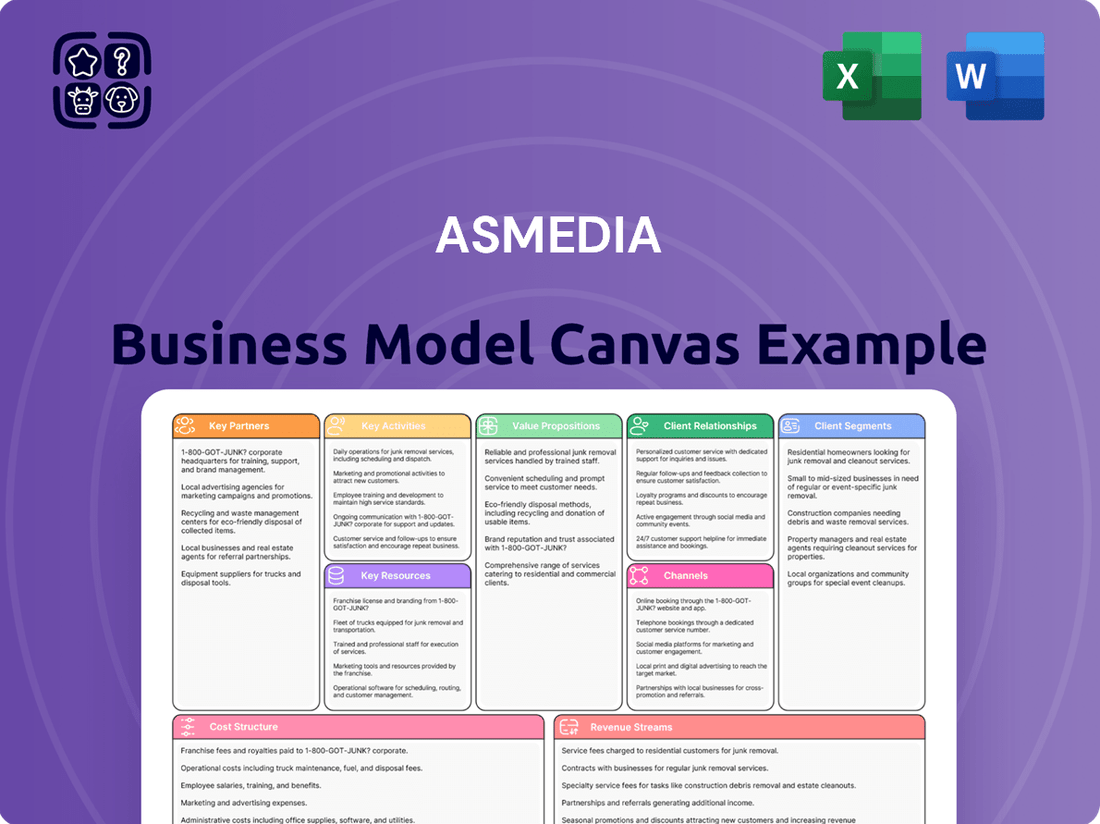

ASMedia Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ASMedia Bundle

Unlock the full strategic blueprint behind ASMedia's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Dive deeper into ASMedia’s real-world strategy with the complete Business Model Canvas. From value propositions to cost structure, this downloadable file offers a clear, professionally written snapshot of what makes this company thrive—and where its opportunities lie.

Want to see exactly how ASMedia operates and scales its business? Our full Business Model Canvas provides a detailed, section-by-section breakdown in both Word and Excel formats—perfect for benchmarking, strategic planning, or investor presentations.

Gain exclusive access to the complete Business Model Canvas used to map out ASMedia’s success. This professional, ready-to-use document is ideal for business students, analysts, or founders seeking to learn from proven industry strategies.

See how the pieces fit together in ASMedia’s business model. This detailed, editable canvas highlights the company’s customer segments, key partnerships, revenue strategies, and more. Download the full version to accelerate your own business thinking.

Partnerships

As a fabless company, ASMedia's most crucial partnerships are with leading semiconductor foundries, predominantly TSMC, which manufactures their advanced chip designs.

These relationships grant ASMedia access to cutting-edge process nodes, such as TSMC's 5nm and 3nm technologies, vital for producing high-performance, power-efficient integrated circuits demanded in 2024.

Effectively managing this complex supply chain is fundamental to ASMedia's operational success, ensuring consistent product availability and meeting robust customer demand for their USB and PCIe solutions.

Collaborating with CPU giants like AMD and Intel is crucial for ASMedia, ensuring their controller chips are compatible and optimized for the latest computing platforms. ASMedia maintains a particularly strong strategic partnership with AMD, often developing dedicated chipsets for their Ryzen platforms, like the B650 and X670 series. This deep integration ensures ASMedia products are designed-in from the start, securing a significant market share within AMD's ecosystem. For instance, ASMedia's USB4 controller solutions are vital for AMD's forward-looking platform designs in 2024.

