aufeminin group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

aufeminin group Bundle

Understanding the competitive landscape for aufeminin group reveals significant pressures from rivals and the constant threat of new entrants disrupting the digital media space. The group's ability to leverage its brand and content against established and emerging platforms is key to its sustained success.

Ready to move beyond the basics? Get a full strategic breakdown of aufeminin group’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

Content creators and talent are crucial for aufeminin's platform, encompassing journalists, writers, and video producers. The escalating demand for engaging digital content, particularly short-form video, and the booming influencer marketing sector, grant these specialized creators increased leverage. This allows them to negotiate higher fees or explore alternative income streams, potentially impacting aufeminin's operational costs.

In 2024, the digital content creation market continued its rapid expansion, with creator earnings showing significant growth. For instance, the global influencer marketing industry was projected to reach over $21 billion in 2023 and was expected to continue its upward trajectory. This trend highlights the growing value and bargaining power of skilled content creators, who are essential for aufeminin's content strategy.

Aufeminin, as part of the TF1 Group, leverages sophisticated ad-tech for programmatic advertising. This reliance on specialized providers like FreeWheel and Magnite, who offer proprietary technology and significant market share in programmatic solutions, grants them considerable bargaining power. Their essential role in aufeminin's advanced targeting and campaign management means their terms and pricing can influence aufeminin's operational costs and effectiveness.

Technology and infrastructure providers, such as cloud hosting services and content delivery networks (CDNs), hold significant bargaining power when they offer specialized, secure, or highly scalable solutions. For aufeminin, the reliance on these core services for platform performance and user experience means that providers with advanced capabilities, particularly those incorporating AI, can command stronger terms. The global cloud computing market, for instance, saw significant growth in 2024, with major players continuing to invest heavily in expanding their offerings and infrastructure, potentially increasing their leverage.

E-commerce Product Suppliers

For aufeminin's e-commerce operations, like its subscription boxes, the power of product suppliers is a key consideration. These suppliers provide everything from beauty essentials to lifestyle items.

The leverage these suppliers hold is directly tied to how unique or exclusive their products are, and how much aufeminin buys from them. For instance, if a supplier offers a highly sought-after niche beauty product not easily found elsewhere, their bargaining power increases. In 2024, the global beauty e-commerce market was valued at approximately $67.7 billion, highlighting the significant demand for such products.

While aufeminin aims to diversify its supplier network to lessen individual supplier influence, dependence on specific, in-demand brands can still tip the scales. This is particularly true for limited-edition or exclusive collaborations that drive customer acquisition and retention for subscription services. A broad supplier base can help aufeminin negotiate better terms, but the allure of exclusive products means some suppliers retain considerable sway.

- Supplier Uniqueness: The more distinctive a product, the stronger the supplier's bargaining position.

- Exclusivity Agreements: Exclusive rights to certain brands or products can significantly enhance supplier leverage.

- Procurement Volume: Larger order volumes typically give aufeminin more negotiating power, but this is counterbalanced by the supplier's importance.

- Market Trends: In a competitive e-commerce landscape, suppliers of trending or high-demand items can command better terms.

Data Providers

Data providers hold significant sway for aufeminin, especially as the company leans into data for audience targeting, content customization, and ad performance. The value of unique, high-quality, and compliant consumer data sets directly translates into supplier leverage. For instance, in 2024, the digital advertising market continued its robust growth, with data analytics and audience segmentation being key differentiators for publishers.

This reliance on external data sources can empower suppliers, as aufeminin's ability to personalize experiences and monetize its audience effectively depends on the quality and comprehensiveness of the data it acquires. The market for third-party data is substantial, with projections indicating continued expansion driven by AI and machine learning applications in marketing.

However, TF1 Group's strategic move to develop internal data solutions, such as Graph:ID, is designed to mitigate this external dependency. By building its own data infrastructure, aufeminin aims to gain greater control over its data assets and reduce the bargaining power of third-party providers over the long term. This internal investment reflects a broader industry trend towards first-party data utilization.

