American Tire Distributors Holdings SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

American Tire Distributors Holdings Bundle

American Tire Distributors Holdings possesses significant strengths in its extensive distribution network and strong supplier relationships, but faces threats from evolving market dynamics and competitive pressures. Understanding these internal capabilities and external challenges is crucial for strategic planning.

Want the full story behind American Tire Distributors Holdings' strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

American Tire Distributors (ATD) possesses a formidable distribution network across North America, a key strength that underpins its market leadership. This extensive infrastructure, covering both the United States and Canada, allows for swift and reliable delivery of products to a wide array of customers, from large retail chains to independent tire dealers.

This broad geographical reach translates into significant market penetration, ensuring ATD's products are readily accessible across diverse regions. In 2024, ATD continued to leverage this network to serve over 8,000 customers, solidifying its position as a primary supplier in the competitive tire distribution landscape.

American Tire Distributors Holdings (ATD) boasts a remarkably broad customer base, serving around 80,000 clients. This extensive network includes independent tire dealers, service stations, and car dealerships, underscoring ATD's deep penetration into the replacement tire market.

This wide reach translates into stable revenue streams, as ATD isn't overly dependent on any particular customer segment. The sheer volume of customers also presents fertile ground for cross-selling various tire and automotive products, further solidifying ATD's market position.

American Tire Distributors Holdings (ATD) boasts a remarkably comprehensive product and service offering that extends well beyond just tires. They are a one-stop shop for automotive aftermarket needs, also supplying custom wheels and essential shop supplies. This broad portfolio significantly boosts customer convenience and fosters loyalty.

ATD further differentiates itself by providing crucial value-added services. These include robust logistical support, efficient inventory management solutions, and tailored marketing programs. These offerings solidify ATD's relationships with its customers, setting it apart from competitors who may focus solely on product distribution.

Leading Independent Distributor Position

American Tire Distributors Holdings (ATD) holds a dominant position as a leading independent tire distributor across North America. This strong market presence cultivates significant brand recognition and deeply entrenched relationships throughout the tire industry. For instance, ATD's extensive network, serving thousands of dealers, highlights its established reach.

This leadership translates directly into tangible advantages, including fortified supplier partnerships, which often result in more favorable pricing structures and enhanced negotiating leverage. ATD's ability to secure better terms from manufacturers is a critical component of its competitive edge.

Furthermore, ATD's established leadership signals a high degree of reliability and specialized expertise to its broad customer base. This reputation is crucial in an industry where trust and consistent service are paramount for tire retailers and service providers.

- Market Leadership: ATD is a top-tier independent tire distributor in North America.

- Supplier Leverage: Strong industry relationships grant ATD preferential pricing and negotiation power.

- Customer Trust: ATD's leading status reinforces its image as a dependable and knowledgeable partner.

Operational Efficiency and Value-Added Support

American Tire Distributors Holdings (ATD) excels in operational efficiency by offering robust logistical support and inventory management programs. These services directly streamline operations for their tire dealer customers, reducing overhead and improving stock turnover. This focus on adding value beyond product distribution cultivates strong customer loyalty and repeat business, a key differentiator in the competitive tire wholesale market.

ATD's commitment to customer success through these integrated support systems enhances their overall value proposition. For instance, in 2024, ATD reported significant improvements in delivery times through optimized routing and warehouse management, directly impacting their clients' ability to meet consumer demand promptly.

- Logistical Excellence: ATD's advanced supply chain network ensures timely and cost-effective delivery of tires, minimizing downtime for dealers.

- Inventory Management: Programs designed to optimize stock levels help customers reduce carrying costs and avoid stockouts.

- Customer Support: Value-added services foster stronger relationships and encourage long-term partnerships.

- Efficiency Gains: By reducing operational friction for their clients, ATD directly contributes to their customers' profitability and competitive edge.

ATD's extensive distribution network is a cornerstone of its strength, enabling rapid and reliable delivery across North America. This robust infrastructure supports over 8,000 customers as of 2024, solidifying its market leadership.

The company's broad customer base, numbering around 80,000, provides revenue stability and opportunities for cross-selling. ATD's comprehensive product and service offering, including wheels and shop supplies, alongside value-added services like logistics and inventory management, further enhances customer loyalty and differentiates it from competitors.

