Atmos Energy Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Atmos Energy Bundle

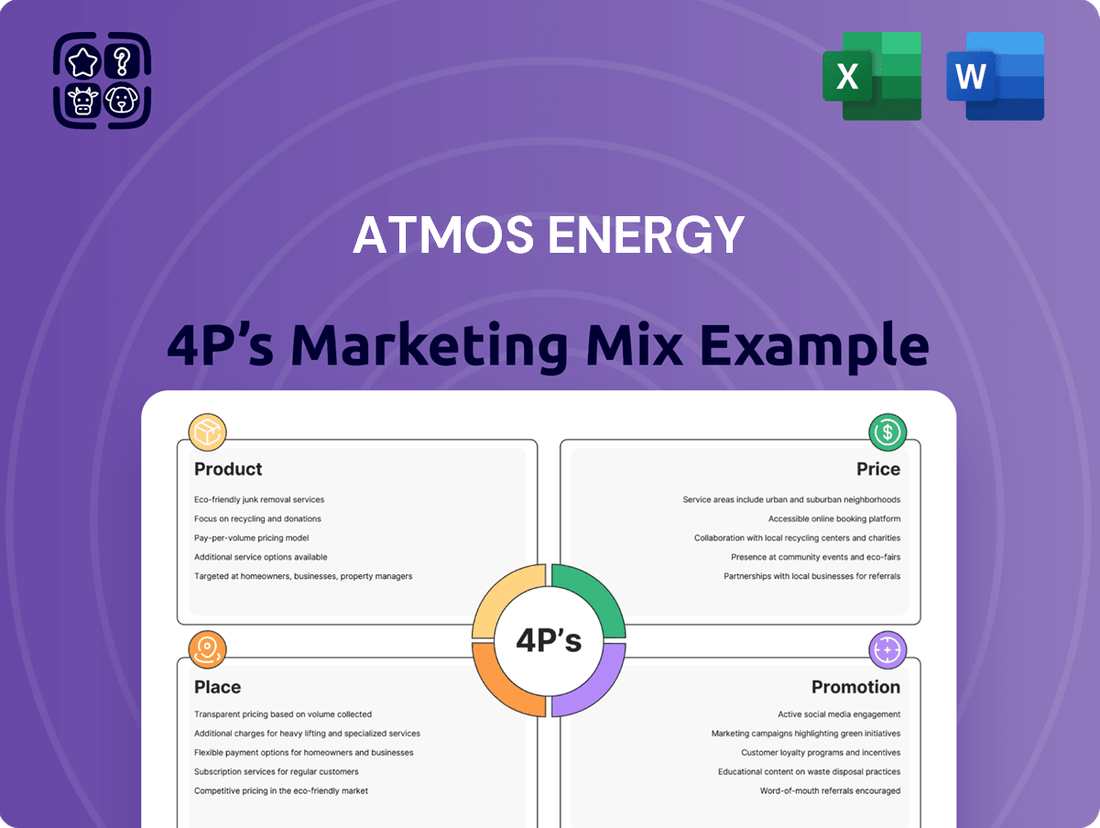

Dive into the strategic brilliance of Atmos Energy's marketing with our comprehensive 4Ps analysis. We dissect their product offerings, pricing structures, distribution channels, and promotional campaigns to reveal the core of their market success.

Go beyond the basics—get access to an in-depth, ready-made Marketing Mix Analysis covering Product, Price, Place, and Promotion strategies. Ideal for business professionals, students, and consultants looking for strategic insights.

Product

Atmos Energy's core product is the safe and reliable distribution of natural gas, reaching over 3.3 million customers across eight states. This involves delivering gas from transmission networks directly to homes and businesses, ensuring consistent service for residential, commercial, and industrial users.

The company prioritizes maintaining and upgrading its vast pipeline infrastructure, a critical element for uninterrupted natural gas delivery. This focus on infrastructure ensures the product's availability and safety for its diverse customer base.

Natural gas transmission is a key component of Atmos Energy's operations, extending beyond local distribution. These transmission pipelines are vital for moving natural gas across longer distances, connecting supply sources to demand centers and supporting the overall energy infrastructure. In fiscal year 2023, Atmos Energy's natural gas transmission segment saw significant investment, with capital expenditures of $882.8 million, highlighting its importance in the company's growth strategy.

