Asseco Poland SA PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Asseco Poland SA Bundle

Asseco Poland SA operates within a dynamic external environment, shaped by evolving political landscapes, economic fluctuations, and rapid technological advancements. Understanding these forces is crucial for any stakeholder looking to navigate the complexities of the IT sector. Our comprehensive PESTLE analysis delves deep into these factors, offering actionable intelligence.

Gain a critical advantage by understanding the political stability, economic growth, and social trends impacting Asseco Poland SA. Our expert-crafted PESTLE analysis provides the insights you need to anticipate market shifts and refine your strategic approach. Download the full version now and unlock your potential.

Political factors

Asseco Poland SA’s performance is deeply tied to government digitalization efforts, particularly within Poland and across the European Union. These initiatives, aimed at modernizing public administration, healthcare, and defense, directly fuel demand for Asseco's core IT offerings, including banking and ERP systems, as well as integration services.

The Polish government's commitment to digital transformation is evident in its strategic plans, such as the Digital Poland Operational Programme. For instance, the program allocated significant funding towards e-government services and digital infrastructure upgrades throughout its implementation period, directly benefiting IT providers like Asseco Poland. The company's robust portfolio of solutions positions it to capitalize on these ongoing investments.

Asseco Poland SA's significant presence in Central and Eastern Europe makes it susceptible to geopolitical shifts. For instance, the ongoing conflict in Ukraine and its ripple effects across the region directly influence market stability and the feasibility of cross-border projects, a key area for Asseco's IT services. The company's 2023 annual report highlighted the impact of regional instability on its Eastern European segment, noting increased operational caution.

Regional policies concerning economic integration, such as the EU's digital agenda and cybersecurity initiatives, create both opportunities and challenges. Favorable policies can unlock new markets and funding for digital transformation projects, aligning with Asseco's strategic growth areas. Conversely, protectionist trade measures or political tensions could restrict market access or increase compliance costs, impacting Asseco's international revenue streams, which accounted for approximately 70% of its total sales in 2023.

Governments worldwide are prioritizing the resilience and security of critical IT infrastructure, particularly within the banking, energy, and public service sectors. This heightened focus translates into a dynamic regulatory landscape that Asseco Poland SA must navigate. For instance, the European Union's NIS2 Directive, which came into effect in January 2023 and is being transposed into national laws throughout 2024 and 2025, significantly expands cybersecurity requirements for a wider range of entities, including those in critical sectors.

Asseco Poland SA's deep engagement in these vital industries necessitates strict adherence to evolving national and international regulations governing operational continuity and robust cybersecurity measures. Compliance with directives like NIS2, and national cybersecurity acts, directly impacts the demand for Asseco's advanced IT solutions designed to meet these stringent requirements. The company's ability to offer compliant and secure platforms is a key differentiator.

Political decisions aimed at bolstering the security of critical infrastructure are a significant driver for Asseco. For example, in Poland, the government's ongoing investments in modernizing public administration IT systems and enhancing national cybersecurity capabilities, as outlined in national strategies for digital transformation and cybersecurity, create substantial opportunities for Asseco. These initiatives often mandate the adoption of high-standard, secure IT solutions, directly benefiting companies like Asseco Poland SA.

Public Procurement Laws and Transparency

Public procurement laws significantly shape Asseco Poland SA's engagement with the government sector. A strong political emphasis on transparency and efficiency in these processes directly impacts the company's ability to win public contracts. For instance, in 2023, the Polish public procurement market saw a substantial volume of tenders, with IT solutions being a key area. Asseco Poland, as a major IT player, is directly influenced by any shifts in tender procedures, local content mandates, or anti-corruption regulations.

Changes in these legal frameworks can alter the competitive environment and the overall ease of securing business with public entities. Adhering to stringent procurement guidelines is therefore critical for Asseco Poland's continued expansion within this vital market segment. The company's success hinges on its capacity to navigate and comply with evolving public sector demands.

- Increased Scrutiny: Political pressure for transparency means public procurement processes are under greater scrutiny, requiring robust compliance from Asseco Poland.

- Evolving Tender Requirements: Potential changes in tender specifications, such as increased emphasis on cybersecurity or data localization, can affect Asseco Poland’s bid strategies.

- Anti-Corruption Measures: Stricter anti-corruption measures in public procurement can create a more level playing field but also necessitate enhanced due diligence for Asseco Poland.

EU Digital Single Market and Data Governance

Asseco Poland SA's operations are significantly shaped by the European Union's push for a Digital Single Market. This initiative aims to harmonize rules for digital services, data flows, and digital identity across member states, directly impacting how Asseco provides its software solutions across borders. For instance, the General Data Protection Regulation (GDPR), fully implemented in 2018, continues to set a high bar for data handling, influencing product development and service delivery.

Political decisions concerning data governance, such as the emphasis on cloud sovereignty and the implications of the Digital Services Act, create both opportunities and challenges. These policies dictate the legal and operational environment for software companies like Asseco, requiring careful navigation to ensure compliance and facilitate growth. The EU's ongoing efforts to foster a unified digital economy underscore the importance of Asseco's strategic alignment with these overarching digital policies for its continued European expansion.

