Atmos Energy PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Atmos Energy Bundle

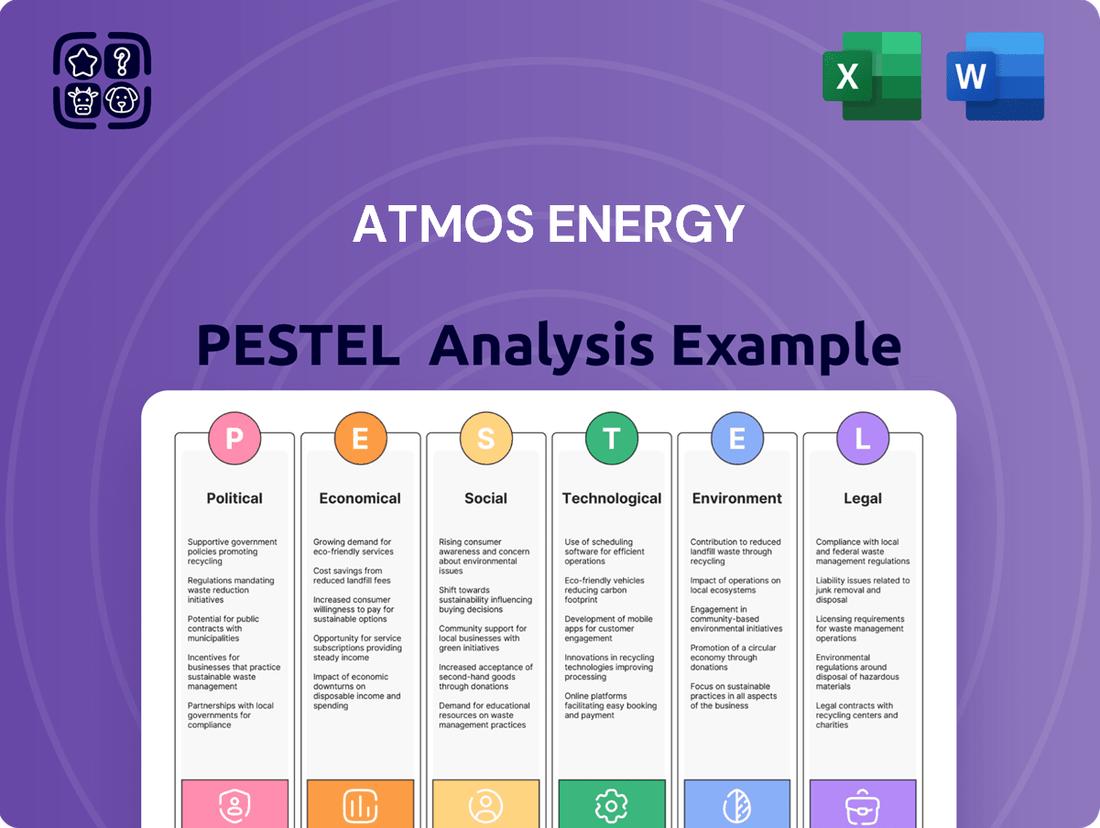

Navigate the complex external forces shaping Atmos Energy's future with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements present both challenges and opportunities. Equip yourself with critical insights to inform your strategy and secure a competitive advantage. Download the full PESTLE analysis now for actionable intelligence.

Political factors

Atmos Energy operates under a stringent regulatory framework, with federal oversight from the Department of Transportation for pipeline safety and state-level Public Utility Commissions (PUCs) dictating rates and service standards. For instance, in 2024, Atmos Energy's Texas division filed for a rate increase, highlighting the ongoing dialogue between the company and regulators concerning infrastructure investments and cost recovery. These regulations directly shape operational expenditures and revenue potential, as seen in the company's ongoing investments in pipeline modernization to meet safety mandates.

Atmos Energy's financial health hinges on regulatory rate cases, where it seeks approval for rate adjustments to cover operating costs and secure a fair return on its infrastructure investments. In fiscal year 2023, the company filed for rate increases in several key states, including Texas and Mississippi, seeking to recover over $700 million in capital investments. Successfully navigating these proceedings is vital for funding its ambitious capital expenditure program, which in FY23 reached approximately $3.5 billion, with a significant portion dedicated to safety and system modernization projects.

Atmos Energy, like other utilities, navigates a complex web of energy transition policies. For instance, the Inflation Reduction Act (IRA) of 2022 offers significant tax credits for clean energy projects, including those involving renewable natural gas (RNG). This could incentivize Atmos to invest in RNG infrastructure, diversifying its supply and potentially lowering its carbon intensity. However, varying state-level decarbonization goals, such as California's ambitious emissions reduction targets, may accelerate shifts away from natural gas in certain markets, posing a challenge to long-term demand projections.