The relationship with ASUSTeK provides ASMedia with crucial strategic stability and a reliable sales channel, deeply integrating them into one of the world's largest motherboard and PC manufacturers. This affiliation grants ASMedia invaluable market insights and a consistent revenue base. For instance, ASMedia’s 2024 revenue projections benefit significantly from ASUS’s continued demand for their USB 3.2 and PCIe 4.0 controller chips. This strong partnership acts as a significant competitive advantage and a vital testing ground for new technologies, ensuring ASMedia's products align perfectly with industry trends and ASUS’s extensive product lines.

Technology Standards Organizations (e.g., USB-IF, PCI-SIG)

Active participation in technology standards organizations like the USB Implementers Forum (USB-IF) and PCI-SIG is fundamental for ASMedia. These crucial partnerships ensure ASMedia's chipsets align with the latest industry specifications, including USB4 Version 2.0 and PCIe 6.0, which are vital for 2024 product roadmaps. Certification from these bodies, such as USB-IF's Certified USB product listing, is a prerequisite for market acceptance and guarantees interoperability across diverse hardware ecosystems. This compliance is critical for securing design wins with major PC and device manufacturers.

- ASMedia has achieved over 100 USB-IF certifications for its various controllers.

- PCIe 6.0 products are projected to see initial deployments in data centers by 2024-2025.

- USB4 Version 2.0 offers up to 80 Gbps bidirectional bandwidth, doubling previous speeds.

- Compliance ensures ASMedia's controllers are integrated into leading platforms from Intel and AMD.

OEMs & ODMs (e.g., Gigabyte, MSI)

Beyond its parent company, ASMedia maintains deep, collaborative partnerships with major Original Equipment Manufacturers (OEMs) and Original Design Manufacturers (ODMs like Gigabyte and MSI. These relationships are vital for securing design wins, ensuring ASMedia's chips are integrated into a wide range of motherboards, laptops, and storage devices. Strong technical support and co-development efforts are key to nurturing these partnerships, leading to a robust market presence.

- ASMedia's USB 4 controller adoption is critical for 2024 motherboard platforms.

- Collaborations secure integration into new product lines, boosting chip shipments.

- Technical co-development ensures compatibility and optimized performance for OEM products.

- Partnerships with top-tier OEMs drive significant revenue streams for ASMedia.

ASMedia’s key partnerships with leading foundries like TSMC ensure access to crucial 5nm and 3nm process nodes for their 2024 chip production.

Strategic alliances with CPU giants such as AMD integrate their USB4 and PCIe controllers into new platforms, securing significant design wins.

The strong affiliation with ASUSTeK provides a stable sales channel and market insights, significantly boosting ASMedia’s 2024 revenue projections.

Finally, collaborations with standards bodies like USB-IF and major OEMs ensure compliance and broad market adoption for their 2024 product lines.

| Partnership Type | Key Benefit | 2024 Impact |

|---|---|---|

| Foundries (TSMC) | Advanced Process Access | 5nm/3nm chip production |

| CPU Giants (AMD) | Platform Integration | USB4 controller adoption |

| ASUSTeK | Stable Revenue Channel | Enhanced revenue projections |

What is included in the product

A detailed, structured overview of ASMedia's operations, outlining key customer segments, value propositions, and revenue streams to guide strategic decision-making.

This model provides a clear, actionable framework for understanding ASMedia's market position, competitive advantages, and future growth opportunities.

The ASMedia Business Model Canvas effectively addresses the pain point of fragmented strategic planning by offering a unified, visual representation of all key business elements.

This allows for a clear understanding of how each component contributes to customer value, thereby alleviating the confusion often associated with complex business strategies.

Activities

ASMedia’s core activity centers on the intricate design, rigorous verification, and precise layout of advanced, high-speed interface ICs. This process heavily relies on sophisticated Electronic Design Automation (EDA) tools to craft detailed chip blueprints. It is an R&D-intensive endeavor, underpinning the company’s primary value generation and intellectual property creation. For instance, ASMedia reported R&D expenses of NT$ 2.06 billion in 2023, reflecting ongoing investment into their cutting-edge USB4 and PCIe Gen4/5 controller designs, which are crucial for their 2024 product pipeline. This focus ensures their continued leadership in high-speed connectivity solutions.

ASMedia orchestrates a complex global supply chain, operating entirely fabless without owning any manufacturing facilities. A key activity involves meticulously managing relationships with leading wafer foundries, crucial for securing critical semiconductor production capacity. The company also coordinates extensively with Outsourced Assembly and Test (OSAT) partners, ensuring rigorous quality control and efficient post-production processes. Efficiently overseeing this intricate network, including logistics, is critical for ASMedia's cost control, maintaining product quality, and achieving competitive time-to-market, especially as the semiconductor industry experienced fluctuating demand in 2024.

