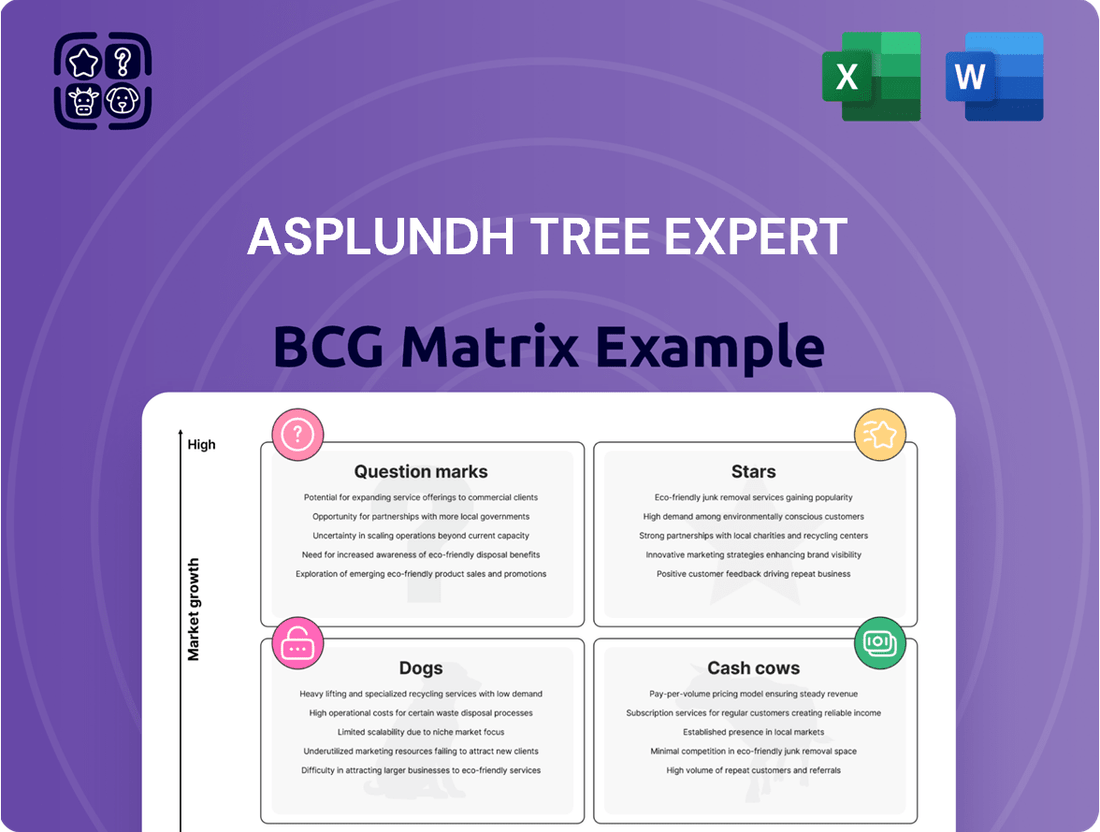

Asplundh Tree Expert Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Asplundh Tree Expert Bundle

Curious about Asplundh Tree Expert's market position? This glimpse into their BCG Matrix highlights key product categories, but the full report unlocks the strategic secrets behind their success and challenges. Understand where their resources are best allocated and where future growth lies.

Don't miss out on the complete Asplundh Tree Expert BCG Matrix analysis. Gain a comprehensive understanding of their Stars, Cash Cows, Dogs, and Question Marks, equipping you with the knowledge to make informed decisions and drive your own business forward. Purchase the full report for actionable insights.

Stars

Asplundh's strategic acquisitions, like Voltyx in May 2024 and Bobcat Power in March 2025, are significantly broadening their scope. These moves are transforming Asplundh from a vegetation management specialist into a full-service utility infrastructure provider.

These expansions into electrical testing, substation services, and power system construction directly address the increasing demand for grid modernization and resilience. This diversification taps into a rapidly growing market, enhancing Asplundh's competitive position.

Asplundh's commitment to advanced vegetation management technology, including drones and AI, positions it strongly for growth. These tools enable more precise risk assessment and proactive maintenance, crucial for utility clients concerned about wildfires and outages. For instance, the company's use of LiDAR and aerial imagery allows for detailed canopy analysis, identifying potential hazards before they become critical issues.

