ASM International Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ASM International Bundle

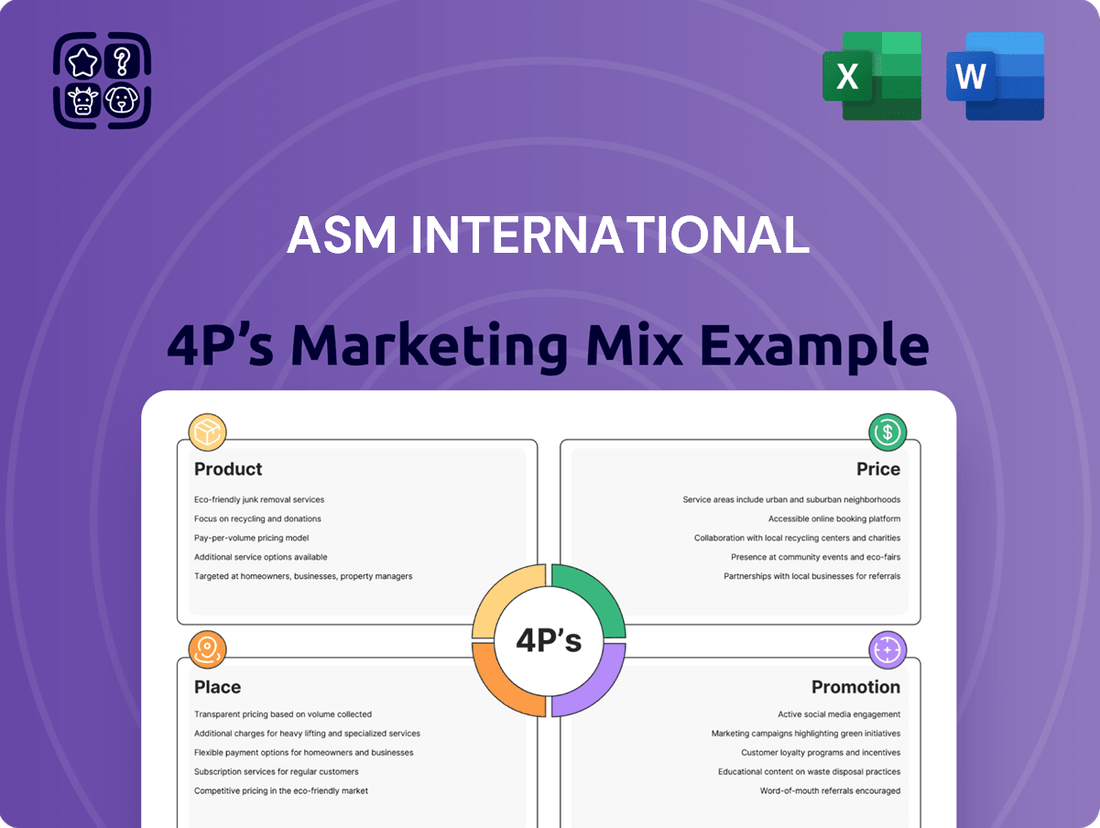

Unlock the secrets behind ASM International's market dominance with a comprehensive 4Ps Marketing Mix Analysis. Discover how their innovative product development, strategic pricing, efficient distribution, and targeted promotions create a powerful synergy.

Go beyond the surface and gain a complete understanding of ASM International's marketing engine. This in-depth analysis is your key to dissecting their success and applying similar strategies.

Save valuable time and gain actionable insights with our ready-made, editable 4Ps Marketing Mix Analysis for ASM International. Perfect for professionals and students seeking a competitive edge.

Product

ASM International's advanced wafer processing equipment is the cornerstone of their product strategy, encompassing deposition, etch, and lithography tools. These are critical for creating the intricate layers of semiconductor chips. The company's focus on innovation ensures their equipment supports the drive towards next-generation integrated circuits.

In 2024, the semiconductor equipment market, where ASM operates, was projected to see robust growth, driven by demand for AI, high-performance computing, and automotive electronics. ASM's advanced tools are essential for manufacturers producing chips with increasingly smaller feature sizes, a trend that continued to accelerate throughout 2024 and into 2025.