Political Stability and State-Level Support

Atmos Energy navigates a diverse political landscape across its operating states, with regulatory frameworks and state-level energy priorities significantly influencing its business. States like Texas, which has a robust economy and a growing population, generally offer a more stable environment for Atmos Energy's investments and customer base expansion. For instance, Texas continues to be a key growth market, contributing significantly to Atmos Energy's overall utility revenue.

However, political shifts can introduce challenges. Policies that push for rapid electrification or impose stringent environmental regulations without clear pathways for cost recovery can create financial risks for the company. For example, a hypothetical state mandating a swift transition away from natural gas infrastructure without a supportive rate structure could impact Atmos Energy's capital expenditure plans and profitability.

- Texas's Favorable Regulatory Environment: Texas's regulatory approach has historically supported utility infrastructure investment, benefiting Atmos Energy's growth.

- Potential Electrification Mandates: States considering aggressive electrification policies could pose a challenge by potentially reducing natural gas demand.

- Environmental Regulations: Evolving environmental standards necessitate ongoing adaptation and investment in compliance by Atmos Energy.

International Energy Policies Impacting Natural Gas Markets

While Atmos Energy primarily operates domestically, international energy policies and geopolitical shifts can indirectly influence its operating environment and customer costs. For example, the European Union's increasing focus on methane emission reduction for imported natural gas, as seen in its Methane Regulation, could subtly alter global supply dynamics and pricing, potentially impacting the broader U.S. natural gas market.

Shifts in global liquefied natural gas (LNG) demand, driven by energy security concerns or climate initiatives in other regions, can also affect the availability and cost of natural gas in the U.S. In 2023, U.S. LNG exports reached record levels, highlighting the interconnectedness of global energy markets.

- Global LNG demand: Increased demand for LNG in Asia and Europe, driven by energy security needs following geopolitical events, can lead to higher international prices, which may indirectly influence domestic U.S. natural gas prices.

- Methane emission regulations: Stricter methane emission standards imposed by major importing regions on natural gas producers could necessitate investments in emissions control technologies across the supply chain, potentially impacting overall production costs.

- Geopolitical stability: Instability in major natural gas-producing regions can disrupt global supply chains, leading to price volatility that can ripple through to domestic markets, affecting Atmos Energy's procurement costs.

Political factors significantly shape Atmos Energy's operations through regulatory oversight and energy policy. Federal agencies like the Department of Transportation mandate pipeline safety, while state Public Utility Commissions (PUCs) control rates and service standards. For instance, in 2024, Atmos Energy's Texas division sought a rate increase, illustrating the ongoing dialogue with regulators regarding infrastructure investments and cost recovery. The company's fiscal year 2023 saw rate increase filings in states like Texas and Mississippi to recover over $700 million in capital investments, underscoring the critical role of regulatory approvals in funding its approximately $3.5 billion capital expenditure program for system modernization and safety.

Energy transition policies, such as the Inflation Reduction Act of 2022, offer incentives like tax credits for renewable natural gas (RNG) projects, potentially encouraging Atmos Energy to invest in cleaner energy sources. However, varying state-level decarbonization goals, like California's stringent emissions reduction targets, could accelerate the shift away from natural gas in specific markets, posing a long-term demand challenge. Atmos Energy's operational success is thus closely tied to navigating these evolving political landscapes and adapting to diverse state energy priorities.

Geopolitical events and international energy policies can indirectly affect Atmos Energy by influencing global natural gas prices and supply dynamics. For example, increased global demand for liquefied natural gas (LNG), driven by energy security concerns in regions like Europe and Asia, can lead to higher U.S. domestic prices. Furthermore, stricter methane emission regulations in importing countries, such as the EU's Methane Regulation, may necessitate investments in emissions control technologies across the entire natural gas supply chain, potentially impacting production costs that could eventually filter through to Atmos Energy's procurement expenses.

| Political Factor | Impact on Atmos Energy | Key Data/Example (2023-2025) |

|---|---|---|

| Regulatory Oversight (Federal & State) | Dictates safety standards, operational procedures, and revenue potential through rate approvals. | Texas PUC filings for rate increases in 2024; FY23 capital investments of ~$3.5 billion focused on modernization. |

| Energy Transition Policies | Incentivizes cleaner fuels (e.g., RNG via IRA tax credits) but also poses challenges from electrification mandates. | IRA tax credits for RNG; potential impact of state-level decarbonization goals on natural gas demand. |

| International Energy Markets & Geopolitics | Influences domestic natural gas prices and supply availability through global LNG demand and emission regulations. | Record U.S. LNG exports in 2023; EU Methane Regulation impacting global supply dynamics. |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Atmos Energy, detailing impacts across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers forward-looking insights and actionable strategies to navigate market dynamics and capitalize on emerging opportunities.

A concise PESTLE analysis of Atmos Energy, distilled into actionable insights, helps alleviate the pain of information overload for busy executives.

