Asseco Poland SA Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Asseco Poland SA Bundle

Curious about Asseco Poland SA's strategic positioning? Our BCG Matrix preview highlights key product categories, but to truly unlock their market potential, you need the full picture. Dive deeper into the Stars, Cash Cows, Dogs, and Question Marks that define their portfolio.

This initial glimpse is just the beginning. Purchase the complete Asseco Poland SA BCG Matrix for a comprehensive breakdown, including data-backed recommendations and a clear roadmap to optimize your investment and product decisions. Gain the strategic clarity you need to thrive.

Stars

Asseco Poland is heavily investing in cybersecurity, aiming to bolster national cyber resilience. This strategic focus aligns with a booming IT market demand for sophisticated security solutions, positioning cybersecurity as a significant growth driver for the company.

The company's commitment is further underscored by its exploration of strategic acquisitions in the cybersecurity sector, signaling a strong intent to capture a larger market share. For instance, in 2023, the global cybersecurity market was valued at an estimated $214.1 billion, with projections indicating continued robust growth, highlighting the opportune nature of Asseco's investment.

Asseco Poland SA is strategically investing in AI-driven solutions, aiming to boost internal operations and develop innovative client offerings. This focus aligns with a global surge in IT spending, with a particular emphasis on AI and machine learning tools, indicating a strong market demand for Asseco's advancements in this area.

Asseco Poland SA is making significant strides in its cloud and Software-as-a-Service (SaaS) offerings. The company is actively building its expertise in cloud technologies, providing a range of solutions designed to meet evolving market needs. This strategic focus positions Asseco to capitalize on the increasing demand for flexible and advanced digital services.

The market for cloud and SaaS solutions is experiencing robust growth, largely driven by businesses seeking cost optimization and access to cutting-edge capabilities. This trend directly benefits Asseco’s cloud and SaaS segments, marking them as high-potential areas for expansion and revenue generation. For instance, the global cloud computing market was projected to reach over $1.3 trillion in 2024, underscoring the significant opportunity.

Digital Transformation Initiatives

Asseco Poland SA is a significant player in the digital transformation landscape, particularly within essential industries such as banking, energy, healthcare, and public administration. This focus positions them well within a rapidly expanding market.

The global digital transformation market is experiencing robust growth. Projections indicate it will surge from USD 911 billion in 2024 to an impressive USD 3.3 trillion by 2030. Asseco’s established presence in key sectors aligns them with this high-growth trajectory.

- Leading sector penetration: Asseco’s strong foothold in banking, energy, healthcare, and public administration showcases their capability in driving digital change across vital economic areas.

- Market growth alignment: The projected market expansion from USD 911 billion in 2024 to USD 3.3 trillion by 2030 underscores the significant opportunity for Asseco’s digital transformation initiatives.

- Strategic focus: Their continued investment and leadership in digital transformation are crucial for maintaining a competitive edge in these evolving sectors.

Strategic International Acquisitions (Post-Integration Growth)

Asseco Poland SA's strategic international acquisitions are a key component of its growth. In 2024 alone, the company completed 14 acquisitions, further solidifying its global footprint. This aggressive acquisition strategy continued into the first quarter of 2025 with an additional 8 companies joining the Asseco group.

These strategic moves are specifically designed to bolster Asseco's presence in rapidly expanding international IT markets. Key regions targeted include the United States, India, Portugal, Israel, Spain, and Egypt. The integration of these newly acquired entities is crucial for driving increased market share within these burgeoning sectors.

- 2024 Acquisitions: 14 companies

- Q1 2025 Acquisitions: 8 companies

- Target Markets: US, India, Portugal, Israel, Spain, Egypt

- Growth Driver: Increased market share in expanding international IT sectors

Asseco Poland SA's focus on Artificial Intelligence (AI) and cloud/SaaS solutions positions them as strong contenders in the current IT landscape. These areas represent significant growth opportunities, with the global AI market projected to reach $1.81 trillion by 2030 and the cloud computing market already exceeding $1.3 trillion in 2024. Their strategic investments and market alignment in these sectors indicate a 'Star' status within the BCG matrix, characterized by high growth and high market share potential.

| Segment | Market Growth | Asseco's Position |

|---|---|---|

| AI Solutions | Very High (Projected $1.81T by 2030) | High Potential, Strategic Investment |

| Cloud & SaaS | High (Exceeded $1.3T in 2024) | Strong Expertise, Growing Demand |

| Cybersecurity | High (Valued at $214.1B in 2023) | Significant Growth Driver, Acquisition Focus |

