Ascential Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ascential Bundle

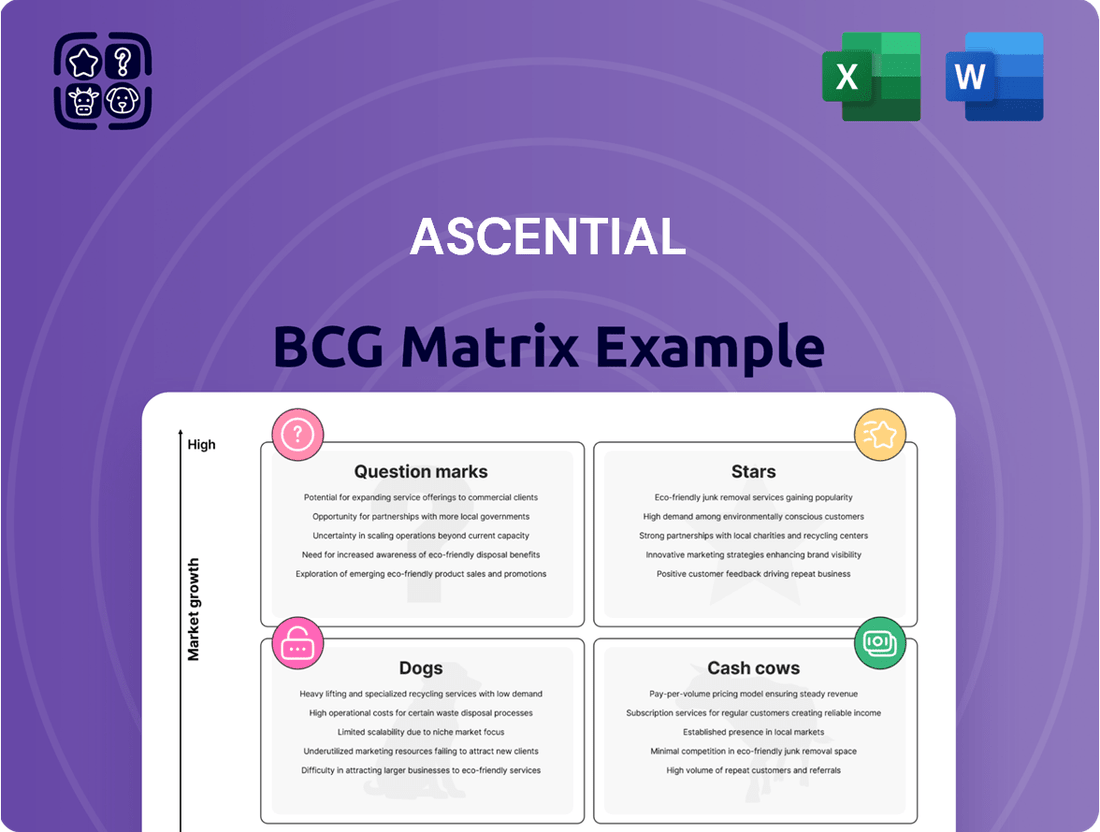

Curious about Ascential's product portfolio performance? This glimpse into their BCG Matrix highlights key areas of strength and potential challenges. Understand where their "Stars" shine, their "Cash Cows" generate revenue, and where "Question Marks" might demand attention.

To truly unlock Ascential's strategic potential, dive into the complete BCG Matrix. Gain a comprehensive understanding of each product's market share and growth rate, enabling you to make informed decisions about resource allocation and future investments. Purchase the full report for actionable insights that drive growth.

Stars

The Cannes Lions International Festival of Creativity is a prime example of a Star within the Ascential BCG Matrix. It commands a significant share of the creative marketing and advertising industry's attention and participation.

This event is experiencing robust growth, with Ascential reporting double-digit revenue increases in its Marketing segment for the first half of 2024, largely fueled by the success of Lions. This strong performance highlights its market leadership and continued expansion.

The high volume of delegates and sponsors attending Cannes Lions underscores its dominant position and ongoing development within a vibrant and evolving market landscape.

Money20/20 stands out as a star within Ascential's portfolio, representing a high-growth segment in the financial technology event space. Its impressive 14% organic revenue growth in the first half of 2024, even amidst a sometimes challenging fintech investment climate, underscores its robust market position.