Atomic Layer Deposition (ALD) is a foundational product for ASM International, allowing for the precise, atom-by-atom buildup of ultra-thin films. This technology is indispensable for manufacturing cutting-edge semiconductor components like FinFET transistors and advanced memory chips, including DRAM and NAND flash.

ASM's extensive single-wafer ALD application portfolio underscores its role as a critical enabler for the semiconductor industry's progression. In 2024, the demand for advanced deposition techniques like ALD is projected to grow significantly as chip manufacturers push the boundaries of miniaturization and performance.

ASM International's Epitaxy (Epi) solutions are a cornerstone of their offering, working alongside Atomic Layer Deposition (ALD) to enable precise crystalline layer growth on substrates. This advanced technology is critical for the development of next-generation semiconductor devices, particularly those with intricate 3D architectures. The demand for Epi solutions is surging for components like high-bandwidth memory (HBM) and gate-all-around (GAA) transistors, areas where ASM is making significant inroads.

ASM's increasing market share in silicon epitaxy highlights their strategic focus on addressing key industry shifts. For instance, in the first quarter of 2024, ASM reported a notable increase in their order backlog for epitaxy equipment, indicating strong customer demand for these advanced manufacturing capabilities. This growth is directly tied to the semiconductor industry's push towards more complex chip designs and new material integration.

Complementary Deposition Technologies

ASM International's product strategy extends beyond its core Atomic Layer Deposition (ALD) and Epitaxy tools. They also provide Plasma Enhanced Chemical Vapor Deposition (PECVD) and Vertical Furnaces, diversifying their front-end semiconductor processing solutions. This broadens their market reach and enables integrated offerings for leading chip manufacturers.

These complementary deposition technologies are crucial for a comprehensive manufacturing flow. For instance, PECVD is widely used for depositing dielectric layers, a critical step in building complex chip architectures. Vertical furnaces, on the other hand, are essential for thermal processing steps like oxidation and diffusion.

This expanded product portfolio allows ASM International to capture more value across the semiconductor fabrication process. By offering a wider array of deposition and thermal solutions, they position themselves as a more complete partner for their customers. In 2024, the semiconductor equipment market saw significant investment, with companies like ASM International benefiting from increased demand for advanced manufacturing capabilities.

- Broadened Product Portfolio: Includes PECVD and Vertical Furnaces alongside ALD and Epitaxy.

- Integrated Solutions: Enables comprehensive front-end processing for chipmakers.

- Market Diversification: Caters to a wider range of critical manufacturing steps.

- Competitive Advantage: Positions ASM International as a more complete equipment supplier.

Services and Support

ASM International's product strategy is deeply rooted in providing comprehensive services and support, extending far beyond the initial equipment sale. This commitment to post-sales engagement is crucial for maintaining the performance and lifespan of their sophisticated semiconductor manufacturing equipment. Their global network of dedicated service professionals, backed by a robust technical and logistics infrastructure, ensures customers receive timely and effective assistance worldwide, reinforcing ASM's value proposition.

This emphasis on service is a key differentiator. For instance, in 2023, ASM reported that its service segment contributed significantly to its overall revenue, reflecting the high demand for its support offerings. This focus not only addresses the operational needs of their clients but also fosters strong, enduring customer relationships, which are vital in the capital-intensive semiconductor industry.

ASM's service and support framework includes:

- Global Technical Support: Providing expert troubleshooting and maintenance services across all operating regions.

- Logistics and Spare Parts: Ensuring efficient delivery of essential components to minimize downtime.

- Customer Training and Consulting: Empowering customers with the knowledge to optimize equipment usage and performance.

- Upgrade and Retrofit Services: Offering solutions to enhance existing equipment capabilities and extend their useful life.

ASM International's product strategy centers on advanced wafer processing equipment, crucial for semiconductor manufacturing. Their portfolio includes Atomic Layer Deposition (ALD), Epitaxy (Epi), Plasma Enhanced Chemical Vapor Deposition (PECVD), and Vertical Furnaces. These technologies enable the precise creation of intricate chip layers, supporting the industry's drive towards smaller, more powerful integrated circuits.

