Austevoll Seafood Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Austevoll Seafood Bundle

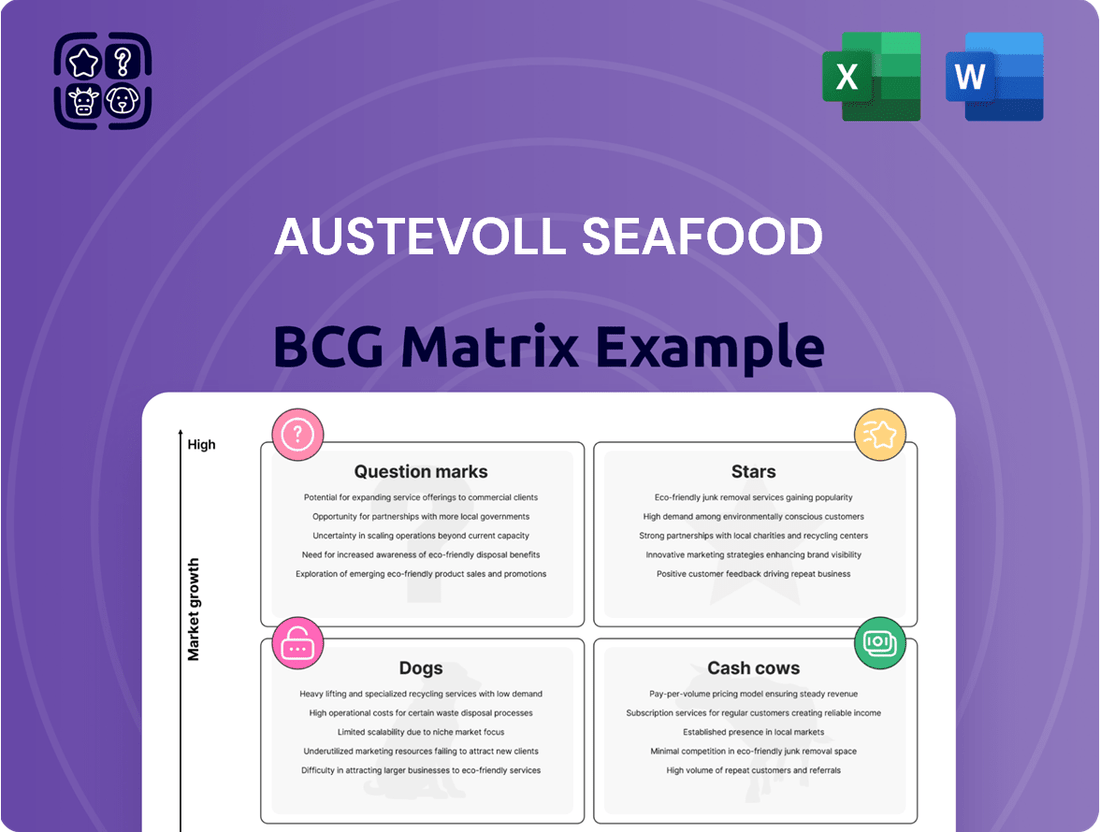

Uncover the strategic positioning of Austevoll Seafood's diverse portfolio with our insightful BCG Matrix preview. See which of their ventures are poised for growth and which are generating steady returns, offering a glimpse into their market dominance.

This snapshot is just the beginning. Purchase the full BCG Matrix to gain a comprehensive understanding of each business unit's performance, enabling you to make data-driven decisions for future investments and resource allocation.

Don't miss out on the complete strategic blueprint. Get the full Austevoll Seafood BCG Matrix report to unlock detailed quadrant analysis, actionable insights, and a clear roadmap to optimize your business strategy.

Stars

Lerøy Seafood Group, a significant part of Austevoll Seafood, is experiencing a strong upward trend in its salmon and trout farming operations. In the fourth quarter of 2024, harvest volumes saw a notable 20% increase when compared to the same period in 2023.

For the entirety of 2024, the total harvest volume reached 171,200 tonnes GWT, a healthy rise from the 159,600 tonnes recorded in 2023. This performance indicates a robust market demand and efficient operations within the company.

Looking ahead, Austevoll Seafood anticipates further expansion, projecting a group harvest volume of 211,000 tonnes for 2025. This forecast underscores the continued positive momentum and strategic growth in the aquaculture sector.

Lerøy Aurora, a key component of Austevoll Seafood's portfolio, demonstrated remarkable biological growth in the fourth quarter of 2024. This region achieved its highest-ever biomass production for a fourth quarter, underscoring its operational strength.