Atmos Energy's regulated natural gas storage facilities, including significant intrastate systems in Texas, are a cornerstone of their operations. These assets, some of the largest in the state, are vital for balancing supply and demand. They store gas when it's plentiful and cheaper, making it accessible during high-demand periods, which is crucial for reliability and energy security in their service territories.

Infrastructure Modernization and Safety

Atmos Energy's commitment to infrastructure modernization is a core component of its product, ensuring the safe and reliable delivery of natural gas. This involves substantial, ongoing investments in replacing aging pipelines and implementing cutting-edge leak detection systems. For instance, in fiscal year 2023, Atmos Energy invested approximately $2.7 billion in its capital expenditure programs, a significant portion of which was dedicated to pipeline safety and modernization efforts.

These investments directly translate into enhanced safety for communities and greater reliability for customers. The company's proactive approach includes comprehensive safety training for all employees, ensuring best practices are followed at every operational level. This focus on safety and modernization underpins the integrity of the natural gas product itself.

- Pipeline Replacement Programs: Atmos Energy is actively engaged in replacing older, less resilient pipelines with modern materials designed for enhanced safety and durability.

- Advanced Leak Detection: The company utilizes sophisticated technologies to identify and address potential leaks promptly, minimizing environmental impact and ensuring operational safety.

- Safety Training Initiatives: Continuous and rigorous safety training for all personnel is a cornerstone of their product delivery, reinforcing a culture of safety.

- Fiscal Year 2023 Capital Investments: Approximately $2.7 billion was invested in capital expenditures, with a substantial allocation towards infrastructure modernization and safety enhancements.

Ancillary Services

Atmos Energy, within its pipeline and storage segment, offers essential ancillary services that complement its core operations. These services are vital for other market participants, providing crucial support and flexibility.

These offerings are typical for the natural gas pipeline industry and include services like natural gas parking, which allows for temporary storage arrangements, and lending services. Additionally, they engage in inventory sales, ensuring a readily available supply for their partners.

These ancillary services enhance Atmos Energy's value proposition by catering to the dynamic needs of the energy market. For instance, in fiscal year 2023, Atmos Energy reported significant growth in its pipeline and storage segment, reflecting the demand for such integrated services.

- Natural Gas Parking: Facilitates temporary storage solutions for natural gas.

- Lending Services: Provides financial flexibility and support to industry partners.

- Inventory Sales: Ensures consistent availability of natural gas for various market needs.

Atmos Energy's product is the safe and reliable delivery of natural gas to over 3.3 million customers across eight states. This involves extensive infrastructure management, including pipeline replacement and advanced leak detection systems. In fiscal year 2023, the company invested approximately $2.7 billion in capital expenditures, with a significant portion dedicated to modernizing its delivery network and enhancing safety protocols.

Beyond direct delivery, Atmos Energy offers ancillary services such as natural gas parking, lending, and inventory sales to other market participants. These services add value and flexibility within the energy sector. The pipeline and storage segment saw notable growth in fiscal year 2023, underscoring the demand for these integrated offerings.

| Product Aspect | Description | Fiscal Year 2023 Data |

|---|---|---|

| Core Service | Safe and reliable natural gas distribution | 3.3+ million customers |

| Infrastructure Investment | Pipeline modernization and safety enhancements | ~$2.7 billion in capital expenditures |

| Ancillary Services | Natural gas parking, lending, inventory sales | Growth in pipeline and storage segment |

What is included in the product

This analysis offers a comprehensive examination of Atmos Energy's marketing strategies, detailing their approach to Product, Price, Place, and Promotion to understand their market positioning and operational effectiveness.

Simplifies Atmos Energy's marketing strategy by clearly outlining how Product, Price, Place, and Promotion address customer needs and pain points, fostering confident decision-making.

Place

Atmos Energy's extensive distribution network is a cornerstone of its 'place' strategy, reaching over 1,400 communities across eight states, predominantly in the Southern United States. This vast infrastructure ensures natural gas is readily available to millions of residential and commercial customers, highlighting their commitment to broad accessibility.