- Data Dependency: aufeminin's increasing reliance on data for core business functions strengthens the bargaining power of data providers.

- Data Quality Premium: Suppliers offering superior, compliant data sets command higher prices and influence.

- Internal Solutions as a Counterbalance: TF1 Group's investment in Graph:ID aims to reduce reliance on external data suppliers, thereby diminishing their bargaining power.

- Market Context: The growing importance of data analytics in digital media in 2024 underscores the strategic value of data providers.

The suppliers of essential components and services for aufeminin's operations, such as technology infrastructure and specialized content, wield considerable bargaining power. This is amplified when these suppliers offer unique, in-demand solutions or possess significant market share, as seen in the programmatic advertising and cloud computing sectors.

In 2024, the global cloud computing market was projected to reach hundreds of billions of dollars, with major providers like Amazon Web Services, Microsoft Azure, and Google Cloud dominating. Their specialized, scalable, and secure offerings mean aufeminin’s reliance on them for platform performance grants these providers leverage in pricing and terms.

Similarly, the continued growth in influencer marketing, with the industry's value surpassing $21 billion in 2023 and expected to climb further, empowers skilled content creators. Their ability to negotiate higher fees directly impacts aufeminin's content acquisition costs.

The bargaining power of suppliers is further influenced by the uniqueness of their products or services, exclusivity agreements, and the volume of procurement. For instance, suppliers of highly sought-after e-commerce items for subscription boxes benefit from the significant demand in the beauty sector, valued at approximately $67.7 billion in 2024.

| Supplier Type | Key Factors Influencing Bargaining Power | 2024 Market Context/Data Point |

|---|---|---|

| Content Creators/Talent | Demand for specialized content, influencer marketing boom | Global influencer marketing industry projected to exceed $21 billion in 2023, with continued growth. |

| Ad-Tech Providers | Proprietary technology, market share in programmatic solutions | Sophisticated ad-tech is crucial for aufeminin's programmatic advertising. |

| Cloud Hosting/CDNs | Specialized, secure, or scalable solutions, AI integration | Global cloud computing market experiencing significant growth in 2024. |

| E-commerce Product Suppliers | Product uniqueness, exclusivity, procurement volume | Global beauty e-commerce market valued at ~$67.7 billion in 2024. |

| Data Providers | Data quality, uniqueness, compliance, market reliance | Digital advertising market growth in 2024 driven by data analytics. |

