ASM International PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ASM International Bundle

Want to understand how ASM International is navigating global changes? Our comprehensive PESTEL Analysis gives you the answers—expertly written, instantly downloadable, and easy to customize. Get your copy today.

Political factors

Geopolitical trade tensions, notably between the United States and China, continue to cast a long shadow over the semiconductor sector, a core market for ASM International. These ongoing disputes can result in stringent export controls and limitations on the movement of advanced technologies. For instance, in 2023, the US expanded its export restrictions on certain advanced chipmaking equipment and technologies to China, directly impacting companies like ASM that supply such critical machinery.

These policies create significant challenges for ASM International, potentially hindering its capacity to supply its state-of-the-art deposition equipment to key markets and complicating its supply chain for essential components. Navigating this complex web of international trade regulations and sanctions is paramount for the company to sustain its global market presence and operational continuity.

Government subsidies and incentives are playing a crucial role in shaping the semiconductor industry. For instance, the US CHIPS and Science Act, enacted in 2022, allocated over $52 billion to bolster domestic semiconductor manufacturing and research. Similarly, the EU Chips Act aims to mobilize €43 billion in public and private investments by 2030. These substantial government backing programs directly benefit companies like ASM International by encouraging chip manufacturers to invest in new or expanded fabrication facilities, thereby increasing the demand for advanced wafer processing equipment.

ASM International's business is significantly impacted by export control regulations, particularly those concerning advanced semiconductor equipment. These rules, implemented by countries like the United States and the Netherlands, aim to restrict the flow of critical technology to certain nations, directly affecting ASM's ability to sell its sophisticated ALD and epitaxy systems globally.

Compliance is paramount; failure to adhere to these evolving export controls can result in substantial penalties and disrupt ASM's supply chain operations. For instance, the Dutch government's tightening of export rules in 2023, influenced by international geopolitical considerations, has already necessitated adjustments in how and where certain advanced equipment can be shipped.

Industrial Policy Shifts

Governments worldwide are increasingly implementing industrial policies to bolster domestic manufacturing and achieve technological self-sufficiency, particularly in strategic sectors like semiconductors. This trend directly impacts global suppliers like ASM International. For instance, the US CHIPS and Science Act, with its significant funding, aims to onshore semiconductor manufacturing and R&D, influencing where companies invest and operate. Similarly, the European Union's European Chips Act is designed to double the EU's share in the global semiconductor market by 2030, fostering regional production capabilities.

These policy shifts necessitate strategic adjustments for ASM International. The company may need to diversify its manufacturing footprint or forge stronger regional partnerships to comply with or capitalize on these national initiatives. Such policies are fundamentally driven by a desire to secure critical supply chains and mitigate risks associated with over-reliance on specific foreign technologies or manufacturing hubs. For example, in 2023, global semiconductor manufacturing capacity was heavily concentrated, with Taiwan and South Korea leading, highlighting the vulnerability these policies aim to address.

- Reshoring Initiatives: Policies like the US CHIPS Act encourage domestic semiconductor production, potentially altering ASM International's supply chain and customer base.

- Technological Sovereignty: National efforts to develop independent technological capabilities in areas like advanced chip manufacturing influence R&D investments and market access for equipment suppliers.

- Regional Partnerships: The EU's focus on building a robust European semiconductor ecosystem may lead to increased collaboration and demand for localized solutions from companies like ASM International.

- Supply Chain Security: A heightened focus on supply chain resilience, spurred by geopolitical events, drives governments to support domestic industries, impacting global trade dynamics for semiconductor equipment.

Political Stability in Key Regions

Political stability in regions critical to ASM International's operations, including Taiwan, South Korea, and various European nations, directly influences the continuity of its business. Geopolitical tensions or shifts can create significant headwinds.

For instance, the ongoing geopolitical complexities in East Asia, particularly concerning Taiwan, pose a constant risk to the semiconductor supply chain, a core market for ASM. Any escalation could lead to production halts or severe logistical challenges. Similarly, political developments within major European economies impact customer capital expenditure plans, directly affecting demand for ASM's advanced manufacturing equipment. Navigating these dynamic political landscapes requires robust risk assessment and contingency planning.

- Taiwan: As a global hub for semiconductor manufacturing, Taiwan's political stability is paramount. Tensions in the region could disrupt the production and shipment of critical components, impacting ASM's global operations.

- South Korea: Home to major electronics manufacturers, South Korea's political climate influences investment decisions and technological advancements that drive demand for ASM's solutions.

- Europe: Economic policies and political stability within key European markets affect ASM's customer base, particularly in sectors relying on advanced manufacturing and automation.

- Supply Chain Resilience: Geopolitical instability can lead to supply chain disruptions, affecting the availability of raw materials and components necessary for ASM's production.

