ASM International Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ASM International Bundle

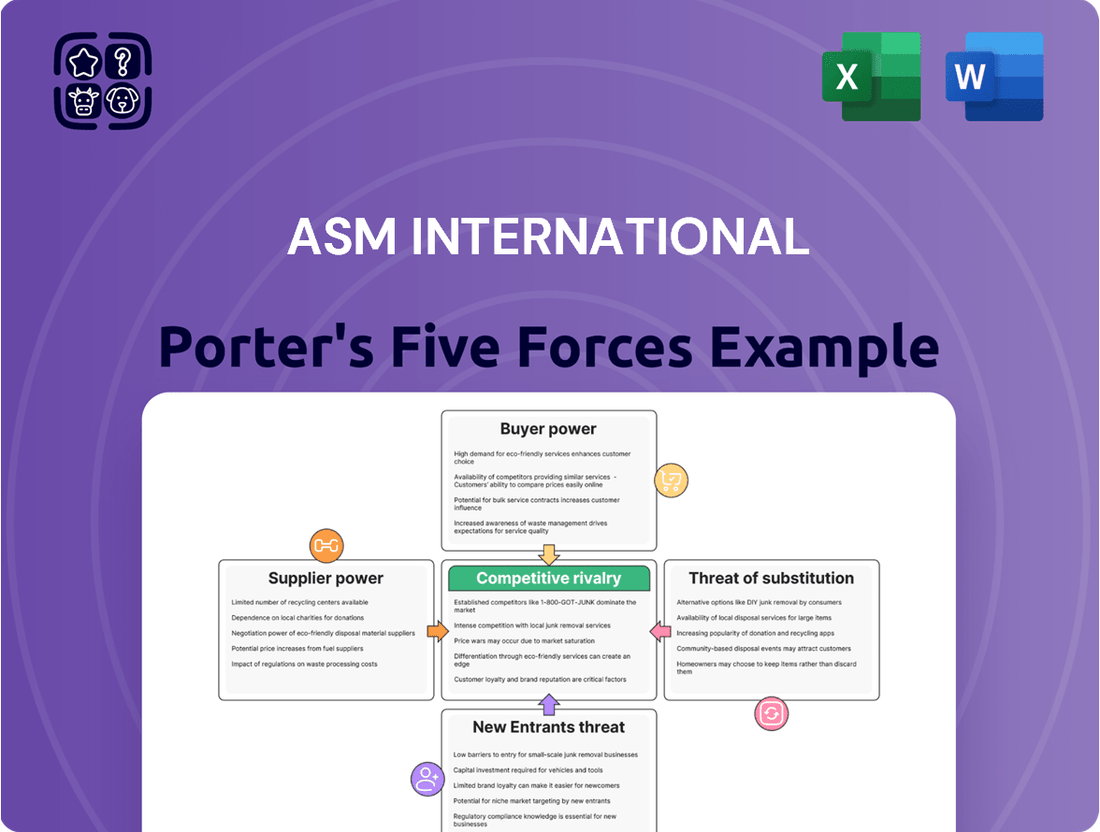

ASM International operates in a dynamic semiconductor equipment market, where understanding the competitive landscape is crucial for success. Our Porter's Five Forces analysis delves into the intensity of rivalry, the bargaining power of buyers and suppliers, and the threats posed by new entrants and substitutes.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore ASM International’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

ASM International's reliance on highly specialized components and advanced materials for its cutting-edge ALD and Epitaxy equipment places considerable bargaining power in the hands of its suppliers. These unique inputs, often proprietary, are sourced from a select global network, meaning a limited number of firms possess the necessary expertise and manufacturing capabilities. For instance, in 2023, the semiconductor equipment industry saw continued demand for advanced materials, with companies like ASM International investing heavily in R&D to maintain their technological edge. Any price hikes or supply chain disruptions from these critical suppliers directly translate to increased production costs and extended lead times for ASM, impacting their ability to meet market demand.