Wildfire Mitigation Services represent a significant growth opportunity for Asplundh, driven by escalating wildfire events across North America. Utilities are facing intensified regulatory scrutiny and public pressure to proactively manage vegetation, especially around critical infrastructure like power lines, to prevent ignition and spread.

This heightened demand directly translates into a strong market position for Asplundh's specialized vegetation management capabilities. The company’s established expertise in clearing and maintaining the right-of-way is directly applicable to reducing the fuel load that exacerbates wildfire intensity, positioning it as a key player in this expanding sector.

Smart Grid Integration Services

The global smart grid market is experiencing significant expansion, projected to reach over $100 billion by 2027, driven by the increasing deployment of smart meters and advanced monitoring technologies. This trend presents a substantial opportunity for Asplundh's smart grid integration services.

Asplundh's existing strong partnerships with utility companies are a key advantage, enabling them to seamlessly incorporate their vegetation management and infrastructure upkeep services into the new smart grid ecosystem. This integration allows for more efficient operations and enhanced grid reliability.

- Market Growth: The smart grid sector is a high-growth area, with significant investment in grid modernization globally.

- Technological Advancements: AI and IoT are increasingly being used for real-time grid monitoring and predictive maintenance, creating demand for integration services.

- Asplundh's Position: Established utility relationships and expertise in infrastructure management position Asplundh to capitalize on this market shift.

Emergency Storm Restoration Services

Asplundh’s Emergency Storm Restoration Services are a prime example of a Star in the BCG Matrix. With climate change fueling more severe weather, the demand for their rapid-response capabilities in power restoration after events like hurricanes is surging.

This segment is a significant growth driver for Asplundh, showcasing their critical role in supporting utility companies during natural disasters. Their expertise in quickly mobilizing vast resources positions them strongly in this expanding market.

- High Demand: Increased frequency and intensity of storms due to climate change directly boost demand for emergency restoration.

- Critical Utility Support: Asplundh's ability to restore power quickly is essential for communities and utility infrastructure.

- Growth Driver: This service line represents a substantial and growing revenue stream for the company.

- Operational Strength: Proven track record in rapid deployment of personnel and equipment during crises.

Asplundh's Emergency Storm Restoration Services are a prime example of a Star in the BCG Matrix. With climate change fueling more severe weather, the demand for their rapid-response capabilities in power restoration after events like hurricanes is surging.

This segment is a significant growth driver for Asplundh, showcasing their critical role in supporting utility companies during natural disasters. Their expertise in quickly mobilizing vast resources positions them strongly in this expanding market, with a proven track record in rapid deployment of personnel and equipment during crises.

The increased frequency and intensity of storms due to climate change directly boost demand for emergency restoration, making this a critical utility support function. This service line represents a substantial and growing revenue stream for the company, essential for communities and utility infrastructure.

| Asplundh Service Line | BCG Category | Market Growth Rate | Asplundh Market Share | Rationale |

|---|---|---|---|---|

| Emergency Storm Restoration | Star | High | High | Increasing storm severity drives demand; Asplundh's rapid response is critical. |

| Vegetation Management | Star | High | High | Wildfire mitigation and grid reliability needs fuel demand; Asplundh's tech and expertise are key. |

| Smart Grid Integration | Question Mark/Star | Very High | Medium | Rapidly growing market; Asplundh's utility relationships offer strong potential. |

What is included in the product

Asplundh's BCG Matrix offers a strategic overview of its business units, categorizing them as Stars, Cash Cows, Question Marks, or Dogs based on market share and growth.

Asplundh's BCG Matrix provides a clear, one-page overview, simplifying complex business unit analysis for strategic decision-making.

Cash Cows

Asplundh's core vegetation management services, including tree pruning, right-of-way clearing, and herbicide application, firmly position it as a Cash Cow within the BCG Matrix. This foundational business boasts a high market share in an essential, stable industry. In 2024, Asplundh continued to leverage its deep expertise and extensive workforce to secure and maintain long-term contracts with major utility providers across North America, a testament to its consistent revenue generation.

Asplundh's utility line clearance business is a classic Cash Cow within their portfolio, mirroring the BCG Matrix concept. They are a pioneer and a leader in this sector, holding a significant market share in a mature yet essential industry. This segment consistently generates substantial and stable cash flow, driven by the ongoing, regulatory-mandated need for vegetation management around critical power and communication infrastructure.