Government industrial policies, like the US CHIPS Act and the EU Chips Act, are actively stimulating semiconductor manufacturing and R&D, creating significant demand for advanced equipment suppliers such as ASM International. These initiatives, with billions allocated for domestic production, directly encourage capital expenditure by chip manufacturers, boosting the market for ASM's deposition solutions.

Export controls imposed by nations like the US and Netherlands, targeting advanced semiconductor technologies, present a direct challenge for ASM. These regulations, exemplified by the Dutch government's tightened rules in 2023, restrict sales to specific countries, necessitating careful compliance and potentially impacting global market access for ASM's sophisticated equipment.

Geopolitical tensions, particularly concerning East Asia, create risks for ASM's supply chain and customer base, given the concentration of semiconductor manufacturing in regions like Taiwan. Political stability in key operational areas directly influences business continuity and customer investment decisions for advanced manufacturing equipment.

What is included in the product

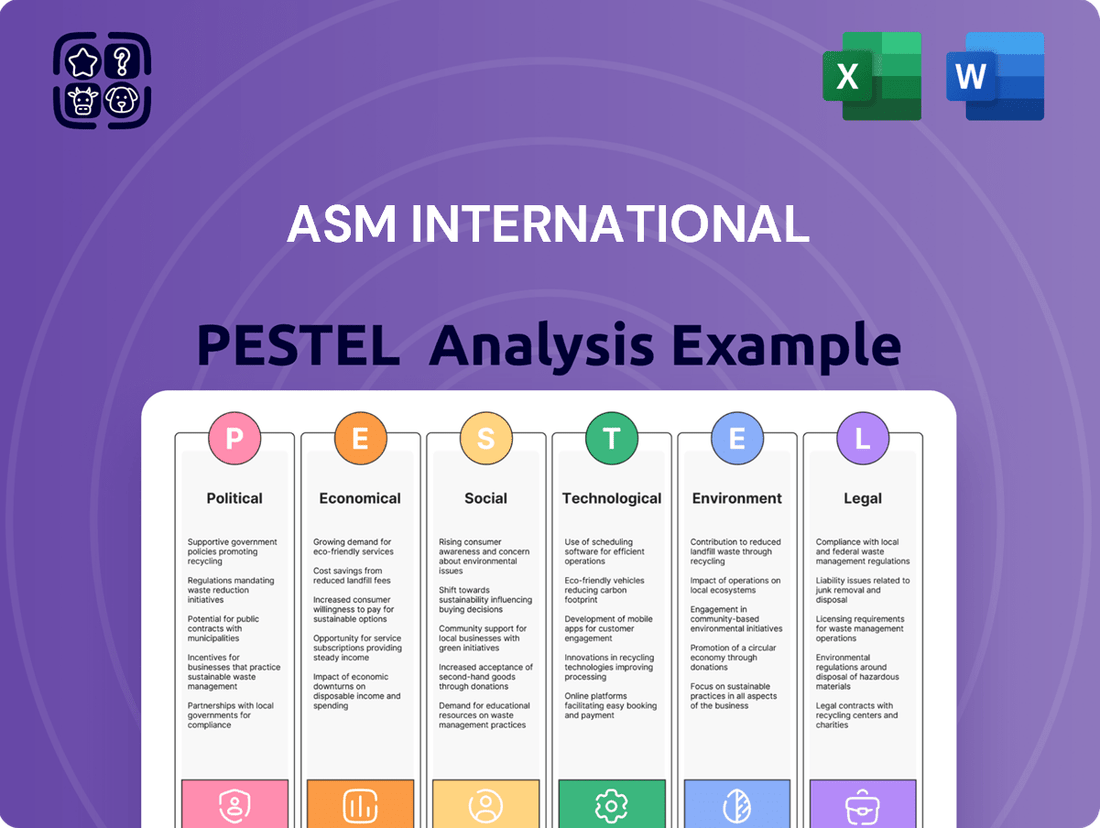

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing ASM International, covering Political, Economic, Social, Technological, Environmental, and Legal aspects.

Provides a structured framework to identify and understand external factors impacting the materials science industry, alleviating the pain of navigating complex market dynamics.

Economic factors

The global semiconductor market is inherently cyclical, experiencing boom and bust periods that significantly impact demand for wafer fabrication equipment, ASM International's core business. For instance, 2023 saw a downturn with semiconductor sales declining by approximately 10% compared to 2022, reflecting a correction after a period of strong growth. This cyclicality directly affects chipmakers' capital expenditure decisions, influencing when they invest in new manufacturing tools from companies like ASM.

ASM International's revenue is therefore closely tied to these industry cycles. When chip demand is high and inventories are low, foundries and integrated device manufacturers (IDMs) ramp up their investments in advanced manufacturing equipment. Conversely, during periods of oversupply or weakened consumer demand, capital spending often contracts, leading to softer demand for ASM's products. Navigating these fluctuations is key for predictable revenue streams and strategic planning.

