ASMedia Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ASMedia Bundle

ASMedia operates in a dynamic semiconductor industry, facing intense competition and evolving technological landscapes. Understanding the forces that shape this market is crucial for strategic planning.

Our Porter's Five Forces analysis delves into the bargaining power of ASMedia's buyers and suppliers, scrutinizing pricing pressures and supply chain dependencies.

We also evaluate the threat of new entrants, assessing the barriers to entry and the potential for disruptive innovations in the semiconductor space.

Furthermore, the analysis examines the intensity of rivalry among existing competitors, highlighting ASMedia's competitive positioning and differentiation strategies.

Finally, we explore the threat of substitute products, identifying alternative solutions that could impact ASMedia's market share.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore ASMedia’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

As a fabless company, ASMedia is entirely dependent on third-party semiconductor foundries like TSMC for its chip manufacturing needs. These foundries wield significant bargaining power due to their high concentration and technological dominance, reflected in their pricing leverage. For instance, TSMC's 2024 capital expenditure forecast of $28-32 billion underscores its market position. Any geopolitical tensions or capacity constraints within these suppliers directly impact ASMedia's production timelines and costs, making supplier relationships critical for operational stability.

The specialized production of high-performance chips, essential for AI and high-speed data transfer, heavily relies on advanced packaging services like CoWoS. The number of providers offering these cutting-edge solutions is highly concentrated, with TSMC dominating the market. In 2024, TSMC is projected to significantly expand its CoWoS capacity, yet demand continues to outstrip supply, creating a bottleneck. This limited pool of suppliers grants immense bargaining power over fabless companies such as ASMedia, influencing costs and production timelines. This leverage means ASMedia must often accept supplier terms to secure necessary packaging for its innovative chip designs.

ASMedia's semiconductor manufacturing heavily relies on specialized raw materials, including high-purity silicon wafers and critical minerals like gallium and germanium. The global supply chain for these essential inputs is often concentrated in a few specific regions. This concentration makes the supply vulnerable to geopolitical instability and potential trade restrictions. For instance, China's control over a significant portion of gallium and germanium supplies, as highlighted by 2024 export controls, increases supplier leverage. Such dependence significantly enhances the bargaining power of these specialized raw material suppliers.

Intellectual Property (IP) and EDA tool providers

ASMedia, a fabless design house, heavily relies on Electronic Design Automation (EDA) software and licensed intellectual property (IP) cores to develop its integrated circuits. The EDA market, dominated by a few key players like Cadence, Synopsys, and Siemens EDA, grants these providers significant bargaining power. Access to essential IP for industry standards such as USB4 and PCIe Gen 5 is critical for ASMedia's product development, making licensing terms a substantial cost factor.

- The global EDA market was valued at approximately 13.7 billion USD in 2023, with projections indicating continued growth into 2024.

- Major EDA vendors command high prices due to the specialized nature and essentiality of their tools for chip design.

- ASMedia's reliance on licensed IP, particularly for high-speed connectivity standards, incurs ongoing royalty and licensing fees.

- IP licensing costs can represent a notable percentage of research and development expenses for fabless semiconductor companies.

Long-term strategic partnerships

While dependency creates supplier power, ASMedia mitigates this by fostering strong, long-term partnerships with key suppliers like TSMC. These relationships are often collaborative, ensuring access to critical production capacity and aligning technology roadmaps for products like PCIe Gen5 controllers. However, the fundamental power still resides with foundries that own the manufacturing capabilities, given TSMC's dominant market share. ASMedia's collaboration with AMD also strengthens its position.

- TSMC held over 60% of the pure-play foundry market share in Q1 2024.

- ASMedia relies on TSMC for its advanced USB 4 and PCIe Gen5 controller production.

- AMD remains a major customer, integrating ASMedia's controllers into its chipsets.