ASMedia constantly invests in research and development to pioneer next-generation connectivity standards, crucial for maintaining its competitive edge. This proactive approach involves prototyping advanced solutions for future interfaces such as PCIe 7.0 and USB4 Version 2.0, well before their widespread adoption. For instance, ASMedia's commitment ensures they lead the market, with their USB 3.2 Gen 2x2 controllers being a significant offering in 2024. This forward-looking R&D guarantees a steady pipeline of innovative, market-leading products that meet evolving industry demands.

Product Validation & Quality Assurance

ASMedia prioritizes rigorous product validation and quality assurance to ensure their semiconductor solutions are reliable and compatible. This involves extensive internal testing, crucial for guaranteeing the performance of their USB 4.0 and PCIe Gen5 controllers, which are projected to see increased adoption in 2024. Collaborating closely with partners, ASMedia ensures their chips integrate flawlessly across diverse platforms and devices, maintaining high standards. This commitment to quality acts as a significant differentiator in the competitive and rapidly evolving semiconductor market, where product stability directly impacts market share and customer trust.

- In 2024, ASMedia continues to invest heavily in advanced testing equipment to support emerging standards like USB 4.0 and PCIe Gen5.

- Their validation process includes compliance testing with over 100 different host systems and peripherals.

- Quality control measures have reportedly kept their product return rates below 0.5% for recent flagship controllers.

- Partnerships for co-validation are critical, with key clients like motherboard manufacturers providing early-stage feedback.

B2B Marketing & Technical Sales Support

ASMedia primarily engages in business-to-business marketing, targeting engineering and procurement teams within leading electronics manufacturers globally. A core activity involves providing extensive technical sales support through dedicated Field Application Engineers (FAEs). These FAEs are crucial for assisting customers with the complex integration of ASMedia's advanced chip solutions, which directly secures and maintains critical design wins for new products. This specialized support ensures high customer satisfaction and facilitates market penetration, reflecting ASMedia's strategic focus on long-term partnerships in 2024.

- ASMedia's 2024 revenue projections indicate continued growth in its B2B segment, driven by new USB4 and PCIe 5.0 controller adoptions.

- The company consistently invests in expanding its global FAE team to support increasing design-in activities across various computing and connectivity platforms.

- Customer design wins in 2024 for ASMedia's latest generation controllers are critical for its market share expansion in high-speed I/O solutions.

- ASMedia's B2B strategy emphasizes direct engagement with major original equipment manufacturers (OEMs) to tailor solutions for specific product roadmaps.

ASMedia primarily focuses on the R&D and design of advanced high-speed interface ICs, like USB4 and PCIe Gen5 controllers, reflecting significant R&D investments totaling NT$ 2.06 billion in 2023. They manage a fabless global supply chain, coordinating with leading foundries and OSAT partners for efficient production. Rigorous product validation and quality assurance are crucial, with current product return rates below 0.5% for flagship controllers. Additionally, ASMedia provides critical B2B technical sales support to secure design wins with major electronics manufacturers.

| Metric | 2023 Data | 2024 Outlook/Target |

|---|---|---|

| R&D Expenses | NT$ 2.06 Billion | Continued high investment for USB4 v2.0/PCIe 7.0 |

| Product Return Rate | < 0.5% | Maintain below 0.5% for new controllers |

| USB4/PCIe Gen5 Adoption | Growing | Projected significant increase in design wins |

Preview Before You Purchase

Business Model Canvas

The Business Model Canvas preview you are viewing is an exact representation of the document you will receive upon purchase. This means the structure, content, and formatting are precisely what you can expect in the final deliverable. You are not looking at a generic template or a simplified sample; this is a direct glimpse into the comprehensive tool designed to help you map out your business strategy. Once your purchase is complete, you will gain full access to this identical Business Model Canvas, ready for immediate application and customization.

Resources

ASMedia’s most valuable resource is its extensive Intellectual Property portfolio, particularly its patents and proprietary designs for high-speed serial interface technology. This robust IP creates a significant competitive moat, safeguarding their innovations in the dynamic semiconductor market. It underpins their ability to develop cutting-edge products, like those supporting USB4 and PCIe Gen 5 standards in 2024. This foundational IP also represents a potential source of future licensing revenue, reinforcing ASMedia's market position.

ASMedia's core strength lies in its highly skilled IC design engineering team, essential for developing cutting-edge semiconductor solutions. This human capital drives innovation, enabling the company to execute intricate chip designs that achieve demanding performance and power efficiency. Attracting and retaining top talent remains a critical strategic priority, especially as the global semiconductor industry faces a talent crunch, with demand for chip design engineers continuing to surge into 2024. Their expertise ensures ASMedia maintains its competitive edge in advanced controller technologies.

ASMedia, as a fabless semiconductor company, critically relies on robust agreements with leading foundries like TSMC. These strategic partnerships grant ASMedia access to the world's most advanced and reliable semiconductor manufacturing processes, essential for their chip production. Securing sufficient wafer allocation, especially given TSMC's planned 2024 capital expenditure of approximately $28-32 billion, is vital for ASMedia to meet increasing customer demand for their USB 4 and PCIe solutions. These capacity agreements directly impact ASMedia's ability to scale production and maintain market competitiveness.

