Arctic Slope Regional Corporation SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Arctic Slope Regional Corporation Bundle

The Arctic Slope Regional Corporation (ASRC) possesses unique strengths rooted in its land ownership and cultural heritage, alongside opportunities in resource development and diversified investments. However, understanding its potential weaknesses, such as reliance on specific industries, and threats, like environmental regulations and market volatility, is crucial for strategic decision-making.

Want the full story behind ASRC’s strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

ASRC's ownership by over 14,000 Iñupiat shareholders from the North Slope creates a powerful, deeply rooted connection to its community. This unique structure ensures business decisions are inherently aligned with the long-term prosperity and cultural heritage of the Iñupiat people, fostering exceptional stability and stakeholder buy-in.

Arctic Slope Regional Corporation's (ASRC) diversified business portfolio, encompassing energy services, government contracting, construction, and resource development, significantly reduces its exposure to any single industry's volatility. This strategic breadth allows ASRC to navigate varying market conditions effectively, ensuring more stable revenue streams. For instance, in 2023, ASRC's government contracting segment continued to be a strong performer, while its energy services division adapted to evolving market demands, showcasing the resilience inherent in its diversified model.

ASRC's substantial footprint in government contracting is a major strength, delivering a consistent and predictable revenue flow. This is largely due to long-term contracts for essential services, a sector that consistently sees government investment in defense, infrastructure, and support functions. This stable financial foundation is crucial for the corporation's overall health.

Strategic Geographic and Resource Position

Arctic Slope Regional Corporation's (ASRC) base in Alaska's North Slope region is a significant strength, offering unparalleled access to substantial natural resources, especially in the energy and mineral sectors. This prime location provides a distinct competitive edge in resource development, enabling ASRC to manage and exploit critical assets effectively.

This strategic positioning translates into tangible benefits for ASRC. For instance, the North Slope is home to the National Petroleum Reserve-Alaska (NPR-A), which holds an estimated 10.6 billion barrels of oil and 57 trillion cubic feet of natural gas, according to the U.S. Geological Survey. ASRC's direct involvement in this region allows it to leverage these vast reserves.

- Exclusive Access: ASRC holds subsurface mineral rights across 11 million acres of its traditional lands, granting it exclusive development opportunities.

- Resource Endowment: The North Slope is estimated to contain billions of barrels of oil and trillions of cubic feet of natural gas, a significant portion of which ASRC can access.

- Strategic Control: ASRC's presence allows for direct oversight and management of resource extraction, ensuring alignment with its long-term goals.

- Economic Advantage: Proximity to resources reduces transportation costs and logistical complexities, enhancing profitability for ASRC's ventures.

ANCSA-Derived Advantages

ASRC's status as an original Alaska Native regional corporation, established under the Alaska Native Claims Settlement Act (ANCSA) of 1971, provides significant foundational advantages. These include unique land entitlements and potential preferences in government contracting.

These ANCSA-derived benefits offer ASRC a distinct competitive edge and operational flexibility. For instance, the legislative framework underpins its long-term economic mandate, allowing for strategic resource management and development.

- Land Entitlements: ASRC manages millions of acres of land, a significant asset base derived from ANCSA.

- Government Contracting Preferences: These can translate into preferential treatment in securing certain federal contracts, boosting revenue streams.

- Tax Benefits: ANCSA may offer certain tax advantages that enhance profitability and reinvestment capacity.

ASRC's deep connection to its Iñupiat shareholders fosters stability and ensures business decisions align with long-term community prosperity and cultural heritage.

Its diverse business portfolio, spanning energy, government contracting, and resource development, mitigates risk and ensures more stable revenue streams, as seen in its resilient performance across sectors in 2023.

ASRC's strong position in government contracting provides a consistent revenue flow through long-term essential service contracts, building a stable financial foundation.

