Ascential SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ascential Bundle

Ascential's market intelligence and data analytics capabilities are significant strengths, but the company faces challenges in adapting to rapidly evolving digital landscapes. Our comprehensive SWOT analysis delves into these dynamics, revealing crucial opportunities for growth and potential threats to consider.

Want the full story behind Ascential's competitive advantages, potential weaknesses, and strategic growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Ascential commands a formidable market position through its flagship events, including the globally recognized Cannes Lions and Money20/20. These are not just gatherings; they are premier platforms for industry professionals to connect, gain insights, and foster innovation, solidifying Ascential's brand authority and market leadership.

The company's strategic focus on its key events is paying off handsomely. In 2023, Ascential reported that its Marketing segment, anchored by Cannes Lions, saw double-digit revenue growth. Similarly, the Financial Technology segment, driven by Money20/20, also experienced robust double-digit expansion, underscoring the strength and demand for these industry-leading events.

Ascential's diverse revenue streams, encompassing live events, awards, digital subscriptions, and advisory services, create a robust financial foundation. This multi-pronged strategy ensures resilience by mitigating risks associated with over-reliance on any single income source.

In 2023, for instance, Ascential reported that its digital segment, including subscriptions and data products, continued to be a significant contributor, alongside its well-established events portfolio. This balance between recurring digital revenue and cyclical event-based income is key to its stability.

Ascential has demonstrated robust financial performance, with its continuing operations showing impressive growth. In the first half of 2024, revenue increased by 15%, and Adjusted EBITDA saw a significant jump of 27%.

The company's financial strength is further bolstered by a strong balance sheet, notably enhanced by substantial proceeds from the divestiture of its Digital Commerce and WGSN businesses. This strategic move has resulted in a healthy net cash position.

This solid financial footing not only reflects operational success but also positions Ascential favorably for future investments and the potential to return value to its shareholders, underscoring its financial resilience and strategic capital management.

Strategic Focus and Value Creation

Ascential's strategic review has honed its focus on its core events business, positioning it as a high-quality, independent asset. This clarity, alongside substantial capital returns to shareholders, underscores a dedication to enhancing shareholder value. For instance, in the first half of 2024, Ascential returned £150 million to shareholders, demonstrating this commitment.

The company's ongoing initiatives to streamline operations and cut corporate overheads further reinforce this strategic direction. These efforts are designed to improve efficiency and profitability, directly contributing to the creation of long-term value for stakeholders.

- Strategic Clarity: Sharpened focus on the events-led business.

- Shareholder Value: Significant capital returns, including £150 million in H1 2024.

- Operational Efficiency: Ongoing efforts to optimize business and reduce corporate costs.

Expertise in Data and Analytics

Ascential's core strength lies in its deep expertise in data and analytics, enabling it to transform raw information into actionable intelligence for its clients. This focus remains even after divesting some digital commerce assets, with the company continuing to emphasize data-driven products and insights for specialized industries.

This capability is crucial in today's market. For instance, Ascential's digital shelf analytics, a key data product, helps brands understand their online performance. In 2023, the company reported that its Digital Commerce segment, which heavily relies on this data expertise, generated £395.2 million in revenue, highlighting the commercial value of their analytical prowess.

- Data-driven insights: Ascential excels at converting complex data into clear, actionable intelligence for businesses operating in specialized sectors.

- Digital commerce focus: Despite divestitures, the company maintains a strong emphasis on leveraging data to support and grow its digital commerce-related offerings.

- Client empowerment: By providing robust analytical tools and data, Ascential empowers clients to make more informed decisions, optimize strategies, and drive growth in the digital landscape.

Ascential's premier events, like Cannes Lions and Money20/20, are powerful brand builders and revenue drivers, cementing its leadership in key industries. The company's strategic focus on these core events has yielded impressive financial results, with both the Marketing and Financial Technology segments experiencing double-digit revenue growth in 2023.

Ascential's diverse revenue streams, including events, awards, and digital subscriptions, provide financial stability and resilience. This multi-faceted approach mitigates risks associated with reliance on any single income source, as seen in 2023 where digital segment revenue complemented its events portfolio.

The company's financial health is robust, evidenced by a 15% revenue increase and a 27% Adjusted EBITDA jump in the first half of 2024. Significant proceeds from divestitures have bolstered its balance sheet, resulting in a healthy net cash position and enabling substantial shareholder returns, such as the £150 million distributed in H1 2024.

