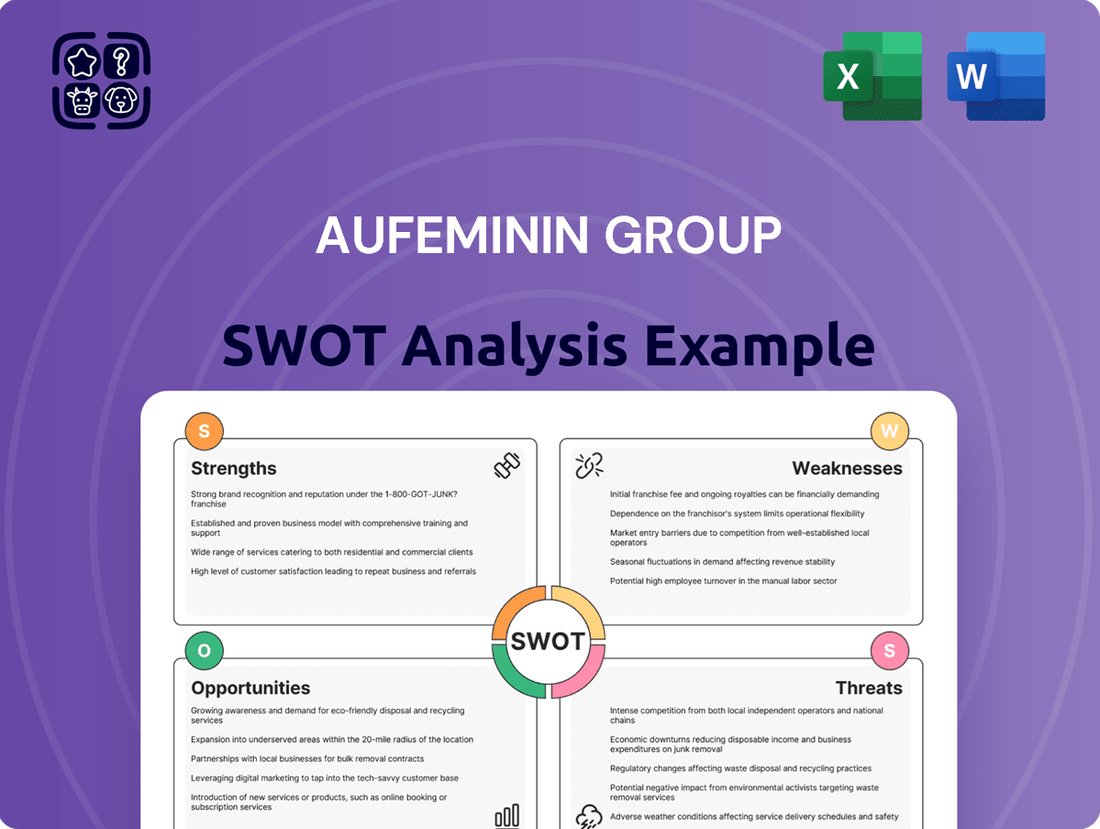

aufeminin group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

aufeminin group Bundle

Aufeminin Group leverages its strong brand recognition and engaged audience, but faces intense competition and evolving digital trends. Understanding these dynamics is crucial for navigating the media landscape.

Want the full story behind aufeminin's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Aufeminin group commands a formidable presence in the digital media landscape, particularly within the female demographic. Its specialized focus on women's lifestyle content, spanning fashion, beauty, parenting, and health, cultivates a highly engaged audience and a robust brand identity. This niche dominance allows for tailored advertising opportunities and a deep understanding of consumer needs within this lucrative segment.

Aufeminin's extensive content portfolio, spanning fashion, beauty, health, parenting, and lifestyle, acts as a significant strength. This diverse offering ensures it appeals to a wide audience, keeping users engaged across multiple interest areas.

This broad content base provides aufeminin with numerous monetization opportunities, from targeted advertising to integrated e-commerce partnerships. For instance, in 2024, lifestyle and fashion content often drove higher click-through rates for affiliate marketing programs, demonstrating the commercial value of this breadth.