The corporation's strategic location on Alaska's North Slope grants unparalleled access to vast natural resources, particularly in energy and minerals, offering a distinct competitive advantage in development.

| Strength Area | Description | Supporting Data/Example |

|---|---|---|

| Shareholder Alignment | Deeply rooted connection to over 14,000 Iñupiat shareholders. | Ensures business decisions prioritize long-term prosperity and cultural heritage. |

| Business Diversification | Portfolio includes energy services, government contracting, construction, and resource development. | Reduced exposure to single industry volatility; resilient performance in 2023. |

| Government Contracting | Consistent and predictable revenue from long-term contracts. | Essential services sector sees consistent government investment. |

| Resource Access | Unparalleled access to substantial natural resources on the North Slope. | Estimated 10.6 billion barrels of oil and 57 trillion cubic feet of natural gas in NPR-A. |

| ANCSA Foundation | Established under ANCSA of 1971, providing land entitlements and contracting preferences. | Manages millions of acres of land; potential preferential treatment in federal contracts. |

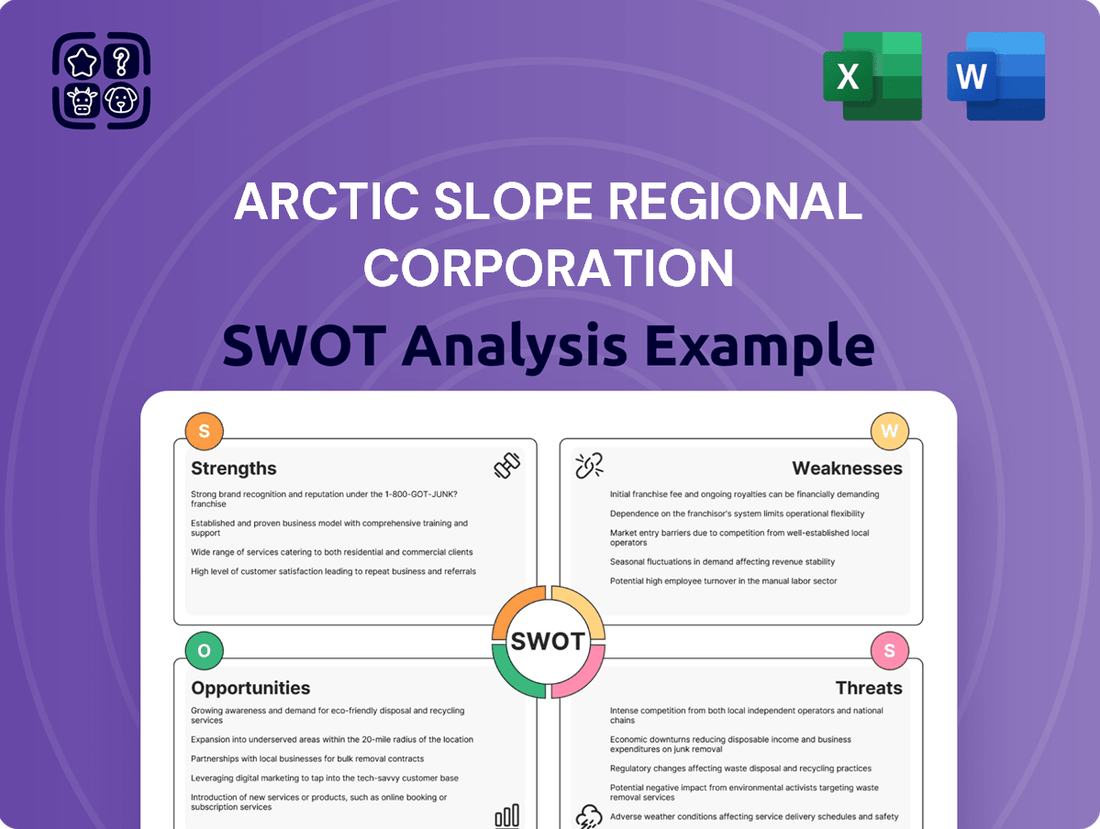

What is included in the product

Delivers a strategic overview of Arctic Slope Regional Corporation’s internal and external business factors, identifying key strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address critical operational challenges and capitalize on emerging opportunities for the Arctic Slope Regional Corporation.

Weaknesses

Arctic Slope Regional Corporation (ASRC) faces a significant weakness in its vulnerability to commodity price volatility. Despite efforts to diversify, the corporation's substantial involvement in energy services and resource development means its financial health is closely tied to global oil and gas prices. For instance, in 2023, average crude oil prices saw fluctuations, impacting revenue streams for companies heavily invested in extraction and related services.