In fiscal year 2023, Atmos Energy reported capital expenditures of approximately $3.4 billion, with a significant portion dedicated to modernizing and expanding its distribution system. This ongoing investment underscores their focus on enhancing the reach and reliability of their 'place' in the market, directly benefiting their customer base.

Atmos Energy's strategic pipeline and storage assets are foundational to its operations. The company boasts a significant intrastate pipeline system primarily in Texas, a crucial artery for natural gas distribution. This network, coupled with multiple underground storage facilities, ensures efficient transportation and reliable delivery across its service territories.

These strategically positioned assets are vital for managing the ebb and flow of natural gas supply and demand. For instance, as of the fiscal year ending September 30, 2023, Atmos Energy reported approximately 74,000 miles of gas distribution mains and service lines, underscoring the extensive reach of its pipeline infrastructure.

Atmos Energy's direct-to-customer delivery is the backbone of its natural gas distribution, serving millions of homes, businesses, and industries. This inherent utility model bypasses intermediaries, ensuring efficient delivery through its extensive pipeline network. In fiscal year 2024, Atmos Energy reported serving approximately 3.3 million customers across its operating states, highlighting the scale of its direct delivery operations.

Regulated Service Territories

Atmos Energy's 'Place' is defined by its regulated utility operations across eight states: Colorado, Kansas, Kentucky, Louisiana, Mississippi, Tennessee, Texas, and Virginia. This regulatory structure establishes exclusive service territories and operational terms, ensuring a stable, albeit geographically constrained, market presence. The company's significant market share, often being the largest natural gas distributor in key states, solidifies its position within these regulated environments.

The company's extensive reach within these territories is substantial. For instance, as of the fiscal year ending September 30, 2023, Atmos Energy served approximately 3.3 million customers. This customer base is concentrated within its regulated operating segments, highlighting the importance of these specific geographic markets to the company's overall strategy and revenue generation.

- Texas: Atmos Energy is the largest natural gas distributor in Texas, serving a significant portion of the state's population and businesses.

- Louisiana and Mississippi: Similar to Texas, the company holds a dominant position in these states, underscoring its critical role in their energy infrastructure.

- Regulatory Framework: The regulated nature of these territories means that service expansion and pricing are subject to state public utility commissions, influencing market dynamics and competitive landscape.

- Customer Base: The company's 3.3 million customers are primarily located within these eight regulated states, making them the core of Atmos Energy's 'Place' strategy.

Community Presence and Local Operations

Atmos Energy's commitment to community presence is evident through its numerous division offices and extensive field operations. These local hubs facilitate tailored customer service, rapid emergency response, and efficient infrastructure upkeep, directly benefiting the neighborhoods they operate in. This decentralized approach ensures that Atmos Energy remains accessible and responsive to the unique needs of each community.

The company actively fosters a sense of local engagement, with its employees frequently participating in community initiatives. This involvement strengthens relationships and underscores Atmos Energy's dedication to being a responsible corporate citizen. For instance, in fiscal year 2023, Atmos Energy invested over $1.2 billion in safety and reliability projects across its service territories, demonstrating a tangible commitment to the well-being of these communities.

- Local Division Offices: Facilitate localized customer support and operational management.

- Field Operations: Ensure timely infrastructure maintenance and emergency response.

- Employee Community Involvement: Demonstrates commitment beyond service provision.

- Infrastructure Investment: $1.2 billion invested in FY2023 for safety and reliability, benefiting local areas.

Atmos Energy's 'Place' strategy centers on its extensive, regulated utility infrastructure across eight Southern U.S. states, serving approximately 3.3 million customers as of fiscal year 2023. This includes over 74,000 miles of gas mains and service lines, with significant investments, like $3.4 billion in capital expenditures in FY2023, dedicated to system modernization and expansion. Their dominant market share in states like Texas, Louisiana, and Mississippi, coupled with local division offices and community engagement, ensures reliable and accessible natural gas delivery.

| Metric | Value (as of FY2023) | Significance to 'Place' |

|---|---|---|

| Operating States | 8 | Defines geographic market presence and regulatory landscape. |

| Customers Served | ~3.3 million | Indicates broad accessibility and market penetration. |

| Miles of Gas Mains/Service Lines | ~74,000 | Represents the physical reach of the distribution network. |

| FY2023 Capital Expenditures | ~$3.4 billion | Highlights investment in infrastructure enhancement and expansion. |

| Dominant Market Position | Texas, Louisiana, Mississippi | Establishes strong foothold and competitive advantage in key regions. |

What You Preview Is What You Download

Atmos Energy 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of Atmos Energy's 4 P's (Product, Price, Place, Promotion) is fully complete and ready for your immediate use.

