ASM Pacific Technology Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ASM Pacific Technology Bundle

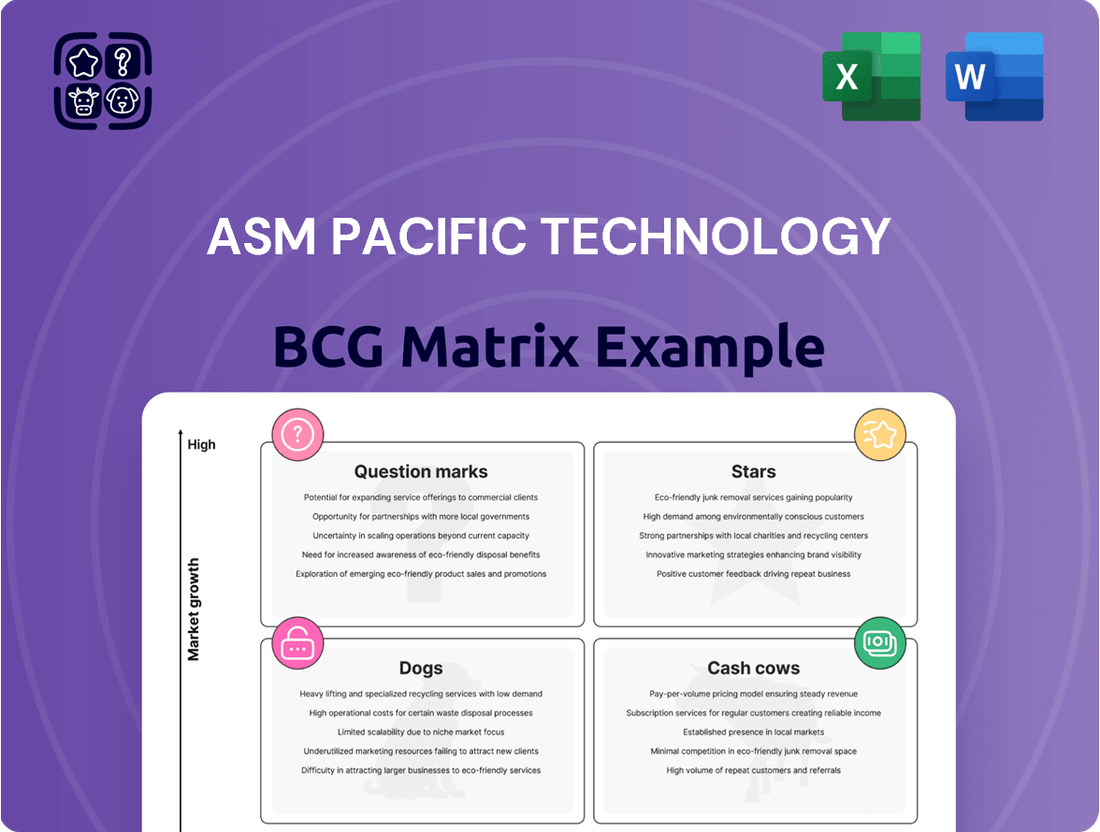

Unlock the strategic positioning of ASM Pacific Technology with our comprehensive BCG Matrix analysis. Understand which of their offerings are market leaders (Stars), reliable profit generators (Cash Cows), potential growth opportunities (Question Marks), or underperforming assets (Dogs).

This preview offers a glimpse into ASM Pacific Technology's product portfolio dynamics. For a complete, actionable strategy, purchase the full BCG Matrix report to receive detailed quadrant placements and data-driven recommendations for optimal resource allocation.

Don't miss out on critical insights into ASM Pacific Technology's competitive landscape. The full BCG Matrix provides a clear roadmap for investment decisions and future product development, ensuring you stay ahead of the curve.

Stars

ASM Pacific Technology's advanced packaging solutions are a significant growth engine, capitalizing on the surge in demand for generative AI and high-performance computing (HPC). This segment captured a substantial portion of the market, contributing almost 30% to the Group's revenue in 2024. The total addressable market for these specialized solutions is expected to expand considerably, signaling robust future growth opportunities.