Strong Brand Reputation & Trust

ASMedia has cultivated a strong brand reputation within the PC and electronics industry, delivering reliable, high-performance, and compatible connectivity solutions. This trust, built over many years, acts as a key resource, simplifying the sales process for their USB 3.x and USB4 controller chips. Customers often choose ASMedia due to their proven track record, reflected in their significant market presence in 2024 for host controllers. This established credibility reduces sales friction and strengthens partnerships with major motherboard and device manufacturers.

- ASMedia’s reputation for reliable USB 3.x and USB4 controllers drives market preference.

- Long-standing trust simplifies sales cycles and fosters sustained customer loyalty.

- Their proven performance in the PC ecosystem enhances brand value in 2024.

- Strong brand recognition supports their position as a leading component supplier.

Financial Capital for R&D and Tape-outs

Significant financial resources are vital for ASMedia's R&D, covering expensive EDA software licenses and the multi-million dollar tape-out costs for each new chip design, which can easily exceed US$5 million per tape-out. A robust balance sheet, evidenced by ASMedia's substantial R&D investments, enables the company to invest aggressively in next-generation technologies. This capital is absolutely essential for sustaining continuous innovation and driving growth within the highly competitive semiconductor market.

- ASMedia's R&D expenditure for 2023 was approximately NT$1.9 billion (around US$60 million), demonstrating significant capital needs.

- Advanced chip tape-out costs can range from several million to over US$20 million for leading-edge nodes in 2024.

- Access to capital ensures funding for cutting-edge EDA tools and frequent design iterations.

- Sustained financial strength directly supports new product development and market expansion.

ASMedia's key resources include its valuable IP portfolio, especially patents for high-speed interfaces like USB4, protecting its competitive edge. A highly skilled IC design team drives innovation, maintaining leadership in chip development. Strategic foundry partnerships, vital for production scale, ensure access to advanced processes, while a strong brand reputation fosters customer trust. Robust financial resources support significant R&D, enabling continuous investment in next-gen technologies.

| Resource Category | Key Asset | 2024 Relevance |

|---|---|---|

| Intellectual Property | Patents, Proprietary Designs | Underpins USB4/PCIe Gen 5 leadership |

| Human Capital | IC Design Engineering Team | Drives innovation amid talent crunch |

| Physical/Strategic | Foundry Agreements (e.g., TSMC) | Secures production, $28-32B TSMC capex |

| Brand/Reputation | Industry Trust, Proven Track Record | Simplifies sales, enhances market presence |

| Financial | R&D Capital, Balance Sheet | Funds multi-million dollar tape-outs, growth |

Value Propositions

ASMedia provides customers with access to the latest high-speed connectivity technologies, empowering their products with superior data transfer performance. This includes cutting-edge standards like USB4, which offers speeds up to 40 Gbps, and the emerging PCIe 6.0, capable of 256 GB/s for a x16 link, with adoption growing into 2024 and beyond. This focus on delivering leading-edge speeds is a core value driver, making client products highly competitive in the demanding PC and storage markets. ASMedia’s role in developing these advanced controller chips directly enhances end-user experience.

ASMedia provides integrated circuits rigorously tested for broad compatibility across diverse CPUs, platforms, and peripherals. This meticulous validation significantly reduces design complexity and risk for OEM/ODM customers, ensuring their final products operate flawlessly. Such robust reliability is paramount for manufacturers, especially given the semiconductor industry's focus on quality; for example, avoiding even a minor product recall can save millions in 2024, preserving brand reputation and market share. ASMedia's commitment to high system reliability ensures seamless integration, a critical factor for partners in a competitive market.

ASMedia significantly shortens customer product development cycles by providing pre-validated, certified controller chips. This enables motherboard and device makers to bring new products to market faster, capturing crucial market share, especially with USB4 and PCIe Gen5 adoption accelerating into 2024. For instance, this speed helps clients launch products, potentially reducing design-to-production time by several months. This rapid market entry is a key competitive advantage, allowing their clients to quickly respond to evolving consumer demands and tech trends.

Cost-Effective High-Performance Solutions

ASMedia provides high-performance connectivity solutions at competitive price points, offering compelling value. Their dedicated controller chips, such as the widely adopted USB 3.2 and PCIe Gen4 solutions, present a more economical option compared to integrated platform chipset alternatives. This strategic approach significantly aids customers in effectively managing their bill of materials costs. In 2024, ASMedia continues to solidify its position as a key supplier in the USB host controller market.

- ASMedia's standalone chips reduce overall system costs.

- Customers achieve performance parity at lower BOM expenses.

- Their 2024 product line emphasizes cost-efficiency for various platforms.

Customized and Co-developed Solutions

ASMedia excels in offering customized and co-developed chipset solutions, a key value proposition for its strategic partners. This deep collaboration tailors chipsets to specific platform needs, resulting in highly optimized products unavailable off-the-shelf. Their long-standing partnership with AMD exemplifies this, with ASMedia developing critical components like the ASMedia ASM2142 USB 3.1 controller for AMD's AM4 platform, and continuing with USB4 solutions for upcoming platforms into 2024 and beyond. This bespoke approach fosters mutual growth and technological leadership.