ATD's market leadership translates into significant supplier leverage, allowing for favorable pricing and negotiation power. This established position fosters customer trust through demonstrated reliability and specialized industry expertise.

What is included in the product

Delivers a strategic overview of American Tire Distributors Holdings’s internal and external business factors, highlighting its market position and potential growth avenues.

Uncovers hidden competitive advantages and potential threats for American Tire Distributors Holdings, enabling proactive strategic adjustments.

Weaknesses

American Tire Distributors Holdings (ATD) faces a significant weakness due to its heavy reliance on the replacement tire market. This segment is inherently susceptible to economic cycles and fluctuations in consumer discretionary spending. When the economy slows, consumers often postpone non-essential purchases, including new tires, directly impacting ATD's sales volumes.

The aftermarket demand, which ATD primarily serves, can be less stable than original equipment manufacturer (OEM) sales. Economic downturns in 2024 and anticipated slower growth in 2025, coupled with potential shifts in consumer behavior like delaying vehicle maintenance, directly threaten ATD's revenue streams. This makes revenue predictability a challenge.

American Tire Distributors Holdings faces substantial operational costs due to its vast distribution network spanning across the United States and Canada. Maintaining numerous warehouses, managing a large transportation fleet, and employing a significant workforce are all major expenses. For instance, in 2023, rising fuel prices alone added considerable strain to logistics budgets.

Fluctuations in fuel costs, coupled with upward pressure on labor wages and the ongoing expenses of fleet upkeep, directly impact profitability by squeezing profit margins. The company must constantly monitor and adapt to these economic variables to mitigate their effect on earnings.

Effectively managing this extensive logistical operation necessitates ongoing investment in technology for route optimization and warehouse efficiency, alongside continuous efforts to streamline processes. Failure to invest in and optimize this network could lead to decreased competitiveness and higher costs.

American Tire Distributors Holdings (ATD) faces significant vulnerability due to its reliance on a robust global supply chain. Disruptions, whether from geopolitical tensions, natural calamities, or issues at tire manufacturing facilities, can severely impact ATD's ability to maintain adequate inventory. For instance, the semiconductor shortage that affected various industries in 2021-2022 also had ripple effects on automotive production, indirectly pressuring tire supply chains.

Such disruptions can lead to stockouts, frustrating ATD's extensive customer base of tire retailers and service centers. Delayed deliveries directly affect these businesses' ability to serve their end consumers, potentially eroding customer loyalty and ATD's market share. In 2023, reports indicated ongoing supply chain challenges for various automotive components, underscoring the persistent risk for distributors like ATD.

Intense Competition and Pricing Pressures

American Tire Distributors Holdings faces a challenging landscape due to intense competition within the tire distribution sector. The market is populated by a multitude of regional and national distributors, alongside the growing possibility of tire manufacturers engaging in direct sales to consumers, which further intensifies rivalry.

This competitive environment directly translates into significant pricing pressures. ATD must navigate the need to maintain competitive pricing, which can unfortunately erode profit margins. For instance, in 2023, the average gross profit margin for tire retailers hovered around 25-30%, a figure ATD likely contends with. Staying ahead requires a continuous focus on service differentiation and agile pricing strategies to secure and grow market share.

- Intense Rivalry: The tire distribution market is crowded with both established regional players and national entities.

- Manufacturer Direct-to-Consumer: The potential for tire manufacturers to bypass distributors and sell directly adds another layer of competition.

- Margin Erosion: Fierce competition often forces distributors like ATD to reduce prices, impacting profitability.

- Strategic Imperative: Maintaining market position necessitates ongoing innovation in customer service and sharp pricing tactics.

Integration Challenges of Technology and Logistics

American Tire Distributors (ATD) faces significant hurdles in seamlessly integrating new technologies across its vast logistics network. The sheer scale of its operations, encompassing numerous distribution centers and a complex supply chain, makes the adoption of advanced inventory management, route optimization, and customer relationship management (CRM) systems a substantial undertaking. This integration is not only costly but also presents a considerable challenge in ensuring all facets of the business operate cohesively.

