American Tire Distributors Holdings Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

American Tire Distributors Holdings Bundle

American Tire Distributors Holdings operates in a dynamic market influenced by intense rivalry and the bargaining power of both suppliers and buyers. Understanding these forces is crucial for navigating the competitive landscape effectively.

The complete report reveals the real forces shaping American Tire Distributors Holdings’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

The bargaining power of suppliers for American Tire Distributors (ATD) is significantly shaped by the concentration within the tire manufacturing industry. When a small number of large manufacturers dominate the market, their collective influence over ATD grows.

Major tire producers often possess highly differentiated products and strong brand recognition, which further amplifies their leverage. This allows them to potentially set pricing, control supply volumes, and influence contractual terms with distributors like ATD, impacting ATD's cost structure and product availability.

The bargaining power of suppliers for American Tire Distributors Holdings (ATD) is significantly influenced by the switching costs ATD faces. If ATD finds it difficult or expensive to change from one tire manufacturer to another, suppliers gain more leverage.

High switching costs can manifest in various ways. For instance, ATD might incur substantial expenses for retooling its distribution centers or sales processes to accommodate a new supplier's product specifications. Furthermore, the loss of established product lines or damage to customer trust due to a change in tire brands could represent considerable indirect costs.

In 2024, the automotive aftermarket, including tire distribution, continued to grapple with supply chain complexities. Manufacturers often invest heavily in brand recognition and proprietary technologies, making it challenging for distributors like ATD to seamlessly transition to alternative suppliers without impacting their own market position or incurring significant upfront costs for new certifications and training.

The volume of business American Tire Distributors (ATD) generates for tire manufacturers is a key factor in their bargaining power. In 2024, ATD continued to be a major player in the North American tire distribution market, handling a significant portion of sales for many of its suppliers.

If ATD represents a substantial percentage of a tire manufacturer's overall revenue, that supplier's ability to exert strong bargaining power is reduced. Such a supplier would likely hesitate to disrupt a relationship that is crucial to their financial performance, making them more amenable to ATD's terms.

Availability of Substitute Inputs

The availability of substitute inputs significantly impacts the bargaining power of suppliers for American Tire Distributors Holdings (ATD). If ATD can easily find alternative raw materials or components for tire production, or source comparable tires from a broader array of manufacturers, including private labels and newer brands, the leverage of existing suppliers diminishes. This expanded choice set for ATD enhances its negotiation position.

For instance, in 2024, the global tire market saw increased competition from manufacturers in emerging economies, offering competitive pricing and quality. This trend, coupled with ATD's own private label initiatives, provides a tangible counter-balance to the power of established tire brands.

- Increased competition from emerging market tire manufacturers in 2024 pressured established suppliers.

- ATD's private label tire programs offer alternatives, diluting supplier power.

- The ability to switch between various raw material suppliers for tire components provides ATD with greater negotiation leverage.

Threat of Forward Integration by Suppliers

The threat of tire manufacturers integrating forward into distribution, directly selling to American Tire Distributors Holdings' (ATD) customers, significantly amplifies supplier bargaining power. This capability, if credible, forces ATD to negotiate on less favorable terms to protect its market share.

If major tire brands like Goodyear or Michelin were to establish their own direct-to-retail networks, they could bypass ATD entirely. This would put immense pressure on ATD's margins and pricing strategies. For instance, in 2024, the global tire market was valued at approximately $270 billion, with a significant portion of that revenue flowing through distribution channels.

- Increased Leverage: Suppliers gain leverage as they can threaten to cut out the distributor and capture more of the value chain's profit.

- Pricing Pressure: ATD would face downward pressure on its pricing to remain competitive against direct supplier sales.

- Distribution Cost Impact: The cost of distribution for suppliers could be absorbed or reduced through direct sales, making the threat more potent.

The bargaining power of suppliers for American Tire Distributors (ATD) is influenced by the concentration of tire manufacturers and the switching costs ATD faces. In 2024, major tire producers continued to leverage strong brand recognition and proprietary technologies, making it costly for ATD to transition suppliers due to retooling and potential customer trust issues.

