AUDI Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AUDI Bundle

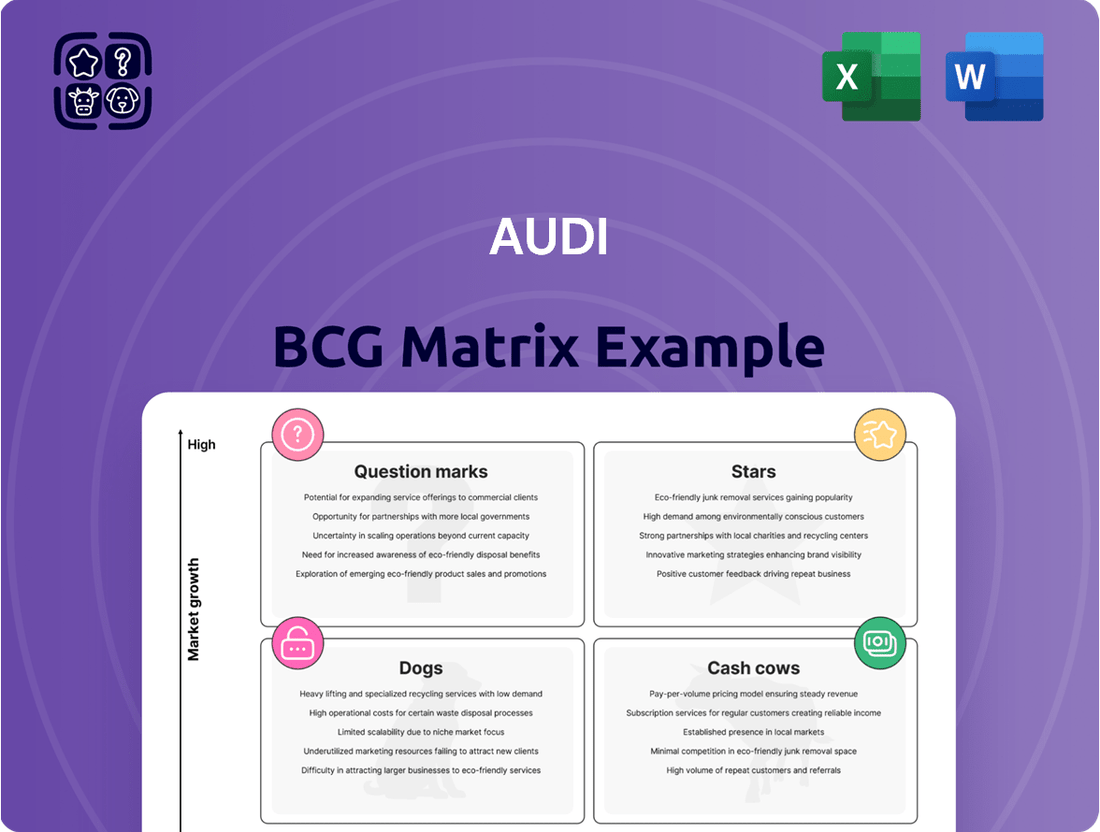

The BCG Matrix is a powerful tool for analyzing a company's product portfolio, categorizing them into Stars, Cash Cows, Dogs, and Question Marks based on market growth and share. Understanding these classifications is crucial for making informed strategic decisions about resource allocation and future investments.

This preview offers a glimpse into the strategic positioning of a company's offerings, but the full BCG Matrix unlocks a comprehensive understanding of each product's potential and challenges. Purchase the complete report for detailed quadrant placements, actionable insights, and a clear roadmap for optimizing your business strategy.

Stars

The Audi Q4 e-tron is a strong contender in the electric vehicle market, evidenced by its impressive global deliveries of nearly 108,000 units in 2024. This robust performance, coupled with a 6.47% increase in US sales for the same period, underscores its growing market share. Its position suggests it's a significant growth driver for Audi.

The Audi Q3 is a shining example of a Star in the automotive BCG matrix. In 2024, its US sales saw a remarkable surge of 45%, contributing to global deliveries of 215,000 units. This robust performance underscores its strong position in the thriving compact SUV market.

The Audi Q6 e-tron, launched in late 2024, is a strong contender in the burgeoning electric vehicle market. With almost 15,000 deliveries already secured, its early performance indicates robust demand and a promising trajectory for market share expansion.