Ascential's core strength lies in its data and analytics expertise, enabling it to provide actionable intelligence to clients. This capability is vital in specialized sectors, as demonstrated by the commercial success of its digital shelf analytics, which contributed significantly to the Digital Commerce segment's £395.2 million revenue in 2023.

What is included in the product

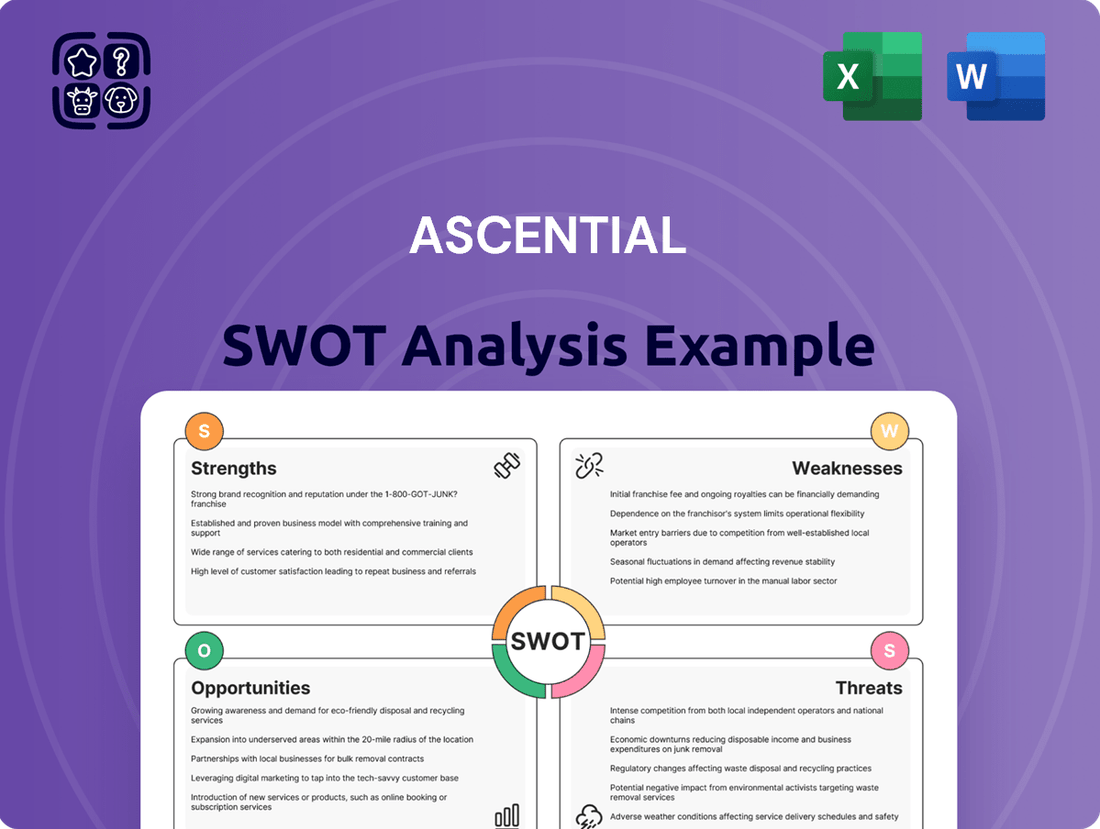

This SWOT analysis outlines Ascential’s strengths in data and analytics, weaknesses in integration, opportunities in emerging markets, and threats from competition and economic downturns.

Offers a clear, actionable framework to identify and mitigate Ascential's strategic challenges.

Weaknesses

Ascential's reliance on the performance of key events, such as Cannes Lions and Money20/20, represents a significant weakness. A substantial portion of its revenue generation is tied to these flagship gatherings, making the company susceptible to external shocks that could impact attendance or sponsorship levels. For example, Money20/20 Europe experienced a revenue dip in the first half of 2024, attributed to a slowdown in Fintech investment, highlighting the vulnerability of this revenue stream.

Ascential's divestitures of its Digital Commerce and WGSN businesses, while bolstering cash reserves, have removed significant revenue and Adjusted EBITDA contributors. For instance, in the first half of 2024, these segments were key to the company's financial performance before their sale, impacting the overall scale of Ascential's operations.

This strategic shift narrows Ascential's business focus primarily to its events and advisory services. While this can lead to greater specialization, it also potentially curtails diversification benefits and limits exposure to growth avenues present in the divested digital sectors.

Ascential's acquisition by Informa in October 2024, while strategically beneficial, introduces significant integration challenges. Merging Ascential's distinct operational frameworks, technological infrastructures, and corporate cultures with Informa's established systems requires meticulous planning and execution to avoid disruption.