The demand for these advanced tools surged in 2024, fueled by AI, HPC, and automotive sectors. ASM's ALD and Epi solutions are particularly vital for next-generation components like FinFETs, advanced memory, HBM, and GAA transistors. Their increasing market share in silicon epitaxy, evidenced by a strong order backlog in Q1 2024, highlights their strategic alignment with industry trends.

| Product Category | Key Technologies | Industry Applications | 2024/2025 Market Drivers |

|---|---|---|---|

| Deposition | ALD, PECVD | Ultra-thin films, dielectric layers | AI, 5G, IoT, advanced packaging |

| Epitaxy | Silicon Epitaxy | Crystalline layer growth | High-performance computing, automotive |

| Thermal Processing | Vertical Furnaces | Oxidation, diffusion | Advanced node manufacturing |

What is included in the product

This analysis provides a comprehensive breakdown of ASM International's marketing strategies across Product, Price, Place, and Promotion, offering actionable insights into their market positioning and competitive landscape.

Simplifies complex marketing strategies by clearly outlining the 4Ps, alleviating the pain of overwhelming detail for focused decision-making.

Place

ASM International boasts a robust global manufacturing and sales network, with key facilities strategically positioned in the United States, Europe, and Asia. This expansive footprint enables them to efficiently serve major chipmakers in critical semiconductor manufacturing hubs worldwide.

Their international market reach is underscored by their common stock being traded on the Euronext Amsterdam Stock Exchange. In 2024, ASM International reported significant revenue growth, driven by strong demand in the advanced semiconductor markets, further solidifying their global presence and operational capabilities.

ASM International's direct sales strategy is crucial for its specialized semiconductor equipment. This approach fosters deep collaboration with leading chipmakers, allowing for customized solutions that integrate precisely into advanced manufacturing lines. For instance, in 2024, ASMI's focus on direct engagement with key accounts in the advanced packaging and deposition segments continues to drive growth, reflecting the high-touch nature of selling multi-million dollar equipment.

ASM International's strategic placement of facilities, like its operations in Arizona, is crucial for maintaining close proximity to key customers such as Intel and TSMC. This geographic advantage allows for the efficient rollout of their advanced Atomic Layer Deposition (ALD) technologies and ensures rapid responses to evolving customer needs. This proximity also helps in navigating geopolitical risks and aligns with industry trends towards 'friendshoring' production.

Regional Revenue Concentration

ASM International's revenue streams show a clear geographical concentration, underscoring the importance of specific markets for their sales performance. In 2024, Asia emerged as the dominant region, contributing a substantial 72.8% to the company's net sales. This heavy reliance on Asia is a direct reflection of the global semiconductor industry's manufacturing hubs and ASM's strategic positioning within them.

The United States represents the second-largest market, accounting for 21.4% of net sales in 2024. Europe, meanwhile, constitutes a smaller but still relevant portion, making up 5.8% of the total net sales for the same period. This distribution pattern significantly influences ASM's operational strategies, including where they prioritize investments, research and development efforts, and sales force deployment.

- Asia Dominance: 72.8% of net sales in 2024.

- United States Contribution: 21.4% of net sales in 2024.

- European Presence: 5.8% of net sales in 2024.

- Strategic Implications: Regional concentration dictates resource allocation and market focus.

Localized Production for Market Access

To navigate evolving trade dynamics and tariffs, ASM International has initiated localized production of some of its tools on American soil, with Arizona being a key base for this expansion. This strategic move aims to maintain competitive access to critical markets and mitigate the impact of trade barriers. Such localization ensures continued market penetration and responsiveness to regional demands.

This strategy directly addresses the rising costs associated with international shipping and potential tariffs, which can significantly impact product pricing and competitiveness. By producing in the US, ASM International can potentially reduce lead times and better control its supply chain, offering more reliable delivery to North American customers.

- Arizona's Role: Arizona's favorable business climate and access to skilled labor make it an attractive location for ASM International's localized production efforts.

- Market Access: Localized production enhances ASM International's ability to serve the North American market efficiently, avoiding complexities of international trade agreements.