What is included in the product

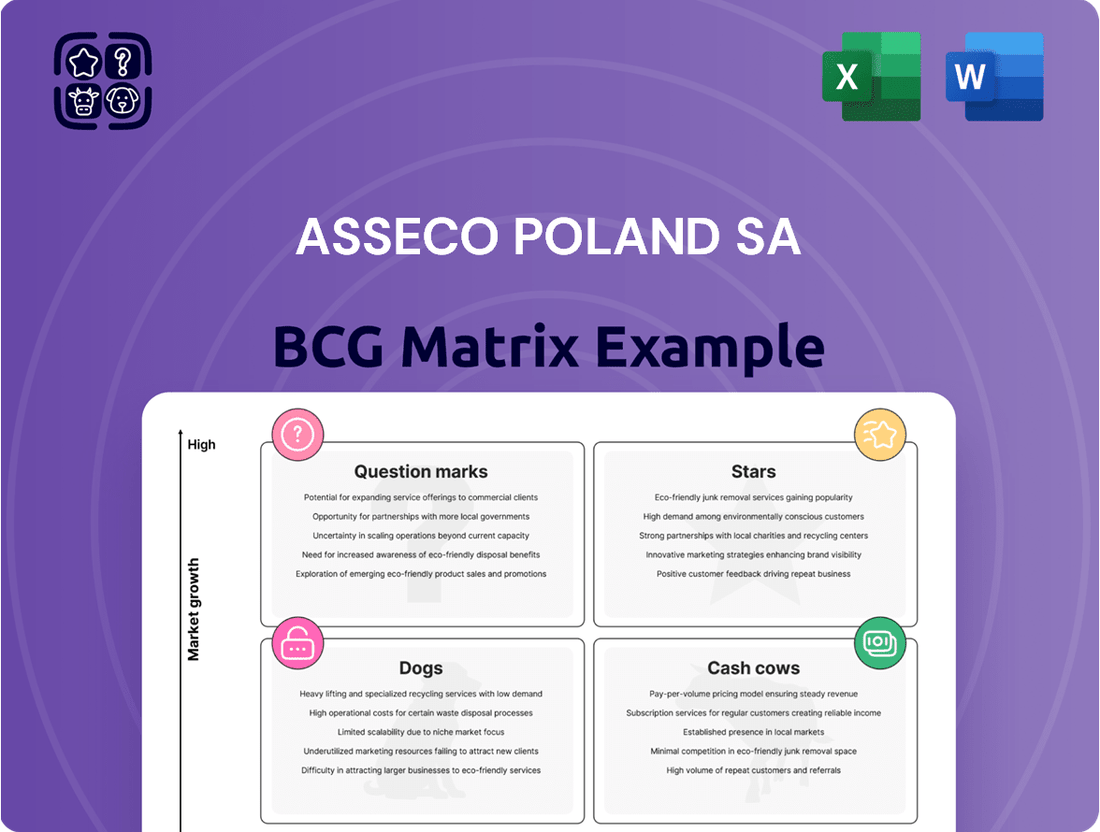

Analysis of Asseco Poland's portfolio, identifying Stars for growth, Cash Cows for funding, Question Marks for evaluation, and Dogs for divestment.

A clear visual BCG Matrix for Asseco Poland SA instantly clarifies business unit performance, relieving the pain of strategic uncertainty.

Cash Cows

Asseco Poland SA's core banking systems in Poland and Southeast Europe are clear cash cows. The company dominates this region with an impressive 85% market share, indicating a mature but highly profitable segment. This strong position translates into consistent and substantial cash generation for Asseco.

Asseco Poland SA holds a commanding position in the Polish public sector IT market, acting as a primary provider of essential systems for government and local administration. This leadership translates into a consistent and predictable revenue stream, solidifying its status as a cash cow.

The company's deep integration within public institutions ensures ongoing demand for its services, from system maintenance to upgrades and new implementations. In 2023, Asseco Poland reported revenues of PLN 17.4 billion, with a significant portion likely attributable to its robust public sector contracts.

Asseco Poland SA's ERP solutions in Central Europe represent a significant cash cow. The company boasts a robust market share in this established software segment, leveraging its proven and innovative offerings to serve a wide client base. This segment generates consistent revenue through ongoing support contracts and a loyal customer base, providing a stable financial foundation.