What is included in the product

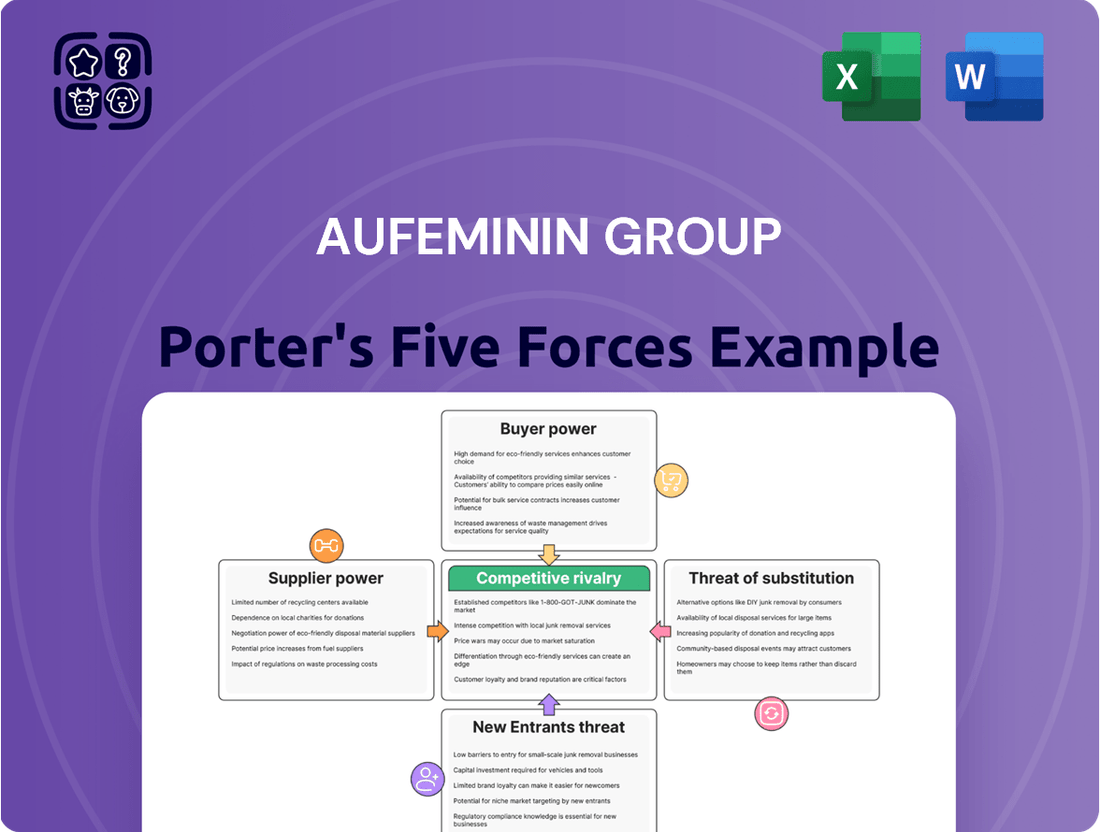

This Porter's Five Forces analysis for the aufeminin group examines the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitutes within the digital media and lifestyle content sector.

Effortlessly identify and mitigate competitive threats by visualizing the intensity of each of Porter's Five Forces, enabling proactive strategic adjustments.

Customers Bargaining Power

Advertisers hold considerable sway over aufeminin, a key revenue driver through ad placements. In France's crowded digital ad space, with alternatives like Meta and Google, advertisers can easily shift spending, giving them leverage. They expect clear returns on investment, precise targeting, and safe brand environments, pushing aufeminin to prove its worth and offer competitive rates.

E-commerce consumers, including those interacting with aufeminin's platforms, wield significant bargaining power. This is largely due to the vast array of choices available, both online and in traditional retail. Consumers can easily compare prices, product features, and delivery options across numerous vendors, making them less reliant on any single seller.

Factors like price sensitivity, the desire for convenience, and the expectation of personalized experiences heavily influence these consumers. A slightly better offer or a more seamless user journey from a competitor can quickly lead to a customer switch. This dynamic is further amplified by the continuous growth of e-commerce in France; for instance, online retail sales in France were projected to reach approximately €116 billion in 2024, indicating a substantial and competitive market landscape.

Digital service subscribers for aufeminin possess significant bargaining power. If the perceived value of premium or subscription-based digital services diminishes, or if more attractive alternatives emerge, subscribers can easily cancel their subscriptions or switch providers. This is particularly relevant as subscription models become more prevalent in e-commerce and content delivery, indicating consumer readiness to pay for curated experiences but also underscoring their demand for continuous improvement and personalization.

Audience/Users (Content Consumption)

The bargaining power of customers, in aufeminin's case, refers to the audience's influence. While they don't pay for content directly, their engagement is aufeminin's primary asset for attracting advertisers. In 2024, the digital advertising market continues to be highly competitive, with advertisers prioritizing platforms that demonstrate strong and consistent audience reach.

Users have an abundance of free content choices across numerous digital platforms. They can easily shift their attention to social media or other content providers if aufeminin's offerings are not engaging, relevant, or if the user experience is suboptimal. This ease of switching significantly empowers the audience.

To mitigate this, aufeminin must focus on retaining its audience by consistently delivering compelling and personalized content. This is vital for maintaining loyalty and ensuring the continued value of its platform to advertisers.

- Audience Engagement is Key: In 2023, average time spent on digital media platforms by users globally reached over 7 hours per day, highlighting the competition for user attention.

- Content Relevance Drives Retention: Studies in 2024 indicate that personalized content can increase user engagement by up to 20%.

