ASMedia PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ASMedia Bundle

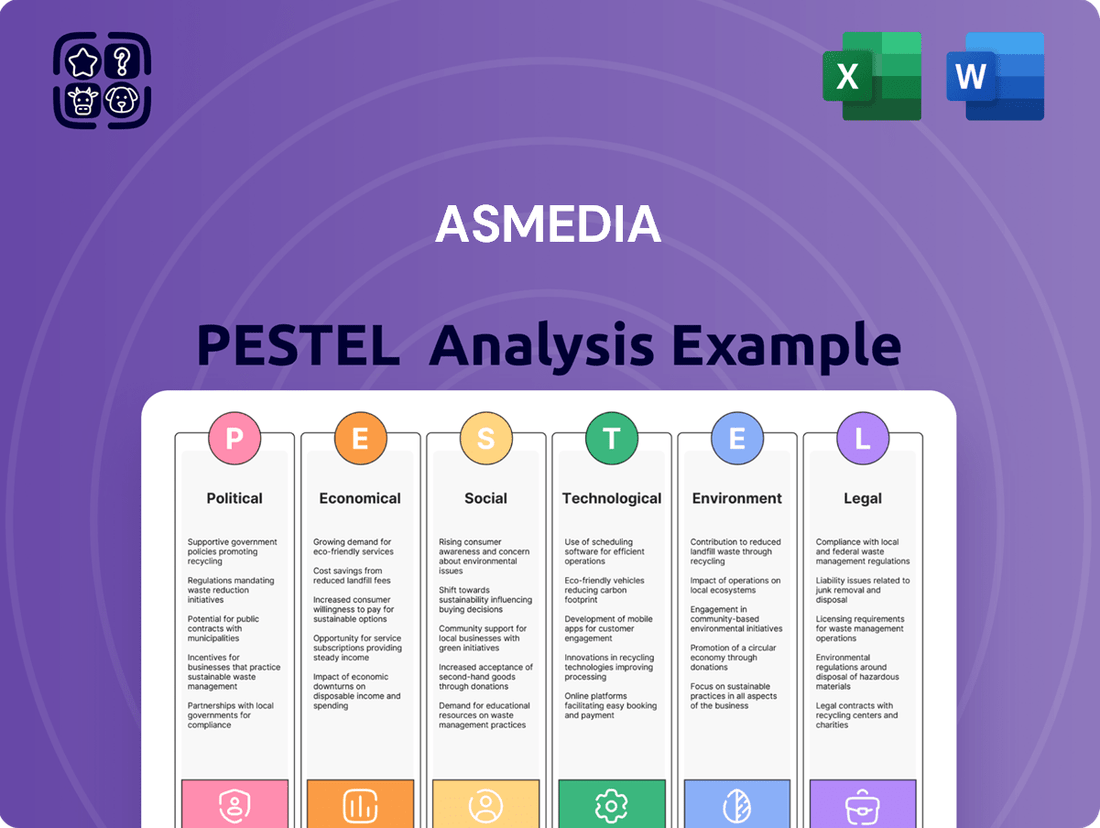

Navigate the dynamic landscape of the semiconductor industry with our comprehensive PESTLE analysis of ASMedia. Understand the political, economic, social, technological, legal, and environmental factors that are shaping ASMedia's present and future. This in-depth report provides actionable insights to inform your strategic decisions and competitive positioning. Unlock the complete analysis now and gain a critical advantage.

Political factors

The semiconductor industry is central to escalating geopolitical tensions, particularly between the U.S. and China. As a Taiwanese company, ASMedia operates from a strategic focal point, facing significant supply chain risks. Taiwan's critical role, producing over 60% of global semiconductors, amplifies these vulnerabilities. Any political instability or conflict in the Taiwan Strait could severely disrupt ASMedia's operations and the entire global technology economy, impacting semiconductor supply chains valued at trillions of dollars annually. This situation demands robust contingency planning for 2024 and 2025.

