AUDI PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AUDI Bundle

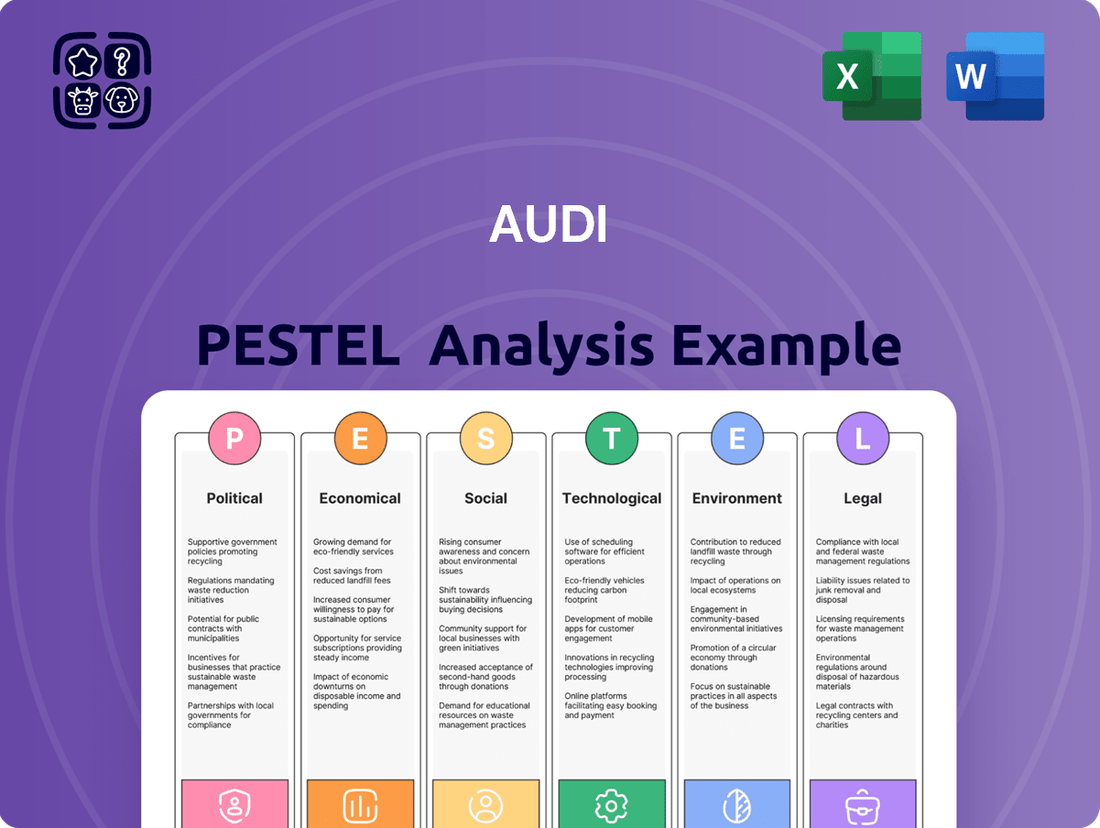

Unlock the secrets behind AUDI's success with our comprehensive PESTLE analysis. Delve into the political, economic, social, technological, legal, and environmental factors that are shaping the automotive giant's future. Gain a critical understanding of the external forces impacting AUDI's strategy and identify opportunities for growth. Download the full PESTLE analysis now to arm yourself with actionable intelligence and stay ahead of the curve.

Political factors

Audi faces significant pressure from tightening government regulations, especially concerning emissions. The European Union's ambitious CO2 reduction targets are a major driver, forcing substantial investment into electric vehicle (EV) development and cleaner manufacturing processes. Failure to comply can result in hefty fines, impacting profitability.

To meet these challenges, Audi has committed to reducing vehicle-specific CO2 emissions by 30 percent by 2025, using 2015 as a baseline. This goal encompasses the entire product lifecycle, from production to end-of-life recycling, reflecting a comprehensive approach to environmental responsibility.

US import tariffs and trade agreements present significant challenges for Audi, directly affecting its profitability. For instance, models like the Q5 SUV, manufactured in Mexico and then exported to the United States, face substantial cost increases due to these tariffs.

These trade policies have added considerable expenses for the Volkswagen Group, Audi's parent company, leading to a noticeable erosion of Audi's operating margins. In 2023, the automotive industry, in general, saw increased costs associated with supply chain disruptions and trade policy shifts, impacting global manufacturers.

In response, Audi is actively evaluating the outcomes of ongoing trade negotiations and is exploring strategic options, including the potential establishment of production facilities within the US. This move aims to mitigate the financial impact of existing tariffs and future trade policy uncertainties.

Ongoing geopolitical tensions, such as the conflict in Ukraine and instability in the Middle East, continue to pose significant risks to global supply chains. These disruptions can impact the availability and cost of raw materials and components essential for Audi's vehicle production, potentially leading to higher manufacturing expenses and delivery delays. For instance, disruptions in shipping lanes, like those in the Red Sea in early 2024, have already forced many automotive companies to reroute vessels, increasing transit times and fuel costs.