For highly specialized components crucial to advanced deposition processes, the supplier landscape for semiconductor equipment manufacturers like ASM International can be quite concentrated. This limited availability of niche technology suppliers grants them significant leverage. For instance, a 2024 market report indicated that for certain critical precursor chemicals, only three global manufacturers possess the necessary purity and production capabilities, directly impacting ASM's sourcing options.

Switching suppliers for critical components in the semiconductor equipment industry, like those ASM International relies on, is a significant undertaking. The complexity and cost associated with qualifying new suppliers, potentially re-engineering existing designs, and the risk of production delays all contribute to making these transitions difficult. This inherent difficulty grants existing, trusted suppliers a stronger hand in negotiations.

The deep integration of specialized supplier components into ASM's advanced manufacturing equipment creates substantial technical hurdles for any potential supplier change. This technological interdependence acts as a strong barrier, reinforcing the bargaining power of established suppliers who have already navigated these integration challenges.

Supplier's Importance to ASM's Innovation

Suppliers in the advanced semiconductor equipment sector are often crucial innovation partners for companies like ASM International. Many suppliers of specialized sub-systems or unique materials invest significantly in their own research and development, making their technological contributions essential for ASM's pursuit of next-generation wafer processing solutions. This deep integration and shared R&D focus enhance the bargaining power of these key suppliers.

For instance, in 2024, the semiconductor industry continued to see intense competition and rapid technological advancements, particularly in areas like advanced lithography and deposition techniques. Suppliers who offer proprietary components or materials that enable these breakthroughs gain considerable leverage. ASM International's reliance on such specialized inputs means that these suppliers can command favorable terms, impacting ASM's cost structure and its ability to bring cutting-edge products to market efficiently.

- Supplier R&D Investment: Many critical suppliers in the semiconductor ecosystem invest heavily in R&D, making their innovations indispensable for ASM's next-generation equipment development.

- Proprietary Technologies: Suppliers offering unique sub-systems or materials that enable advanced wafer processing often hold strong bargaining power due to their specialized offerings.

- Collaborative Dependency: The close R&D partnerships and mutual reliance between ASM and its key suppliers strengthen the suppliers' negotiating position.

- Market Dynamics in 2024: The competitive and fast-evolving nature of the semiconductor industry in 2024 amplified the importance of suppliers who provide critical technological advancements.

Potential for Forward Integration by Suppliers

While less common for highly specialized component suppliers, there's a theoretical possibility for some with unique intellectual property to integrate forward into equipment manufacturing. However, the semiconductor equipment market's complexity, capital needs, and existing customer ties present significant barriers, thereby limiting this specific avenue of supplier leverage for companies like ASM.

ASM International faces significant supplier bargaining power due to its reliance on highly specialized, often proprietary components for its advanced ALD and Epitaxy equipment. The limited number of global manufacturers capable of producing these niche inputs, such as high-purity precursor chemicals, grants these suppliers considerable leverage. For instance, in 2024, reports highlighted that for certain critical semiconductor precursors, only a handful of companies worldwide possess the required purity and production scale, directly impacting ASM's sourcing options and negotiation flexibility.

The difficulty and cost associated with qualifying new suppliers, coupled with the potential for re-engineering and production delays, reinforce the power of existing, trusted suppliers. Furthermore, many suppliers are crucial innovation partners, investing heavily in R&D that is indispensable for ASM's next-generation product development. This symbiotic relationship, especially in the fast-paced 2024 semiconductor market, strengthens their negotiating position, allowing them to command favorable terms.

| Factor | Impact on ASM International | 2024 Context |

| Supplier Specialization | High reliance on few, specialized component providers | Limited global suppliers for advanced materials and precursors |

| Switching Costs | High costs and technical challenges in changing suppliers | Significant R&D and re-engineering required for new integrations |

| Supplier R&D Investment | Suppliers are key innovation partners | Essential for developing next-gen wafer processing solutions |

| Proprietary Technologies | Suppliers offer unique, enabling technologies | Crucial for competitive edge in rapidly advancing semiconductor market |

What is included in the product

This analysis dissects the competitive landscape for ASM International by examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the semiconductor equipment industry.

