Asplundh Tree Expert SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Asplundh Tree Expert Bundle

Asplundh Tree Expert boasts significant strengths in its established brand and extensive operational network, but faces challenges like evolving environmental regulations and intense competition. Understanding these dynamics is crucial for any stakeholder looking to navigate the utility vegetation management landscape.

Want the full story behind Asplundh's market position, including detailed breakdowns of their competitive advantages and potential threats? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Asplundh stands as a dominant force in vegetation management and utility infrastructure services, boasting a significant global footprint. Its leadership is underscored by a comprehensive suite of offerings, encompassing everything from routine tree trimming and brush clearing to critical storm restoration and diverse infrastructure solutions. This broad service spectrum, catering to electric utilities, municipalities, pipelines, and railroads across key international markets like the U.S., Canada, Australia, and New Zealand, firmly establishes its market dominance.

Asplundh's core strength lies in its deeply entrenched relationships with primary clients, predominantly utility companies, municipalities, and various governmental bodies. These partnerships are not merely transactional; they are built on the critical nature of Asplundh's services, which are fundamental to maintaining the reliable and safe delivery of essential utilities like electricity.

The company's long-standing tenure with these vital entities underscores a profound level of trust and the indispensable role Asplundh plays in infrastructure resilience and public safety. For instance, Asplundh has been a key contractor for numerous major utility providers across North America for decades, a testament to their consistent performance and reliability in crucial vegetation management and line clearance operations.

Asplundh's strength lies in its robust storm and emergency response capabilities, a critical service for utility clients. They can rapidly deploy thousands of trained personnel to assist in power restoration following major weather events, a testament to their operational readiness. For instance, during the widespread power outages caused by severe storms in the Eastern United States in early 2024, Asplundh was a key player in restoring service to millions of customers.

Commitment to Safety and Training

Asplundh Tree Expert's dedication to safety is a significant strength, underscored by robust training initiatives and a deeply ingrained culture of employee well-being. This focus is not merely procedural; it's a strategic imperative that directly impacts operational efficiency and risk mitigation.

The company actively fosters continuous learning and leverages data to inform safety decisions, ensuring its workforce remains highly skilled and protected. This proactive approach is further reinforced by strict adherence to industry standards and collaborative efforts with organizations like OSHA, aiming to minimize workplace incidents and maintain a superior safety record.

- Comprehensive Training Programs: Asplundh invests heavily in developing and delivering extensive training, covering everything from technical skills to hazard recognition.

- Data-Driven Safety Decisions: The company utilizes incident data and near-miss reporting to identify trends and implement targeted safety improvements.

- Industry Partnerships: Collaborations with bodies like OSHA demonstrate a commitment to exceeding minimum safety requirements and adopting best practices.

- Low Incident Rates: While specific 2024/2025 figures are proprietary, Asplundh consistently aims for and historically achieves industry-leading low incident rates compared to sector averages.

Strategic Acquisitions and Diversification

Asplundh Tree Expert has strategically bolstered its market position through targeted acquisitions, enhancing its service portfolio. The acquisition of Bobcat Power, LLC in March 2025 significantly broadens Asplundh's expertise into electrical construction and substation infrastructure. This move, alongside the May 2024 acquisition of Voltyx, which specializes in electrical testing services, diversifies Asplundh's revenue streams beyond its core vegetation management business. These strategic integrations are designed to create a more comprehensive, 'One Asplundh' offering for clients.

These acquisitions are not just about expanding services; they are about building a more resilient and integrated business model. By adding electrical construction and testing capabilities, Asplundh is better positioned to capture a larger share of the utility services market. This diversification strengthens their ability to offer end-to-end solutions, from right-of-way clearing to critical electrical infrastructure maintenance and upgrade projects.

- March 2025: Acquisition of Bobcat Power, LLC, adding electrical construction and substation infrastructure expertise.

- May 2024: Acquisition of Voltyx, enhancing capabilities in electrical testing services.

- Strategic Impact: Diversification beyond traditional vegetation management strengthens the 'One Asplundh' integrated service model.

- Market Position: Enhanced ability to compete for comprehensive utility infrastructure projects.

