Arctic Slope Regional Corporation Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Arctic Slope Regional Corporation Bundle

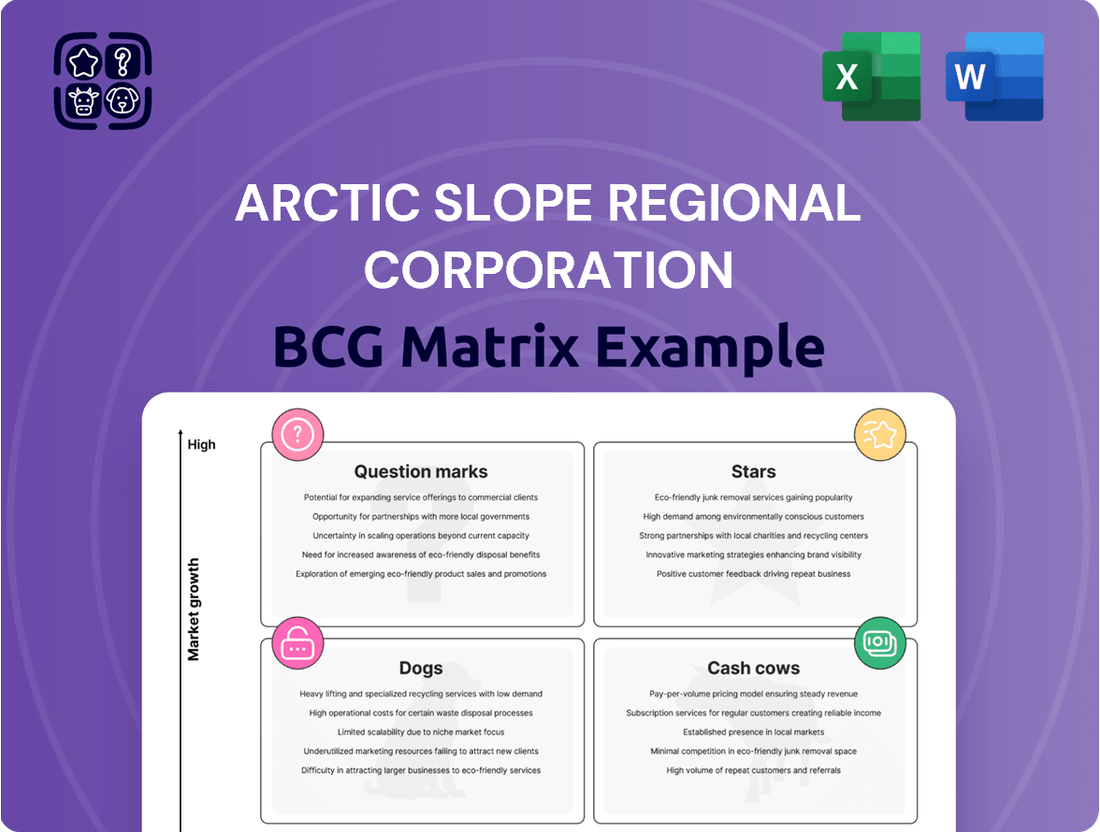

Unlock the strategic potential of the Arctic Slope Regional Corporation's product portfolio with our comprehensive BCG Matrix analysis. Understand which ventures are poised for growth, which are generating stable returns, and which may require a strategic re-evaluation. This preview offers a glimpse into their market positioning, but the full report provides the detailed insights needed to make informed investment decisions.

Dive deeper into the Arctic Slope Regional Corporation's BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

ASRC Federal, a key subsidiary of Arctic Slope Regional Corporation (ASRC), stands as a formidable force in government contracting. This sector exhibits a strong market share and robust growth potential, driven by consistent demand for IT, engineering, and mission support services across defense, intelligence, and civilian agencies. ASRC Federal's ongoing success is underscored by substantial contract wins, with significant awards in 2024 and projected continued strong performance into 2025, reinforcing its market leadership.