Effortlessly identify and mitigate competitive threats with a comprehensive overview of industry power dynamics.

Customers Bargaining Power

ASM International's customer base is highly concentrated, primarily consisting of major global chipmakers such as TSMC, Samsung, and Intel. These entities are not only large but also possess significant financial strength, which amplifies their influence.

The substantial order volumes placed by these key customers give them considerable bargaining power. This leverage allows them to negotiate favorable terms, including pricing, delivery schedules, and product customization, directly impacting ASM's profit margins and operational flexibility.

For chipmakers, the cost and complexity of switching core equipment suppliers are substantial, significantly limiting their bargaining power. For instance, integrating new advanced wafer processing equipment, such as Applied Materials' (AMAT) latest epitaxy systems or ASML's (ASML) lithography machines, into existing fabrication lines demands massive capital expenditure, extensive re-qualification processes, and the potential for costly production interruptions.

These high switching costs effectively lock customers into long-term relationships with their established equipment providers. This is particularly true when considering the deep integration and calibration required for critical processes like Atomic Layer Deposition (ALD) and epitaxy, where even minor changes can impact yield and performance.

Customers in the semiconductor sector, particularly those developing advanced chips like those for AI and high-performance computing, exert significant influence. Their demand for technologies enabling smaller, faster, and more efficient transistors, such as Gate-All-Around (GAA) architectures and High-Bandwidth Memory (HBM), drives innovation. This constant push for next-generation capabilities means customers are powerful, yet also reliant on suppliers capable of delivering these complex solutions.

ASM International's strong position in critical deposition technologies like Atomic Layer Deposition (ALD) and epitaxy is a key factor here. For instance, their ALD systems are vital for fabricating GAA transistors, a key advancement in chip miniaturization. In 2023, ASM reported a significant increase in orders for their advanced deposition equipment, reflecting this customer demand for leading-edge manufacturing capabilities.

Customer's Ability for Backward Integration

While major chipmakers possess significant in-house research and development, the highly specialized nature and immense capital investment required for semiconductor process equipment manufacturing present a substantial barrier to full backward integration. For instance, ASML's EUV lithography machines represent decades of focused innovation and billions in R&D, a level of specialized expertise that chip manufacturers typically do not possess or find economical to replicate.

Consequently, the ability of customers like Intel or TSMC to directly manufacture such complex equipment themselves is severely limited. This lack of feasible backward integration means that customers, while influential, cannot easily bypass the need for specialized equipment suppliers like ASM International.

- Limited Feasibility: Chipmakers focus on chip design and fabrication, not specialized equipment engineering.

- High Capital Costs: Developing and producing advanced semiconductor equipment requires massive, ongoing investment.

- Specialized Expertise: Semiconductor equipment manufacturing demands unique technical knowledge and experience.

Impact of Semiconductor Industry Cycles

The bargaining power of customers in the semiconductor equipment sector, like ASM International, is significantly shaped by industry cycles. During periods of oversupply or economic slowdown, chip manufacturers can leverage their purchasing power to demand lower prices or more favorable terms from equipment suppliers.

However, the landscape in 2024 and extending into 2025 presents a different dynamic. The robust demand for advanced chips, particularly those powering artificial intelligence and expanding data centers, has created a strong growth environment. This surge in demand bolsters the position of leading equipment providers like ASM.

Consequently, chipmakers are finding it more challenging to exert significant pricing pressure on essential, high-demand equipment. This shift means suppliers are in a more advantageous negotiating stance, reflecting the current industry momentum.

- Cyclical Influence: Semiconductor equipment demand often mirrors the broader chip market cycles, impacting customer leverage.