Legacy IT systems, still in use in some areas, can impede the agility required to implement and leverage cutting-edge solutions effectively. For instance, ATD's 2024 financial reports indicate ongoing investment in IT infrastructure upgrades, with a notable portion allocated to modernizing their core systems. However, the complexity of replacing or overhauling these foundational technologies means that achieving full integration and realizing the full benefits of advanced solutions, such as AI-driven demand forecasting or real-time fleet tracking, remains a work in progress. Failing to overcome these integration challenges could impact ATD's ability to maintain operational efficiency and its competitive standing in an industry that increasingly relies on technological innovation.

- Integration Complexity: ATD's extensive operational footprint amplifies the difficulty and expense of rolling out new technologies for inventory, routing, and customer management.

- Legacy System Constraints: Older IT infrastructure may limit the speed and effectiveness of adopting modern, agile technological solutions.

- Cost of Implementation: Significant capital expenditure is required for the successful integration of advanced technological systems across the entire distribution network.

- Competitive Necessity: Efficiently integrating new technologies is critical for ATD to remain competitive and responsive in a rapidly evolving market landscape.

ATD's heavy reliance on the replacement tire market makes it vulnerable to economic downturns. For example, a slowdown in consumer spending in 2024 could directly impact sales as new tires are often deferred purchases. This dependence on aftermarket demand, rather than more stable OEM sales, creates revenue unpredictability.

The company's extensive distribution network, while a strength, also represents a significant weakness due to high operational costs. Rising fuel prices in 2023 and ongoing labor wage pressures directly squeeze profit margins. Maintaining this vast infrastructure requires continuous investment in technology and process optimization to avoid escalating expenses.

ATD's vulnerability to global supply chain disruptions is a key weakness. Issues like geopolitical tensions or manufacturing problems can lead to inventory shortages, frustrating customers and potentially eroding loyalty. Supply chain challenges persisted in various automotive sectors through 2023, highlighting this ongoing risk.

Intense competition within the tire distribution sector, including the potential for manufacturers to sell directly to consumers, puts significant pricing pressure on ATD. This often forces distributors to lower prices, impacting profitability. In 2023, gross profit margins for tire retailers were generally in the 25-30% range, a benchmark ATD must contend with.