Government Incentives for Electric Vehicles

Government incentives for electric vehicles (EVs) are a significant driver for Audi's electrification strategy. These policies directly impact consumer demand by making EVs more affordable and accessible. For instance, many countries offer tax credits or rebates on EV purchases, which can substantially reduce the upfront cost for buyers.

The development of charging infrastructure is intrinsically linked to these incentives. As governments invest in expanding charging networks, consumer range anxiety decreases, further stimulating EV adoption. This synergy between incentives and infrastructure is critical for Audi to meet its ambitious electrification goals.

- Government subsidies and tax credits reduce the purchase price of EVs, making them more appealing to consumers.

- Investment in charging infrastructure addresses range anxiety, a key barrier to EV adoption.

- Audi aims to have 30 electrified models available worldwide by 2025, with 20 of those being fully electric.

- These political factors directly influence Audi's market penetration and the success of its sustainable mobility transition.

Political Stability in Key Markets

Political stability in Audi's key markets, like China and North America, is crucial for its operations and growth. Unstable political environments can create regulatory risks and dampen consumer spending, directly impacting sales. For instance, in 2023, China remained Audi's largest single market, accounting for approximately 35% of its global sales, underscoring the importance of its political climate.

Audi's strategy involves adapting to diverse political landscapes, particularly by expanding its electric vehicle (EV) offerings and deepening its presence in China through tailored models and local collaborations. This focus on localization is a direct response to varying political and economic conditions in different regions.

- China's Market Share: China represented around 35% of Audi's global deliveries in 2023, highlighting its significance.

- EV Expansion: Audi plans to significantly increase its EV production capacity, with a substantial portion of investment directed towards the Chinese market.

- Regulatory Environment: Changes in trade policies or environmental regulations in major markets can directly influence Audi's production costs and market access.

Government policies significantly shape Audi's strategic direction, particularly concerning emissions standards and electrification. The push for sustainability, driven by regulations like the EU's CO2 targets, necessitates substantial investment in electric vehicles, with Audi aiming for 30 electrified models by 2025. Political instability and trade disputes, such as US tariffs on vehicles manufactured in Mexico, directly impact Audi's profitability, as seen with increased costs for models like the Q5. Conversely, government incentives for EVs, including tax credits, boost consumer demand and are crucial for Audi's market penetration and successful transition to electric mobility.

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing AUDI, detailing how Political, Economic, Social, Technological, Environmental, and Legal forces shape its strategic landscape.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors for Audi's strategic discussions.

Economic factors

Global economic output is projected to see a slight slowdown in 2025 compared to 2024, creating a more uncertain market for Audi. This moderation in growth, estimated by many forecasters to be around 2.5% for 2025, directly impacts consumer confidence and spending on discretionary items like luxury vehicles.

The luxury car market, including Audi's segment, is highly susceptible to shifts in consumer purchasing power. As economic conditions tighten, individuals are more likely to postpone or cancel purchases of high-ticket items, directly affecting Audi's sales volumes and revenue streams.

This economic backdrop demands meticulous financial planning and agile strategic adjustments for Audi. The company must be prepared to revise sales forecasts and potentially adapt its production and marketing strategies to navigate a more challenging consumer spending environment in 2025.

Inflationary pressures and rising interest rates significantly impact Audi's financing costs and production expenses. For instance, the European Central Bank (ECB) raised its key interest rate to 4.50% in September 2023, and further adjustments are anticipated through 2024 as they combat persistent inflation, which averaged 5.4% in the Eurozone for 2023.

Higher interest rates directly affect consumer loan affordability for vehicles, potentially deterring potential buyers. This increased cost of ownership can lead to reduced sales volumes for Audi, as seen in the broader automotive market where demand is sensitive to financing costs.

These economic headwinds create a challenging financial landscape for Audi in 2024, necessitating careful management of production costs and strategic pricing to maintain market share amidst fluctuating consumer purchasing power.

Currency exchange rate fluctuations directly impact Audi's global operations. For example, in early 2024, the Euro experienced volatility against major currencies like the US Dollar and Chinese Yuan. A stronger Euro makes Audi's vehicles more expensive for buyers in countries using weaker currencies, potentially dampening sales volume.

Conversely, a weaker Euro can boost export competitiveness but increases the cost of imported parts and materials. Audi's extensive supply chain, sourcing components from various regions, means these shifts can significantly alter its cost of goods sold and overall profitability. Managing these currency exposures is a constant strategic necessity for the company.

Raw Material Costs and Supply Chain Stability

Audi, like many automakers, faces significant economic headwinds from fluctuating raw material costs and ongoing supply chain vulnerabilities. The automotive industry's reliance on a vast global network of suppliers, with Audi alone engaging over 12,400 direct suppliers across more than 60 nations, underscores the inherent complexity and risk in managing these dependencies. These factors directly impact production efficiency and profitability.