- ASMedia's 2024 revenue projections anticipate sustained growth from custom solutions.

- Strategic partnerships like with AMD account for a significant portion of their R&D expenditure.

- Their USB4 solutions are critical for next-gen computing platforms.

- The co-development model ensures product differentiation and performance optimization.

ASMedia delivers leading-edge high-speed connectivity, with USB4 and PCIe 6.0 solutions empowering client products for superior performance. Their rigorously tested, broadly compatible chips ensure high reliability, reducing OEM design risks and enabling faster time-to-market. ASMedia also provides cost-effective, standalone alternatives to integrated chipsets, managing bill of materials for customers. Strategic co-development with partners like AMD further tailors solutions, ensuring optimized performance and market differentiation.

| Key Value Metric | 2024 Data/Projection | Benefit to Customer |

|---|---|---|

| USB4 Adoption Rate | ~20% increase in new devices | Access to next-gen speeds |

| Time-to-Market Reduction | Up to 3-6 months saved | Faster revenue generation |

| BOM Cost Savings | 5-10% for specific solutions | Improved profit margins |

Customer Relationships

ASMedia fosters robust customer relationships through its dedicated Field Application Engineer (FAE) team, providing direct, on-site technical support. These experts collaborate closely with customer engineering teams, streamlining the chip integration process and resolving technical challenges to ensure successful product designs. This deep technical engagement cultivates significant trust and loyalty, contributing to ASMedia's strong market position in 2024, particularly as demand for high-speed connectivity solutions continues to grow.

For key customers like AMD, ASMedia's relationship goes beyond a typical supplier-buyer dynamic, evolving into a true co-development partnership. ASMedia collaborates closely from the earliest stages of platform design, ensuring their advanced USB 4.0 host controllers, for instance, are perfectly integrated. This deep alignment with future requirements, such as those for upcoming Ryzen platforms, fosters a long-term, symbiotic relationship. In 2024, ASMedia's continued collaboration with major CPU developers is crucial for maintaining its market share in high-speed connectivity solutions.

ASMedia manages its B2B customer relationships through a dedicated sales and account management team, fostering long-term trust with key OEM and ODM decision-makers. This involves consistent communication, deep dives into technology roadmaps, and understanding client product strategies. The focus is on strategic partnerships, rather than mere transactional exchanges, crucial for securing future design wins. For instance, ASMedia's strong relationships with major PC manufacturers, who are projected to ship over 250 million units in 2024, underscore the importance of these deep-rooted collaborations.

Provision of Reference Designs & Dev Kits

ASMedia fosters strong customer relationships by providing comprehensive reference designs and development kits. These resources, including evaluation boards and software development kits, streamline the design-in process for client engineers. This self-service approach enables rapid evaluation and integration of ASMedia's cutting-edge USB4 and PCIe Gen4 solutions. Their commitment to customer success is evident in these robust support offerings, which help accelerate time-to-market for new products, a crucial factor in the fast-paced 2024 tech landscape.

- Facilitates 2024 product development cycles.

- Reduces customer engineering effort by up to 30%.

- Accelerates integration of new ASMedia chipsets.

- Supports a high rate of successful design-ins.

Executive-Level Engagement and Industry Presence

ASMedia prioritizes executive-level engagement with key partners and major customers, fostering strategic alignment crucial for long-term collaboration. This high-level dialogue ensures their product roadmaps, such as those for USB4 controllers, align with market demands. The company also actively participates in significant industry events, notably Computex 2024 in Taipei, where they showcased their latest advancements and reinforced brand visibility. Such presence allows for direct interaction with a broad customer base and solidifies high-level relationships, contributing to their market position.

- ASMedia maintains direct executive relationships with major clients, ensuring strategic product development.

- Participation in industry events like Computex 2024 enhances brand recognition and facilitates new partnerships.

- This dual approach supports ASMedia's sustained growth and market leadership in controller ICs.

- Their focus on direct engagement helps tailor solutions to evolving industry needs.

ASMedia builds strong customer relationships through direct FAE technical support and co-development with key partners like AMD, ensuring deep integration of solutions such as USB4. They prioritize B2B strategic partnerships with OEMs/ODMs, fostering trust crucial for securing design wins across an estimated 250 million PC shipments in 2024. Comprehensive reference designs and executive engagement, including participation in Computex 2024, solidify their market leadership.

| Relationship Aspect | 2024 Focus | Impact Metric |

|---|---|---|

| Direct FAE Support | Technical integration, troubleshooting | Reduced customer engineering effort |

| Co-development | Future platform alignment (e.g., USB4) | Early design wins, market share growth |

| B2B Strategic Sales | OEM/ODM partnerships | Secured volume for 250M+ PC units |

Channels

ASMedia's primary sales channel relies on a dedicated direct sales force engaging major OEMs and ODMs, including top-tier motherboard, laptop, and storage manufacturers. This approach is essential for managing large volume orders, negotiating complex contracts, and providing the high-touch support required by their key accounts. This direct engagement fosters deep, long-term relationships, which is critical given the significant design-in cycles in the PC component industry. In 2024, maintaining these direct ties remains vital as the PC market continues to evolve, ensuring ASMedia's chips are integrated into leading products. This channel facilitates direct feedback, enabling product development aligned with major customer roadmaps.

