American Tire Distributors Holdings PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

American Tire Distributors Holdings Bundle

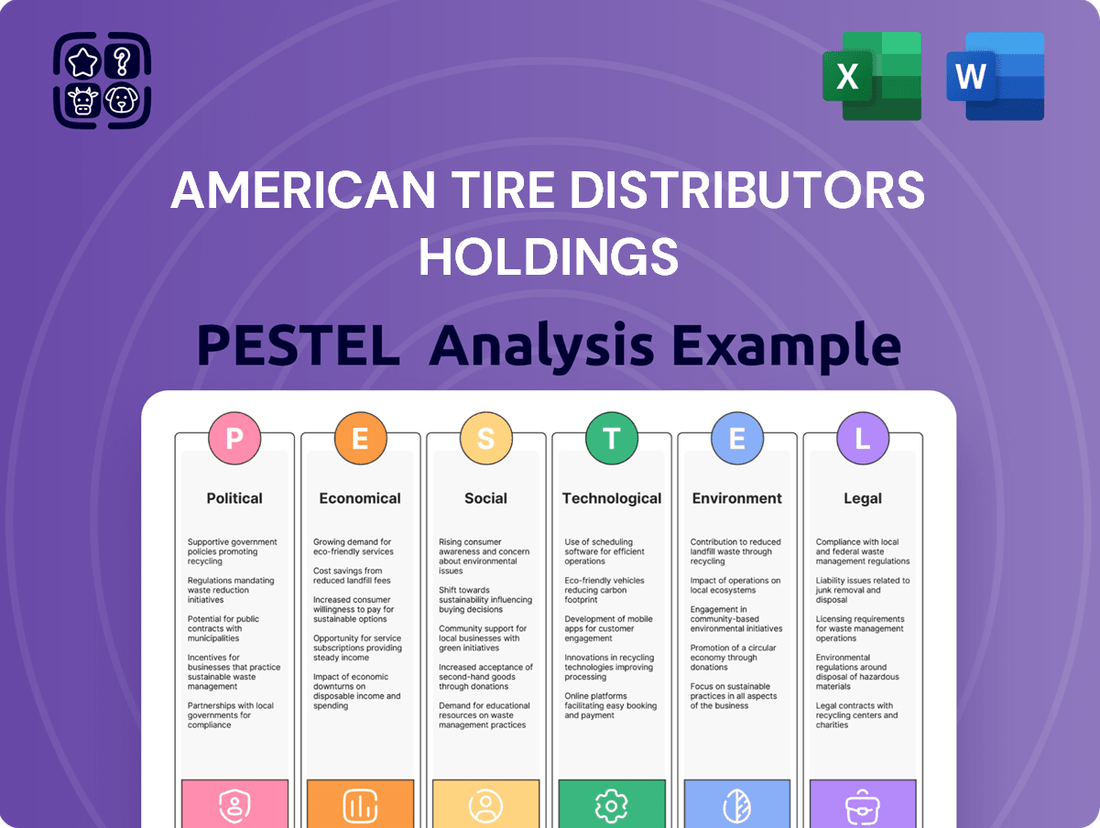

Navigate the complex external forces shaping American Tire Distributors Holdings with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements present both challenges and opportunities for the company. Gain a strategic advantage by leveraging these expert insights to refine your market approach. Download the full PESTLE analysis now for actionable intelligence that drives informed decision-making.

Political factors

Government incentives, including federal tax credits of up to $7,500 for new EVs and state-level rebates, are significantly boosting electric vehicle sales across North America. This trend directly translates to increased demand for specialized EV tires, a key product category for American Tire Distributors Holdings (ATD). For instance, the Inflation Reduction Act of 2022 extended and modified these credits, providing a sustained push for EV adoption through 2032.

These supportive policies foster a more favorable market environment for ATD to supply new tire technologies designed for the unique performance characteristics of EVs, such as lower rolling resistance and higher torque. As EV market share grows, projected to reach over 20% of new vehicle sales in the US by 2025, ATD is positioned to capitalize on this evolving demand for specialized tire solutions and related aftermarket services.

Ongoing reviews of trade agreements, such as the United States-Mexico-Canada Agreement (USMCA), alongside potential new tariffs, like those discussed between the US and Canada for early 2025, directly influence the cost and accessibility of imported tires and essential raw materials. These shifts in trade policy introduce significant volatility in pricing and create complex supply chain hurdles for distributors like American Tire Distributors Holdings (ATD).

ATD's established distribution infrastructure means it must actively adapt to these evolving trade dynamics. For instance, a 10% tariff on imported rubber, a key component for tire manufacturing, could increase ATD's cost of goods sold by millions, impacting profitability and retail pricing strategies throughout their network.