Built on the innovative Premium Platform Electric (PPE), the Q6 e-tron embodies Audi's strategic commitment to its electric future. This advanced platform, coupled with its cutting-edge technology, positions the vehicle to capture significant growth in the high-demand EV segment.

Upcoming PPE-based EVs

Audi is strategically positioning its upcoming PPE-based electric vehicles (EVs) as stars within its product portfolio, reflecting significant investments and strong growth potential. The company's ambitious electrification roadmap includes 30 electrified models by 2025, with 20 of these being fully electric, many leveraging the new Premium Platform Electric (PPE) architecture.

These new PPE-based EVs are entering a rapidly expanding electric vehicle market, a segment projected for substantial growth. Audi's substantial investment in this area, aiming to capture a significant market share, underscores their expectation of these models becoming future market leaders.

- High Investment: Audi is dedicating substantial capital to the development and launch of its PPE-based EV range.

- Market Growth: The electric vehicle market is experiencing robust expansion, providing a fertile ground for these new models.

- Strategic Importance: These vehicles are crucial for Audi's electrification strategy and its ambition to lead in the premium EV segment.

- Future Potential: The combination of investment and market opportunity positions these PPE-based EVs as potential stars with high future growth prospects.

RS Models (e.g., RS 6 Avant GT)

While the broader Audi brand navigated a complex market in 2024, its high-performance RS models, like the RS 6 Avant GT, continued to carve out a significant and profitable niche.

The limited-edition 2025 Audi RS 6 Avant GT, released in early 2024, highlights this strategy. It represents peak performance and exclusivity, appealing to a dedicated and expanding segment of automotive enthusiasts who value these attributes. This focus on specialized, high-margin products helps offset broader sales pressures.

- RS Models as Stars: Performance-oriented RS models are Audi's Stars in the BCG matrix due to their strong niche market and high profitability, despite overall sales fluctuations.

- RS 6 Avant GT Exemplifies Strategy: The 2025 RS 6 Avant GT, a limited-run model, showcases Audi's commitment to catering to a growing enthusiast base with exclusive, high-performance offerings.

- Market Positioning: These models command premium pricing and attract a loyal customer base, contributing significantly to brand image and revenue per unit.

Stars in Audi's product portfolio represent high-growth, high-market-share offerings. The Q4 e-tron, with nearly 108,000 global deliveries in 2024 and a 6.47% US sales increase, exemplifies this. Similarly, the Q3's 45% US sales surge in 2024, contributing to 215,000 global units, cements its Star status in the competitive compact SUV segment.

The Q6 e-tron, launched late 2024, is positioned as a future Star, already securing almost 15,000 deliveries and built on the advanced PPE platform. Audi's broader strategy includes 30 electrified models by 2025, with many leveraging PPE, indicating a significant investment in these high-potential EVs.

Audi's high-performance RS models, particularly the 2025 RS 6 Avant GT released in early 2024, also function as Stars. These niche, high-margin products cater to a growing enthusiast base, contributing significantly to brand image and profitability despite potentially lower overall unit volumes.

| Model | 2024 Global Deliveries | 2024 US Sales Growth | BCG Category |

| Audi Q4 e-tron | ~108,000 | +6.47% | Star |

| Audi Q3 | 215,000 | +45% | Star |

| Audi Q6 e-tron (Late 2024 Launch) | ~15,000 (Initial) | N/A (New Model) | Potential Star |

| Audi RS 6 Avant GT (2025 Model) | Limited Edition | Niche Market Focus | Star (Niche) |

What is included in the product

This analysis categorizes Audi's product lines into Stars, Cash Cows, Question Marks, and Dogs based on market share and growth.

It provides strategic recommendations for investment, divestment, or maintenance for each product category.

AUDI BCG Matrix offers clarity by visualizing each business unit's position, easing strategic decision-making.

Cash Cows

The Audi Q5 stands as a prime example of a Cash Cow within Audi's product portfolio. In 2024, it achieved global sales of 298,000 units, underscoring its position as Audi's best-selling model. This consistent high volume in a mature market signifies strong, reliable cash generation for the company.

Despite a slight sales dip, the Q5 maintained its status as the top seller in the crucial US market. This enduring demand in the competitive luxury SUV segment ensures it continues to be a significant contributor to Audi's financial stability and profitability.