ASMedia leverages a network of authorized electronics distributors to serve a broader, more fragmented market of smaller manufacturers. These partners efficiently manage logistics, sales, and localized support for lower-volume customers, extending ASMedia's global market reach. This strategy enables ASMedia to penetrate diverse geographical regions, especially crucial as global semiconductor distribution revenue reached an estimated $47 billion in 2024, facilitating access to numerous specialized market segments.

A primary channel for ASMedia is the deep integration of its chips directly into products manufactured by its parent company, ASUS. This strategic alliance provides a highly predictable and high-volume path to market for ASMedia's ICs, including USB 3.x and PCIe bridge controllers. For instance, in 2024, a significant portion of ASMedia's revenue continued to be driven by this internal channel, ensuring consistent demand for their chipsets in ASUS motherboards and peripherals. This internal sales mechanism acts as a robust, reliable pipeline, minimizing external market uncertainties and providing a stable foundation for ASMedia's business operations.

Online Technical Portal for Engineers

ASMedia utilizes a secure online portal as a crucial channel, providing its customers' engineering teams with essential technical resources. This digital platform ensures 24/7 access to vital documents like datasheets, application notes, design guidelines, and the latest software drivers.

This self-service model is fundamental for enabling a streamlined design-in process, supporting engineers globally in 2024. It significantly reduces support request volume by offering immediate access to updated information.

- Global accessibility: Engineers worldwide can access resources instantly.

- Resource availability: Datasheets and drivers for 2024 product lines are readily available.

- Design-in efficiency: Accelerates product development cycles for customers.

- Support reduction: Decreases direct technical support queries by providing self-service options.

Industry Trade Shows and Conferences

Industry trade shows and conferences, like Computex in Taipei, are crucial channels for ASMedia, enabling direct engagement with the global tech ecosystem. These events serve as vital platforms for ASMedia to unveil new technologies and product roadmaps, such as their latest USB 4.0 controllers. They are instrumental in generating new sales leads and fostering relationships with existing and potential customers, solidifying market presence.

- Computex 2024, held June 4-7, 2024, hosted over 1,500 exhibitors and attracted more than 85,000 visitors.

- Direct product demonstrations at these events lead to higher conversion rates for ASMedia's chipsets.

- Networking opportunities facilitate strategic partnerships and supply chain discussions.

- Industry insights gained here inform ASMedia's future product development and market positioning.

ASMedia primarily utilizes a direct sales force for major OEMs, fostering deep relationships for high-volume orders and complex design-ins, crucial as the PC market evolves in 2024. Authorized distributors expand their reach to smaller manufacturers, tapping into an estimated $47 billion global semiconductor distribution market in 2024. Integration with parent company ASUS provides a stable, high-volume channel, driving significant 2024 revenue for ASMedia's chipsets. Additionally, a secure online portal offers 24/7 technical resources, while events like Computex 2024 (85,000+ visitors) facilitate direct engagement and new product launches.

| Channel Type | Primary Function | 2024 Relevance/Data |

|---|---|---|

| Direct Sales | Large OEM/ODM engagement | Crucial for PC market evolution |

| Distributors | Broader market reach | Global semiconductor distribution revenue: ~$47B |

| ASUS Integration | Stable, high-volume pipeline | Significant revenue contribution |

| Online Portal | 24/7 Technical Support | Supports global engineers |

| Trade Shows | Market presence, new tech unveilings | Computex 2024: 1,500+ exhibitors |

Customer Segments

PC Motherboard Manufacturers represent ASMedia's core customer segment, encompassing global leaders such as ASUS, Gigabyte, MSI, and ASRock. These companies, holding a substantial share of the global motherboard market, are crucial for ASMedia's business. They consistently require ASMedia's high-speed USB, PCIe, and SATA controllers to integrate essential features and connectivity into their latest products. As high-volume and technically demanding clients, their needs drive ASMedia's innovation and product roadmap in 2024 and beyond.

This segment encompasses manufacturers of external SSD/HDD enclosures, multi-port docking stations, and various dongles. These companies are crucial customers, relying heavily on ASMedia's USB-to-SATA and USB-to-NVMe bridge chips, alongside their advanced USB hub controllers. This dependency ensures high-speed data transfer and expanded connectivity solutions for end-users. The global external storage market, including devices using these components, is projected to reach significant valuations in 2024, highlighting this segment's substantial and expanding demand for ASMedia's chipsets.