This PESTLE analysis offers a clear, segmented view of external factors impacting Atmos Energy, simplifying strategic decision-making and reducing the burden of complex market assessments.

Economic factors

Fluctuations in natural gas commodity prices directly affect Atmos Energy's customers by influencing their utility bills, which can impact overall demand and affordability. While Atmos Energy's regulated structure generally allows for the pass-through of these commodity costs, significant price swings can attract unwanted public and regulatory attention.

Looking ahead to 2025, analysts foresee persistent natural gas price volatility. This is largely attributed to ongoing geopolitical tensions impacting global energy supplies and dynamic shifts in supply-demand balances, creating an uncertain pricing environment.

Atmos Energy's commitment to infrastructure is substantial, with plans to invest around $3.7 billion in fiscal year 2025. This significant capital expenditure is largely directed towards enhancing safety, improving system reliability, and modernizing its extensive pipeline network.

These investments are essential for both maintaining the current operational integrity of Atmos Energy's infrastructure and supporting its expansion to accommodate growing customer demand. Such modernization efforts are critical for long-term operational efficiency and service delivery.

The financial viability of these extensive capital expenditures hinges on Atmos Energy's ability to recover these costs through regulatory-approved rate increases. Successful rate recovery is paramount for ensuring the company's financial health and its capacity to continue these vital infrastructure upgrades.

Atmos Energy's growth is intrinsically linked to the economic vitality and population expansion within its service areas. Texas, a key operational state, exemplifies this, experiencing robust population increases that directly fuel customer additions for Atmos Energy.

In the fiscal year 2023, Atmos Energy reported adding approximately 55,000 new customers across its operations, a testament to the ongoing economic development driving demand for natural gas services. This growth spans residential, commercial, and industrial sectors, all contributing to increased throughput and revenue for the company.

The sustained economic development in regions like Texas, characterized by job creation and business expansion, directly supports the continued growth of Atmos Energy's customer base. This positive feedback loop ensures a steady increase in natural gas consumption and, consequently, the company's financial performance.

Inflation and Interest Rates

Inflation directly impacts Atmos Energy by increasing the cost of essential materials like steel and natural gas, as well as labor for maintaining and expanding its extensive pipeline network. For instance, the Producer Price Index for industrial commodities saw a notable increase in early 2024, a trend that continues to pressure utility input costs. This escalation in expenses can lead to higher capital expenditures for infrastructure upgrades and maintenance, directly affecting operating budgets.

Rising interest rates, a key tool in combating inflation, present a significant challenge for Atmos Energy. The company relies on substantial debt financing for its capital-intensive projects, such as pipeline modernization and new construction. As of mid-2024, benchmark interest rates remain elevated compared to previous years, meaning the cost of borrowing has increased. This higher cost of capital can impact profitability and necessitate adjustments to customer rates to ensure financial viability.

Utilities nationwide, including Atmos Energy, are experiencing a surge in required capital spending. This is driven by the need to upgrade aging infrastructure, meet growing energy demand, and comply with stricter environmental regulations. For example, Atmos Energy has outlined significant capital investment plans for 2024-2025, focusing on pipeline replacement and safety enhancements. The interplay of inflation and interest rates directly influences the feasibility and cost-effectiveness of these crucial investments, shaping the company's financial outlook and operational strategies.

- Inflationary Pressures: The Consumer Price Index (CPI) for energy commodities saw a significant year-over-year increase in late 2023 and early 2024, directly impacting Atmos Energy's material and fuel costs.

- Interest Rate Environment: Federal Reserve interest rate decisions in 2024 have kept borrowing costs higher, increasing the expense of Atmos Energy's substantial debt-funded capital expenditures.

- Capital Investment Needs: Atmos Energy's 2025 capital plan, projected to be in the billions, is particularly sensitive to these macroeconomic factors, influencing project timelines and funding strategies.

- Cost of Service Impact: Increased operating and financing costs due to inflation and interest rates may necessitate rate adjustments for Atmos Energy's customer base.

Energy Affordability and Consumer Spending

The affordability of natural gas is a significant economic driver for Atmos Energy. While natural gas remains a relatively cost-effective energy option, fluctuations in global energy markets can lead to price volatility. For instance, in early 2024, natural gas prices experienced some upward pressure due to increased demand and geopolitical factors, which could impact consumer spending on other goods and services.

Economic downturns or periods of high inflation can strain household budgets, potentially affecting customer payment behavior and increasing the need for assistance programs. Atmos Energy's commitment to customer support is evident through initiatives like their 'Sharing the Warmth' program, which, along with federal aid such as the Low Income Home Energy Assistance Program (LIHEAP), aims to mitigate these challenges for vulnerable populations.

- Natural Gas Affordability: Remains a key economic consideration, influencing household and business budgets.

- Price Volatility: Global energy market dynamics can impact natural gas prices, affecting consumer spending.

