Atmos Energy Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Atmos Energy Bundle

Atmos Energy navigates a landscape where regulatory oversight significantly tempers the threat of new entrants and buyer power. However, the substantial capital investment required for infrastructure creates a formidable barrier to entry, while the essential nature of natural gas limits customer switching. The complete report reveals the real forces shaping Atmos Energy’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The natural gas upstream supply market exhibits a notable concentration, with a limited number of major producers and pipeline companies holding substantial control over available supply. This consolidation of power means these suppliers can exert significant influence over pricing and contract terms when negotiating with distributors such as Atmos Energy.

Natural gas is the lifeblood of Atmos Energy, forming the core of its distribution business. This fundamental reliance means the company’s operational success is directly tied to the consistent and dependable availability of this essential commodity from its suppliers.

The critical nature of natural gas as an input creates a significant dependency for Atmos Energy on its upstream suppliers. In 2023, Atmos Energy reported that natural gas purchases constituted a substantial portion of its cost of goods sold, underscoring the importance of managing these supplier relationships effectively.

Atmos Energy's extensive reliance on pipeline networks and storage facilities for natural gas delivery means that the infrastructure itself, and those who control it, can exert significant influence. The availability and cost of utilizing this essential transportation and storage capacity, often managed by other large entities in the energy sector, directly impacts Atmos's operational flexibility and costs, thereby affecting supplier power.

Long-Term Contracts and Regulatory Oversight

Atmos Energy frequently secures its natural gas supply through long-term contracts, a strategy that helps stabilize costs and reduce the immediate impact of volatile market prices. These agreements often span several years, providing a predictable cost structure and lessening the leverage individual suppliers might otherwise wield.

Regulatory oversight significantly tempers supplier bargaining power for Atmos Energy. Agencies like the Public Utility Commission of Texas (PUCT) and the Louisiana Public Service Commission (LPSC) review and approve fuel procurement practices and rates. For instance, in 2023, Atmos Energy reported that its purchased gas costs were passed through to customers with minimal markup, a testament to regulatory frameworks designed to protect consumers from supplier-driven price hikes.

- Long-term contracts: Atmos Energy's commitment to multi-year supply agreements limits the frequency with which it must renegotiate terms with individual suppliers, thereby reducing supplier leverage.

- Regulatory approval: Fuel procurement contracts and associated costs are subject to review and approval by state utility commissions, ensuring fair pricing and limiting supplier ability to dictate terms.

- Pass-through mechanisms: Regulatory frameworks allow Atmos Energy to pass through approved purchased gas costs to customers, insulating the company from bearing the full brunt of supplier price increases.

Commodity Price Volatility

Commodity price volatility, particularly for natural gas, presents a significant challenge for Atmos Energy. While long-term supply contracts can provide a degree of predictability, the inherent fluctuations in natural gas prices, driven by weather patterns, global supply and demand dynamics, and geopolitical influences, can still impact the company's cost of goods. For instance, during periods of extreme cold in 2024, natural gas spot prices saw considerable upward movement, directly affecting the procurement costs for utilities like Atmos Energy, even for those with existing supply agreements.

This volatility means that even with contractual stability, Atmos Energy faces potential cost escalations. The company's ability to pass these increased costs onto consumers through regulatory mechanisms is crucial, but the timing and extent of such adjustments can lag behind the actual market price changes. This creates a margin squeeze risk.

- Natural gas prices can fluctuate significantly due to weather events, impacting procurement costs.

- Geopolitical factors and global supply/demand imbalances contribute to price volatility.

- Even with long-term contracts, Atmos Energy can experience cost increases from volatile commodity prices.

- Regulatory approval is needed to pass on increased natural gas costs to customers, creating potential lag effects.