ASM Pacific Technology's Thermo-Compression Bonding (TCB) tools are a standout performer, firmly positioned as a Star in the BCG Matrix. In 2024, ASMPT saw its TCB solutions achieve record yearly revenue and bookings, a testament to strong demand from major artificial intelligence companies.

The TCB market itself is experiencing phenomenal growth, with projections indicating a compound annual growth rate (CAGR) exceeding 45% between 2024 and 2027. This rapid expansion underscores the strategic importance and high potential of ASMPT's TCB offerings.

ASM Pacific Technology's High Bandwidth Memory (HBM) solutions are a clear Star in their BCG Matrix. The company has solidified its market leadership by securing substantial TCB (Test Cell Board) orders from key HBM players. These orders include successful implementations for HBM3E 12H and early-stage, low-volume manufacturing for HBM4.

This robust performance in the rapidly expanding HBM sector, which is essential for powering advanced AI applications, underscores HBM's Star status. The demand for HBM is projected to grow significantly, with market research indicating a compound annual growth rate (CAGR) of over 40% through 2027, driven by AI and high-performance computing.

Chip-to-Substrate (C2S) Solutions

ASM Pacific Technology's Chip-to-Substrate (C2S) solutions are a prime example of their strong position within the advanced packaging market. ASMPT holds an exclusive supplier role for C2S solutions with a major foundry's OSAT partner. This exclusivity, coupled with significant order wins and large shipments during the first half of 2025, underscores their dominance in this high-growth sector.

The demand for C2S technology is robust, driven by the increasing complexity and performance requirements of modern semiconductors. ASMPT's sole supplier status highlights their technological leadership and the trust placed in their solutions by key industry players. This strategic advantage positions C2S as a star performer within their product portfolio.

- Exclusive Supplier: ASMPT is the only provider of C2S solutions for a leading foundry's OSAT partner.

- Strong Market Demand: Significant orders and large shipments occurred in H1 2025, indicating high market adoption.

- Technological Leadership: This exclusive position reflects ASMPT's advanced capabilities in a critical packaging segment.

- Growth Potential: The increasing demand for advanced packaging solidifies C2S as a star product.

2.5D/3D Packaging Technologies

ASM Pacific Technology's (ASMPT) solutions are critical for the burgeoning 2.5D/3D packaging market. This advanced packaging segment is a key growth driver, with projections indicating a compound annual growth rate of 20.9% over the next five years. ASMPT's commitment to innovation and its leading position in this space, especially for high-demand applications like AI accelerators, solidifies its standing.

- Market Growth: The 2.5D/3D packaging market is anticipated to expand significantly, driven by the increasing complexity of semiconductor devices.

- ASMPT's Role: ASMPT provides essential equipment and technologies that enable the intricate processes required for 2.5D/3D packaging.

- AI Accelerator Demand: The demand for AI accelerators is a major catalyst for the adoption of these advanced packaging techniques, where ASMPT plays a pivotal role.

- Technological Leadership: Continuous investment in R&D ensures ASMPT remains at the forefront of packaging technology advancements.

ASMPT's advanced packaging solutions, particularly in Thermo-Compression Bonding (TCB) and High Bandwidth Memory (HBM), are solidifying their Star status in the BCG Matrix. The company's exclusive supplier role for Chip-to-Substrate (C2S) solutions with a major foundry's OSAT partner further cements its leadership in this high-growth sector. These segments are experiencing substantial market expansion, driven by the escalating demand for AI and high-performance computing.

| Product Segment | 2024 Revenue Contribution (Approx.) | Projected CAGR (2024-2027) | Key Growth Drivers |

|---|---|---|---|

| Thermo-Compression Bonding (TCB) | Significant portion of advanced packaging revenue | >45% | AI, HPC |

| High Bandwidth Memory (HBM) | Strong contributor to advanced packaging | >40% | AI accelerators |

| Chip-to-Substrate (C2S) | Exclusive supplier role, significant orders | High growth sector | Increasing semiconductor complexity |

What is included in the product

This BCG Matrix analysis provides a tailored view of ASM Pacific Technology's portfolio, highlighting which units to invest in, hold, or divest based on their market share and growth.