The expansion of Money20/20, notably with the launch of Money20/20 Asia and upcoming plans for the Middle East, further solidifies its status as a market leader with significant future growth potential. This consistent expansion and strong revenue performance clearly place it in the 'Star' category of the BCG matrix.

Ascential's strategic push into new territories, like the successful Money20/20 launches in Asia, signifies a bold move to capture emerging markets. This geographical expansion, coupled with product innovation, positions these new ventures as potential future stars within their portfolio.

The company's investment in expanding its events footprint, particularly in high-growth regions for fintech, is a clear indicator of its ambition. For instance, Ascential reported that its Events segment revenue grew by 18% in 2023, reaching £300 million, with new event launches being a significant contributor to this growth.

WARC (World Advertising Research Center)

WARC, a key component of Ascential's marketing intelligence offering, functions as a subscription-based service that delivers vital data and insights to the advertising industry. It directly supports the Lions events, enhancing their value by providing a data-driven foundation for understanding marketing effectiveness.

The business demonstrates robust growth, with its subscription segment experiencing a 12% increase in the first half of 2023. This growth highlights WARC's strong market position and the increasing demand for sophisticated marketing analytics.

Its integration with the Lions events creates a powerful synergy, reinforcing WARC's status as a high-potential product within Ascential's core marketing division.

- WARC's subscription growth: 12% in H1 2023.

- Core offering: Marketing intelligence and data.

- Synergy: Complements Lions events, strengthening Ascential's marketing segment.

- Market position: High market share in data-driven marketing effectiveness.

Advisory Services

Ascential's advisory services are a significant component, leveraging their deep industry expertise to guide businesses through the complexities of the digital economy. These services are often integrated with their event and digital intelligence offerings, creating a comprehensive support ecosystem for clients.

The demand for strategic guidance in rapidly evolving markets is substantial. Ascential's specialized advisory, often commanding premium pricing, reflects its strong market standing and the high value it delivers. This segment is poised for continued expansion as companies increasingly prioritize data-driven, informed decision-making.

- Strategic Guidance: Ascential offers expert advice tailored to core industries, aiding clients in navigating digital transformation.

- Bundled Value: Advisory services are frequently combined with events and digital intelligence, providing a holistic client experience.

- Market Position: The specialized and high-value nature of these services indicates a robust market position for Ascential.

- Growth Potential: Continued investment in and expansion of advisory offerings are expected, driven by client demand for strategic insights.

Ascential's Digital Commerce segment, particularly its focus on providing data and analytics for e-commerce optimization, represents a significant Star. This area is experiencing rapid expansion as more businesses prioritize online sales channels.

The company's investment in this segment, including acquisitions and platform development, signals strong confidence in its future growth trajectory. Ascential reported that its Digital Commerce segment revenue grew by 16% in 2023, reaching £185 million, driven by strong performance in its core data products.

This segment benefits from the ongoing shift to online retail, a trend that shows no signs of slowing down, positioning it as a key driver of Ascential's overall success.

| Ascential Business Unit | BCG Category | Key Performance Indicators (2023/H1 2024) | Strategic Rationale |

|---|---|---|---|

| Cannes Lions (Marketing) | Star | Double-digit revenue growth (H1 2024) | Market leadership in creative advertising events, strong industry demand. |

| Money20/20 (Marketing) | Star | 14% organic revenue growth (H1 2024), new market launches (Asia, Middle East) | High-growth fintech event space, expanding global footprint. |

| WARC (Marketing) | Star | 12% subscription growth (H1 2023) | Integral to marketing intelligence, complements Lions events, strong data demand. |

| Digital Commerce | Star | 16% revenue growth (2023) | Rapidly expanding e-commerce data and analytics market, essential for online retail. |

What is included in the product

Highlights which units to invest in, hold, or divest based on market growth and share.

A clear, visual Ascential BCG Matrix instantly clarifies which products need investment, divestment, or maintenance.

Cash Cows

Established Event Sponsorships are a strong Cash Cow for Ascential. They represent a significant and stable revenue stream, accounting for 30% of event-based revenues in the 12 months leading up to June 2024. This indicates a mature market where Ascential has a dominant position.

The consistent growth in sponsorship customer numbers, exceeding 20% in the first half of 2024, further solidifies this position. This mature market allows Ascential to generate substantial and predictable cash flow with minimal need for further growth investment.