ATD's significant market volume in 2024 provided some counter-leverage, as suppliers relied on its substantial revenue contribution. However, the increasing availability of tires from emerging markets and ATD's own private label brands in 2024 offered alternative sourcing options, thereby diluting the power of established suppliers.

The threat of forward integration by tire manufacturers into distribution channels in 2024 posed a significant risk, potentially forcing ATD into less favorable negotiations to maintain its market share in a global tire market valued around $270 billion.

| Factor | Impact on ATD's Supplier Bargaining Power | 2024 Context |

| Supplier Concentration | High | Dominated by a few large manufacturers |

| Switching Costs | High | Retooling, brand loyalty, training |

| ATD's Volume Share | Moderate | ATD is a major customer for many suppliers |

| Availability of Substitutes | Moderate | Emerging market brands, private labels |

| Threat of Forward Integration | High | Direct sales by manufacturers bypass distributors |

What is included in the product

This analysis uncovers the competitive forces impacting American Tire Distributors Holdings, evaluating supplier and buyer power, the threat of new entrants and substitutes, and the intensity of rivalry within the tire distribution market.

A clear, one-sheet summary of all five forces—perfect for quick decision-making regarding competitive pressures in the tire distribution market.

Customers Bargaining Power

American Tire Distributors (ATD) serves a vast network of approximately 80,000 customers. This customer base includes a wide array of independent tire dealers, service stations, and car dealerships. This extensive and fragmented customer base significantly dilutes the bargaining power of any single customer or small group of customers.

The sheer volume of customers means that no single entity commands a substantial portion of ATD's overall sales. In 2024, ATD's diversified customer portfolio, spread across numerous small and medium-sized businesses, inherently limits their collective ability to negotiate terms that could disproportionately impact ATD's profitability.

The bargaining power of American Tire Distributors' (ATD) customers is significantly influenced by the availability of alternative distributors. In 2024, the tire distribution market remains competitive, with numerous regional and national players vying for market share. This abundance of choice allows customers, particularly larger fleet operators and retail chains, to easily switch suppliers if ATD's pricing, service, or product availability doesn't meet their expectations.

Furthermore, the ease with which customers can bypass traditional distributors and source tires directly from manufacturers or through online platforms further amplifies their leverage. With low switching costs, customers can readily compare offers and negotiate more favorable terms, putting downward pressure on ATD's margins and demanding greater flexibility in delivery and support services.

The degree to which tires are standardized significantly influences the bargaining power of customers. If tires are largely seen as commodities with minimal differentiation across brands and models, consumers can readily compare prices and switch between suppliers. This ease of comparison and switching directly translates into increased leverage for customers, allowing them to push for lower prices or more favorable terms from American Tire Distributors (ATD).

In 2024, the automotive aftermarket, including tire sales, continued to see a strong emphasis on value. Consumers are increasingly research-driven, utilizing online platforms to compare specifications and pricing. For instance, data from a 2024 automotive consumer survey indicated that over 70% of tire purchasers considered price as a primary decision factor, with brand loyalty playing a secondary role for a significant portion of the market, especially in the mass-market segments.

Customer Price Sensitivity

Customer price sensitivity is a major factor for American Tire Distributors Holdings (ATD). Smaller independent dealers, in particular, feel the pinch of competition in their local markets, making them very watchful of tire prices. This sensitivity directly translates into their ability to push ATD for better deals.

Because these customers are so focused on price, they can effectively leverage this to negotiate more favorable pricing and promotional support from ATD. This bargaining power can put a strain on ATD's profit margins as they work to remain competitive in a crowded marketplace.

- Price Sensitivity: Independent tire dealers often operate on thin margins, making them highly responsive to price fluctuations.

- Negotiating Power: This sensitivity empowers customers to demand competitive pricing and special offers from distributors like ATD.

- Margin Impact: ATD faces pressure to maintain aggressive pricing strategies, potentially affecting its overall profitability.