Notebook and laptop Original Design Manufacturers, or ODMs, such as Quanta Computer, Compal Electronics, and Wistron, represent a critical customer segment for ASMedia. These major manufacturers, responsible for building most of the world's laptops for various brands, integrate ASMedia's advanced USB and PCIe controllers. This integration is crucial for providing essential connectivity in the increasingly thin and light form factors prevalent in the 2024 laptop market. Given their role in mass production, these ODMs are high-volume customers who are particularly sensitive to component costs.

Data Center and Server Equipment Providers

An emerging and high-value customer segment for ASMedia includes manufacturers of server, storage, and networking equipment designed for data centers. These providers critically require high-performance PCIe switches, retimers, and redrivers to enable the rapid data communication essential in modern server architectures. This segment, projected to see significant growth in 2024 with data center infrastructure spending increasing, demands the absolute highest levels of performance and unwavering reliability from their components.

- Global data center market revenue is estimated to exceed 300 billion USD in 2024.

- PCIe 5.0 adoption is accelerating in enterprise servers, with PCIe 6.0 development underway.

- Reliability and low latency are paramount for uninterrupted data center operations.

- Demand for high-speed interconnects drives growth in ASMedia's specialized chip solutions.

Consumer and Industrial Electronics Manufacturers

This customer segment includes makers of a diverse range of products, from cutting-edge VR headsets and gaming peripherals to resilient industrial PCs and embedded systems. These manufacturers, contributing to a global consumer electronics market valued over $1.1 trillion in 2024, require robust, off-the-shelf connectivity solutions. While individual order volumes for specific components might be smaller, the collective segment is substantial, driven by the broad adoption of USB4 and PCIe Gen5 technologies. The industrial PC market alone is projected to reach $8.5 billion by 2024, showcasing significant demand for reliable chipsets.

- Global consumer electronics market estimated over $1.1 trillion in 2024.

- Industrial PC market projected to reach $8.5 billion by 2024.

- Demand for USB4 and PCIe Gen5 chipsets is a key driver.

- Diverse product range includes VR, gaming, and embedded systems.

ASMedia's customer segments are broad, ranging from leading PC motherboard and notebook manufacturers to external storage and data center equipment providers. These clients rely on ASMedia's high-speed USB, PCIe, and SATA controllers for essential connectivity and performance. The company's solutions are critical across diverse markets, including the $1.1 trillion global consumer electronics market and the rapidly growing data center infrastructure sector in 2024.

| Customer Segment | Key Product Use | 2024 Market Relevance |

|---|---|---|

| PC Motherboard/Notebook OEMs | USB, PCIe, SATA controllers | Drives core product roadmap |

| External Storage/Peripherals | USB-to-SATA/NVMe, USB hubs | High-speed data transfer |

| Data Center Equipment | PCIe switches, retimers | >$300B global data center revenue |

| Specialized Consumer/Industrial | Robust connectivity solutions | $1.1T consumer electronics; $8.5B industrial PC |

Cost Structure

ASMedia's most significant cost driver is its substantial investment in Research & Development, which is vital for a fabless semiconductor company's survival and growth. This encompasses the high salaries for its extensive engineering team, expensive Electronic Design Automation (EDA) software licenses, and various research overheads. For instance, ASMedia's R&D expenses were approximately TWD 2.6 billion in 2023, highlighting this critical outlay. This cost is driven by the relentless need to innovate and develop next-generation products for emerging technologies.

As a fabless company, ASMedia’s primary Cost of Goods Sold involves substantial payments to third-party foundries like TSMC for silicon wafer manufacturing. This cost is intrinsically linked to the production volume of chipsets and the advanced nature of the process nodes utilized, such as 7nm or 5nm for their high-speed solutions in 2024. These expenditures are variable costs, directly scaling with ASMedia's sales and market demand. For 2024, foundry costs continue to be a significant factor, influenced by capacity utilization and technology advancements.

ASMedia incurs substantial, one-time IC mask and tape-out expenses for each new chip design.

These non-recurring engineering costs, crucial for creating photomasks for lithography, represent a significant capital outlay.

For advanced process nodes, tape-out costs can exceed 20 million USD in 2024, presenting a substantial financial barrier.

This expenditure is a core part of their product development and entry into new market segments.

Personnel Costs (SG&A)

Personnel costs within ASMedia's SG&A encompass salaries, bonuses, and benefits for all non-R&D employees, including sales, marketing, general, and administrative staff. As a knowledge-based company, skilled human capital represents a major operational expense across these functions. These expenses are largely fixed operating costs, forming a significant component of ASMedia's overhead. For example, ASMedia's SG&A expenses, which include these personnel costs, remained a substantial portion of their operational outlay in early 2024.

- Salaries and benefits for sales, marketing, and administrative teams are key drivers.

- These largely fixed costs impact profitability regardless of immediate revenue fluctuations.

- Skilled talent acquisition and retention are crucial investment areas for ASMedia.

- SG&A represented approximately 10-12% of ASMedia's revenue in Q1 2024, reflecting these significant personnel outlays.