Harvest volumes at Lerøy Aurora surged to 15,398 GWT in Q4 2024, a significant jump from 12,549 GWT recorded in the same quarter of 2023. This consistent upward trend in production signals Lerøy Aurora's robust performance and its solid standing in a dynamic salmon market segment.

Lerøy Midt is a significant contributor to Austevoll Seafood's portfolio, demonstrating robust performance. In the fourth quarter of 2024, the company achieved its highest Q4 biomass production on record, underscoring its operational strength and biological advancements. Harvest volumes in this key region saw a notable increase, reaching 22,582 GWT in Q4 2024, up from 20,257 GWT in the same period of 2023.

Looking ahead, Lerøy Midt's trajectory indicates continued expansion. The projected harvest volume for 2025 is approximately 75,000 GWT, a substantial rise from the 69,000 GWT harvested in 2024. This sustained growth pattern positions Lerøy Midt as a strong performer within the company's business units, likely classifying it as a star in the BCG matrix due to its high growth and market share.

Increased Revenue from Salmon and Value-Added Products

In 2024, Lerøy Seafood experienced a significant revenue surge, with a 14% year-on-year increase to NOK 26.7 billion. This impressive growth was primarily fueled by robust demand for both its salmon and a range of value-added seafood products.

This performance underscores Lerøy Seafood's strategic advantage in the expanding salmon market. The company's success in offering diverse and desirable products positions it firmly as a star performer within the Austevoll Seafood portfolio.

- Lerøy Seafood 2024 Revenue: NOK 26.7 billion

- Year-on-Year Revenue Growth: 14%

- Key Growth Drivers: Strong demand for salmon and value-added products

- Market Position: Solidified star status due to capitalization on high-growth salmon market

Overall Harvest Volume Projections for 2025

Austevoll Seafood is projecting a robust harvest volume for 2025, aiming for around 220,000 tonnes of salmon and trout. This marks a substantial uptick from their 2024 target of 190,000 tonnes.

This ambitious production goal for 2025 is supported by anticipated enhancements in biological performance and a reduction in mortality rates. These factors are crucial for achieving such an increase and reflect the company's confidence in its operational capabilities and its strategic focus on the expanding aquaculture market.

- Projected 2025 Harvest Volume: Approximately 220,000 tonnes (salmon and trout).

- 2024 Harvest Volume: 190,000 tonnes.

- Growth Driver: Improved biological performance and lower mortality rates.

- Strategic Focus: Continued investment in the high-growth aquaculture sector.

Stars in the BCG matrix represent business units with high market share in a high-growth industry. Lerøy Seafood Group, specifically its salmon and trout farming operations, fits this description perfectly. The company's 2024 performance, with a 14% revenue increase to NOK 26.7 billion and a 20% rise in Q4 harvest volumes, demonstrates strong momentum.

Lerøy Midt's projected 2025 harvest of 75,000 GWT, up from 69,000 GWT in 2024, further solidifies its star status. This consistent growth, driven by operational efficiency and market demand, positions these segments as key growth drivers for Austevoll Seafood.

| Business Unit | 2024 Harvest (GWT) | 2025 Projected Harvest (GWT) | Revenue Growth (YoY) | BCG Classification |

|---|---|---|---|---|

| Lerøy Seafood Group (Overall) | 171,200 | 211,000 | 14% | Star |

| Lerøy Midt | 69,000 | 75,000 | N/A | Star |

| Lerøy Aurora | N/A (Q4: 15,398) | N/A | N/A | Star |

What is included in the product

This BCG Matrix overview identifies Austevoll Seafood's Stars, Cash Cows, Question Marks, and Dogs, guiding strategic investment decisions.

The Austevoll Seafood BCG Matrix provides a clear, one-page overview, relieving the pain of scattered business unit data.

Cash Cows

The Austral Group's pelagic operations in Peru are a significant contributor to Austevoll Seafood's financial performance, acting as a reliable cash cow. These operations consistently generate substantial revenue and earnings, underpinning the company's overall profitability.

Q3 2024 saw a notable surge in earnings, directly linked to robust sales volumes from the Peruvian segment. Looking ahead, the Q1 2025 fishing season commenced with an encouraging higher quota for the Centre/North region when contrasted with the 2024 season, signaling continued market stability and strong production potential.

The established market presence and high production volumes in Peru translate into considerable cash flow generation for Austevoll Seafood. This consistent cash generation solidifies the pelagic operations' position as a key cash cow within the company's portfolio.