Threat of Backward Integration by Customers

The bargaining power of customers, particularly large dealership groups, presents a notable threat to American Tire Distributors Holdings (ATD). These powerful buyers could potentially engage in backward integration, establishing their own distribution networks or forging direct alliances with tire manufacturers. This possibility, even if not fully acted upon, serves to amplify their leverage in negotiations with ATD.

For instance, consider the consolidation within the automotive retail sector. As of early 2024, major dealership consolidators have significantly increased their purchasing volume, giving them greater influence. A hypothetical scenario where a top-tier dealership group, with substantial annual tire procurement exceeding hundreds of millions of dollars, decides to build its own regional distribution hub would directly challenge ATD's market position and pricing power.

- Threat of Backward Integration: Large dealership groups possess the financial and operational capacity to establish their own distribution centers, bypassing intermediaries like ATD.

- Increased Customer Leverage: The credible threat of backward integration empowers these large customers to negotiate more favorable terms, including lower prices and preferential service, from ATD.

- Market Dynamics: Industry consolidation and the growing purchasing power of major automotive retail chains in 2024 underscore the increasing potential for customers to exert this type of pressure.

American Tire Distributors (ATD) faces moderate bargaining power from its customers, largely due to the fragmented nature of its customer base, which includes around 80,000 independent dealers and service stations. While no single customer holds significant sway, their collective price sensitivity, especially in 2024's value-focused market, allows them to negotiate for better terms.

The availability of numerous alternative tire distributors and the increasing ease of direct sourcing or online purchasing further empower customers. In 2024, over 70% of tire buyers prioritized price, a trend that pressures ATD to maintain competitive pricing strategies.

Large dealership groups, in particular, represent a growing concern. Their substantial purchasing volumes and the credible threat of backward integration, such as establishing their own distribution networks, amplify their negotiating leverage with ATD.

| Factor | Impact on ATD | 2024 Data/Trend |

|---|---|---|

| Customer Base Size | Dilutes individual power | ~80,000 customers |

| Price Sensitivity | Drives negotiation for lower prices | >70% of buyers prioritize price |

| Availability of Alternatives | Increases switching likelihood | Competitive market with multiple distributors |

| Threat of Backward Integration | Leverage for large buyers | Consolidation in automotive retail |