Sharp downturns in commodity markets directly affect ASRC's profitability and its ability to fund investments, particularly within its energy sectors. This dependency can lead to unpredictable revenue streams, making long-term financial planning more challenging. The energy sector, a core component of ASRC's operations, is inherently cyclical and sensitive to geopolitical events and global supply-demand dynamics.

Arctic Slope Regional Corporation's (ASRC) heavy reliance on the remote North Slope of Alaska creates substantial logistical hurdles. Extreme weather conditions, scarce infrastructure, and difficult terrain significantly inflate operational costs, impacting efficiency and profitability. For instance, the cost of transporting essential goods and personnel to these isolated areas is considerably higher than in more accessible regions.

This geographic concentration also makes ASRC particularly vulnerable to localized economic fluctuations and specific environmental regulations unique to the Arctic. Any downturn in regional industries or stricter environmental mandates could disproportionately affect the corporation's performance, unlike more diversified entities.

Arctic Slope Regional Corporation (ASRC) navigates a complex path balancing its commitment to shareholder economic prosperity with its foundational duty to preserve Iñupiat cultural heritage. This dual mandate presents ongoing strategic challenges, as decisions favoring immediate financial returns may sometimes diverge from long-term cultural or environmental preservation objectives. ASRC's 2023 annual report highlighted a significant increase in revenue to $4.4 billion, underscoring its financial strength, yet the integration of cultural considerations remains a constant strategic imperative.

Environmental and Regulatory Scrutiny

Arctic Slope Regional Corporation's (ASRC) operations, especially those involving resource development in the fragile Arctic ecosystem, face considerable environmental and regulatory scrutiny. This heightened attention can translate into substantial compliance burdens and potential project disruptions.

Navigating this landscape requires significant investment in environmental impact assessments and adherence to increasingly stringent regulations. For instance, the Biden-Harris administration's focus on climate change and conservation, as seen in policies enacted through 2024, means that new oil and gas leasing in the Arctic National Wildlife Refuge (ANWR) remains a contentious issue, potentially impacting future development plans for entities like ASRC. The costs associated with meeting these environmental standards can be considerable, impacting profitability and operational timelines.

- Increased Compliance Costs: Adhering to evolving environmental standards for Arctic operations can elevate operational expenses significantly.

- Project Delays and Cancellations: Public opposition and stricter environmental protection measures can lead to unforeseen project delays or even outright cancellations.

- Regulatory Uncertainty: The dynamic nature of environmental regulations in sensitive regions creates an element of uncertainty for long-term planning and investment.

- Resource Allocation: Managing environmental compliance demands substantial allocation of financial and human resources, diverting them from other potential growth areas.

Capital Intensive Operations

ASRC's operations in sectors like energy services, resource development, and major construction are inherently capital-intensive. This means significant, continuous investment is needed for equipment, infrastructure, and technology upgrades. For instance, in 2023, ASRC's capital expenditures across its diverse portfolio reflected substantial outlays to maintain and expand these resource-heavy operations, impacting available capital for other initiatives.

These high capital demands can strain financial resources, often requiring ASRC to tap into capital markets for funding. Such requirements can also affect the company's liquidity and its capacity to distribute dividends to its shareholders. The need for ongoing, large-scale investments directly influences ASRC's financial flexibility.

- High Capital Requirements: Core business areas necessitate substantial, ongoing investment in physical assets and technology.

- Financial Strain: Continuous capital expenditure can put pressure on financial resources and liquidity.

- Market Dependence: Reliance on capital markets for funding can expose the company to external financial conditions.

- Dividend Impact: Significant capital outlays may limit the amount available for shareholder dividends.

Arctic Slope Regional Corporation (ASRC) faces a notable weakness in its substantial reliance on the energy sector, making it susceptible to commodity price volatility. Despite diversification efforts, fluctuations in oil and gas prices, as seen in 2023, directly impact its revenue streams and profitability, complicating long-term financial planning due to the sector's cyclical nature.