The Audi A6 stands as a prime example of a Cash Cow for Audi. Globally, it achieved sales of 244,000 units in 2024, a testament to its strong position in the established luxury sedan and wagon market. This consistent performance, driven by robust brand loyalty and a high market share, ensures a steady and substantial contribution to Audi's overall revenue stream.

The Audi Q7, a cornerstone in the large luxury SUV segment, demonstrated continued profitability in 2024, even with a reported sales dip. Its established market presence and premium positioning allow it to command strong margins, making it a consistent revenue generator for Audi.

Audi A5 Sportback

The Audi A5 Sportback, a key player in the luxury segment, demonstrated notable resilience in 2024 with a 4% increase in US sales. This performance solidifies its position as a stable revenue generator for Audi, even as it assumes a more significant role by potentially replacing the A4 in certain markets.

Its consistent market presence in a mature segment underscores its status as a cash cow. The A5 Sportback contributes reliably to Audi's financial health, reflecting a strong demand for its blend of style and practicality within the premium automotive landscape.

- Sales Growth: 4% increase in US sales for 2024.

- Market Position: Strong presence in the mature luxury segment.

- Strategic Role: Replacing the A4 in some markets, broadening its impact.

- Financial Contribution: Consistent revenue generation, indicative of a cash cow.

Financial Services & After-Sales Support

Audi's financial services, including financing and leasing, along with its robust after-sales support, function as significant cash cows. These offerings tap into a substantial existing customer base, generating predictable and profitable income with minimal need for further investment.

These ancillary services are crucial for Audi's overall profitability. For instance, in 2024, the automotive financial services sector globally saw continued strong performance, with many OEMs reporting substantial contributions to operating profit from these divisions. Audi's established network of dealerships and its brand loyalty ensure a steady demand for these high-margin services.

- Financing and Leasing: Audi Financial Services provides tailored financing and leasing options, capturing a significant portion of vehicle purchases and generating recurring revenue through interest and fees.

- After-Sales Support: This includes maintenance, repairs, genuine parts sales, and extended warranties, all of which benefit from Audi's reputation for quality and cater to a large, loyal owner base.

- High Profitability: These services typically boast higher profit margins compared to vehicle manufacturing itself, contributing substantially to Audi's bottom line.

- Stable Cash Flow: The recurring nature of service contracts and financing agreements ensures a consistent and predictable cash flow, characteristic of a cash cow business unit.

Cash Cows represent established products or services with a high market share in a mature industry. They generate more cash than they consume, requiring minimal investment to maintain their position. These are the reliable profit engines of a company.

For Audi, models like the Q5 and A6 exemplify Cash Cows. The Q5, Audi's best-selling model globally in 2024 with 298,000 units sold, and the A6, with 244,000 units sold, demonstrate consistent demand and strong market share in their respective segments. These vehicles are crucial for stable revenue generation.

Audi's financial services and after-sales support also function as significant cash cows. In 2024, these high-margin offerings leveraged Audi's established customer base and brand loyalty to deliver predictable and profitable income streams, contributing substantially to the company's overall financial health.

| Product/Service | Market Share | Sales Volume (2024) | Cash Generation | Strategic Role |

|---|---|---|---|---|

| Audi Q5 | High (Best-selling model) | 298,000 units | High, stable | Core revenue driver |

| Audi A6 | High (Established luxury segment) | 244,000 units | High, stable | Consistent profit contributor |

| Audi Financial Services | High (Leverages existing customer base) | N/A (Service-based) | High, recurring | High-margin profitability |

| Audi After-Sales Support | High (Brand loyalty driven) | N/A (Service-based) | High, recurring | Predictable income stream |

What You’re Viewing Is Included

AUDI BCG Matrix

The AUDI BCG Matrix document you are previewing is the precise, fully formatted report you will receive immediately after purchase. This means no watermarks, no placeholder text, and no demo content—just the complete, analysis-ready strategic tool designed for immediate application in your business planning.

Dogs

The Audi TT, a model that once defined a segment, has officially ceased production following the 2023 model year. This discontinuation is underscored by a dramatic sales decline; in 2024, sales plummeted by an astonishing 95% compared to previous years.