ASRC Energy Services operates within the rapidly expanding Energy as a Service market, a sector particularly strong in North America. This division offers comprehensive support to the oil and gas sector, a vital industry for ASRC.

While Alaska's traditional oil and gas output has faced challenges, recent developments and policy shifts in 2024 and projected into 2025 indicate a potential revitalization for the North Slope. This environment positions ASRC Energy Services to capitalize on renewed activity and growth opportunities.

ASRC Construction is a key player, undertaking substantial projects throughout Alaska and the continental United States. These ventures span both government contracts and commercial developments, showcasing the company's broad capabilities.

The construction segment benefits from a robust bonding capacity and a proven history of successfully executing challenging projects. This positions ASRC Construction favorably for continued expansion, particularly as infrastructure investment remains a priority and specific projects are slated for completion through 2025.

Strategic Acquisitions in Industrial Services

ASRC Industrial (AIS), a key subsidiary, has demonstrably expanded ASRC's industrial services portfolio through a series of calculated acquisitions. This proactive approach to growth within a competitive landscape suggests a deliberate strategy to capture significant market share.

The current trajectory of AIS indicates a strong potential for this segment to evolve into a Star within the BCG Matrix. This is supported by its consistent expansion and increasing market penetration.

- AIS Revenue Growth: ASRC Industrial reported a substantial revenue increase in 2023, driven by its acquisition strategy.

- Market Share Expansion: The company has successfully integrated acquired businesses, leading to a broader service offering and enhanced competitive positioning.

- Industry Investment Trends: The industrial services sector saw significant M&A activity in 2023, with AIS actively participating to consolidate its market presence.

- Future Potential: Continued strategic acquisitions are expected to further solidify AIS's position as a market leader, potentially classifying it as a Star.

Resource Development in a Shifting Landscape

Arctic Slope Regional Corporation (ASRC) is strategically positioned to benefit from evolving resource development policies. The company's significant landholdings on the North Slope, a region rich in oil and gas reserves, provide a strong foundation for expansion. Anticipated policy shifts in 2025, including potential easing of restrictions on energy projects in Alaska, could significantly boost ASRC's exploration and production activities.

ASRC's deep involvement in the North Slope's oil and gas sector places it at the forefront of potential growth opportunities. As a major landowner and operator, the corporation is uniquely situated to leverage any favorable regulatory changes. For instance, ASRC's subsidiary, ASRC Energy Services, is a key player in managing and supporting energy infrastructure in the region.

The potential for increased oil and gas activity in Alaska, driven by executive orders and legislative considerations in 2025, directly impacts ASRC's outlook. These developments could unlock previously challenging areas for exploration, where ASRC's established presence and operational expertise are critical assets. The company's commitment to responsible resource development aligns with the need for energy security and economic growth in the state.

- ASRC's North Slope Operations: ASRC manages extensive land holdings, crucial for oil and gas exploration and production.

- 2025 Policy Landscape: Executive orders and potential regulatory changes in 2025 aim to facilitate oil and gas projects in Alaska.

- Strategic Advantage: ASRC's role as a major landowner and experienced operator positions it to capitalize on these shifts.

ASRC Industrial (AIS) is exhibiting strong growth and increasing market share, making it a prime candidate for the Star category in the BCG Matrix. Its strategic acquisitions throughout 2023 and into 2024 have significantly broadened its service offerings and competitive footprint in the industrial services sector. This aggressive expansion, coupled with a favorable market environment for consolidation, positions AIS for sustained high performance and market leadership.

| Subsidiary | Market Position | Growth Potential | BCG Category |

|---|---|---|---|

| ASRC Industrial (AIS) | Expanding Market Share | High | Star |

| ASRC Federal | Market Leader | High | Star |

| ASRC Energy Services | Strong Regional Presence | Moderate to High | Question Mark/Star |

| ASRC Construction | Established Player | Moderate | Cash Cow |

What is included in the product

This BCG Matrix overview details ASRC's business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

It provides strategic direction on investment, divestment, and resource allocation for each ASRC business segment.