Persistent global inflationary pressures, a significant economic factor in 2024 and projected into 2025, directly impact ASM International by increasing the cost of essential inputs like raw materials, energy, and transportation. For instance, global inflation rates hovered around 5-6% in late 2023 and early 2024, a figure expected to moderate but remain elevated. This necessitates strategic pricing adjustments and robust supply chain management to protect profit margins.

These rising operational costs can also dampen the investment capacity of ASM International's customer base, particularly those in sectors sensitive to economic downturns. As businesses face their own cost pressures, their willingness to invest in new equipment or technologies may decrease, potentially slowing order volumes for ASM International.

Interest rate fluctuations significantly impact ASM International by altering borrowing costs for capital expenditures, such as new fabrication plants and equipment upgrades. For instance, if global central banks, like the US Federal Reserve or the European Central Bank, continue their tightening cycles through 2024 and into 2025, borrowing becomes more expensive. This could lead to ASM International and its customers delaying or scaling back investments in advanced semiconductor manufacturing equipment.

Higher interest rates can dampen demand for high-ticket items, potentially slowing the order pipeline for ASM's sophisticated deposition and etch technologies. For example, a 1% increase in interest rates can add millions in annual interest payments on large capital projects, making them less attractive. This financial leverage directly affects the semiconductor industry's overall growth trajectory and ASM's revenue streams.

Supply Chain Resilience and Costs

ASM International, like many in the semiconductor equipment manufacturing sector, faces significant headwinds from global supply chain disruptions. Geopolitical tensions and unexpected events, such as the lingering effects of the COVID-19 pandemic and regional conflicts, continue to create volatility. This directly impacts the availability and cost of critical components, essential for producing their advanced deposition and etch systems.

The stability of raw material and component availability remains a crucial factor for ASM International's production continuity. For instance, the semiconductor industry has grappled with shortages of specialized chemicals and electronic components throughout 2023 and into early 2024. These shortages can extend lead times and inflate prices, directly affecting ASM International's operational expenses and ability to meet customer demand promptly.

- Component Shortages: Persistent shortages in key semiconductor components, including advanced microcontrollers and specialized sensors, have been a recurring issue.

- Increased Freight Costs: Global shipping rates saw significant fluctuations in 2023, with surcharges and delays impacting the landed cost of imported parts.

- Geopolitical Impact: Trade restrictions and export controls implemented in late 2023 and continuing into 2024 have added complexity and potential cost increases for sourcing materials from certain regions.

R&D Investment by Chipmakers

The significant R&D investments by leading chipmakers are a direct driver of demand for advanced equipment from companies like ASM International. For instance, in 2023, Intel announced plans to invest $40 billion in new fabrication plants, with a substantial portion allocated to R&D for next-generation chip technologies. This commitment to innovation directly translates into increased orders for sophisticated Atomic Layer Deposition (ALD) and epitaxy equipment, which are critical for producing these advanced semiconductors.

This trend is expected to continue, with global semiconductor R&D spending projected to reach over $100 billion annually by 2025, according to industry analysts. Such robust investment by major players like TSMC and Samsung in areas like EUV lithography and advanced packaging directly fuels the need for ASM International's cutting-edge solutions, ensuring a strong market for their specialized equipment.

- Intel's 2023 R&D and CapEx: Over $40 billion invested in new fabs and process development, boosting demand for advanced equipment.

- Global Semiconductor R&D Growth: Projected to exceed $100 billion annually by 2025, indicating sustained demand for innovation.

- Key Technology Focus: Investments in EUV lithography and advanced packaging by industry leaders directly benefit suppliers of critical process equipment.

The economic landscape for ASM International is shaped by the semiconductor industry's inherent cyclicality and broader macroeconomic trends. For instance, 2023 saw a global semiconductor market contraction of approximately 10%, impacting capital expenditure by chipmakers, ASM's primary customers. This cyclicality dictates the timing and scale of investments in advanced manufacturing equipment.

Inflationary pressures, with global rates around 5-6% in late 2023 and early 2024, increase operational costs for ASM and can reduce customer investment capacity. Furthermore, rising interest rates through 2024-2025 make borrowing more expensive, potentially delaying large capital projects for both ASM and its clients, thereby slowing demand for sophisticated deposition and etch technologies.

Supply chain stability remains a critical concern, with shortages of specialized chemicals and electronic components impacting production throughout 2023 and into early 2024. Geopolitical factors, including trade restrictions enacted in late 2023 and continuing into 2024, add further complexity and cost to sourcing vital materials.