Asplundh's extensive operational experience, particularly in vegetation management and utility infrastructure services, forms a cornerstone of its strength. The company's deep-rooted relationships with major utility clients, built over decades, highlight its reliability and indispensable role in maintaining essential services. Its robust storm and emergency response capabilities, demonstrated by rapid deployment during events like the early 2024 Eastern US power outages, showcase operational readiness.

What is included in the product

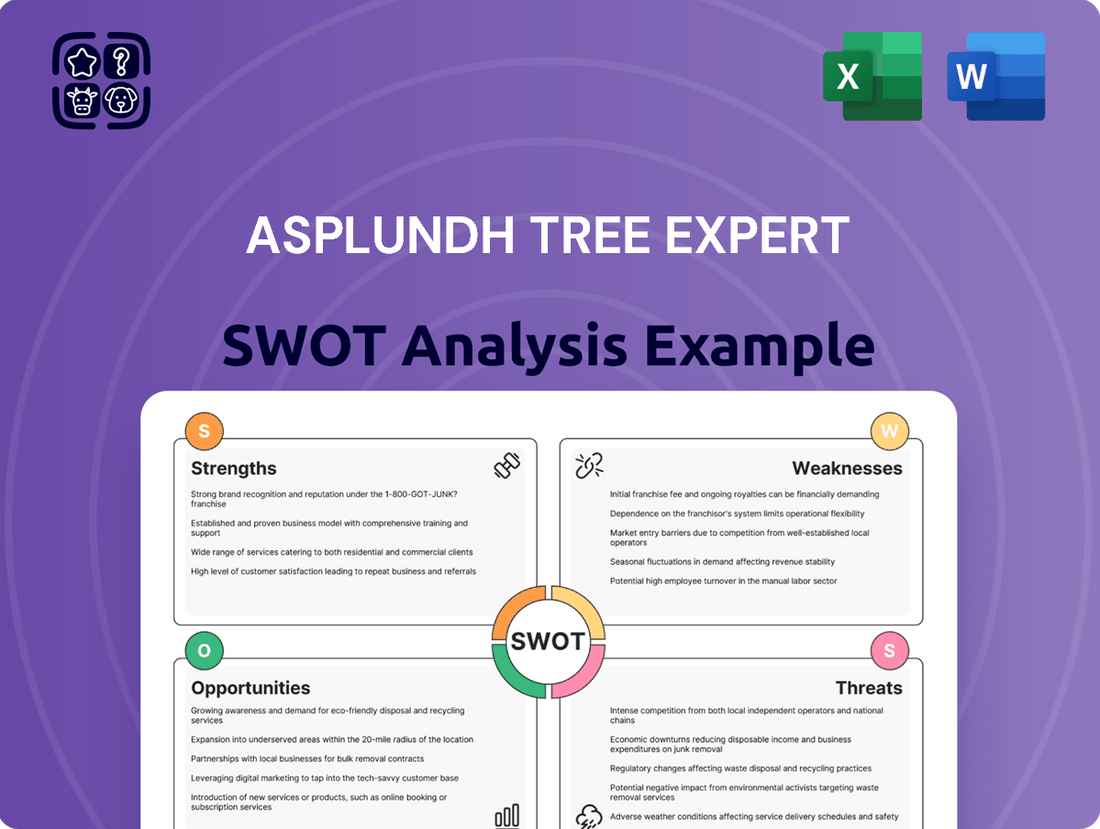

Analyzes Asplundh Tree Expert’s competitive position through key internal and external factors, detailing its strengths in expertise and market reach, weaknesses in potential operational inefficiencies, opportunities in infrastructure development, and threats from competition and environmental regulations.

Identifies critical internal weaknesses and external threats, enabling proactive mitigation strategies to prevent operational disruptions and reputational damage.

Weaknesses

Asplundh, like many in the utility vegetation management sector, grapples with persistent labor shortages and widening skill gaps. This challenge is amplified by a competitive job market, making it difficult to attract and retain qualified personnel, which can directly affect the company's ability to meet service demands and maintain operational efficiency. For instance, industry-wide reports in late 2024 indicated an average deficit of 15% in available skilled labor for specialized roles within vegetation management.