Environmental regulations are becoming increasingly stringent, impacting tire distributors. The Environmental Protection Agency (EPA) and various state bodies are implementing stricter rules for tire manufacturing, distribution, and end-of-life management. For instance, by the end of 2024, many states are expected to have updated or reinforced their scrap tire management plans, focusing on reducing landfill waste and increasing recycling rates, which directly affects how companies like American Tire Distributors Holdings handle their inventory and waste streams.

Compliance with these mandates, such as those requiring proper storage and processing of used tires, is crucial for avoiding significant penalties. Failure to adhere to these regulations can lead to fines that could impact profitability. For example, some states have increased penalties for improper disposal, with fines potentially reaching thousands of dollars per violation. This necessitates investment in compliant storage facilities and partnerships with certified recycling centers, adding to operational costs but also fostering a more sustainable business model.

Vehicle Safety and Performance Standards

Canadian federal regulations, such as those requiring specific performance metrics for winter tires including snow traction tests, directly influence the tire industry. These mandates compel manufacturers and distributors like American Tire Distributors Holdings (ATD) to align their product offerings and stock levels with increasingly stringent safety benchmarks, affecting product development and supply chain strategies.

The evolving landscape of vehicle safety and performance standards, driven by governmental oversight, necessitates continuous adaptation within the tire sector. For ATD, this translates into a dynamic product portfolio, where compliance with regulations like those in Canada for winter tire performance becomes a critical factor in inventory management and market competitiveness.

- Canadian Winter Tire Regulations: Mandate specific snow traction test performance.

- Impact on ATD: Requires alignment of product portfolio and inventory with evolving safety standards.

- Industry Adaptation: Drives manufacturers and distributors to meet new safety benchmarks.

Infrastructure Investment

Government investments in infrastructure, particularly through initiatives like the U.S. Infrastructure Investment and Jobs Act, are a significant political factor impacting American Tire Distributors Holdings (ATD). This legislation allocates substantial funding towards improving roads, bridges, and other transportation networks. For ATD, this translates directly into increased demand for commercial vehicle tires, as enhanced logistics and freight transport become more efficient and prevalent. The boost in economic activity driven by these projects directly benefits ATD's core business.

The Infrastructure Investment and Jobs Act, signed into law in November 2021, is set to invest hundreds of billions of dollars over several years. For example, it includes significant funding for highway and bridge repair and upgrades. This sustained investment creates a more robust environment for the trucking industry, a key customer segment for ATD. As more goods are moved across improved infrastructure, the wear and tear on commercial tires increases, necessitating higher replacement volumes for ATD.

- Increased Freight Volume: Infrastructure improvements facilitate greater movement of goods, directly boosting the need for commercial tires.

- Economic Stimulus: Government spending on infrastructure acts as an economic stimulus, supporting sectors reliant on transportation.

- Long-Term Demand: The multi-year nature of infrastructure projects ensures a consistent, long-term demand for ATD's products.

- Fleet Modernization: Investments may also encourage fleet upgrades, leading to demand for newer, more specialized tires.

Government policies supporting electric vehicle (EV) adoption, such as federal tax credits and state rebates, are a significant tailwind for American Tire Distributors Holdings (ATD). The Inflation Reduction Act of 2022, for example, extends EV tax credits through 2032, directly increasing demand for specialized EV tires. Projections indicate EVs could represent over 20% of US new vehicle sales by 2025, creating a substantial market opportunity for ATD's specialized tire offerings.

Trade policy shifts, including potential tariffs on imported materials like rubber, directly impact ATD's cost of goods sold and pricing strategies. For instance, a hypothetical 10% tariff on rubber could add millions to ATD's expenses. Similarly, changes to trade agreements like the USMCA introduce volatility and supply chain complexities, requiring ATD to remain agile in its sourcing and distribution.

Stricter environmental regulations concerning tire disposal and recycling, with many states updating their management plans by the end of 2024, necessitate investment in compliant storage and partnerships with recycling centers for ATD. Non-compliance can result in substantial fines, underscoring the importance of adhering to these evolving mandates for operational integrity and financial health.

Government infrastructure spending, driven by legislation like the Infrastructure Investment and Jobs Act, is a key driver for ATD's commercial tire segment. This act's multi-year investment in roads and bridges supports increased freight volume and economic activity, directly translating to higher demand for commercial tires. The sustained nature of these projects ensures a consistent, long-term market for ATD's products.

What is included in the product

This PESTLE analysis of American Tire Distributors Holdings examines the impact of Political, Economic, Social, Technological, Environmental, and Legal factors on its operations and strategy.

It provides a comprehensive overview of the external forces shaping the tire distribution landscape, offering insights for strategic decision-making.