Asplundh's long-standing relationships with major utility companies, municipalities, and government bodies are a cornerstone of its business. These deep-rooted connections, built over decades, secure the company's position as a preferred provider, leading to a consistent stream of long-term contracts. This stability is crucial for predictable revenue generation.

These utility contracts function as dependable cash cows for Asplundh. The recurring nature of this revenue means less reliance on volatile market fluctuations or costly, intensive new client acquisition. In 2023, Asplundh reported significant revenue from its utility services segment, underscoring the consistent cash flow generated by these agreements.

Geographic Market Dominance

Asplundh's extensive geographic footprint, spanning the United States, Canada, Australia, and New Zealand, positions it as a dominant force in mature utility markets. This widespread presence translates into substantial market penetration and strong brand recognition, creating a reliable foundation for consistent revenue generation.

The company's significant market share in these established regions underscores its status as a cash cow. For instance, in 2024, Asplundh continued to be a primary contractor for numerous utility companies across North America, securing long-term vegetation management contracts that are vital for grid reliability.

- Geographic Reach: Operations in the US, Canada, Australia, and New Zealand.

- Market Penetration: High brand recognition and established customer relationships in mature utility markets.

- Revenue Stability: Steady stream of business derived from widespread operations and significant market share.

- Contractual Basis: Reliance on long-term contracts with utility providers ensures predictable income.

Integrated Vegetation Management (IVM) Programs

Asplundh's Integrated Vegetation Management (IVM) programs are a cornerstone of their business, acting as significant cash cows. These programs are designed to be highly efficient and cost-effective for clients, often combining various vegetation control methods. This comprehensive approach solidifies Asplundh's reputation as a go-to provider in the utility and infrastructure sectors, ensuring a steady stream of revenue.

The success of IVM programs stems from their ability to deliver predictable, recurring profits. By offering a suite of services that optimize vegetation control, Asplundh secures long-term contracts and repeat business. For instance, in 2024, Asplundh reported that its vegetation management services, which heavily feature IVM principles, accounted for a substantial portion of its overall revenue, demonstrating the consistent profitability of these operations.

- High Client Retention: IVM programs foster strong client relationships due to their proven efficiency and cost savings, leading to sustained revenue.

- Diversified Service Offering: Combining mechanical, chemical, and biological control methods within IVM allows Asplundh to meet diverse client needs, maximizing service utilization.

- Operational Scale: Asplundh's extensive operational footprint and expertise in managing large-scale IVM projects enable them to achieve economies of scale, further boosting profitability.

- Regulatory Compliance: IVM programs help clients meet regulatory requirements for vegetation clearance, creating a consistent demand for Asplundh's services.

Asplundh's established utility vegetation management services are its primary cash cows. These operations benefit from high market share in a stable, essential industry, generating consistent and predictable revenue streams. In 2024, Asplundh continued to secure long-term contracts with major utility providers, a testament to its leadership and the ongoing need for its services.

These core services, including tree pruning and right-of-way clearing, represent a mature business segment for Asplundh. The company’s extensive experience and established client base ensure a steady flow of income, allowing it to fund other growth initiatives. Asplundh's 2023 financial reports highlighted the significant contribution of these utility services to its overall revenue, underscoring their cash-generating power.

The predictable demand for vegetation management, driven by regulatory requirements and the need for grid reliability, makes these services a reliable source of cash. Asplundh's ability to deliver these services efficiently across its broad geographic footprint, including the US and Canada, further solidifies its position as a cash cow.

Asplundh's Integrated Vegetation Management (IVM) programs are also strong cash cows. These comprehensive solutions offer clients cost-effective and efficient vegetation control, leading to high client retention and recurring revenue. The company's 2024 performance indicated that IVM-related services remained a significant revenue driver, demonstrating their consistent profitability.

| Business Segment | Market Share | Industry Growth | Cash Flow Generation | Strategic Role |

| Utility Vegetation Management | High | Low/Stable | High | Cash Cow |

| Integrated Vegetation Management (IVM) | High | Low/Stable | High | Cash Cow |

Delivered as Shown

Asplundh Tree Expert BCG Matrix

The preview of the Asplundh Tree Expert BCG Matrix you are currently viewing is the exact, unadulterated document you will receive upon purchase. This means no watermarks, no placeholder text, and no altered content – just the complete, professionally formatted strategic analysis ready for your immediate use. You can be confident that the comprehensive insights and actionable recommendations presented here are precisely what you'll download, enabling you to make informed decisions about Asplundh's business units. This is your direct gateway to a fully realized strategic planning tool, delivered without compromise.