Governments globally, including the U.S. with its $52.7 billion CHIPS Act and the EU's €43 billion European Chips Act, are actively bolstering domestic semiconductor production in 2024-2025. These initiatives aim to reduce dependency on foreign suppliers, directly influencing ASMedia's strategic decisions regarding global manufacturing and partnerships. For instance, the CHIPS Act seeks to bring more chip fabrication onshore, potentially altering ASMedia's supply chain dynamics. Furthermore, potential changes in U.S. trade policy, such as new tariffs on Taiwanese semiconductor components, could directly impact ASMedia's export costs and market access. Such policy shifts necessitate ASMedia to adapt its operational and investment strategies for resilience.

Taiwan's dominance in semiconductor manufacturing, exemplified by companies like TSMC and ASMedia, forms a crucial 'silicon shield' for its national security. The Taiwanese government actively supports this industry to maintain its global leadership, with the semiconductor sector projected to contribute over 20% of Taiwan's GDP in 2024. This strong political backing provides a relatively stable operating environment for ASMedia, fostering innovation and global market access for its USB and PCIe solutions. However, ASMedia's position also places it at the epicenter of intense international political maneuvering, particularly between the US and China, influencing export controls and supply chain dynamics through 2025.

Export Controls and Blacklisting

The U.S. has imposed stringent export controls on semiconductor technology to China, impacting firms like SMIC, and Taiwan followed suit in 2024 by restricting shipments to blacklisted entities such as Huawei. These regulations compel Taiwanese companies like ASMedia to obtain government approval for exports, significantly impacting their market access and customer base, potentially reducing their China-bound revenue by 10-15% in 2025. This creates complex compliance burdens and forces a realignment of ASMedia's supply chains, prioritizing non-sanctioned markets.

- Taiwan's 2024 export controls mirror U.S. restrictions on semiconductor tech to China.

- ASMedia requires government approval for shipments to blacklisted Chinese entities like Huawei and SMIC.

- Potential 10-15% reduction in ASMedia's China-bound revenue for 2025 due to market access limitations.

- Compliance complexities necessitate supply chain realignment away from sanctioned customers.

International Alliances and Technology Pacts

International alliances are reshaping the semiconductor landscape as nations prioritize supply chain security. Initiatives like the U.S.-India ICET, launched in January 2023, aim to diversify production away from concentrated regions like Taiwan, which currently produces over 60% of global foundry output. While this geopolitical shift presents long-term risks of increased competition for ASMedia, it also creates significant opportunities for strategic partnerships and expansion into new markets, potentially boosting their market share in USB 4.0 and PCIe Gen5 solutions. Such pacts could lead to government-backed incentives for localized manufacturing, benefiting ASMedia's chip development and integration efforts.

- U.S.-India ICET focuses on diversifying critical tech supply chains.

- Taiwan holds over 60% of global foundry capacity, driving diversification efforts.

- New alliances offer ASMedia avenues for strategic partnerships and market expansion.

- Increased competition is a long-term risk for semiconductor component manufacturers.

Geopolitical tensions, particularly the US-China rivalry and Taiwan Strait stability, significantly impact ASMedia, with global semiconductor supply chains valued at trillions of dollars annually. Government incentives like the US CHIPS Act ($52.7B) and EU Chips Act (€43B) for 2024-2025 aim to onshore production, influencing ASMedia's strategic decisions. Taiwan's export controls, mirroring US restrictions, could reduce ASMedia's 2025 China-bound revenue by 10-15%, forcing supply chain realignment. International alliances like the U.S.-India ICET further reshape the competitive landscape.

| Factor | Impact | 2024/2025 Data | ||

|---|---|---|---|---|

| Geopolitical Risk | Supply Chain Disruption | Trillions $ semiconductor market | Taiwan Strait Instability | US-China Tensions |

| Government Policy | Onshoring Incentives | US CHIPS Act ($52.7B), EU (€43B) | Domestic Production Focus | Altered Supply Chains |

| Export Controls | Market Access Reduction | 10-15% ASMedia China revenue risk | Compliance Burdens | Supply Chain Realignment |

What is included in the product

This ASMedia PESTLE analysis provides a comprehensive overview of the macro-environmental factors impacting the company across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights and forward-looking perspectives to aid strategic decision-making and identify potential threats and opportunities.