FoodCorp Chile, a significant part of Austevoll Seafood's operations, showcased steady results, boosting revenue in the final quarter of 2024. This Chilean subsidiary is a prime example of a cash cow due to its predictable and substantial contributions.

In 2024, the company set a new record, landing an impressive 133,000 tonnes of pelagic fish in Chile, a notable jump from the prior year. This consistent high-volume output from an established market segment provides a reliable source of cash flow for the business.

Pelagia Holding AS, a significant joint venture for Austevoll Seafood, consistently generates robust financial performance, especially in the fishmeal and fish oil sectors. In 2023, Pelagia reported a substantial contribution to Austevoll's overall revenue, highlighting its role as a reliable income stream.

Despite potentially slower market growth for commodities like fishmeal and fish oil, Pelagia leverages its strong market position and efficient operations. This allows it to maintain a steady and significant cash flow for the Austevoll group, solidifying its status as a cash cow.

High Volume from Owned Pelagic Quotas

Austevoll Seafood leverages its substantial owned pelagic quotas, enabling the annual catch of over 500,000 tonnes of fish, primarily in Chile and Peru. This consistent, high-volume supply chain fuels its processing operations, positioning these activities as a classic cash cow within the BCG matrix.

The sheer scale of raw material processed through Austevoll's factories underscores the maturity and efficiency of this segment. For instance, in 2023, the company reported significant contributions from its pelagic operations, with the segment consistently demonstrating strong profitability, a hallmark of established market leaders.

- Annual Catch Volume: Exceeding 500,000 tonnes of pelagic fish.

- Geographic Focus: Primarily Chile and Peru.

- Operational Strength: Extensive factory network for processing.

- Financial Characteristic: Reliable cash generation due to high, consistent volume.

Efficient Value-Added Processing and Distribution (Established Products)

Austevoll Seafood's Value-Added Processing and Distribution segment, a clear Cash Cow, demonstrated robust performance. The Group reported good earnings in Q4 2024, with a significant improvement noted for the full year 2024. This positive trend was largely attributable to enhanced utilization of its processing capacity.

This segment's success highlights the consistent profitability derived from established value-added products and efficient distribution networks within a mature market segment. The strategy of optimizing existing operations is clearly paying off.

- Segment Earnings: Strong performance in Q4 2024 and full-year 2024.

- Key Driver: Improved utilization of processing capacity.

- Market Position: Consistent profits from established products in a mature market.

- Strategic Advantage: Efficient distribution channels contribute to profitability.

Austevoll Seafood's pelagic operations in Peru and Chile, along with its joint venture Pelagia Holding AS, firmly establish themselves as cash cows within the company's BCG matrix. These segments consistently generate substantial and reliable cash flow due to high, stable production volumes and established market positions. For instance, Austevoll's overall pelagic catch exceeded 500,000 tonnes annually, with Chile alone landing a record 133,000 tonnes in 2024.

| Segment | Key Characteristic | Financial Contribution | 2024 Highlight |

| Austral Group (Peru Pelagic) | High, consistent sales volumes | Substantial revenue and earnings | Strong Q3 2024 earnings |

| FoodCorp Chile | Established market presence | Predictable and substantial contributions | Record 133,000 tonnes landed |

| Pelagia Holding AS | Strong market position (fishmeal/oil) | Steady and significant cash flow | Continued robust financial performance |

| Value-Added Processing | Optimized processing capacity | Consistent profitability | Good Q4 2024 earnings, improved full-year 2024 |

What You See Is What You Get

Austevoll Seafood BCG Matrix

The Austevoll Seafood BCG Matrix preview you are viewing is the precise, fully formatted document you will receive immediately after purchase. This means no watermarks, no demo content, and no hidden surprises—just a professionally crafted strategic tool ready for your immediate use in business planning and analysis.

Dogs

The wild catch segment, specifically whitefish operations under Lerøy Havfisk, is grappling with substantial headwinds from declining quotas. For 2025, cod quotas are projected to decrease by a significant 32%, with haddock quotas seeing an 8% reduction, building on existing cuts in 2024.

This contraction in available catch volumes directly curtails revenue potential, positioning this segment as a 'dog' within the BCG matrix due to its limited growth outlook.

Lerøy's Wild Catch segment faced a significant revenue dip of NOK 180 million in Q4 2024 compared to the previous year. While the segment managed a positive operational EBIT in the fourth quarter, it's important to note that Q3 2024 saw a negative EBIT, underscoring its precarious financial standing.