Aufeminin group's significant audience reach, spanning key markets like France, Germany, Spain, Italy, the UK, the US, and Japan, is a major strength. This broad global presence allows for effective community building across its platforms and social networks.

The group boasts nearly 6.5 million monthly users in France alone, alongside almost 6 million subscribers across its social networks. This substantial engagement is a powerful asset for attracting advertisers and fostering e-commerce growth.

Integration with TF1 Group Synergies

Being part of the TF1 Group, a major French media player, gives aufeminin group a significant advantage through synergistic opportunities. This integration bolsters its market standing and grants access to a wider pool of resources, enabling the development of more innovative brand solutions. The group can effectively leverage the strong reach of television to support its digital offerings.

TF1 Group's financial performance in the first nine months of 2024 highlights this strength, with a consolidated revenue increase of 2.8%. This growth was primarily fueled by a robust 4.5% rise in advertising revenue, demonstrating the group's ability to monetize its extensive media assets and channels.

- Synergistic Advantage: Integration with TF1 Group provides aufeminin with enhanced market position and resource access.

- Cross-Promotion Power: Ability to leverage TF1's TV reach to amplify digital brands and attract advertisers.

- Revenue Growth: TF1 Group's 2.8% consolidated revenue growth in the first nine months of 2024, with advertising up 4.5%, indicates strong operational synergy.

- Resource Amplification: Access to TF1's broader infrastructure and expertise supports aufeminin's innovation and market penetration.

Diversified Monetization Model

Aufeminin's diversified monetization model is a significant strength, built on three core pillars: programmatic advertising, social e-commerce, and tailored marketing solutions. This multi-faceted approach enhances financial resilience by not depending on a single income source, allowing for broader revenue generation and sustained profitability. For instance, the TF1 Group, which aufeminin is part of, experienced a substantial 39.2% increase in advertising revenue for TF1+ in 2024, underscoring the effectiveness of its digital advertising strategies and the platform's attractiveness to advertisers.

Aufeminin's core strength lies in its deep understanding and engagement with the female demographic, offering a specialized platform for fashion, beauty, and lifestyle content. This niche focus translates into highly targeted advertising opportunities and a loyal user base, as evidenced by its significant reach in key markets. The group's integration with TF1 Group further amplifies its market position, providing access to extensive resources and cross-promotional capabilities, as reflected in TF1's robust advertising revenue growth in 2024.

| Metric | Value | Source/Period |

|---|---|---|

| Monthly Users (France) | ~6.5 million | Internal Data (2024) |

| Social Network Subscribers | ~6 million | Internal Data (2024) |

| TF1 Group Consolidated Revenue Growth | +2.8% | Q1-Q3 2024 |

| TF1 Group Advertising Revenue Growth | +4.5% | Q1-Q3 2024 |

| TF1+ Advertising Revenue Growth | +39.2% | 2024 |

What is included in the product

Delivers a strategic overview of aufeminin group’s internal and external business factors, identifying key strengths, weaknesses, opportunities, and threats.

Helps identify and mitigate potential risks by clearly outlining weaknesses and threats.

Weaknesses

While aufeminin group benefits from diversification, a significant reliance on advertising revenue remains a notable weakness. This dependence makes the company vulnerable to shifts in the broader advertising market and economic slowdowns.

The digital advertising sector in France, though expanding, is not immune to market volatility. A general deceleration in advertising spend could directly affect aufeminin's top line. For context, TF1 Group reported stable linear advertising revenue in 2024, a period marked by intense competition and challenging market conditions towards the year's end, highlighting the sensitivity of this revenue stream.

The digital media space is incredibly crowded, with countless entities all trying to capture people's attention and advertising dollars. aufeminin group contends with a wide array of competitors, including other sites specifically targeting women, broader lifestyle websites, major social media networks, and a growing number of independent content creators. This intense rivalry makes it difficult to hold onto and expand its slice of the market.

Social media platforms, in particular, are becoming fiercer competitors for both how people spend their leisure time and where advertisers choose to invest. This trend directly impacts aufeminin group's ability to attract and retain users, as well as secure vital advertising revenue in a rapidly evolving digital ecosystem.

