aufeminin group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

aufeminin group Bundle

Unlock the strategic potential of the aufeminin group with a comprehensive BCG Matrix analysis. Understand which of their brands are market leaders, which are generating consistent revenue, and which require careful consideration for future investment.

This preview offers a glimpse into the powerful insights available. Purchase the full BCG Matrix to gain a detailed breakdown of each product's position, enabling you to make informed decisions about resource allocation and drive sustainable growth for the aufeminin group.

Stars

TF1+ is demonstrating robust expansion within the French streaming landscape. The platform saw a notable surge in monthly streamers and viewing hours throughout 2024 and into the first quarter of 2025, signaling its growing appeal. This upward trajectory is further evidenced by a substantial 39.2% increase in advertising revenue in 2024.

The platform's strategic positioning as a premium alternative to YouTube highlights its significant market growth potential and its ambition to dominate the free streaming segment. TF1 Group's commitment to enhancing its advanced advertising technology, implementing data-centric strategies, and forging new content collaborations are key drivers bolstering TF1+'s position as a market star.

TF1 PUB's innovative digital advertising solutions, including the upcoming Shoppable Ads and Playable Ads in 2025, solidify aufeminin group's strong market position. This focus on cutting-edge formats caters to evolving advertiser demands for engaging and interactive campaigns, a key driver for growth in the digital ad space.

The introduction of Graph:ID in January 2025 will empower aufeminin group with a sophisticated data-driven approach. This tool is designed to enhance audience segmentation and support full-funnel marketing, addressing the critical need for precision and effectiveness in digital advertising. In 2024, the digital advertising market saw significant growth, with global digital ad spending projected to reach over $600 billion, highlighting the immense opportunity for platforms offering advanced targeting capabilities.

Aufeminin group's robust digital content leadership, covering fashion, beauty, health, parenting, and lifestyle, maintains a significant market share. This core business is positioned as a strong Star within the BCG Matrix, benefiting from a consistently growing niche audience.

The increasing reliance on digital media and social platforms for content discovery among women, a trend projected to intensify through 2025, fuels high market growth for platforms like aufeminin. This digital shift directly supports their Star status, indicating continued strong performance and potential for further expansion.

Strategic Content Aggregation on TF1+

TF1+'s strategic aggregation of third-party content, including partnerships with L'Equipe, Le Figaro, and Deezer, significantly broadens its appeal. This move effectively doubles the available programming hours on the platform, a crucial factor in attracting and retaining viewers in the crowded streaming market.

This content aggregation strategy is designed to boost TF1+'s market share. By offering a more diverse and extensive library, TF1+ aims to become a go-to destination for a wider audience, enhancing its competitive standing.

- Expanded Content Library: Partnerships with L'Equipe, Le Figaro, and Deezer enrich TF1+'s offerings.

- Increased Programming Hours: The aggregation strategy doubles the available viewing time on TF1+.

- Audience Growth Potential: A broader content selection is expected to attract a larger and more diverse user base.

- Market Share Enhancement: TF1+ aims to solidify its position in the competitive streaming landscape through this expanded offering.

Innovation in User Engagement and Personalization

Innovation in user engagement and personalization is a key driver for growth within the digital media landscape, directly impacting aufeminin group's performance. TF1+'s strategic focus on personalized content engines and AI-driven campaigns, slated for rollout in Q1 2025, aims to capture a larger share of user attention and advertising revenue.

These advancements are crucial for staying competitive, as consumers increasingly expect tailored digital experiences. The introduction of new ad formats, such as Cover+ and In-Content Banners, represents a significant push into high-growth monetization areas, aligning with aufeminin group's overall digital strategy.

- Personalized Content Engines: TF1+ is investing in sophisticated algorithms to deliver content recommendations tailored to individual user preferences, enhancing engagement.

- AI-Driven Campaigns: The use of artificial intelligence in marketing campaigns allows for more targeted and effective user acquisition and retention efforts.

- New Ad Formats: Cover+ and In-Content Banners are designed to offer more integrated and less intrusive advertising experiences, potentially increasing advertiser appeal and CPMs.

- Q1 2025 Rollout: This planned launch signifies a proactive approach to leveraging emerging technologies and consumer trends in the digital advertising space.

TF1+ is a prime example of a Star within the BCG Matrix, showcasing rapid growth and a dominant market position in the French streaming sector. Its expansion is clearly demonstrated by significant increases in monthly streamers and viewing hours throughout 2024 and early 2025. This strong performance is further bolstered by a substantial 39.2% surge in advertising revenue in 2024, underscoring its high market share and growth rate.