The bargaining power of Atmos Energy's natural gas suppliers is somewhat mitigated by the company's strategic use of long-term contracts, which lock in prices and reduce the need for frequent renegotiations. Furthermore, stringent regulatory oversight by bodies like the PUCT and LPSC ensures that fuel procurement practices are fair and that costs are passed through to customers with minimal markups, limiting suppliers' ability to dictate terms. However, significant commodity price volatility, as seen with upward price movements in 2024 due to weather events, can still create cost pressures for Atmos Energy, even with existing agreements.

| Factor | Impact on Supplier Bargaining Power | Atmos Energy's Mitigation Strategy |

|---|---|---|

| Market Concentration | High; limited producers/pipelines | Long-term contracts, diversified sourcing |

| Contractual Agreements | Reduced leverage through multi-year deals | Secures stable pricing, predictable costs |

| Regulatory Oversight | Limits supplier pricing power | Pass-through mechanisms, rate case approvals |

| Commodity Price Volatility | Potential for cost increases (e.g., 2024 weather impacts) | Regulatory pass-through, hedging strategies |

What is included in the product

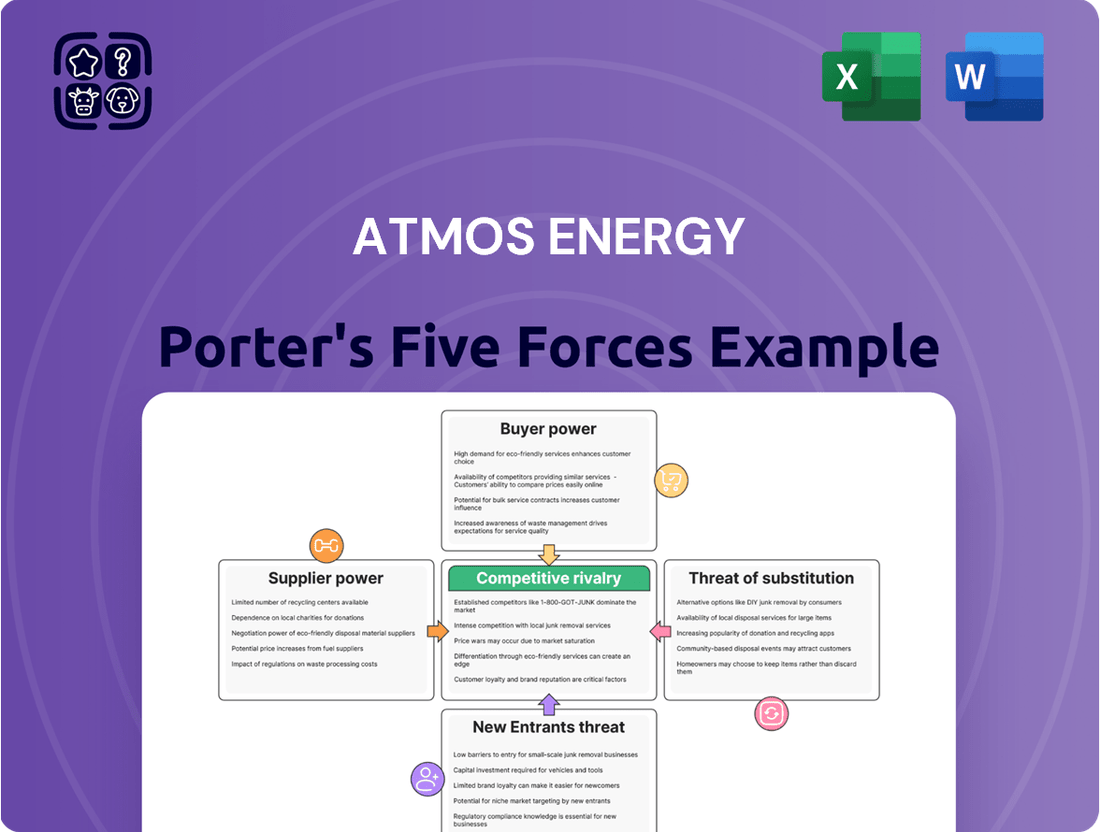

Tailored exclusively for Atmos Energy, analyzing its position within its competitive landscape by examining supplier power, buyer bargaining, new entrant threats, substitute products, and existing industry rivalry.