- 2024-2025 Outlook: Strong AI and data center growth provides a tailwind for equipment suppliers, reducing customer bargaining power.

- Supplier Advantage: High demand for advanced manufacturing tools limits customers' ability to negotiate price concessions.

ASM International's key customers, like TSMC and Samsung, hold substantial bargaining power due to their massive order volumes and significant financial clout. This allows them to negotiate favorable pricing and terms, directly affecting ASM's profitability.

However, the high switching costs for advanced semiconductor manufacturing equipment, coupled with the specialized expertise required, limit customers' ability to easily change suppliers. This inherent lock-in strengthens ASM's position.

The current industry trend, particularly the surge in AI-driven chip demand in 2024 and projected into 2025, further shifts the balance. This robust demand for critical deposition technologies means customers face greater difficulty in dictating terms, giving suppliers like ASM an advantage.

| Customer Type | Bargaining Power Factor | Impact on ASM International |

|---|---|---|

| Major Chipmakers (TSMC, Samsung, Intel) | High order volumes, financial strength | Ability to negotiate favorable pricing and terms |

| All Customers | High switching costs for advanced equipment | Limited ability to change suppliers, creating customer loyalty |

| AI/HPC Chip Demand (2024-2025) | Strong demand for advanced manufacturing tools | Reduced customer leverage, increased supplier negotiation advantage |

Preview the Actual Deliverable

ASM International Porter's Five Forces Analysis

This preview showcases the complete ASM International Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the materials science and engineering sector. The document you see here is precisely the same professionally formatted and ready-to-use analysis you will receive immediately after purchase, ensuring no surprises or placeholder content.

Rivalry Among Competitors

The semiconductor equipment sector is defined by its intense R&D focus, a continuous technological arms race to produce smaller, more capable, and energy-efficient chips. ASM International's commitment to R&D, with an anticipated 12% compound annual growth rate through 2025, is vital for sustaining its competitive edge in ALD and epitaxy technologies against its peers.

The advanced semiconductor process equipment market is a tight race, with a handful of global giants like Applied Materials, ASML, Lam Research, Tokyo Electron, KLA, and ASM International itself holding significant sway. This oligopolistic structure means competition is fierce, but the established players benefit from high entry barriers and deep customer ties, leading to a relatively stable competitive landscape.

ASM International faces intense competition, but its strategic focus on product differentiation, particularly in Atomic Layer Deposition (ALD) and epitaxy, sets it apart. While rivals like Applied Materials and Lam Research are broad-based, ASM has carved out a strong niche.

This specialization is evident in its leading market position; for instance, ASM held approximately 35% of the ALD market share in 2023. This allows them to command premium pricing and build deep expertise, but it also means direct competition with other players heavily investing in these same high-growth segments.

High Fixed Costs and Exit Barriers

ASM International operates in the semiconductor equipment manufacturing sector, an industry characterized by exceptionally high fixed costs. These costs are driven by the need for advanced research and development, sophisticated manufacturing facilities, and the employment of a highly specialized and skilled workforce.

The substantial investment required in these areas creates significant exit barriers. Companies are compelled to continue operating and competing aggressively, even when market demand softens, to avoid the substantial losses associated with shutting down or divesting specialized assets. This dynamic inherently fuels sustained competitive rivalry among existing players.

- High R&D Investment: Semiconductor equipment manufacturers like ASM International typically allocate a significant portion of their revenue to R&D, often exceeding 10% annually, to stay at the forefront of technological advancements. For instance, in 2023, the industry saw continued heavy investment in areas like advanced lithography and deposition technologies.

- Capital Intensive Manufacturing: Building and maintaining state-of-the-art manufacturing facilities for semiconductor equipment demands hundreds of millions of dollars in capital expenditure. This high upfront investment makes it difficult for new entrants to compete and discourages existing firms from exiting.