Preview Before You Purchase

American Tire Distributors Holdings Porter's Five Forces Analysis

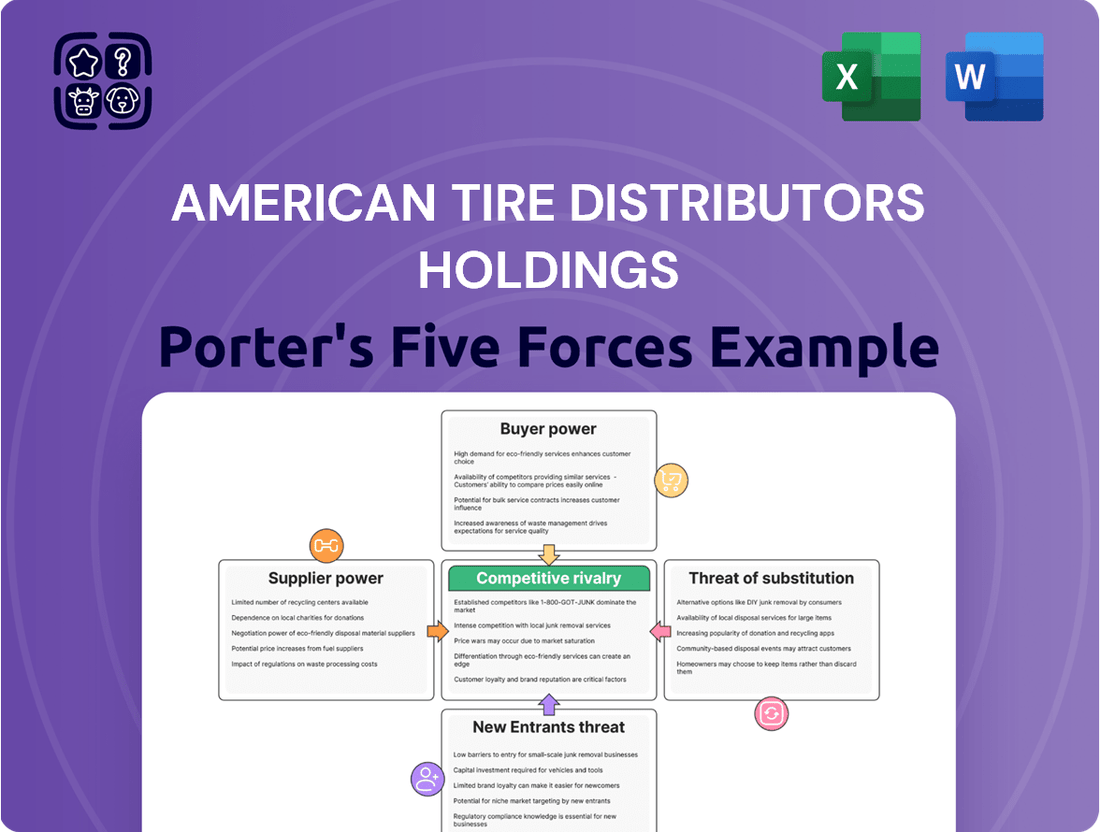

This preview showcases the comprehensive Porter's Five Forces analysis of American Tire Distributors Holdings, detailing the competitive landscape and strategic implications for the tire distribution industry. The document you see here is precisely what you will receive immediately after purchase, offering an in-depth examination of buyer power, supplier power, threat of new entrants, threat of substitute products, and industry rivalry. This exact, fully formatted analysis is ready for your immediate use, providing valuable insights for strategic decision-making.

Rivalry Among Competitors

The North American tire distribution arena is quite crowded, featuring major national distributors like Bridgestone Americas Tire Operations and Goodyear Tire & Rubber Company, alongside a multitude of regional and local outfits. This means American Tire Distributors Holdings faces competition not just from direct rivals but also from manufacturers selling directly to consumers and businesses, creating a complex and often intense competitive environment.

The replacement tire market, a key segment for American Tire Distributors Holdings, is characterized by a moderate to slow growth rate. In 2023, the U.S. replacement tire market was valued at approximately $40 billion, with projections indicating a compound annual growth rate (CAGR) of around 2-3% through 2028. This relatively mature market dynamic intensifies competitive rivalry.

When growth is sluggish, companies often resort to more aggressive strategies to capture market share. This can manifest as price wars, increased spending on advertising and promotional activities, and a greater emphasis on customer service and value-added offerings to differentiate themselves from competitors.

For American Tire Distributors Holdings, this means that maintaining market position and profitability requires constant vigilance against rivals who may engage in price undercutting or intensified marketing efforts. The battle for customers in a slower-growing environment often becomes a zero-sum game, where one company's gain is another's loss.

The tire distribution industry, including players like American Tire Distributors Holdings, is characterized by significant fixed costs. These costs stem from maintaining extensive warehouse networks, managing large inventories, and operating a complex logistical infrastructure. For instance, in 2024, major distributors continued to invest heavily in optimizing their supply chains, with capital expenditures often running into tens of millions of dollars for facility upgrades and fleet modernization.

Furthermore, high exit barriers contribute to intense competitive rivalry. These barriers include specialized, non-transferable assets like dedicated distribution centers and long-term contracts with manufacturers and retailers. These factors make it difficult and costly for underperforming companies to leave the market, forcing them to continue operating and thus intensifying competition for market share.

Product Differentiation and Switching Costs

While the core tire product can be seen as a commodity, American Tire Distributors Holdings (ATD) navigates competitive rivalry by differentiating through value-added services. These include robust logistical support, efficient inventory management, tailored marketing programs, and exceptional customer service, all of which aim to build loyalty and reduce the incentive for customers to switch. For instance, ATD’s commitment to same-day delivery in many regions, a critical factor in the fast-paced automotive service industry, serves as a key differentiator.