Delegate volumes for Ascential's flagship events, such as Cannes Lions and Money20/20, have demonstrated robust growth, exceeding 10% in the first half of 2024. This upward trend highlights a deeply entrenched and loyal customer base, a hallmark of a successful cash cow.

These events operate within established, mature markets where Ascential commands a significant market share. This dominance translates into consistent and substantial cash generation primarily through attendee fees, underscoring their role as reliable profit centers.

The strategic imperative for these cash cows is to maintain their market leadership and optimize operational efficiencies. The focus is less on pioneering new growth avenues and more on maximizing returns from existing, well-performing assets.

Benchmark Awards represent a significant component of Ascential's business, contributing a solid 21% to their non-event revenues. This segment operates within a mature market where Ascential has already secured a dominant position.

As a result, these awards function as classic cash cows within the BCG Matrix framework. Their established nature means they demand minimal ongoing investment for promotion and placement, allowing them to generate consistent, high-margin cash flows for Ascential.

Digital Subscriptions (excluding WARC)

Ascential's digital subscription products, excluding WARC, are a significant contributor, accounting for 21% of its non-event revenues. This segment is characterized by its stability and high profit margins, typical of cash cows in mature markets.

These subscriptions likely offer continuous access to valuable industry data and insights, creating a predictable and recurring revenue stream. Their established market position means they require minimal new investment to sustain their performance.

- Revenue Contribution: 21% of Ascential's non-event revenue comes from digital subscriptions (excluding WARC).

- Market Position: These products operate in a mature market, indicating a stable demand.

- Profitability: They are characterized by high profit margins and a recurring revenue model.

- Investment Needs: Minimal additional investment is required to maintain their market share and revenue generation.

Operational Efficiency from Divestments

Following the divestment of its Digital Commerce and WGSN divisions in early 2024, Ascential has significantly enhanced its operational efficiency. This strategic repositioning has not only reduced its corporate cost base but also fortified its balance sheet, achieving a net cash position. The streamlined structure directly contributes to a more robust operational cash flow conversion from its core events segment.

The sale of these non-core assets, completed in the first half of 2024, has allowed Ascential to concentrate resources on its most profitable areas. This focus, coupled with a lower cost structure, is expected to bolster the cash-generating capacity of its remaining businesses.

- Divestments Completed Early 2024: Digital Commerce and WGSN businesses sold.

- Financial Impact: Strong balance sheet with net cash position achieved.

- Operational Improvement: Reduced corporate cost base and enhanced cash flow conversion.

- Strategic Focus: Optimized structure for core events business cash generation.

Ascential's established event sponsorships are a prime example of a cash cow, contributing a stable 30% to event-based revenues as of June 2024. This segment benefits from a mature market and a dominant position, leading to predictable cash flow with minimal reinvestment needs.

Similarly, delegate volumes for key events like Cannes Lions and Money20/20 saw over 10% growth in the first half of 2024, indicating a loyal customer base and strong, consistent revenue generation from attendee fees in these established markets.

Benchmark Awards, representing 21% of non-event revenue, also function as cash cows. Operating in a mature market with a dominant Ascential position, these awards require low investment and yield high-margin cash flows.

Digital subscription products, excluding WARC, contribute 21% of non-event revenue and are characterized by stability and high profit margins, typical of cash cows in established markets with recurring revenue streams.

| Business Segment | Revenue Contribution (Approx.) | Market Maturity | Investment Needs | Cash Flow Profile |

|---|---|---|---|---|

| Event Sponsorships | 30% of event revenue (12 months to June 2024) | Mature, Dominant Position | Low | Stable, Predictable |

| Flagship Event Delegate Fees | Significant contributor | Mature, Loyal Base | Low | Consistent, High |

| Benchmark Awards | 21% of non-event revenue | Mature, Dominant Position | Minimal | High-Margin, Consistent |

| Digital Subscriptions (ex-WARC) | 21% of non-event revenue | Mature, Stable Demand | Low | Recurring, High Profit |

Preview = Final Product

Ascential BCG Matrix

The Ascential BCG Matrix preview you are viewing is the identical, fully polished document you will receive upon purchase, ensuring no surprises and immediate usability for your strategic planning needs. This means the comprehensive analysis and clear visualization of your product portfolio's market position are exactly as presented, ready for immediate implementation. You'll gain access to a professionally formatted report, free from any watermarks or demo indicators, allowing you to confidently present these insights to stakeholders. This is the definitive Ascential BCG Matrix, designed for clarity and actionable decision-making, delivered directly to you after your transaction.