Established Financial Sector Solutions

Asseco Poland SA's established financial sector solutions represent a significant Cash Cow. These offerings, catering to banks, insurance firms, and payment processors, generate substantial and consistent revenue. The company's deep integration into mission-critical systems fosters enduring client relationships, leading to high profit margins and predictable cash flows.

In 2024, Asseco Poland reported robust performance driven by its financial sector segment. For instance, the company's financial solutions division often accounts for over half of its total revenue, demonstrating its maturity and market dominance. This segment benefits from recurring revenue streams through maintenance and support contracts, solidifying its Cash Cow status.

- Dominant Market Share: Asseco holds a leading position in providing IT solutions to the Polish banking sector.

- High Profitability: Long-term contracts and the critical nature of financial systems ensure strong profitability.

- Stable Cash Generation: Mission-critical systems and ongoing support services provide a reliable and steady cash inflow.

- Client Retention: Deeply embedded solutions foster high client retention rates, minimizing customer acquisition costs.

IT Solutions for the Energy Sector

Asseco Poland SA's IT solutions for the energy sector are a prime example of a Cash Cow within their business portfolio. The company consistently secures and implements new projects within this vital industry, especially in Poland.

This sector demands highly reliable and robust IT infrastructure, making it a stable and predictable revenue stream for Asseco. Their strong market position is built on delivering these essential services.

For instance, in 2023, Asseco's energy sector segment contributed significantly to their overall revenue, reflecting the ongoing demand for digital transformation and operational efficiency in energy companies. The company’s ability to maintain and grow its presence here underscores its status as a mature and profitable business line.

- Consistent Revenue Generation: The energy sector's need for stable IT systems provides a predictable income for Asseco.

- Strong Market Position: Asseco has established itself as a key IT provider within the Polish energy market.

- High Demand for Reliability: Energy companies require dependable IT solutions, a niche Asseco excels in.

- Project Pipeline: Continued project wins in 2024 highlight the ongoing relevance and profitability of this segment.

Asseco Poland SA's core banking and financial sector IT solutions are definitive cash cows, generating consistent and substantial revenue. The company's dominance in the Polish banking market, often accounting for over half of its total revenue in 2024, is a testament to this. These deeply integrated, mission-critical systems foster high client retention and recurring income streams from maintenance and support, ensuring strong profitability.

| Segment | Market Position | Revenue Contribution (Approx.) | Cash Flow Generation |

|---|---|---|---|

| Core Banking (Poland & SEE) | 85% Market Share (SEE) | Significant | High & Stable |

| Public Sector IT (Poland) | Dominant Provider | Consistent | Predictable |

| Financial Sector Solutions | Market Leader | Over 50% of Total Revenue (2024) | Substantial & Recurring |

| ERP Solutions (Central Europe) | Robust Market Share | Consistent | Stable |

| Energy Sector IT (Poland) | Key Provider | Significant (2023) | Reliable |

What You See Is What You Get

Asseco Poland SA BCG Matrix

The preview you are currently viewing is the identical, fully comprehensive Asseco Poland SA BCG Matrix document you will receive immediately after your purchase. This means you'll get the complete analysis, meticulously prepared and formatted, with no watermarks or placeholder content, ready for your strategic decision-making. You can confidently rely on this preview as the exact deliverable, ensuring you know precisely what you're acquiring for your business planning needs. This ensures a transparent and efficient acquisition process, allowing you to leverage expert-level market insights without delay.

Dogs

Asseco Poland SA's legacy on-premise software solutions, those not central to their strategic cloud or SaaS initiatives, are likely categorized as Dogs. These products, often characterized by high maintenance costs and diminishing market relevance, face declining demand. For instance, if a significant portion of Asseco's revenue in 2024 still stems from these older systems, it signals a need for careful divestment or modernization strategies.

If Asseco Poland SA engages in basic IT hardware reselling without significant value-added services, this segment would likely fall into the Dogs category of the BCG matrix. This is because the market for commoditized hardware is typically characterized by intense competition and low profit margins, offering little room for differentiation or substantial growth.

In 2024, the global IT hardware resale market, particularly for standard components, continued to face price pressures due to widespread availability and the rise of cloud-based solutions. Companies operating solely in this space often struggle to achieve significant market share or generate high returns, making it a challenging area for sustained profitability.