A concise, actionable overview of ASMedia's PESTLE factors, enabling rapid identification of external opportunities and threats to inform strategic decision-making.

Economic factors

The global semiconductor market is poised for robust expansion, with projections indicating it will approach $700 billion in 2025. This significant growth, potentially reaching $1 trillion by 2030, is largely fueled by escalating demand from sectors like artificial intelligence, cloud computing, and advanced automotive applications. For ASMedia, a key player in high-speed connectivity and a fabless semiconductor company, this expanding market landscape translates into substantial opportunities for revenue acceleration. The increasing integration of high-performance components across various industries directly benefits ASMedia's specialized product offerings.

The semiconductor industry is grappling with rising inflation and escalating operational costs, directly impacting profitability. Notably, Taiwan's industrial electricity rates are projected to double between 2022 and 2025, eroding the region's historical competitive advantage in energy pricing. These increased expenses for foundries, which are ASMedia's manufacturing partners, translate into higher production costs. Consequently, fabless companies like ASMedia experience significant pressure on their gross margins due to these amplified operational expenditures. This economic shift necessitates strategic adjustments to maintain financial health.

The semiconductor industry, including ASMedia, has navigated significant supply chain disruptions and inventory imbalances in recent years. While the excess inventory situation is improving into early 2025, the market remains highly sensitive to geopolitical risks, especially concerning mature-node technologies. For instance, global chip inventory levels are projected to normalize by mid-2025, yet new shortages could emerge from unforeseen events. This necessitates careful inventory management and strategic sourcing to mitigate risks of both oversupply and critical component scarcity.

Currency Exchange Rate Fluctuations

As a global semiconductor solutions provider, ASMedia faces significant exposure to currency exchange rate fluctuations. The company's revenues, largely denominated in foreign currencies, can be materially impacted by the New Taiwan Dollar's (NTD) relative strength, especially against the US Dollar and Euro. For instance, a stronger NTD, which saw rates around 32.5 NTD per USD in early 2024, could reduce the value of overseas sales when converted back. Managing this inherent currency risk is a crucial financial challenge for ASMedia, influencing profit margins and overall financial performance.

- ASMedia's 2024 revenue conversion is sensitive to NTD/USD fluctuations, with the NTD trading around 32.5 per USD.

- A 1% appreciation of the NTD against major currencies could reduce reported foreign revenue value.

- Hedging strategies, such as forward contracts, are vital to mitigate potential 2025 foreign exchange losses.

- Global economic shifts, like US interest rate policy, directly influence NTD volatility and ASMedia's profitability.

Capital Expenditure and Investment Trends

The semiconductor industry demands immense capital expenditure for new fabrication plants, yet ASMedia's fabless model allows it to bypass these direct investments. Instead, ASMedia relies heavily on the capital investment cycles of its foundry partners, such as TSMC, whose 2024 capital expenditure is projected to be between $28 billion and $32 billion. These investments directly influence the availability of advanced process capacity and the associated costs for ASMedia's chip production. The success of the fabless model, commanding a significant share of market revenue, underscores its efficiency by enabling companies like ASMedia to focus solely on design and innovation rather than costly manufacturing.

- TSMC's projected capital expenditure for 2024 ranges from $28 billion to $32 billion.

- Global fabless semiconductor revenue is expected to grow by approximately 16% in 2024.

- New fab construction costs often exceed $10 billion, with some advanced fabs approaching $20 billion.