- Low Switching Costs: The availability of countless free content alternatives means users face minimal barriers to switching platforms, amplifying their bargaining power.

TF1 Group (Internal Stakeholder)

As an integral part of the TF1 Group, aufeminin experiences significant influence over its strategic decisions and resource deployment. TF1 Group, in essence, functions as a powerful internal stakeholder, utilizing aufeminin's digital assets and user base to bolster its overarching digital strategy and foster cross-portfolio synergies, notably through initiatives like the development of TF1+.

This internal dynamic means TF1 Group's demand for aufeminin's content and audience engagement directly impacts aufeminin's operational focus. For instance, in 2023, TF1 Group reported a revenue of €2.5 billion, highlighting the scale of its operations and its capacity to direct resources towards integrated digital platforms.

- TF1 Group's Strategic Integration: aufeminin's operations are directly shaped by TF1 Group's broader digital transformation objectives.

- Internal Demand Driver: TF1 Group leverages aufeminin's platform to enhance its digital presence and audience reach.

- Synergy Focus: The development of platforms like TF1+ demonstrates TF1 Group's strategy to create value across its media assets.

- Financial Influence: TF1 Group's substantial revenue, reported at €2.5 billion in 2023, underscores its ability to dictate strategic priorities for its subsidiaries like aufeminin.

The bargaining power of customers for aufeminin is primarily represented by its audience, whose engagement is crucial for attracting advertisers. With a vast array of free digital content available in 2024, users can easily switch to competing platforms if aufeminin's content or user experience is not compelling or personalized enough. This constant competition for attention, with global users spending over 7 hours daily on digital media in 2023, means aufeminin must prioritize audience retention through high-quality, relevant content.

aufeminin's audience, while not direct payers, holds significant leverage as their attention is the core asset for advertisers. The ease with which users can access alternative content sources in 2024 means aufeminin must continually innovate to maintain engagement. Personalized content, which studies in 2024 suggest can boost engagement by up to 20%, is a key strategy to counter the low switching costs inherent in the digital content landscape.

The bargaining power of aufeminin's audience is amplified by the sheer volume of free content alternatives available. Users can readily shift their focus to social media or other content providers if aufeminin fails to deliver engaging, relevant material or a smooth user experience. This dynamic underscores the necessity for aufeminin to focus on delivering value and maintaining audience loyalty to remain attractive to advertisers.

| Factor | Impact on aufeminin | Mitigation Strategy |

|---|---|---|

| Audience Attention Competition | High; Users spend 7+ hours daily on digital media (2023) | Deliver highly engaging and relevant content |

| Availability of Free Alternatives | High; Users can easily switch platforms | Focus on personalization and unique value proposition |

| Demand for Personalization | High; Personalized content can boost engagement by 20% (2024 studies) | Invest in data analytics and content customization |

Full Version Awaits

aufeminin group Porter's Five Forces Analysis

This preview shows the exact Porter's Five Forces Analysis of the aufeminin group you'll receive immediately after purchase, offering a comprehensive examination of competitive forces within its industry. You will gain access to a professionally formatted document detailing the intensity of rivalry, the bargaining power of buyers and suppliers, the threat of new entrants, and the threat of substitute products. This complete analysis is ready for your immediate use, ensuring no surprises or placeholder content.

Rivalry Among Competitors

Aufeminin operates in a crowded digital space, facing intense rivalry from other women-focused media platforms. These competitors, ranging from established brands to emerging niche sites, all vie for the attention of the same female demographic with content spanning fashion, beauty, health, and lifestyle.

The market is highly fragmented, meaning there are many companies competing for a limited pool of audience engagement and advertising revenue. For instance, in 2024, the digital advertising market for lifestyle content continues to be highly competitive, with brands allocating budgets across multiple platforms to reach women effectively.

To thrive, aufeminin must differentiate itself. This involves offering unique content that resonates deeply with its audience, fostering a strong sense of community, and providing an exceptional user experience that encourages repeat visits and loyalty.