Preview Before You Purchase

Arctic Slope Regional Corporation SWOT Analysis

The preview below is taken directly from the full SWOT report you'll get. Purchase unlocks the entire in-depth version, detailing the Arctic Slope Regional Corporation's Strengths, Weaknesses, Opportunities, and Threats.

This is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. It provides a comprehensive overview of the Arctic Slope Regional Corporation's strategic position.

Opportunities

The global shift towards decarbonization presents a significant opportunity for Arctic Slope Regional Corporation (ASRC) to expand into renewable energy. Alaska's specific energy demands, coupled with the worldwide drive for sustainability, create a fertile ground for ASRC to invest in projects like wind, solar, or geothermal power.

This strategic diversification offers a chance to tap into new revenue streams, lessen dependence on traditional fossil fuels, and potentially benefit from green energy incentives. For instance, by 2024, renewable energy sources are projected to account for over 20% of global electricity generation, a trend ASRC can leverage.

Investing in renewables not only aligns with environmental responsibility but also enhances ASRC's public image, positioning it as a forward-thinking entity committed to a sustainable future. This move can attract investors and partners focused on ESG (Environmental, Social, and Governance) principles.

Growing geopolitical interest and the impacts of climate change are spurring significant investment in Arctic infrastructure, from new ports and roads to enhanced communication networks. This trend is creating substantial opportunities for companies with specialized capabilities.

Arctic Slope Regional Corporation's (ASRC) proven expertise in construction and logistics places it in a prime position to capitalize on these large-scale projects. Securing contracts in this burgeoning sector could significantly boost its construction segment and foster crucial regional development.

For instance, projections indicate that Arctic infrastructure spending could reach tens of billions of dollars annually by the early 2030s, with a considerable portion allocated to transportation and energy projects. This presents a long-term growth trajectory for ASRC's involvement.

Arctic Slope Regional Corporation (ASRC) has a significant opportunity to boost its operational efficiency by embracing advanced technologies like artificial intelligence, automation, and big data analytics. These tools can streamline processes across all its business units, from energy services to construction, leading to substantial cost savings and enhanced safety protocols.

By investing in digital transformation, ASRC can unlock new service possibilities and solidify its competitive edge. For instance, AI-powered predictive maintenance in its energy sector could reduce downtime, while automated project management software in construction can improve resource allocation and on-time delivery, reflecting a broader trend where companies leveraging such tech saw an average 15% increase in productivity in 2024.

Growth in Federal Contracting for Arctic Resilience

The increasing focus on national security and climate change adaptation is driving a significant rise in federal contracting opportunities within the Arctic. This surge is particularly evident in areas demanding resilience, defense infrastructure, and scientific research. The US government's commitment to Arctic security and environmental monitoring, highlighted by initiatives like the National Strategy for the Arctic Region, translates into substantial contract potential.

ASRC's existing government contracting division is strategically positioned to leverage this growing demand. Its deep understanding of the Arctic environment and established operational capabilities allow it to pursue specialized contracts focused on resilience projects, defense support, and critical research initiatives. For instance, the Department of Defense's Arctic Strategy, updated in 2023, outlines significant investments in infrastructure and operational readiness in the region, creating direct opportunities.

- Growing Federal Investment: The US government allocated over $1.2 billion to Arctic-related programs in fiscal year 2024, with a substantial portion directed towards defense and infrastructure resilience.

- ASRC's Advantage: ASRC's unique regional expertise and existing contracting infrastructure provide a competitive edge in securing these specialized, high-value contracts.

- Defense and Research Demand: Increased military presence and climate research in the Arctic are fueling demand for services in areas like logistics, construction, and environmental monitoring.

Strategic Partnerships and Acquisitions

Arctic Slope Regional Corporation (ASRC) can significantly bolster its market position through strategic alliances and acquisitions. By partnering with established players or acquiring companies with complementary services, ASRC can broaden its service portfolio and tap into new geographical markets. For instance, in 2023, ASRC's subsidiary, ASRC Federal, completed the acquisition of a cybersecurity firm, enhancing its capabilities in a high-growth sector.