ASMedia faces substantial supplier bargaining power due to its reliance on highly concentrated foundries like TSMC, which held over 60% of the pure-play market in Q1 2024. Specialized inputs such as CoWoS packaging, where demand continues to outstrip TSMC's expanding 2024 capacity, and critical raw materials subject to 2024 export controls, amplify this leverage. Essential EDA software and IP from a few dominant vendors, with the global EDA market valued at approximately 13.7 billion USD in 2023, also contribute to higher costs. While ASMedia mitigates this through strategic partnerships, the fundamental power imbalance impacts production and expenses.

| Supplier Category | Key Suppliers/Inputs | 2024 Data/Impact |

|---|---|---|

| Semiconductor Foundries | TSMC | Over 60% pure-play foundry market share Q1 2024 |

| Advanced Packaging | TSMC (CoWoS) | Demand outstrips expanding 2024 capacity |

| Raw Materials | Gallium, Germanium | China's 2024 export controls increase leverage |

| EDA Software & IP | Cadence, Synopsys, Siemens EDA | Global EDA market ~13.7B USD in 2023, ongoing growth |

What is included in the product

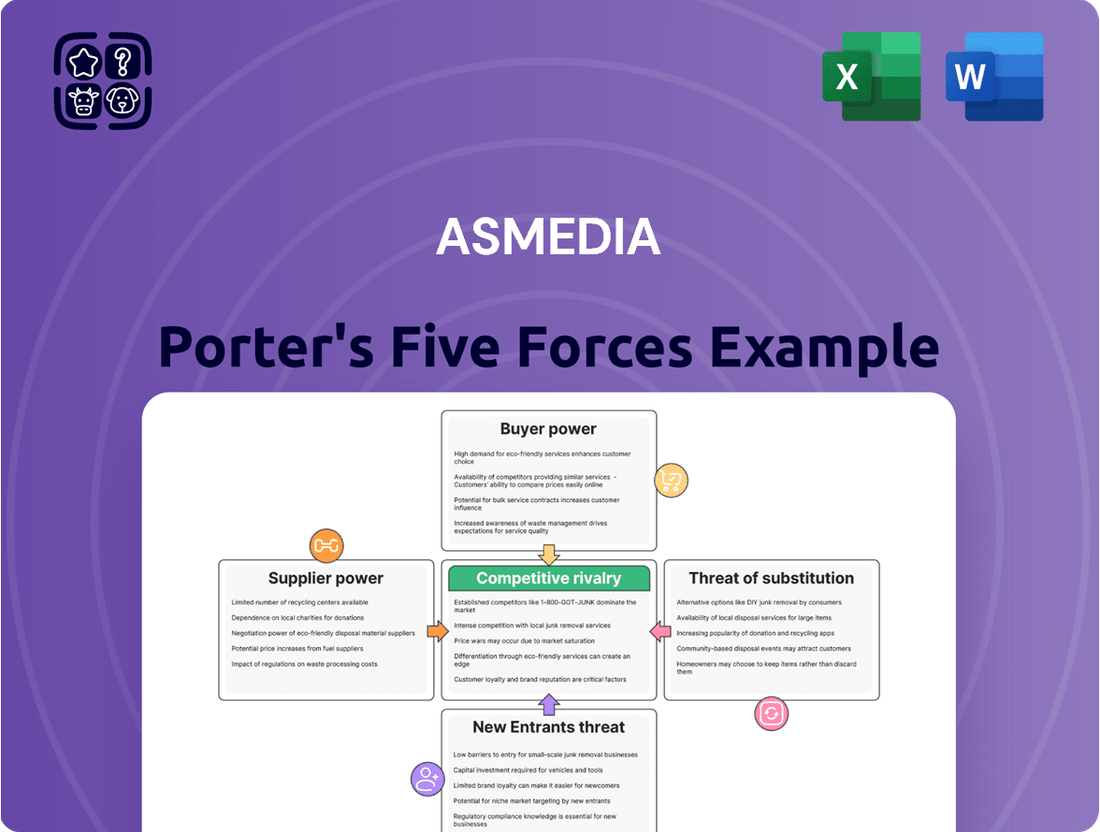

This analysis unpacks the competitive forces shaping ASMedia's market, examining supplier power, buyer bargaining, new entrant threats, substitute product risks, and the intensity of rivalry.

Effortlessly identify and mitigate competitive threats with a visual representation of ASMedia Porter's Five Forces, allowing for proactive strategic adjustments.