- Specialized Workforce: The industry relies on engineers and technicians with highly specialized skills in areas such as vacuum technology, plasma physics, and advanced materials science. Training and retaining this talent represents a considerable ongoing cost.

- Capacity Utilization Pressure: With high fixed costs, maintaining high capacity utilization is crucial for profitability. This pressure forces companies to compete fiercely on price and innovation to secure orders, even during cyclical downturns in the semiconductor market.

Geopolitical Factors and Trade Tensions

Geopolitical tensions and export controls significantly shape competitive rivalry. For instance, US export controls targeting China directly impact companies like ASM International, influencing their market access and revenue streams. ASM anticipates a revenue decrease in China for 2025 due to these restrictions, highlighting the direct competitive impact.

These geopolitical factors can also foster regionalization of supply chains. As companies navigate export controls and trade barriers, they may shift production or sourcing to different regions. This can intensify competition within specific geographic markets as businesses adapt their strategies to comply with new regulations and secure alternative supply routes.

- Impact of Export Controls: US export controls on advanced technology, particularly impacting sales to China, create a more challenging competitive landscape.

- Regionalization of Supply Chains: Geopolitical tensions encourage the development of regionalized supply chains, potentially leading to increased competition in specific geographical areas.

- ASM International's Outlook: ASM International projects a decline in its China revenue for 2025, directly attributed to US export controls, illustrating the tangible effects on market competition.

The semiconductor equipment sector is a battlefield where a few major players, including ASM International, Applied Materials, and Tokyo Electron, engage in intense competition. This rivalry is fueled by the necessity for continuous innovation and significant R&D spending, often exceeding 10% of revenue annually, to maintain market share.

ASM International's focused strategy on ALD and epitaxy differentiates it, but it still faces direct competition from broader-based rivals. For example, in 2023, ASM held a substantial 35% share of the ALD market, demonstrating its competitive strength in specialized areas.

The high fixed costs associated with advanced manufacturing and R&D create strong exit barriers, forcing companies to compete aggressively to maintain capacity utilization and profitability, even during market downturns.

Geopolitical factors, such as US export controls impacting sales to China, further shape this competitive landscape, with ASM International anticipating a revenue decrease in China for 2025 due to these restrictions.

| Competitor | Focus Areas | Approx. 2023 Market Share (Relevant Segments) | Key Competitive Strengths |

|---|---|---|---|

| ASM International | ALD, Epitaxy | ALD: ~35% | Specialization, technological leadership in niche areas |

| Applied Materials | Broad Portfolio (Deposition, Etch, Ion Implantation) | Leading player across multiple segments | Scale, breadth of offerings, strong customer relationships |

| Lam Research | Etch, Deposition | Strong in etch and certain deposition technologies | Process innovation, strong installed base |

| Tokyo Electron (TEL) | Deposition, Etch, Lithography Support | Significant player in deposition and etch | Diverse product portfolio, strong presence in Asia |

SSubstitutes Threaten

The threat of substitutes for Atomic Layer Deposition (ALD) and Epitaxy technologies, critical for ASM International, is relatively low in the advanced semiconductor manufacturing space. While alternative deposition methods exist, they often lack the precision, conformality, and atomic-level control required for cutting-edge chip architectures like Gate-All-Around (GAA) transistors. For instance, Chemical Vapor Deposition (CVD) can be a substitute in some less demanding applications, but it typically cannot achieve the same level of film uniformity and thickness control as ALD.

The market for advanced semiconductor manufacturing equipment, where ALD and Epitaxy are paramount, is characterized by high barriers to entry and significant R&D investment. Companies seeking to replicate the capabilities of ALD and Epitaxy would face substantial challenges in developing comparable precision and material quality. This makes it difficult for substitutes to gain significant traction, especially as chip complexity and performance demands continue to escalate, driving the need for these highly specialized deposition techniques.