The sheer volume of digital content and platforms available today presents a significant challenge for aufeminin group. As consumers spread their attention across numerous streaming services, social media video, and gaming platforms, it becomes increasingly difficult for any single entity to capture and hold a dominant share of audience engagement. This fragmentation means aufeminin group must constantly adapt its strategies to remain visible and relevant in a crowded digital landscape.

Challenges in Data Privacy Compliance

The digital media sector, heavily reliant on user data for personalized content and targeted advertising, faces significant hurdles in adhering to increasingly stringent data privacy regulations. Navigating laws like GDPR and CCPA demands continuous investment in compliance infrastructure and adaptive strategies. By 2025, digital marketers will grapple with a patchwork of global privacy mandates, making cross-border operations particularly complex.

Failure to comply can result in substantial financial penalties and severe damage to brand reputation. For instance, in 2023, Meta was fined €1.2 billion under GDPR for transferring EU user data to the US. This highlights the financial risks associated with inadequate data privacy management.

- Evolving Legal Landscape: Keeping pace with new and updated privacy laws globally is a constant challenge.

- Compliance Costs: Significant financial resources are required for legal counsel, technology upgrades, and staff training.

- Reputational Risk: Data breaches or non-compliance incidents can erode user trust and brand image.

- Operational Complexity: Implementing and maintaining data privacy protocols across different platforms and regions adds layers of operational difficulty.

Dependency on TF1 Group's Overall Performance

Aufeminin group's reliance on TF1 Group creates a significant weakness. While integration with its parent company offers potential synergies, it also exposes aufeminin to the broader financial health and strategic choices of TF1 Group. Any downturn or strategic missteps by TF1 could directly affect aufeminin's access to resources and its ability to pursue growth initiatives.

This dependency means that aufeminin's performance is intrinsically linked to TF1 Group's overall success. For instance, TF1 Group's net cash position at the end of March 2025 was €559 million, a figure that remained almost unchanged from the previous year. This stability, while positive for TF1, underscores how aufeminin's operational capacity and investment potential are tied to the parent company's financial standing.

- Performance Linkage: Aufeminin's results are susceptible to TF1 Group's financial performance and strategic direction.

- Resource Allocation Risk: Challenges faced by TF1 Group could limit aufeminin's access to capital and investment opportunities.

- Strategic Alignment Constraints: Aufeminin's growth strategy may be constrained by TF1 Group's overarching corporate objectives.

The group's primary weakness lies in its substantial dependence on advertising revenue, making it susceptible to market fluctuations and economic downturns. This reliance is further amplified by the intense competition within the digital media landscape, where user attention is fragmented across numerous platforms.

Navigating the complex and evolving data privacy regulations presents another significant challenge, requiring continuous investment in compliance and potentially limiting data utilization for personalized content and advertising. Furthermore, aufeminin group's performance is closely tied to its parent company, TF1 Group, meaning any financial or strategic difficulties faced by TF1 could directly impact aufeminin's resources and growth prospects.

| Weakness Category | Description | Implication | Example/Context |

|---|---|---|---|

| Revenue Dependency | Heavy reliance on advertising income. | Vulnerability to advertising market volatility and economic slowdowns. | TF1 Group's 2024 linear advertising revenue remained stable amid challenging conditions, highlighting the sensitivity of ad spend. |

| Market Competition | Crowded digital media space with numerous competitors. | Difficulty in capturing and expanding market share; user attention fragmentation. | Competition from social media platforms and independent creators directly impacts user engagement and advertising revenue. |

| Regulatory Compliance | Adherence to stringent data privacy laws (e.g., GDPR). | Requires significant investment in compliance; risk of penalties and reputational damage. | Meta's €1.2 billion GDPR fine in 2023 underscores the financial risks of non-compliance. |

| Parent Company Linkage | Dependence on TF1 Group's financial health and strategy. | Exposure to TF1's performance; potential constraints on resources and growth initiatives. | TF1 Group's stable net cash position of €559 million (March 2025) indirectly influences aufeminin's investment capacity. |

Full Version Awaits

aufeminin group SWOT Analysis

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It details the strengths, weaknesses, opportunities, and threats facing the Aufeminin group. The preview provides a clear glimpse into the comprehensive insights you'll gain.