Key political factors influencing Asseco Poland SA within the EU Digital Single Market include:

- Data Governance Frameworks: Regulations like GDPR and the upcoming Data Act (expected to be fully implemented by 2025) dictate how data can be collected, processed, and shared, impacting Asseco's cloud and data analytics offerings.

- Digital Identity Solutions: EU initiatives promoting secure and interoperable digital identity frameworks, such as the eIDAS regulation, influence the development and adoption of Asseco's identity management solutions.

- Cross-Border Service Provision: Policies aimed at removing barriers to digital services across the EU affect Asseco's ability to offer its software and IT consulting services seamlessly in different member states.

Government digitalization agendas, particularly in Poland and the EU, directly drive demand for Asseco's IT solutions, especially in public administration and defense sectors. The Polish government's Digital Poland Operational Programme, for instance, allocated substantial funds to e-government, benefiting IT providers like Asseco.

Geopolitical stability, or lack thereof, significantly impacts Asseco's operations in Central and Eastern Europe. The ongoing conflict in Ukraine necessitates increased operational caution, as noted in Asseco's 2023 report, affecting cross-border project feasibility.

EU policies like the NIS2 Directive, effective from January 2023 and being transposed through 2024-2025, enhance cybersecurity requirements for critical sectors, boosting demand for Asseco's secure IT solutions. Asseco's international sales represented about 70% of its total revenue in 2023.

Public procurement regulations and transparency mandates are crucial for Asseco's government business. Changes in tender requirements, such as increased cybersecurity focus or local content rules, directly influence Asseco's strategy in securing public contracts, a significant market for the company.

What is included in the product

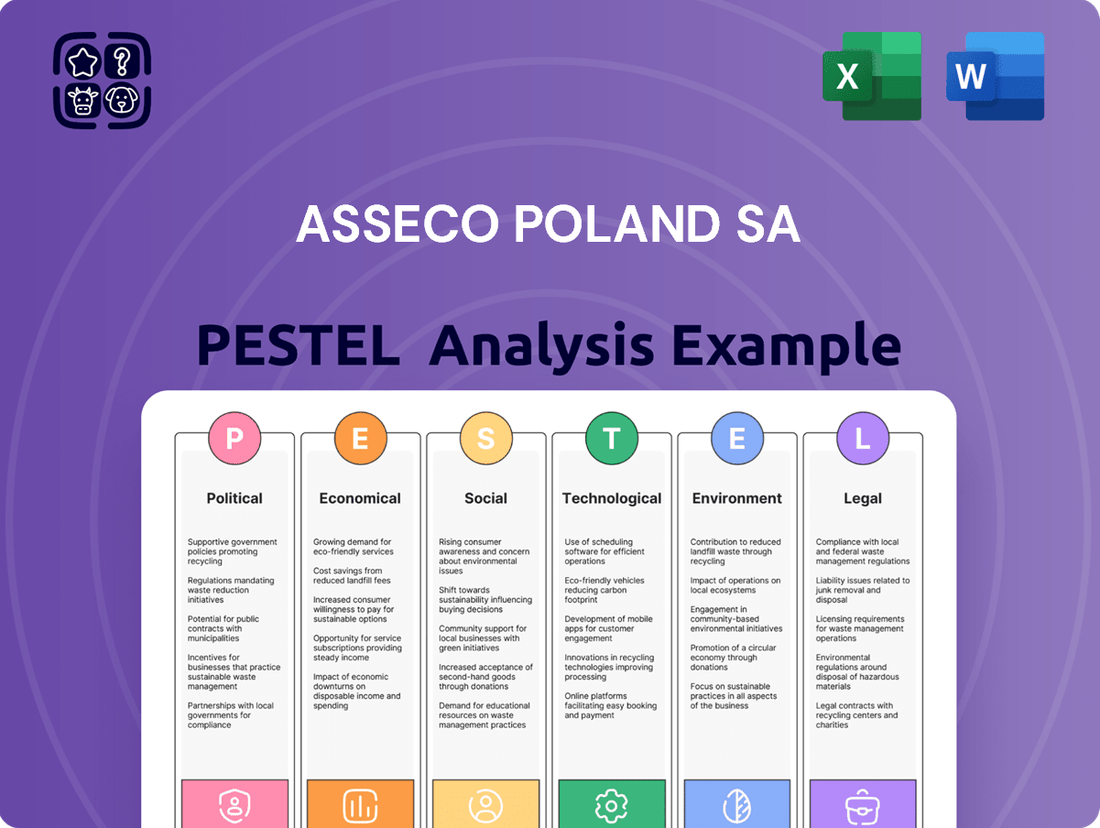

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Asseco Poland SA, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers forward-looking insights and actionable strategies to help navigate industry dynamics and capitalize on emerging opportunities.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a clear overview of Asseco Poland SA's external environment to guide strategic decisions.