In 2024, the demand for advanced semiconductor nodes, such as those utilizing GAA transistor designs, continued to grow, underscoring the indispensable nature of ALD and Epitaxy. These technologies are not easily replaced because they enable the creation of the ultra-thin, precisely layered materials essential for next-generation logic and memory devices. The capital expenditure in the semiconductor industry for advanced manufacturing, including tools for ALD and Epitaxy, remained robust, reflecting the ongoing reliance on these core technologies.

The threat of direct process substitutes for ASM International's core technologies, Atomic Layer Deposition (ALD) and advanced epitaxy, is remarkably low for leading-edge semiconductor manufacturing. These advanced deposition methods are practically indispensable for achieving the extreme precision, conformality, and specific material properties required for today's most sophisticated chip designs.

While alternative deposition techniques like Chemical Vapor Deposition (CVD) and Physical Vapor Deposition (PVD) exist, they generally fall short when it comes to the atomic-level control and uniformity demanded by advanced nodes. For instance, in critical applications for 3nm and below, the ability of ALD to deposit ultra-thin, uniform films with precise thickness control is paramount, a feat often unachievable by other methods. This inability of substitutes to replicate these essential characteristics significantly dampens the threat.

The threat of substitutes for advanced semiconductor manufacturing equipment, like that offered by ASM International, is often less about entirely new technologies replacing ALD and epitaxy, and more about the continuous innovation within these core methods. Companies like ASM are constantly pushing the boundaries, developing advancements such as selective ALD, novel precursor chemistries, and enhanced process control. These improvements ensure that ALD and epitaxy remain highly relevant and competitive, adapting to the ever-evolving demands of new chip designs and material requirements.

High Cost and Risk of Developing Alternatives

Developing entirely new manufacturing processes to replace Atomic Layer Deposition (ALD) or epitaxy demands substantial research and development expenditure, potentially running into hundreds of millions of dollars. These ventures also require years of dedicated effort and overcoming complex technical challenges. For instance, a breakthrough in a completely novel deposition method would need to demonstrate comparable or superior precision, uniformity, and material quality to existing, highly refined techniques.

The inherent risks in such ambitious projects, coupled with the proven effectiveness and ongoing advancements in ALD and epitaxy, significantly dampen the immediate threat of disruptive substitutes. Companies like ASM International, a leader in ALD and epitaxy equipment, continually invest in refining their existing technologies, making it an uphill battle for any new entrant. In 2023, the semiconductor equipment market saw significant investment in advanced manufacturing processes, but the focus remained on enhancing current methods rather than entirely replacing them.

- High R&D Investment: Developing novel deposition technologies requires billions in research, testing, and scaling up.

- Long Development Cycles: Bringing a new manufacturing process from concept to market readiness can take a decade or more.

- Technical Hurdles: Achieving the nanometer-level precision and uniformity of ALD and epitaxy is exceptionally difficult.

- Established Efficacy: ALD and epitaxy are proven, reliable, and continuously improved technologies, creating a high barrier for substitutes.

Interdependence with Lithography and Other Steps

The threat of substitutes for Atomic Layer Deposition (ALD) and epitaxy in semiconductor manufacturing is significantly mitigated by their deep integration with other critical front-end processing steps. For instance, ALD and epitaxy are intrinsically linked to lithography and etching, forming a complex, sequential workflow. Any alternative technology would need to be compatible with this entire intricate process, necessitating a complete overhaul of established fabrication methods.

This high degree of interdependence makes wholesale substitution exceptionally challenging. Consider the 2024 landscape where advanced nodes rely on precise layer-by-layer deposition, a capability ALD and epitaxy excel at. Introducing a substitute would require not only replicating this precision but also ensuring seamless integration with lithography tools, which are themselves highly specialized and costly investments for foundries.

- Interdependence with Lithography: ALD and epitaxy are critical for creating the ultra-thin, uniform layers required for advanced lithography patterning.

- Manufacturing Flow Integration: Any substitute must fit into the existing, highly optimized semiconductor fabrication sequence, which includes etching, cleaning, and metrology.