Conversely, significant R&D investments by leading chipmakers, such as Intel's $40 billion investment in new fabrication plants in 2023, directly drive demand for ASM's advanced equipment. Global semiconductor R&D spending is projected to exceed $100 billion annually by 2025, underscoring sustained demand for innovation in areas like EUV lithography and advanced packaging.

| Economic Factor | 2023 Impact | 2024-2025 Outlook | ASM International Relevance |

|---|---|---|---|

| Semiconductor Market Cyclicality | ~10% sales decline | Recovery expected, but cyclicality persists | Directly affects customer CapEx and equipment demand |

| Inflation | 5-6% global rates (late 2023/early 2024) | Moderating but remaining elevated | Increases operational costs, may dampen customer investment |

| Interest Rates | Tightening cycles by major central banks | Continued potential for higher borrowing costs | Impacts cost of capital for ASM and customers, influencing investment decisions |

| Supply Chain Disruptions | Component shortages, increased freight costs | Lingering volatility, geopolitical impact on sourcing | Affects availability and cost of critical production inputs |

| R&D Investment | Intel's $40B in new fabs | Global R&D projected >$100B annually by 2025 | Drives demand for advanced deposition and etch equipment |

Preview Before You Purchase

ASM International PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of ASM International covers all key political, economic, social, technological, legal, and environmental factors impacting the organization.

Sociological factors

The semiconductor sector, including companies like ASM International, is grappling with a pronounced global talent shortage, especially for highly specialized engineers and technicians crucial for advanced manufacturing processes and cutting-edge research and development. This scarcity directly impacts the industry's ability to innovate and scale.

ASM International faces intense competition to secure top-tier talent, essential for designing, producing, and maintaining its sophisticated semiconductor manufacturing equipment. The ability to attract and retain a skilled and diverse workforce is paramount for driving innovation and ensuring operational efficiency in this demanding field.

Consumer demand for cutting-edge electronics, like AI-powered smartphones and smart home devices, is rapidly increasing. This surge directly impacts the need for advanced semiconductor components, influencing ASM International's customer base. For instance, the global smartphone market, projected to reach over 1.4 billion units in 2024, highlights this trend.

The growing adoption of the Internet of Things (IoT) is also a significant driver, with the IoT market expected to exceed $1.5 trillion by 2025. This expansion necessitates more sophisticated and efficient semiconductor solutions, pushing ASM International's customers to invest in advanced wafer processing technologies.

Societal expectations are increasingly prioritizing diversity, equity, and inclusion (DEI). For ASM International, this translates to a need for an inclusive workplace to draw from a wider range of talent and spark greater innovation. A diverse team brings a multitude of viewpoints, essential for tackling intricate engineering problems and grasping diverse global market demands.

Embracing DEI principles also significantly bolsters a company's public image. For instance, in 2024, companies with strong DEI initiatives reported an average of 12% higher employee engagement compared to those with weaker programs, according to a study by Deloitte. This positive perception can be a significant competitive advantage for ASM International in attracting both top talent and customers.

Corporate Social Responsibility (CSR) Expectations

Societal expectations for corporate social responsibility are significantly impacting ASM International. Consumers and investors are increasingly demanding ethical operations, fair labor practices, and positive community contributions. For instance, a 2024 study by Edelman revealed that 59% of consumers globally are more loyal to brands that align with their values, a trend that directly affects ASM International's brand perception and market share.

Demonstrating robust CSR initiatives can translate into tangible benefits for ASM International. Strong commitments to sustainability and ethical sourcing can enhance brand reputation, making the company more attractive to socially conscious investors. In 2023, sustainable investing accounted for over $37 trillion in assets under management globally, highlighting the financial appeal of companies with strong ESG (Environmental, Social, and Governance) performance.

Transparency in supply chains and responsible business conduct are becoming non-negotiable. ASM International faces pressure to ensure fair labor conditions and environmental stewardship throughout its operations. Companies that proactively address these concerns, such as by publishing detailed supplier codes of conduct or investing in community development programs, often see improved employee morale and reduced operational risks.

- Consumer Demand: 59% of consumers in 2024 show increased loyalty to value-aligned brands (Edelman).

- Investor Focus: Sustainable investing surpassed $37 trillion in global assets under management by 2023.

- Supply Chain Scrutiny: Growing emphasis on ethical sourcing and labor conditions in global supply chains.

- Employee Morale: Strong CSR can boost employee engagement and retention, a key factor in talent acquisition.

Impact of Automation and AI on Labor

The accelerating adoption of automation and AI across industries, particularly in manufacturing, presents a dual challenge for ASM International. While these technologies promise enhanced efficiency and productivity, they also necessitate significant investments in workforce reskilling to address potential job displacement. For instance, a 2024 report indicated that up to 30% of tasks in manufacturing could be automated by 2030, highlighting the urgency for proactive training programs.

ASM International must therefore develop robust strategies for integrating AI and automation within its own production facilities and support systems. This includes not only optimizing its internal processes but also guiding its customer base, the semiconductor fabrication plants (fabs), through this technological shift. Ensuring a smooth transition for employees and maintaining the integrity of the value chain are paramount to continued success.