Promotion

Atmos Energy prioritizes public safety through extensive, multi-channel awareness campaigns. These initiatives, including community events and media outreach, focus on educating customers about natural gas safety, such as recognizing leaks and the importance of calling 811 before digging. This commitment to proactive communication is vital for building and maintaining public trust and ensuring the safe delivery of energy.

Atmos Energy actively cultivates community ties through various support initiatives. For instance, their energy assistance programs help low-income customers manage utility costs. In 2023, Atmos Energy reported dedicating over $10 million to customer assistance programs, directly impacting thousands of households.

The company's presence at local events and sponsorships further solidifies its commitment to social responsibility. This engagement builds trust and strengthens relationships within the communities they serve. Such efforts contribute to a positive public image, fostering goodwill that can translate into customer loyalty and a more favorable operating environment.

Atmos Energy prioritizes investor relations, actively engaging with shareholders and the financial community. Through quarterly earnings calls, investor days, and detailed annual reports, the company transparently shares its financial performance, strategic direction, and growth prospects. This commitment to clear communication aims to foster investor confidence and attract capital for future endeavors.

Digital and Social Media Presence

Atmos Energy actively engages its audience across various digital and social media channels. The company leverages platforms like its official website, Facebook, Twitter, Instagram, and YouTube to share vital information. This multi-platform strategy ensures broad reach for news, crucial safety updates, and customer service announcements, facilitating timely communication with a diverse customer base.

Their digital presence is key to modern stakeholder engagement. For instance, as of late 2024, Atmos Energy's website serves as a central hub for investor relations, operational reports, and customer account management. Their social media feeds frequently highlight community initiatives and energy efficiency tips, demonstrating a commitment to transparency and customer education.

- Website: A primary source for corporate information, customer accounts, and safety guidelines.

- Social Media Platforms: Facebook, Twitter, Instagram, and YouTube used for news dissemination, safety alerts, and community engagement.

- Content Focus: Emphasis on timely updates, safety information, and customer service assistance.

- Audience Reach: Aims to connect with a wide spectrum of customers and the general public efficiently.

Customer Service and Direct Communication

Atmos Energy prioritizes direct customer communication, ensuring knowledgeable service agents are accessible by phone and email. This direct line of communication is crucial for handling inquiries and emergencies, fostering stronger customer relationships and demonstrating a commitment to service excellence.

The company's focus on personalized customer service is particularly vital for a utility provider. For instance, in fiscal year 2023, Atmos Energy reported significant investments in infrastructure reliability, which directly impacts customer experience and the need for responsive support.

- Customer Accessibility: Knowledgeable agents available via phone and email.

- Emergency Support: Direct communication channels for urgent needs.

- Relationship Building: Personalized interactions to enhance customer loyalty.

- Service Quality Reinforcement: Demonstrating commitment through responsive support.

Atmos Energy's promotional efforts center on robust public safety campaigns and community engagement. Their multi-channel approach, utilizing media, events, and digital platforms, educates customers on crucial safety practices like leak detection and the importance of calling 811 before digging. This proactive communication builds trust and reinforces their commitment to safe energy delivery.

The company actively supports communities, with over $10 million allocated to customer assistance programs in fiscal year 2023, aiding thousands of low-income households. Event sponsorships and local involvement further solidify their social responsibility, fostering positive relationships and customer loyalty.

Investor relations are maintained through transparent communication via earnings calls and annual reports, aiming to build confidence and attract capital. Their digital presence, including an active website and social media channels, ensures broad reach for important updates, safety alerts, and customer service information, as seen in their consistent use of platforms like Facebook and Twitter throughout 2024.

Price

Atmos Energy's pricing is dictated by a regulated structure, with rates needing approval from state public utility commissions. This oversight ensures fairness and aligns pricing with the actual costs of delivering safe, dependable natural gas. For instance, in fiscal year 2023, Atmos Energy filed numerous rate cases across its service territories to adjust tariffs, reflecting investments in infrastructure modernization and operational expenses.