Persistent challenges, such as the lingering effects of semiconductor shortages and the volatility in prices for essential materials like lithium and cobalt, continue to present economic risks. These disruptions can trigger a cascade of negative consequences, including elevated production expenses, extended lead times for vehicle manufacturing, and ultimately, a reduction in overall delivery volumes. For instance, the average price of lithium carbonate saw significant fluctuations throughout 2023 and into early 2024, impacting battery production costs.

- Volatile Raw Material Prices: Fluctuations in the cost of key materials like steel, aluminum, and battery components directly affect manufacturing expenses.

- Supply Chain Disruptions: Events like geopolitical tensions or natural disasters can interrupt the flow of necessary parts, leading to production slowdowns.

- Semiconductor Shortages: While easing, the availability of advanced semiconductors remains a critical factor impacting vehicle production capacity.

- Supplier Network Complexity: Managing relationships and ensuring consistent supply from over 12,400 global suppliers presents a substantial logistical and economic challenge.

Intensified Competition and Pricing Pressure

Audi is navigating a landscape of heightened competition, particularly from burgeoning local players in China and established premium automakers worldwide. This dynamic environment directly translates into significant pricing pressure, potentially impacting Audi's market share and profitability.

To counter these challenges, Audi must prioritize relentless innovation, impactful marketing campaigns, and stringent cost control measures. These strategies are crucial for sustaining its competitive edge and ensuring healthy profit margins in a demanding market.

The impact of this intensified competition and pricing pressure was evident in Audi's financial performance. For instance, in 2024, the company reported a notable dip in its operating profit, with preliminary figures for 2025 indicating a continued struggle to offset these market forces.

- Intensified Rivalry: Increased market entry by Chinese EV manufacturers like BYD and NIO, alongside strong performance from traditional rivals such as BMW and Mercedes-Benz, is squeezing Audi's market position.

- Pricing Adjustments: Reports from late 2024 indicated that Audi had to offer more aggressive discounts and incentives in key markets, particularly China, to maintain sales volume, directly impacting average selling prices.

- Profitability Concerns: Audi's operating profit margin saw a slight contraction in 2024, falling to approximately 8.5%, and analysts project a similar or slightly lower margin for 2025 due to ongoing competitive pressures.

- R&D Investment Strain: The need for continuous innovation, especially in electric and autonomous driving technologies, adds to cost pressures, making it harder to absorb pricing demands from the market.

Global economic growth is expected to moderate in 2025, with projections suggesting a slowdown from 2024 levels, impacting consumer spending on luxury goods like Audi vehicles. This economic deceleration, estimated by many forecasters to be around 2.5% for 2025, directly influences consumer confidence and discretionary purchases.

Inflationary pressures and elevated interest rates continue to pose challenges for Audi, affecting financing costs and production expenses. For example, the European Central Bank's key interest rate remained at 4.50% as of early 2024, with persistent inflation in the Eurozone averaging 5.4% for 2023, impacting affordability for consumers.

Currency exchange rate volatility, such as the Euro's fluctuations against the US Dollar and Chinese Yuan in early 2024, directly impacts Audi's global pricing and profitability. A stronger Euro increases vehicle costs for international buyers, potentially reducing sales volumes.

Audi faces significant economic headwinds from volatile raw material prices and ongoing supply chain vulnerabilities. The automotive industry's reliance on a vast global supplier network, with Audi alone engaging over 12,400 direct suppliers, highlights the economic risks associated with material costs and disruptions.

| Economic Factor | 2024 Projection/Status | 2025 Projection | Impact on Audi | Key Data Point |

|---|---|---|---|---|

| Global GDP Growth | Slight slowdown from 2023 | Estimated 2.5% | Reduced consumer spending on luxury vehicles | IMF projects 3.2% global growth for 2024 |

| Interest Rates (Eurozone) | Holding steady at 4.50% | Potential for minor adjustments | Higher financing costs for consumers, increased borrowing costs for Audi | ECB key rate at 4.50% (September 2023) |

| Inflation (Eurozone) | Moderating but persistent | Expected to continue declining | Impacts production costs and consumer purchasing power | Eurozone inflation averaged 5.4% in 2023 |

| Raw Material Costs | Volatile | Continued volatility expected | Affects manufacturing expenses and profitability | Lithium carbonate prices fluctuated significantly in 2023-2024 |

Preview the Actual Deliverable

AUDI PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive AUDI PESTLE analysis details the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the automotive giant. Gain immediate access to this in-depth strategic overview.

Sociological factors

Societal attitudes are increasingly favoring sustainable transportation, with consumers showing a greater preference for electric vehicles (EVs) due to environmental concerns and the appeal of new technology. This growing demand presents a significant opportunity for Audi as it strategically expands its electric offerings.