Major social media platforms like TikTok, Instagram, and YouTube are intense rivals for aufeminin group, acting as significant content hubs and e-commerce avenues. These platforms command substantial user attention and advertising budgets, diverting them from traditional digital publishers.

In 2024, global social media ad spending was projected to surpass $280 billion, demonstrating the immense scale of competition. TikTok, in particular, has seen explosive growth, with its user base reaching over 1 billion monthly active users by early 2024, directly challenging established platforms.

This intense rivalry is evident in aufeminin's strategic positioning of TF1+ as a premium alternative to YouTube, underscoring the direct competition for audience engagement and advertising revenue in the digital content landscape.

General lifestyle and news portals, even those not exclusively focused on women, pose a significant competitive threat to aufeminin group. These broader platforms often boast established brand recognition and extensive content libraries, drawing in a wide audience. For instance, major news organizations with dedicated lifestyle sections, like those found on CNN or the BBC, compete directly for reader attention and, consequently, advertising dollars.

Traditional Media Companies with Strong Digital Presence

Established French media conglomerates are aggressively pursuing digital transformation, intensifying rivalry for aufeminin. Companies like Vivendi and TF1 are channeling significant investments into their streaming services and digital content offerings. This strategic pivot directly challenges aufeminin's established position in both linear and digital advertising markets.

These competitors are capitalizing on their extensive content libraries and strong brand equity to draw audiences to their digital platforms. For instance, TF1’s MyTF1 platform and Vivendi’s Canal+ streaming services offer a wide array of content, directly competing for user attention and advertising spend. This leverages existing brand loyalty, making it harder for aufeminin to capture new digital audiences.

- Increased Digital Ad Spend Competition: In 2024, the French digital advertising market is projected to grow, but competition for these revenues is fierce, with traditional players increasing their digital investment.

- Content Library Leverage: Competitors are using their deep back catalogs of popular shows and films to populate their streaming services, a significant advantage against newer digital-native platforms.

- Brand Recognition Advantage: Established media brands benefit from higher consumer trust and awareness, which translates into stronger initial engagement for their digital ventures compared to less recognized entities.

Niche Content Creators and Influencers

The growing prominence of individual content creators and micro-influencers, especially within beauty and lifestyle niches, significantly fragments the competitive environment. These creators cultivate deeply engaged audiences, directly monetizing through brand collaborations and direct sales. This trend challenges established platforms by siphoning off niche market segments and advertising revenue.

By 2024, the influencer marketing industry was projected to reach approximately $21.1 billion, a testament to the power of these individual creators. For instance, a single successful beauty influencer might command fees upwards of $10,000 for a sponsored post, directly competing for marketing spend that might otherwise go to larger media groups like aufeminin.

- Fragmented Market: The rise of individual creators makes the market highly atomized, with many small players competing for attention.

- Direct Monetization: Influencers bypass traditional platforms by directly partnering with brands, capturing value previously held by media conglomerates.

- Niche Audience Capture: Creators excel at building loyal followings within specific niches, making them attractive alternatives for advertisers targeting specialized demographics.

- Revenue Diversion: Advertising budgets are increasingly diverted from larger platforms to individual influencers, impacting revenue streams for companies like aufeminin.

Aufeminin faces intense competition from a wide array of digital platforms, including social media giants and established media conglomerates. The market is fragmented, with numerous players vying for audience attention and advertising revenue, making differentiation crucial for survival and growth.

Major social media platforms like TikTok and Instagram are significant rivals, commanding substantial user engagement and advertising budgets. By 2024, global social media ad spending was projected to exceed $280 billion, highlighting the immense competitive pressure.

Established French media groups are also intensifying rivalry through aggressive digital investments, leveraging their brand recognition and content libraries to attract audiences to their digital offerings.