Provides a clear, visual overview of ASM Pacific Technology's portfolio, simplifying complex strategic decisions.

Cash Cows

ASM Pacific Technology's established Surface Mount Technology (SMT) solutions represent a significant Cash Cow. This sector, despite some current market headwinds, is fundamentally a mature and substantial market poised for healthy growth through 2033.

The company's broad range of SMT products ensures consistent revenue streams and robust profit margins, which stood impressively above 40% in the first half of 2025. This financial strength allows ASMPT to generate substantial cash flow from its SMT business.

ASM Pacific Technology's mainstream semiconductor packaging business in China, especially for electric vehicles and consumer electronics, is a significant cash cow. This segment is experiencing robust demand, with increasing utilization and bookings, demonstrating resilience even amidst broader industry fluctuations. In 2024, ASMPT's strong foothold in this large and growing market is expected to continue generating substantial and consistent cash flow for the company.

ASM Pacific Technology's core die bonding and wire bonding equipment represent significant cash cows for the company. Their established global leadership in these mature markets ensures a consistent and substantial revenue stream from a wide array of customers.

While these product lines may not exhibit explosive growth, they command considerable market share. This stability translates directly into reliable cash flow generation, underpinning ASMPT's financial strength.

In 2023, the semiconductor equipment industry, including bonding solutions, saw a projected revenue of approximately $130 billion, with ASMPT holding a notable position in these segments. The demand for advanced packaging, driven by AI and high-performance computing, continues to support the ongoing need for these essential machines.

Integrated Smart Factory Software Solutions (MES)

ASM Pacific Technology's Integrated Smart Factory Software Solutions, particularly their Manufacturing Execution Systems (MES), represent a strong Cash Cow. Through significant investments in Industry 4.0 capabilities, ASMPT delivers software that directly boosts customer efficiency and product quality. This focus on value-added software generates consistent, recurring revenue streams, solidifying customer relationships within the established manufacturing sector.

The MES segment is characterized by its ability to generate predictable income. For instance, ASMPT’s commitment to enhancing these solutions means customers rely on their software for ongoing operational improvements. This creates a stable revenue base, a hallmark of a Cash Cow, allowing ASMPT to leverage this strong position for other strategic initiatives.

- Recurring Revenue: MES solutions typically involve ongoing software licenses and support contracts, providing a predictable income stream for ASMPT.

- Customer Loyalty: By enhancing operational efficiency and quality, ASMPT's software solutions foster strong customer retention and loyalty in the manufacturing sector.

- Mature Market Strength: Operating in a mature manufacturing environment, these software offerings benefit from established demand and ASMPT's strong market presence.

- Strategic Investment Focus: ASMPT's continued development in MES and Industry 4.0 solutions ensures these offerings remain competitive and valuable to their customer base.

Broad Portfolio for General Electronics Assembly

ASM Pacific Technology's Broad Portfolio for General Electronics Assembly represents a significant Cash Cow. This segment offers a comprehensive suite of hardware and software solutions tailored for the general electronics assembly market, catering to a wide spectrum of end-user devices. The mature nature of this market ensures a stable and predictable demand for ASMPT's established product lines.

The company's extensive offerings in this area, which include solutions for consumer electronics, automotive, and industrial applications, contribute to a consistent revenue stream. For instance, in 2023, ASMPT reported revenue of HK$16.06 billion, with a substantial portion stemming from their established product segments serving these broader markets.

- Broad Market Reach: ASMPT's general electronics assembly solutions serve diverse end-user devices, ensuring a wide customer base.

- Mature Market Stability: The established nature of this market provides a consistent and reliable demand for ASMPT's products.

- Steady Revenue Generation: This segment acts as a dependable source of income, supporting overall company financial health.

- Established Product Lines: ASMPT leverages its long-standing presence and proven technologies in this segment.

ASM Pacific Technology's established Surface Mount Technology (SMT) solutions and mainstream semiconductor packaging business in China are significant Cash Cows. These segments, particularly for electric vehicles and consumer electronics, are experiencing robust demand and consistent revenue streams, demonstrating resilience. In 2024, ASMPT's strong position in these large and growing markets is expected to continue generating substantial and consistent cash flow.

