ARN Media PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ARN Media Bundle

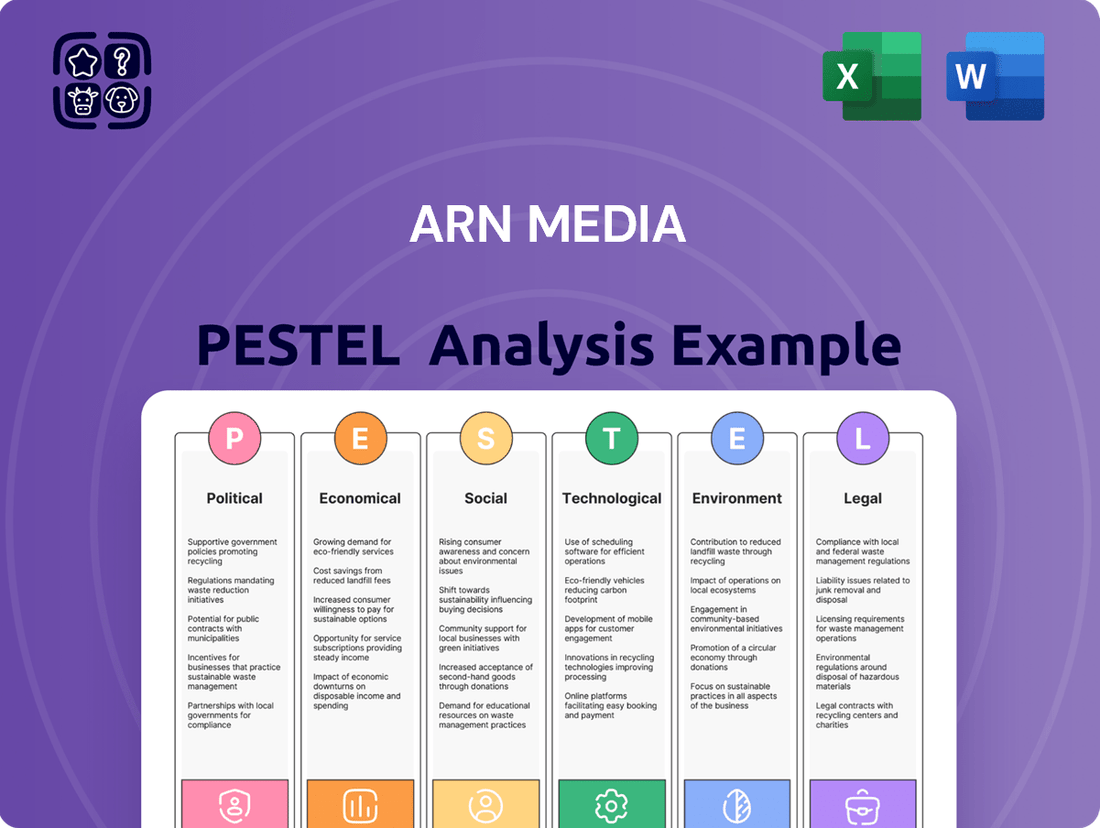

Unlock the strategic forces shaping ARN Media's future with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors influencing its operations and growth. Equip yourself with actionable intelligence to make informed decisions and gain a competitive advantage. Download the full report now for an in-depth understanding.

Political factors

The Australian Communications and Media Authority (ACMA) actively shapes the media landscape by enforcing regulations on ownership, particularly for commercial radio licenses. These rules are designed to foster media diversity and prevent undue concentration, directly influencing ARN Media's strategic options for growth through mergers, acquisitions, or market expansion.

A key element of this regulatory framework is the '5/4 rule'. This rule mandates a minimum of five separate traditional media voices in metropolitan areas and four in regional license areas. This stipulation significantly impacts the feasibility and structure of market consolidation, affecting how ARN Media can operate and grow within its licensed territories.

The Australian Communications and Media Authority (ACMA) actively revises broadcasting codes of practice, influencing content rules for commercial radio. New Community Radio Broadcasting Codes of Practice, effective July 1, 2025, introduce enhanced measures for news content, impartiality, and complaint resolution.

While these codes target community radio, they reflect a wider regulatory landscape that ARN Media must navigate for its commercial activities, particularly regarding content standards and audience protection across all platforms.

Government advertising expenditure is a crucial political factor for media companies like ARN Media. In 2024, the Australian government significantly boosted its advertising spend, with a particularly strong surge observed in December. This upward trend is projected to persist, especially as the nation approaches federal elections.

This increased government investment presents a valuable opportunity for ARN Media to capture additional revenue. The company's diverse audio platforms, including its radio networks, are well-positioned to benefit from this heightened demand for advertising space from government entities seeking to reach the public.