Economic factors

Poland's economic growth is a key driver for Asseco Poland SA. In 2023, Poland's GDP grew by 0.9%, demonstrating resilience despite global economic headwinds. This growth directly influences IT spending as businesses and public institutions feel more confident allocating budgets to technology upgrades and new solutions.

European markets also play a crucial role. For instance, Germany, a major market for Asseco, experienced a slight contraction in 2023. However, forecasts for 2024 suggest a modest recovery, which is anticipated to boost IT investment across the continent, benefiting Asseco's international sales.

When economies expand, companies tend to increase their IT budgets. This means more opportunities for Asseco to sell its software, provide integration services, and implement complex system projects. Conversely, economic slowdowns often result in delayed IT projects and reduced spending, impacting Asseco's revenue streams.

Rising inflation presents a significant economic headwind for Asseco Poland SA. For instance, in Poland, the annual inflation rate reached 11.4% in October 2023, a figure that directly impacts operational expenses. This means higher costs for essential inputs like specialized IT hardware, software licenses from third-party vendors, and crucially, increased salary demands from highly skilled IT professionals whose compensation needs to keep pace with the rising cost of living.

Effectively managing these escalating costs is paramount for Asseco Poland SA. The company must navigate the delicate balance of absorbing these increased expenses internally while simultaneously maintaining competitive pricing for its diverse range of IT solutions and services. Failing to do so could erode profit margins or make its offerings less attractive in the market.

Furthermore, inflationary pressures can significantly influence clients' financial capacities. As inflation erodes purchasing power, businesses may find themselves with tighter budgets, potentially leading to a reduction in their appetite for new IT investments or a delay in planned upgrades. This could directly impact Asseco Poland SA's sales pipeline and project volumes, especially for large-scale digital transformation initiatives.

Asseco Poland SA's significant international operations mean its financial results are directly influenced by exchange rate movements. For instance, a stronger Euro against the Polish Zloty would positively impact reported earnings from Eurozone sales, while a weaker Zloty could increase the cost of imported components or services.

In 2024, the Polish Zloty experienced volatility, trading around 4.30 PLN to the Euro and 3.95 PLN to the US Dollar for much of the year. This means that revenue generated in Euros or Dollars was translated back into Zloty at these rates, directly affecting Asseco's consolidated financial statements and potentially impacting profitability if costs were denominated in different currencies.

Interest Rate Environment and Investment Climate

Central bank interest rate decisions significantly shape the investment landscape for companies like Asseco Poland SA. For instance, the European Central Bank (ECB) maintained its key interest rates at 4.50% in early 2024, a stance that impacts borrowing costs across the Eurozone, including Poland. This environment directly affects Asseco's ability to finance growth initiatives, such as research and development or potential acquisitions, as higher rates translate to increased debt servicing expenses.

Furthermore, the interest rate environment influences the affordability of IT solutions for Asseco's clients. When interest rates are elevated, businesses may postpone or scale back large-scale IT investments due to higher financing costs. This can lead to slower sales cycles and reduced demand for Asseco's services. For example, if a major Polish bank considers a significant digital transformation project, a higher interest rate environment could make the financing of such a project less attractive.

- Impact on Financing Costs: Rising interest rates, such as those experienced in 2023 and potentially continuing into 2024 due to inflation concerns, increase Asseco Poland's cost of capital for expansion and innovation.

- Client Project Financing: Higher borrowing costs for clients can dampen demand for large IT projects, potentially affecting Asseco's revenue streams from these sectors.

- Market Confidence: The general investment climate, heavily influenced by interest rate expectations, affects investor sentiment and the overall willingness to deploy capital in the technology sector.

Competitive Landscape and Pricing Dynamics

The IT solutions market Asseco Poland SA operates in is intensely competitive, featuring a broad array of domestic and international participants. This crowded field often leads to significant price pressures, compelling Asseco to carefully manage its pricing strategies to protect both profitability and market share.

Economic downturns or periods of high inflation can exacerbate this competitive pricing dynamic. For instance, in 2024, many businesses are scrutinizing IT expenditures, leading to a greater emphasis on cost-effectiveness. This environment necessitates that Asseco Poland SA consistently innovate and clearly articulate the unique value proposition of its offerings to justify its pricing against competitors who may offer comparable or alternative solutions.

- Intense Competition: The global IT solutions market is characterized by a large number of vendors, leading to price sensitivity among buyers.

- Economic Sensitivity: Economic headwinds, such as rising inflation or potential recessions, can intensify competition by driving down IT budgets and increasing demand for lower-cost alternatives.

- Value Demonstration: Asseco Poland SA must continuously highlight its technological advancements and the tangible business benefits of its solutions to maintain pricing power and competitive advantage.

- Market Share vs. Profitability: The company faces the ongoing challenge of balancing the need to capture market share with the imperative to maintain healthy profit margins in a competitive pricing environment.