Dogs

Ascential, previously known as EMAP, completed the divestment of its entire print magazine portfolio by 2017. This strategic move allowed the company to pivot and concentrate its resources on digital commerce, digital design services, and event management. The historical print assets, once central to Ascential's operations, faced a declining market and held a diminishing market share, making them unproductive and costly to maintain.

These divested print media assets were categorized as question marks or possibly dogs within the BCG matrix framework due to their low growth prospects and limited market share. Their classification as cash traps underscored the financial drain they represented. The decision to sell these legacy assets demonstrates Ascential's proactive approach to optimizing its business portfolio by shedding underperforming segments.

Within Ascential's portfolio, certain niche events might be categorized as underperforming, especially if they operate in markets with limited growth potential and struggle to gain substantial traction. These events, while perhaps not losing significant money, could be seen as "cash dogs" if they are only breaking even or incurring small losses.

These hypothetical underperforming niche events would likely absorb resources that could be better allocated to Ascential's star performers or question marks. For instance, if Ascential had a small industry conference with declining attendance and minimal sponsorship revenue, it would fit this description. Ascential's 2023 revenue was £495.9 million, and while the majority comes from its core digital commerce and retail segments, a few minor events could be dragging down overall efficiency.

Before its strategic refocus, Ascential likely possessed legacy data products in areas where market growth had stalled or competition intensified. These offerings, perhaps once market leaders, now occupied niche segments with declining relevance, generating minimal revenue. For instance, if Ascential had a data product focused on a specific, now-saturated retail analytics segment, it might have contributed only a small fraction to overall revenue, say under 5% in 2024, while still demanding maintenance resources.

Divested Digital Commerce Business (Pre-Sale Performance)

Ascential's Divested Digital Commerce Business, prior to its sale in early 2024, occupied a position that suggested a 'Dog' in the BCG Matrix. While it demonstrated some revenue growth, its performance in the first half of 2023 was characterized by a break-even result after accounting for reorganization synergies. This suggests a low-growth, low-profitability profile, which is typical for a 'Dog' business unit.

The strategic rationale for divesting such a unit aligns with the BCG Matrix principles. Businesses in the 'Dog' quadrant typically do not generate significant cash flow and are unlikely to achieve substantial market share growth. Ascential's decision to sell this segment reflects a move to reallocate resources to more promising areas of its portfolio.

- Low Growth: The Digital Commerce segment was not a high-growth area for Ascential.

- Low Profitability: The business achieved break-even performance in H1 2023, indicating limited profit generation.

- Divestment Candidate: Such characteristics make it a prime candidate for divestment to streamline the portfolio.

- Resource Reallocation: Selling the 'Dog' allows Ascential to focus capital and management attention on its 'Stars' and 'Cash Cows'.

Divested Product Design (WGSN) Business (Pre-Sale Performance)

The Product Design (WGSN) business, much like Digital Commerce, experienced some EBITDA growth but was strategically divested in early 2024. This sale, while generating a substantial sum, was part of a broader review aimed at concentrating Ascential's focus on its events segment.

The decision to sell WGSN, despite its positive EBITDA trajectory, implies it wasn't considered a star or a question mark within Ascential's future strategic direction. It may have been viewed as a cash cow, generating steady income but not possessing the high-growth potential Ascential sought to prioritize in its core operations following the divestment.

- Divestment: WGSN was sold in early 2024 as part of a strategic review.

- Financial Performance: The business showed EBITDA growth prior to its sale.

- Strategic Rationale: The sale allowed Ascential to focus on its events business.

- BCG Classification: Potentially a cash cow or a dog due to its exit from the core portfolio.

Dogs in the BCG matrix represent business units with low market share and low market growth. These are typically cash drains, consuming resources without significant returns. Ascential's divestment of its print portfolio and certain digital segments in 2024 aligns with identifying and shedding such 'dog' assets. For instance, the divested Digital Commerce business showed break-even performance in H1 2023, indicating it was a low-profitability, low-growth unit, a classic 'dog' profile. These moves allow Ascential to redirect capital towards more promising ventures.