These collaborations are crucial for gaining access to cutting-edge technologies and fostering innovation, particularly in emerging fields like advanced energy solutions and specialized government contracting. Such moves can accelerate growth and strengthen ASRC's competitive advantage. For example, a partnership could provide access to proprietary AI technology, allowing ASRC to offer more sophisticated data analytics services to its clients.

This strategy of inorganic growth is vital for ASRC to maintain its trajectory.

- Expanded Service Offerings: Acquiring or partnering with companies in areas like renewable energy or advanced manufacturing can diversify ASRC's revenue streams.

- Market Entry and Expansion: Strategic acquisitions can provide immediate access to new customer bases and geographic regions, accelerating market penetration.

- Technology and Innovation Access: Collaborations can bring in new technologies and R&D capabilities, such as those in AI or sustainable materials, enhancing ASRC's future competitiveness.

- Risk Sharing and Synergies: Partnerships allow for the sharing of development costs and operational risks, while acquisitions can create operational synergies leading to cost efficiencies.

ASRC can capitalize on the global push for decarbonization by investing in renewable energy projects, leveraging Alaska's unique energy landscape and worldwide sustainability trends. This diversification into wind, solar, or geothermal power offers new revenue streams and reduces reliance on fossil fuels, aligning with the projected growth of renewables in global electricity generation, which is expected to exceed 20% by 2024.

The increasing global focus on Arctic infrastructure development, driven by climate change and geopolitical interests, presents substantial opportunities for ASRC, particularly in construction and logistics. With projections suggesting Arctic infrastructure spending could reach tens of billions annually by the early 2030s, ASRC is well-positioned to secure contracts that foster regional development and boost its construction segment.

Embracing advanced technologies like AI and automation can significantly enhance ASRC's operational efficiency and competitive edge. Companies adopting these technologies saw an average 15% productivity increase in 2024, a benefit ASRC can realize through streamlined processes and improved safety protocols.

The rising demand for federal contracts in the Arctic, fueled by national security and climate adaptation initiatives, offers a significant avenue for growth. ASRC's established government contracting division and regional expertise allow it to pursue specialized contracts in defense, resilience, and research, aligning with substantial US government investments in Arctic programs.

Strategic alliances and acquisitions can broaden ASRC's service portfolio and market reach, as demonstrated by its subsidiary ASRC Federal's 2023 acquisition of a cybersecurity firm. These moves are crucial for accessing new technologies and fostering innovation in high-growth sectors like advanced energy and specialized government contracting.

Threats

Adverse regulatory and policy shifts present a considerable threat to Arctic Slope Regional Corporation (ASRC). Changes in environmental regulations, particularly those impacting resource extraction in Alaska, could significantly curtail ASRC's operational capacity and profitability. For instance, stricter enforcement of the Endangered Species Act or new methane emission standards could increase operational costs and limit access to vital resource reserves.

Furthermore, alterations in government contracting preferences by federal and state authorities pose a risk. ASRC's substantial involvement in government contracting, especially in sectors like defense and energy, makes it vulnerable to shifts in procurement policies or budget allocations. For example, a reduction in federal spending on infrastructure projects or a change in contracting set-asides for Alaska Native corporations could directly impact revenue streams.

These evolving policy landscapes introduce considerable uncertainty and can escalate compliance burdens. The potential for increased environmental impact assessments, new permitting requirements, or changes in tax policies related to resource development can create significant headwinds, affecting long-term strategic planning and investment decisions for ASRC.

The accelerating effects of climate change, including permafrost thaw and coastal erosion, pose a significant threat to Arctic Slope Regional Corporation's (ASRC) infrastructure and operational continuity in the region. These environmental shifts can necessitate substantial investments in infrastructure repair and adaptation, potentially increasing operational expenses and insurance costs.

Unpredictable weather patterns, a direct consequence of climate change, can lead to disruptions in ASRC's supply chains and logistical operations, impacting project timelines and overall efficiency. Such volatility also heightens safety concerns for personnel working in the Arctic, potentially affecting project execution and increasing the risk of accidents.

Furthermore, the impacts of climate change on traditional hunting and fishing grounds could affect the subsistence lifestyles of ASRC's shareholders and the broader Inupiat community, indirectly influencing the corporation's social license to operate and its relationship with local stakeholders.