The nature of the tire distribution market often presents relatively low switching costs for customers. This means that tire retailers and repair shops can move between distributors with relative ease, intensifying the rivalry among players like ATD. Consequently, distributors must constantly compete on factors beyond just product price, focusing heavily on service quality, reliability, and the overall value proposition they offer. In 2024, the industry continues to see distributors invest in technology and supply chain optimization to maintain a competitive edge in this environment.

- Logistical Prowess: ATD's ability to offer efficient and reliable delivery services is a significant differentiator in a market where timely access to inventory is crucial for automotive repair businesses.

- Inventory Management Solutions: Providing advanced inventory management tools and support helps customers optimize their stock levels, reducing carrying costs and improving cash flow, thereby fostering stronger relationships.

- Marketing and Sales Support: ATD offers marketing programs and sales training to its dealer network, enhancing their ability to compete and sell more tires, which in turn benefits ATD.

- Customer Service Excellence: A focus on responsive and knowledgeable customer service is paramount when switching costs are low, as it directly impacts customer satisfaction and retention.

Strategic Stakes and Aggressiveness

The North American tire market holds immense strategic importance for global manufacturers and major distributors, fueling aggressive competitive tactics. Companies often prioritize capturing or defending market share, sometimes at the expense of immediate profits. This dynamic intensifies pricing wars and service-level competition as players vie for dominance.

- Market Share Focus: In 2023, the US tire market alone was valued at approximately $45 billion, highlighting the significant prize for market share.

- Aggressive Pricing: Manufacturers and distributors frequently engage in promotional pricing and rebate programs to attract and retain customers, especially during economic downturns.

- Service Differentiation: Beyond price, companies compete on delivery speed, technical support, and value-added services to differentiate themselves in a crowded marketplace.

- Consolidation Trends: The ongoing consolidation within the distribution sector, such as potential mergers or acquisitions, further raises the stakes for remaining independent players.

Competitive rivalry within the tire distribution sector is fierce, driven by a mature market and low switching costs for customers. Companies like American Tire Distributors Holdings (ATD) must constantly innovate and provide superior value to retain business.

The U.S. replacement tire market, valued at around $40 billion in 2023, exhibits moderate growth, intensifying the battle for market share. This environment often leads to aggressive pricing and a strong emphasis on differentiated service offerings to stand out from a crowded field of national, regional, and local distributors.

ATD counters this intense rivalry by focusing on value-added services such as efficient logistics, advanced inventory management, and robust marketing support for its dealer network. These strategies aim to build customer loyalty and mitigate the impact of low switching costs, ensuring ATD remains competitive in a challenging landscape.

| Competitive Factor | ATD's Approach | Industry Trend (2024) |

| Market Growth | Navigating moderate growth (~2-3% CAGR projected for replacement market) | Slow growth necessitates aggressive market share capture. |

| Switching Costs | Minimizing with superior service and loyalty programs | Low switching costs drive focus on service quality and value. |

| Differentiation | Logistics, inventory solutions, marketing support | Companies invest in technology and supply chain optimization. |

SSubstitutes Threaten

Technological leaps in tire manufacturing are creating products with significantly longer lifespans. For instance, advancements in rubber compounds and tread designs have led to tires that can endure 20% more mileage than those produced just a few years ago. This increased durability directly impacts the frequency of replacement purchases, acting as a potent substitute for the constant demand for new tires.

A significant societal shift towards public transportation and ride-sharing services presents a notable threat to American Tire Distributors Holdings (ATD). As more individuals opt for these alternatives, the reliance on personal vehicles diminishes, directly impacting the demand for replacement tires. For instance, in 2024, major metropolitan areas saw continued growth in ride-sharing usage, with some reporting a 15% year-over-year increase in passenger miles traveled via these platforms.