What You See Is What You Get

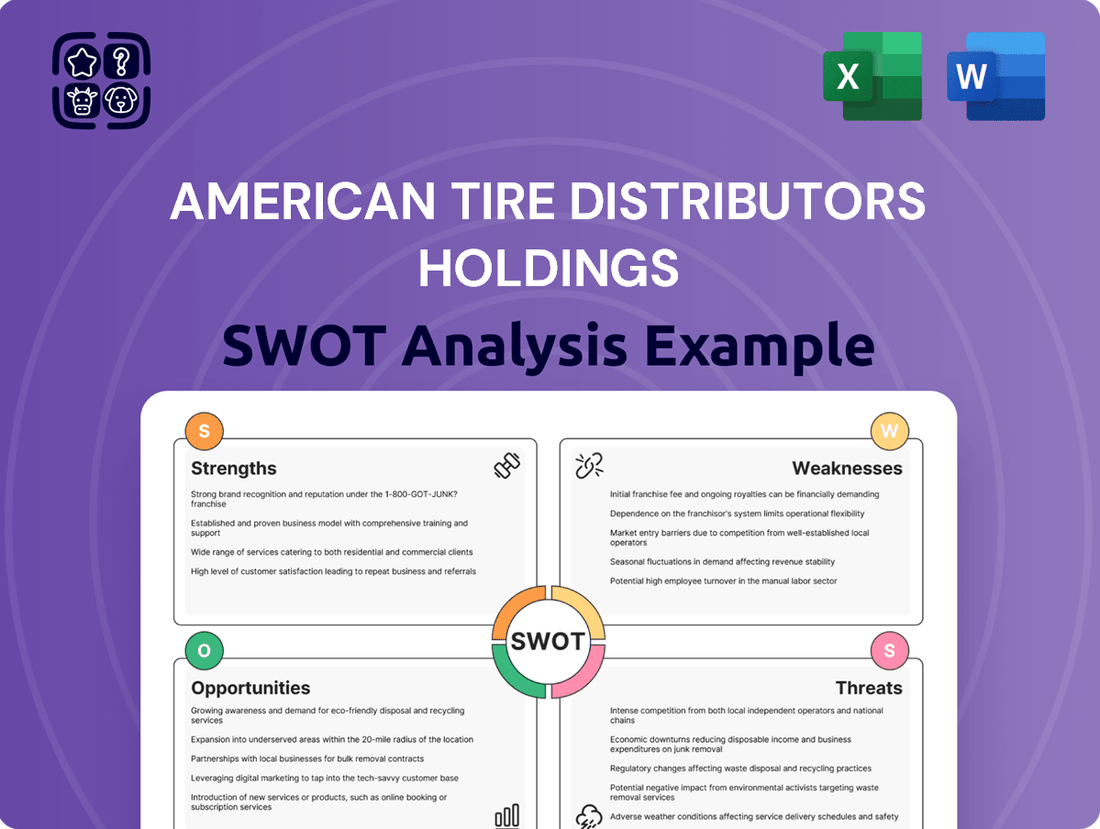

American Tire Distributors Holdings SWOT Analysis

You’re viewing a live preview of the actual SWOT analysis file for American Tire Distributors Holdings. The complete version, detailing their Strengths, Weaknesses, Opportunities, and Threats, becomes available after checkout. This ensures you receive the full, professional report you expect.

Opportunities

The burgeoning electric vehicle (EV) and autonomous vehicle (AV) markets represent a significant growth avenue for American Tire Distributors (ATD). As these technologies mature, there's a clear demand for specialized tires that cater to their unique performance requirements, such as the increased torque and weight of EVs. This shift offers ATD a prime opportunity to diversify its product portfolio and capture a new segment of the automotive aftermarket.

By 2025, it's projected that EVs will constitute a substantial portion of new vehicle sales, necessitating a corresponding increase in the availability of compatible tire solutions. ATD can leverage this trend by developing and distributing tires optimized for EV range, noise reduction, and wear characteristics. This proactive strategy not only addresses the evolving needs of consumers but also positions ATD as a forward-thinking leader in the tire distribution industry.

American Tire Distributors Holdings (ATD) can significantly boost its market reach by expanding its e-commerce and digital platforms. Enhancing B2B e-commerce capabilities allows for more efficient online ordering and inventory management for independent dealers, a critical segment for ATD. This digital push is crucial as B2B e-commerce sales in the automotive aftermarket were projected to grow substantially, with some estimates suggesting a compound annual growth rate of over 10% leading up to 2025.

Optimizing online ordering systems and improving real-time inventory visibility directly addresses dealer needs, reducing friction in their purchasing process. Furthermore, exploring direct-to-consumer partnerships for last-mile delivery could tap into new revenue streams and improve customer experience, especially for smaller, independent repair shops that may not have robust logistics. Digital marketing efforts can also be refined to better target these independent dealers, increasing engagement and brand loyalty.

American Tire Distributors (ATD) has a significant opportunity to bolster its market position through strategic acquisitions. By targeting smaller, regional distributors, ATD can efficiently expand its geographic footprint and consolidate market share. For example, in 2024, the tire distribution landscape continues to see consolidation as companies seek economies of scale. Acquiring specialized capabilities, such as advanced logistics or niche product lines, can also provide a competitive edge.

Furthermore, ATD can forge strategic partnerships with technology providers to integrate cutting-edge solutions, enhancing operational efficiency and customer experience. Collaborating with companies offering complementary services, like tire repair or fleet management, can create a more comprehensive value proposition. These inorganic growth strategies are crucial for accelerating expansion and solidifying ATD's competitive standing in the dynamic tire industry.

Optimization of Logistics and Supply Chain through AI/ML

American Tire Distributors (ATD) can unlock significant efficiencies by integrating AI and machine learning into its logistics and inventory operations. For instance, by analyzing vast datasets, ATD could refine delivery routes, potentially reducing fuel consumption and transit times. This data-driven approach can also forecast demand more accurately, ensuring optimal stock levels across its network, thereby minimizing both stockouts and excess inventory carrying costs.