- Customer Assistance: Programs like LIHEAP and Atmos Energy's 'Sharing the Warmth' are crucial for supporting low-income customers during economic strain.

- Economic Impact: Higher energy costs can reduce discretionary spending, impacting overall economic activity.

Economic factors significantly shape Atmos Energy's operational landscape and financial performance. Persistent inflation, as seen in rising commodity and labor costs, directly increases the expense of maintaining and expanding its infrastructure. Elevated interest rates, a consequence of efforts to curb inflation, raise the cost of debt financing for the company's substantial capital investment plans. These macroeconomic conditions necessitate careful financial planning and potential rate adjustments to ensure the company's ability to invest in essential infrastructure upgrades and maintain service reliability.

| Economic Factor | Impact on Atmos Energy | Relevant Data/Trend (2024-2025) |

| Inflation | Increased cost of materials (steel, pipe), labor, and fuel. Higher capital expenditure for infrastructure projects. | Producer Price Index for industrial commodities showed increases in early 2024. CPI for energy commodities saw year-over-year increases in late 2023/early 2024. |

| Interest Rates | Higher cost of borrowing for debt-financed capital expenditures. Potential impact on profitability and rate-setting. | Benchmark interest rates remained elevated in mid-2024 compared to previous years. |

| Economic Growth & Demand | Population growth in service areas (e.g., Texas) drives customer additions and natural gas demand. | Atmos Energy added approximately 55,000 new customers in fiscal year 2023. Continued economic development supports customer base growth. |

| Natural Gas Prices | Volatility affects customer affordability and utility bills. While pass-through mechanisms exist, significant swings can draw regulatory scrutiny. | Analysts foresee persistent natural gas price volatility in 2025 due to geopolitical tensions and supply-demand shifts. Prices experienced upward pressure in early 2024. |

What You See Is What You Get

Atmos Energy PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Atmos Energy PESTLE analysis explores the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Gain valuable insights into the external forces shaping Atmos Energy's operations and strategic decisions.

Sociological factors

Atmos Energy actively engages with its communities, demonstrating a strong commitment to social responsibility. In 2023, the company reported investing over $4 million in energy assistance programs, directly helping customers facing affordability challenges. These initiatives, alongside partnerships with local non-profits, foster positive community relations and bolster Atmos Energy's brand image as a supportive corporate citizen.

Public perception of natural gas is a significant sociological factor for Atmos Energy, heavily shaped by environmental concerns and safety incidents. As of early 2024, the ongoing energy transition narrative often casts natural gas as a bridge fuel, but also as a fossil fuel contributing to emissions. Atmos Energy's ability to maintain a positive public image hinges on effectively communicating its safety protocols and the role natural gas plays in providing reliable, affordable energy during this transition.

The availability of a skilled workforce is paramount for Atmos Energy, especially as it faces the ongoing need to maintain and modernize its extensive pipeline infrastructure. Regions where Atmos operates, like Texas, have seen robust job growth. For instance, Texas's unemployment rate hovered around 4.0% in early 2024, indicating a competitive labor market that could affect labor availability and wage pressures for specialized roles needed in energy infrastructure.

Employment trends directly influence Atmos Energy's ability to staff critical positions, from pipeline technicians to engineers. As the energy sector evolves, attracting and retaining talent with specific expertise in areas like advanced welding techniques or digital monitoring systems becomes increasingly important. The company's demonstrated commitment to employee safety, underscored by its safety performance metrics, is a key factor in its ability to draw and keep skilled professionals in a demanding industry.

Demographic Shifts and Urbanization

Demographic shifts and ongoing urbanization are significant drivers for Atmos Energy. As populations grow and concentrate in urban centers within its service territories, the demand for reliable natural gas infrastructure naturally increases. This trend directly fuels customer acquisition and necessitates strategic investments in expanding and upgrading the existing network to meet rising energy needs.

For instance, projections indicate continued population growth across many of Atmos Energy's key states. In Texas, a state with a substantial Atmos presence, the population was estimated to be over 30.5 million by mid-2024, a figure expected to climb. Similarly, states like Colorado and Virginia are experiencing steady population increases, translating into more households and businesses relying on natural gas services.

- Population Growth: Continued expansion in states like Texas, Colorado, and Virginia directly increases the potential customer base for Atmos Energy.

- Urbanization Trends: The movement of people into cities and surrounding suburbs drives demand for denser, more robust gas distribution networks.

- Infrastructure Needs: Meeting the energy demands of growing and concentrating populations requires ongoing capital investment in pipeline maintenance, upgrades, and expansions.

- Strategic Planning: Understanding these demographic patterns is vital for Atmos Energy's long-term business planning, including forecasting demand and prioritizing infrastructure development projects.