Key considerations for ASM International include:

- Workforce Development: Implementing comprehensive training and reskilling initiatives to equip employees with the necessary skills for operating and maintaining advanced automated systems.

- Technology Integration: Strategically deploying AI and automation in a manner that complements, rather than solely replaces, human labor, focusing on areas like quality control and predictive maintenance.

- Customer Support: Providing guidance and solutions to customer fabs on managing their own automation transitions, including workforce impact and process optimization.

- Ethical AI Deployment: Establishing clear ethical guidelines for the use of AI in its operations and encouraging responsible AI adoption among its customers.

Societal expectations around diversity, equity, and inclusion (DEI) are increasingly influencing corporate strategies. For ASM International, fostering a diverse workforce is not just an ethical imperative but a driver of innovation, with companies strong in DEI reporting higher employee engagement. Furthermore, a growing emphasis on corporate social responsibility (CSR) means that consumers and investors are prioritizing companies with ethical operations and positive community impact, with a significant portion of consumers showing loyalty to value-aligned brands.

The financial implications of these societal shifts are substantial. In 2023, sustainable investing globally reached over $37 trillion in assets under management, indicating a strong investor preference for companies demonstrating robust ESG performance. This trend highlights the importance for ASM International to integrate strong CSR and DEI initiatives into its core business strategy to attract both talent and capital.

| Societal Factor | Impact on ASM International | Supporting Data (2024/2025) |

|---|---|---|

| Diversity, Equity, and Inclusion (DEI) | Enhanced innovation, improved employee engagement, broader talent pool attraction. | Companies with strong DEI initiatives reported 12% higher employee engagement (Deloitte, 2024). |

| Corporate Social Responsibility (CSR) | Increased brand loyalty, improved public image, attraction of socially conscious investors. | 59% of consumers globally are more loyal to value-aligned brands (Edelman, 2024). |

| Ethical Operations & Transparency | Reduced operational risks, improved employee morale, stronger supply chain relationships. | Growing scrutiny on fair labor practices and environmental stewardship across global supply chains. |

| Sustainable Investing | Access to capital, enhanced investor relations, positive market valuation. | Sustainable investing assets under management exceeded $37 trillion globally by 2023. |

Technological factors

ASM International's dominance in Atomic Layer Deposition (ALD) and Epitaxy is a cornerstone of its business, directly impacting its technological standing. These deposition techniques are fundamental to creating the intricate layers required for cutting-edge semiconductor devices. For instance, in 2024, the demand for advanced ALD equipment for next-generation logic and memory chips continued to surge, driven by the need for finer feature sizes and improved performance.

Ongoing research and development in ALD and Epitaxy are critical for ASM International's sustained competitive advantage. Breakthroughs in depositing novel materials and refining processes for sub-3nm node technologies are paramount. This R&D focus ensures the company remains at the forefront of semiconductor manufacturing advancements, anticipating and meeting the evolving demands of the industry through 2025 and beyond.

The ongoing drive for smaller, more powerful semiconductors, exemplified by advancements in 3D NAND and chiplets, directly impacts ASM International. Their deposition and growth equipment must adapt to these intricate manufacturing processes, enabling the creation of next-generation integrated circuits that offer enhanced performance and energy efficiency. This technological evolution fuels a strong demand for ASM's advanced solutions in the semiconductor industry.

The burgeoning fields of artificial intelligence, quantum computing, and neuromorphic computing are fundamentally reshaping semiconductor demands, necessitating highly specialized fabrication equipment. ASM International's advanced deposition and etch technologies are pivotal in manufacturing the intricate chips required for these next-generation computing paradigms.

This evolution presents significant growth avenues for ASM International, as its expertise in wafer processing becomes indispensable for producing chips with novel material compositions and complex device architectures. The company's ability to adapt its equipment to these emerging needs will be key to capturing new market share in this rapidly advancing sector.

R&D Investment and Innovation Pace

ASM International's commitment to research and development is crucial for maintaining its leadership in semiconductor manufacturing equipment. The company's significant R&D expenditure directly fuels its ability to innovate and introduce advanced solutions, which is vital in an industry characterized by rapid technological shifts. For instance, in 2023, ASM International reported R&D expenses of €405 million, reflecting a substantial investment aimed at staying ahead of the curve.

This sustained investment allows ASM to develop next-generation deposition technologies and other critical equipment, ensuring they meet the ever-increasing demands of chipmakers for higher performance and smaller feature sizes. The pace of innovation in semiconductor technology necessitates continuous R&D to develop new products and enhance existing ones, directly contributing to ASM's competitive edge.

Key areas of R&D focus for ASM International include:

- Advanced deposition techniques: Developing new methods for depositing thin films with atomic-level precision.

- Process optimization: Improving the efficiency and yield of semiconductor manufacturing processes.