Customers Bargaining Power

ASMedia's revenue heavily depends on a limited number of large customers, particularly within the PC and motherboard sectors. Major players like AMD represent a significant portion of their business, alongside large original equipment manufacturers and motherboard makers such as ASUS. These high-volume purchasers possess substantial bargaining power, enabling them to negotiate favorable pricing and terms. This customer concentration exposes ASMedia to considerable risk from shifts in its key clients' market share or strategic direction through 2024 and beyond.

In the highly competitive PC market, motherboard manufacturers and OEMs constantly seek cost optimization, giving them significant bargaining power. While ASMedia's specialized USB4 and PCIe Gen 5 retimer chips offer performance advantages, the pressure to reduce bill-of-materials costs remains intense. Customers can consider alternative chipsets from rivals like VIA Labs for certain applications, especially as the PC market saw a projected 2.6% shipment growth in 2024, emphasizing cost efficiency. This availability of competing solutions means customers face relatively low switching costs in some segments, empowering their negotiation.

Major customers such as AMD and Intel possess the technical capability to integrate high-speed I/O functionalities directly into their CPUs and chipsets. This potential for backward integration creates a significant threat, bolstering their bargaining power over ASMedia. For example, Intel's 2024 roadmap continues to emphasize integrated platform solutions. ASMedia effectively counters this by consistently offering specialized, cutting-edge solutions for the very latest standards, which integrated designs may not yet support. This strategic focus helps ASMedia maintain its market position.

Price sensitivity of the end market

The end market for ASMedia's components, primarily consumer electronics like PCs and storage devices, is highly price-sensitive. This inherent price pressure on final products directly translates into demands for competitive pricing from component suppliers such as ASMedia. Customers, including major PC manufacturers, relentlessly push for lower component costs to maintain their own profit margins, especially given the competitive landscape of consumer electronics in 2024. This constant downward pressure on pricing forces ASMedia to optimize its production and operational efficiencies.

- Global PC shipments, a key end market for ASMedia, saw a projected recovery in 2024, with modest growth expected after declines in 2023, but price competition remains fierce.

- The average selling price (ASP) for many consumer electronics, like external storage devices, has remained under pressure, directly impacting component pricing.

- In Q1 2024, ASMedia reported a gross margin of approximately 47.9%, reflecting the balance between pricing power and market competition.

Importance of performance and innovation

While pricing is a factor, the performance and innovation in ASMedia's chips are crucial for its customers' end products. As a leader in new standards like USB4, ASMedia provides essential, high-performance technology that enables its customers to differentiate their offerings. This technological leadership and a strong reputation for quality significantly reduce customer bargaining power. Switching from ASMedia's solutions, especially given the rapid adoption of USB4 in 2024, could mean compromising on critical performance and features.

- ASMedia's 2024 USB4 controller shipments are pivotal for high-speed connectivity.

- Superior chip performance allows customers to gain competitive edge in consumer electronics.

- Innovation in I/O standards reduces customer leverage due to specialized technical needs.

- Reliable quality minimizes customer risks, limiting their power to demand concessions.

ASMedia faces significant customer bargaining power due to reliance on a few large clients like AMD, who negotiate favorable terms, especially given the PC market's focus on cost efficiency. The threat of backward integration from major customers like Intel also bolsters their leverage. However, ASMedia's cutting-edge USB4 and PCIe Gen 5 innovations, pivotal for high-performance products, somewhat mitigate this power by making switching costly in terms of performance and features. ASMedia's Q1 2024 gross margin of approximately 47.9% reflects this dynamic balance between customer demands and technological value.

| Factor | 2024 Data Point | Impact on Bargaining Power |

|---|---|---|

| PC Shipments Growth | Projected 2.6% growth | Slightly increases customer price demands due to competition |

| ASMedia Gross Margin | Q1 2024: 47.9% | Reflects balance of pricing power vs. market pressure |

| USB4 Adoption | Pivotal controller shipments | Reduces customer leverage due to specialized tech needs |

Preview the Actual Deliverable

ASMedia Porter's Five Forces Analysis

This preview showcases the complete ASMedia Porter's Five Forces analysis, offering a comprehensive examination of the competitive landscape. The document you see here is precisely what you will receive immediately after purchase, ensuring no surprises or missing information. This professionally formatted analysis is ready for your immediate use, providing valuable insights into ASMedia's industry dynamics. You are viewing the final, ready-to-use document, guaranteeing instant access to this detailed strategic evaluation upon completion of your purchase.