Basic, undifferentiated IT support services, especially for clients not moving to managed services, can be categorized as a 'dog' within Asseco Poland SA's BCG Matrix. These offerings typically exhibit low market growth and are subject to significant price pressure from competitors. For instance, in 2024, the IT support market segment for basic helpdesk functions continued to see stagnant growth, with many clients seeking more integrated solutions.

Legacy Systems with Stagnant Client Base

Asseco Poland SA's legacy systems with stagnant client bases often fall into the Dogs category of the BCG Matrix. These are typically very old, highly customized software solutions for clients who are not actively seeking modernization or integration with newer technologies. This scenario can lead to a shrinking market for these specific offerings.

Maintaining these older systems can be challenging and costly, limiting opportunities for generating new revenue streams. For instance, if a significant portion of Asseco's revenue in a particular segment comes from support contracts for outdated platforms, the long-term viability is questionable. In 2024, companies across the IT services sector are increasingly seeing clients divest from or significantly reduce spending on legacy infrastructure, making these segments less attractive.

- Market Shrinkage: Clients are migrating away from highly customized, aging systems, reducing the addressable market for these solutions.

- High Maintenance Costs: The cost of maintaining and supporting these legacy systems can outweigh the revenue generated.

- Limited Growth Potential: Lack of modernization and integration opportunities restricts the ability to upsell or cross-sell new services.

Underperforming Niche Acquisitions (Pre-Divestiture)

Asseco Poland SA's BCG Matrix likely includes certain niche acquisitions that, while potentially strategic at the time, have not met performance expectations. These entities might be categorized as underperforming niche acquisitions, indicating a need for reassessment. Without explicit segment reporting, it's challenging to pinpoint exact figures, but companies often review their portfolios for underperforming assets. For example, if a niche acquisition made in 2020 for PLN 50 million is now contributing less than 1% to group revenue and showing minimal growth, it could fall into this category.

These underperforming units may not align with Asseco Poland's current strategic direction or are not generating sufficient returns to justify continued investment. The decision to divest or significantly restructure these businesses would be based on their future potential and the opportunity cost of capital. A review of such assets is a standard practice in portfolio management to ensure resources are allocated to areas with the highest growth and profitability prospects.

- Potential Divestiture Candidates: Smaller, acquired entities that haven't integrated well or achieved projected synergies.

- Minimal Investment Focus: Businesses that are not core to current growth strategies and receive only essential operational funding.

- Performance Review: A continuous process to evaluate whether acquired assets meet financial and strategic objectives.

- Portfolio Optimization: The strategic goal is to streamline the business portfolio by divesting non-core or underperforming units.

Certain legacy on-premise software solutions from Asseco Poland SA, particularly those not central to their cloud or SaaS strategy, are likely classified as Dogs. These products often face declining market relevance and can incur high maintenance costs. For example, if Asseco's 2024 revenue from these older systems remains significant, it highlights a need for strategic divestment or modernization.

Basic IT hardware reselling without added value services would also fit into the Dogs category. The market for commoditized hardware is highly competitive with low profit margins, limiting differentiation and growth potential. In 2024, the global IT hardware resale market continued to experience price pressures, making it difficult for companies focusing solely on this segment to achieve substantial profitability.

Undifferentiated IT support services, especially for clients not transitioning to managed services, represent another potential Dog category for Asseco Poland SA. These services typically have low market growth and face intense price competition. The IT support market for basic helpdesk functions in 2024 showed stagnant growth, with many clients preferring integrated solutions.

Asseco Poland SA's portfolio may also include niche acquisitions that have not met performance expectations, classifying them as underperforming. For instance, an acquisition made in 2020 for PLN 50 million that contributes less than 1% to group revenue with minimal growth could be a candidate for divestiture. These businesses might not align with current strategic direction, necessitating a review for portfolio optimization.

| Asseco Poland SA - Dogs Category Examples | Market Relevance | Growth Potential | Profitability | Strategic Fit |

| Legacy On-Premise Software | Declining | Low | Low/Negative | Poor |

| Basic Hardware Reselling | Stable but Commoditized | Low | Low | Poor |

| Undifferentiated IT Support | Stagnant | Low | Low | Poor |

| Underperforming Niche Acquisitions | Varies (often low) | Low | Low | Poor |

Question Marks

Asseco Poland SA's strategic expansion in 2024 and early 2025 has seen the acquisition of 14 companies throughout 2024 and an additional 8 in the first quarter of 2025. These acquisitions, particularly those in emerging markets like India, the United States, Spain, and Egypt, signify Asseco's entry into regions with substantial growth potential.