Audi is responding to this shift by investing heavily in its EV lineup, aiming to electrify all its main vehicle segments by 2027. The company plans to launch over 20 new models by the close of 2025, a substantial portion of which will be fully electric or plug-in hybrids, directly addressing the evolving consumer desire for greener mobility solutions.

Demographic shifts, such as aging populations in developed markets and a growing middle class in emerging economies, coupled with rapid urbanization, directly impact Audi's product strategy. For instance, by 2050, the UN projects that 68% of the world's population will live in urban areas, a significant increase from 55% in 2018. This trend fuels demand for smaller, more efficient vehicles suitable for city driving and a greater need for integrated mobility solutions beyond traditional car ownership.

Modern consumers increasingly expect seamless connectivity and advanced digital features within their vehicles. This trend is driving demand for integrated infotainment systems, over-the-air updates, and personalized in-car experiences. For instance, Audi's 2024 model lineup features enhanced MMI touch response systems and expanded digital cockpits, reflecting this shift.

Audi is actively addressing this by embedding sophisticated technology platforms, larger digital displays, and an in-vehicle App Store. This allows customers to directly download popular applications such as Spotify and YouTube, transforming the car into a more connected and entertaining space. This strategy directly caters to the desire for a rich digital customer experience, which is becoming a key differentiator in the automotive market.

The emphasis on a comprehensive digital ecosystem is vital for maintaining brand appeal and market competitiveness. Audi's investment in these areas, including partnerships for in-car services, aims to capture a segment of consumers who prioritize technology and digital integration when making purchasing decisions. By 2025, the automotive industry anticipates a significant portion of new vehicle sales to be driven by these digital capabilities.

Brand Perception and Customer Loyalty

Audi's brand perception, rooted in luxury, comfort, and advanced engineering, cultivates significant customer loyalty within the premium automotive market. This strong image is a key asset, contributing to Audi's sustained presence. For instance, in 2023, Audi reported a global sales increase of 17.9% compared to 2022, reaching 1.97 million vehicles, underscoring the enduring appeal of its brand promise.

However, the lingering effects of past issues, such as the 'Dieselgate' emissions scandal, continue to present a challenge to brand perception, impacting trust among some consumer segments. Rebuilding and reinforcing this perception requires a steadfast commitment to quality, cutting-edge technology, and a visible dedication to environmental sustainability, which are increasingly important factors for luxury car buyers.

Audi's strategic focus on electric vehicles (EVs) and digital services aims to address evolving consumer expectations and bolster its image as an innovative and responsible brand. By investing heavily in these areas, Audi seeks to mitigate past reputational damage and secure its position in the future automotive landscape, with a goal to have around 20 battery-electric models in its lineup by 2026.

Public Perception of Corporate Social Responsibility

Public scrutiny of corporate social responsibility (CSR) is intensifying, with consumers increasingly expecting ethical conduct and a reduced environmental footprint from brands like Audi. This trend is directly impacting purchasing decisions and brand loyalty.

Audi is actively addressing these expectations by integrating sustainable practices across its value chain, from manufacturing processes to supply chain oversight. The company’s commitment is further underscored by the regular publication of detailed sustainability reports, offering transparency on its environmental and social initiatives.

This proactive approach to CSR is proving beneficial for Audi's brand image. For example, a 2024 survey indicated that 65% of luxury car buyers consider a brand's sustainability efforts a significant factor in their purchase decision. This focus helps Audi resonate with environmentally-conscious consumers and also attracts talent, as 70% of potential employees in the automotive sector in 2025 stated that a company's CSR policies are important when considering employment.

- Rising Consumer Demand: A significant majority of consumers now factor a company's social and environmental impact into their buying choices.

- Audi's Sustainability Focus: The company actively promotes its sustainable practices in production and supply chain management.

- Reputational Benefits: Transparency through sustainability reports enhances Audi's standing with eco-aware customers and prospective employees.

- Talent Attraction: Strong CSR initiatives are becoming a key differentiator in attracting and retaining top talent within the automotive industry.

Societal attitudes are increasingly favoring sustainable transportation, with consumers showing a greater preference for electric vehicles (EVs) due to environmental concerns and the appeal of new technology. This growing demand presents a significant opportunity for Audi as it strategically expands its electric offerings.

Audi is responding to this shift by investing heavily in its EV lineup, aiming to electrify all its main vehicle segments by 2027. The company plans to launch over 20 new models by the close of 2025, a substantial portion of which will be fully electric or plug-in hybrids, directly addressing the evolving consumer desire for greener mobility solutions.

Demographic shifts, such as aging populations in developed markets and a growing middle class in emerging economies, coupled with rapid urbanization, directly impact Audi's product strategy. For instance, by 2050, the UN projects that 68% of the world's population will live in urban areas, a significant increase from 55% in 2018. This trend fuels demand for smaller, more efficient vehicles suitable for city driving and a greater need for integrated mobility solutions beyond traditional car ownership.