Rivalry Among Competitors

ASMedia faces significant competitive rivalry from large integrated device manufacturers (IDMs) such as Intel and AMD. These dominant players possess the advantage of integrating I/O controller functionalities directly into their central processing units (CPUs) and platform controller hubs (PCHs). This strategic integration, prominent in 2024 PC architectures, inherently reduces the available market for ASMedia's discrete controller chips. Consequently, this direct integration strategy by major IDMs presents a substantial and ongoing competitive threat to ASMedia's core business.

The fabless semiconductor market for interface ICs, where ASMedia operates, faces intense direct competition. Key rivals like Realtek, Phison, VIA Labs, and Microchip fiercely compete across product lines such as USB, PCIe, and SATA controllers. This rivalry centers on price, performance, and feature sets, continuously pressuring profit margins. For instance, in 2024, the demand for high-speed connectivity solutions continues to drive innovation, but also intensifies price competition among these major players, impacting ASMedia's strategic positioning.

The high-speed interface industry, vital for ASMedia, faces rapid technological advancements and evolving standards, such as the ongoing transition from PCIe 4.0 to PCIe 5.0, with PCIe 6.0 development active in 2024. Companies must heavily invest in research and development to stay competitive, a significant expenditure for firms like ASMedia in 2023. Being first-to-market with certified solutions is critical. Failure to innovate quickly, especially as USB4 gains wider adoption in 2024, can lead to a rapid loss of market share and intensified competitive rivalry.

Strategic importance of partnerships

Success in this industry hinges on robust relationships with major platform providers like AMD and Intel, along with key motherboard and PC OEMs. ASMedia maintains a strong design relationship with AMD for its chipsets, evidenced by its role in USB 4 and PCIe Gen 4/5 controller solutions. This tight integration is crucial, as competitors also fiercely vie for these pivotal strategic partnerships, making the landscape highly contested for market share.

- ASMedia's 2024 revenue projections are significantly influenced by its continued collaboration with AMD for new platform chipsets.

- The global PC market's projected growth in 2024, albeit modest, underscores the importance of securing OEM design wins.

- Competitors like Realtek also aggressively pursue partnerships, intensifying the rivalry for crucial design-ins.

- Strategic alliances dictate market penetration and technology adoption rates for new interface standards.

Price-based competition in mature markets

While innovation drives new standards, ASMedia's controllers for mature technologies often face intense price-based competition. As a technology like USB 3.2 Gen 1 becomes mainstream, it is increasingly integrated into larger System-on-Chips (SoCs) by major platform providers, reducing demand for discrete components. This dynamic forces ASMedia to maintain a balanced portfolio of cutting-edge solutions, like USB4, alongside legacy products that face pressure from lower-cost providers in 2024. The average selling prices for mature connectivity ICs continue to decline, intensifying the competitive rivalry.

- Mature USB 3.2 Gen 1/2 controllers see significant price erosion.

- Increased integration into CPU/chipset SoCs by Intel and AMD reduces discrete controller market.

- Lower-cost manufacturers from competitive regions drive down market prices.

- Maintaining profitability requires a strategic balance of high-margin innovations and volume-driven mature products.

ASMedia faces intense competitive rivalry from integrated device manufacturers like Intel and AMD, who integrate I/O functions into their CPUs, reducing the market for discrete chips. Direct competitors such as Realtek and Phison also pressure ASMedia on price, performance, and features across high-speed interface ICs. The necessity for continuous R&D for evolving standards like USB4 and PCIe 5.0, crucial in 2024, further intensifies this competition. Maintaining strategic partnerships and navigating declining average selling prices for mature technologies are critical for ASMedia's market position.

| Metric | 2024 Outlook | Impact on ASMedia |

|---|---|---|

| Global PC Shipments Growth | Projected 2-3% increase | Modest growth offers some opportunity, but intensifies fight for design wins. |

| USB4/PCIe 5.0 Adoption | Increasing in premium/new platforms | Critical for ASMedia's high-margin product growth, requires timely innovation. |

| Mature IC ASP Trends | Continued 5-10% decline annually | Pressures profitability on legacy products, necessitates focus on new technologies. |

SSubstitutes Threaten

The most significant substitute threat for ASMedia is the ongoing integration of high-speed I/O controllers directly into CPUs or SoCs by major players like Intel and AMD.