Dogs

Legacy manual clearing methods, while still a component of Asplundh's operations, represent a segment with potentially lower growth and efficiency compared to technologically integrated services. As the utility vegetation management sector increasingly adopts advanced tools, these traditional approaches may face challenges in maintaining competitiveness and profitability.

Asplundh's older equipment fleets, particularly those not updated for basic services, can be classified as Dogs in the BCG matrix. These assets often incur higher operational costs due to poor fuel efficiency and increased maintenance needs. For instance, older chippers and aerial lifts might consume 15-20% more fuel than their modern counterparts, directly impacting profitability.

Services with a high labor-to-revenue ratio, often characterized by significant manual effort and limited technological integration, can be classified as Dogs in the BCG Matrix. These are typically services where the cost of labor heavily outweighs the income generated, hindering profitability and growth potential. For instance, Asplundh's smaller, specialized tree removal projects, especially in remote or difficult-to-access areas, might fit this description if they don't leverage efficient equipment or streamlined processes. In 2024, the average hourly wage for a certified arborist in the US was around $25-$35, and without significant project scale, these costs can quickly eat into revenue.

Non-Strategic, Low-Margin Niche Services

Asplundh Tree Expert may offer niche services that are not central to its strategic vision and yield low profit margins. These services, sometimes termed 'Dogs' in a BCG matrix context, can tie up valuable resources without generating significant returns.

For instance, Asplundh might have provided highly specialized vegetation management for a very specific industrial client or a particular type of infrastructure, which, while technically proficient, represented a small fraction of their overall business and offered limited scalability. In 2024, such services might account for less than 1% of Asplundh's total revenue, contributing minimally to their profitability compared to their core utility vegetation management operations.

- Low Revenue Contribution: These niche services typically generate less than 1% of Asplundh's annual revenue.

- Minimal Profitability: Their contribution to Asplundh's overall profit margin is often negligible, potentially even negative after accounting for specialized equipment and personnel.

- Resource Drain: They can divert management attention and operational resources from more lucrative core business segments.

- Limited Growth Potential: The market for these highly specialized services is often small and unlikely to expand significantly for Asplundh.

Operations in Stagnant or Declining Local Markets

Operations in stagnant or declining local markets for Asplundh Tree Expert would fall into the Dogs category of the BCG Matrix. These are areas where growth is minimal, offering little potential for expansion or significant market share gains.

For instance, if a specific rural county in the Midwest, with an aging population and limited new housing development, shows a consistent year-over-year decline in utility infrastructure upgrades, Asplundh's contracts there might be considered Dogs. Such markets may only generate enough revenue to cover operational costs without contributing substantially to overall company growth.

- Low Market Growth: Regions with minimal to no increase in demand for vegetation management or utility line clearing.

- Limited Expansion Potential: Opportunities for Asplundh to grow its business or capture a larger share are scarce.

- Focus on Efficiency: Management in these areas often prioritizes maintaining existing contracts and optimizing operational costs rather than seeking aggressive growth.

- Potential Divestment Consideration: If these operations consistently underperform and drain resources, Asplundh might consider divesting them in the long term.

Dogs in Asplundh's BCG matrix represent services or operational segments with low growth and low market share, often characterized by older equipment or niche offerings. These areas can tie up resources without generating substantial returns. For example, older chippers might have 15-20% lower fuel efficiency than newer models, impacting profitability.

| Category | Description | Example | 2024 Data/Impact |

| Dogs | Low market share, low growth | Legacy manual clearing methods | May represent <1% of revenue, minimal profit contribution |

| Dogs | Low market share, low growth | Older equipment fleets | Higher operational costs (e.g., 15-20% more fuel) |

| Dogs | Low market share, low growth | Niche, low-margin services | Divert resources from core business, limited scalability |

| Dogs | Low market share, low growth | Operations in stagnant markets | Minimal revenue to cover costs, little expansion potential |

Question Marks

The market for underground utility mapping and installation is experiencing robust growth, fueled by smart city developments and the critical need for resilient infrastructure. This expansion presents a significant opportunity for companies like Asplundh.

While Asplundh's strategic acquisitions in electrical testing and substation services highlight a growing commitment to the broader infrastructure sector, their direct market share in comprehensive underground utility construction is still in its nascent stages. For context, the global underground utility locating market was valued at approximately USD 2.5 billion in 2023 and is projected to grow at a CAGR of over 7% through 2030.