Arctic Slope Regional Corporation (ASRC) faces significant headwinds from intensified competition in its core sectors, particularly government contracting and energy services. Major national and international players, alongside other Alaska Native Corporations, are vying for the same contracts, creating a challenging landscape.

This heightened rivalry directly impacts ASRC by exerting downward pressure on pricing and potentially squeezing profit margins. Securing new business becomes more difficult, threatening market share and overall profitability. For instance, in the federal contracting space, ASRC competes with giants like Leidos and SAIC, which often possess larger resources and established government relationships.

Economic Downturns and Market Contractions

Broader economic downturns, whether regional or global, can significantly reduce demand for construction services, energy resources, and government spending, impacting ASRC. For instance, a global recession could see oil prices plummet, affecting ASRC's substantial energy segment.

A contraction in the economy could lead to decreased revenues, project deferrals, and potential layoffs across ASRC's diverse operations, impacting financial stability and shareholder benefits. In 2023, while ASRC reported strong revenues, a prolonged economic slowdown could reverse these gains.

- Reduced Demand: Economic contractions typically lower consumer and business spending, directly impacting ASRC's key markets like oil and gas exploration and construction.

- Project Delays: Companies and governments facing economic uncertainty often postpone or cancel capital projects, affecting ASRC's backlog and future revenue streams.

- Financial Strain: Lower revenues and potential increases in operating costs during a downturn can strain ASRC's financial resources, potentially impacting dividend payouts or investment in new ventures.

Social and Environmental Activism

Heightened public awareness and activism concerning environmental protection, indigenous rights, and climate change pose a significant threat to ASRC's operations. This increased scrutiny can translate into greater opposition to resource development projects, potentially leading to reputational damage and legal hurdles.

Such activism can cause substantial delays or even outright cancellations of crucial projects, directly impacting ASRC's capacity to achieve its economic goals. For instance, in 2024, several major energy projects globally faced significant delays due to environmental impact assessments and community consultations, highlighting the financial implications of such opposition.

- Reputational Risk: Negative publicity from environmental or rights groups can tarnish ASRC's image, affecting consumer and investor confidence.

- Project Delays and Costs: Activist opposition can lead to extended permitting processes and litigation, increasing project development costs and timelines.

- Partnership Strain: Potential partners may reconsider collaborations if ASRC is perceived as environmentally or socially irresponsible, impacting strategic alliances.

Intensified competition from both established corporations and other Alaska Native Corporations presents a significant threat, potentially eroding ASRC's market share and profitability. For example, in the federal contracting sector, ASRC competes with major players like Fluor Corporation and AECOM, which often have broader reach and deeper resources.

Economic downturns, both regionally and globally, can severely impact ASRC's revenue streams, particularly in its energy and construction segments. A significant drop in oil prices, for instance, could directly affect the profitability of its oil and gas ventures. In 2023, ASRC reported strong revenues, but a sustained economic contraction could reverse these gains.

The increasing focus on environmental, social, and governance (ESG) factors by investors and the public can create challenges. Activist opposition to resource development, amplified by social media, can lead to project delays and increased compliance costs, impacting ASRC's ability to execute its strategic plans.

The corporation also faces risks from adverse regulatory and policy shifts, such as changes in environmental regulations or government contracting preferences, which could curtail operations or reduce revenue. For instance, stricter methane emission standards could increase operational costs in its energy sector.

| Threat Category | Specific Example | Potential Impact |

|---|---|---|

| Competition | Rivalry with large federal contractors (e.g., Leidos) | Reduced profit margins, loss of market share |

| Economic Downturn | Global recession impacting oil prices | Decreased revenue from energy segment, project deferrals |

| Public Activism | Opposition to resource development projects | Project delays, increased compliance costs, reputational damage |

| Regulatory Changes | Stricter environmental regulations (e.g., methane standards) | Increased operational costs, limited access to resources |

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of verified financial reports, comprehensive market research, and insights from industry experts. These sources provide a robust understanding of the Arctic Slope Regional Corporation's operational landscape and strategic positioning.