A PESTLE analysis for American Tire Distributors Holdings offers a clear, summarized overview of external factors, acting as a pain point reliever by simplifying complex market dynamics for strategic decision-making.

Economic factors

The North American automotive aftermarket is expected to see consistent expansion, with the tire sector playing a crucial role in revenue generation. This growth is fueled by increasing vehicle miles traveled and an aging vehicle parc, both of which necessitate more tire replacements and maintenance services.

In 2024, the North American automotive aftermarket was valued at approximately $300 billion, with tires representing a substantial portion of this figure. ATD, as a major distributor, is well-positioned to capitalize on this trend, serving both original equipment manufacturers (OEMs) and the independent aftermarket for replacement tires.

By 2025, projections indicate continued upward momentum for the aftermarket, with an estimated Compound Annual Growth Rate (CAGR) of 3-4%. This sustained demand for tires and related services directly benefits distributors like ATD, reinforcing their market position.

The tire industry, including companies like American Tire Distributors Holdings (ATD), is navigating persistent inflation, which directly translates to higher raw material expenses such as natural rubber and petrochemicals. For instance, crude oil prices, a key component in synthetic rubber production, saw significant volatility throughout 2024, impacting input costs.

These escalating material and energy costs, coupled with increased freight charges due to higher fuel prices and supply chain bottlenecks, are pushing up overall production expenses. This forces manufacturers to consider price adjustments, potentially affecting consumer demand and ATD's ability to maintain competitive pricing and healthy operational margins.

American Tire Distributors (ATD) successfully navigated a major financial restructuring, culminating in the sale of nearly all its assets to a new entity backed by its lenders in early 2025. This pivotal move has significantly bolstered ATD's financial health.

The transaction effectively provided ATD with a de-leveraged balance sheet and enhanced liquidity, a crucial step for funding future growth initiatives and strategic investments. This fresh start positions the company to pursue new opportunities with greater financial flexibility.

Demand for Replacement Tires

The demand for replacement tires is significantly boosted by an aging vehicle fleet across North America. Many consumers are choosing to repair and maintain their existing vehicles rather than purchasing new ones, a trend amplified by ongoing supply chain disruptions affecting new car availability. This directly supports American Tire Distributors Holdings' (ATD) primary business focus.

For instance, the average age of vehicles on U.S. roads reached a record high of 12.5 years in 2023, according to S&P Global Mobility. This extended vehicle lifespan translates into a greater need for tire replacements. ATD's strategic position in supplying these essential parts to a market prioritizing vehicle longevity positions it favorably.

- Aging Fleet: The average age of vehicles on U.S. roads hit 12.5 years in 2023, a record high.

- Consumer Behavior: Consumers are extending the life of existing vehicles due to new car supply chain issues.

- Market Impact: This trend directly benefits ATD's core business of supplying replacement tires.

Supply Chain Disruptions

Ongoing global supply chain disruptions remain a significant hurdle for the automotive and tire sectors. Shortages of key components, persistent port congestion, and a scarcity of truck drivers directly affect companies like American Tire Distributors Holdings (ATD). These issues can cause production slowdowns, inflate operational expenses, and lengthen the time customers wait for essential parts.

The impact of these disruptions is substantial. For instance, in early 2024, the average transit time for ocean freight containers remained elevated compared to pre-pandemic levels, contributing to inventory challenges. ATD, like many in the industry, faces the challenge of managing these volatile conditions, which can squeeze profit margins and affect customer satisfaction due to extended lead times.

- Component Shortages: Continued lack of semiconductors and other critical materials impacts tire manufacturing and vehicle production.

- Logistics Bottlenecks: Port congestion and a shortage of qualified truck drivers in the US lead to delivery delays and increased freight costs.

- Cost Inflation: Higher shipping rates and raw material prices directly translate to increased operating costs for ATD.

- Inventory Management: Unpredictable supply chains make it difficult for ATD to maintain optimal inventory levels, potentially leading to stockouts or excess stock.

Economic factors present a mixed but generally positive outlook for American Tire Distributors Holdings (ATD). While inflation, particularly in raw materials like natural rubber and petrochemicals, continues to pressure input costs, the overall market demand remains robust.

The automotive aftermarket, a key sector for ATD, was valued around $300 billion in 2024, with projections for a 3-4% CAGR through 2025. This growth is underpinned by an aging vehicle fleet, with the average age of vehicles on U.S. roads reaching a record 12.5 years in 2023, driving increased demand for replacement tires.