The semiconductor market's projected growth to nearly $700 billion in 2025 offers ASMedia significant revenue opportunities. However, rising operational costs, with Taiwan's industrial electricity rates doubling by 2025, pressure gross margins. Currency fluctuations, particularly the NTD's movement against the USD (around 32.5 in early 2024), also impact reported foreign earnings. ASMedia's fabless model benefits from foundry capital expenditures like TSMC's $28-32 billion for 2024, ensuring advanced capacity.

| Economic Factor | 2024/2025 Data Point | Impact on ASMedia |

|---|---|---|

| Semiconductor Market Growth | Approaching $700 billion by 2025 | Increased demand for high-speed connectivity solutions |

| Taiwan Electricity Rates | Projected to double 2022-2025 | Higher production costs from foundry partners |

| NTD/USD Exchange Rate | Around 32.5 in early 2024 | Affects foreign revenue conversion value |

Preview the Actual Deliverable

ASMedia PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use.

This ASMedia PESTLE analysis provides a comprehensive overview of the external factors impacting the company. It covers Political, Economic, Social, Technological, Legal, and Environmental aspects, offering crucial insights for strategic decision-making.

The content and structure shown in the preview is the same document you’ll download after payment, giving you immediate access to valuable market intelligence.

This professionally structured analysis is designed to equip you with the knowledge needed to navigate the complex business landscape ASMedia operates within.

Sociological factors

The consumer electronics market continues its robust growth, fueled by ongoing replacement cycles and increasing first-time buyers, especially in emerging markets. Projections for 2024 indicate global smartphone shipments reaching 1.2 billion units and PC shipments recovering to 260 million units, both segments heavily relying on high-speed connectivity solutions like those from ASMedia. Demand for smart home devices and wearables is also expanding rapidly, with the smart home market expected to exceed $150 billion in 2025. Trends toward hyper-personalization and AI-integrated devices further amplify this consumer demand.

The sustained global shift towards remote and hybrid work models has dramatically increased demand for high-performance home and professional computing equipment. This societal trend, further solidified in 2024, necessitates robust data transfer capabilities for laptops, PCs, and peripherals. ASMedia's core business in USB, PCIe, and SATA controllers directly addresses this need, as consumers and businesses upgrade their digital infrastructure. Analysts project continued strong demand for components supporting digital lifestyles through 2025, with PC shipments expected to reach 267 million units in 2024, highlighting the long-term relevance of ASMedia's offerings.

The health and wellness technology market is rapidly expanding, fueled by increased consumer health consciousness. Wearable devices like smartwatches and fitness trackers, which saw global shipments near 144 million units in 2023, are key drivers. This booming sector, projected to reach a market value of over $160 billion by 2025, significantly relies on efficient, low-power connectivity solutions. Consequently, this expanding market represents a substantial and growing opportunity for ASMedia's specialized integrated circuits.

Eco-Consciousness and Sustainability Demands

Consumers increasingly demand sustainable products, pressuring electronics brands to address e-waste and their carbon footprint. This societal shift, with over 60% of global consumers prioritizing eco-friendly options in 2024, extends to component manufacturers like ASMedia. Companies are expected to adopt green manufacturing principles and transparently report their environmental impact. The global e-waste volume, projected to exceed 74 million metric tons by 2030, highlights the urgency for sustainable practices across the supply chain, impacting ASMedia’s operational strategies and material sourcing by 2025.

- By 2025, new EU Ecodesign regulations will mandate stricter sustainability criteria for electronic components.

- Over 70% of Gen Z and Millennial consumers consider a brand’s environmental record before purchasing electronics in 2024.

- Taiwanese manufacturers, including ASMedia, face increasing pressure to align with global net-zero commitments by 2050.

- The global market for green electronics is forecasted to grow at a CAGR of 15% through 2025, driven by consumer demand.