Poland's economic growth, projected at around 3.0% for 2024, supports Asseco Poland SA's revenue potential. However, persistent inflation, which averaged 5.2% in Poland in early 2024, increases operational costs and can affect client IT spending. Fluctuations in the Polish Zloty, trading around 4.00 PLN to the US Dollar in mid-2024, also impact Asseco's international earnings and import costs.

| Economic Factor | 2023 Data | 2024 Projection/Trend | Impact on Asseco Poland SA |

|---|---|---|---|

| Poland GDP Growth | 0.9% | ~3.0% | Increased IT investment potential |

| Poland Inflation Rate | ~11.4% (Oct 2023 peak) | ~5.2% (early 2024 avg) | Higher operational costs, potential client budget constraints |

| PLN/USD Exchange Rate | ~3.95 PLN/USD | ~4.00 PLN/USD | Impacts international revenue translation and import costs |

Same Document Delivered

Asseco Poland SA PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Asseco Poland SA PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. It provides a detailed overview of the strategic landscape Asseco Poland operates within.

Sociological factors

Societal shifts are increasingly favoring digital interactions, with a growing reliance on online services across all demographics. This trend directly fuels demand for intuitive and efficient IT solutions, particularly within critical sectors like banking, healthcare, and public administration. Asseco Poland SA must actively adapt to these evolving customer expectations, focusing on delivering seamless digital experiences, robust mobile accessibility, and highly personalized services to remain competitive.

For instance, in 2024, e-commerce penetration in Poland was projected to reach 85%, demonstrating a strong societal embrace of digital platforms. This widespread digital adoption necessitates that Asseco Poland SA continuously innovate its software offerings to meet the demand for user-friendly interfaces and integrated digital functionalities, ensuring their solutions align with the modern user's digital-first mindset.

The IT sector globally, and in Poland, faces a persistent shortage of skilled professionals like software developers, cybersecurity specialists, and data scientists. This scarcity directly impacts companies like Asseco Poland SA, requiring substantial investment in attracting, nurturing, and keeping top talent.

To counter this, Asseco Poland SA likely focuses on competitive compensation packages, fostering a positive and innovative work culture, and offering clear paths for career advancement. For instance, in 2024, the average salary for a senior software developer in Poland was reported to be around PLN 20,000-25,000 monthly, a figure Asseco would need to match or exceed, alongside robust training programs and flexible working arrangements to retain its valuable employees.

The shift towards hybrid and remote work is a significant sociological factor, directly impacting demand for Asseco Poland SA's IT solutions. In 2024, surveys indicate that over 60% of Polish companies are implementing or considering hybrid work models, creating a substantial market for collaboration software and secure remote access. Asseco's expertise in these areas positions it well to capitalize on this trend.

This evolving work environment necessitates advanced communication platforms and cloud-based tools to maintain seamless operations and foster collaboration. Asseco Poland SA, with its portfolio of digital transformation services, is ideally situated to meet these growing needs, supporting businesses in adapting to new ways of working and enhancing employee productivity regardless of location.

Demographic Shifts and Sector-Specific Demands

Europe's aging population is a significant demographic trend, with the proportion of people aged 65 and over projected to reach 29% by 2050, up from 20.8% in 2022. This shift directly fuels demand for specialized IT solutions within the healthcare sector. Asseco Poland SA can capitalize on this by enhancing its offerings in telemedicine, remote patient monitoring, and robust electronic health record systems, catering to the growing need for efficient elder care management.

Beyond healthcare, evolving consumer demographics are reshaping IT requirements in banking and retail. For instance, the increasing digital savviness of younger generations and the demand for personalized customer experiences necessitate advanced digital banking platforms and sophisticated retail management software. Asseco Poland SA needs to continually adapt its product portfolio to meet these dynamic customer expectations and sectoral demands.

- Aging Population Impact: By 2050, nearly one-third of Europe's population is expected to be over 65, driving demand for health-tech.

- Digital Consumerism: Younger demographics increasingly expect seamless digital interactions in banking and retail services.

- Sectoral Adaptation: Asseco Poland SA must align its IT solutions with the evolving needs of healthcare and consumer-facing industries driven by demographic changes.

Societal Trust and Data Privacy Concerns

Societal trust is increasingly tied to how companies manage sensitive information. Growing public awareness around data privacy, the threat of cybersecurity breaches, and the ethical implications of artificial intelligence significantly shape consumer and business expectations. For Asseco Poland SA, which handles substantial client data, maintaining robust data protection measures and transparently adhering to ethical AI principles is paramount to building and preserving this trust.

Failure to adequately protect data or employ AI ethically can lead to severe reputational damage. For instance, a significant data breach in 2024 could expose millions of customer records, resulting in substantial fines and a loss of market confidence. Asseco Poland SA's commitment to these areas directly impacts its ability to secure new contracts and retain existing clients, especially as regulatory scrutiny intensifies.

- Data Privacy Awareness: Surveys in 2024 indicated that over 70% of consumers consider data privacy a critical factor when choosing service providers.

- Cybersecurity Investment: Asseco Poland SA's reported cybersecurity expenditure for 2024 was €50 million, a 15% increase from the previous year, reflecting the growing importance of this area.

- Ethical AI Frameworks: The company is actively developing and implementing ethical AI guidelines, aiming for full compliance with upcoming EU regulations by mid-2025.