The company's core die bonding and wire bonding equipment, along with its Integrated Smart Factory Software Solutions like MES, also represent strong Cash Cows. These mature markets ensure a consistent revenue stream, with software generating predictable income through licenses and support contracts, fostering customer loyalty.

ASMPT's Broad Portfolio for General Electronics Assembly, serving diverse end-user devices, provides a stable and predictable demand, acting as a dependable source of income. In 2023, ASMPT reported revenue of HK$16.06 billion, with a substantial portion stemming from these established product segments.

| Business Segment | BCG Category | Key Characteristics | 2023 Revenue Contribution (Est.) | Growth Outlook |

|---|---|---|---|---|

| Surface Mount Technology (SMT) | Cash Cow | Mature market, consistent revenue, strong profit margins (>40% H1 2025) | Significant | Healthy growth |

| Mainstream Semiconductor Packaging (China) | Cash Cow | Robust demand (EVs, consumer electronics), increasing utilization | Significant | Strong and consistent |

| Die Bonding & Wire Bonding Equipment | Cash Cow | Established global leadership, mature markets, stable revenue | Substantial | Moderate |

| Integrated Smart Factory Software (MES) | Cash Cow | Recurring revenue, customer loyalty, Industry 4.0 focus | Growing | Stable |

| General Electronics Assembly Portfolio | Cash Cow | Broad market reach, mature market stability, established products | Substantial | Steady |

What You’re Viewing Is Included

ASM Pacific Technology BCG Matrix

The preview you're currently viewing is the exact ASM Pacific Technology BCG Matrix report you will receive upon purchase. This comprehensive document, meticulously prepared for strategic insights, contains no watermarks or demo content, ensuring you get a fully formatted and ready-to-use analysis.

Rest assured, the BCG Matrix you see here is the definitive version that will be delivered after your purchase. It's a professionally crafted report designed to provide clear strategic direction, offering actionable insights into ASM Pacific Technology's product portfolio without any hidden alterations.

What you are previewing is the actual ASM Pacific Technology BCG Matrix file that will be yours once you complete the purchase. This means you'll receive the complete, analysis-ready document immediately, perfect for integration into your business planning and decision-making processes.

Dogs

Segments of traditional wire bonding equipment have faced challenges with below-optimal utilization, with some conventional back-end equipment seeing rates as low as 60%. This suggests a smaller market share coupled with limited growth in these particular areas.

This scenario places traditional wire bonding equipment firmly in the Dogs quadrant of the BCG Matrix. These are products that generate minimal cash and can even become a drain on resources, requiring careful management to avoid further investment.

The mainstream semiconductor equipment business serving the automotive and industrial sectors has experienced a noticeable slowdown. This softness is attributed to lower growth expectations and a potential erosion of ASMPT's competitive standing within these particular market niches.

Older, commoditized packaging technologies, while not explicitly categorized by ASM Pacific Technology, would likely represent their Dogs. These are legacy solutions facing intense price competition and declining demand as newer, more efficient methods emerge. For instance, traditional wire bonding technologies, while still functional, are increasingly being supplanted by advanced flip-chip and wafer-level packaging, leading to shrinking market share for older methods.

Products Affected by Tepid Consumer Spending (Non-Strategic Areas)

While ASMPT's strategic growth areas like AI data centers and Chinese EVs are showing promise, some of its mainstream business segments continue to feel the pinch of tepid consumer spending. These areas, outside of the high-growth strategic zones, are experiencing subdued demand.

These segments are characterized by low demand and a struggle to capture substantial market share, posing a risk of becoming cash traps for the company. For instance, in 2024, ASMPT's overall revenue growth, while positive, was largely driven by its advanced packaging and equipment solutions for the semiconductor industry, particularly those catering to AI and high-performance computing. However, segments serving more consumer-discretionary markets, such as certain types of consumer electronics manufacturing equipment, saw more modest performance.

The impact of this tepid spending is evident in the slower growth rates observed in these non-strategic product lines compared to the company's more forward-looking investments.