Instantly visualize Atmos Energy's competitive landscape with a dynamic Porter's Five Forces model, simplifying complex market pressures for strategic clarity.

Customers Bargaining Power

Atmos Energy's regulated monopoly status in its service territories greatly diminishes customer bargaining power. Because customers generally cannot choose an alternative natural gas provider, their ability to negotiate prices or terms is severely limited. This lack of competition means customers must accept the rates and services approved by regulatory bodies.

Natural gas is a fundamental utility for homes, businesses, and industries, powering everything from heating and cooking to crucial manufacturing processes. This inherent necessity significantly curtails customers' leverage.

Because natural gas is an essential service, customers have very limited options to switch providers or go without. For instance, in 2024, Atmos Energy serves millions of customers across its operating states, highlighting the widespread reliance on its services for daily life and economic activity.

Atmos Energy's customer bargaining power is largely mediated through formal rate case mechanisms overseen by public utility commissions. Customers, or their representatives, can voice concerns and present evidence during these proceedings, influencing approved rate adjustments. For instance, in fiscal year 2023, Atmos Energy filed rate cases in multiple states, with the outcomes reflecting extensive review of their proposed capital investments and operating expenses.

Customer Segmentation

The bargaining power of customers for Atmos Energy is generally low, largely due to the regulated nature of the natural gas distribution industry. Customer segmentation reveals this dynamic clearly. Individual residential customers possess minimal bargaining power, as their choices are limited and their individual consumption volumes are insignificant to Atmos Energy.

Larger customer segments, such as industrial users or significant commercial entities, might exhibit slightly more leverage. This stems from their higher consumption volumes, which represent a more substantial revenue stream for Atmos Energy. However, even these larger customers operate within a regulated framework that limits their ability to negotiate pricing or service terms significantly, keeping their overall bargaining power constrained.

For context, in 2023, Atmos Energy served approximately 3.3 million customers across its service territories. While the exact breakdown by segment isn't publicly detailed for bargaining power analysis, the vast majority are residential, underscoring the limited collective power of the customer base.

- Low individual customer power: Residential customers have negligible bargaining power due to low individual consumption and limited alternative providers.

- Slightly increased power for large consumers: Industrial and large commercial customers may have a marginal increase in leverage due to higher volumes, but this is still heavily regulated.

- Regulatory constraints limit negotiation: The highly regulated environment for natural gas utilities significantly restricts the ability of any customer segment to negotiate substantial price or service concessions.

- Dominance of residential customer base: With millions of residential customers, the overall customer base is fragmented, further diluting any potential for collective bargaining.

Customer Growth and Retention

While customers generally have limited direct bargaining power with Atmos Energy, their collective demand and retention are crucial for sustained growth. Atmos Energy actively focuses on attracting and keeping customers by ensuring reliable service delivery and investing in infrastructure upgrades. This focus on customer satisfaction and service quality represents an indirect but significant influence on the company's strategic direction and long-term planning.

- Customer Acquisition and Retention: Atmos Energy's strategy prioritizes attracting new customers and retaining existing ones, underscoring the importance of customer loyalty for revenue stability.

- Service Reliability as a Differentiator: The company leverages its commitment to dependable natural gas distribution as a key factor in customer attraction and retention, directly impacting its growth trajectory.

- Infrastructure Modernization: Investments in upgrading and modernizing its pipeline systems are aimed at improving service quality and safety, which in turn supports customer satisfaction and reduces churn.

- Indirect Customer Influence: The need to maintain and grow its customer base means that customer preferences for reliable and safe service indirectly shape Atmos Energy's operational and capital expenditure decisions.

