant contribution in 2023 |

| Omega-3 Oil | Fish oil supplements | Health & pharmaceutical demand | Global market ~USD 3.5 billion (2023) |

Business Model Canvas Data Sources

The Austevoll Seafood Business Model Canvas is built upon comprehensive financial statements, detailed operational reports, and extensive market research. These data sources provide a robust foundation for understanding the company's current performance and future potential.