As the global energy landscape pivots to renewables, the demand for supporting infrastructure, such as vegetation management for new solar and wind farm transmission lines, is surging. Asplundh, with its established expertise in vegetation control, is well-positioned to capitalize on this trend.

The renewable energy sector saw significant growth in 2024, with global investment in clean energy infrastructure reaching an estimated $1.7 trillion, according to the International Energy Agency (IEA). This expansion directly translates to increased needs for Asplundh’s services in maintaining the operational integrity of these new energy assets.

Asplundh's existing international footprint in Canada, Australia, and New Zealand provides a solid foundation. However, venturing into new, rapidly developing regions with expanding utility infrastructure presents a classic Question Mark scenario on the BCG matrix.

These new markets demand substantial upfront capital for infrastructure development, regulatory navigation, and building local operational capabilities. For instance, the global utility infrastructure market was projected to reach over $1.7 trillion in 2024, with significant growth anticipated in emerging economies in Asia and Africa.

The success of these expansions hinges on Asplundh's ability to adapt its proven service models to diverse regulatory environments and competitive landscapes. The inherent risks include potential underestimation of local market dynamics and slower-than-expected adoption of services, which could strain investment returns.

Advanced Predictive Analytics & AI for Vegetation Management

Asplundh's strategic focus on advanced predictive analytics and AI for vegetation management positions it in a high-growth potential quadrant. Integrating sophisticated AI and machine learning for predictive vegetation growth modeling, wildfire risk assessment, and optimized crew deployment is a key driver. For instance, in 2024, the utility vegetation management market was projected to reach over $10 billion globally, with AI adoption accelerating efficiency by an estimated 15-20% in predictive tasks.

The extent to which Asplundh fully adopts and leverages these cutting-edge technologies across all its operations will be critical in determining its BCG Matrix placement. Successful implementation could lead to significant cost savings and enhanced service delivery, transforming this segment into a 'Star' performer.

- AI-driven growth modeling: Enhances precision in predicting vegetation encroachment, reducing unnecessary trimming.

- Wildfire risk assessment: Utilizes AI to identify high-risk areas, enabling proactive mitigation efforts.

- Optimized crew deployment: AI algorithms ensure efficient allocation of resources, improving response times and reducing operational costs.

- Market growth: The global utility vegetation management market is expanding, with AI expected to be a major catalyst for growth.

Environmental Consulting and Sustainability Solutions

Asplundh Tree Expert is strategically positioned to leverage the growing demand for environmental consulting and sustainability solutions. The company's commitment to sustainability is evident in its operational practices and reporting, aligning with a market that saw global spending on environmental consulting services reach an estimated $35 billion in 2023, with projections for continued robust growth.

Developing specialized consulting services, such as environmental impact assessments or carbon footprint reduction strategies tailored for utility clients, represents a significant opportunity. This segment of the market is experiencing rapid expansion, driven by increasing regulatory pressures and corporate ESG (Environmental, Social, and Governance) initiatives. While Asplundh may currently have a lower market share in this specific niche, its existing utility relationships provide a strong foundation for growth.

- Market Expansion: The global environmental consulting market is projected to grow at a CAGR of over 4% through 2028.

- Utility Focus: Utilities are increasingly investing in sustainability, with many setting ambitious net-zero targets by 2050.

- Service Development: Offering specialized services like biodiversity assessments and renewable energy integration consulting could capture new revenue streams.

- Competitive Landscape: While established players exist, Asplundh's operational expertise offers a unique value proposition.

Asplundh's expansion into new, developing geographic markets presents a classic "Question Mark" scenario on the BCG matrix. These ventures require significant investment for infrastructure, regulatory compliance, and building local operational capacity, with potential for high growth but also considerable risk.

The success of these international expansions depends on Asplundh's ability to adapt its established service models to diverse regulatory frameworks and competitive landscapes. Key risks include underestimating local market dynamics and slower-than-anticipated service adoption, which could impact investment returns.

The global utility infrastructure market was projected to exceed $1.7 trillion in 2024, with emerging economies in Asia and Africa showing particularly strong growth prospects. This growth trajectory underscores the potential, but also the capital intensity, of these Question Mark markets.

The inherent uncertainty in these new territories means Asplundh must carefully manage its investments and adapt quickly to local conditions to turn these Question Marks into Stars or Cash Cows.

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive data from Asplundh's financial statements, industry growth rates, and market share analysis to accurately position each business unit.