- New material integration: Enabling the use of novel materials in advanced chip designs.

- Digitalization and automation: Incorporating AI and automation into equipment for smarter manufacturing.

Intellectual Property and Cybersecurity

ASM International's ability to protect its intellectual property (IP) through patents and trade secrets is fundamental to maintaining its edge in the semiconductor equipment market. In 2023, the company reported spending $591.8 million on research and development, a significant investment in innovation that requires robust IP protection. This focus on safeguarding proprietary designs and manufacturing processes is crucial for its ongoing competitive advantage.

Cybersecurity is equally paramount for ASM International, given the sensitive nature of its data. The company must implement strong measures to shield its proprietary designs, customer information, and intricate manufacturing processes from evolving cyber threats. A breach in cybersecurity could compromise its operational integrity and customer trust, directly impacting its market leadership.

The company's commitment to IP and cybersecurity is directly linked to its financial performance and market standing. For instance, the semiconductor industry, which ASM International serves, is highly susceptible to intellectual property theft, with estimates suggesting billions of dollars in losses annually due to IP infringement globally. Ensuring the integrity of its IP and data is therefore not just a technical necessity but a core business imperative for ASM International.

- ASM International's R&D investment in 2023 was $591.8 million, highlighting the value of its intellectual property.

- The semiconductor industry faces significant financial losses due to intellectual property theft, underscoring the need for robust protection.

- Maintaining strong cybersecurity is essential for safeguarding proprietary designs and customer data, vital for market trust.

ASM International's technological prowess is centered on Atomic Layer Deposition (ALD) and Epitaxy, critical for advanced semiconductor manufacturing. The company's substantial investment in research and development, amounting to $591.8 million in 2023, underscores its commitment to innovation in these areas. This focus ensures ASM remains at the forefront of enabling smaller, more powerful chips for emerging technologies like AI and quantum computing.

Protecting its intellectual property (IP) and maintaining robust cybersecurity are paramount for ASM International. The semiconductor industry's vulnerability to IP theft, estimated to cause billions in annual losses globally, highlights the critical need for safeguarding proprietary designs and sensitive data. Strong cybersecurity measures are essential for preserving operational integrity and customer trust.

| Metric | Value (2023) | Significance |

|---|---|---|

| R&D Expenditure | $591.8 million | Indicates significant investment in technological innovation and IP development. |

| Key Technologies | ALD & Epitaxy | Core competencies driving demand for advanced semiconductor fabrication. |

| Emerging Tech Demand | AI, Quantum Computing | Creates new markets for specialized deposition and etch equipment. |

Legal factors

ASM International, as a global supplier, navigates a complex web of international trade laws and sanctions. This includes adhering to export controls, import regulations, and economic sanctions mandated by numerous nations. For instance, the U.S. Department of Commerce's Bureau of Industry and Security (BIS) regularly updates its Entity List, impacting companies like ASM that engage in international trade, potentially restricting their access to certain technologies or markets.

Failure to comply with these intricate regulations can result in significant financial penalties, severe reputational damage, and ultimately, restricted market access. For example, in 2023, several companies faced substantial fines for violating export control regulations, underscoring the critical need for diligent compliance. Staying abreast of these constantly evolving legal frameworks presents an ongoing challenge for ASM’s global operations.

Protecting ASM International's vast intellectual property, particularly its patents for cutting-edge technologies like Atomic Layer Deposition (ALD) and epitaxy, is fundamental to its market leadership. This necessitates a robust strategy for patent enforcement and defense against any infringement to preserve its technological edge.

In 2024, the semiconductor industry, a key market for ASM, continued to see significant investment in R&D, underscoring the value of proprietary technology. ASM's commitment to safeguarding its innovations directly impacts its competitive advantage and revenue streams derived from licensing and sales of its advanced equipment.

ASM International's manufacturing and product lines face growing environmental regulations concerning emissions, waste management, and hazardous substances. Compliance with directives like REACH and RoHS is critical for avoiding penalties, securing operational permits, and showcasing corporate responsibility, with varying requirements across different global regions.

Labor Laws and Employment Regulations

ASM International navigates a complex web of global labor laws, necessitating strict adherence to varying regulations concerning working conditions, minimum wages, and employee rights across its operational bases. For instance, in 2024, the company must consider evolving legislation in key markets such as the United States, where the Fair Labor Standards Act sets federal standards, and in European Union countries, which often have more stringent protections for workers. This compliance is vital for maintaining operational integrity and mitigating risks associated with labor disputes.

The company's commitment to fair labor practices extends to ensuring robust health and safety standards, a critical component of employment regulations worldwide. In 2024, data from the U.S. Bureau of Labor Statistics indicated a continued focus on workplace safety, with specific industries experiencing updated guidelines. ASM International's proactive approach to implementing and exceeding these standards not only safeguards its employees but also enhances its reputation as a responsible global employer.