The application of advanced analytics offers several key opportunities for ATD:

- Enhanced Route Optimization: AI algorithms can process real-time traffic data, weather conditions, and delivery priorities to create the most efficient routes, potentially cutting down delivery times by 10-15% based on industry benchmarks.

- Predictive Inventory Management: Machine learning models can predict product demand at specific locations, enabling proactive stocking and reducing the likelihood of stockouts or overstocking, which can improve inventory turnover by an estimated 5-10%.

- Reduced Operational Costs: By streamlining logistics and inventory, ATD can expect a reduction in operational expenses, including fuel, labor, and warehousing costs, contributing to improved profit margins.

- Improved Delivery Accuracy and Speed: Data-driven insights allow for more precise delivery scheduling and execution, leading to higher customer satisfaction and a stronger competitive edge in the market.

Growth in Vehicle Miles Traveled and Aging Vehicle Fleet

The average age of vehicles on U.S. roads is increasing, with the average age reaching a record 12.5 years in 2023, according to S&P Global Mobility. This aging fleet directly fuels demand for replacement tires as vehicles require more maintenance to stay operational. Furthermore, vehicle miles traveled (VMT) have shown a robust recovery post-pandemic. In 2024, VMT is projected to increase by 2.1% over 2023 levels, reaching an estimated 3.34 trillion miles, according to the Federal Highway Administration. This combination of older vehicles and more driving creates a significant and sustained market opportunity for American Tire Distributors (ATD).

This macro trend translates into a stronger underlying demand for ATD's core business. As consumers keep their vehicles longer, the necessity for tire replacements and related maintenance services escalates. This sustained demand provides a solid foundation for ATD's growth and reinforces its position in the aftermarket tire sector.

- Aging Fleet: The average age of vehicles on U.S. roads hit a record 12.5 years in 2023, increasing the need for tire replacements.

- VMT Growth: Vehicle miles traveled are projected to rise by 2.1% in 2024, indicating increased tire wear and demand.

- Market Demand: These trends create a strong, sustained demand for replacement tires, benefiting ATD's business model.

- Operational Advantage: ATD is well-positioned to capitalize on this increased demand for tire maintenance and replacement services.

The growing electric and autonomous vehicle markets present a substantial opportunity for ATD to offer specialized tires. By 2025, EVs are expected to be a significant part of new car sales, requiring tires optimized for their unique needs like torque and range. ATD can also enhance its market reach by expanding digital and e-commerce platforms, streamlining ordering for dealers, with B2B e-commerce in the automotive aftermarket projected for strong growth up to 2025.

Threats

A significant economic downturn or prolonged high inflation could severely dampen consumer discretionary spending. This directly impacts vehicle maintenance and tire replacement, as consumers may postpone these purchases or seek out lower-cost options. For American Tire Distributors Holdings (ATD), this translates to potentially lower sales volumes and reduced profitability.

Major tire manufacturers are increasingly venturing into direct sales, bypassing traditional distributors like American Tire Distributors (ATD). For instance, in 2024, Goodyear announced plans to expand its direct-to-consumer online sales, aiming for a more integrated customer experience. This shift poses a significant threat to ATD's established distribution model.

This direct sales push by manufacturers could lead to a considerable erosion of ATD's market share, as both retailers and end-consumers might opt for these more streamlined purchasing channels. Furthermore, it could weaken ATD's bargaining power with its supplier base, impacting its margins and overall profitability.

To counter this, ATD must double down on its value-added services, such as logistics expertise, inventory management solutions, and technical support, which manufacturers cannot easily replicate. Maintaining robust relationships with both suppliers and a diverse retail network remains paramount to navigating this evolving landscape.

Rising fuel and transportation costs present a significant threat to American Tire Distributors (ATD). Given ATD's extensive distribution network, fluctuations and sustained increases in fuel prices directly impact its operational costs. For instance, the average diesel price in the U.S. hovered around $4.00-$4.50 per gallon in early 2024, a notable increase from previous years, directly affecting ATD's logistics expenses.

Higher transportation expenses can compress profit margins for ATD and necessitate price adjustments, which could affect competitiveness in the market. Effectively managing these escalating fuel costs through optimized logistics and potentially hedging strategies is therefore critical for maintaining profitability and market position.