Atmos Energy's pricing strategy heavily relies on cost recovery mechanisms, enabling them to recoup significant investments in modernizing their natural gas infrastructure. For instance, in fiscal year 2023, the company invested approximately $2.5 billion in capital expenditures, a substantial portion of which is recovered through these approved rate adjustments.

These mechanisms are vital for ensuring the company's financial health, allowing for continued capital spending on safety and reliability enhancements, such as leak detection and replacement programs. This focus on infrastructure upgrades is critical for maintaining the integrity and efficiency of the natural gas distribution system across their service territories.

Atmos Energy strives to offer competitive and affordable natural gas rates, recognizing its importance for customers. The company frequently positions natural gas as a more economical choice compared to electricity or propane, especially for heating needs. For instance, in the 2023 fiscal year, Atmos Energy reported an average residential monthly natural gas bill that was often the lowest among major utility costs for their customers.

Dividend and Shareholder Value

Atmos Energy's pricing strategy, heavily influenced by regulated rates, directly underpins its commitment to shareholder value. This stability allows for consistent earnings per share growth, a key indicator for investors. For instance, as of the first quarter of fiscal year 2024, Atmos Energy reported diluted earnings per share of $1.48, a notable increase from the previous year.

The company's ability to generate reliable financial performance translates into attractive returns for shareholders through dependable dividend payments. This reflects the inherent stability and predictability characteristic of the utility sector. Atmos Energy has a strong history of returning capital to shareholders, demonstrating its financial discipline.

- Consistent Earnings Growth: Atmos Energy's regulated rate structure supports predictable revenue streams, fostering steady earnings per share increases.

- Reliable Dividend Payments: The company's financial strength enables consistent dividend payouts, rewarding shareholders for their investment.

- Investor Returns: The predictable nature of the utility business model allows Atmos Energy to offer attractive and stable returns to its investors.

- Financial Stability: Regulated operations contribute to a robust financial foundation, ensuring long-term value creation for shareholders.

Rate Case Filings and Regulatory Outcomes

Atmos Energy's pricing strategy is deeply intertwined with its rate case filings before regulatory commissions. These filings are crucial as they establish the new tariff rates customers pay and dictate how the company recovers its investments and operational expenses. For instance, in its fiscal year 2023, Atmos Energy invested approximately $3.4 billion in its pipeline infrastructure, a significant portion of which is sought to be recovered through these regulatory proceedings.

The company actively engages in these continuous filings to adjust rates based on factors like capital investments, operating costs, and customer base expansion. These adjustments are vital for maintaining financial stability. Successful outcomes in these rate cases directly impact Atmos Energy's ability to fund necessary infrastructure upgrades and ensure reliable service delivery to its customers.

- Rate Case Impact: Regulatory approvals determine the prices customers pay for natural gas services.

- Cost Recovery: Filings allow Atmos Energy to recover investments in infrastructure, such as the $3.4 billion invested in FY2023.

- Financial Health: Favorable regulatory outcomes are essential for the company's financial performance and future investment capacity.

- Continuous Process: Rate cases are ongoing, enabling dynamic adjustments to pricing based on evolving operational needs and capital plans.

Atmos Energy's pricing is fundamentally shaped by regulatory approvals, ensuring rates reflect the cost of service and necessary investments. For instance, in fiscal year 2023, the company invested $3.4 billion in infrastructure, with rate cases designed to recover these expenditures. This regulated approach provides a stable framework for pricing, balancing customer affordability with the company's need for capital recovery.

| Metric | Value (FY2023/Early FY2024) | Significance |

|---|---|---|

| Infrastructure Investment | $3.4 billion | Drives rate case filings for cost recovery. |

| Diluted EPS | $1.48 (Q1 FY2024) | Demonstrates earnings stability supported by pricing. |

| Capital Expenditures | ~$2.5 billion | Highlights ongoing investment necessitating rate adjustments. |

4P's Marketing Mix Analysis Data Sources

Our 4P's Marketing Mix analysis for Atmos Energy is grounded in comprehensive data, including official company reports, regulatory filings, and customer service information. We also incorporate industry-specific research and public sentiment analysis to provide a well-rounded view of their strategies.