Customer Expectations for Service and Reliability

Customers today demand more than just a utility; they expect safe, reliable, and affordable natural gas delivery. Atmos Energy's commitment to meeting these expectations is evident in its ongoing infrastructure investments. For instance, in fiscal year 2023, Atmos Energy invested approximately $3.3 billion in capital expenditures, with a significant portion directed towards pipeline replacement and modernization projects designed to enhance safety and reliability.

Proactive maintenance and responsive customer service are critical to maintaining customer satisfaction and securing the necessary regulatory support. Atmos Energy's focus on safety and reliability isn't just a talking point; it's a core part of their operational vision, aiming to minimize disruptions and build trust with the communities they serve.

- Safety First: Customers prioritize the safe delivery of natural gas, influencing regulatory oversight and public perception.

- Reliability is Key: Consistent service without interruptions is a baseline expectation, directly impacting customer loyalty.

- Affordability Matters: While safety and reliability are paramount, the cost of service remains a significant factor in customer satisfaction and regulatory considerations.

- Investment in Infrastructure: Companies like Atmos Energy are expected to continuously invest in upgrading and maintaining their systems to meet these evolving expectations.

Customer expectations are evolving, with a growing emphasis on safety, reliability, and affordability. Atmos Energy's investments reflect this, with $3.3 billion in capital expenditures in fiscal year 2023, largely for pipeline upgrades. This focus on infrastructure directly addresses customer demands and supports regulatory approval by demonstrating a commitment to dependable service.

Public perception of natural gas, influenced by environmental discourse and safety concerns, presents a complex sociological landscape. While often framed as a transition fuel, its fossil fuel status necessitates clear communication from Atmos Energy regarding safety protocols and its role in providing stable energy. This communication is vital for maintaining public trust amidst the ongoing energy transition.

Demographic shifts, particularly urbanization, are a key driver for Atmos Energy's growth. States like Texas, with over 30.5 million residents by mid-2024, showcase this trend, increasing demand for natural gas services. This necessitates strategic infrastructure investments to meet the energy needs of growing urban populations.

The labor market dynamics, with Texas's unemployment rate around 4.0% in early 2024, highlight the importance of attracting and retaining skilled workers for Atmos Energy. Maintaining a safe work environment and offering competitive compensation are crucial for securing the specialized talent needed for pipeline maintenance and modernization.

Technological factors

Atmos Energy is actively investing in upgrading its pipeline network, a crucial technological factor for safety and efficiency. In fiscal year 2023, the company reported spending $2.2 billion on its pipeline modernization program, focusing on replacing older infrastructure. This includes the use of advanced materials and construction methods to reduce leaks and improve overall system integrity.

The company is also integrating sophisticated leak detection and repair technologies. These advancements are key to minimizing methane emissions, a significant environmental concern. For instance, Atmos Energy utilizes advanced aerial surveillance and ground-based sensors to identify potential leaks, allowing for quicker and more effective repairs, thereby enhancing operational safety and environmental performance.

The development of advanced methane detection and reduction technologies is crucial, driven by escalating environmental regulations. Innovations in sensor technology and data analytics allow for more precise monitoring and faster leak identification, directly impacting operational efficiency and environmental stewardship.

Atmos Energy's commitment to reducing methane emissions is paramount for both regulatory adherence and enhancing its environmental profile. For instance, the company has been investing in technologies like advanced leak detection and repair (LDAR) programs, utilizing tools such as infrared cameras and mobile detection units, which are vital in pinpointing and mitigating fugitive emissions across its vast pipeline network.

The U.S. Environmental Protection Agency (EPA) has been actively promoting methane reduction strategies, with initiatives like the Natural Gas Methane Emissions Reduction Program highlighting the industry's focus. Companies like Atmos Energy are integrating these technological advancements to meet and exceed emission reduction targets, a trend expected to intensify through 2024 and 2025 as climate policies evolve.

Atmos Energy is increasingly leveraging data analytics and digitalization to sharpen its operations. By analyzing vast datasets, the company can pinpoint areas for efficiency gains, refine maintenance planning, and make more informed strategic choices across its vast natural gas distribution network. This digital transformation is key to ensuring the safety and reliability of its services.

The application of data analytics extends to crucial areas like risk assessment and asset integrity management. For instance, predictive analytics can help identify potential equipment failures before they occur, allowing for proactive maintenance. In 2023, Atmos Energy reported capital expenditures of $3.4 billion, a significant portion of which is directed towards infrastructure modernization and safety initiatives, areas directly benefiting from advanced data insights.

Renewable Natural Gas (RNG) and Hydrogen Blending

The integration of Renewable Natural Gas (RNG) and the exploration of hydrogen blending into existing natural gas networks are key technological advancements. These innovations could allow the current infrastructure to support a lower-carbon energy landscape. For example, the U.S. Environmental Protection Agency's (EPA) Renewable Fuel Standard (RFS) program incentivizes the production of RNG, with over 1 billion gallons of advanced biofuel (largely RNG) produced in 2023. This indicates growing industry adoption and a tangible shift towards cleaner gas sources.