Aufeminin group's core digital content business, covering popular lifestyle areas, also holds a strong Star position. This is driven by a consistently growing niche audience and the increasing reliance of women on digital platforms for content discovery, a trend expected to accelerate through 2025. This positions the group for continued strong performance and further market expansion.

| Business Unit | Market Growth | Market Share | BCG Category |

|---|---|---|---|

| TF1+ (Streaming) | High | High | Star |

| Aufeminin Digital Content | High | High | Star |

| TF1 PUB (Digital Advertising) | High | High | Star |

What is included in the product

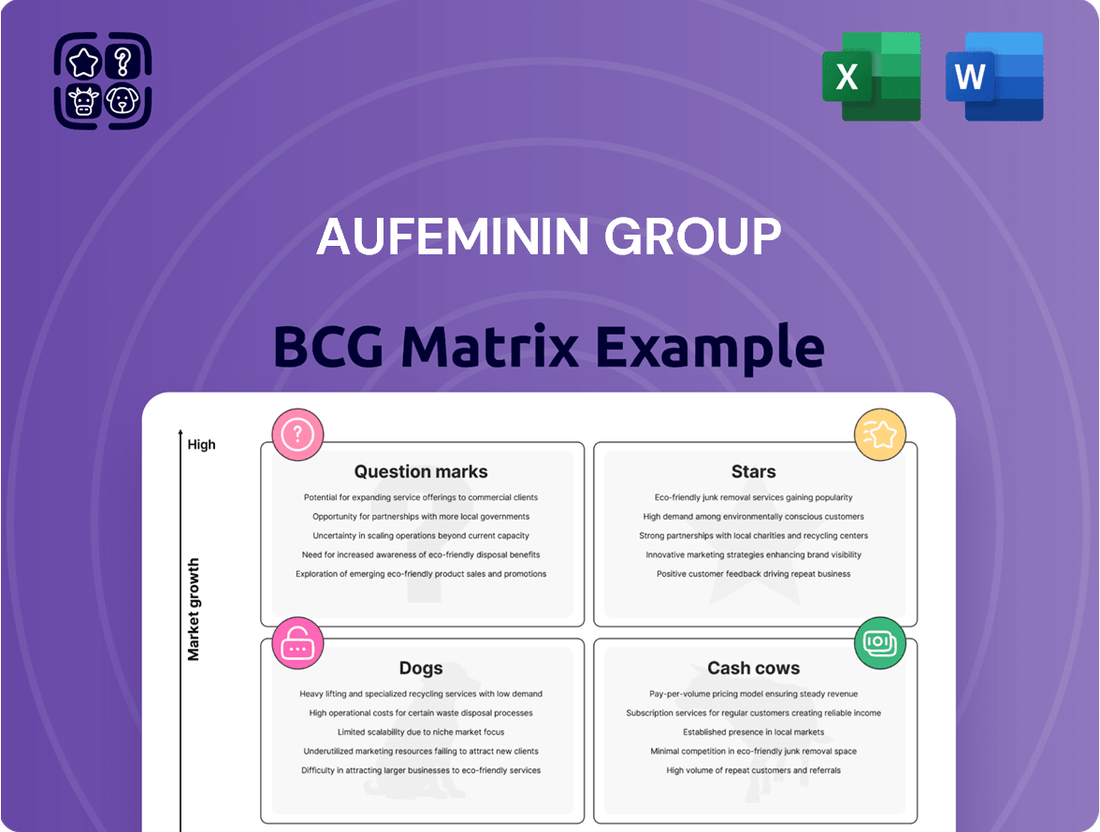

The aufeminin Group BCG Matrix analyzes its brands, identifying Stars for growth, Cash Cows for funding, Question Marks for potential, and Dogs for divestment.

The aufeminin group BCG Matrix offers a clear, visual snapshot of business unit performance, simplifying complex portfolio analysis for strategic decision-making.

Cash Cows

Despite shifts in the advertising landscape, TF1's flagship channel continues to dominate key demographics, notably women under 50. This enduring audience appeal translates into a reliable and substantial revenue stream, solidifying its position as a mature product with a commanding market share in a segment experiencing limited growth.

Aufeminin's established e-commerce verticals, particularly in beauty and fashion, are strong contenders for cash cows. These segments benefit from the group's extensive audience and long-standing market presence, leading to predictable revenue streams. For instance, in 2024, the beauty e-commerce market globally was projected to reach over $70 billion, with established players like those within aufeminin often holding significant market share.