Atmos Energy's customers possess very low bargaining power, primarily due to the essential nature of natural gas and the company's regulated monopoly status in its service territories. Individual customers, especially residential ones, have virtually no ability to negotiate prices or terms, as their consumption is small and alternatives are non-existent. Even larger industrial or commercial clients find their leverage significantly constrained by regulatory oversight, which dictates pricing and service standards. This regulatory environment effectively shields Atmos Energy from direct customer price pressure, making formal rate cases the primary avenue for customer input.

| Customer Segment | Bargaining Power Level | Reasoning |

|---|---|---|

| Residential Customers | Very Low | Minimal individual consumption, no alternative providers, regulated pricing. |

| Commercial Customers | Low | Higher consumption but still subject to regulatory price controls and limited switching options. |

| Industrial Customers | Low to Moderate | Significant consumption can provide marginal influence, but regulatory framework remains a primary constraint on price negotiation. |

What You See Is What You Get

Atmos Energy Porter's Five Forces Analysis

This preview showcases the complete Atmos Energy Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the energy sector. The document you see here is precisely what you will receive immediately after purchase, ensuring no surprises and full readiness for your strategic planning needs.

Rivalry Among Competitors

Atmos Energy operates primarily as a regulated natural gas distribution company, effectively holding geographic monopolies in the territories it serves. This structure inherently limits direct competition from other natural gas distributors within the same areas, as service rights are typically exclusive.

This lack of direct competition means Atmos Energy faces minimal rivalry from similar companies vying for customers in its established service territories. For instance, as of the first quarter of fiscal year 2024, Atmos Energy reported serving over 3.3 million customers across eight states, each representing a distinct, often monopolistic, service area.

Atmos Energy operates within a heavily regulated utility sector, where state and federal commissions, such as the Public Utility Commission of Texas and the U.S. Department of Transportation, dictate operational standards, pricing structures, and service territories. This oversight significantly curtails direct competitive rivalry among established natural gas distributors.

The stringent regulatory environment acts as a substantial barrier to entry for potential new competitors, effectively limiting the number of players within specific service areas. For instance, in 2023, Atmos Energy reported approximately 3.2 million customers across its various divisions, a testament to its established and protected market presence.

Atmos Energy operates in a sector characterized by intense competition, primarily driven by the need for massive infrastructure investments. The natural gas distribution business demands significant capital outlays for pipelines, storage facilities, and delivery networks. These substantial fixed costs act as a formidable barrier to entry, effectively discouraging new companies from entering the market and thus limiting the intensity of direct rivalry among existing players.

In 2023, Atmos Energy reported capital expenditures of approximately $2.5 billion, highlighting the ongoing investment required to maintain and upgrade its extensive natural gas distribution system. This continuous reinvestment in infrastructure not only supports operational efficiency but also reinforces the high barriers to entry, making it challenging for potential competitors to establish a comparable footprint and compete effectively on a large scale.

Focus on Safety and Reliability

For Atmos Energy, competitive rivalry in the utility sector is less about undercutting prices and more about demonstrating unwavering commitment to safety and reliability. This focus is critical because the regulated nature of the industry means price wars are generally not feasible. Customers, and regulators alike, prioritize uninterrupted service and the secure delivery of natural gas. Atmos Energy explicitly highlights safety and reliability as foundational pillars of its operational strategy, aiming to build trust and maintain its license to operate.

The emphasis on safety and reliability translates into significant investments. In fiscal year 2023, Atmos Energy reported capital expenditures of approximately $3.5 billion, with a substantial portion dedicated to infrastructure modernization and safety enhancements. This ongoing investment directly addresses the core competitive factors, ensuring the company can meet stringent regulatory standards and customer expectations for dependable service.

- Safety and Reliability as Differentiators: Competition among natural gas utilities like Atmos Energy centers on operational excellence and customer trust, not price.

- Regulatory Influence: The heavily regulated environment limits price competition, shifting the competitive battleground to service quality and safety.

- Capital Investment in Safety: Atmos Energy's substantial capital expenditures, such as the $3.5 billion in FY2023, are strategically allocated to infrastructure upgrades that bolster safety and reliability, directly impacting its competitive standing.

- Customer Perception: A strong track record in safety and reliability is paramount for maintaining customer satisfaction and regulatory approval, key elements in the utility industry's competitive landscape.