This trend, increasingly prevalent in 2024 with more extensive USB4 and PCIe integration into mainstream chipsets, diminishes the need for standalone discrete controller chips.

As CPU manufacturers like Intel, holding a significant share of the global PC market, continue this integration, ASMedia's market for basic I/O expansion shrinks.

Consequently, ASMedia must pivot, focusing on providing advanced next-generation standards or offering specialized port configurations not natively included by these CPU giants.

Alternative high-speed interconnect technologies present a moderate threat to ASMedia, though their core markets remain strong. While USB, PCIe, and SATA dominate, Thunderbolt, increasingly converged with USB4, offers a high-performance alternative, seeing more adoption in 2024. For specialized high-performance computing, InfiniBand and high-speed Ethernet can substitute PCIe, offering speeds like 400GbE. However, ASMedia's strong position in PC and storage markets benefits from the robust ecosystem and widespread adoption of USB (e.g., USB 3.2, USB4) and PCIe (e.g., PCIe Gen 5) standards, which are deeply integrated into consumer and enterprise platforms.

Wireless connectivity solutions, such as Wi-Fi 6E/7 and 5G, offer alternatives for some data transfer needs, potentially substituting for wired USB connections in specific scenarios. While the convenience of wireless is appealing, especially with Wi-Fi 7 offering theoretical speeds up to 46 Gbps in 2024, these technologies generally cannot match the sustained speed and stability of high-speed wired interfaces for large data transfers or high-demand peripherals. For ASMedia, whose core business relies on wired USB controller chips, this substitution is currently limited to low-bandwidth or highly mobile use cases. Therefore, the threat posed by wireless solutions to ASMedia's primary revenue streams remains relatively low.

Software-based interface solutions

Software-based interface solutions present a very limited threat to hardware interface controller manufacturers like ASMedia. These software alternatives simply cannot match the performance, reliability, or low latency essential for high-speed data transfer protocols. Hardware-based integrated circuits remain indispensable for the efficient operation of critical interfaces such as USB, PCIe, and SATA in 2024, ensuring robust system stability and data integrity.

- Hardware ICs offer sub-microsecond latency, crucial for high-bandwidth data.

- Software emulation significantly increases CPU overhead, impacting system performance.

- The global USB controller market, dominated by hardware, was valued at over $1.5 billion in 2023.

- PCIe Gen 5 and upcoming Gen 6 demand hardware-level signal integrity, unattainable by software.

Emergence of chiplets and heterogeneous integration

The emergence of chiplet-based designs presents a significant substitution threat for ASMedia. While ASMedia can offer its IP as a chiplet, this model empowers platform manufacturers to more easily integrate intellectual property from various vendors or their own in-house designs. This flexibility could lead to ASMedia's full controller chips being substituted by smaller, specialized IP blocks from competitors within a larger, integrated package. The industry's adoption of standards like UCIe (Universal Chiplet Interconnect Express) in 2024 further accelerates this modular trend.

- By 2024, the chiplet market was rapidly expanding, driven by demand for custom silicon.

- Major players like Intel and AMD are heavily investing in chiplet architectures for their next-gen processors.

- The UCIe standard, gaining traction in 2024, facilitates multi-vendor chiplet integration.

- This modular approach could reduce reliance on single-vendor integrated solutions.

ASMedia primarily faces substitution from CPU manufacturers like Intel and AMD integrating high-speed I/O controllers, including USB4 and PCIe, directly into their processors, a trend accelerating in 2024.

The growing adoption of chiplet-based designs, driven by standards such as UCIe, also threatens ASMedia by enabling the integration of specialized IP blocks from various vendors. This reduces the need for discrete controller chips.