These mature verticals likely exhibit stable profit margins due to achieved competitive advantages and brand recognition. Unlike high-growth areas requiring substantial investment, these cash cows generate consistent cash flow with minimal need for aggressive new capital expenditure, allowing aufeminin to reinvest profits elsewhere.

Aufeminin's core lifestyle content portfolios, covering fashion, beauty, health, and parenting, represent a significant Cash Cow within their portfolio. This extensive library of evergreen content, cultivated over many years, holds a dominant market share in its respective niches.

This established content base requires minimal new investment for promotion, consistently drawing and retaining a substantial audience. In 2024, such content is expected to generate stable advertising and engagement revenue, solidifying its position as a reliable income stream for the group.

Subscription-based or Premium Digital Services (if any exist)

If aufeminin group were to offer premium digital services, such as exclusive content, advanced tools, or ad-free experiences, these would likely be classified as cash cows. This is due to their potential to generate consistent, recurring revenue from a loyal and engaged audience. The established user base minimizes the need for extensive marketing, leading to lower acquisition costs and a strong position in a mature market segment.

For instance, a hypothetical premium subscription service from aufeminin, offering in-depth lifestyle guides or expert Q&A sessions, could leverage its existing brand recognition. This would allow it to command a significant market share within its niche. In 2024, the digital subscription market continued its growth, with many media companies reporting substantial increases in recurring revenue streams, underscoring the potential for such services.

- Predictable Revenue: Subscription models offer a stable income stream, crucial for financial planning.

- Low Acquisition Costs: Existing user loyalty reduces the expense of acquiring new subscribers.

- Mature Market Position: These services often operate in established niches where aufeminin can hold a high market share.

- Profitability Potential: High revenue with controlled costs translates to strong profit margins.

Strategic Partnerships and Affiliations

Existing, well-established partnerships for content distribution and affiliate marketing within the digital ecosystem, particularly those that have reached maturity, contribute a steady stream of revenue. These represent high market share in a stable, low-growth operational area for aufeminin group, generating consistent cash flow.

These mature affiliations, often involving long-term contracts with minimal ongoing management needs, are prime examples of Cash Cows. For instance, in 2024, affiliate marketing revenue for many digital media groups continued to be a significant contributor, with partnerships in fashion and lifestyle sectors showing resilience. Aufeminin's established relationships in these areas are expected to maintain their strong performance.

- Mature affiliate marketing programs provide consistent revenue.

- Cross-promotional partnerships enhance user acquisition and retention.

- Stable, low-growth markets ensure predictable cash flow.

- These strategic alliances require minimal ongoing investment.

Aufeminin's established lifestyle content, particularly in fashion and beauty, functions as a Cash Cow. These segments benefit from a dominant market share in low-growth but stable niches, generating predictable revenue with minimal new investment. In 2024, the digital content market continued to see established players leverage their evergreen libraries for consistent advertising and engagement income.

These mature verticals likely exhibit stable profit margins due to achieved competitive advantages and brand recognition. Unlike high-growth areas requiring substantial investment, these cash cows generate consistent cash flow with minimal need for aggressive new capital expenditure, allowing aufeminin to reinvest profits elsewhere.

The group's core lifestyle content portfolios, covering fashion, beauty, health, and parenting, represent a significant Cash Cow. This extensive library of evergreen content, cultivated over many years, holds a dominant market share in its respective niches, requiring minimal new investment for promotion.

These mature affiliations, often involving long-term contracts with minimal ongoing management needs, are prime examples of Cash Cows. For instance, in 2024, affiliate marketing revenue for many digital media groups continued to be a significant contributor, with partnerships in fashion and lifestyle sectors showing resilience.

Preview = Final Product

aufeminin group BCG Matrix

The BCG Matrix analysis you are currently viewing is the identical, fully comprehensive document you will receive immediately after purchase. This means you'll get the complete strategic breakdown of Aufeminin's portfolio, with no watermarks or demo content, ready for immediate application in your business planning.

Dogs

Outdated or niche content archives, often found in the 'Dogs' quadrant of the BCG Matrix, represent assets with low market share in low-growth segments. For instance, a media group like aufeminin might have older lifestyle articles from the early 2010s that no longer align with current reader interests, leading to minimal traffic and ad revenue. These archives can become a drain, incurring hosting and maintenance costs without contributing significantly to overall engagement or profitability.

Within the aufeminin group's digital ecosystem, underperforming legacy products or features would fall into the 'dog' category of the BCG matrix. These are elements that exhibit low user engagement and minimal market growth. For instance, a dated forum feature that has seen a decline in active participation, perhaps with only a few hundred daily active users compared to more interactive community tools, exemplifies such a product.