- Low Demand: Certain ASMPT product lines serving consumer-facing industries are experiencing a noticeable slowdown in order volumes.

- Market Share Struggles: These segments are finding it difficult to expand their footprint and gain significant traction against competitors.

- Cash Trap Risk: Continued investment in these underperforming areas without a clear path to recovery could tie up capital, acting as a drain on resources.

- 2024 Performance Snapshot: While ASMPT reported a consolidated revenue increase of approximately 10% year-on-year for the first half of 2024, a significant portion of this growth was attributed to its semiconductor equipment division, highlighting the differential performance across its business units.

Underperforming Niche SMT Machine Models

Within ASM Pacific Technology's extensive SMT (Surface Mount Technology) machine offerings, certain older or less competitive models, particularly those serving niche applications, have likely experienced a decline in market relevance. These specific machine models, often representing earlier generations of technology, might be facing increased competition from newer, more advanced solutions. Their contribution to the company's overall revenue is probably minimal, reflecting their reduced market share within their specialized segments.

These underperforming niche SMT machine models would typically fall into the Dogs quadrant of the BCG matrix. This classification signifies products with low growth and low market share. For instance, a specific older generation die-bonder designed for a very specialized semiconductor packaging process might now be overshadowed by more versatile and faster machines. ASM Pacific Technology’s 2023 annual report indicated a diverse product portfolio, but specific segment performance data for individual legacy SMT models is not publicly detailed, underscoring the challenge of pinpointing exact revenue contributions for such niche products.

- Low Market Share: These models likely hold a small percentage of their specific SMT sub-markets.

- Minimal Revenue Contribution: Their sales figures are expected to be negligible compared to the company's core product lines.

- Technological Obsolescence: They may be superseded by newer, more efficient SMT technologies.

- Niche Application Focus: Their specialized nature limits their broad market appeal.

Certain legacy product lines within ASM Pacific Technology, particularly those in traditional wire bonding and older SMT machines serving less dynamic markets, are classified as Dogs in the BCG Matrix. These segments exhibit low market share and minimal growth, often requiring careful management to prevent them from becoming cash drains.

For instance, while ASMPT's advanced packaging solutions for AI and high-performance computing are thriving, some equipment catering to more discretionary consumer markets saw subdued demand in 2024. This suggests that older, commoditized technologies are struggling against newer, more efficient alternatives, leading to reduced market relevance.

The company's 2023 annual report highlighted a diverse portfolio, but the performance of specific legacy SMT models is not publicly detailed, making it challenging to quantify their exact contribution. However, the overall trend indicates that segments with low demand and shrinking market share, such as older wire bonding equipment with utilization rates as low as 60%, are firmly in the Dogs quadrant.

These underperforming areas risk becoming cash traps if continued investment is not strategically re-evaluated, especially when compared to the robust growth seen in ASMPT's forward-looking investments.

Question Marks

ASMPT's second-generation Hybrid Bonding (HB) tools are positioned for the future of High Bandwidth Memory (HBM). These advanced tools are engineered for enhanced accuracy, crucial for next-generation HBM designs, and are slated for customer delivery in Q3 2025. This strategic move targets a rapidly expanding market segment.

While the market for advanced HB solutions presents significant growth potential, ASMPT's second-generation tools are currently in the nascent stages of market adoption. This translates to a relatively low market share at present, reflecting the early-stage penetration of this innovative technology.

ASM Pacific Technology's (ASMPT) advancements in ultrafine pitch chip-to-wafer (C2W) logic applications, particularly with a leading foundry, mark a significant step into a high-growth, next-generation area. This collaboration, moving from pilot phases to volume production, highlights a strong potential for future revenue streams.

While the technology is promising, ASMPT's market share within this emerging C2W logic segment is still in its formative stages, indicating a need for continued market penetration and competitive positioning. The company's investment in this area suggests a strategic focus on capturing future market demand in advanced packaging solutions.

ASM Pacific Technology's (ASMPT) traditional business segments are starting to see positive impacts from the burgeoning demand driven by AI data centers. This represents a nascent but promising growth avenue for the company's established product lines.