The rise of individual content creators and micro-influencers further fragments the landscape, directly competing for advertising spend through brand collaborations.

| Competitor Type | Key Competitive Actions | Impact on Aufeminin |

| Social Media Platforms (TikTok, Instagram) | High user engagement, vast content libraries, direct e-commerce integration | Divert audience attention and advertising budgets |

| Established Media Conglomerates (TF1, Vivendi) | Digital transformation, investment in streaming services, leveraging brand equity | Intensify competition for digital advertising revenue and audience share |

| Individual Creators/Influencers | Niche audience building, direct brand partnerships, personalized content | Fragment market, siphon niche advertising spend, challenge traditional media models |

SSubstitutes Threaten

Social media platforms are a significant threat of substitutes for aufeminin. Users increasingly discover content and products directly on platforms like TikTok and Instagram, bypassing traditional websites. In 2024, it's estimated that over 4.9 billion people actively use social media globally, with a substantial portion using these platforms for content discovery and purchasing decisions.

This shift means users may never visit aufeminin's site if they find what they need through social feeds or influencer endorsements. For instance, a user looking for fashion advice might find it through a popular fashion influencer on Instagram rather than searching aufeminin's articles, directly impacting aufeminin's traffic and engagement metrics.

The rise of direct-to-consumer (DTC) brand websites presents a significant threat of substitutes for platforms like aufeminin. Many fashion, beauty, and lifestyle brands are now channeling substantial investment into their own e-commerce platforms and content marketing. This direct engagement allows consumers to bypass intermediary sites for both product discovery and purchasing.

In 2024, the DTC e-commerce market continued its robust growth, with many direct brands reporting double-digit percentage increases in online sales year-over-year. For instance, the global DTC e-commerce market was projected to reach hundreds of billions of dollars by the end of 2024, indicating a strong consumer preference for direct brand interaction and a reduced reliance on third-party content sites for purchasing decisions.

Offline retail and in-person experiences present a significant threat of substitutes for online platforms, particularly in categories like beauty and fashion. Physical stores and beauty counters provide a tactile and sensory engagement that e-commerce struggles to match, allowing consumers to see, touch, and try products before purchasing.

In 2024, the allure of these offline experiences continues to draw consumers, with reports indicating that a substantial portion of beauty sales still occur in physical retail environments. For instance, while online beauty sales have grown, brick-and-mortar stores remain crucial for discovery and impulse purchases, driven by the desire for immediate gratification and personalized service.

Specialized Apps and Niche Communities

Dedicated mobile applications and niche online communities pose a significant threat of substitution for broad digital platforms like those within the aufeminin group. For instance, specialized health tracking apps offer more in-depth functionality than general lifestyle content, and parenting support forums provide targeted community engagement that a broader platform might struggle to replicate. These specialized services cater to specific user needs with greater precision.

The rise of these specialized substitutes is evident in market trends. By mid-2024, the global mobile health app market was projected to reach over $100 billion, indicating a strong user preference for focused digital solutions. Similarly, the engagement within niche online communities continues to grow, with many reporting high user retention rates due to the tailored content and peer support offered.

- Specialized Functionality: Apps for fitness tracking, meal planning, or virtual beauty try-ons offer features far beyond general content, directly substituting for those specific user needs.

- Targeted Communities: Niche forums and social media groups provide highly relevant discussions and support, substituting for the community aspect of broader platforms.

- User Engagement: In 2023, engagement rates on specialized apps often surpassed those on generalist platforms, demonstrating a clear preference for focused experiences.

- Market Growth: The increasing investment in and adoption of specialized digital services highlights their growing competitive threat to diversified digital media groups.

Traditional Broadcast Media (Linear TV)

Despite the increasing migration to digital platforms, traditional broadcast media, particularly linear television, continues to exert influence. In 2024, linear TV advertising spend remained substantial, demonstrating its enduring appeal for reaching broad audiences, especially among older demographics. For instance, a significant portion of advertising budgets still allocates funds to traditional TV, indicating its perceived value in delivering reach and impact.

Within the aufeminin group's ecosystem, which is part of the larger TF1 Group, other television channels and their companion digital platforms represent viable substitutes for content consumption. These alternatives offer viewers choices for entertainment and news, directly competing with the digital content aufeminin provides. This competitive landscape means that aufeminin must continually innovate its digital offerings to retain user engagement against the backdrop of established broadcast players.