These 'dogs' often represent past innovations that have been outpaced by newer technologies or changing user preferences. Consider a specific app module that launched in 2020 but has since experienced a consistent year-over-year decline in downloads, potentially dropping by 15% annually. This stagnation, coupled with a low market share, indicates it's not contributing significantly to the group's overall performance.

Segments where aufeminin faces intense new competition, like emerging social media platforms or direct-to-consumer (DTC) brands, could be classified as Dogs. These areas often see aufeminin's market share shrink in a low-growth environment, making recovery efforts costly and unlikely to succeed. For instance, a niche fashion content area where a new DTC brand captures significant audience attention, leaving aufeminin with declining engagement and ad revenue, exemplifies this.

Non-core, Divested or Downsized Business Units

Non-core, divested, or downsized business units within the aufeminin group's BCG Matrix would represent their 'Dogs'. These are segments that historically showed little promise or failed to gain traction. For instance, any past ventures or acquisitions that were divested due to poor performance or low market share would fit this category. Their eventual disposal highlights their status as low-return assets that no longer align with the company's strategic direction.

The aufeminin group, like many media and digital companies, has likely experienced periods of restructuring. While specific divestitures are not publicly detailed in a way that directly maps to a BCG matrix for past periods, the general trend in the digital media landscape often involves shedding underperforming or non-strategic assets. For example, in 2023, many digital publishers downsized or sold off niche content verticals that struggled to monetize effectively or compete for audience attention.

- Divested Ventures: Past acquisitions or internal projects that failed to achieve profitability or significant market share.

- Downsized Segments: Business units that saw reduced investment and operational scope due to declining relevance or profitability.

- Low Growth Potential: Units operating in stagnant or shrinking markets, offering minimal future upside for the group.

- Historical Underperformers: Assets that consistently generated low returns or incurred losses, necessitating their removal from the portfolio.

Content Formats with Declining Audience Preference

Certain content formats are experiencing a noticeable dip in popularity across the digital realm. For aufeminin, formats like lengthy, text-heavy articles without strong visual components or interactive elements are likely candidates for the dogs quadrant in a BCG matrix. Engagement rates for these types of pieces have been steadily decreasing, as audiences increasingly favor more dynamic and easily digestible content.

This decline in preference translates directly to lower market share and engagement for aufeminin in these specific areas. For instance, reports from late 2023 and early 2024 indicate a significant drop in time spent on static, non-video content for many publishers. Investing further resources into these underperforming formats would likely result in diminishing returns.

Consider these formats as potential dogs:

- Static, text-only articles: These often struggle to capture attention in a visually saturated digital environment.

- Infographics with low interactivity: While visuals are important, static infographics can be outperformed by dynamic or animated versions.

- Long-form written content without multimedia integration: Audiences often prefer a mix of text, images, and video to stay engaged.

- Forums or comment sections with low moderation and activity: These can become ghost towns if not actively managed and populated.

Dogs within the aufeminin group's BCG Matrix represent offerings with low market share in low-growth industries. These are often legacy products or content that have been surpassed by newer trends or technologies. For instance, older, less interactive content formats that see minimal user engagement and generate negligible revenue would fit this category.

These assets typically require ongoing maintenance but provide little return, acting as a drain on resources. A key characteristic is their inability to gain traction in a market that is not expanding. For example, a niche content vertical that has seen its audience shrink consistently over the past few years exemplifies a 'dog'.

In 2024, many digital media companies, including those in the aufeminin group's sphere, are actively pruning such assets. This strategy aims to reallocate resources towards more promising growth areas. The focus is on efficiency and maximizing the return on investment across the entire portfolio.

Question Marks

TF1+'s new digital initiatives, such as Shoppable Ads and the forthcoming Graph:ID platform launching in 2025, are positioned as potential Stars within the aufeminin group's BCG Matrix. These ventures operate in the rapidly expanding digital advertising and e-commerce sectors, indicating a promising future.

However, their current market share and ultimate commercial viability are still developing. Significant investment is necessary to nurture these nascent projects and solidify their competitive standing in these high-growth markets.

TF1 Group's strategic push to expand TF1+ into new French-speaking markets globally presents a significant growth avenue. This ambition taps into a large, potentially underserved audience eager for French-language content.

However, this expansion is not without its challenges. Penetrating these new territories, estimated to include millions of potential new users across Africa, Canada, and other regions, will necessitate considerable upfront investment in marketing, content localization, and infrastructure. This positions these new geographic markets as potential stars or question marks within the BCG matrix, depending on execution and competitive response.