Global Talent Shortage in Semiconductors

The semiconductor industry faces a critical global shortage of skilled talent, from advanced design engineers to essential manufacturing technicians. As a Taiwanese company, ASMedia competes fiercely for this limited pool against global industry giants. Reports from early 2024 indicate a deficit of over 10,000 skilled workers in Taiwan's semiconductor sector alone, with global shortages projected to reach 1 million by 2030 without intervention. Government and industry initiatives, like increased funding for STEM education and vocational training programs, are crucial for sustaining ASMedia's innovation and growth in this competitive landscape.

- Taiwan's semiconductor industry faced a talent gap of 10,000+ workers in early 2024.

- Global semiconductor talent shortages could exceed 1 million by 2030.

- ASMedia competes for talent against firms like TSMC and Intel.

- Initiatives like the National Science and Technology Council's talent cultivation programs are vital.

Societal shifts toward remote work and digital lifestyles continue to drive demand for high-performance computing, with PC shipments reaching 267 million units in 2024. The booming health and wellness technology market, projected to exceed $160 billion by 2025, further relies on ASMedia's connectivity solutions for wearables. Additionally, consumer preference for sustainable electronics, with over 60% prioritizing eco-friendly options in 2024, influences component sourcing and manufacturing practices.

| Sociological Factor | 2024/2025 Data Point | Impact on ASMedia |

|---|---|---|

| Digital Lifestyle & Remote Work | PC shipments: 267M units (2024) | Increased demand for USB, PCIe, SATA controllers |

| Health & Wellness Tech | Market value: >$160B (2025) | Opportunity for low-power connectivity in wearables |

| Consumer Sustainability Demand | 60%+ consumers prioritize eco-friendly (2024) | Pressure for green manufacturing and material sourcing |

Technological factors

ASMedia operates at the forefront of connectivity, with standards like USB4 and PCIe 6.0/7.0 constantly evolving. The industry push for faster data transfer, driven by AI and high-performance computing, means PCIe 6.0, ratified in 2022, is now reaching mainstream adoption with 64 GT/s per lane, while PCIe 7.0 is targeted for 2025 with 128 GT/s. This rapid pace necessitates continuous innovation in ASMedia's IC design to maintain its strong market position in 2024 and beyond. Keeping pace with these next-gen interfaces is critical for their controller chip dominance.

The exponential growth of Artificial Intelligence and High-Performance Computing is a primary driver for semiconductor demand. The global AI chip market is projected to exceed $83 billion by 2025, necessitating massive data throughput. This creates strong demand for ASMedia's high-speed interface solutions, particularly PCIe Gen 5 and upcoming Gen 6. The development of specialized AI processors and the need for seamless inter-processor communication further fuels innovation in data transfer technology for 2024-2025.

The burgeoning trend of major tech firms like Apple, Google, and Amazon designing custom in-house chips, such as Apple's M-series processors, significantly impacts ASMedia. This vertical integration, driven by a need for optimized performance and supply chain resilience, presents ASMedia with both collaboration opportunities for specialized IP and heightened competition. Industry projections for 2024-2025 indicate continued investment in custom silicon, with companies aiming to reduce reliance on off-the-shelf solutions and gain a competitive edge in AI and high-performance computing.

Advanced Semiconductor Packaging

Advanced semiconductor packaging is increasingly vital for boosting chip performance and integrating diverse components, especially in 2024 and 2025. These techniques are crucial for combining multiple chiplets into powerful processors, driving demand for innovative interconnects. ASMedia's high-speed interface IP, such as its PCIe Gen5 and upcoming Gen6 solutions, is essential for enabling the rapid communication needed between these chiplets within a single package. This positions ASMedia strategically in the expanding chiplet ecosystem, where market projections indicate advanced packaging could exceed $60 billion by 2025.

- The global advanced packaging market is forecast to reach approximately $65 billion by 2025.

- Chiplet-based designs are projected to comprise over 30% of high-performance computing (HPC) chips by 2026.