The success of this integration hinges on Informa's ability to manage the complexities of combining two sizable organizations, ensuring that Ascential's core strengths and market positions are preserved. Failure to navigate these hurdles could impact Ascential's performance and its contribution to Informa's overall growth strategy.

Competitive Landscape in Information and Data

Ascential operates in a crowded marketplace for information, data, and analytics, facing intense competition across its core sectors like digital marketing and e-commerce. The company contends with a broad spectrum of rivals, from well-funded startups to established industry giants, all vying for market share. This dynamic landscape means Ascential must constantly innovate to maintain its edge.

The competitive pressures are significant. For instance, in the digital advertising intelligence space, Ascential's WARC unit competes with firms like Kantar and Nielsen, both of which have substantial market presence and data resources. Similarly, its e-commerce intelligence offerings, such as those from its Edge by Ascential segment, face challenges from specialized data providers and broader market intelligence platforms. The sheer number of active competitors, many with significant financial backing, underscores the need for Ascential to differentiate its value proposition effectively.

- Intense Competition: Ascential faces numerous specialized providers in digital marketing, e-commerce, and B2B data.

- Established and Emerging Rivals: Competition comes from both well-funded startups and large, incumbent players.

- Market Saturation: The information and data analytics market is highly competitive, requiring continuous innovation.

Sensitivity to Economic Cycles and Industry-Specific Headwinds

Ascential's reliance on specific market segments, particularly its Financial Technology (Fintech) division, makes it susceptible to broader economic downturns and shifts in industry investment. The company's performance is directly tied to the health of these sectors, meaning a slowdown in one area can have a ripple effect.

For instance, the Fintech sector experienced significant headwinds in investment throughout 2023 and the first half of 2024. This trend directly impacted Ascential's event revenues within this segment, demonstrating a clear vulnerability to market volatility and changing investor sentiment. This sensitivity to industry-specific cycles is a notable weakness.

- Economic Sensitivity: Ascential's revenue streams are closely linked to the economic health of the industries it serves, particularly Fintech.

- Fintech Investment Trends: A slowdown in Fintech investment, as seen in 2023 and H1 2024, directly affects event participation and sponsorship, impacting Ascential's growth.

- Industry-Specific Headwinds: Challenges within specific sectors can disproportionately affect Ascential's performance, highlighting a lack of diversification against industry-specific downturns.

Ascential's concentrated revenue model, heavily dependent on a few key events like Cannes Lions and Money20/20, poses a significant weakness. This reliance makes the company vulnerable to external disruptions affecting attendance or sponsorship, as evidenced by the revenue dip at Money20/20 Europe in H1 2024 due to a Fintech investment slowdown.

The divestiture of its Digital Commerce and WGSN segments, while strengthening its balance sheet, has reduced Ascential's overall scale and removed substantial revenue and EBITDA contributors. This strategic pivot narrows its focus to events and advisory, potentially limiting diversification benefits and future growth opportunities in other sectors.

Ascential faces intense competition from numerous specialized providers in digital marketing, e-commerce, and B2B data. Its WARC unit competes with established players like Kantar and Nielsen, while its e-commerce intelligence offerings face pressure from specialized data providers and broader market intelligence platforms, necessitating continuous innovation.

The company's performance is closely tied to the economic health of specific industries, particularly Fintech. The investment slowdown in Fintech during 2023 and H1 2024 directly impacted Ascential's event revenues in this segment, highlighting a vulnerability to industry-specific downturns and investor sentiment shifts.

Preview the Actual Deliverable

Ascential SWOT Analysis

This is the actual Ascential SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You're seeing a genuine excerpt, ensuring you know exactly what you're getting. Unlock the full, in-depth report by completing your purchase.

Opportunities

Informa's acquisition of Ascential offers a prime opportunity to tap into its extensive global network and substantial resources. This integration allows Ascential to significantly broaden its market presence and access new customer segments. For instance, Informa's established operations in emerging markets, which saw revenue growth in the high single digits in early 2024, can be leveraged to accelerate Ascential's expansion into these lucrative regions.

The synergy between Ascential's digital commerce intelligence and Informa's broader portfolio creates avenues for cross-selling services. Ascential can now offer its data analytics to Informa's existing client base across sectors like healthcare and finance, potentially unlocking new revenue streams. This strategic alignment is expected to drive accelerated growth by combining Ascential's specialized capabilities with Informa's scale and investment capacity.