Modern consumers increasingly expect seamless connectivity and advanced digital features within their vehicles. This trend is driving demand for integrated infotainment systems, over-the-air updates, and personalized in-car experiences. For instance, Audi's 2024 model lineup features enhanced MMI touch response systems and expanded digital cockpits, reflecting this shift.

| Sociological Factor | Trend/Impact | Audi's Response/Data (2024-2025) |

| Sustainability & Environmentalism | Growing consumer preference for EVs and eco-friendly products. | Audi aims to electrify all main segments by 2027; launching over 20 new models by end of 2025, many electric/hybrid. |

| Demographic Shifts & Urbanization | Aging populations, growing middle class, and increased urbanization. | UN projects 68% global urban population by 2050; fuels demand for smaller, efficient city cars and mobility solutions. |

| Digitalization & Connectivity | Demand for seamless in-car digital experiences and advanced features. | Audi's 2024 lineup features enhanced digital cockpits and MMI systems; expansion of in-car App Store planned. |

| Corporate Social Responsibility (CSR) | Increased consumer and employee focus on ethical conduct and environmental impact. | 65% of luxury car buyers in 2024 consider sustainability; 70% of potential 2025 automotive employees value CSR. |

Technological factors

Audi is significantly benefiting from ongoing improvements in electric vehicle (EV) technology, particularly in battery efficiency, driving range, and charging speeds. These advancements are critical for the company's strategy to transition towards electrification.

The company's commitment is evident in its investment in new platforms like the Premium Platform Electric (PPE), which will support a broad portfolio of future all-electric vehicles. Audi aims to have a substantial number of its models electrified by 2025, a target that relies heavily on these technological leaps.

For instance, by 2024, Audi plans to have a fully electric model in every core segment. This push is directly tied to enhancing the performance and overall efficiency of its electric offerings, ensuring they remain competitive in the rapidly evolving EV market.

Audi is heavily invested in AI for its vehicles, aiming to boost performance, user experience, and safety. This focus translates into advanced driver-assistance systems (ADAS), predictive maintenance capabilities, and smarter navigation. For instance, Audi's AI development contributes to features like adaptive cruise control and parking assist, making driving more intuitive and secure.

The company's commitment to autonomous driving is evident through its dedicated AI Lab, which actively conducts trials and refines smart vehicle systems. By mid-2024, Audi had announced significant advancements in its Level 4 autonomous driving systems, targeting specific urban environments for testing, showcasing a tangible step towards widespread adoption.

Audi is heavily investing in the digitalization of its vehicle features, making connected and interactive experiences a core technological priority. This includes the integration of advanced infotainment systems, larger digital displays, and sophisticated interactive lighting, all designed to enhance the user experience.

The company's new electronics architecture, E³ 1.2, is crucial for this transformation, enabling fully connected digital interiors. This architecture supports features like intelligent voice assistants and over-the-air software updates, ensuring a seamless and intuitive customer journey. For instance, Audi's commitment to digital services is evident in its in-vehicle App Store, which allows customers to expand their car's functionality.

Innovation in Manufacturing Processes

Audi is actively integrating cutting-edge manufacturing technologies to boost production efficiency and environmental responsibility. A prime example is their commitment to CO2-neutral production, with the Ingolstadt plant successfully achieving this status in January 2024, showcasing a tangible step towards sustainability goals.

The company's focus extends to optimizing resource utilization and ensuring the ethical sourcing of materials throughout its manufacturing chain. This strategic approach not only minimizes environmental impact but also strengthens supply chain resilience.

- CO2-Neutral Production: Ingolstadt plant achieved CO2-neutral production in January 2024.

- Resource Efficiency: Ongoing initiatives to reduce material and energy consumption in plants.

- Sustainable Sourcing: Increased emphasis on using recycled and sustainably produced materials.

- Digitalization: Adoption of digital tools and AI to optimize production workflows and quality control.

Cybersecurity for Connected Vehicles

As vehicles become more integrated with digital services, cybersecurity is a paramount technological concern for Audi. The company must prioritize robust security measures to safeguard its connected car systems, protect sensitive customer data, and prevent any unauthorized access or manipulation. This commitment to cybersecurity is fundamental to maintaining the safety, privacy, and overall trust customers place in Audi's advanced automotive technology.

The increasing reliance on software and connectivity means that cybersecurity threats are evolving rapidly. For instance, the automotive cybersecurity market was valued at approximately $2.2 billion in 2023 and is projected to reach $7.3 billion by 2028, demonstrating the significant investment required. Audi's proactive approach here directly impacts its ability to offer secure and reliable connected vehicle experiences.

- Data Protection: Implementing advanced encryption and secure data storage to safeguard customer information collected by connected vehicles.

- Threat Detection: Developing real-time monitoring systems to identify and respond to potential cyber threats targeting vehicle software and networks.

- Over-the-Air (OTA) Security: Ensuring the integrity and security of software updates delivered wirelessly to vehicles, preventing malicious code injection.