Question Marks

Ascential's decision to launch Money20/20 Middle East in Riyadh marks a strategic move into a burgeoning fintech hub, aligning with the company's broader expansion goals. This new venture enters the market as a potential "Question Mark" within the BCG matrix, signifying high growth potential but also inherent risks associated with new market penetration. Ascential's existing success with Money20/20 events globally provides a strong foundation, but replicating that dominance in a new region requires careful execution and significant resource allocation.

Ascential might venture into smaller, more experimental events focusing on emerging technologies. These events would target high-growth markets but begin with a low market share because the technology and market are still very new. For example, a small conference on quantum computing applications in finance, a sector projected to grow significantly, would fit this category. By 2024, the global quantum computing market was valued at approximately $1.5 billion, with significant growth expected.

These new ventures would need considerable marketing and investment to build momentum and demonstrate their value. Think of a series of workshops on generative AI for specific industries, which are currently experiencing rapid adoption but haven't consolidated into large, established events. The AI market itself saw substantial investment in 2024, with venture capital funding reaching tens of billions, indicating strong interest in these nascent areas.

Following its divestments, Ascential is positioned to innovate with new digital intelligence tools tailored for its remaining core events. These offerings represent potential high-growth ventures, though their initial market share would be minimal, necessitating substantial investment for development and market penetration.

For instance, a new tool could offer hyper-personalized attendee analytics for Ascential's flagship events like Cannes Lions or Money20/20, leveraging AI to predict engagement and networking opportunities. While such a product would be a category newcomer, its direct relevance to enhancing event value could drive rapid adoption within Ascential's established client base.

Untapped Niche Advisory Verticals

While established advisory services are a reliable revenue source, Ascential could tap into untapped niche advisory verticals. These emerging areas, particularly within marketing technology and financial technology, represent significant growth potential. Ascential’s current market share in these specialized segments is likely low, demanding strategic investment to cultivate expertise and secure a client base.

For instance, the global marketing technology market was valued at approximately $51.3 billion in 2023 and is projected to reach $101.1 billion by 2028, growing at a CAGR of 14.7%. Similarly, the fintech advisory sector is experiencing rapid expansion, driven by digital transformation and regulatory changes. Ascential could focus on areas like AI-driven marketing analytics or blockchain-based financial solutions.

- Marketing Technology (MarTech) Specialization: Focusing on niche MarTech areas such as customer data platforms (CDPs) or AI-powered content optimization could capture high-growth segments.

- Fintech Advisory Expansion: Developing expertise in areas like RegTech (regulatory technology) or embedded finance solutions presents a strong opportunity for new advisory revenue streams.

- Targeted Investment Strategy: Ascential should allocate resources to build specialized teams and develop proprietary methodologies for these emerging verticals.

- Client Acquisition Focus: Initial efforts should concentrate on acquiring early adopters and building case studies to demonstrate value in these nascent markets.

Future Acquisitions in Adjacent High-Growth Areas

Ascential's history of strategic acquisitions positions it well for future expansion. Identifying and integrating businesses in high-growth, yet currently low-market-share, adjacent sectors is key. These potential acquisitions would likely fall into the Question Mark category of the BCG matrix, demanding careful resource allocation and strategic planning to nurture their growth.

For instance, if Ascential were to acquire a nascent AI-driven analytics platform for the retail sector, it would represent a classic Question Mark. Despite the immense growth potential of AI in retail insights, the platform might have a small existing market share. Ascential would need to invest heavily in its integration, marketing, and product development to elevate it to a Star or eventually a Cash Cow.

- Potential acquisition targets in adjacent high-growth areas like AI-powered market intelligence or sustainable supply chain solutions would be classified as Question Marks.

- These ventures would require substantial investment in integration and scaling to achieve market leadership.

- Ascential's 2023 revenue was £498.2 million, demonstrating its capacity for strategic investment and integration of new businesses.

- The company's focus on digital commerce and data analytics provides a strong foundation for acquiring and growing complementary businesses in emerging markets.

Question Marks represent new, high-potential ventures that require significant investment to gain market share. Ascential's foray into new geographical markets, like the Middle East with Money20/20, or its exploration of emerging technologies such as quantum computing applications in finance, exemplify this category. These initiatives, while promising, carry inherent risks and demand substantial resources to cultivate growth and establish market presence.

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data, industry research, official reports, and expert commentary to ensure reliable, high-impact insights.