This sharp drop in demand signifies the TT's position as a 'Dog' in the BCG matrix for Audi. Its low market share and rapidly declining sales indicate a product with little growth potential, especially as the automotive industry, including Audi, shifts its strategic focus heavily towards electrification and newer vehicle segments.

The Audi R8, a symbol of performance, has been officially discontinued. Production wrapped up in 2024, marking the end of an era for this beloved supercar. This decision was influenced by a significant 48% decline in sales during 2024, highlighting a shrinking market for such vehicles.

The R8's position within Audi's product portfolio, when viewed through the lens of the BCG Matrix, clearly places it in the 'Dog' category. Its low sales volume, coupled with substantial production costs, made it a less attractive investment, especially as Audi pivots towards electrification.

The Audi A4's performance places it firmly in the Dog category of the BCG Matrix. In 2024, US sales plummeted by a staggering 48%.

The first half of 2025 saw an even more concerning trend, with only 500 A4 units sold in the US market. This sharp decline highlights a shrinking market share in a highly competitive sedan segment.

With minimal growth prospects and a weak market position, the A4's future within Audi's portfolio appears limited, characteristic of a Dog product.

Audi A3 (US Market)

While a strong contender in Europe, the Audi A3 faced significant headwinds in the US during 2024. Sales plummeted by 30% for the model in the US market that year.

This sharp decline, coupled with its battle to gain traction in the crowded entry-luxury sedan space, firmly positions the Audi A3 as a Dog in the US market according to the BCG matrix.

- US Sales Decline: A 30% drop in sales for the Audi A3 in the US during 2024.

- Market Share Challenges: Difficulty competing for market share in the highly competitive US entry-luxury sedan segment.

- BCG Matrix Classification: Due to low market share and low growth prospects in the US, it falls into the Dog quadrant.

Audi A8

The Audi A8, Audi's flagship sedan, is positioned as a Dog within the BCG matrix. This classification stems from its weak market performance, particularly in key regions. In the United States, for instance, the A8 experienced a significant 28% drop in sales during 2024.

Further underscoring its struggles, the A8 only managed to sell 749 units in the US during the first half of 2025. This data points to a declining market share within the highly competitive ultra-luxury sedan segment. The combination of low sales volume and substantial associated costs for development and marketing solidify its status as a Dog.

- Declining US Sales: A 28% decrease in 2024 highlights market weakness.

- Low Volume in H1 2025: Only 749 units sold in the US indicates a shrinking customer base.

- Ultra-Luxury Segment Challenges: The A8 faces intense competition and shifting consumer preferences.

- High Costs, Low Returns: Significant investment is required with minimal market share gains.

Products classified as Dogs in the BCG Matrix are characterized by low market share and low growth potential. For Audi, several models exhibited these traits in the 2024-2025 period. These vehicles typically require significant resources for maintenance but generate minimal returns, making them candidates for divestment or discontinuation.

The Audi TT and R8 have both ceased production, with significant sales declines in 2024 signaling their Dog status. The A4 and A3 also faced substantial sales drops in the US market during 2024, indicating market share erosion and limited growth prospects. Even the flagship A8 experienced a notable sales decrease in the US in 2024, further cementing its position as a Dog.

| Model | 2024 US Sales Change | H1 2025 US Sales | BCG Classification |

|---|---|---|---|

| Audi TT | -95% | N/A (Discontinued) | Dog |

| Audi R8 | -48% | N/A (Discontinued) | Dog |

| Audi A4 | -48% | 500 | Dog |

| Audi A3 (US) | -30% | N/A | Dog |

| Audi A8 | -28% | 749 | Dog |

Question Marks

The Audi Q8 e-tron and Q8 Sportback e-tron, despite operating within the expanding electric vehicle sector, are currently positioned as Question Marks in the BCG Matrix. Their 2024 US sales experienced notable drops, with the Q8 e-tron down 27% and the Q8 Sportback e-tron falling 33%.

Furthermore, performance in the first half of 2025 indicated they were significantly outpaced by competitors in the market. This combination of a high-growth industry backdrop and their current low market share and sales trajectory suggests a precarious future, requiring considerable strategic investment to alter their trajectory.

The Audi e-tron GT, a premium electric sedan, is positioned as a Question Mark within Audi's product portfolio. Despite operating in the rapidly expanding electric vehicle (EV) segment, its 2024 sales experienced a 10% decline. This performance, coupled with a relatively modest market share, suggests that significant strategic investment is necessary for the e-tron GT to transition from a Question Mark to a potential Star product.