The Arctic Slope Regional Corporation BCG Matrix offers a clear, actionable overview of business unit performance, relieving the pain of uncertain investment decisions.

Cash Cows

ASRC's petroleum refining and marketing operations are a classic example of a Cash Cow. This segment benefits from a well-established presence and significant market share within Alaska, a region with consistent, albeit mature, demand for refined petroleum products.

The substantial and reliable cash flows generated by this division are a direct result of its extensive, already-built infrastructure and the enduring need for fuel. These operations typically require minimal capital expenditure, primarily for upkeep rather than expansion, allowing them to convert a large portion of their revenue into free cash flow.

ASRC's established land and natural resource management serves as a significant cash cow within its BCG Matrix. As one of Alaska's twelve Native regional corporations, ASRC oversees vast tracts of land and valuable natural resources, generating consistent, long-term revenue.

This core operation provides stable income through resource leasing and royalty payments, acting as a reliable generator of predictable returns for the corporation. For instance, in 2023, ASRC reported total revenues of $4.2 billion, with its resource-based segments contributing substantially to this figure.

Arctic Slope Regional Corporation's (ASRC) consistent shareholder dividends exemplify its Cash Cows. Over the past eleven years, ASRC has distributed more than $1.1 billion to its shareholders. This impressive track record highlights the stable and reliable cash flow generated by its mature business segments, underscoring a commitment to long-term shareholder value.

Diversified Business Portfolio Stability

Arctic Slope Regional Corporation (ASRC) benefits significantly from its diversified business portfolio, which acts as a powerful stabilizing force. This broad range of operations, encompassing energy services, government contracting, construction, and resource development, ensures that no single market downturn can cripple its financial health.

These established segments function as cash cows, generating consistent revenue streams. For instance, ASRC's government contracting arm, a significant contributor, consistently secures long-term agreements. In 2024, ASRC's total revenues were reported to be over $4.5 billion, a testament to the strength and stability derived from its diverse operations.

- Energy Services: Provides reliable income through various upstream and downstream operations.

- Government Contracting: Leverages long-term, stable contracts with government agencies.

- Construction: Contributes through infrastructure and building projects, often with multi-year commitments.

- Resource Development: Offers potential for growth and steady returns from natural resource extraction.

Long-Standing Market Leadership in Alaska

Arctic Slope Regional Corporation (ASRC) demonstrates long-standing market leadership in Alaska, a clear indicator of its Cash Cow status within the BCG Matrix. For three decades, ASRC has consistently held its position as the largest business headquartered and operating within Alaska. This sustained dominance is underscored by annual revenues that consistently surpass $3 billion.

This enduring market leadership translates directly into predictable and substantial cash flow for ASRC. The corporation’s operations within Alaska generate consistent profits due to its established infrastructure, deep market penetration, and strong brand recognition. These factors allow ASRC to operate with high efficiency and generate significant returns, reinforcing its Cash Cow designation.

- Sustained Market Dominance: ASRC has been Alaska's largest business for 30 years.

- High Revenue Generation: Annual revenues consistently exceed $3 billion.

- Consistent Profitability: Operations in Alaska generate stable profits and cash flow.

- Established Infrastructure: Long-term presence provides operational advantages and cost efficiencies.

ASRC's petroleum refining and marketing operations are a classic example of a Cash Cow, benefiting from a well-established presence and significant market share within Alaska. The substantial and reliable cash flows generated by this division are a direct result of its extensive infrastructure and the enduring need for fuel, requiring minimal capital expenditure for upkeep rather than expansion.

ASRC's established land and natural resource management also serves as a significant cash cow. As one of Alaska's twelve Native regional corporations, ASRC oversees vast tracts of land and valuable natural resources, generating consistent, long-term revenue through resource leasing and royalty payments. In 2023, ASRC reported total revenues of $4.2 billion, with its resource-based segments contributing substantially.