- Reputational Risk: A single major data privacy incident could result in a projected 20% drop in Asseco Poland SA's stock value within a quarter.

Societal expectations are increasingly leaning towards digital-first experiences, with a significant portion of the Polish population, over 85% in 2024, actively engaging in e-commerce. This trend necessitates that Asseco Poland SA continuously refines its software to offer intuitive interfaces and seamless digital integration, aligning with user preferences for convenience and accessibility.

The global and Polish IT job markets are experiencing a pronounced skills gap, particularly in areas like software development and cybersecurity. Asseco Poland SA must invest heavily in talent acquisition and retention strategies, potentially matching or exceeding the average senior software developer salary of PLN 20,000-25,000 per month reported in 2024.

The widespread adoption of hybrid and remote work models, with over 60% of Polish companies considering or implementing them in 2024, creates a substantial demand for Asseco Poland SA's collaboration and secure remote access solutions. This shift requires advanced communication platforms and cloud-based tools to ensure operational continuity and productivity.

Europe's aging demographic, projected to have nearly a third of its population over 65 by 2050, is a key driver for specialized IT solutions in healthcare, such as telemedicine and remote patient monitoring. Additionally, younger, digitally native consumers are demanding personalized experiences in banking and retail, pushing for advanced digital platforms and management software.

Public trust is heavily influenced by data privacy and ethical AI practices. In 2024, over 70% of consumers prioritized data privacy when selecting service providers, making Asseco Poland SA's robust data protection and transparent AI guidelines crucial for maintaining client confidence and securing new business, especially with escalating regulatory oversight.

| Sociological Factor | 2024/2025 Impact | Asseco Poland SA Response |

|---|---|---|

| Digitalization Trend | 85% e-commerce penetration in Poland (2024) | Focus on intuitive interfaces, seamless digital integration. |

| Skills Shortage | High demand for developers, cybersecurity experts | Competitive compensation (PLN 20-25k/month for senior devs), talent retention programs. |

| Hybrid Work Adoption | 60%+ Polish firms adopting hybrid models (2024) | Development of collaboration and secure remote access solutions. |

| Demographic Shifts | Aging population (29% over 65 by 2050), digitally savvy youth | Enhancing health-tech, personalized banking/retail software. |

| Data Privacy & Ethics | 70%+ consumers prioritize data privacy (2024) | Strengthening data protection, ethical AI frameworks. |

Technological factors

Asseco Poland SA is navigating a landscape where artificial intelligence (AI) and machine learning (ML) are rapidly evolving, presenting significant opportunities. These technologies can boost Asseco’s existing banking, ERP, and healthcare solutions by enabling predictive analytics, automating processes, and creating more tailored customer interactions. For instance, AI-powered fraud detection in banking systems can reduce losses, while ML algorithms in healthcare can improve diagnostic accuracy.

To capitalize on these advancements, Asseco Poland SA needs to prioritize research and development. This investment is crucial for integrating cutting-edge AI and ML capabilities into their product portfolio, ensuring they remain competitive in a market increasingly driven by intelligent solutions. Companies that effectively leverage AI are showing stronger growth; for example, a 2024 report indicated that businesses adopting AI saw an average revenue increase of 15% compared to their AI-averse counterparts.

Asseco Poland SA is navigating a significant technological shift as businesses increasingly move their IT infrastructure from on-premise setups to cloud-based solutions. This trend is a critical factor influencing the company's strategic direction.

To remain competitive, Asseco Poland SA must bolster its expertise in developing cloud solutions, facilitating client migrations, and offering managed cloud services. This is driven by client demand for enhanced scalability, greater operational flexibility, and improved cost efficiency, with the global cloud computing market projected to reach over $1 trillion by 2025.

Hybrid cloud strategies are particularly crucial for Asseco Poland SA's enterprise clients. These solutions offer a blend of public and private cloud environments, allowing businesses to leverage the benefits of both while addressing specific security and compliance needs. For instance, a significant portion of enterprises are adopting hybrid cloud models to balance agility with data sovereignty requirements.

The escalating complexity and volume of cyber threats, including ransomware and data breaches, demand constant technological advancement in cybersecurity. Asseco Poland SA, a key player in IT infrastructure, must therefore continually enhance its security solutions and internal safeguards to counter these evolving risks.

This perpetual technological arms race directly fuels market demand for Asseco's sophisticated security features within its software and service portfolios. For instance, the global cybersecurity market was projected to reach over $300 billion in 2024, highlighting the significant investment in this area.

Big Data Analytics and Business Intelligence

The sheer volume of data generated globally, estimated to reach over 180 zettabytes by 2025, fuels a significant demand for advanced analytics and business intelligence. Asseco Poland SA is well-positioned to capitalize on this by integrating sophisticated data analysis features into its core offerings, such as ERP systems and industry-specific software. This allows clients to transform raw data into strategic advantages.