The 'TT Moment 2.0', Audi's planned electric sports car, is positioned as a Question Mark in the BCG Matrix. This signifies its entry into a rapidly expanding electric vehicle (EV) market, a sector projected to see substantial growth in the coming years. For instance, the global EV market size was valued at approximately $380 billion in 2023 and is expected to reach over $1.5 trillion by 2030, demonstrating the high-growth potential.

However, as a new entrant with no existing market share, the 'TT Moment 2.0' faces considerable uncertainty. Audi's substantial investment in its development and production means its success hinges on achieving significant market adoption and establishing a strong competitive position. Without this, it risks becoming a cash drain, requiring careful strategic management to transition it to a Star or divest if it fails to gain traction.

Audi Q5 e (Plug-in Hybrid)

The Audi Q5 e plug-in hybrid represents a transitional technology in the automotive industry, aiming to capture consumers looking for a blend of electric and traditional driving. Its position as a Question Mark in the BCG matrix highlights the uncertainty surrounding its long-term market dominance compared to fully electric vehicles.

While plug-in hybrids like the Q5 e offer a solution for range anxiety and charging infrastructure limitations, the accelerating adoption of battery electric vehicles (BEVs) presents a significant challenge. The Q5 e needs substantial investment to maintain or grow its market share in this rapidly evolving landscape.

- Market Position: The Q5 e operates in a segment where consumer preference is shifting towards pure EVs, making its future growth trajectory uncertain.

- Investment Needs: Continued development and marketing are crucial for the Q5 e to compete effectively against established and emerging BEV models.

- Industry Trends: Global automotive sales data from 2024 indicates a strong upward trend for BEVs, potentially impacting the long-term viability of PHEVs. For instance, in Q1 2024, BEV sales globally saw a significant year-over-year increase, outpacing PHEV growth in many key markets.

- Strategic Consideration: Audi must carefully evaluate the Q5 e's potential return on investment against the strategic advantages of focusing resources on its fully electric portfolio.

Broader Electrification Strategy

Audi's broad electrification strategy, aiming for 20 fully electric models by 2025, represents a significant investment in research, development, and infrastructure. This aggressive push into the high-growth EV market positions many of its electric models as Question Marks within the BCG matrix.

The sheer scale of this transition, coupled with current sales challenges in the EV sector, introduces uncertainty regarding the profitability of this expansive electric portfolio. For instance, while global EV sales continue to rise, Audi's own sales figures for its electric models in early 2024 have shown mixed results, highlighting the execution risk.

- High Investment: Audi is investing billions into its electric future, a substantial outlay for a segment still maturing.

- Market Uncertainty: Despite overall EV growth, consumer adoption rates and competitive pressures create a Question Mark for individual model success.

- Profitability Concerns: The broad portfolio approach means many models might not achieve immediate profitability, impacting overall financial performance in the short to medium term.

- Infrastructure Dependence: The success of Audi's EVs is also tied to the development and accessibility of charging infrastructure, a factor outside of Audi's direct control.

Question Marks in Audi's BCG Matrix represent products with low market share in high-growth industries, demanding significant investment to determine their future. The Audi Q8 e-tron and Q8 Sportback e-tron, despite the booming EV market, saw substantial sales declines in 2024, down 27% and 33% respectively, indicating their Question Mark status. Similarly, the e-tron GT, also in the high-growth EV segment, experienced a 10% sales drop in 2024, reinforcing its need for strategic investment to move from a Question Mark to a potential Star.

| Product | Market Growth | Market Share | 2024 Sales Trend | BCG Status |

|---|---|---|---|---|

| Q8 e-tron | High (EV) | Low | -27% | Question Mark |

| Q8 Sportback e-tron | High (EV) | Low | -33% | Question Mark |

| e-tron GT | High (EV) | Low | -10% | Question Mark |

| 'TT Moment 2.0' (Planned) | High (EV) | None (New) | N/A | Question Mark |

| Q5 e (PHEV) | Moderate (Transitioning) | Moderate | Mixed (vs. BEV growth) | Question Mark |

BCG Matrix Data Sources

Our AUDI BCG Matrix is informed by comprehensive sales figures, market share data, and industry growth projections, ensuring a data-driven strategic overview.