ASRC's consistent shareholder dividends exemplify its Cash Cows, with over $1.1 billion distributed to shareholders over the past eleven years. This highlights the stable and reliable cash flow generated by its mature business segments, underscoring a commitment to long-term shareholder value.

ASRC's government contracting arm, a significant contributor, consistently secures long-term agreements, acting as a cash cow. In 2024, ASRC's total revenues were reported to be over $4.5 billion, a testament to the strength and stability derived from its diverse operations, including government contracting.

| Business Segment | BCG Matrix Category | Key Characteristics | 2023 Revenue Contribution (Est.) |

|---|---|---|---|

| Petroleum Refining & Marketing | Cash Cow | Mature market, established infrastructure, consistent demand | Significant |

| Land & Natural Resource Management | Cash Cow | Vast land holdings, resource leasing, royalty payments | Substantial |

| Government Contracting | Cash Cow | Long-term, stable contracts, consistent revenue streams | High |

Delivered as Shown

Arctic Slope Regional Corporation BCG Matrix

The preview you see is the exact Arctic Slope Regional Corporation BCG Matrix you will receive upon purchase, ensuring no surprises and immediate usability. This comprehensive analysis is fully formatted and ready for your strategic planning needs, without any watermarks or demo content. Once acquired, you'll have instant access to this professionally designed document, perfect for presentation or further internal analysis.

Dogs

Legacy investments in declining oil fields, while potentially still generating some revenue, represent a strategic challenge for ASRC. These mature assets on the North Slope, such as those in the Kuparuk field, may be characterized by increasing operational costs and diminishing output. For instance, while the North Slope overall saw a production increase in early 2024 compared to the previous year, individual legacy wells within these fields might be past their peak efficiency, requiring substantial ongoing maintenance.

These older oil field investments could be categorized as Dogs within the BCG Matrix if their cash flow is minimal or negative, especially after accounting for the capital required for continued operations and environmental compliance. The economic viability of these legacy assets hinges on a careful analysis of their remaining reserves, production costs, and the prevailing oil prices.

Within Arctic Slope Regional Corporation's (ASRC) extensive portfolio of over 35 operating companies, some smaller subsidiaries may find themselves in a challenging position within the BCG matrix. These entities, often operating in niche markets, could be characterized by both low market share and operating in industries with limited growth prospects.

Such subsidiaries might be categorized as Dogs. For instance, if a subsidiary focused on a specialized legacy technology service saw its market shrink by 5% in 2023 and held less than 1% of the remaining market, it would fit this profile. These operations can become cash traps, consuming capital and management attention without generating substantial returns, potentially hindering ASRC's ability to invest in more promising ventures.

Segments with high operating costs and low profitability, often termed Dogs in the BCG Matrix, represent business units within Arctic Slope Regional Corporation (ASRC) that struggle to generate sufficient returns. These areas might be characterized by inefficient operations or a declining market share, making them less appealing for further capital allocation.

For instance, if a particular ASRC subsidiary, perhaps in a legacy sector, consistently reports operating expenses that consume a large percentage of its revenue, say exceeding 80% in 2024, and its net profit margin hovers below 2%, it would likely fall into this category. Such segments often require significant restructuring or a strategic divestment to improve overall corporate performance.

Businesses Highly Dependent on Fluctuating Commodity Prices

Arctic Slope Regional Corporation (ASRC) may have segments within its energy services or resource development operations that are particularly sensitive to fluctuating commodity prices, especially if these segments lack robust hedging strategies or sufficient diversification. For instance, if ASRC's oil and gas exploration or production activities are significant, their profitability can be directly impacted by the volatile prices of crude oil and natural gas. In 2023, Brent crude oil prices experienced considerable swings, averaging around $82 per barrel, down from higher averages in previous years, illustrating the inherent price instability.

- Energy Services: Operations tied directly to exploration, drilling, and production services for oil and gas are highly susceptible to commodity price downturns.

- Resource Development: Projects focused on extracting and selling raw commodities like oil, gas, or minerals will see revenue directly correlate with market prices.