Asplundh, like many in the vegetation management sector, faces substantial operational costs. These expenses stem from the necessity of frequent property inspections, the upkeep of specialized machinery like chippers and aerial lifts, and the employment of trained arborists and line clearance crews. For instance, the average hourly wage for a certified arborist can range significantly, but often falls within the $25-$50 per hour bracket, not including benefits or overhead, making labor a major cost driver.

Asplundh operates within an industry heavily regulated by federal and state agencies, particularly concerning vegetation management. This means adhering to strict standards, which can be a significant operational challenge. For instance, the Environmental Protection Agency (EPA) sets guidelines for pesticide use, and the Occupational Safety and Health Administration (OSHA) mandates safety protocols for tree work, impacting how Asplundh conducts its operations and requiring continuous adaptation to evolving rules.

Integration of Acquired Businesses

Integrating newly acquired businesses, such as the recent additions of Bobcat Power and Voltyx, presents a significant hurdle for Asplundh. While these acquisitions fuel growth, the process of merging operations, cultures, and technology demands substantial management attention and resources. This can strain existing systems and personnel, potentially impacting efficiency during the transition period.

The complexities of integrating diverse business units can lead to:

- Operational Disruptions: Mismatched systems and processes can cause temporary slowdowns or errors.

- Cultural Clashes: Differences in company culture can hinder collaboration and employee morale.

- Synergy Realization Delays: Achieving expected cost savings and revenue enhancements from acquisitions may take longer than anticipated.

Dependence on Utility Sector Health

Asplundh's reliance on utility companies as its main clients means its success is closely linked to the financial well-being and spending patterns of this sector. If utilities face economic challenges or shift their investment focus, it could directly reduce the need for Asplundh's services.

Consider these points regarding this dependency:

- Utility Sector Sensitivity: Asplundh's revenue is heavily influenced by utility capital expenditure budgets, which can fluctuate based on regulatory environments and economic conditions.

- Economic Downturn Impact: During economic slowdowns, utilities might cut back on non-essential vegetation management or infrastructure upgrades, directly affecting Asplundh's order book.

- Diversification Needs: While utilities are a core market, a lack of significant diversification into other sectors could leave Asplundh more vulnerable to sector-specific downturns.

Asplundh faces ongoing challenges with labor availability and skill development, a common issue in the vegetation management industry. Reports from late 2024 highlighted a significant shortage of skilled workers, impacting the company's capacity to meet demand and maintain efficient operations.

Full Version Awaits

Asplundh Tree Expert SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You're getting a direct look at the Asplundh Tree Expert SWOT analysis, detailing its Strengths, Weaknesses, Opportunities, and Threats. The complete, in-depth report is unlocked upon purchase.

Opportunities

The global utility vegetation management market is projected to reach approximately $13.5 billion by 2027, exhibiting a compound annual growth rate of around 5.5%. This expansion is fueled by the escalating need for grid resilience and the growing emphasis on preventing power outages, especially in the face of more frequent extreme weather events. Asplundh is well-positioned to capitalize on this trend, as utilities increasingly outsource these critical services to specialized providers.

The utility vegetation management sector is rapidly integrating advanced technologies. Innovations like drones, LiDAR, and AI are becoming standard for enhancing efficiency and precision in tasks like identifying potential hazards and planning trimming schedules. For instance, the global drone services market, which includes vegetation management, was projected to reach over $20 billion by 2024, highlighting the significant investment and adoption of these tools.

Asplundh can capitalize on these technological advancements to refine its service delivery. By adopting remote sensing for better grid analysis and AI for predictive maintenance of vegetation, the company can offer more proactive and data-driven solutions to its utility clients. This strategic adoption not only improves operational effectiveness but also positions Asplundh as a leader in a technologically evolving industry, potentially leading to increased contract wins and client satisfaction.

Global investment in utility infrastructure and renewable energy, including smart grids and energy storage, is experiencing significant growth. For example, the International Energy Agency reported that global clean energy investment reached an estimated $1.7 trillion in 2023, a substantial increase from previous years.