Ascential's strategic expansion into new geographies, supported by Informa, presents a significant growth avenue. Key event brands, like Money20/20, are well-positioned to enter untapped markets. The successful debut of Money20/20 Asia and the upcoming Money20/20 Middle East in Riyadh exemplify this strategy.

This geographic diversification allows Ascential to access new customer segments and unlock fresh revenue streams. By replicating its successful event models in regions with burgeoning financial technology sectors, Ascential can drive substantial future growth and solidify its global presence.

The planned integration of databases like Warc and Effies under Informa's umbrella presents a prime opportunity to build a comprehensive global effectiveness database. This unified resource, when interrogated by AI, promises to deliver significantly enhanced data-driven insights for marketers, moving beyond raw data to strategic, evidence-based solutions. For example, by 2024, the marketing analytics market is projected to reach $10.4 billion, highlighting the growing demand for such sophisticated tools.

Strategic Acquisitions and Partnerships

Ascential's strategic approach has historically involved acquisitions to broaden its portfolio. Following its acquisition by Informa in 2024, there's a strong likelihood of continued strategic acquisitions that synergize with its core events and intelligence segments. This move could unlock further avenues for growth and market penetration.

Partnerships, both within Informa's extensive network and with external industry players, present a significant opportunity for Ascential. These collaborations can bolster its market standing and enrich its service capabilities, potentially leading to new product developments and expanded customer reach. For instance, Informa's existing digital intelligence platforms could be integrated with Ascential's event data to offer more comprehensive market insights.

- Acquisition Strategy: Ascential has a proven track record of acquiring companies to enhance its service offerings, a strategy likely to continue under Informa's ownership.

- Informa Ecosystem Integration: Leveraging Informa's existing digital and event platforms can create synergistic opportunities, enhancing data analytics and customer engagement.

- Market Position Enhancement: Strategic partnerships can solidify Ascential's competitive edge by expanding its reach and diversifying its revenue streams.

Growing Demand for Actionable Insights in the Digital Economy

The digital economy's increasing complexity fuels a significant demand for actionable insights, data-driven products, and specialized consulting. Ascential is strategically positioned to capitalize on this trend, as its core business directly addresses the need for informed decision-making and business expansion in this evolving landscape.

Ascential's expertise in areas like digital commerce intelligence and market analysis directly supports brands and businesses striving to understand and optimize their online presence. The company's data and analytics platforms provide critical intelligence for navigating the fast-paced digital marketplace.

- Growing Demand for Digital Commerce Intelligence: Brands are increasingly investing in understanding online consumer behavior and market trends, a core area for Ascential.

- Data-Driven Product Development: Ascential's focus on data analytics aligns with the market's shift towards data-informed product and strategy development.

- Expert Consulting Services: The need for specialized advice in digital strategy and execution creates opportunities for Ascential's consulting arms.

- Market Expansion in Emerging Digital Sectors: Ascential can leverage its insights to support businesses entering or expanding within new digital verticals.

Ascential's integration with Informa presents significant opportunities for leveraging a wider global network and enhanced resources, particularly in emerging markets where Informa saw high single-digit revenue growth in early 2024. This synergy allows for cross-selling Ascential's digital commerce intelligence to Informa's diverse client base, potentially unlocking new revenue streams and accelerating growth through combined scale and investment capacity.

The company is well-positioned to capitalize on the increasing demand for actionable insights and data-driven products in the complex digital economy, with its core business directly addressing the need for informed decision-making. Ascential's expertise in digital commerce intelligence and market analysis supports brands in optimizing their online presence, providing critical intelligence for navigating the fast-paced digital marketplace.

Ascential's strategic expansion into new geographies, supported by Informa, offers a significant growth avenue, with event brands like Money20/20 poised for entry into untapped markets, exemplified by its successful debut in Asia and upcoming Middle East launch. This geographic diversification allows access to new customer segments and revenue streams by replicating successful event models in regions with burgeoning financial technology sectors.

The planned integration of databases like Warc and Effies under Informa is set to create a comprehensive global effectiveness database, promising enhanced data-driven insights for marketers. This development is timely, as the marketing analytics market is projected to reach $10.4 billion by 2024, underscoring the growing demand for sophisticated analytical tools.

Threats

Ascential operates in a crowded space within the events and information sector, facing pressure from numerous established companies and emerging players. These competitors offer comparable B2B services, digital marketing tools, and data analytics solutions, directly challenging Ascential’s market position.

The fierce rivalry necessitates continuous innovation and competitive pricing strategies, which can impact Ascential's profitability and market share. For instance, in 2023, the digital commerce intelligence segment, a key area for Ascential, saw continued investment and expansion from competitors like Nielsen and GfK, highlighting the dynamic competitive landscape.