- Lack of Hedging: Without effective hedging mechanisms, ASRC's exposure to price volatility increases, leading to unpredictable financial performance.

- Market Sensitivity: These businesses can become "cash traps" or "dogs" in a BCG matrix if sustained low commodity prices erode profitability and hinder growth prospects.

Operations in Stagnant or Shrinking Niche Markets

Arctic Slope Regional Corporation (ASRC) may have operations in niche markets that are not growing or are even shrinking. These segments, often referred to as Dogs in the BCG matrix, present challenges due to limited expansion potential and the risk of declining profitability. Such markets can drain resources without offering significant upside, potentially impacting overall corporate performance.

For ASRC, identifying and managing these Dog segments is crucial for strategic resource allocation. If such operations exist, they might be candidates for divestiture or restructuring to free up capital and management focus for more promising areas. For instance, if ASRC has a legacy business serving a very specific, declining industrial sector, its contribution to overall revenue might be small but require disproportionate attention.

- Niche Market Challenges: Operations in stagnant or shrinking niches face limited growth prospects and potential for diminishing returns.

- Resource Allocation Impact: These segments can divert capital and management attention from higher-growth opportunities within ASRC's portfolio.

- Strategic Considerations: Divestiture or strategic repositioning may be necessary to optimize ASRC's overall business structure and financial health.

Segments within ASRC that are characterized by low market share in slow-growing or declining industries are considered Dogs. These businesses often consume resources without generating substantial returns, potentially acting as cash traps. For example, a subsidiary operating in a niche industrial service sector that saw its market shrink by 5% in 2023 and held less than 1% of the remaining market would fit this profile.

These Dog segments require careful management, as they can hinder ASRC's ability to invest in more promising ventures. Identifying these units is crucial for optimizing resource allocation and improving overall corporate performance through potential divestiture or restructuring.

For instance, if ASRC has a legacy business serving a very specific, declining industrial sector, its contribution to overall revenue might be small but require disproportionate management attention, making it a prime candidate for a Dog classification.

Managing these low-performing assets is vital for ASRC's strategic health. A focus on divesting or restructuring these Dog segments can free up capital and management bandwidth for higher-potential opportunities within the corporation's diverse portfolio.

| ASRC Segment Example | Market Growth Rate | ASRC Market Share | BCG Classification | Strategic Implication |

|---|---|---|---|---|

| Legacy Industrial Service | -5% (2023) | <1% | Dog | Divestiture or Restructuring |

| Mature Oil Field Operations | Low/Declining | Moderate | Dog/Cash Cow (depending on cash flow) | Cost Optimization, Potential Divestiture |

| Niche Technology Service | Stagnant | Low | Dog | Strategic Repositioning or Divestiture |

Question Marks

Arctic Slope Regional Corporation's (ASRC) ventures into emerging renewable energy sectors would likely be classified as Question Marks within a BCG Matrix. This is due to the high-growth potential of the global sustainable energy market, driven by increasing environmental concerns and government incentives. For example, the global renewable energy market was valued at approximately $1.2 trillion in 2023 and is projected to grow significantly in the coming years.

ASRC's current market share in these nascent renewable energy ventures would likely be low, reflecting the early stage of their involvement. Establishing a competitive position in this rapidly evolving landscape requires substantial capital investment for research and development, infrastructure, and market penetration. ASRC would need to strategically allocate resources to build brand recognition and secure a foothold against established players.

Integrating advanced technologies such as AI for predictive maintenance and IoT security for its energy operations positions ASRC in a high-growth potential quadrant. While the market for these integrated solutions is rapidly expanding, ASRC's current share within its existing operational framework might be considered relatively low.

These forward-thinking initiatives demand considerable capital outlay and a robust strategy for successful implementation to transition into a Star category within the BCG matrix. For instance, investments in AI-driven energy optimization could yield efficiency gains, but their market penetration within ASRC's current structure is still developing.