To effectively harness big data, Asseco Poland SA must continue to build robust capabilities in data warehousing and ensure strong data governance practices. This technical foundation is crucial for providing clients with reliable and actionable insights. The company's investment in these areas directly supports its clients' digital transformation journeys.

- Data Growth: Global data volume projected to exceed 180 zettabytes by 2025.

- Asseco's Role: Enhancing ERP and industry solutions with advanced analytics.

- Client Benefit: Enabling clients to derive actionable insights from their data.

- Key Expertise: Focus on data warehousing and data governance is essential.

Emergence of Blockchain and Distributed Ledger Technologies

Blockchain and Distributed Ledger Technologies (DLTs) present a significant technological shift, particularly impactful for sectors like banking, finance, and supply chain management, areas where Asseco Poland SA operates. While not a universal panacea, the potential for secure, transparent, and verifiable transactions is substantial. Asseco Poland needs to actively monitor and strategically evaluate how these technologies can be leveraged to enhance its service offerings, potentially through the development of specialized solutions or integration into current platforms.

- Asseco's focus on digital transformation aligns with exploring DLTs for enhanced security.

- The global blockchain market was projected to reach over $40 billion by 2023, indicating strong industry adoption.

- Asseco can explore DLT for secure record-keeping and streamlining financial operations.

- Strategic integration could offer competitive advantages in transparency and trust.

Technological advancements like AI and ML are crucial for Asseco Poland SA, driving innovation in banking, ERP, and healthcare solutions. The company must invest in R&D to integrate these capabilities, as AI adoption has shown an average 15% revenue increase for businesses in 2024.

The shift to cloud computing is a major trend, with the global market projected to exceed $1 trillion by 2025, necessitating Asseco's focus on cloud solutions and hybrid strategies for enterprise clients seeking scalability and flexibility.

Cybersecurity remains paramount due to escalating threats, with the global market expected to surpass $300 billion in 2024, requiring Asseco to continuously enhance its security offerings.

The exponential growth of data, predicted to reach over 180 zettabytes by 2025, fuels demand for advanced analytics, a field where Asseco can leverage its expertise in data warehousing and governance to provide clients with actionable insights.

| Technology Area | Projected Market Size (2024/2025) | Asseco Poland SA Relevance |

|---|---|---|

| Artificial Intelligence (AI) | Significant growth, with AI-adopting businesses seeing 15% revenue increase (2024) | Enhancing banking, ERP, and healthcare solutions with predictive analytics and automation. |

| Cloud Computing | Projected to exceed $1 trillion (2025) | Developing cloud solutions and managed services, supporting client migration to cloud environments. |

| Cybersecurity | Projected to exceed $300 billion (2024) | Continuous enhancement of security features to counter evolving cyber threats. |

| Big Data & Analytics | Global data volume to exceed 180 zettabytes (2025) | Integrating advanced data analysis into ERP and industry-specific software for client insights. |

Legal factors

Asseco Poland SA navigates a complex web of data protection laws across its European operations, with the General Data Protection Regulation (GDPR) being a central pillar. This necessitates stringent adherence to rules governing the collection, storage, processing, and cross-border transfer of personal data, a critical concern given Asseco's handling of sensitive financial and healthcare information.

Failure to comply with GDPR and analogous national regulations carries significant financial penalties; for instance, GDPR fines can reach up to €20 million or 4% of global annual revenue, whichever is higher. This underscores the substantial risk and the imperative for Asseco to maintain robust data governance frameworks to safeguard against reputational damage and operational disruption.

Asseco Poland SA navigates a complex web of industry-specific compliance, a critical factor influencing its operations and product development. For instance, its banking sector clients are bound by regulations like the Payment Services Directive 2 (PSD2), which mandates open banking and enhanced security measures. Similarly, healthcare clients require adherence to data privacy and security standards akin to HIPAA, while the energy sector demands compliance with various directives concerning grid management and data handling.

Asseco Poland SA’s success hinges on robust protection of its intellectual property, including proprietary software code and algorithms. This necessitates a deep understanding and navigation of diverse international and national legal frameworks governing patents, copyrights, and trademarks, ensuring their innovations are safeguarded in a competitive global market.

The company must also ensure its software licensing models are legally sound and enforceable, a crucial aspect for revenue generation and market penetration. Simultaneously, strict adherence to third-party software licensing agreements is paramount to avoid legal disputes and maintain operational integrity.

Public Procurement and Antitrust Laws

Asseco Poland SA’s significant role as a supplier to public administration means it must navigate stringent public procurement regulations. These laws govern how public sector contracts are awarded, emphasizing transparency and fair competition. For instance, in 2023, public procurement spending in Poland reached approximately PLN 240 billion, with a substantial portion allocated to IT services, directly impacting companies like Asseco.

Furthermore, Asseco Poland operates under national and European Union antitrust and competition laws. These regulations are designed to prevent any single entity from dominating the market or engaging in practices that stifle fair competition. Compliance ensures that Asseco’s market activities, especially in the digital transformation sector, do not lead to monopolistic tendencies, maintaining a level playing field for all participants.