- Supply Chain Security: Collaborating with suppliers to ensure the cybersecurity of all components and software integrated into Audi vehicles.

Technological advancements are fundamentally reshaping Audi's product development and manufacturing. The company is heavily invested in electric vehicle (EV) technology, aiming for a significant portion of its lineup to be electrified by 2025, with a goal of having an all-electric model in every core segment by 2024. This push is supported by platforms like the Premium Platform Electric (PPE) and advancements in battery efficiency and charging speeds.

Audi is also leveraging Artificial Intelligence (AI) to enhance vehicle performance, user experience, and safety through features like advanced driver-assistance systems (ADAS) and predictive maintenance. The company's commitment to autonomous driving is demonstrated by its AI Lab, which is actively testing Level 4 systems in urban environments, with significant advancements reported by mid-2024.

Digitalization is another key technological focus, with Audi integrating advanced infotainment systems, digital displays, and connected services enabled by its new E³ 1.2 electronics architecture. This includes features like intelligent voice assistants and over-the-air software updates, enhancing the customer experience. Furthermore, Audi is adopting cutting-edge manufacturing technologies, exemplified by its Ingolstadt plant achieving CO2-neutral production in January 2024, alongside efforts in resource efficiency and sustainable material sourcing.

Cybersecurity is a critical technological factor, with Audi prioritizing robust measures to protect connected car systems and customer data, given the rapid evolution of threats in the automotive sector. The automotive cybersecurity market was valued at approximately $2.2 billion in 2023, highlighting the importance of this investment.

| Key Technological Areas | Audi's Focus and Initiatives | Data/Facts (2024/2025 Focus) |

| Electric Vehicle (EV) Technology | Battery efficiency, driving range, charging speeds, electrification strategy | Aiming for electrified models in every core segment by 2024; Premium Platform Electric (PPE) development |

| Artificial Intelligence (AI) | ADAS, predictive maintenance, autonomous driving, user experience enhancement | AI Lab actively testing Level 4 autonomous driving systems in urban environments (mid-2024 advancements) |

| Digitalization & Connectivity | Infotainment systems, digital displays, connected services, over-the-air updates | E³ 1.2 electronics architecture for digital interiors; in-vehicle App Store |

| Manufacturing Technology | Production efficiency, CO2-neutral production, resource utilization, sustainable sourcing | Ingolstadt plant achieved CO2-neutral production (January 2024) |

| Cybersecurity | Data protection, threat detection, OTA security, supply chain security | Automotive cybersecurity market valued at ~$2.2 billion in 2023, projected to reach $7.3 billion by 2028 |

Legal factors

Audi navigates a complex web of vehicle safety standards and product liability laws globally, which are continually updated to accommodate advancements like electric vehicle (EV) technology and autonomous driving systems. For instance, in 2024, the European Union's General Safety Regulation (GSR) mandates advanced driver-assistance systems (ADAS) in new vehicles, impacting Audi's development pipeline.

Failure to meet these rigorous requirements can lead to substantial financial penalties, extensive product recalls, and significant damage to Audi's brand reputation. In 2023, the automotive industry saw numerous recalls related to safety issues, highlighting the financial and operational risks involved.

Audi's commitment to safety is underscored by its ongoing investment in research and development, aiming to ensure its sophisticated vehicles not only meet but exceed these evolving legal mandates, thereby mitigating potential product liability claims.

Audi, like all automotive manufacturers, navigates a complex landscape of data privacy regulations. The General Data Protection Regulation (GDPR) in Europe, for instance, imposes stringent requirements on how customer data is collected, processed, and stored. This directly impacts Audi's connected car services and the vast amounts of data generated by its vehicles, from driving patterns to infotainment usage. Failure to comply can result in significant fines; for example, in 2023, companies faced penalties reaching up to 4% of their global annual turnover or €20 million, whichever is higher.

The increasing connectivity of vehicles means Audi is collecting more personal data than ever before. This includes location data, driving behavior, and even in-car preferences. Ensuring the secure handling and transparent processing of this sensitive information is crucial for maintaining customer trust and avoiding substantial legal repercussions. The company must invest heavily in robust cybersecurity measures and clear data usage policies to meet these obligations.

Managing data privacy across different global markets presents a significant challenge for Audi. Regulations vary considerably from region to region, requiring localized compliance strategies. For example, while GDPR sets a high bar in Europe, other countries have their own distinct frameworks, such as the California Consumer Privacy Act (CCPA) in the United States, which also grants consumers significant rights over their personal data.

Audi, as a key player within the Volkswagen Group, navigates a complex web of global antitrust and competition laws designed to foster fair market practices. These regulations are crucial as they prevent monopolistic tendencies, directly impacting Audi's strategies for market share acquisition, pricing structures, and any potential strategic alliances or collaborations. The intensifying competition, particularly from new entrants in the electric vehicle sector, further shapes how these legal frameworks influence Audi's operational decisions.