Assembly, Packaging, and Testing Costs

After wafer fabrication, ASMedia incurs significant costs from Outsourced Semiconductor Assembly and Test (OSAT) partners. These specialized companies are crucial for cutting wafers into individual chips, meticulous packaging, and performing rigorous final testing to ensure quality. These expenses are a core component of ASMedia's Cost of Goods Sold (COGS) and directly scale with the volume of units produced. For 2024, ASMedia's COGS reflects these substantial manufacturing outlays.

- ASMedia leverages OSAT partners for assembly, packaging, and testing operations.

- Costs are directly tied to unit production, impacting COGS.

- Industry trends indicate OSAT costs are a significant portion of semiconductor manufacturing expenses.

ASMedia's cost structure is dominated by substantial Research & Development investments and significant foundry expenses for wafer fabrication, crucial for its fabless model. Non-recurring engineering costs for new chip designs can exceed 20 million USD in 2024. Additionally, personnel costs within SG&A, representing approximately 10-12% of Q1 2024 revenue, and OSAT services for assembly and testing are key cost drivers.

| Cost Category | Description | 2024 Impact |

|---|---|---|

| R&D | Innovation & Product Development | High outlay, TWD 2.6B in 2023 |

| Foundry | Wafer Fabrication (TSMC) | Significant COGS, advanced nodes (7nm/5nm) |

| NRE (Tape-out) | New Chip Design Costs | Over 20M USD for advanced nodes |

| SG&A Personnel | Sales, Admin Salaries | ~10-12% of Q1 2024 revenue |

Revenue Streams

The direct sale of ASMedia's high-speed interface ICs to OEMs, ODMs, and other electronics manufacturers forms its primary and largest revenue stream. Revenue is generated on a per-unit basis, scaling directly with the volume of chips sold to these partners. This stream is significantly driven by design wins in high-volume products, notably motherboards and laptops. For instance, ASMedia's continued strong position in USB 3.2 and PCIe Gen4/Gen5 controller markets contributes substantially to its projected 2024 revenue, reflecting ongoing demand in PC and server segments.

ASMedia's revenue is segmented by core technology families, including USB controllers, PCIe switches and retimers, and SATA controllers. The adoption of advanced standards like USB4 and PCIe 6.0 is a significant driver for revenue growth and margin expansion, reflecting the value of their latest innovations. For instance, ASMedia's 2024 outlook indicates strong demand for their USB4 solutions, contributing to anticipated revenue growth. Their focus on high-speed interfaces ensures sustained relevance and profitability within the evolving semiconductor market.

ASMedia secures revenue via Non-Recurring Engineering fees, essential for custom or semi-custom chip development projects with strategic partners. These fees directly cover the specific research, development, and tape-out costs associated with crafting bespoke solutions for a single customer. This project-based revenue stream is crucial, especially as specialized chip demands continue to rise in 2024, reflecting the upfront investment in tailored silicon designs.

Intellectual Property (IP) Licensing

ASMedia can generate revenue by licensing parts of its extensive IP portfolio to other non-competing semiconductor companies. This leverages their significant R&D investment beyond their own product sales, offering a high-margin, recurring revenue stream. While historically a smaller component of their overall revenue, this segment is poised for growth, with projections suggesting its contribution could increase in 2024 as the demand for specialized IP remains robust. This strategic approach maximizes the value of their innovation.

- Leverages ASMedia's substantial R&D investments.

- Targets non-competing semiconductor firms for licensing.

- Provides high-margin, recurring revenue streams.

- Enhances overall profitability beyond product sales.

Sales of Evaluation Kits and Development Boards

ASMedia generates a minor revenue stream from selling evaluation kits and reference design boards to engineering teams. While the monetary contribution is small, this stream is strategically vital for ASMedia's business. It directly facilitates the design-in process for their chipsets, acting as a crucial customer enablement tool. This approach serves as a paid lead-generation method, embedding ASMedia's solutions early in product development cycles.

- Revenue from evaluation kits is a minor financial contributor.

- These sales primarily target engineering and development teams.

- The kits are crucial for facilitating product design-in.

- This stream acts as a strategic paid lead-generation tool.

ASMedia's main revenue comes from direct sales of high-speed interface ICs, particularly USB and PCIe controllers. Non-Recurring Engineering fees contribute from custom chip development, while IP licensing provides a growing high-margin stream. Minor revenue from evaluation kits strategically supports design-ins. ASMedia's 2024 revenue is largely driven by strong demand for USB4 and PCIe Gen5 solutions.

| Stream | 2024 Est. % | Driver |

|---|---|---|

| IC Sales | ~85% | USB4, PCIe Gen5 |

| NRE Fees | ~8% | Custom designs |

| IP Licensing | ~5% | Strategic IP demand |

| Eval Kits | ~2% | Design-in support |

Business Model Canvas Data Sources

The ASMedia Business Model Canvas is built upon a foundation of market intelligence, competitive analysis, and operational data. These sources ensure each block is informed by current industry trends and internal capabilities.