Expansion into new geographic markets, where Arctic Slope Regional Corporation (ASRC) currently has a minimal footprint, would be classified as question marks within the BCG Matrix. These ventures demand substantial initial investment to build brand recognition and secure market share. For instance, ASRC's recent strategic initiatives in emerging renewable energy sectors in regions like Southeast Asia, aiming to leverage its expertise in resource management, represent such a question mark opportunity, requiring significant capital outlay for market entry and development.

Development of Untapped Resource Plays

The exploration and development of previously untapped resource plays within Arctic Slope Regional Corporation's (ASRC) vast landholdings represent a significant Question Mark in its BCG Matrix. These ventures are characterized by high geological and market risks, demanding substantial upfront capital for seismic surveys, drilling, and infrastructure development. For instance, ASRC's strategic focus on the National Petroleum Reserve-Alaska (NPR-A) could unlock new hydrocarbon potential, mirroring the early stages of the Alpine field development, which required billions in investment before becoming a major producer.

The potential upside for these Question Mark plays is considerable, offering the chance to establish new, long-term revenue streams and enhance ASRC's energy portfolio. Success hinges on favorable commodity prices, technological advancements in extraction, and a supportive regulatory environment. As of early 2024, the global demand for oil and gas remains robust, providing a potential tailwind for such exploration efforts, though the transition to renewable energy introduces long-term uncertainty.

- High Risk, High Reward Potential: Untapped plays like potential shale oil or gas deposits in ASRC's territory could yield significant returns but face substantial exploration uncertainty.

- Capital Intensive: Developing these resources requires significant investment, potentially in the hundreds of millions or even billions of dollars, impacting ASRC's liquidity and debt levels.

- Market Volatility: The success of these ventures is heavily tied to fluctuating global energy prices and demand, making them inherently volatile investments.

- Technological Dependence: Advancements in drilling and extraction technologies are crucial for making these previously uneconomical plays commercially viable.

Strategic Partnerships in Novel Industries

Strategic partnerships in emerging sectors, such as advanced materials or sustainable energy technologies, would position Arctic Slope Regional Corporation (ASRC) in areas where its existing market share is minimal. These ventures are classified as question marks in the BCG Matrix, signifying potential for substantial growth but also considerable risk due to market volatility and unproven business models.

For instance, if ASRC were to partner with a startup developing novel carbon capture technology, this collaboration would likely fall into the question mark category. Such a partnership would require significant investment and offer the possibility of high returns if the technology gains widespread adoption, a scenario that remains uncertain as of mid-2024.

- Potential for High Growth: Partnerships in novel industries offer ASRC the chance to enter rapidly expanding markets.

- Inherent Uncertainties: These collaborations carry risks related to market acceptance and the profitability of new technologies.

- Strategic Investment: ASRC's involvement in these areas represents a strategic bet on future industry trends.

- Resource Allocation: Success in these question mark ventures will depend on ASRC's ability to effectively allocate resources and manage risk.

ASRC's ventures into new, high-growth markets with low current market share, such as emerging renewable energy technologies or undeveloped resource plays, are classic Question Marks. These initiatives require substantial capital investment for research, development, and market entry, carrying significant risk but also the potential for high future returns.

The global renewable energy market, for instance, was valued at approximately $1.2 trillion in 2023 and is projected for robust growth, presenting a fertile ground for ASRC's potential expansion. Similarly, the exploration of untapped resource plays, while capital-intensive and subject to market volatility, could unlock significant long-term revenue streams for the corporation.

| Venture Area | Market Growth Potential | ASRC Current Market Share | Capital Requirement | Risk Level |

|---|---|---|---|---|

| Renewable Energy Technologies | High | Low | High | High |

| Untapped Resource Plays | Moderate to High (commodity dependent) | Low | Very High | High |

| Strategic Partnerships in Novel Sectors | High | Low | High | High |

BCG Matrix Data Sources

Our BCG Matrix for Arctic Slope Regional Corporation is constructed using a blend of internal financial statements, publicly available annual reports, and market research data. This includes industry growth rates and competitor performance metrics to accurately position ASRC's business units.