While promising, these technologies are still in development. Significant research and development are ongoing to ensure the safe and efficient blending of hydrogen and the widespread adoption of RNG. The American Gas Association reported in 2024 that pilot projects are exploring hydrogen blending levels up to 20% in certain distribution systems, demonstrating progress in this area. However, challenges related to infrastructure compatibility, cost-effectiveness, and regulatory frameworks remain to be fully addressed.

- RNG Production Growth: U.S. RNG production is projected to reach 1.5 billion gallons in 2024, up from approximately 1 billion gallons in 2023, driven by environmental regulations and corporate sustainability goals.

- Hydrogen Blending Pilots: Numerous utility companies are conducting pilot programs to test hydrogen blending in existing natural gas pipelines, with some aiming for up to 5% hydrogen by volume in specific areas by 2025.

- Infrastructure Investment: Significant investment is required to upgrade and adapt existing pipeline infrastructure to safely and reliably accommodate higher percentages of hydrogen or the widespread distribution of RNG.

- Technological Hurdles: Ongoing research focuses on material compatibility, leak detection, and the development of advanced monitoring systems to manage the complexities of blended gas streams.

Cybersecurity and Grid Resilience

Atmos Energy, like all critical infrastructure operators, faces significant cybersecurity risks. The natural gas distribution network is a prime target for cyberattacks aiming to disrupt operations, steal sensitive customer data, or even cause physical damage. Investing in advanced cybersecurity solutions is therefore not just a matter of operational integrity but also a crucial component of national security, given the essential role of natural gas in the energy supply chain.

The company's commitment to grid resilience directly addresses these threats. This involves implementing multi-layered security protocols, continuous monitoring of network activity, and rapid response capabilities to mitigate any potential breaches. For instance, in 2023, the U.S. Department of Energy highlighted increased state-sponsored cyber activity targeting energy infrastructure, underscoring the urgency of these investments.

- Cyber Threat Landscape: Increased sophistication of cyberattacks targeting critical infrastructure.

- Investment Priority: Robust cybersecurity measures are essential for protecting operations and customer data.

- Grid Resilience: Ensuring the continuous and reliable delivery of natural gas services.

- National Security Alignment: Protecting energy infrastructure is a key national security imperative.

Technological advancements are pivotal for Atmos Energy's operational efficiency and safety. The company is heavily invested in modernizing its pipeline infrastructure, with $2.2 billion allocated in fiscal year 2023 for pipeline replacement and upgrades, utilizing advanced materials and construction techniques. This focus on technological integration is crucial for minimizing leaks and enhancing system integrity.

Sophisticated leak detection technologies, including aerial surveillance and advanced sensors, are being deployed to reduce methane emissions, a key environmental and regulatory concern. Furthermore, Atmos Energy is leveraging data analytics and digitalization to optimize operations, improve maintenance planning, and enhance asset integrity management through predictive analytics. The exploration of Renewable Natural Gas (RNG) and hydrogen blending into existing infrastructure represents a significant technological shift, with U.S. RNG production projected to reach 1.5 billion gallons in 2024.

Cybersecurity is another critical technological factor, with Atmos Energy implementing multi-layered security protocols to protect its network from increasing cyber threats. The company's grid resilience efforts are directly tied to these cybersecurity investments, ensuring the reliable delivery of natural gas services and aligning with national security imperatives. These technological investments are essential for navigating the evolving energy landscape and regulatory environment through 2024 and 2025.

Legal factors

Atmos Energy is heavily regulated by the Pipeline and Hazardous Materials Safety Administration (PHMSA), which sets rigorous standards for pipeline safety. These regulations are constantly evolving; for instance, recent updates have integrated advanced industry standards like ASME B31.8S, necessitating continuous adaptation in how Atmos manages pipeline integrity and trains its workforce. Failure to comply can result in significant fines and operational disruptions, impacting the company's financial performance and public trust.

Atmos Energy operates under stringent environmental laws, with a particular focus on methane emissions. The U.S. Environmental Protection Agency's (EPA) final rule, implemented in 2024, mandates significant reductions in methane from oil and natural gas operations. This regulation, alongside similar initiatives in the European Union that affect global supply chains, requires Atmos Energy to invest heavily in sophisticated monitoring, reporting, and emission reduction technologies.

Atmos Energy operates under the watchful eye of state-level public utility commissions, which are the primary regulators. These bodies have the authority to approve everything from the rates Atmos charges its customers to its ambitious capital investment plans and the very standards by which it provides service. For instance, in 2023, Atmos Energy reported capital expenditures of $3.1 billion, a significant portion of which requires regulatory approval for cost recovery.