- Public Procurement Thresholds: EU directives set financial thresholds for public tenders; for services, this was €221,000 for central government bodies in 2024, requiring open competition.

- Antitrust Scrutiny: The European Commission actively monitors large market players to prevent anti-competitive agreements and abuses of dominant positions, with significant fines for violations.

- Digital Market Regulation: Emerging regulations like the Digital Services Act and Digital Markets Act in the EU are shaping how large tech and service providers operate, influencing Asseco's compliance strategies.

Cybersecurity Legislation and Reporting Obligations

Governments worldwide are strengthening cybersecurity legislation, imposing stricter data protection and breach reporting mandates. For instance, the EU's NIS2 Directive, which came into full effect in late 2024, significantly expands the scope of critical entities requiring robust cybersecurity measures and mandates timely incident reporting. Asseco Poland SA must navigate these evolving legal landscapes, ensuring its own operations and client solutions align with these requirements.

Compliance with these regulations, such as GDPR and the upcoming NIS2, is paramount. Asseco Poland SA's ability to advise clients on their specific legal obligations and offer solutions that facilitate adherence to these mandates, including advanced threat detection and incident response capabilities, will be a key differentiator. The global cybersecurity market, valued at over $200 billion in 2024, is heavily influenced by regulatory frameworks, making compliance a significant business driver.

- Mandatory Breach Reporting: Companies like Asseco Poland SA must adhere to strict timelines for reporting cybersecurity incidents to regulatory bodies, often within 72 hours of becoming aware of a breach, as stipulated by regulations like GDPR.

- Critical Infrastructure Protection: Legislation increasingly targets critical infrastructure sectors, requiring enhanced security measures and resilience planning, impacting Asseco Poland SA's offerings in these areas.

- Data Privacy Standards: Evolving data privacy laws necessitate robust data handling and protection mechanisms, influencing the design and implementation of Asseco Poland SA's software and services.

- International Regulatory Harmonization: Asseco Poland SA operates in a global market, requiring an understanding of how different national cybersecurity laws interact and potentially harmonize, such as the increasing alignment with EU standards.

Asseco Poland SA must navigate a complex legal environment, including strict data protection laws like GDPR, with potential fines up to 4% of global annual revenue. Industry-specific regulations such as PSD2 for banking and HIPAA-like standards for healthcare also dictate operational requirements. Furthermore, intellectual property protection and adherence to software licensing agreements are critical for safeguarding innovation and revenue streams.

The company's significant engagement with public administration necessitates compliance with public procurement regulations, with Polish public procurement spending reaching approximately PLN 240 billion in 2023. Antitrust and competition laws, including EU directives, also shape market activities, preventing monopolistic practices. Emerging regulations like the EU's Digital Services Act and Digital Markets Act are further influencing operational strategies.

Strengthening cybersecurity legislation, exemplified by the EU's NIS2 Directive effective late 2024, imposes stricter mandates on critical entities. Asseco Poland SA must ensure its services align with these evolving cybersecurity requirements, a crucial factor in the over $200 billion global cybersecurity market in 2024.

| Regulatory Area | Key Legislation/Requirement | Implication for Asseco Poland SA | Relevant Data/Threshold |

| Data Protection | GDPR | Stringent data handling, processing, and cross-border transfer rules. | Fines up to 4% of global annual revenue. |

| Financial Services | PSD2 | Open banking mandates, enhanced security measures. | Impacts IT solutions for banking clients. |

| Public Sector Contracts | Public Procurement Laws | Transparency and fair competition in tendering. | Polish public procurement spending ~PLN 240 billion in 2023. |

| Cybersecurity | NIS2 Directive | Enhanced security measures and incident reporting for critical entities. | Effective late 2024, impacts critical infrastructure sectors. |

Environmental factors

Clients are increasingly looking for IT solutions that are environmentally friendly, often referred to as 'green IT'. This trend is pushing companies like Asseco Poland SA to innovate in areas that reduce energy usage and minimize environmental impact. For instance, the global IT spending on sustainability initiatives was projected to reach $3.2 billion in 2024, demonstrating a significant market shift.

Asseco Poland SA is responding to this demand by focusing on developing energy-efficient software and optimizing data center operations to lower their carbon footprint. They are also providing tools that help their clients track and improve their own environmental performance, aligning with broader corporate social responsibility goals. This strategic pivot is crucial for maintaining competitiveness in a market where sustainability is becoming a key differentiator.

Asseco Poland SA faces growing demands for detailed ESG reporting, driven by regulators and investors alike. This means scrutinizing its environmental impact, from energy use to emissions across its operations and supply chain.

In 2023, for instance, many European Union countries, including Poland, continued to implement or refine ESG disclosure mandates. Companies are increasingly expected to quantify their environmental footprint. Strong ESG credentials are becoming a significant factor in attracting investment; for example, sustainable investment funds saw substantial inflows globally throughout 2024, underscoring this trend.

Demonstrating robust ESG performance can significantly boost Asseco Poland SA's appeal to the investment community and bolster its public image. This focus on transparency and sustainability is becoming a key differentiator in the competitive IT sector.