ATD's successful financial restructuring in early 2025 provided a de-leveraged balance sheet and enhanced liquidity, positioning the company to leverage these favorable market conditions and manage inflationary pressures effectively.

| Economic Factor | 2024/2025 Data/Trend | Impact on ATD |

| Inflation (Raw Materials) | Persistent, impacting natural rubber & petrochemicals. Crude oil volatility in 2024 affected synthetic rubber costs. | Increased input costs, potential price adjustments, margin pressure. |

| Market Growth (Aftermarket) | Valued at ~$300B in 2024, projected 3-4% CAGR through 2025. | Sustained demand for tires and related services, benefiting distributors. |

| Vehicle Age | Average U.S. vehicle age hit record 12.5 years in 2023. | Increased demand for replacement tires and maintenance. |

| Financial Health | Completed major asset sale/restructuring in early 2025. | De-leveraged balance sheet, enhanced liquidity, greater financial flexibility. |

Preview the Actual Deliverable

American Tire Distributors Holdings PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive PESTLE analysis of American Tire Distributors Holdings. This detailed report covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company.

Sociological factors

The growing consumer interest in electric vehicles (EVs) is a significant sociological trend impacting the tire industry. As more Americans opt for EVs, there's a rising demand for tires specifically engineered to meet their unique requirements, such as supporting heavier vehicle weights due to batteries, managing instant torque, and optimizing for longer ranges through reduced rolling resistance. For instance, by the end of 2024, it's projected that over 1.7 million EVs will be on U.S. roads, a substantial increase from previous years, highlighting this shift.

American Tire Distributors Holdings (ATD) needs to proactively adjust its product offerings and marketing strategies to align with this consumer preference. This means ensuring a robust inventory of EV-specific tires and educating consumers and partners about their benefits. The market for EV replacement tires is expected to grow considerably, with some forecasts suggesting it could reach $10 billion in the U.S. by 2030, underscoring the urgency for ATD to capitalize on this evolving demand.

Consumers are increasingly prioritizing sustainability, with a significant portion of US shoppers willing to pay more for eco-friendly products. This growing environmental consciousness directly impacts the tire industry, pushing for innovations in recycled materials and energy-efficient manufacturing processes.

This shift presents American Tire Distributors Holdings (ATD) with a clear opportunity to expand its distribution of environmentally friendly tires. Highlighting ATD's commitment to sustainability, such as through partnerships with tire manufacturers focused on green technologies or by promoting tires with lower rolling resistance, can resonate with this expanding consumer segment.

The average age of vehicles on U.S. roads reached a record 12.6 years in 2023, according to S&P Global Mobility. This aging fleet directly fuels demand for maintenance and replacement parts, including tires, as consumers opt to repair rather than replace vehicles, benefiting the automotive aftermarket sector where American Tire Distributors Holdings (ATD) operates.

Changing Purchasing Habits and E-commerce Growth

The surge in e-commerce has fundamentally reshaped how consumers buy goods, including automotive parts and tires. For American Tire Distributors Holdings (ATD), this means a critical need to bolster its digital presence and optimize online sales channels. This evolution directly influences how customers acquire tires and associated services, demanding sophisticated online ordering systems and efficient delivery networks.

Consumer purchasing habits are increasingly favoring convenience and digital accessibility. In 2024, e-commerce sales in the US are projected to reach over $2 trillion, with a significant portion attributed to retail sectors that include automotive parts. This trend necessitates that ATD adapts its distribution and fulfillment strategies to meet these evolving expectations, ensuring a seamless experience for online tire purchasers.

- E-commerce Dominance: Online tire sales are a growing segment, requiring ATD to invest in user-friendly digital platforms.

- Logistical Adaptations: Efficient last-mile delivery and inventory management are crucial for meeting online customer demand.

- Customer Experience: Providing a smooth online-to-offline experience, from browsing to installation, is paramount.

- Digital Marketing: Reaching consumers online through targeted marketing efforts is essential for driving sales.

Labor Shortages in the Automotive Aftermarket

The automotive aftermarket, a critical sector for companies like American Tire Distributors Holdings (ATD), is grappling with significant labor shortages. This scarcity is particularly acute for skilled technicians and those willing to work less conventional hours, such as after-hours service. These workforce gaps directly affect the ability of ATD's customers to provide timely and efficient services, potentially increasing operational costs and impacting the entire distribution network's responsiveness.

The repercussions of these labor shortages are tangible. For instance, a 2024 survey indicated that over 70% of independent repair shops reported difficulty finding qualified technicians. This shortage can lead to longer customer wait times, reduced service capacity, and increased wage pressure as businesses compete for a limited pool of talent. Consequently, ATD's customers might experience slower inventory turnover and higher overheads, influencing their purchasing decisions and overall demand for distribution services.

- Skilled Technician Gap: The industry faces a persistent deficit in experienced mechanics and tire specialists.

- After-Hours Service Strain: Finding staff for evening and weekend shifts exacerbates service delivery challenges.