Comparison with Other Utilities

While direct competition among natural gas distributors is limited, Atmos Energy faces indirect rivalry from other utility providers like electric and water companies when attracting investor capital. These other utilities, however, do not typically compete for the same essential energy needs as natural gas.

For instance, in 2024, Atmos Energy's regulated utility operations mean it often holds a near-monopoly in its service territories for natural gas delivery. However, investors might compare its performance metrics, such as dividend yield and revenue stability, against electric utilities that serve similar geographic areas or have comparable market capitalizations.

- Investor Comparison: Atmos Energy's stock performance and financial health are often benchmarked against other utilities, including electric and water companies, by investors seeking stable, income-generating assets.

- Limited Direct Competition: The core business of natural gas distribution has low direct rivalry due to the significant infrastructure investment and regulatory hurdles required to enter the market.

- Indirect Competition for Capital: Utilities across different sectors compete for investor dollars, with factors like regulatory environments, growth prospects, and dividend policies influencing investment decisions.

- Different Energy Sources: While electric utilities might serve the same customers, they offer a different primary energy source, meaning they aren't direct substitutes for natural gas in many applications.

Competitive rivalry for Atmos Energy is notably low due to its regulated, geographically exclusive service territories. This structure inherently limits direct competition from other natural gas distributors within the same areas, as service rights are typically granted on a monopolistic basis. For instance, in fiscal year 2023, Atmos Energy served over 3.3 million customers, each residing in areas where it holds exclusive distribution rights.

The primary competitive battleground for Atmos Energy revolves around operational safety and reliability rather than price wars, which are largely precluded by regulatory oversight. Investors and regulators alike prioritize uninterrupted service and secure delivery, making these factors key differentiators. Atmos Energy's commitment to these areas is underscored by its significant capital investments; in FY2023, the company invested approximately $3.5 billion in infrastructure modernization and safety enhancements.

| Key Competitive Factor | Atmos Energy's Approach | Supporting Data (FY2023) |

| Direct Rivalry | Minimal due to regulated monopolies | Serves over 3.3 million customers in exclusive territories |

| Key Differentiators | Safety and Reliability | Capital expenditures of $3.5 billion focused on infrastructure and safety |

| Indirect Competition | For investor capital against other utilities | Performance metrics compared to electric and water utilities |

SSubstitutes Threaten

Electricity poses a significant threat as a substitute for natural gas, especially in residential and commercial sectors for heating, water heating, and cooking. The growing emphasis on electrification, driven by environmental concerns and advancements in renewable energy technologies, makes electric alternatives increasingly viable and attractive to consumers and businesses alike. For instance, by the end of 2023, over 40% of new home construction in the US featured electric heat pumps, a trend that directly competes with natural gas heating systems.

The increasing prevalence of renewable energy sources like solar and wind presents a significant threat to Atmos Energy. As these technologies become more cost-effective and widely adopted for electricity generation, they directly compete with natural gas, potentially diminishing demand in this key sector. For instance, by the end of 2023, renewable energy sources accounted for approximately 23% of total electricity generation in the United States, a figure projected to rise.

Alternative fuels such as propane, heating oil, and geothermal systems pose a threat to natural gas, particularly in areas with less robust natural gas infrastructure or where these alternatives offer specific advantages. For instance, in some rural or developing regions, propane might be more readily available and cost-effective for residential heating than extending natural gas lines. Geothermal systems, while having higher upfront costs, offer long-term energy savings and environmental benefits that can appeal to certain customer segments.

Energy Efficiency and Conservation

Improvements in energy efficiency for appliances and buildings, coupled with growing consumer awareness and conservation efforts, directly reduce the demand for natural gas. This trend can be seen as a significant threat of substitutes for Atmos Energy.

For instance, advancements in insulation technology and smart home systems are making buildings more energy-efficient, requiring less heating fuel. Additionally, the increasing adoption of electric vehicles and heat pumps, powered by electricity, offers an alternative to natural gas for transportation and heating needs.

- Energy Efficiency Gains: In 2023, the U.S. Energy Information Administration (EIA) reported ongoing improvements in energy intensity across various sectors, indicating less energy is needed per unit of economic output.