The company's financial health and its capacity to earn a reasonable profit are directly tied to the effectiveness of these state-specific regulatory frameworks and the rate mechanisms they employ. These mechanisms determine how quickly and efficiently Atmos can recoup its investments in infrastructure, such as pipeline upgrades, and ensure a stable return for its shareholders. The efficiency of these processes can significantly impact Atmos's ability to fund future growth and maintain reliable service.

Land Use and Eminent Domain Laws

Atmos Energy's operations are significantly shaped by land use and eminent domain laws. These regulations govern how the company can acquire and utilize land for its extensive pipeline network, including expansion and maintenance projects. For instance, securing rights-of-way often necessitates navigating complex state and federal land use statutes.

Eminent domain, the power of the government to take private property for public use, plays a crucial role when voluntary agreements with landowners cannot be reached. Atmos Energy must adhere strictly to legal procedures and fair compensation requirements when exercising this power. Failure to comply can lead to costly legal battles and project delays, impacting service reliability and growth strategies.

- Land Acquisition Challenges: In 2023, Atmos Energy reported ongoing efforts to secure rights-of-way, with the exact number of eminent domain actions not publicly detailed but understood to be a necessary component of infrastructure development.

- Regulatory Compliance Costs: The company allocates significant resources annually to ensure compliance with all relevant land use regulations and legal requirements, which is a critical operational expense.

- Landowner Relations: Maintaining positive relationships with landowners is paramount, as disputes can escalate into lengthy legal proceedings, potentially costing millions in legal fees and settlements.

- Infrastructure Development Impact: The ability to efficiently secure land through legal means directly influences the pace of pipeline upgrades and new construction, vital for meeting growing energy demands.

Consumer Protection Laws and Customer Rights

Atmos Energy operates under a stringent framework of consumer protection laws that dictate everything from billing accuracy and service disconnections to the safeguarding of customer data. These regulations are designed to ensure customers are treated fairly and that Atmos Energy maintains transparency in its pricing and operational procedures. For instance, in Texas, the Public Utility Commission of Texas (PUCT) oversees rules that prevent unfair billing practices and mandate specific procedures before service can be disconnected, protecting millions of residential customers.

These legal requirements directly influence how Atmos Energy interacts with its customer base, particularly concerning service reliability and dispute resolution. The company's commitment to customer advocacy, including initiatives like their customer assistance programs, is a direct reflection of their need to comply with these consumer rights mandates. For example, in 2023, Atmos Energy reported assisting over 100,000 customers with energy assistance programs, underscoring their proactive approach to meeting these legal and ethical obligations.

- Billing Transparency: Adherence to regulations ensuring clear and accurate billing statements, preventing deceptive practices.

- Service Disconnection Protections: Compliance with rules that limit when and how service can be disconnected, often requiring advance notice and offering payment arrangements.

- Data Privacy: Strict adherence to laws protecting sensitive customer information collected and utilized by the company.

- Customer Advocacy Alignment: Efforts to support customers, especially vulnerable populations, are often shaped by and contribute to meeting legal consumer protection standards.

Atmos Energy's operations are significantly influenced by federal and state regulations concerning pipeline safety and environmental protection. The Pipeline and Hazardous Materials Safety Administration (PHMSA) mandates rigorous standards, with recent updates in 2024 incorporating advanced industry practices like ASME B31.8S, requiring continuous investment in pipeline integrity management and workforce training. Failure to comply can result in substantial fines and operational interruptions.

State public utility commissions are crucial, approving rates, capital investments, and service standards. For instance, Atmos Energy's 2023 capital expenditures of $3.1 billion required significant regulatory approval for cost recovery, directly impacting the company's ability to fund infrastructure upgrades and maintain shareholder returns.

Land use and eminent domain laws dictate how Atmos acquires and utilizes land for its pipeline network, with adherence to legal procedures and fair compensation being paramount to avoid costly disputes and project delays. Consumer protection laws also shape customer interactions, mandating billing accuracy and data privacy, with initiatives like customer assistance programs reflecting compliance with these mandates.

| Regulatory Body | Key Focus Area | Impact on Atmos Energy | 2023 Data/Context |

|---|---|---|---|

| PHMSA | Pipeline Safety Standards | Requires investment in integrity management and training. | Integration of ASME B31.8S standards. |

| EPA | Methane Emissions | Mandates investment in monitoring and reduction technologies. | Final rule implemented in 2024. |

| State Public Utility Commissions | Rates, Capital Investments, Service Standards | Approves cost recovery for infrastructure projects. | $3.1 billion in capital expenditures in 2023. |

| Consumer Protection Laws | Billing Accuracy, Data Privacy, Service Disconnections | Shapes customer interactions and requires support programs. | Assisted over 100,000 customers via energy assistance programs in 2023. |

Environmental factors

Methane, a potent greenhouse gas, presents a significant environmental challenge, particularly concerning emissions from natural gas infrastructure. Atmos Energy is actively addressing this through its environmental strategy, aiming to slash methane emissions by 50% by 2035, referencing a 2017 baseline.