- Global Compliance: Adherence to diverse labor laws in countries like the US, Germany, and Singapore, covering wages, working hours, and employee protections.

- Workplace Safety: Meeting and exceeding international health and safety standards, crucial for employee well-being and operational continuity.

- Employee Rights: Upholding rights related to fair treatment, non-discrimination, and collective bargaining, as mandated by local and international frameworks.

- Regulatory Evolution: Staying abreast of changes in labor legislation, such as potential increases in minimum wage or new regulations on remote work, impacting workforce management.

Data Privacy and Cybersecurity Laws

ASM International faces increasing scrutiny regarding data privacy and cybersecurity. Compliance with regulations like the EU's General Data Protection Regulation (GDPR) and similar national laws, such as the California Consumer Privacy Act (CCPA), is paramount. These laws mandate strict handling of personal data, impacting how ASM International collects, stores, and processes information from customers and employees. Failure to comply can result in significant fines; for example, GDPR penalties can reach up to 4% of global annual revenue or €20 million, whichever is higher.

The legal imperative to protect sensitive data extends to robust cybersecurity measures. ASM International must implement and maintain strong frameworks to prevent data breaches, which can lead to severe financial penalties and reputational damage. In 2024, the average cost of a data breach globally reached $4.73 million, highlighting the substantial financial risk involved. Maintaining customer trust and avoiding legal liabilities are directly tied to the effectiveness of these cybersecurity protocols.

- GDPR Fines: Penalties can reach up to 4% of global annual revenue or €20 million.

- CCPA Impact: California's law grants consumers rights over their personal data.

- Data Breach Costs: The global average cost of a data breach was $4.73 million in 2024.

- Cybersecurity Investment: Proactive investment in cybersecurity is a legal necessity to avoid breaches.

ASM International operates within a strict legal framework governing international trade, including export controls and sanctions. Adherence to regulations like those from the U.S. Bureau of Industry and Security (BIS) is crucial, as violations can lead to substantial fines. For instance, in 2023, numerous companies faced penalties for export control non-compliance, underscoring the critical need for diligent oversight.

Protecting its intellectual property, particularly patents for advanced technologies like ALD, is vital for ASM's market position. The semiconductor industry, a key market, saw significant R&D investment in 2024, highlighting the value of proprietary innovations. Safeguarding these technologies directly impacts ASM's competitive edge and revenue.

Environmental regulations, such as REACH and RoHS, impact ASM's manufacturing processes, requiring careful management of emissions and hazardous substances. Compliance is essential for operational permits and corporate responsibility, with varying global requirements.

Labor laws globally dictate fair working conditions and employee rights. In 2024, ASM must navigate differing regulations in markets like the U.S. and EU to avoid labor disputes and maintain operational integrity.

Data privacy and cybersecurity are increasingly regulated, with laws like GDPR and CCPA imposing strict data handling requirements. Failure to comply can result in significant fines, with GDPR penalties potentially reaching 4% of global annual revenue. The average cost of a data breach in 2024 was $4.73 million, emphasizing the financial risks of non-compliance.

Environmental factors

ASM International's operations, like much of the semiconductor industry, are inherently energy-intensive. The manufacturing of their sophisticated equipment and the operation of the chip fabrication plants that use them consume significant amounts of electricity. This presents a direct environmental challenge.

There's increasing pressure on companies like ASM International to not only reduce their own operational energy consumption but also to innovate and design more energy-efficient equipment. This focus on efficiency helps lower the overall carbon footprint throughout the entire semiconductor value chain, which is crucial for meeting global climate change mitigation targets.

The semiconductor industry, including equipment suppliers, is increasingly scrutinized for its environmental impact. For instance, global efforts to reduce greenhouse gas emissions are intensifying, with many countries setting ambitious net-zero targets. ASM International's commitment to energy efficiency in its products and operations directly supports these broader environmental objectives.

The semiconductor sector, including companies like ASM International, faces significant environmental challenges related to waste generation, particularly hazardous materials used in manufacturing. Robust waste management strategies are crucial, focusing on reduction at the source, increased recycling rates, and secure disposal methods to meet increasingly stringent global regulations. For instance, the European Union's Waste Framework Directive sets ambitious recycling targets for member states, impacting supply chains and operational practices.

ASM International's commitment to resource efficiency directly addresses these environmental concerns. By designing products and optimizing manufacturing processes to use fewer materials and energy, the company can significantly lower its environmental footprint. This approach not only aligns with sustainability goals but also offers tangible cost savings through reduced material consumption and waste disposal fees, a trend seen across the industry as companies like Intel reported a 15% reduction in water usage per wafer in their 2023 sustainability report through process optimization.