Global economic uncertainties, particularly those impacting the technology and finance sectors, pose a significant threat. A slowdown in these areas can directly translate to reduced corporate investment in marketing, events, and crucial advisory services. This directly affects Ascential's revenue streams.

For instance, the Fintech investment landscape experienced headwinds in 2023, which demonstrably impacted delegate numbers and sponsorship revenue for key Ascential events like Money20/20 Europe. This trend highlights the vulnerability of Ascential's business model to broader economic contractions and shifts in corporate spending priorities.

The digital economy, driven by advancements like AI and sophisticated data analytics, presents a significant threat. Ascential must constantly innovate its data-driven offerings to stay relevant.

Failure to adapt to these rapid technological shifts or facing disruption from emerging platforms could seriously undermine Ascential's market standing.

Regulatory and Data Privacy Concerns

Ascential, as a data and analytics firm, faces significant threats from evolving regulatory landscapes, particularly concerning data privacy. The General Data Protection Regulation (GDPR) in Europe and similar legislation globally impose strict rules on how customer data is collected, processed, and stored. Failure to comply can result in substantial fines, impacting profitability and operational freedom. For instance, the potential for increased compliance costs and limitations on data utilization due to new privacy mandates remains a persistent concern for Ascential's business model.

The increasing global focus on data privacy, exemplified by regulations like the GDPR, presents a substantial threat to Ascential's operations. Stricter enforcement of these rules could necessitate significant adjustments to data handling practices, potentially increasing operational expenses and restricting the scope of Ascential's analytics services. This environment demands continuous adaptation to ensure ongoing compliance and maintain customer trust.

- Heightened Regulatory Scrutiny: Ascential operates in a sector where data privacy laws are constantly being updated and enforced more rigorously globally.

- Compliance Cost Increases: New regulations or stricter interpretations of existing ones could lead to higher operational costs for data management and compliance.

- Service Offering Limitations: Restrictions on data collection or usage could limit the types of analytics and insights Ascential can provide to its clients.

- Reputational Risk: Data breaches or non-compliance incidents can severely damage Ascential's reputation and client relationships.

Integration Risks Post-Acquisition

The integration of Ascential into Informa, following its acquisition in May 2024 for £1.4 billion, presents significant integration risks that could hinder expected synergies. A key concern is the potential for clashes in organizational culture between the two entities, which could lead to employee dissatisfaction and reduced productivity. For instance, Informa's focus on information services and events might differ significantly from Ascential's data analytics and intelligence platforms, creating friction during the merger process.

Difficulties in merging disparate IT systems pose another substantial threat. Inefficiently integrated systems can lead to operational disruptions, data inconsistencies, and increased costs. Furthermore, the risk of losing key personnel, particularly those with deep knowledge of Ascential's operations and client relationships, could severely impact the realization of anticipated synergies and overall financial performance. Reports from similar large-scale acquisitions often highlight employee retention as a critical success factor, with a significant percentage of key talent departing within the first 12-18 months post-deal if integration is not managed effectively.

Failure to achieve the projected synergies, estimated to be around £100 million by Informa, is a direct consequence of these integration challenges. These synergies are crucial for justifying the acquisition price and driving future growth. If cultural integration falters, IT systems are not harmonized smoothly, or key talent departs, Ascential's financial performance post-acquisition could be negatively impacted, failing to meet investor expectations.

Ascential faces intense competition from established players and new entrants in the B2B services, digital marketing, and data analytics sectors, demanding constant innovation and potentially impacting profit margins. The digital commerce intelligence segment, for example, saw increased investment from rivals like Nielsen in 2023, intensifying market pressure.

Global economic downturns, particularly in technology and finance, directly threaten Ascential's revenue by reducing corporate spending on events and advisory services. Money20/20 Europe, a key Ascential event, experienced reduced delegate numbers and sponsorship in 2023 due to headwinds in Fintech investment.

Rapid advancements in the digital economy, including AI, necessitate continuous adaptation of Ascential's data-driven offerings to remain competitive and avoid disruption from emerging platforms.

Evolving data privacy regulations like GDPR present a significant threat, potentially increasing compliance costs and limiting data utilization for Ascential's analytics services. Failure to comply can result in substantial fines and damage reputation.

SWOT Analysis Data Sources

This Ascential SWOT analysis is built upon a robust foundation of data, drawing from Ascential's official financial statements, comprehensive market intelligence reports, and expert industry analyses to provide a thorough and accurate strategic overview.