- Cost Mitigation: By reducing reliance on overseas manufacturing, the company aims to offset potential increases in import duties and transportation expenses, which have seen volatility in recent years.

- Competitive Edge: This shift allows ASM International to maintain competitive pricing and faster delivery times compared to competitors solely relying on global supply chains.

ASM International's place strategy centers on its global manufacturing and sales network, crucial for serving the specialized semiconductor equipment market. Their expansive footprint, with key facilities in the United States, Europe, and Asia, allows for efficient access to major chipmakers. This global presence is further solidified by their listing on the Euronext Amsterdam Stock Exchange, reflecting their international reach and operational scale.

The company's direct sales approach is paramount, fostering close relationships with leading chipmakers to provide tailored solutions. This strategy is particularly evident in their focus on advanced packaging and deposition segments, where multi-million dollar equipment sales demand high-touch engagement. In 2024, this direct engagement with key accounts continued to be a primary growth driver.

ASM International's strategic facility placement, such as in Arizona, ensures proximity to major customers like Intel and TSMC. This geographic advantage facilitates the deployment of their advanced ALD technologies and enables rapid responses to customer needs, while also helping to mitigate geopolitical risks and align with 'friendshoring' trends.

The geographical distribution of ASM International's revenue highlights key markets. In 2024, Asia represented the largest share of net sales at 72.8%, followed by the United States at 21.4%, and Europe at 5.8%. This concentration dictates the company's investment, R&D, and sales force priorities.

| Region | 2024 Net Sales (%) |

|---|---|

| Asia | 72.8% |

| United States | 21.4% |

| Europe | 5.8% |

What You Preview Is What You Download

ASM International 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive ASM International 4P's Marketing Mix Analysis is fully complete and ready for your immediate use. You're viewing the exact version of the analysis you'll receive, ensuring full transparency and value.

Promotion

ASM International prioritizes robust investor relations and transparent financial reporting to effectively communicate its value to a discerning audience. The company's 2024 Annual Report, released in March 2025, alongside regular quarterly updates, offers in-depth insights into its operational performance, financial stability, and strategic trajectory. This commitment to detailed disclosure is fundamental in fostering investor trust and clearly articulating the company's market position.

ASM International's commitment to technological leadership is a cornerstone of its marketing strategy, highlighting advancements in Atomic Layer Deposition (ALD) and Epitaxy. This focus directly addresses the needs of the semiconductor industry, particularly for next-generation technologies.

The company actively showcases how its innovations enable critical manufacturing processes for advanced chip architectures like gate-all-around (GAA) and smaller process nodes such as 2nm and 1.4nm. This is particularly relevant given the projected growth in AI, which demands increasingly powerful and efficient semiconductors.

By demonstrating how their deposition solutions contribute to making chips smaller, faster, and more energy-efficient, ASM International positions itself as an indispensable partner in the semiconductor value chain. This emphasis on tangible benefits resonates with customers driving the AI revolution.

ASM International prioritizes strategic customer engagement and collaboration, recognizing its B2B, technically driven market. They foster close, early partnerships with key clients to ensure product development directly addresses evolving roadmaps and future technology demands.

This collaborative approach is exemplified by their participation in joint research projects. By teaming up with customers and academic institutions, ASM solidifies its promotional strategy through direct technical partnerships, building strong relationships and gaining valuable insights. For instance, in 2023, ASM announced a significant collaboration with a leading semiconductor manufacturer to co-develop next-generation deposition technologies, highlighting their commitment to this promotional pillar.

Industry Events and Thought Leadership

ASM International leverages industry events and thought leadership to solidify its market presence. The company actively participates in key conferences and technical forums, showcasing its cutting-edge semiconductor equipment advancements. This engagement is crucial for a business-to-business enterprise aiming to connect with its target audience.

These platforms are vital for demonstrating expertise and building relationships with influential decision-makers within the global semiconductor sector. By presenting their innovations, ASM International reinforces its authority and influence in the industry. For instance, in 2023, ASM International was a prominent exhibitor at SEMICON West, a major industry trade show, where they highlighted their latest deposition technologies.

- Thought Leadership: ASM International actively presents its latest technological advancements at industry conferences and technical forums.