- Impact on ATD Customers: Service delays and increased labor costs for repair shops can affect their operational efficiency and ATD's distribution volume.

- Wage Inflation: Competition for scarce labor is driving up wages, adding to the cost of doing business in the aftermarket.

Sociological factors significantly shape the tire market, influencing consumer preferences and purchasing behaviors. The accelerating adoption of electric vehicles (EVs) is a prime example, driving demand for specialized tires designed for EV performance characteristics. Furthermore, a growing consumer emphasis on sustainability is pushing manufacturers and distributors towards eco-friendly materials and production methods.

The aging vehicle fleet in the U.S., averaging 12.6 years in 2023, directly boosts demand for replacement tires as owners prioritize repairs over new vehicle purchases. Simultaneously, the shift towards e-commerce for automotive parts, with U.S. online sales projected to exceed $2 trillion in 2024, necessitates robust digital platforms and efficient delivery networks for tire distributors like ATD.

Labor shortages, particularly for skilled technicians, present a challenge for the automotive aftermarket, impacting service delivery and potentially increasing operational costs for ATD's customers. This deficit, with over 70% of independent repair shops reporting difficulty finding qualified technicians in 2024, can lead to longer wait times and higher labor expenses.

| Sociological Factor | Trend Description | Impact on ATD | Supporting Data (2023-2025) |

|---|---|---|---|

| EV Adoption | Increasing consumer preference for electric vehicles. | Demand for specialized EV tires; product mix adjustment. | Over 1.7 million EVs projected on U.S. roads by end of 2024. |

| Sustainability Focus | Consumer willingness to pay more for eco-friendly products. | Opportunity to distribute green tires; highlight sustainable practices. | Growing consumer segment prioritizing environmental impact. |

| Vehicle Aging | Average age of U.S. vehicles reached 12.6 years in 2023. | Increased demand for replacement tires and aftermarket services. | S&P Global Mobility data on vehicle fleet age. |

| E-commerce Growth | Shift in consumer purchasing habits towards online channels. | Need for enhanced digital platforms and optimized online sales. | U.S. e-commerce sales projected over $2 trillion in 2024. |

| Labor Shortages | Scarcity of skilled automotive technicians. | Potential strain on ATD's customer service capacity and efficiency. | 70%+ of repair shops reported difficulty finding technicians in 2024. |

Technological factors

Smart tires are increasingly equipped with embedded sensors, offering real-time data on crucial metrics like tire pressure and tread wear. These advancements also allow for monitoring of road conditions, directly contributing to enhanced vehicle safety and operational efficiency. For instance, by 2024, the global smart tire market was projected to reach approximately $3.5 billion, indicating significant adoption and investment in this technology.

American Tire Distributors (ATD) can capitalize on these smart tire developments by integrating them into their product offerings, providing customers with a more sophisticated and data-driven service. This allows ATD to not only sell advanced products but also deliver valuable insights for proactive tire maintenance and optimized fleet management, potentially reducing downtime and improving fuel economy for their clients.

Technological advancements are significantly shaping the automotive industry, particularly with the rise of electric vehicles. Tire manufacturers are heavily investing in developing next-generation tires specifically engineered for EVs. These specialized tires prioritize low rolling resistance to maximize energy efficiency and extend driving range, a critical factor for EV adoption. They also need to be more durable to support the increased weight of EV battery packs and engineered for reduced noise, enhancing the quiet ride characteristic of EVs.

American Tire Distributors (ATD) must ensure its product portfolio reflects this technological shift. By stocking and promoting these specialized EV tires, ATD can cater to the burgeoning EV market. For instance, the global EV tire market was valued at approximately $25 billion in 2023 and is projected to reach over $60 billion by 2030, demonstrating substantial growth potential. ATD's ability to adapt its offerings will be crucial for capturing a significant share of this expanding segment.

Technological advancements are revolutionizing tire production with sustainable materials. Innovations include the increased use of natural rubber, silica compounds, and recycled tire content, alongside the development of bio-based alternatives. These materials not only reduce environmental impact but also enhance tire performance, offering improved fuel efficiency and durability.

American Tire Distributors Holdings (ATD) can leverage these innovations to secure a competitive advantage. By focusing on distributing tires that incorporate these eco-friendly and performance-optimized materials, ATD can cater to a growing market segment demanding sustainable solutions. For instance, by 2025, it's projected that the global market for sustainable tires will see substantial growth, driven by both consumer preference and regulatory pressures.

Automation and AI in Logistics and Operations

Automation and artificial intelligence are revolutionizing how tires are made and distributed. Advanced analytics are also playing a bigger role in streamlining these processes. This means more efficient production lines and smarter delivery routes.