- Re-engineering Costs: A complete re-engineering of the semiconductor fabrication process to accommodate a substitute would involve substantial capital expenditure and development time, making it economically unfeasible for most manufacturers.

The threat of substitutes for ASM International's core Atomic Layer Deposition (ALD) and epitaxy technologies is minimal in advanced semiconductor manufacturing due to their unparalleled precision and conformality. While alternatives like Chemical Vapor Deposition (CVD) exist, they cannot match the atomic-level control essential for next-generation chip architectures such as Gate-All-Around (GAA) transistors.

The significant R&D investment and technical complexity required to replicate ALD and epitaxy capabilities create high barriers to entry for potential substitutes. As chip complexity increases, the demand for these specialized deposition techniques remains robust, as evidenced by continued capital expenditures in advanced semiconductor manufacturing in 2024.

The integration of ALD and epitaxy within the broader semiconductor fabrication process, particularly with lithography, further solidifies their position. Any substitute would need to seamlessly integrate with existing, highly optimized workflows, a feat that would necessitate substantial re-engineering and capital investment, making it economically unviable.

| Factor | Description | Impact on ASM International |

| Technical Superiority | ALD and epitaxy offer atomic-level precision and conformality unmatched by alternatives. | Low threat from substitutes for critical applications. |

| R&D and Capital Investment | Developing comparable technologies requires billions and years of development. | High barrier to entry for substitutes. |

| Manufacturing Integration | These processes are deeply embedded in existing fabrication flows. | Difficult for substitutes to gain traction without process overhaul. |

| Market Demand (2024) | Growing demand for advanced nodes (e.g., GAA) reinforces the need for ALD/epitaxy. | Sustains demand for ASM's core technologies. |

Entrants Threaten

The semiconductor process equipment industry, particularly for advanced technologies like Atomic Layer Deposition (ALD) and epitaxy, presents an extreme barrier to entry due to its incredibly high capital expenditure requirements. Companies looking to compete must invest billions in research and development to create cutting-edge tools and establish sophisticated, global manufacturing and service networks.

For instance, developing a new generation of ALD equipment can easily cost hundreds of millions of dollars, encompassing everything from material science research to precision engineering and cleanroom facilities. This financial hurdle significantly limits the pool of potential new entrants, making it exceptionally difficult for newcomers to challenge established players like ASM International.

The semiconductor equipment manufacturing industry presents a formidable threat of new entrants, largely due to the immense R&D and intellectual property barriers. Decades of accumulated knowledge and a constant drive for innovation mean that established players like ASM International possess extensive patent portfolios safeguarding their proprietary processes and equipment. For any newcomer to compete, they would need to invest heavily in developing comparable technologies from the ground up, a process that is both time-consuming and prohibitively expensive. Alternatively, licensing crucial IP is an option, but such core technologies are seldom made available to potential competitors.

Established customer relationships and trust represent a significant barrier to entry for new competitors in the semiconductor equipment market. Major chipmakers, such as Intel and TSMC, have cultivated deep, long-standing partnerships with their existing equipment suppliers, including ASM International. These relationships are built on a foundation of proven performance, reliability, and extensive technical collaboration, often spanning decades.

The process of qualifying new equipment for high-volume semiconductor manufacturing is exceptionally lengthy and rigorous. It involves extensive testing, validation, and integration into complex production lines, a process that can take years and substantial investment. This creates a powerful incumbency advantage for established players like ASM, as their equipment is already proven and trusted within these critical manufacturing environments.

For instance, in 2023, the capital expenditure by leading semiconductor manufacturers was substantial, with companies like TSMC investing over $30 billion. Introducing new, unproven equipment into such high-stakes, capital-intensive operations carries immense risk, further solidifying the advantage of incumbent suppliers who have demonstrated consistent performance and support.