This commitment is being realized through continuous investments in system modernization and enhanced leak detection and repair technologies. Such initiatives are crucial for mitigating environmental impact and aligning with broader climate change mitigation efforts.

Atmos Energy's operations face increasing risk from extreme weather events, a growing concern amplified by climate change. The company's extensive natural gas pipeline network and storage facilities are susceptible to damage from severe storms, flooding, and prolonged periods of extreme cold, which are projected to become more common.

Maintaining infrastructure resilience is paramount for ensuring uninterrupted service delivery to customers and preventing potential environmental hazards. For instance, in early 2024, regions served by Atmos experienced significant cold snaps, testing the capacity and integrity of their delivery systems.

Atmos Energy's extensive pipeline infrastructure, spanning thousands of miles, inherently affects land use and natural habitats. Construction activities for new pipelines or maintenance on existing ones can disrupt ecosystems, impacting soil, vegetation, and wildlife corridors. For instance, in 2023, Atmos Energy reported managing over 35,000 miles of gas distribution and transmission pipelines, each requiring careful consideration of its environmental footprint.

To mitigate these impacts, Atmos Energy employs responsible land management practices. This includes conducting thorough environmental assessments before undertaking projects, identifying and protecting sensitive areas, and implementing restoration plans post-construction. The company adheres to federal and state regulations, such as those from the Pipeline and Hazardous Materials Safety Administration (PHMSA), which mandate measures to minimize environmental damage and protect endangered species or critical habitats.

Water Usage and Waste Management

Atmos Energy's operational activities, while not inherently water-intensive like some other energy sectors, still necessitate careful management of water usage and waste. Even in natural gas distribution, routine maintenance, facility operations, and emergency response can involve water, and consequently, the generation of waste. Adherence to stringent environmental regulations concerning water quality and waste disposal is paramount for minimizing the company's ecological impact and ensuring compliance.

The company's commitment to environmental stewardship is reflected in its ongoing efforts to manage its operational footprint. For instance, in fiscal year 2023, Atmos Energy reported a focus on environmental compliance and sustainability initiatives across its service territories, aiming to reduce waste and manage water resources responsibly. Specific metrics on water usage and waste generation are often detailed in their annual sustainability reports, underscoring the importance of these factors for regulatory adherence and corporate responsibility.

- Water Management: Implementing best practices for water conservation and responsible discharge in all operational phases.

- Waste Disposal: Ensuring all waste materials, including those from pipeline maintenance and facility operations, are disposed of in accordance with federal, state, and local regulations.

- Regulatory Compliance: Maintaining strict adherence to environmental protection agency (EPA) guidelines and state-specific environmental laws governing water quality and waste management.

- Environmental Footprint: Proactively seeking ways to reduce the company's overall environmental impact through efficient resource utilization and waste minimization strategies.

Transition to Lower-Carbon Energy Sources

The global and national drive towards lower-carbon energy sources poses significant challenges and opportunities for Atmos Energy. While natural gas offers a cleaner alternative to coal, the overarching trend favors renewable energy. Atmos Energy is actively investigating avenues such as renewable natural gas (RNG) and the potential for hydrogen blending to meet decarbonization targets and ensure the continued utility of its existing infrastructure.

This transition necessitates strategic adaptation. For instance, the U.S. Energy Information Administration (EIA) reported that in 2023, natural gas accounted for approximately 42% of total U.S. utility-scale electricity generation, highlighting its current importance while also underscoring the growing share of renewables. Atmos Energy's investments in RNG, which is produced from organic waste, are a direct response to this evolving energy mix, aiming to capture value from these emerging cleaner fuels.

- RNG Investments: Atmos Energy is exploring partnerships and infrastructure development for renewable natural gas, a key component in reducing the carbon intensity of its gas delivery systems.

- Hydrogen Blending: The company is also assessing the feasibility and safety of blending hydrogen into its existing natural gas pipelines, a strategy that could further decarbonize the energy supply.

- Infrastructure Modernization: Adapting its extensive pipeline network to accommodate lower-carbon fuels is a critical operational and capital expenditure consideration for Atmos Energy's long-term strategy.

Atmos Energy faces environmental pressures related to methane emissions, aiming for a 50% reduction by 2035 from a 2017 baseline through infrastructure upgrades and leak detection. The company also manages risks from extreme weather events, which are becoming more frequent due to climate change, impacting its extensive pipeline network. Furthermore, Atmos Energy is navigating the broader energy transition by exploring renewable natural gas and hydrogen blending to align with decarbonization goals.

PESTLE Analysis Data Sources

Our PESTLE analysis for Atmos Energy is grounded in a comprehensive review of official government publications, regulatory filings, and reports from leading energy industry associations. This ensures all political, economic, and legal insights are derived from authoritative and current data.