- Linear TV advertising spend in key markets remains robust, underscoring its continued relevance.

- Demographic skews in viewership mean certain segments of the population still heavily rely on traditional broadcast.

- Competitor TV channels and their digital extensions offer direct substitutes for user attention and engagement.

- The integrated nature of TF1 Group allows for cross-promotion, but independent channels still present a competitive threat.

The threat of substitutes for aufeminin is multifaceted, encompassing digital and traditional channels. Social media platforms like TikTok and Instagram are increasingly becoming primary sources for content discovery and purchasing, drawing users away from dedicated websites. In 2024, with over 4.9 billion global social media users, this trend directly impacts aufeminin's reach.

Direct-to-consumer (DTC) brands are also a significant substitute, investing heavily in their own e-commerce and content marketing. The DTC market's projected multi-billion dollar valuation in 2024 highlights a consumer preference for direct brand interaction, reducing reliance on intermediary sites.

Offline retail and specialized digital services, such as niche apps and online communities, further substitute for aufeminin's offerings. While offline retail provides a tactile experience, specialized apps offer deeper functionality, with the global mobile health app market alone expected to exceed $100 billion by mid-2024.

Traditional linear television, despite the digital shift, remains a substitute, especially for broad audience reach. In 2024, substantial TV advertising spend indicates its continued relevance, with TF1 Group's own television channels and digital platforms also competing for viewer attention.

| Substitute Category | Key Characteristics | 2024 Impact/Data Point |

|---|---|---|

| Social Media Platforms | Content discovery, influencer marketing, direct purchasing | 4.9 billion+ global users; preference for feed-based discovery |

| Direct-to-Consumer (DTC) Brands | Own e-commerce, brand-focused content, direct customer relationships | Robust market growth, significant investment in digital presence |

| Specialized Digital Services | Niche functionality (e.g., health apps), focused communities | Mobile health market projected >$100 billion; high engagement in niche forums |

| Traditional Broadcast Media | Broad audience reach, established brand recognition | Significant linear TV ad spend; continued relevance for certain demographics |

Entrants Threaten

The digital landscape has dramatically lowered the barriers to entry for content creators. Platforms like YouTube, TikTok, and WordPress are readily available, often with free or very affordable options for setting up a channel or blog. This accessibility means that individuals or small groups can now compete with established media companies without significant upfront investment, directly impacting the threat of new entrants in the digital content space.

The rise of AI-powered content generation poses a significant threat to aufeminin group. Tools capable of producing text, images, and video at speed and lower cost dramatically reduce the barriers to entry for new players. For instance, by mid-2024, many AI writing assistants were demonstrating capabilities to generate blog posts and social media updates in minutes, a process that previously took hours of human effort.

This technological shift means that emerging competitors can scale their content output rapidly without substantial upfront investment in creative teams or expensive production equipment. A new platform could leverage AI to flood niche markets with relevant content, quickly building an audience and challenging established players like aufeminin group, which may have higher operational costs associated with traditional content creation methods.

The digital media and e-commerce sectors remain magnets for venture capital, with global investment in tech startups reaching hundreds of billions in recent years. For example, in 2023, venture capital funding for tech startups globally, while seeing a dip from peak years, still represented significant capital availability.

This robust capital flow empowers new digital startups to scale rapidly, attract top talent, and launch aggressive marketing initiatives. Such a financial runway allows them to quickly capture market share, posing a direct threat to established companies like aufeminin by intensifying competition.

Niche Market Exploitation

New entrants can effectively target and cultivate highly engaged communities within specific, underserved segments of the women's lifestyle market. By concentrating on particular interests or demographic groups, these emerging platforms can foster strong brand loyalty and secure a dedicated user base before established, broader platforms can react. For instance, a platform focusing solely on sustainable fashion for young professionals might attract a significant following, as seen with the growth of brands like Reformation, which saw revenue increase by approximately 50% between 2021 and 2023, demonstrating the power of niche appeal.