Asplundh's strategic expansion, bolstered by recent acquisitions, has broadened its service offerings in infrastructure development and maintenance. This enhanced capability directly aligns with the increasing demand for modern energy grid solutions, positioning Asplundh to benefit from this burgeoning market.

Increasing Focus on Sustainability and ESG

Utilities are increasingly prioritizing sustainability and climate resilience, actively seeking innovative solutions to manage vegetation-related risks while championing environmental stewardship. This shift presents a significant opportunity for Asplundh. The company's explicit commitment to environmentally sustainable practices, as detailed in its 2024 Sustainability Report, directly aligns with these evolving industry demands. This alignment can unlock new avenues for strategic partnerships and the development of specialized services.

Asplundh's proactive stance on sustainability is not just a response to market trends but a strategic advantage. For instance, the company's investment in electric fleet vehicles and advanced pruning techniques that minimize environmental impact caters directly to utility clients aiming to reduce their carbon footprint. This focus can translate into increased contract wins and a stronger competitive position in a market where ESG (Environmental, Social, and Governance) performance is becoming a critical evaluation criterion.

- Growing demand for eco-friendly vegetation management solutions

- Asplundh's 2024 Sustainability Report highlights commitment to environmental stewardship

- Opportunities for partnerships with utilities focused on climate resilience

- Development of new services aligned with ESG objectives

Expansion into New Geographies and Service Areas

Asplundh's existing global footprint, which includes operations in Canada, Australia, and the UK, presents a strong foundation for further international growth. The company can capitalize on the increasing demand for vegetation management services in developing economies, particularly in Asia and Latin America, where infrastructure development is accelerating. For instance, countries like India and Brazil are investing heavily in expanding their power grids, creating significant opportunities for Asplundh's core services.

Further diversification into adjacent service areas could also unlock substantial growth. This might include expanding offerings in utility consulting, advanced vegetation analytics using AI and drone technology, or even specialized services for renewable energy infrastructure maintenance. The company's deep expertise in managing complex utility environments positions it well to adapt and expand its service portfolio to meet evolving market needs. In 2024, the global vegetation management market was valued at approximately $25 billion, with projections indicating continued robust growth.

- Geographic Expansion: Target emerging markets in Asia and Latin America with significant infrastructure development.

- Service Diversification: Explore opportunities in utility consulting, AI-driven vegetation analytics, and renewable energy infrastructure maintenance.

- Market Growth: Leverage the projected continued growth in the global vegetation management market, which was valued around $25 billion in 2024.

- Leveraging Expertise: Utilize Asplundh's established knowledge in utility operations to adapt and expand its service offerings.

The increasing global focus on grid resilience and the prevention of power outages, especially with more extreme weather events, drives significant demand for vegetation management. The utility vegetation management market is projected to grow substantially, indicating a strong need for Asplundh's core services.

Technological advancements, such as drones, LiDAR, and AI, are revolutionizing the sector, offering opportunities for enhanced efficiency and precision. Asplundh can leverage these innovations to provide more data-driven and proactive solutions, solidifying its position as a technologically advanced provider.

Growing investments in utility infrastructure and renewable energy projects present a clear avenue for expansion. Asplundh's broadened service capabilities, including infrastructure development, directly align with these market trends, positioning the company to benefit from this growth.

The emphasis on sustainability and climate resilience by utilities creates a demand for environmentally conscious solutions. Asplundh's commitment to sustainable practices, as evidenced by its 2024 Sustainability Report, aligns perfectly with these client needs, opening doors for new partnerships and specialized service development.

Threats

Asplundh faces escalating threats from climate-related disasters. The growing frequency and intensity of events like wildfires, hurricanes, and severe storms directly impact operations. For instance, the NOAA reported a record 28 separate billion-dollar weather and climate disasters in the U.S. during 2023, a stark increase from previous years, highlighting the growing environmental instability.

These extreme weather events, while boosting demand for Asplundh's restoration services, simultaneously elevate operational risks. The complexity and inherent dangers of vegetation management in post-disaster scenarios increase, potentially leading to higher insurance premiums and greater liability exposure for the company.