American Tire Distributors Holdings (ATD) is actively investing in logistics technology and data analytics. Their goal is to improve how precisely they operate, ensure tires are available when needed, and make sure orders are right every time across their wide network. For instance, by 2024, ATD has been noted for its significant investments in upgrading its distribution centers with automated systems to boost efficiency.

- Increased Efficiency: Automation in warehouses can speed up inventory management and order fulfillment by up to 30%.

- Data-Driven Decisions: AI and advanced analytics allow for better demand forecasting, reducing stockouts and overstock situations.

- Enhanced Accuracy: Automated sorting and picking systems minimize human error in order processing, leading to higher customer satisfaction.

- Optimized Routing: AI-powered logistics software can optimize delivery routes, saving fuel costs and reducing delivery times by an estimated 10-15%.

Digital Transformation and Predictive Maintenance

The automotive aftermarket is actively embracing digital transformation, with a significant push towards data analytics and predictive maintenance. This shift is enabling businesses to better forecast demand and manage inventory proactively. For American Tire Distributors Holdings (ATD), this translates into enhanced logistical support and more efficient inventory management for their customer base.

Predictive maintenance, in particular, is a game-changer. By leveraging data from vehicle sensors and tire performance, ATD can anticipate potential issues before they arise. This not only reduces downtime for customers but also optimizes tire replacement cycles, ensuring customers have the right tires at the right time.

The impact of these technological advancements is substantial. For instance, the global automotive aftermarket services market was valued at over $460 billion in 2023 and is projected to grow significantly, driven by these digital innovations. ATD's ability to integrate these technologies positions them to capitalize on this growth.

- Data-Driven Inventory: ATD can leverage predictive analytics to optimize stock levels, reducing carrying costs and stockouts.

- Enhanced Customer Service: Proactive maintenance insights allow ATD to offer more valuable services, improving customer loyalty.

- Operational Efficiency: Digital tools streamline operations, from order processing to delivery, boosting overall efficiency.

- Market Competitiveness: Early adoption of these technologies keeps ATD ahead of competitors in a rapidly evolving market.

Technological advancements in tire manufacturing are leading to the development of smart tires equipped with sensors that provide real-time data on tire pressure, temperature, and wear. This data can be used for predictive maintenance, enhancing vehicle safety and efficiency. The global smart tire market was valued at approximately $3.5 billion in 2024, with significant growth anticipated.

The rise of electric vehicles (EVs) is a major technological driver, necessitating specialized tires designed for lower rolling resistance, increased durability to handle heavier weights, and reduced noise. The EV tire market was valued at around $25 billion in 2023 and is expected to exceed $60 billion by 2030, presenting a substantial opportunity for tire distributors.

Automation, AI, and advanced analytics are transforming tire production and distribution, leading to more efficient operations and optimized logistics. American Tire Distributors Holdings (ATD) is investing in these areas, with significant upgrades to distribution centers noted by 2024 to boost efficiency and accuracy in their supply chain.

Digital transformation in the automotive aftermarket, including data analytics and predictive maintenance, is enhancing demand forecasting and inventory management. The global automotive aftermarket services market, valued at over $460 billion in 2023, is increasingly driven by these digital innovations, allowing companies like ATD to offer more proactive and valuable services to customers.

Legal factors

American Tire Distributors (ATD) successfully navigated Chapter 11 bankruptcy, culminating in the early 2025 sale of its core assets. This strategic move saw a buyer entity, established by ATD's existing lenders, acquire these assets, signaling a significant legal and financial restructuring.

The bankruptcy filing and subsequent asset sale, completed in Q1 2025, were designed to address ATD's financial challenges. This legal process aimed to shed burdensome debt and create a leaner, more resilient operational structure for the future.

By selling substantially all its assets, ATD is poised to emerge as a new, financially sound entity. This legal maneuver is expected to provide a stable platform for continued operations and growth, effectively resetting its financial trajectory.

Federal and state environmental regulations, including those from the Environmental Protection Agency (EPA), are becoming more stringent concerning scrap tire disposal and recycling. These laws often ban whole tires from landfills, pushing for processing to protect the environment and reclaim valuable materials.

American Tire Distributors Holdings (ATD) and its customer base must navigate these evolving legal landscapes. For instance, in 2023, the U.S. generated an estimated 300 million scrap tires, highlighting the scale of the challenge and the importance of compliance with mandates like those requiring tire-derived products or specific recycling methods.

Trade and import regulations significantly influence American Tire Distributors Holdings (ATD). Tariffs and trade agreements, like the United States-Mexico-Canada Agreement (USMCA), can directly impact the cost and availability of imported tires, affecting ATD's pricing strategies and supply chain resilience. For instance, in 2023, the U.S. continued to assess tariffs on certain imported goods, and while specific tire tariffs under the USMCA are complex, the overall trade landscape remains a critical factor.