This niche market exploitation poses a threat to aufeminin group by fragmenting its potential audience. Smaller, agile competitors can gain traction by offering tailored content and experiences that resonate deeply with specific consumer groups. This can lead to a gradual erosion of market share for larger, more generalized platforms that struggle to cater to such specialized needs. In 2024, the digital advertising market for lifestyle content is projected to reach over $150 billion globally, with a significant portion of growth attributed to hyper-targeted campaigns within niche communities.

The success of these niche entrants can be amplified by several factors:

- Specialized Content: Offering highly relevant and curated content that speaks directly to the needs and desires of a defined audience.

- Community Building: Fostering a sense of belonging and interaction among users with shared interests, creating a sticky platform experience.

- Agile Marketing: Utilizing cost-effective digital marketing strategies, such as influencer collaborations and social media engagement, to reach target demographics efficiently.

- Data-Driven Personalization: Leveraging user data to provide personalized recommendations and experiences, enhancing user satisfaction and retention.

Technological Disruption & Emerging Platforms

Emerging technologies like Web3 and the metaverse present a significant threat of new entrants for aufeminin group. These innovations can spawn entirely new platforms for content and e-commerce, potentially bypassing established players. For instance, the projected growth of the metaverse, estimated to reach $500 billion by 2025, indicates a substantial new digital frontier where novel business models can emerge rapidly.

Companies adept at leveraging these disruptive shifts, such as those focusing on decentralized social networks or immersive shopping experiences, could gain a substantial first-mover advantage. This could fragment aufeminin's existing user base and revenue streams. The rise of social commerce, which saw global sales projected to reach $1.2 trillion by 2025, highlights how new platforms can quickly capture market share by integrating shopping directly into social interactions.

- Web3 and Metaverse: Potential for entirely new digital ecosystems and platforms.

- Social Commerce Growth: Projected $1.2 trillion global sales by 2025, indicating rapid adoption of new sales channels.

- First-Mover Advantage: Early adopters of disruptive tech can capture significant market share.

- Platform Fragmentation: New entrants may draw users and advertisers away from existing aufeminin platforms.

The threat of new entrants for aufeminin group is amplified by the ease with which digital platforms can be established and scaled. Low barriers to entry, fueled by readily available technology and venture capital, allow agile startups to quickly gain traction.

AI content generation further lowers these barriers, enabling new players to produce content at speed and scale, challenging established players with potentially higher operational costs. For example, AI writing assistants in 2024 can generate blog posts in minutes, a task that previously took hours.

New entrants also effectively target niche markets, building strong communities and brand loyalty. This can fragment aufeminin's audience, as seen with specialized platforms gaining significant followings. The digital advertising market for lifestyle content, projected to exceed $150 billion globally in 2024, shows the potential for hyper-targeted campaigns within these niches.

Emerging technologies like Web3 and the metaverse also present opportunities for new platforms to bypass existing players and capture market share, as indicated by the metaverse's projected growth to $500 billion by 2025.

| Factor | Impact on New Entrants | Example/Data Point |

|---|---|---|

| Digital Platform Accessibility | Lowers barriers to entry significantly | Free/affordable tools for blogs and channels |

| AI Content Generation | Enables rapid content scaling | AI writing assistants producing content in minutes (2024) |

| Venture Capital Funding | Provides capital for rapid growth | Significant global tech startup funding in 2023 |

| Niche Market Exploitation | Builds strong community loyalty | Growth of specialized fashion brands |

| Emerging Technologies (Web3, Metaverse) | Creates new ecosystems and business models | Metaverse projected to reach $500 billion by 2025 |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Aufeminin Group is built upon a robust foundation of data, drawing from Aufeminin's official annual reports, investor relations disclosures, and publicly available financial statements. This ensures an accurate understanding of the company's financial health and strategic positioning.

Additionally, we incorporate insights from reputable industry analysis firms, market research reports focusing on the digital media and content sector, and relevant trade publications. This secondary data provides a broader context for competitive dynamics and market trends affecting Aufeminin.