While the exact market size and ASMPT's potential share within this specific AI-driven mainstream equipment application are still taking shape, early indicators are encouraging. For instance, the global data center market was projected to reach over $300 billion in 2024, with AI workloads expected to significantly contribute to this expansion.

Solutions for Future 5G/6G and Autonomous Vehicle Technologies

ASM Pacific Technology's advanced packaging solutions are crucial enablers for the burgeoning 5G/6G and autonomous vehicle sectors. These technologies, like advanced wafer-level packaging and complex substrate integration, are essential for the high-density, high-performance components required by these future-facing industries.

While these markets represent significant growth potential, ASMPT's current penetration in specialized solutions for 5G/6G and autonomous vehicles is likely in its early stages. This suggests a need for focused research and development, strategic partnerships, and targeted market entry to capture substantial market share in these evolving high-growth areas.

- Market Growth: The global 5G infrastructure market was valued at approximately $20.3 billion in 2023 and is projected to reach over $130 billion by 2030, indicating substantial demand for enabling technologies.

- Autonomous Vehicle Impact: The automotive semiconductor market, driven by autonomous driving features, is expected to grow significantly, with advanced packaging being a key component in enabling the necessary processing power and reliability.

- ASMPT's Role: ASMPT's expertise in die attach, wire bonding, and advanced packaging is well-positioned to address the intricate manufacturing requirements of next-generation communication and automotive electronics.

- Strategic Focus: Continued investment in R&D for specialized packaging for AI accelerators, high-frequency communication modules, and robust automotive-grade components will be critical for ASMPT's success in these segments.

Newly Launched High-Speed SMT Placement Machines

ASM Pacific Technology's (ASMPT) newly launched high-speed SMT placement machines exemplify their commitment to innovation, addressing the dynamic demands of the electronics manufacturing sector. These advanced machines are designed to boost throughput and precision, crucial for industries like automotive electronics and 5G infrastructure, which are experiencing significant growth. For instance, the global SMT equipment market was valued at approximately USD 5.8 billion in 2023 and is projected to grow, with high-speed placement being a key driver.

These cutting-edge products are positioned within a growing market segment, aiming to capture market share through superior performance and technological advancements. However, as relatively new entrants, their market penetration and adoption are still in the early stages. ASMPT is investing heavily in sales and marketing to build brand awareness and customer trust, essential for establishing a dominant position.

- Product Category: Question Marks

- ASMPT's Strategy: Continuous new product launches to meet evolving market needs.

- Market Position: Targeting growing segments, but adoption and share are in initial phases.

- Key Focus Areas: Significant investment in marketing and sales to establish a strong market foothold.

ASMPT's advanced packaging solutions are crucial enablers for the burgeoning 5G/6G and autonomous vehicle sectors. These technologies, like advanced wafer-level packaging and complex substrate integration, are essential for the high-density, high-performance components required by these future-facing industries.

While these markets represent significant growth potential, ASMPT's current penetration in specialized solutions for 5G/6G and autonomous vehicles is likely in its early stages. This suggests a need for focused research and development, strategic partnerships, and targeted market entry to capture substantial market share in these evolving high-growth areas.

The global 5G infrastructure market was valued at approximately $20.3 billion in 2023 and is projected to reach over $130 billion by 2030, indicating substantial demand for enabling technologies. ASMPT's expertise in die attach, wire bonding, and advanced packaging is well-positioned to address the intricate manufacturing requirements of next-generation communication and automotive electronics.

ASMPT's strategy involves continuous new product launches to meet evolving market needs, targeting growing segments where adoption and market share are in initial phases. The company is making significant investments in marketing and sales to establish a strong market foothold.

| Market Segment | ASMPT's Current Position | Growth Potential | Key Enablers |

|---|---|---|---|

| 5G/6G Infrastructure | Early Stage Penetration | High (>$130B by 2030) | Advanced Wafer-Level Packaging, Substrate Integration |

| Autonomous Vehicles | Early Stage Penetration | High (Automotive Semiconductor Market Growth) | High-Density, High-Performance Components |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.