Advancements in tire repair technologies present a significant threat of substitutes for American Tire Distributors Holdings (ATD). Innovations allowing for more extensive or permanent repairs of damaged tires directly reduce the demand for new tire replacements. For instance, the increasing adoption of advanced patching systems and internal sealants means more drivers may opt for repair over purchasing entirely new tires, potentially impacting ATD's sales volume.

Emergence of Non-Pneumatic Tire Technologies

The emergence of non-pneumatic tire technologies presents a potential long-term threat to the traditional tire market, including for distributors like American Tire Distributors Holdings. While still in early stages, widespread adoption of airless tires could significantly disrupt the existing replacement market. For instance, Michelin's Uptis (Unique Puncture-Proof Tire System) has been undergoing testing and development, aiming to eliminate flats and reduce maintenance needs, which are key drivers of tire replacement purchases.

If these advanced tire solutions prove to offer superior longevity and reliability, they would directly substitute for conventional pneumatic tires. This could lead to a reduction in the volume of tires sold, impacting revenue streams for distributors. By 2024, while not yet mainstream, advancements in materials science and manufacturing are steadily bringing these concepts closer to commercial viability.

- Potential for reduced replacement frequency: Non-pneumatic tires, if durable, could mean consumers buy tires less often.

- Elimination of common failures: Punctures and blowouts, major reasons for tire replacement, would be negated.

- Early market penetration: While niche, applications in specialized vehicles or fleets could pave the way for broader adoption.

- Technological advancements: Companies are investing heavily in R&D, signaling a serious long-term competitive threat.

Shifts in Vehicle Ownership Models

Shifts in vehicle ownership models, such as the rise of car subscription services, present a threat. In these models, tire maintenance is often bundled, potentially bypassing traditional tire distributors like American Tire Distributors (ATD). This trend could divert purchasing decisions away from ATD's existing customer base of independent dealers and service stations, indirectly impacting demand for their distribution services.

For instance, by 2024, the global car subscription market was projected to reach over $5 billion, indicating a significant and growing alternative to outright ownership. This burgeoning market directly influences how consumers interact with vehicle maintenance, including tire replacement.

The increasing popularity of ride-sharing and fleet management services also contributes to this shift. These services often centralize procurement and maintenance, potentially reducing the volume of tires purchased through ATD's traditional channels.

This evolving landscape necessitates ATD's strategic adaptation to maintain its market position and service relevance in the face of changing consumer and fleet operator behaviors.

The threat of substitutes for American Tire Distributors Holdings (ATD) is multifaceted, encompassing technological advancements and evolving consumer behaviors. Increased tire longevity, due to improved materials, means fewer replacements are needed, directly impacting sales volume. For example, advancements in rubber compounds have led to tires lasting up to 20% longer compared to a few years ago.

Furthermore, the rise of ride-sharing and public transportation services reduces overall reliance on personal vehicles, thereby decreasing demand for replacement tires. In 2024, ride-sharing services saw a notable 15% year-over-year increase in passenger miles in major cities.

Innovations in tire repair technology also offer a substitute for new tire purchases, with advanced patching systems becoming more prevalent. The growing adoption of car subscription services, where tire maintenance is often included, further diverts purchasing decisions away from traditional channels, with the global car subscription market projected to exceed $5 billion in 2024.

Entrants Threaten

Establishing a tire distribution network akin to American Tire Distributors Holdings (ATD) demands substantial upfront capital. This includes acquiring and maintaining extensive warehousing facilities across strategic locations, stocking a diverse and large inventory of tires to meet varied customer demands, and investing in a sophisticated logistics fleet for efficient delivery. These considerable financial outlays act as a significant barrier, deterring numerous potential new entrants from entering the market on a national scale.

Existing large distributors, such as American Tire Distributors (ATD), leverage substantial economies of scale in purchasing, warehousing, and transportation. This allows them to secure more favorable terms from manufacturers and operate more efficiently.