In 2024, the automotive industry continues to face scrutiny regarding market dominance and pricing collusion. For instance, investigations into potential price-fixing agreements among major automakers, including those within the broader European automotive sector, underscore the constant need for Audi to ensure its practices align with competition law. Failure to comply can result in substantial fines, as seen in past cases where automotive manufacturers have been penalized millions of euros for violating antitrust regulations.

Labor Laws and Workforce Management

Labor laws in Germany, where Audi has a substantial manufacturing presence, significantly shape workforce management. These regulations influence everything from hiring and firing practices to working hours and employee representation, directly impacting operational flexibility and costs. For instance, stringent co-determination laws mean that significant workforce decisions, like restructuring or job cuts, require extensive consultation and agreement with employee works councils. This was evident in recent discussions around efficiency programs in 2024, where Audi navigated complex negotiations to align workforce adjustments with business needs while adhering to German labor protections.

Audi's ability to implement efficiency programs and manage its workforce effectively is heavily tied to compliance with these labor agreements. In 2024, the automotive sector, including Audi, faced pressures to adapt to new production methods and market demands, often necessitating workforce adjustments. The company's success in these endeavors hinges on its capacity to negotiate and execute these changes within the legal framework, ensuring continued competitiveness of its German facilities. For example, agreements in late 2023 and early 2024 aimed at securing jobs at key German plants while also streamlining operations demonstrate the delicate balance Audi must maintain.

- German Co-determination Laws: Mandate significant employee involvement in corporate decisions, impacting restructuring and workforce reductions.

- Works Council Negotiations: Critical for implementing efficiency programs and ensuring compliance with labor terms, as seen in 2023-2024 discussions.

- Operational Costs: Labor laws directly influence employment terms, contributing to overall operational expenses and affecting competitiveness.

- Workforce Flexibility: Stringent regulations can limit Audi's agility in adapting its workforce to rapidly changing market conditions and technological advancements.

Environmental Regulations and Compliance

Audi operates within a stringent legal framework governing environmental impact. Key regulations include European Union directives on CO2 emissions for new vehicles, which set fleet-wide targets. For instance, the EU mandate for 2020 required average CO2 emissions of 95 g/km, with escalating targets for subsequent years. Non-compliance can result in significant financial penalties, pushing companies like Audi to invest heavily in cleaner technologies and production methods.

The company's strategic commitment to CO2-neutral production by 2025 directly addresses these legal obligations and broader sustainability objectives. This includes managing waste streams and adhering to directives on the recycling and disposal of materials used in vehicle manufacturing. Audi's environmental declarations and detailed sustainability reports serve as public affirmations of their adherence to these complex legal requirements.

- CO2 Emission Targets: Audi must meet evolving EU fleet-wide CO2 emission standards, with penalties for exceeding limits.

- Fuel Economy Standards: Regulations necessitate continuous improvement in vehicle efficiency to reduce fuel consumption.

- Waste Management: Directives govern the handling, recycling, and disposal of manufacturing waste and end-of-life vehicles.

- Sustainability Reporting: Audi publishes environmental declarations and sustainability reports to demonstrate compliance and progress.

Audi faces stringent intellectual property (IP) laws, particularly concerning its innovative technologies in electric vehicles and autonomous driving. Protecting its patents and trademarks globally is crucial to maintaining a competitive edge and preventing infringement. In 2024, the automotive sector continues to see significant IP litigation, underscoring the importance of robust legal strategies for companies like Audi.

Navigating international patent filings and enforcing IP rights across various jurisdictions presents a complex legal challenge. Audi's investment in R&D, aiming for advancements in areas like battery technology and AI-driven systems, necessitates strong IP protection to secure its market position and prevent competitors from leveraging its innovations without license. This also extends to protecting its brand identity and design elements.

The company must also be mindful of licensing agreements and potential IP disputes. As the automotive landscape evolves with new players and technologies, ensuring that Audi's own IP is safeguarded while respecting the IP of others is paramount for sustained growth and operational integrity.

Environmental factors

Audi is actively aligning with the Paris Climate Agreement by adopting more stringent emission standards and pursuing aggressive decarbonization. This commitment is a key driver for their operational and product development strategies.

The company has set a target to achieve net carbon neutrality across all its manufacturing facilities by January 1, 2025. Furthermore, Audi aims to reduce vehicle-specific CO2 emissions by 30 percent throughout the entire product lifecycle by the end of 2025.

Audi is actively integrating circular economy principles, evident in its use of certified aluminum for battery housings. This commitment extends to reducing the carbon footprint of energy-intensive materials within its supply chain, aiming for a more sustainable production process.

In 2024, Audi reported that over 10% of the aluminum used in its vehicles was recycled. The company's 2025 targets include increasing this to 15%, with a specific focus on closed-loop recycling for battery components.