While alternative wired interconnects like Thunderbolt and wireless solutions like Wi-Fi 7 offer limited substitution for some applications, software-based alternatives are not viable due to performance and reliability constraints crucial for high-speed data.

| Threat Type | Impact Level | 2024 Context |

|---|---|---|

| CPU Integration | High | USB4/PCIe Gen5 integration pervasive. |

| Chiplets | High | UCIe adoption, Intel/AMD investment. |

| Wireless | Low | Wi-Fi 7 (46 Gbps), but wired stability prevails. |

Entrants Threaten

Entering the fabless semiconductor design industry, especially for advanced high-speed mixed-signal ICs like ASMedia's, demands substantial research and development investment. Designing these complex chips requires deep engineering expertise and significant capital to fund extensive design, testing, and validation cycles. In 2024, leading semiconductor firms often allocate over 15% of their revenue to R&D, reflecting the immense financial commitment needed. These high upfront costs act as a formidable barrier, significantly deterring potential new entrants from competing effectively.

New entrants into the controller design market, especially for standards like USB and PCIe, face a significant barrier due to the need for extensive intellectual property. Developing proprietary IP for these complex chip designs is incredibly costly and time-consuming, requiring substantial R&D investment through 2024 and beyond. Alternatively, licensing existing IP from established players like ASMedia, which holds numerous patents in high-speed connectivity, is prohibitively expensive. Navigating this dense patent landscape without infringing on existing IP presents a major legal and financial challenge, effectively deterring potential competitors.

ASMedia benefits from robust, long-standing relationships with key partners, including premier foundries like TSMC and major customers such as AMD and leading motherboard manufacturers. In 2024, securing advanced manufacturing capacity at leading-edge nodes remains fiercely competitive, making it exceptionally challenging for new entrants to gain a foothold. Building the deep trust and collaborative design-win relationships with customers required to displace established players like ASMedia takes years, further solidifying their market position. This network of strong, embedded relationships acts as a significant barrier for any potential newcomer.

Economies of scale and experience curve

The semiconductor industry, where ASMedia operates, is characterized by substantial economies of scale and a steep experience curve, posing a significant barrier for new entrants. Established players like ASMedia, with decades of optimization in design flows and supply chains, achieve significantly lower unit costs and higher yields. A new company would face immense challenges in matching the cost efficiency and pricing of incumbents. For instance, the average cost of developing a leading-edge semiconductor fab in 2024 is estimated to exceed $15 billion, a prohibitive investment for a newcomer.

- New fab construction costs frequently surpass $15 billion as of 2024.

- Incumbents benefit from decades of optimized supply chain efficiencies.

- Yield rates for mature processes often exceed 90% for established firms.

- Market share data indicates dominant players control over 70% of the global semiconductor market in 2024.

Complex certification and compliance requirements

New entrants into the semiconductor industry, particularly for interface controllers like those ASMedia produces, face significant hurdles due to complex certification. Products must undergo rigorous testing and certification by industry standards bodies such as the USB-IF to ensure vital interoperability. This process is both time-consuming and expensive, often requiring deep technical knowledge of intricate specifications. For instance, achieving USB4 certification in 2024 involves extensive validation and can incur substantial engineering and testing costs. The complexity and financial burden of compliance create a formidable barrier, effectively limiting the threat of new companies entering this specialized market.

- USB-IF compliance is mandatory for interoperability, a key barrier.

- Rigorous testing cycles extend product development timelines significantly.

- Certification costs can run into hundreds of thousands of USD per product family.

- Deep technical expertise is required, making talent acquisition challenging for startups.

The threat of new entrants for ASMedia is low due to formidable barriers, including the massive R&D investment for high-speed ICs, often exceeding 15% of revenue for leading firms in 2024. Extensive IP requirements and costly licensing, alongside the need for deep, trusted relationships with foundries like TSMC and key customers, further deter new players. Significant economies of scale and the $15 billion average cost for a new semiconductor fab in 2024 establish a high barrier. Moreover, rigorous and expensive industry certifications, such as USB4 compliance, add substantial hurdles for newcomers.

| Barrier Type | Impact | 2024 Data Point |

|---|---|---|

| R&D Investment | High Capital Outlay | >15% of revenue for leading firms |

| Economies of Scale | Cost Efficiency | New fab cost >$15 billion |

| Certification | Time/Cost Burden | USB4 validation is extensive |

Porter's Five Forces Analysis Data Sources

Our ASMedia Porter's Five Forces analysis is built upon a robust foundation of data, drawing from company annual reports, industry association publications, and market research databases. This comprehensive approach ensures accurate insights into competitive rivalry, supplier power, and buyer influence.