Opportunities

Aufeminin has a substantial opportunity to boost its e-commerce by diversifying its product range and improving the user journey, creating a more integrated shopping experience directly from its content. The global e-commerce market is projected to reach $7.4 trillion by 2025, with mobile commerce alone expected to account for over half of all e-commerce sales.

Further investment in digital services, particularly mobile-first strategies, can capitalize on the ongoing expansion of online retail. This includes enhancing platform features and exploring new digital revenue streams to complement existing content offerings.

Aufeminin can significantly boost user engagement by employing advanced data analytics and AI to offer personalized content recommendations. This tailored approach not only enhances the user experience but also makes advertising more effective by reaching the right audience with relevant messages.

The French digital advertising market is projected for robust growth, with forecasts indicating an expansion driven by the increasing integration of AI and sophisticated targeted marketing strategies. This trend presents a prime opportunity for aufeminin to capitalize on enhanced advertising revenue through its data-driven personalization efforts.

The escalating demand for video content across platforms like TikTok, YouTube, and Instagram, encompassing both short and long formats, offers aufeminin group a significant avenue for expansion and revenue generation. Digital advertising, a core revenue stream, heavily relies on video ads, with social media channels proving particularly effective for engaging audiences through video.

In 2024, the global digital advertising market is projected to reach over $700 billion, with video advertising accounting for a substantial and growing portion. aufeminin group can leverage this trend by creating more compelling video content and exploring new monetization strategies within the video ecosystem.

Development of Niche Communities and Influencer Marketing

Aufeminin can strengthen its position by nurturing specialized communities within its extensive female user base. This strategic focus allows for more targeted content and engagement, which in turn can attract brands seeking to connect with specific demographics.

Leveraging micro-influencers presents a significant opportunity. These influencers often possess a highly engaged and loyal following within niche segments, making them effective conduits for marketing campaigns. For instance, a 2024 study indicated that influencer marketing campaigns with micro-influencers can achieve engagement rates up to 60% higher than those with macro-influencers.

- Deeper Engagement: Niche communities foster stronger user connections and loyalty.

- Targeted Marketing: Allows for precise audience reach for advertisers.

- Micro-Influencer Impact: Micro-influencers deliver higher engagement rates for specialized content.

- New Revenue Streams: Opens doors for tailored brand partnerships and sponsored content.

International Expansion and Market Penetration

Aufeminin's international presence offers a solid foundation for further growth. The TF1 Group, its parent company, has expressed a clear strategy to broaden the reach of its streaming service, TF1+, into additional French-speaking territories. This aligns with aufeminin's existing international footprint and presents a clear avenue for deepening market penetration.

Expanding into new geographical regions with a strong digital media market for women represents a significant opportunity. This could involve leveraging existing content and brand recognition to capture new audiences. For instance, while specific 2024/2025 data for aufeminin's new market penetration is still emerging, the broader trend of digital ad spend growth in key emerging markets, particularly in Southeast Asia and parts of Africa, presents fertile ground.

- Deepen Penetration: Increase market share in existing international markets where aufeminin already operates.

- Explore New Markets: Identify and enter new geographical regions with high growth potential in the female digital media sector.

- Leverage TF1+ Expansion: Capitalize on TF1 Group's strategic push to expand TF1+ into other French-speaking countries to cross-promote and integrate aufeminin's offerings.

- Digital Ad Growth: Target regions with projected increases in digital advertising expenditure, especially within the female demographic.

Aufeminin can enhance its e-commerce by diversifying its product offerings and streamlining the user journey, creating a seamless shopping experience directly from its content. The global e-commerce market is anticipated to reach $7.4 trillion by 2025, with mobile commerce expected to constitute over half of all online sales.

Further investment in digital services, particularly mobile-first strategies, can capitalize on the ongoing expansion of online retail. This includes enhancing platform features and exploring new digital revenue streams to complement existing content offerings.

Aufeminin can significantly boost user engagement by employing advanced data analytics and AI to offer personalized content recommendations. This tailored approach not only enhances the user experience but also makes advertising more effective by reaching the right audience with relevant messages.