These figures point to a challenging environment for wild catch operations, characterized by a low market share and struggling profitability. The segment's performance suggests it's operating within a declining market, making it a potential candidate for a 'Dog' in the BCG Matrix.

Two specific pelagic fishing vessels, having concluded their quotas in April 2025, have ceased further operations for the remainder of the year. This action signifies the discontinuation of these assets' contribution due to market limitations, reflecting a low or negligible future impact on market share or growth.

Impact of New Resource Rent Tax

The introduction of Norway's new resource rent tax has altered the financial landscape for salmon and trout farming, directly impacting the profitability of the sector. While salmon farming generally holds a strong position, akin to a star in the BCG matrix, this new tax regime introduces a significant variable.

This increased tax burden can diminish the net profitability of individual farming sites. Sites that are already operating at higher costs or with lower efficiency might find their margins squeezed considerably. Consequently, these less competitive locations could see their status shift from a potential star or cash cow towards a dog category if they cannot adapt to the new economic realities.

- Tax Rate Impact: The new resource rent tax directly increases the overall tax burden on salmon and trout production in Norway.

- Profitability Squeeze: Higher taxes can reduce net profitability, especially for less efficient or higher-cost salmon farming operations.

- Potential for 'Dog' Status: Less competitive sites may become less attractive, potentially moving towards a 'dog' category within the BCG matrix if profitability declines significantly.

- Industry Adaptation: The sector will need to focus on efficiency improvements and cost management to mitigate the impact of the new tax structure.

Historically Challenged Farming Sites

Lerøy Sjøtroll, a key entity within Austevoll Seafood's farming operations, has faced significant headwinds. Despite biological improvements noted in 2024, the company reported a poor financial result for the year. This follows a period of difficulty, including a negative EBIT per kilogram in the third quarter of 2024, indicating ongoing challenges in achieving profitability.

These historically challenged farming sites, like those managed by Lerøy Sjøtroll, often represent areas with lower market share and profitability within the broader farming segment. The persistent financial strain suggests that these locations may require strategic reassessment, potentially involving further investment in efficiency upgrades or consideration of divestment to optimize the overall business portfolio.

- Lerøy Sjøtroll's 2024 financial performance was described as poor.

- Negative EBIT per kilogram was recorded in Q3 2024.

- Biological performance showed recent improvements in 2024.

- These sites may have low market share and profitability, necessitating careful management.

The wild catch segment, particularly whitefish operations, is a clear 'dog' due to declining quotas. For 2025, cod quotas are down 32% and haddock by 8%, building on 2024 reductions. This directly limits revenue potential and market share. For instance, two pelagic fishing vessels ceased operations in April 2025 after exhausting their quotas, highlighting the severe impact of these market limitations.

Lerøy Sjøtroll's farming operations also exhibit 'dog' characteristics. Despite biological improvements in 2024, the segment reported poor financial results, including a negative EBIT per kilogram in Q3 2024. This persistent financial strain suggests these sites may have low market share and profitability, requiring strategic reassessment.

The introduction of Norway's resource rent tax on salmon and trout farming, while impacting the entire sector, disproportionately affects less efficient or higher-cost sites. These struggling locations could shift from potential stars or cash cows to 'dogs' if their profitability is significantly squeezed by the increased tax burden.

| Segment | BCG Category | Key Challenges | Financial Performance Indicators (2024/2025 Projections) |

| Wild Catch (Whitefish) | Dog | Declining quotas (Cod -32% in 2025, Haddock -8% in 2025) | Revenue potential curtailed; Q4 2024 revenue dip of NOK 180 million YoY; Q3 2024 negative EBIT. |

| Farming (Specific Sites like Lerøy Sjøtroll) | Dog | Low profitability, potential low market share, impact of resource rent tax | Poor financial results in 2024; Negative EBIT per kilogram in Q3 2024. |

Question Marks

Lerøy Midt and Lerøy Sjøtroll are actively integrating shielding technology into their aquaculture practices, demonstrating positive outcomes observed in the fourth quarter of 2024. This strategic adoption is poised to see a growing percentage of their fish harvests originating from these technologically advanced sites throughout 2025.

This investment signifies a commitment to enhancing biological performance and driving down operational expenses through innovative methods. While the potential for increased market share and improved profitability is significant, the full realization of these benefits is still in its nascent stages, positioning this initiative as a question mark with considerable future growth prospects.

Lerøy Seafood Group's introduction of a carbon-neutral salmon product in 2024, a move that builds on their success in surpassing 2025 greenhouse gas emission reduction goals, positions this offering as a potential question mark within the BCG matrix.