- ASMedia's high-speed interface IP supports critical standards like USB4 and PCIe Gen5, vital for inter-chiplet data flow.

- Increased demand for AI/ML accelerators in 2024-2025 heavily relies on advanced packaging for performance scaling.

Internet of Things (IoT) Expansion

The expansion of the Internet of Things (IoT) significantly drives demand for ASMedia's connectivity solutions, with global IoT market value expected to reach $1.3 trillion by 2025. Billions of devices, from industrial sensors to smart home gadgets, require reliable, high-speed data transfer. ASMedia's advanced chipsets are well-positioned to serve this growing need, facilitating efficient communication between these devices and cloud infrastructure. This trend ensures a consistent market for their high-performance data transfer technologies.

- Global IoT connections are projected to exceed 27 billion by 2025.

- Industrial IoT (IIoT) alone is forecast to grow at a CAGR of 22% through 2025.

- Demand for high-speed USB and PCIe interfaces in edge devices is increasing.

ASMedia operates amidst rapid technological evolution in 2024-2025, driven by evolving standards like PCIe 6.0/7.0 and surging demand from AI and high-performance computing. The shift towards custom in-house chips and advanced chiplet packaging necessitates continuous innovation in high-speed interface IP. Furthermore, the expanding IoT market creates sustained demand for ASMedia's connectivity solutions, crucial for modern data throughput requirements.

| Technology Trend | 2024-2025 Projection | Impact on ASMedia |

|---|---|---|

| AI Chip Market Value | >$83 Billion by 2025 | Increased demand for high-speed interfaces |

| Advanced Packaging Market | >$60 Billion by 2025 | Critical for chiplet interconnect solutions |

| Global IoT Market Value | $1.3 Trillion by 2025 | Sustained demand for connectivity chipsets |

Legal factors

As a fabless semiconductor company, ASMedia's intellectual property, including its USB 4.0 controller patents, represents its core asset. Protecting these patents and trade secrets from infringement is a critical legal concern within the highly competitive global semiconductor market, which saw over 500 IP-related lawsuits filed globally in 2023. The robustness of legal frameworks for IP protection in jurisdictions like Taiwan and the US, where ASMedia operates and sells its solutions, directly impacts its market position and potential revenue streams, which are projected to grow with increased adoption of new interface standards through 2025.

The semiconductor industry faces a complex web of international trade regulations, including evolving export controls and tariffs. ASMedia must meticulously navigate these rules, such as the ongoing Taiwanese restrictions on advanced technology exports to certain Chinese companies, which tightened further in early 2024 to align with global security frameworks. Non-compliance could result in substantial penalties and market access limitations, highlighting the need for a robust legal and compliance framework. This framework is crucial for ASMedia to manage the inherent risks associated with its global supply chain and export activities, ensuring adherence to the dynamic regulatory landscape as of mid-2025.

The electronics industry, including ASMedia, faces stringent Environmental, Health, and Safety (EH&S) regulations such as RoHS, REACH, and WEEE. These mandates dictate the permissible materials in chip manufacturing and the proper disposal of electronic waste, significantly impacting the entire supply chain. Compliance adds considerable complexity to product design and manufacturing processes, with the global e-waste volume projected to exceed 75 million metric tons by 2030, necessitating robust recycling and material management strategies.

Labor and Employment Laws

ASMedia must rigorously comply with Taiwan's labor laws, particularly concerning the recruitment and retention of highly skilled engineers, a fiercely competitive field. Regulations governing contracts for white-collar tech talent, including non-compete clauses, directly impact the company's ability to secure its workforce. Additionally, rules for hiring foreign professionals, updated through 2024, influence ASMedia's international talent acquisition strategies, while legal issues surrounding the illegal poaching of talent by competitors remain a persistent concern within the semiconductor sector.