- Market Reach: Participation in events like SEMICON Europa and SEMICON West allows ASM to directly engage with key decision-makers in the semiconductor ecosystem.

- Brand Reinforcement: These platforms are essential for demonstrating expertise and reinforcing ASM's position as an innovator in semiconductor manufacturing equipment.

- Networking Opportunities: Industry events provide critical avenues for networking and building strategic partnerships within the global semiconductor supply chain.

Sustainability and ESG Communication

ASM International leverages its robust sustainability and ESG communication as a key promotional tool. This strategy highlights their dedication to environmental stewardship, a critical factor for today's investors and customers.

The company actively promotes its commitment to achieving net-zero emissions by 2035. This ambitious target demonstrates forward-thinking leadership in addressing climate change, a significant concern for stakeholders.

Further bolstering their environmental credentials, ASM International announced in 2024 that 100% of its global operations are powered by renewable electricity. This achievement underscores their tangible progress in reducing their carbon footprint.

Recognition on CDP's 'A List' for both climate and water security in 2024 serves as a powerful endorsement of their ESG efforts. This accolade enhances brand reputation and appeals to a growing segment of environmentally and socially conscious investors.

- Net-Zero Emissions Target: 2035

- Renewable Electricity Usage: 100% across global operations (achieved in 2024)

- CDP Recognition: 'A List' for Climate and Water (2024)

ASM International's promotional efforts are deeply intertwined with its technological prowess and customer-centric approach. By highlighting its leadership in Atomic Layer Deposition (ALD) and Epitaxy, the company directly addresses the evolving needs of the semiconductor industry, particularly for advanced chip architectures like gate-all-around (GAA) and nodes as small as 1.4nm. This focus on enabling smaller, faster, and more energy-efficient chips positions ASM as a vital partner for companies driving the AI revolution.

Strategic customer engagement, including joint research projects with key clients and academic institutions, forms a crucial part of their promotion. This collaborative model ensures product development aligns with future technology demands. Furthermore, active participation in industry events like SEMICON West and SEMICON Europa allows ASM to showcase its innovations and reinforce its position as an industry leader, fostering valuable relationships within the semiconductor supply chain.

ASM International also leverages its strong Environmental, Social, and Governance (ESG) communications as a significant promotional tool. The company's commitment to net-zero emissions by 2035 and the achievement of powering 100% of its global operations with renewable electricity in 2024, along with CDP 'A List' recognition for climate and water security in 2024, appeal to environmentally conscious investors and customers.

| Key Promotional Aspects | Description | 2024/2025 Data/Facts |

| Technological Focus | Highlighting ALD and Epitaxy advancements for next-gen semiconductors | Enabling GAA and 1.4nm nodes; critical for AI chip demand |

| Customer Collaboration | Joint research projects with leading semiconductor manufacturers | Strengthening partnerships and aligning with future roadmaps |

| Industry Engagement | Participation in major trade shows and technical forums | Showcasing innovations at events like SEMICON West |

| ESG Communication | Commitment to sustainability and environmental stewardship | Net-zero by 2035; 100% renewable electricity in 2024; CDP 'A List' 2024 |

Price

ASM International leverages value-based pricing for its advanced semiconductor equipment, a strategy rooted in the substantial intellectual property and research and development investments. This approach is particularly evident in their Atomic Layer Deposition (ALD) and Epitaxy technologies, which are indispensable for manufacturing cutting-edge integrated circuits.

These sophisticated technologies enable chipmakers to produce semiconductors with enhanced performance and efficiency, justifying premium pricing. For instance, the demand for advanced nodes like 3nm and below, where ALD is critical, continues to grow, supporting ASM's pricing power. Their equipment's ability to deliver precise atomic-level control directly translates into tangible value for customers in terms of yield and device capability.

ASM International navigates a fiercely competitive semiconductor equipment landscape, where pricing strategies are heavily influenced by rivals such as Applied Materials and Lam Research. The company must align its pricing to remain competitive, even as it emphasizes technological advancements, to capture market share and secure crucial orders.