New entrants would find it extremely difficult to match these cost efficiencies without first establishing a significant volume of business. This initial disadvantage in operational costs would likely translate into less competitive pricing, hindering their ability to gain market share against established players.

American Tire Distributors Holdings (ATD) benefits from an established distribution network spanning the U.S. and Canada. This extensive infrastructure, coupled with deep-rooted relationships with around 80,000 customers, creates a significant hurdle for potential new entrants. The sheer scale and established trust within this network represent a substantial investment in time and capital that newcomers would need to replicate, making market entry exceptionally challenging.

Access to Supply and Brand Portfolios

New entrants into the tire distribution market would struggle to gain access to the diverse brand portfolios that established players like American Tire Distributors (ATD) currently manage. Major tire manufacturers often have exclusive or preferred distribution agreements, making it difficult for newcomers to secure a comprehensive selection of popular brands.

These established relationships translate into significant advantages for ATD, including better purchasing power and preferential product allocation. For instance, in 2024, ATD's extensive network likely allowed them to negotiate favorable terms with leading tire brands, a feat that would be incredibly challenging for a new entrant to match from day one.

- Limited Brand Access: New distributors face hurdles in obtaining a wide range of tire brands from top manufacturers.

- Preferred Distributor Status: Established companies like ATD benefit from long-standing relationships, securing better pricing and product availability.

- Economies of Scale: ATD's size allows for greater negotiating leverage with suppliers, a difficult advantage for new entrants to overcome.

- Supply Chain Integration: Existing distributors often have deeply integrated supply chains, providing a competitive edge in product delivery and inventory management.

Regulatory and Compliance Hurdles

The automotive aftermarket, including tire distribution, is heavily regulated. For instance, in 2024, the U.S. Environmental Protection Agency (EPA) continues to enforce stringent standards for tire manufacturing and disposal, impacting operational costs and requiring significant upfront investment in compliance technology. These safety standards, environmental regulations, and logistical compliance requirements act as substantial barriers.

Navigating these intricate regulatory landscapes and ensuring consistent adherence demands considerable expertise and financial resources. This complexity deters many potential new entrants who may lack the specialized knowledge or capital to meet these demanding obligations, thereby strengthening the position of established players like American Tire Distributors Holdings.

- Regulatory complexity: Navigating a web of federal, state, and local regulations including emissions standards and safety certifications.

- Compliance costs: Significant investment required for equipment, training, and ongoing audits to meet standards.

- Logistical compliance: Adhering to specific transportation and warehousing regulations for hazardous materials and consumer goods.

The threat of new entrants for American Tire Distributors Holdings (ATD) is relatively low due to significant capital requirements and established economies of scale. Building a comparable distribution network, including warehousing and logistics, demands millions in investment, a substantial hurdle for newcomers. For example, in 2024, the cost of maintaining a national fleet and extensive inventory would easily run into tens of millions of dollars.

Furthermore, ATD's established brand relationships and preferred distributor status with major manufacturers, like Michelin and Goodyear, are difficult to replicate. These long-standing partnerships, solidified over years, grant ATD better pricing and product allocation, as seen in 2024 negotiations where volume purchasing power secured favorable terms.

Regulatory compliance also presents a considerable barrier. Navigating complex environmental and safety standards, such as those overseen by the EPA in 2024, requires specialized knowledge and financial commitment for technology and training, further deterring new market participants.

| Barrier Type | Description | Estimated Cost/Impact (2024) |

|---|---|---|

| Capital Requirements | Warehousing, inventory, logistics fleet | Tens of millions USD |

| Economies of Scale | Purchasing, warehousing, transportation efficiencies | Significant cost advantage for incumbents |

| Brand Relationships | Access to diverse tire portfolios, preferred status | Difficult for new entrants to secure comparable lines |

| Regulatory Compliance | Environmental, safety, and logistical standards | Substantial investment in compliance technology and expertise |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for American Tire Distributors Holdings leverages data from industry-specific market research reports, company financial statements, and trade association publications to provide a comprehensive view of competitive dynamics.