- Taiwan's Ministry of Labor projects a 15% increase in demand for IC design engineers by mid-2025.

- New 2024 amendments to the Act for the Recruitment and Employment of Foreign Professionals aim to simplify long-term residency for high-tech talent.

- Over 70% of Taiwanese tech firms reported challenges in retaining key R&D personnel in 2024.

- Legal cases involving intellectual property and talent poaching in Taiwan's tech industry saw a 20% rise in 2024 compared to the previous year.

Corporate Governance and Securities Law

As a publicly-traded entity on the Taiwan Stock Exchange (TWSE), ASMedia Technology Inc. must strictly adhere to Taiwanese securities laws and robust corporate governance standards. This compliance covers detailed financial reporting, ensuring transparency for its shareholders, and upholding shareholder rights, which is critical given its current market capitalization exceeding NT$200 billion as of early 2025. Furthermore, regulations governing mergers and acquisitions, such as ASMedia's strategic acquisition of Techpoint, Inc. completed in 2024, are paramount. Strict adherence to these legal frameworks is essential for maintaining strong investor confidence and the overall integrity of the capital market.

- Taiwan Stock Exchange (TWSE) Listing: ASMedia's primary listing mandates compliance with specific Taiwanese regulatory bodies like the Financial Supervisory Commission (FSC).

- Financial Reporting Standards: The company must follow IFRS, with regular filings reviewed by the TWSE to ensure accuracy and transparency for investors.

- Shareholder Rights Protection: Regulations ensure fair treatment, including proxy voting mechanisms and access to company information, bolstering investor trust.

- M&A Regulatory Oversight: The 2024 Techpoint, Inc. acquisition required adherence to fair valuation and disclosure rules, preventing market manipulation and protecting all parties.

ASMedia navigates complex legal landscapes, crucial for its intellectual property and USB 4.0 patents, especially with over 500 IP lawsuits globally in 2023. Strict adherence to international trade regulations, like Taiwan's 2024 export controls, is vital to avoid penalties and market access limitations.

Compliance with stringent labor laws, including updated 2024 regulations for foreign professionals, impacts talent acquisition. Legal cases involving IP and talent poaching in Taiwan's tech sector rose 20% in 2024, posing ongoing challenges for ASMedia.

As a TWSE-listed company with a market capitalization over NT$200 billion as of early 2025, ASMedia must strictly follow Taiwanese securities laws and corporate governance standards, including transparent financial reporting and M&A oversight.

| Legal Aspect | Key Data/Regulation (2024-2025) | Impact on ASMedia |

|---|---|---|

| Intellectual Property | >500 global IP lawsuits (2023); USB 4.0 patents | Protects core assets, market position, revenue streams |

| Trade Regulations | Taiwanese export controls tightened (early 2024) | Ensures market access, avoids penalties for global supply chain |

| Labor Laws | 20% rise in talent poaching cases (2024); 15% IC engineer demand increase (mid-2025) | Influences talent acquisition, retention, and competitive edge |

| Securities & Governance | TWSE listing; Market Cap >NT$200B (early 2025) | Maintains investor confidence, ensures capital market integrity |

Environmental factors

Semiconductor fabrication is an incredibly energy and water-intensive process, with a single 300mm wafer fab potentially consuming over 15 million gallons of water daily and significant electricity. While ASMedia operates as a fabless company, the substantial environmental footprint of its foundry partners, such as TSMC or UMC, remains a critical concern within its value chain. There is escalating industry pressure for these manufacturing partners to transition to renewable energy sources, targeting goals like 50% renewable energy use by 2030, and to implement advanced water recycling systems, aiming for over 90% water recycling rates by 2025.

The rapid pace of technological advancement globally contributes to a growing problem of electronic waste, projected to reach 74.7 million metric tons by 2030. Increasing regulatory and consumer pressure, exemplified by the EU's Right to Repair legislation expected by 2025, pushes electronics companies to design products for longevity, repairability, and recyclability. This critical shift toward a circular economy affects the entire electronics value chain, including chip designers like ASMedia. ASMedia must ensure its USB and PCIe controller ICs support longer device lifespans and modularity to align with these evolving environmental standards.