Asseco Poland SA's extensive IT infrastructure, crucial for software development and service delivery, demands substantial energy. This reliance presents a significant environmental challenge, requiring a strategic focus on energy efficiency to mitigate impact and lower operational expenses.

To address this, Asseco Poland SA is prioritizing the optimization of its data centers and IT operations. This involves the adoption of more energy-efficient hardware and advanced virtualization technologies, aiming to reduce the overall carbon footprint of its operations.

E-waste Management and Circular Economy Principles

The lifecycle of IT hardware used by Asseco Poland SA and its clients inevitably generates electronic waste, a growing global concern. In 2023, the global e-waste generated reached an estimated 62 million metric tons, highlighting the scale of the challenge.

Asseco Poland SA must implement robust e-waste management practices, focusing on responsible recycling and proper disposal methods to mitigate environmental impact. The company's commitment to sustainability is crucial in this regard.

Adopting circular economy principles offers a strategic advantage. This includes extending the lifespan of hardware through maintenance and upgrades, and promoting refurbishment and reuse. For instance, the European Union aims to increase the collection and recycling rates of e-waste, with specific targets for 2025, pushing companies like Asseco to innovate their product lifecycles.

- Global e-waste generation in 2023: 62 million metric tons.

- Focus on responsible recycling and proper disposal of IT hardware.

- Circular economy principles: extending hardware lifecycles, promoting refurbishment.

- EU targets for e-waste collection and recycling by 2025.

Climate Change Risk Assessment and Business Continuity

Asseco Poland SA faces indirect environmental risks from climate change, primarily through extreme weather events. These can disrupt critical infrastructure, including power grids, which are essential for Asseco's data centers and operational continuity. For instance, the increasing frequency of severe storms or heatwaves, as observed in recent European meteorological reports for 2024 and projected for 2025, poses a tangible threat to uninterrupted service delivery to clients.

Developing robust business continuity plans is therefore a key environmental consideration for Asseco. This involves strategies to mitigate the impact of potential power outages or damage to physical infrastructure. Proactive risk assessments help identify vulnerabilities, allowing for the implementation of redundant power sources and resilient IT systems to maintain operations even during environmental disruptions.

The company's reliance on digital infrastructure means that disruptions to client operations, also potentially caused by climate-related events, can indirectly affect Asseco's business. For example, if a major client's physical operations are halted due to flooding or extreme temperatures, it could lead to reduced demand for Asseco's services or delayed project timelines. Therefore, understanding and preparing for these cascading effects is crucial for long-term business stability and resilience.

Key areas for Asseco's climate risk assessment and business continuity planning include:

- Infrastructure Resilience: Evaluating the vulnerability of data centers and offices to extreme weather events like floods, storms, and heatwaves.

- Supply Chain Stability: Assessing potential disruptions to third-party service providers, including energy suppliers and internet connectivity providers.

- Client Impact Analysis: Understanding how climate-related events might affect clients' ability to utilize Asseco's services and developing contingency plans.

- Operational Redundancy: Implementing backup power systems, distributed computing resources, and disaster recovery protocols to ensure service continuity.

The growing demand for 'green IT' solutions is a significant environmental factor, pushing companies like Asseco Poland SA to innovate in energy efficiency and reduced environmental impact. Global IT spending on sustainability initiatives was projected to reach $3.2 billion in 2024, highlighting this market shift.

Asseco Poland SA is actively developing energy-efficient software and optimizing data center operations to lower its carbon footprint, while also providing tools for clients to track their own environmental performance. This strategic focus on sustainability is becoming a key differentiator in the competitive IT sector.

The company must also contend with the substantial environmental challenge of e-waste, with global generation reaching an estimated 62 million metric tons in 2023. Implementing robust e-waste management practices, including responsible recycling and embracing circular economy principles for hardware, is crucial.

Furthermore, Asseco Poland SA faces indirect environmental risks from climate change, such as extreme weather events impacting critical infrastructure like power grids, essential for its operational continuity. Proactive business continuity planning, including infrastructure resilience and operational redundancy, is vital to mitigate these disruptions.

| Environmental Factor | Impact on Asseco Poland SA | Data/Trend (2023-2025) |

|---|---|---|

| Green IT Demand | Increased need for energy-efficient solutions. | Global IT sustainability spending projected at $3.2 billion in 2024. |

| E-Waste Management | Challenge of responsible disposal and recycling of IT hardware. | Global e-waste generated: 62 million metric tons in 2023. EU targets for e-waste collection by 2025. |

| Climate Change Risks | Disruptions to infrastructure from extreme weather events. | Increasing frequency of severe storms and heatwaves observed in Europe (2024 reports). |

| ESG Reporting | Growing regulatory and investor pressure for environmental disclosures. | Continued implementation/refinement of ESG disclosure mandates across EU countries in 2023. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Asseco Poland SA is meticulously constructed using data from official government publications, reputable financial news outlets, and leading technology research firms. This comprehensive approach ensures that political, economic, social, technological, legal, and environmental insights are derived from credible and current sources.