Intensifying Competition from Online Retailers and Large Chains

The tire distribution landscape is increasingly challenged by online retailers and large automotive service chains that are expanding their own distribution networks. These competitors often leverage aggressive pricing and enhanced customer convenience, directly impacting ATD's independent dealer base by diverting sales. For instance, online tire sales in the US were projected to reach over $10 billion by the end of 2024, a significant increase from previous years.

These entities can offer competitive pricing and streamlined purchasing experiences, forcing ATD to constantly reinforce its value proposition. This includes highlighting its extensive product selection, logistical expertise, and support services that go beyond mere product delivery. The ongoing growth of large retail chains, such as Discount Tire, which operates over 1,100 stores and has its own robust distribution, exemplifies this threat.

- Online tire sales are a rapidly growing segment, expected to exceed $10 billion in the US by late 2024.

- Large automotive service chains, like Discount Tire with over 1,100 locations, are vertically integrating and expanding distribution.

- Price and convenience are key competitive advantages for these new market entrants.

Regulatory Changes and Trade Policies

Changes in trade policies and tariffs on imported tires present a significant threat to American Tire Distributors Holdings (ATD). For instance, a hypothetical 10% tariff on tires imported from a major manufacturing hub could directly increase ATD's cost of goods sold, potentially impacting profit margins if these costs cannot be fully passed on to consumers.

New environmental regulations, such as those mandating specific tread compounds or end-of-life tire disposal methods, could necessitate substantial capital investments. For example, compliance with stricter emissions standards for tire manufacturing could require ATD to source or develop tires with different materials, altering its product mix and supply chain dynamics.

Navigating these evolving trade and environmental landscapes requires ATD to maintain robust market intelligence and strategic flexibility. The ability to adapt sourcing strategies and product offerings in response to policy shifts is crucial for mitigating potential disruptions and maintaining competitive pricing in the 2024-2025 period.

- Tariff Impact: A potential 10% tariff on imported tires could increase ATD's procurement costs by millions annually, depending on import volumes.

- Environmental Compliance Costs: Investments in new tire technologies or disposal methods to meet evolving environmental standards could range from tens of millions to hundreds of millions of dollars.

- Supply Chain Volatility: Trade disputes or sudden policy changes can lead to unpredictable fluctuations in tire availability and pricing, impacting inventory management.

- Market Access Restrictions: New trade barriers could limit ATD's access to key international tire manufacturers, affecting product diversity and sourcing options.

The increasing consolidation within the automotive repair and tire retail sectors presents a significant threat. Large national chains are acquiring independent dealerships, potentially reducing ATD's customer base. For instance, the number of independent tire dealers in the US has seen a steady decline, with larger entities capturing a greater market share.

Furthermore, the rise of private-label tire brands, often offered by large retailers, directly competes with the established brands ATD distributes. This can put pressure on ATD's margins and product mix. The automotive aftermarket is projected to see continued growth, but this growth may be increasingly captured by larger, integrated players.

A key challenge is the evolving nature of vehicle technology, including the growth of electric vehicles (EVs). EVs often require specialized tires, and the maintenance and replacement cycles may differ from traditional internal combustion engine vehicles. ATD must adapt its inventory and services to cater to this growing segment, which represented approximately 8% of new vehicle sales in the US in early 2024, a figure expected to rise significantly by 2025.

| Threat Category | Specific Threat | Impact on ATD | 2024-2025 Data/Trend |

|---|---|---|---|

| Market Consolidation | Acquisition of independent dealers by national chains | Reduced customer base, potential loss of market share | Continued trend of consolidation in automotive repair and retail. |

| Brand Competition | Growth of private-label tire brands | Margin pressure, need to adapt product mix | Increasing presence of retailer-owned brands in the aftermarket. |

| Technological Shift | Increased adoption of Electric Vehicles (EVs) | Need for specialized tire inventory and services | EVs accounted for ~8% of US new vehicle sales in early 2024, with strong growth projected. |

SWOT Analysis Data Sources

This SWOT analysis for American Tire Distributors Holdings is built upon a foundation of robust data, including their official financial statements, comprehensive market research reports, and insights from industry experts. These sources provide a detailed understanding of the company's performance and the competitive landscape.