Emerging Femtech and niche health/wellness verticals represent potential stars for aufeminin. These sectors are experiencing rapid growth, with the global Femtech market projected to reach $60 billion by 2027, up from an estimated $25 billion in 2022. Aufeminin's existing audience base provides a strong foundation to enter these markets, but significant investment will be needed to build substantial market share.

Integration of Advanced AI for Content Creation/Personalization

Integrating advanced AI for personalized content and user experience at aufeminin positions the company in a Question Mark quadrant. While the market for AI-driven content is expanding, with global AI market size projected to reach over $1.5 trillion by 2030, aufeminin needs to navigate significant investment and development costs to gain a competitive edge and demonstrate a clear return on investment.

The challenge lies in translating AI capabilities into tangible user engagement and revenue growth. For instance, while platforms like Netflix have seen success with AI-driven recommendations, achieving similar personalization at scale for diverse content like aufeminin's requires sophisticated data analysis and continuous model refinement. The rapid evolution of AI technology means ongoing R&D is crucial, but also carries inherent risks.

- Market Growth: The global AI market is experiencing exponential growth, indicating a strong demand for AI-powered solutions across industries.

- Investment Needs: Significant capital is required for AI talent acquisition, infrastructure, and ongoing research and development to build and maintain advanced AI capabilities.

- ROI Uncertainty: Proving a direct and substantial return on investment from advanced AI integration can be challenging, especially in the early stages of implementation.

- Competitive Landscape: Many players are investing in AI, making it difficult to achieve a dominant market share without a unique value proposition or superior execution.

Innovative E-commerce Models (e.g., Social Commerce, Live Shopping)

Exploring and implementing innovative e-commerce models like social commerce and live shopping on aufeminin's platforms would position them as a potential star or question mark in a BCG matrix. These channels are experiencing significant growth; for instance, global social commerce sales were projected to reach $1.2 trillion by the end of 2023, a substantial increase from previous years. Aufeminin's current market share in these nascent areas might be low, requiring substantial investment to build a user base and drive conversions.

These ventures represent high-growth opportunities, but also carry risks due to the need for significant upfront investment in technology, content creation, and influencer partnerships. For example, live shopping events can drive immediate sales, with some platforms reporting that live streams can boost conversion rates by up to 30%. Aufeminin would need to carefully allocate resources to develop these capabilities, aiming to capture a share of this expanding market.

- Social Commerce Growth: Global social commerce sales are expected to continue their upward trajectory, driven by platforms integrating shopping features directly into social feeds.

- Live Shopping Potential: Live shopping events offer an engaging way to showcase products, with data indicating higher conversion rates compared to traditional e-commerce.

- Investment Requirements: Establishing a strong presence in these innovative models will necessitate considerable investment in technology, marketing, and user engagement strategies.

- Market Position: Aufeminin's success will depend on its ability to effectively integrate these models and attract users, moving from a potential question mark to a star in the BCG matrix.

Question Marks represent initiatives with low market share in high-growth markets. Aufeminin's exploration into new digital advertising formats and global content expansion falls into this category. These ventures require significant investment to gain traction and establish a competitive position.

The success of these Question Marks hinges on strategic execution and market response. For instance, while TF1+'s international expansion targets large audiences, the actual user acquisition and monetization remain uncertain, demanding substantial capital outlay.

Similarly, emerging areas like Femtech and AI integration, while high-growth, present challenges in market penetration and demonstrating clear ROI. Aufeminin must navigate these complexities, investing wisely to transform these potential question marks into future stars.

The company's foray into social commerce and live shopping also exemplifies this. These are rapidly growing sectors, with global social commerce sales projected to reach $1.2 trillion by the end of 2023. However, aufeminin's current share is likely small, necessitating considerable investment to build a user base and achieve profitability.

| Initiative | Market Growth | Current Market Share | Investment Need | BCG Category |

| TF1+ Digital Initiatives (Shoppable Ads, Graph:ID) | High | Low | High | Question Mark |

| TF1+ Global Expansion | High | Low | High | Question Mark |

| Femtech & Niche Health/Wellness | High | Low | High | Question Mark |

| AI Integration for Personalization | High | Low | High | Question Mark |

| Social Commerce & Live Shopping | High | Low | High | Question Mark |

BCG Matrix Data Sources

Our aufeminin group BCG Matrix leverages a robust blend of internal financial disclosures and external market research. This includes detailed sales data, competitor analysis, and industry growth projections to accurately position each business unit.