This innovation directly addresses the increasing consumer desire for environmentally responsible choices, a trend that saw the global sustainable seafood market valued at approximately USD 25 billion in 2023 and projected to grow significantly.

However, the product's current market penetration and its impact on Lerøy's total revenue are likely modest, necessitating substantial investment to achieve broader market adoption and establish leadership in this niche segment.

Austevoll Seafood's strategy emphasizes expanding into value-added processing to serve global markets with diverse seafood products. This involves identifying and investing in new product lines or niche markets within this segment where current market share is low but growth potential is high, necessitating focused market adoption efforts.

Exploration of New Geographical Markets

Austevoll Seafood's presence across Norway, Europe, Asia, the USA, and South America offers a foundation for growth. Identifying specific high-potential emerging markets within these continents where the company currently holds a minor stake would categorize them as question marks. These markets demand significant investment in marketing and distribution to build a more substantial presence and capitalize on their growth trajectories.

For instance, certain markets in Southeast Asia or parts of Latin America could represent question marks. Austevoll Seafood might need to allocate considerable resources to establish robust supply chains and brand awareness in these regions. This strategic focus is crucial for transforming these nascent opportunities into future cash cows.

- Emerging Asian Markets: Continued investment in markets like Vietnam or Indonesia, where demand for seafood is rising, could yield significant returns if market share is effectively captured.

- Latin American Growth Pockets: Exploring deeper penetration in countries like Peru or Chile, beyond existing operations, presents a question mark due to their strong seafood consumption patterns.

- Strategic Investment: The success of these question marks hinges on substantial marketing and distribution investments, aiming to convert them into stars or at least strong cash cows in the coming years.

Potential for Strategic Acquisitions in Emerging Segments

Austevoll Seafood's robust financial position, characterized by a strong balance sheet and ample financial flexibility, positions it well for both internal expansion and strategic acquisitions. This financial strength is crucial for exploring new frontiers.

Emerging segments, such as innovative seafood technologies, novel aquaculture species, or untapped geographical markets, represent potential question marks within Austevoll's business portfolio. These areas, while currently small in scale, often possess significant untapped growth potential.

Investing in these question mark segments requires careful consideration and substantial capital allocation to nurture them into future stars. For instance, a hypothetical acquisition of a company specializing in cellular aquaculture could cost upwards of $50 million in 2024, reflecting the high investment needed for such nascent technologies.

- Potential for Strategic Acquisitions in Emerging Segments

- Financial Flexibility: Austevoll Seafood possesses a strong balance sheet and financial flexibility, enabling strategic acquisitions.

- Question Mark Segments: Innovative seafood technologies, new aquaculture species, and emerging markets are classified as question marks.

- High Growth Potential: These segments, though currently small, exhibit significant future growth prospects.

- Investment Requirements: Realizing the full potential of these question marks necessitates considerable investment.

The new carbon-neutral salmon product launched by Lerøy Seafood Group in 2024, building on their impressive achievement of exceeding 2025 greenhouse gas emission reduction targets, represents a significant question mark. This product taps into a growing consumer demand for sustainable options, a market valued at approximately USD 25 billion in 2023. However, its current market share is likely modest, requiring substantial investment to gain broader traction and establish market leadership.

Emerging markets in Southeast Asia, such as Vietnam or Indonesia, and specific growth pockets in Latin America, like Peru or Chile, are also categorized as question marks for Austevoll Seafood. These regions show strong seafood consumption trends, but Austevoll's current stake is minor, necessitating considerable investment in marketing and distribution to build brand awareness and robust supply chains.

Innovative seafood technologies, novel aquaculture species, and untapped geographical markets represent further question marks for Austevoll Seafood. These nascent areas, though currently small in scale, hold significant untapped growth potential. For example, acquiring a company in cellular aquaculture could cost upwards of $50 million in 2024, highlighting the substantial capital required for these emerging segments.

| Business Area | Current Market Share | Growth Potential | Investment Needed | BCG Category |

| Carbon-Neutral Salmon (Lerøy) | Low | High | High | Question Mark |

| Emerging Asian Markets (Austevoll) | Low | High | High | Question Mark |

| Latin American Growth Pockets (Austevoll) | Low | High | High | Question Mark |

| Innovative Seafood Tech | Very Low | Very High | Very High | Question Mark |

BCG Matrix Data Sources

Our Austevoll Seafood BCG Matrix is built on verified market intelligence, combining financial data, industry research, and official reports to ensure reliable, high-impact insights.