The French digital advertising market is projected for robust growth, with forecasts indicating an expansion driven by the increasing integration of AI and sophisticated targeted marketing strategies. This trend presents a prime opportunity for aufeminin to capitalize on enhanced advertising revenue through its data-driven personalization efforts.

The escalating demand for video content across platforms like TikTok, YouTube, and Instagram, encompassing both short and long formats, offers aufeminin group a significant avenue for expansion and revenue generation. Digital advertising, a core revenue stream, heavily relies on video ads, with social media channels proving particularly effective for engaging audiences through video.

In 2024, the global digital advertising market is projected to reach over $700 billion, with video advertising accounting for a substantial and growing portion. Aufeminin group can leverage this trend by creating more compelling video content and exploring new monetization strategies within the video ecosystem.

Aufeminin can strengthen its position by nurturing specialized communities within its extensive female user base. This strategic focus allows for more targeted content and engagement, which in turn can attract brands seeking to connect with specific demographics.

Leveraging micro-influencers presents a significant opportunity. These influencers often possess a highly engaged and loyal following within niche segments, making them effective conduits for marketing campaigns. For instance, a 2024 study indicated that influencer marketing campaigns with micro-influencers can achieve engagement rates up to 60% higher than those with macro-influencers.

Aufeminin's international presence offers a solid foundation for further growth. The TF1 Group, its parent company, has expressed a clear strategy to broaden the reach of its streaming service, TF1+, into additional French-speaking territories. This aligns with aufeminin's existing international footprint and presents a clear avenue for deepening market penetration.

Expanding into new geographical regions with a strong digital media market for women represents a significant opportunity. This could involve leveraging existing content and brand recognition to capture new audiences. For instance, while specific 2024/2025 data for aufeminin's new market penetration is still emerging, the broader trend of digital ad spend growth in key emerging markets, particularly in Southeast Asia and parts of Africa, presents fertile ground.

| Opportunity Area | Description | Supporting Data/Trend |

|---|---|---|

| E-commerce Enhancement | Diversify product range and improve user journey for integrated shopping. | Global e-commerce to reach $7.4 trillion by 2025; mobile commerce to exceed 50%. |

| Digital Services Expansion | Invest in mobile-first strategies and explore new digital revenue streams. | Continued growth in online retail and digital platform features. |

| Personalized Content & Advertising | Utilize AI for tailored recommendations to boost engagement and ad effectiveness. | French digital advertising market growth driven by AI and targeted marketing. |

| Video Content Monetization | Capitalize on rising video content demand across platforms. | Global digital advertising market to exceed $700 billion in 2024, with video ads a significant portion. |

| Nurturing Niche Communities | Develop specialized communities for targeted content and brand partnerships. | Micro-influencers achieve up to 60% higher engagement rates than macro-influencers. |

| International Market Penetration | Leverage TF1+ expansion and target regions with growing digital media markets for women. | Growth in digital ad spend in emerging markets like Southeast Asia and Africa. |

Threats

The significant market share held by global tech behemoths like Google and Meta in digital advertising presents a considerable challenge. These giants command extensive user data and sophisticated advertising technologies, which can divert advertising budgets away from platforms like aufeminin.

In 2024, the digital advertising market in France is projected to reach approximately €10.5 billion, with a substantial portion captured by these major international players, underscoring the intense competition aufeminin faces for ad revenue and user engagement.

The global landscape of data privacy is constantly shifting, with new regulations like the California Privacy Rights Act (CPRA) and the ongoing evolution of GDPR impacting how companies like aufeminin group can collect and use user data. This, coupled with the planned deprecation of third-party cookies by major browsers like Google Chrome, presents a significant challenge to targeted advertising, a crucial revenue stream for many media entities. For instance, industry estimates suggest a potential 50% reduction in ad revenue for some publishers due to cookie deprecation alone.

Navigating this complex regulatory environment requires a proactive strategy that extends beyond mere legal compliance. Media companies must develop robust roadmaps to address privacy concerns, considering not only governmental laws but also the increasingly stringent platform policies enforced by tech giants. This means investing in first-party data strategies and exploring alternative, privacy-preserving advertising technologies to maintain advertising effectiveness and revenue generation capabilities.