Asplundh, like other utility service providers, operates under a microscope of increasing regulatory oversight concerning vegetation management. Non-compliance with these evolving standards can lead to substantial fines and legal repercussions, impacting profitability and operational continuity. For instance, in 2023, the industry continued to grapple with evolving environmental regulations impacting land use and tree removal practices, with potential penalties for violations reaching millions of dollars depending on the severity and scope.

The utility vegetation management sector is quite crowded, featuring numerous regional and national companies vying for contracts. Asplundh encounters significant competition from other specialized tree service firms and broader industrial vegetation management providers. This intense competition can put pressure on market share and influence pricing strategies, potentially impacting revenue streams.

Economic Downturns and Budget Constraints for Clients

Economic downturns pose a significant threat to Asplundh Tree Expert by potentially leading to budget constraints for its core clients, which include utility companies, municipalities, and government agencies. These entities often face reduced spending during economic slowdowns, directly impacting the demand for vegetation management services. For instance, a widespread economic recession in 2024-2025 could see utility providers scaling back on non-essential capital expenditures, including their tree trimming and line clearance programs, which are crucial revenue streams for Asplundh.

This reduction in client spending can translate into delayed or canceled projects, directly affecting Asplundh's revenue and overall profitability. In 2023, utility vegetation management spending was robust, but projections for 2024-2025 indicate a potential softening if economic headwinds persist. This could mean fewer large-scale contracts and a greater emphasis on cost-saving measures by clients, putting pressure on Asplundh's margins.

- Reduced Client Spending: Economic downturns can force utility companies and municipalities to cut back on discretionary spending, including vegetation management projects.

- Project Delays or Cancellations: Financial constraints may lead clients to postpone or cancel contracts, directly impacting Asplundh's project pipeline and revenue.

- Margin Pressure: Clients seeking to reduce costs during economic hardship might negotiate lower rates for services, squeezing Asplundh's profit margins.

- Impact on Growth: A sustained economic downturn could slow Asplundh's ability to secure new contracts and expand its service offerings.

Technological Disruption and Rapid Innovation

Asplundh Tree Experts faces a significant threat from technological disruption. A failure to invest in and adopt emerging vegetation management technologies, such as artificial intelligence for predictive maintenance or advanced robotics for more efficient line clearing, could leave the company behind. For instance, competitors leveraging AI-driven analytics might optimize their routing and scheduling more effectively, leading to cost savings and faster service delivery. By mid-2025, the vegetation management sector is expected to see increased adoption of drone technology for inspections, with early adopters potentially gaining a competitive edge in data accuracy and operational speed.

The rapid pace of innovation means that staying current is not just an advantage, but a necessity. Companies that are slower to integrate new tools risk becoming less efficient and cost-competitive. This could impact Asplundh's market position if rivals can offer superior service quality or lower prices due to their technological advancements. The global market for vegetation management is projected to grow, and technological adoption will be a key differentiator. For example, the market for autonomous vegetation management equipment was estimated to be worth over $500 million in 2024 and is expected to expand significantly by 2025.

- Lagging Adoption: Falling behind in adopting AI, advanced analytics, and robotics in vegetation management.

- Competitive Disadvantage: Competitors gaining efficiency and cost advantages through faster innovation integration.

- Service Quality Impact: Potential decline in service quality relative to technologically advanced rivals.

- Market Share Erosion: Risk of losing market share to more agile and technologically forward competitors.

Intensifying competition from both established players and emerging specialized firms presents a significant threat to Asplundh's market dominance. The utility vegetation management sector is highly competitive, with numerous regional and national companies vying for contracts. This intense rivalry can exert downward pressure on pricing, potentially impacting Asplundh's profit margins and ability to secure lucrative agreements. For instance, in 2024, several smaller, agile competitors have gained traction by offering niche services or more localized expertise, challenging Asplundh's broad market penetration.

SWOT Analysis Data Sources

This SWOT analysis is built upon a foundation of verified financial statements, comprehensive market research, and expert industry commentary to provide a robust and actionable assessment of Asplundh Tree Expert's position.