The semiconductor manufacturing process, vital for ASMedia's products, heavily relies on hazardous chemicals and gases which pose significant environmental risks if not strictly managed. Global regulations, such as the EU's RoHS Directive 2011/65/EU and REACH Regulation (EC) No 1907/2006, rigorously limit or ban specific hazardous substances in electronic components. ASMedia must ensure its product designs and its manufacturing partners' processes are fully compliant with these evolving chemical management standards. Non-compliance could result in substantial fines, potentially exceeding millions of USD annually, and market access restrictions, particularly in key European markets, impacting revenue streams in 2024 and 2025.

Climate Change and Supply Chain Vulnerability

Climate change presents tangible physical risks to the semiconductor supply chain, notably the impact of severe drought on water-intensive processes like copper mining and chip fabrication. A substantial portion of global semiconductor supply, potentially over 50% by 2030, faces disruption from escalating climate events. This necessitates companies such as ASMedia integrating robust climate resilience into their supply chain strategies to mitigate future operational risks and ensure continuity.

- Taiwan, a key semiconductor hub, experienced significant drought in 2021, impacting water-intensive operations.

- Semiconductor fabs can consume millions of gallons of ultra-pure water daily, making them highly vulnerable to water scarcity.

- The World Economic Forum estimates that over 50% of global GDP, roughly $44 trillion, is moderately or highly dependent on nature and its services, including water availability.

Green Procurement and Sustainable Sourcing

The semiconductor industry faces increasing pressure for green procurement, with companies like ASMedia needing to ensure their supply chains meet strict environmental standards. There is a strong trend towards requiring suppliers to demonstrate sustainable practices, impacting how ASMedia sources its materials for chip design and development. This global push for ethical and sustainable raw materials means ASMedia must actively collaborate with partners committed to reducing their environmental footprint. Such initiatives are crucial as the industry projects significant growth, with the global semiconductor market expected to reach approximately $700 billion by 2025, intensifying the need for responsible sourcing.

- By 2025, many major tech companies aim to achieve significant reductions in supply chain emissions, driving demands for sustainable practices from their component suppliers.

- Taiwan's semiconductor strategy emphasizes resource efficiency and environmental protection, influencing companies like ASMedia to adopt greener operations.

- Investors increasingly evaluate semiconductor firms based on their Environmental, Social, and Governance (ESG) performance, linking sustainability to financial viability.

ASMedia operates within an industry under immense environmental scrutiny, driven by its fabless model's reliance on foundry partners facing pressure for sustainable practices like 90% water recycling by 2025. Growing electronic waste, projected to reach 74.7 million metric tons by 2030, and stringent hazardous material regulations necessitate ASMedia's product designs support longevity and compliance by 2024/2025. Climate change-induced water scarcity poses a significant threat to the semiconductor supply chain, potentially disrupting over 50% of global output by 2030, urging resilient strategies and green procurement in this $700 billion market by 2025.

| Environmental Factor | Impact on ASMedia | 2024/2025 Data Point |

|---|---|---|

| Water Scarcity Risk | Supply chain disruption via foundry partners | 90% water recycling target for fabs by 2025 |

| Electronic Waste (E-waste) | Demand for repairable, recyclable product designs | 74.7 million metric tons e-waste projected by 2030 |

| Hazardous Materials Compliance | Regulatory fines, market access restrictions | EU Right to Repair legislation expected by 2025 |

PESTLE Analysis Data Sources

Our ASMedia PESTLE Analysis is built upon a robust foundation of data, drawing from official government publications, reputable financial institutions, and leading industry research firms. Each factor is meticulously informed by current economic indicators, policy changes, and technological advancements.