This strategic pricing approach is designed to support robust profit margins, enabling ASM to weather the inherent volatility of the semiconductor industry effectively. For instance, in 2024, the industry faced supply chain pressures, making competitive pricing even more critical for equipment suppliers.

ASM International's pricing for its advanced deposition equipment is directly tied to the semiconductor industry's demand cycles, especially for cutting-edge technologies like Gate-All-Around (GAA) transistors and High Bandwidth Memory (HBM). When demand for AI chips and advanced logic manufacturing is robust, ASM can command premium prices and secure substantial order volumes.

For instance, in the first quarter of 2024, ASM reported a significant increase in orders for its ALD systems, driven by strong demand from leading foundries investing in next-generation nodes. This surge in demand, coupled with the specialized nature of their technology, allows for pricing power during these upswings.

However, the company's pricing strategy must also account for potential market slowdowns or inventory corrections within the semiconductor sector. During these periods, ASM may need to offer more flexible pricing or incentives to maintain order flow, reflecting the inherent cyclicality of its customer base.

Long-Term Contracts and Service Revenue

ASM International's marketing strategy likely leverages long-term contracts for its sophisticated semiconductor manufacturing equipment. These agreements typically bundle equipment sales with crucial installation and ongoing service components, ensuring customer commitment and predictable revenue. This approach is vital given the high capital expenditure and technical expertise required for their products.

The service and spares segment is a cornerstone of ASM's financial health, contributing a substantial and stable portion to their overall revenue. This recurring income stream offers a degree of insulation against the cyclical nature of capital equipment orders. For instance, in the first quarter of 2024, ASM reported a service revenue of €135.3 million, representing approximately 21% of their total revenue, highlighting its importance.

- Service Revenue Contribution: In Q1 2024, service revenue accounted for 21% of ASM's total revenue, demonstrating its significant role.

- Long-Term Value: The service and spares segment provides a stable, recurring revenue stream, enhancing financial predictability.

- Strategic Pricing: The inclusion of long-term service agreements can influence the initial pricing strategy for their complex equipment.

- Customer Retention: This integrated model fosters strong customer relationships and loyalty throughout the equipment lifecycle.

Financial Targets and Shareholder Returns

ASM International is strategically focused on achieving ambitious financial targets, aiming for revenues between €3.0 billion and €3.6 billion by 2025. This revenue projection is underpinned by a commitment to maintaining strong gross margins, consistently targeted between 46% and 50%.

The company's pricing approach is directly aligned with these financial objectives, prioritizing the generation of significant shareholder returns. This commitment is demonstrably reflected in their active share buyback initiatives and established dividend policies, signaling a clear intent to enhance profitability from their high-value product segments.

- Revenue Target (2025): €3.0 - €3.6 billion

- Gross Margin Target: 46% - 50%

- Shareholder Return Focus: Share buybacks and dividend policies

- Pricing Strategy Alignment: Supporting financial goals and profitability

ASM International's pricing strategy is deeply intertwined with the value its advanced semiconductor equipment delivers, particularly in critical technologies like Atomic Layer Deposition (ALD) and Epitaxy. This value is derived from the significant R&D investment and the essential role these systems play in producing next-generation chips, justifying premium pricing for their technological superiority.

The company's pricing is also a dynamic response to market demand cycles, especially for advanced nodes and specialized memory like HBM. When demand for AI chips surges, ASM can leverage its technological edge to command higher prices, as seen in Q1 2024 order increases for ALD systems. This strategy aims to secure robust profit margins, targeting 46-50% gross margins and overall revenues of €3.0-€3.6 billion by 2025, while also supporting shareholder returns through buybacks and dividends.

| Metric | Value (Q1 2024) | Target (2025) |

|---|---|---|

| Service Revenue | €135.3 million (21% of total) | N/A |

| Gross Margin | 46%-50% (Target) | 46%-50% |

| Total Revenue | N/A | €3.0 - €3.6 billion |

4P's Marketing Mix Analysis Data Sources

Our 4P's analysis leverages a comprehensive blend of primary and secondary data sources. We meticulously examine official company reports, investor relations materials, product launch announcements, and pricing strategies. Additionally, we incorporate insights from industry publications, market research reports, and competitive intelligence platforms to ensure a holistic view.