- Consumer Behavior: Surveys consistently show a rising public interest in sustainability and energy conservation, leading to more conscious energy usage patterns.

- Electrification Trends: The market for electric heating systems and appliances continues to expand, presenting a direct substitute for natural gas in residential and commercial applications.

Cost and Availability of Substitutes

The threat of substitutes for Atmos Energy's natural gas services is significantly shaped by the cost and availability of alternative energy sources. When natural gas prices are high, options like electricity, propane, or even heating oil become more appealing to residential and commercial customers. For instance, in early 2024, fluctuating natural gas spot prices directly impacted the competitiveness of gas versus electricity for heating purposes in many regions where Atmos operates.

The relative cost advantage of natural gas is a primary driver for its adoption. If the price of electricity, for example, remains stable or decreases while natural gas prices spike, customers may consider switching their appliances or heating systems. This dynamic is crucial for Atmos Energy, as it directly influences customer retention and the potential for new customer acquisition.

- Cost Competitiveness: The price difference between natural gas and substitutes like electricity or propane directly influences customer switching behavior.

- Availability of Alternatives: The widespread availability and reliability of alternative energy sources in Atmos Energy's service territories are key factors.

- Price Volatility: Fluctuations in natural gas prices can rapidly alter the attractiveness of substitutes, impacting demand.

- Technological Advancements: Improvements in the efficiency and cost-effectiveness of electric or propane appliances can strengthen the threat of substitutes.

Electricity, powered by increasingly efficient heat pumps and renewable sources, directly challenges natural gas for heating and cooking. By the end of 2023, over 40% of new US homes featured electric heat pumps, a significant shift away from gas. Furthermore, renewable energy sources like solar and wind made up roughly 23% of US electricity generation in 2023, a share projected to grow, making electric alternatives more competitive.

Alternative fuels such as propane and heating oil, alongside geothermal systems, present localized threats, especially where natural gas infrastructure is less developed. Propane can be more accessible in rural areas, while geothermal offers long-term savings appealing to specific demographics. Energy efficiency improvements also play a role, as better insulation and smarter appliances reduce overall heating fuel demand.

| Substitute | Key Driver | 2023/2024 Trend Impact |

|---|---|---|

| Electricity (Heat Pumps) | Electrification, Environmental Concerns | 40%+ of new US homes had electric heat pumps by end of 2023. |

| Renewable Energy Sources | Cost-Effectiveness, Grid Decarbonization | 23% of US electricity generation in 2023, with continued growth. |

| Propane/Heating Oil | Infrastructure Gaps, Regional Availability | Remains a viable alternative in areas without extensive gas networks. |

| Geothermal Systems | Long-term Savings, Environmental Benefits | Growing interest for new construction and retrofits despite higher upfront costs. |

| Energy Efficiency | Consumer Awareness, Technological Advancements | Reduced overall energy consumption per unit of economic output reported by EIA in 2023. |

Entrants Threaten

The natural gas distribution sector, which Atmos Energy operates within, demands substantial upfront capital. Building and maintaining the extensive pipeline networks, storage facilities, and distribution infrastructure necessary to serve customers requires billions of dollars. For instance, in fiscal year 2023, Atmos Energy reported capital expenditures of approximately $3.4 billion, highlighting the scale of investment needed to maintain and upgrade its operations.

The natural gas distribution industry presents significant barriers to entry due to stringent regulatory requirements. Companies must obtain numerous permits and licenses, a process that can be both time-consuming and costly. For instance, in 2024, the average time to secure all necessary operating permits for new utility infrastructure projects often exceeded 18-24 months, deterring many potential competitors.

Established infrastructure and a substantial customer base pose a significant barrier for new entrants. Existing utilities, like Atmos Energy, have already invested billions in extensive pipeline networks and distribution systems, creating a high capital requirement for any newcomer. For instance, Atmos Energy's capital expenditures in fiscal year 2023 alone were approximately $3.2 billion, highlighting the scale of investment needed to replicate their operational capacity.