Aufeminin, like many media groups, faces the challenge of rapidly changing consumer tastes. The surge in short-form video content, for instance, demands significant investment in new production capabilities and adaptable content strategies to capture audience attention and maintain relevance in a crowded digital landscape.

Social media platforms are increasingly dominating how people consume media and entertainment, pulling user engagement away from traditional outlets. This shift requires aufeminin to innovate its distribution and engagement models to compete effectively for user time and loyalty.

Economic Downturns Impacting Advertising Spend

Economic uncertainties and potential downturns pose a significant threat to aufeminin group. Brands often reduce their advertising budgets during periods of economic instability, directly impacting the company's primary revenue stream derived from advertising sales. This sensitivity to macroeconomic fluctuations means aufeminin group's financial performance can be volatile.

The advertising market is inherently susceptible to broader economic conditions. For instance, global advertising spending growth slowed in 2023, with projections for 2024 indicating continued caution. A significant economic contraction could lead to a sharp decline in demand for digital advertising, aufeminin group's core business.

- Reduced Brand Investment: Economic slowdowns typically trigger budget cuts from advertisers, directly impacting aufeminin group's ad revenue.

- Market Volatility: The advertising sector is highly sensitive to macroeconomic shifts, making revenue streams unpredictable during uncertain economic times.

- Competitive Pressure: During downturns, competition for a shrinking advertising pie intensifies, potentially forcing aufeminin group to offer lower ad rates.

Brand Safety and Misinformation Concerns

Brand safety and the pervasive issue of misinformation pose significant threats to aufeminin group. Advertisers are increasingly wary of associating their brands with content that could be deemed inappropriate or misleading, impacting aufeminin's appeal to major marketing partners. For instance, in 2024, a significant percentage of global marketers expressed concerns about brand safety, with studies indicating that over 70% of them actively review their digital ad placements to avoid problematic content.

Failure to robustly moderate content and ensure brand alignment could lead to reputational damage for aufeminin group. This could manifest as a decline in user trust and a subsequent reduction in advertising revenue. The broader digital media industry, as of early 2025, continues to grapple with effective content moderation strategies, with platforms investing heavily in AI and human oversight to mitigate these risks.

- Brand Safety Scrutiny: Advertisers in 2024/2025 are placing heightened emphasis on brand safety, demanding greater control over where their ads appear.

- Misinformation Impact: The spread of misinformation erodes user trust and can negatively affect the perceived credibility of publishing platforms.

- Reputational Risk: Ineffective content moderation by aufeminin group could damage its reputation, deterring both users and advertisers.

- Industry-Wide Challenge: Combating misinformation and ensuring brand safety are ongoing, complex challenges across the entire digital media landscape.

The dominance of tech giants like Google and Meta in digital advertising presents a formidable threat, as they command vast user data and sophisticated ad technologies, diverting significant ad spend. In 2024, the French digital ad market, valued around €10.5 billion, sees these international players capturing a substantial share, intensifying competition for aufeminin's ad revenue.

Shifting data privacy regulations and the deprecation of third-party cookies by browsers like Chrome pose a direct challenge to targeted advertising, a key revenue driver. Industry estimates suggest potential ad revenue reductions of up to 50% for publishers due to cookie phase-outs alone.

Rapidly evolving consumer tastes, particularly the rise of short-form video, necessitate substantial investment in new content production and adaptable strategies. Furthermore, social media platforms increasingly capture user engagement, requiring aufeminin to innovate its distribution and interaction models to remain competitive.

Economic uncertainties and potential downturns directly impact aufeminin's advertising revenue, as brands often reduce marketing budgets during unstable periods. Global advertising spending growth showed caution in 2023, with similar trends anticipated for 2024, making the company's core business sensitive to macroeconomic fluctuations.

Brand safety concerns and the prevalence of misinformation are significant threats, as advertisers become more selective about ad placement. In 2024, over 70% of global marketers reported actively reviewing ad placements to avoid problematic content, underscoring the need for robust content moderation to maintain advertiser confidence and prevent reputational damage.

SWOT Analysis Data Sources

This SWOT analysis for Aufeminin Group is built upon a robust foundation of data, including audited financial statements, comprehensive market research reports, and expert industry analyses to provide a well-rounded strategic perspective.