Product Safety and Certification Standards

In the North American automotive market, vehicles, tires, and associated components require manufacturer certification to meet stringent safety standards prior to sale. American Tire Distributors Holdings (ATD) must diligently ensure that all products distributed adhere to these federal and provincial regulations. For instance, Transport Canada mandates specific safety requirements for winter tires, a critical category for ATD's operations.

Compliance with these product safety and certification standards is paramount for ATD to avoid penalties and maintain market access. Failure to meet these benchmarks can lead to significant financial repercussions and damage to brand reputation. Key regulatory bodies like the National Highway Traffic Safety Administration (NHTSA) in the U.S. and Transport Canada set forth these essential guidelines.

- Federal Motor Vehicle Safety Standards (FMVSS): These U.S. standards are critical for all new motor vehicles and associated equipment, including tires.

- Transport Canada Regulations: These govern vehicle safety in Canada, with specific attention paid to tire performance, particularly in winter conditions.

- Tire Performance Criteria: Manufacturers must demonstrate that their tires meet established criteria for durability, traction, and load-bearing capacity.

- Certification and Labeling Requirements: Products must carry appropriate certification marks and labels indicating compliance with safety regulations.

Antitrust and Competition Laws

American Tire Distributors (ATD) operates in a fiercely competitive North American tire distribution market, necessitating strict adherence to antitrust and competition laws. These regulations are crucial to prevent monopolistic practices and ensure fair dealings across the supply chain. For instance, ATD must maintain equitable relationships with tire manufacturers, ensuring fair pricing and access to products, while also fostering transparent and competitive terms with its diverse customer base, which includes independent tire dealers and automotive service providers.

The enforcement of these laws aims to promote a level playing field. In 2023, the Federal Trade Commission (FTC) continued its focus on anticompetitive practices across various industries, including distribution. While specific ATD actions aren't publicly detailed, the general regulatory environment demands vigilance. For example, price-fixing or exclusive dealing arrangements that stifle competition could attract scrutiny. ATD's business model, which relies on a vast network of suppliers and customers, inherently requires careful navigation of these legal boundaries to avoid potential penalties or market disruptions.

- Fair Trade Practices: ATD must ensure its pricing and sales strategies do not unfairly disadvantage competitors or customers.

- Monopoly Prevention: The company must avoid actions that could lead to a dominant market share that harms competition.

- Equitable Relationships: Maintaining balanced and fair terms with both tire manufacturers and its broad customer base is paramount.

- Regulatory Scrutiny: Antitrust agencies like the FTC actively monitor distribution channels for anticompetitive behavior.

Federal and state environmental regulations, particularly those concerning tire disposal and recycling, continue to shape ATD's operational landscape. Laws mandating the processing of scrap tires, such as those banning whole tires from landfills, are increasingly common. In 2023, the U.S. generated approximately 300 million scrap tires, underscoring the scale of waste management challenges and the necessity of compliance with recycling mandates.

Product safety and certification remain critical legal considerations for American Tire Distributors Holdings. ATD must ensure all distributed tires meet stringent federal and provincial safety standards, like the Federal Motor Vehicle Safety Standards (FMVSS) in the U.S. and Transport Canada regulations. Failure to comply can result in significant penalties and restricted market access, highlighting the importance of rigorous adherence to these guidelines.

Antitrust and competition laws are vital for ATD's operations in the highly competitive tire distribution market. These regulations prevent monopolistic practices and ensure fair dealings with both manufacturers and customers. The Federal Trade Commission (FTC) actively monitors distribution channels for anticompetitive behavior, making vigilance in pricing, sales strategies, and contractual agreements essential for ATD.

Environmental factors

The tire industry is experiencing a significant shift towards sustainability, with manufacturers actively developing tires made from eco-friendly materials such as natural rubber, recycled rubber, and bio-based compounds. This push is fueled by growing environmental awareness and stricter regulatory requirements. For American Tire Distributors Holdings (ATD), this trend presents an opportunity to distribute products that resonate with environmentally conscious consumers and meet evolving market demands.

Environmental regulations are increasingly pushing for better tire recycling and end-of-life management. Many states have programs in place to ensure scrap tires are handled responsibly, aiming to reduce landfill waste and promote resource recovery. For instance, by the end of 2024, several states are expected to have expanded their tire-derived product procurement mandates, further incentivizing recycling efforts.

As a significant distributor, American Tire Distributors (ATD) is positioned to support these initiatives through its extensive logistics network. ATD can facilitate the collection and transportation of end-of-life tires, contributing to more efficient recycling processes. This involvement not only helps ATD meet regulatory requirements but also opens avenues for new revenue streams, such as selling recycled tire materials for use in construction or manufacturing.