New companies would face the daunting task of building a comparable network from scratch while simultaneously trying to lure customers away from a regulated utility with an established service history and often lower, predictable rates. This entrenched advantage makes it incredibly difficult for new market participants to gain traction and achieve economies of scale necessary for competitive pricing.

Economies of Scale and Experience

Incumbent natural gas distributors like Atmos Energy significantly benefit from substantial economies of scale. This allows them to spread fixed costs across a larger customer base, leading to lower per-unit operating, maintenance, and procurement expenses. For instance, in 2023, Atmos Energy reported operating revenues of $3.5 billion, indicative of its large-scale operations.

New entrants would face a steep uphill battle to replicate the decades of operational experience and specialized expertise that established players possess. This accumulated knowledge is crucial for efficiently managing intricate pipeline networks, ensuring safety, and effectively responding to unforeseen emergencies, areas where new companies would initially be at a distinct disadvantage.

The threat of new entrants is therefore mitigated by these entrenched advantages:

- Economies of Scale: Large existing infrastructure and customer bases reduce per-unit costs for incumbents.

- Operational Experience: Decades of managing complex, regulated systems provide a significant barrier.

- Capital Investment: Building new, extensive natural gas distribution networks requires massive upfront capital, often exceeding what new entrants can readily secure.

Public Safety and Reliability Requirements

The critical nature of natural gas delivery for public safety and reliability places immense barriers on new entrants. Atmos Energy, like other utility providers, operates under strict regulatory oversight demanding proven operational excellence and a deep commitment to safety protocols. Demonstrating the capacity to meet these rigorous standards, which often involve significant capital investment in infrastructure and specialized training, presents a substantial hurdle.

New companies entering the natural gas distribution market would face intense scrutiny from regulators and the public alike. They would need to prove their ability to maintain uninterrupted service, manage potential leaks effectively, and adhere to all safety mandates. For instance, in 2023, Atmos Energy reported investing billions in pipeline modernization and safety initiatives, a scale of commitment that is difficult for newcomers to replicate quickly.

- High Capital Investment: New entrants require substantial upfront capital for infrastructure, safety systems, and regulatory compliance, potentially running into billions of dollars.

- Stringent Regulatory Approval: Gaining approval from bodies like the Public Utility Commission requires a demonstrable track record of safety and reliability.

- Operational Expertise: Managing a complex natural gas distribution network demands specialized knowledge and experienced personnel, which are not easily acquired.

- Public Trust and Reputation: Existing providers benefit from established public trust; new entrants must build this from scratch, a challenging feat given the sensitive nature of utility services.

The threat of new entrants in the natural gas distribution sector is significantly low, primarily due to the immense capital required to establish a comparable infrastructure. Atmos Energy's fiscal year 2023 capital expenditures alone neared $3.4 billion, a figure that new companies would need to match or exceed to compete effectively. Furthermore, the industry is heavily regulated, demanding extensive permits and licenses that can take 18-24 months to secure in 2024, creating a substantial hurdle for any potential competitor.

| Barrier | Description | Example Data |

|---|---|---|

| Capital Requirements | Building extensive pipeline networks and distribution systems demands billions of dollars. | Atmos Energy FY2023 CapEx: ~$3.4 billion |

| Regulatory Hurdles | Obtaining numerous permits and licenses is time-consuming and costly. | Average permit acquisition time: 18-24 months (2024) |

| Economies of Scale | Incumbents benefit from lower per-unit costs due to large operations. | Atmos Energy FY2023 Operating Revenues: ~$3.5 billion |

| Operational Expertise | Managing complex systems requires decades of specialized knowledge and experience. | N/A (Qualitative Barrier) |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Atmos Energy is built upon a foundation of publicly available financial reports, including annual and quarterly filings with the SEC, alongside industry-specific research from reputable sources like the American Gas Association and EIA data.

We also leverage market intelligence from financial data providers such as S&P Capital IQ and Bloomberg, complemented by news and press releases from Atmos Energy and its direct competitors to capture current competitive dynamics.