Economies of Scale and Experience Curve

Existing players in the semiconductor equipment manufacturing industry, like ASM International, benefit from substantial economies of scale. This allows them to spread high fixed costs across a larger production volume, leading to lower per-unit costs in manufacturing, R&D, and procurement. For instance, in 2023, the global semiconductor equipment market was valued at approximately $110 billion, with major players like ASML, Applied Materials, and Lam Research dominating market share.

- Economies of Scale: Larger production volumes enable cost efficiencies in manufacturing and procurement for established firms.

- Experience Curve: Continuous operational improvements and process refinements lead to lower costs over time for incumbents.

- Barriers to Entry: New entrants face challenges in matching the cost structures of established players without significant upfront investment and market penetration.

- Competitive Disadvantage: Start-ups would initially operate at a cost disadvantage, making it difficult to compete on price or profitability.

Talent Scarcity and Specialized Expertise

The design, manufacturing, and servicing of semiconductor process equipment demand a highly specialized and scarce talent pool. This includes experts like physicists, materials scientists, and advanced engineers, whose skills are critical for innovation and production.

Attracting and retaining this specialized expertise presents a significant hurdle for any new entrant aiming to establish a foothold in the industry. For instance, the semiconductor industry, in general, faced a projected shortage of up to 67,000 skilled workers in the US alone by 2030, as reported by the Semiconductor Industry Association (SIA) in 2023. This scarcity directly impacts the ability of new companies to build the necessary technical capabilities to compete.

- Talent Pool Requirements: Physicists, materials scientists, and advanced engineers are essential for developing and maintaining complex semiconductor manufacturing equipment.

- Attraction and Retention Challenges: New entrants must overcome significant obstacles in attracting and retaining this highly sought-after expertise.

- Industry-Wide Shortages: The broader semiconductor sector experienced a projected shortage of up to 67,000 skilled workers in the US by 2030 (SIA, 2023), exacerbating the challenge for new entrants.

- Impact on Competition: The difficulty in securing specialized talent directly hinders a new company's ability to build a competitive organization and innovate effectively.

The threat of new entrants for ASM International is extremely low due to massive capital requirements, extensive R&D, and established customer relationships. Developing cutting-edge semiconductor process equipment demands billions in investment, making it nearly impossible for newcomers to match the scale and innovation of incumbents. For example, the global semiconductor equipment market was valued at around $110 billion in 2023, with a few dominant players controlling significant market share.

The rigorous qualification process for new equipment, which can take years and substantial investment, further solidifies the advantage of established suppliers like ASM. Major chipmakers, such as TSMC, which invested over $30 billion in capital expenditure in 2023, prioritize proven reliability and decades-long partnerships, creating a high barrier for unproven technologies.

Intellectual property and the scarcity of specialized talent also act as significant deterrents. Decades of accumulated knowledge and extensive patent portfolios protect established players, while the projected shortage of up to 67,000 skilled workers in the US semiconductor industry by 2030 (SIA, 2023) makes it difficult for new companies to assemble the necessary expertise.

| Barrier to Entry | Description | Example/Data Point |

|---|---|---|

| Capital Requirements | Massive investment needed for R&D, manufacturing, and global service networks. | Billions of dollars for advanced technologies; TSMC's 2023 capex exceeded $30 billion. |

| R&D and IP | Extensive knowledge, innovation drive, and patent portfolios. | Developing new ALD equipment can cost hundreds of millions. |

| Customer Relationships & Trust | Long-standing partnerships with major chipmakers based on proven performance. | Decades-long collaborations with companies like Intel and TSMC. |

| Qualification Process | Lengthy and rigorous testing and validation for high-volume manufacturing. | Can take years and significant investment to integrate new equipment. |

| Talent Scarcity | Need for highly specialized physicists, materials scientists, and engineers. | Projected US shortage of up to 67,000 skilled workers by 2030 (SIA, 2023). |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for ASM International is built upon a foundation of robust data, including financial reports from the company and its competitors, industry-specific market research, and publicly available regulatory filings.