While these new ventures represent significant investment and future opportunity, their current market share within these specific nascent markets is likely minimal. This positions them as question marks within the BCG matrix, requiring further investment and development to determine their future success and potential to become stars.

Asseco Poland's AI advancements in niche verticals, while promising, represent a strategic investment area. These specialized AI solutions, targeting sectors with high growth potential but limited current Asseco penetration, require significant capital to establish a strong market foothold. The company recognizes the need for substantial R&D and market development to capitalize on these emerging opportunities.

Asseco's Payten group is actively exploring new payment markets, a strategic move into potentially high-growth but underdeveloped regions. These ventures, while promising, typically begin with a nascent market share for Asseco. For instance, in 2024, Payten expanded its reach into several African nations, aiming to tap into the growing digital payment adoption, which is projected to reach $1.5 trillion globally by 2027.

These new geographic ventures for payment solutions, though part of a rapidly expanding sector, inherently require substantial investment to establish a strong foothold and scale operations effectively. Asseco's commitment to these markets signifies a long-term vision, anticipating future gains from early-mover advantages in regions with limited existing payment infrastructure.

New SaaS Offerings Beyond Core Strengths

Asseco Poland's strategic expansion into new Software-as-a-Service (SaaS) markets, where its current market penetration is minimal, positions these ventures as question marks within the BCG matrix. This is despite the inherently high-growth nature of the SaaS sector itself.

These new offerings require substantial capital infusion and dedicated resources to build brand awareness, establish a customer base, and overcome competitive landscapes. For instance, if Asseco were to enter a rapidly expanding niche SaaS market, say, AI-powered customer relationship management (CRM) for a specific industry where they have little prior presence, this would represent a classic question mark.

- Market Entry Challenges: Entering new SaaS markets with low existing share necessitates significant marketing and sales investment to gain traction.

- High Growth Potential: The general SaaS market continues to exhibit robust growth, with global SaaS revenue projected to reach over $320 billion in 2024.

- Investment Requirements: Developing and launching new SaaS products, especially in competitive or unfamiliar territories, demands considerable R&D and go-to-market funding.

- Strategic Risk: These ventures carry a higher risk profile as market acceptance and competitive response are uncertain, requiring careful monitoring and potential pivots.

Specialized Solutions for New Regulatory Demands (e.g., KSeF)

Asseco Poland SA's engagement with solutions for Poland's mandatory National e-Invoicing System (KSeF) positions it to capitalize on significant growth driven by new regulatory requirements. This regulatory shift is a key catalyst for demand in the IT sector.

While Asseco has a strong foundation in ERP systems, its specific market share for novel, specialized KSeF solutions is still in its nascent stages. This indicates a strategic need for focused investment to capture a larger portion of this emerging market.

The KSeF mandate, expected to be fully enforced, creates a substantial market for specialized software and integration services. For instance, companies are investing in adapting their financial and accounting processes to comply with the new e-invoicing standards.

- KSeF Market Opportunity: The mandatory adoption of KSeF by businesses in Poland presents a substantial new revenue stream for IT providers.

- Asseco's Position: Asseco's existing client base and expertise in financial software provide a strong starting point for developing and deploying KSeF-compliant solutions.

- Strategic Investment Need: Further investment is crucial for Asseco to differentiate its offerings beyond basic integrations and capture a leading share in specialized KSeF functionalities.

- Regulatory Impact: The successful implementation of KSeF is projected to streamline business transactions and enhance tax compliance across the Polish economy.

Asseco Poland SA's ventures into new geographic markets and specialized technology areas, such as AI and new payment platforms, largely fall into the question mark category of the BCG matrix. These initiatives, while targeting high-growth sectors and regions, typically begin with a low market share for Asseco. Significant investment is required to build brand recognition, develop tailored solutions, and establish a competitive presence in these nascent markets, making their future success a key area of strategic focus.

BCG Matrix Data Sources

Our BCG Matrix leverages Asseco Poland SA's official financial statements, annual reports, and investor presentations. This is supplemented by reputable industry research and market growth forecasts.