Water is absolutely essential for semiconductor manufacturing, especially for the meticulous cleaning of wafers. ASM International, as a key player, must actively assess the water consumption of its advanced equipment. By 2024, the semiconductor industry's water demand is projected to rise significantly, making efficiency a critical concern.

ASM International has an opportunity to innovate by developing solutions that allow its customers to use water more efficiently in their manufacturing processes. This focus on water-saving technologies is becoming increasingly vital as global water scarcity intensifies, with regions like California already experiencing severe drought conditions impacting industrial operations.

Adopting and promoting sustainable water management practices is no longer optional but a strategic imperative. ASM International can position itself as a leader by demonstrating a commitment to reducing the environmental impact of its products, which is a growing expectation from customers and regulators alike.

Sustainability Reporting and ESG Initiatives

Investor and stakeholder pressure for transparency is driving ASM International to enhance its sustainability reporting and bolster its Environmental, Social, and Governance (ESG) initiatives. This means setting ambitious environmental goals, transparently sharing performance data, and proving a dedication to ethical operations.

Companies with robust ESG profiles are increasingly attractive to investors. For instance, a 2024 report by Morningstar indicated that sustainable funds attracted over $200 billion in net inflows globally, highlighting a significant shift in capital allocation towards ESG-conscious businesses. ASM International's commitment to these principles can therefore unlock new avenues for capital and significantly boost its public image.

- Environmental Targets: ASM International is expected to set measurable targets for reducing its carbon footprint and waste generation, aligning with global climate agreements.

- Disclosure Metrics: The company will likely report on key ESG indicators, such as water usage, energy consumption, and supply chain labor practices, providing stakeholders with quantifiable data.

- Reputation Enhancement: Strong ESG performance can differentiate ASM International in the market, fostering trust and loyalty among customers, employees, and investors alike.

Climate Change Risks and Supply Chain Resilience

Climate change presents significant physical risks, such as increased frequency and intensity of extreme weather events, which can directly impact manufacturing facilities and disrupt global supply chains. For ASM International, this translates to potential production delays and increased logistics costs, as seen in the 2024 disruptions caused by severe flooding in Southeast Asia impacting semiconductor component availability.

ASM International must proactively assess and mitigate these physical climate risks, not only within its own facilities but also throughout its extensive supply chain network. This includes understanding the vulnerability of key suppliers to climate-related hazards and developing contingency plans. For instance, a 2025 report highlighted that 40% of critical electronic component suppliers for the semiconductor industry are located in regions with high water stress or flood risk.

Building a resilient and sustainable supply chain is therefore paramount for ASM International's long-term stability and its ability to adapt to evolving environmental conditions. This involves diversifying supplier locations, investing in climate-resilient infrastructure, and fostering closer collaboration with partners to enhance transparency and preparedness. Companies that prioritize supply chain adaptation are better positioned to maintain operational continuity and meet customer demand amidst climate volatility.

- Physical Risk Assessment: Identifying suppliers in climate-vulnerable regions (e.g., areas prone to extreme heat, flooding, or droughts).

- Supply Chain Diversification: Reducing reliance on single-source suppliers or geographically concentrated production hubs.

- Infrastructure Resilience: Investing in or encouraging suppliers to invest in climate-proof facilities and logistics.

- Contingency Planning: Developing robust business continuity plans to address potential disruptions from extreme weather events.

ASM International's operations, like much of the semiconductor industry, are inherently energy-intensive, requiring significant electricity for equipment manufacturing and chip fabrication. Increasing pressure is on companies to reduce energy consumption and develop more energy-efficient equipment to lower the industry's carbon footprint and meet global climate targets, with a focus on reducing greenhouse gas emissions.

The semiconductor sector faces waste generation challenges, particularly with hazardous materials, necessitating robust waste management strategies focused on reduction, recycling, and secure disposal to comply with stringent global regulations. Resource efficiency, through reduced material and energy use in products and manufacturing, is a key strategy for lowering environmental impact and achieving cost savings, mirroring industry trends where companies report reductions in water usage through process optimization.

Water is critical for semiconductor manufacturing, especially wafer cleaning, making water consumption assessment by companies like ASM International vital as industry water demand is projected to rise significantly by 2024. Developing water-saving technologies presents an opportunity for innovation and leadership, particularly as global water scarcity intensifies, impacting industrial operations in drought-prone regions.

Climate change poses physical risks, such as extreme weather, which can disrupt manufacturing and supply chains, leading to production delays and increased costs, as evidenced by 2024 disruptions impacting component availability. Proactive risk assessment and mitigation across the supply chain, including supplier vulnerability to climate hazards and contingency planning, are essential for long-term stability and adaptation.

PESTLE Analysis Data Sources

Our PESTLE Analysis for ASM International is meticulously crafted using data from reputable sources including industry-specific market research reports, official government publications, and leading economic and technological trend analyses. This ensures a comprehensive understanding of the macro-environmental factors influencing the advanced materials sector.