Environmental awareness and the accelerating adoption of electric vehicles (EVs) are significantly boosting the demand for tires designed with low rolling resistance. These advanced tires are crucial for enhancing fuel efficiency in traditional gasoline-powered cars and, importantly, for extending the driving range of EVs. For American Tire Distributors (ATD), ensuring their product catalog features these increasingly sought-after tires is essential to align with both consumer preferences and evolving regulatory landscapes.

The market for low rolling resistance tires is projected for substantial growth. For instance, the global market for these tires was valued at approximately $75 billion in 2023 and is anticipated to reach over $120 billion by 2030, demonstrating a compound annual growth rate (CAGR) of around 7%. This trend underscores ATD's strategic imperative to stock and promote tire technologies that directly address these environmental and performance demands.

Reduction of Carbon Footprint in Operations

American Tire Distributors Holdings (ATD), like many in the automotive supply chain, faces increasing pressure to shrink its environmental impact. This means actively working to reduce its carbon footprint through more energy-efficient operations and smarter, more sustainable logistics. For ATD, this translates to optimizing how its vast distribution network functions and embracing greener practices to lessen its overall environmental toll.

The push for sustainability is driving significant changes. For instance, by 2024, the transportation sector, a key area for distributors, is seeing a greater emphasis on electrification and alternative fuels. ATD's efforts in this area could involve:

- Optimizing delivery routes: Utilizing advanced software to minimize mileage and fuel consumption.

- Investing in fuel-efficient fleets: Transitioning to vehicles that consume less fuel or exploring electric/hybrid options for certain routes.

- Warehouse energy efficiency: Implementing LED lighting, improved insulation, and potentially renewable energy sources for their distribution centers.

- Sustainable packaging: Reducing waste and using recyclable materials in their product handling and shipping processes.

Addressing Pollution from Tire Production and Use

The environmental footprint of tires, from manufacturing to daily use, is a significant concern. Tire production can generate emissions and waste, while the wear and tear of tires on roads releases microplastics into the environment. For instance, studies in 2024 indicated that tire wear particles are a major source of microplastic pollution in waterways.

Recognizing this, the tire industry is actively pursuing solutions. Innovations such as biodegradable tire compounds and the development of advanced, more durable materials are underway to lessen this impact. American Tire Distributors Holdings (ATD) will need to stay abreast of these developments when making product selection decisions.

Key areas of focus for environmental mitigation include:

- Reducing manufacturing emissions: Implementing cleaner production processes to lower greenhouse gas output.

- Waste management in production: Developing better recycling and repurposing methods for production byproducts.

- Mitigating microplastic shedding: Researching tire designs and rubber compounds that minimize particle release during driving.

- Exploring sustainable materials: Investigating the use of bio-based or recycled materials in tire construction.

Environmental consciousness is reshaping the tire market, pushing demand for sustainable and low-impact products. For American Tire Distributors Holdings (ATD), this translates to an opportunity to champion eco-friendly tire options and efficient distribution practices. The industry is also grappling with tire wear particles as a significant source of microplastic pollution, a challenge ATD can help address by distributing tires designed for reduced shedding.

Regulatory pressures are intensifying around tire end-of-life management, with expanded scrap tire recycling mandates expected in several states by the close of 2024. ATD's logistics capabilities can play a crucial role in facilitating these recycling efforts, potentially creating new revenue streams from recycled materials.

The growing adoption of electric vehicles (EVs) further amplifies the need for low rolling resistance tires, essential for maximizing EV range and overall fuel efficiency. This segment, valued at approximately $75 billion in 2023, is projected to exceed $120 billion by 2030, highlighting a key growth area for ATD.

| Environmental Factor | Impact on ATD | Key Data/Trends (2024-2025) |

|---|---|---|

| Sustainability Demand | Increased sales of eco-friendly tires; need for sustainable operations. | Growing consumer preference for recycled and bio-based materials. |

| Tire Recycling Regulations | Opportunity to support collection/transport; potential new revenue. | Expansion of state-level tire-derived product procurement mandates by end of 2024. |

| EV Growth & Low Rolling Resistance | Higher demand for specialized tires; strategic product stocking. | Low rolling resistance tire market projected to grow from ~$75B (2023) to >$120B by 2030. |

| Microplastic Pollution | Need to distribute tires with reduced wear particle shedding. | Tire wear particles identified as a major source of microplastic pollution in waterways (2024 studies). |

PESTLE Analysis Data Sources

Our PESTLE analysis for American Tire Distributors Holdings is informed by a robust blend of official government data, industry-specific market research reports, and economic forecasting from reputable institutions. This ensures a comprehensive understanding of the political, economic, social, technological, legal, and environmental factors impacting the tire distribution sector.