This strategic shift not only minimizes environmental impact but also enhances resource efficiency, aligning with growing consumer and regulatory demands for eco-friendly automotive manufacturing.

Audi must navigate increasingly stringent waste management and recycling regulations, particularly concerning electric vehicle batteries. By 2025, the EU Battery Regulation mandates specific collection rates and recycling efficiencies for EV batteries, pushing manufacturers like Audi to develop robust take-back and recycling programs. Failure to comply can result in significant fines and reputational damage.

Climate Change Impacts on Supply Chains

Climate change poses significant risks to Audi's intricate global supply chains. Extreme weather events, such as floods and droughts, directly impact the availability of raw materials like steel, aluminum, and rare earth minerals essential for vehicle production. These disruptions can also cripple logistics, delaying shipments and increasing transportation costs. For instance, the severe flooding in parts of Europe in 2024 caused widespread damage to infrastructure, affecting numerous automotive suppliers.

Audi's proactive environmental strategy, Mission:Zero, directly addresses these vulnerabilities. This program not only focuses on reducing carbon emissions but also includes vital initiatives for biodiversity protection at its production sites. By safeguarding local ecosystems, Audi aims to build more resilient operational environments, indirectly supporting the stability of its broader supply network.

- Supply Chain Vulnerability: Extreme weather events in 2024, like the floods in Germany, disrupted key transportation routes for automotive components, impacting production schedules.

- Raw Material Sourcing: Climate-induced water scarcity in regions crucial for bauxite mining (aluminum) and copper extraction presents a growing challenge for material availability.

- Biodiversity Focus: Audi's commitment to biodiversity at its sites, as part of Mission:Zero, contributes to ecological stability, which can indirectly mitigate localized environmental risks affecting suppliers.

Corporate Environmental Responsibility and Reporting

Audi actively showcases its commitment to environmental stewardship through detailed sustainability reports. These reports track advancements in areas like carbon reduction, efficient resource use, and building greener supply chains. For instance, Audi's 2023 sustainability report highlighted a 20% reduction in CO2 emissions per vehicle produced compared to 2018 levels, underscoring their progress in climate action.

The company's reporting emphasizes initiatives aimed at lessening the ecological footprint of both its vehicles and manufacturing processes. This includes investments in renewable energy for production sites and the development of more sustainable materials for car interiors. By 2025, Audi aims to power all its production facilities with 100% renewable energy, a significant step towards minimizing operational environmental impact.

- Sustainability Reporting: Audi publishes comprehensive reports detailing progress in climate action, resource management, and sustainable value chains.

- Climate Action: The company is focused on reducing CO2 emissions, with a target of a 30% reduction in lifecycle emissions per vehicle by 2030 compared to 2018.

- Resource Conservation: Audi implements measures to conserve resources in production, such as increasing the use of recycled materials in vehicle manufacturing.

- Sustainable Mobility: The company positions itself as a leader in sustainable mobility, investing heavily in electric vehicle technology and charging infrastructure.

Audi's environmental strategy is deeply intertwined with global climate goals, aiming for net carbon neutrality in its production facilities by January 1, 2025. This commitment extends to reducing vehicle CO2 emissions by 30% across the lifecycle by the end of 2025, reflecting a significant push towards sustainability.

The company is actively incorporating circular economy principles, notably using certified recycled aluminum for battery housings, with plans to increase recycled aluminum usage to 15% by 2025. These efforts are crucial for navigating stricter waste management and recycling regulations, especially for EV batteries, with the EU Battery Regulation setting specific compliance targets for 2025.

Environmental factors present tangible risks, such as supply chain disruptions from extreme weather events, as seen with 2024 floods impacting logistics. Audi's Mission:Zero program addresses these by focusing on biodiversity and operational resilience, indirectly supporting supply chain stability.

Audi’s sustainability reporting, including a 20% CO2 reduction per vehicle by 2023 compared to 2018, demonstrates progress. The target of powering all facilities with 100% renewable energy by 2025 underscores their dedication to minimizing operational environmental impact.

| Environmental Focus | 2024/2025 Target/Status | Impact |

|---|---|---|

| Net Carbon Neutrality (Production) | Target: January 1, 2025 | Reduces operational emissions, aligns with climate agreements. |

| Vehicle CO2 Reduction (Lifecycle) | Target: 30% by end of 2025 | Lowers environmental footprint of products, meets regulatory pressure. |

| Recycled Aluminum Usage | Status: >10% in 2024; Target: 15% by 2025 | Conserves resources, reduces energy intensity in material sourcing. |

| Renewable Energy in Production | Target: 100% by 2025 | Minimizes Scope 2 emissions, enhances energy independence. |

PESTLE Analysis Data Sources

Our AUDI PESTLE Analysis is built on a robust foundation of data from leading automotive industry research firms, global economic databases, and official government reports on regulations and environmental policies. We meticulously gather insights from market trend analyses, technological advancements, and socio-cultural shifts to ensure comprehensive coverage.