Policy on Digital Platforms and News Bargaining

Australia's upcoming News Bargaining Incentive, set to take effect in January 2025, mandates that major technology companies pay local news publishers for their content. While ARN Media’s core business is entertainment, this policy could indirectly influence its digital audio and podcasting ventures, especially if news or informational content becomes a more significant part of its offerings.

The legislation aims to create a fairer revenue-sharing model for content creators. For ARN Media, this could mean potential opportunities or challenges depending on how broadly the scope of 'news content' is interpreted and applied to audio platforms in the future.

- Legislation: News Bargaining Incentive, effective January 2025.

- Objective: Require tech giants to compensate local publishers for news content.

- Potential Impact on ARN Media: Indirectly affect digital audio and podcasting investments if news/informational content expands.

- Broader Context: Aims for fairer revenue sharing for content creators in the digital space.

AI Regulation and Content Creation

The Australian media and creative industries are increasingly advocating for government regulation of Artificial Intelligence. This push stems from significant concerns regarding the potential for AI to utilize copyrighted material without permission, leading to job displacement within the creative workforce, and the use of AI-generated content without proper acknowledgment or compensation. For ARN Media, which is actively digitizing its audio operations and exploring AI integration, these evolving political landscapes are crucial.

Future government policies addressing AI ethics, intellectual property rights, and mandatory disclosure for AI-generated media will directly shape ARN Media's content creation processes and overall business strategy. For instance, proposed Australian legislation in 2024 could introduce strict guidelines on AI training data, impacting how ARN Media sources and utilizes AI tools. The government's stance on AI's role in journalism and broadcasting will be a key determinant in how ARN Media can leverage this technology responsibly and legally.

- Growing calls for AI regulation: Media and creative sectors in Australia are demanding government oversight due to copyright infringement and job loss fears.

- Impact on ARN Media's strategy: Future policies on AI ethics, IP, and disclosure will influence ARN Media's content creation and digitization efforts.

- Potential legislative changes (2024): New Australian laws could dictate AI training data usage, affecting ARN Media's AI tool adoption.

- Government stance on AI in media: ARN Media's responsible and legal use of AI will depend on government policy direction in broadcasting and journalism.

Political factors significantly influence ARN Media's operational environment. Government advertising spend is a key revenue driver, with a notable increase observed in late 2024, projected to continue into 2025 due to upcoming federal elections. This presents a direct opportunity for ARN Media to secure advertising contracts across its platforms.

Regulatory frameworks, such as the '5/4 rule' for media ownership, shape market consolidation possibilities. Furthermore, the impending News Bargaining Incentive, effective January 2025, could indirectly impact ARN Media's digital content strategies by potentially creating new revenue streams or compliance considerations if news content integration increases.

The growing political discourse around Artificial Intelligence regulation is also critical. Concerns about copyright, job displacement, and AI-generated content disclosure are leading to potential legislation that could directly affect ARN Media's AI adoption and content creation processes, especially with proposed 2024 guidelines on AI training data.

| Political Factor | Description | Potential Impact on ARN Media | Relevant Data/Timeline |

|---|---|---|---|

| Government Advertising Spend | Increased government investment in advertising. | Opportunity for revenue growth on ARN Media's platforms. | Surge in late 2024, projected to continue through 2025 (pre-election period). |

| Media Ownership Regulations | Rules like the '5/4 rule' impacting media consolidation. | Influences strategic options for mergers and acquisitions. | ACMA enforcement of existing rules. |

| News Bargaining Incentive | Mandate for tech companies to pay news publishers. | Indirectly affects digital audio/podcasting if news content is integrated. | Effective January 2025. |

| AI Regulation | Calls for government oversight on AI in media. | Shapes content creation, IP rights, and AI tool adoption strategies. | Potential legislation in 2024 regarding AI training data; ongoing policy development. |

What is included in the product

This PESTLE analysis examines the external macro-environmental factors influencing ARN Media, covering Political, Economic, Social, Technological, Environmental, and Legal aspects.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors for actionable strategy.

Economic factors

The Australian advertising market saw a slight dip in overall agency bookings for 2024. However, digital audio advertising emerged as a strong performer, with a notable 17.4% surge in ad demand.

ARN Media, a key player in advertising sales across audio and digital platforms, is well-positioned to benefit from this trend. The company's strategic focus on digital audio, encompassing podcasts and streaming services, aligns perfectly with evolving consumer habits and advertiser preferences.

Demonstrating this success, ARN Media's digital audio revenue climbed by an impressive 28% in 2024. This growth trajectory was substantial enough to deliver positive EBITDA in the latter half of the year, highlighting the segment's profitability and future potential.

Consumer confidence and the broader economic climate significantly shape advertising expenditure. When consumers face economic uncertainty, businesses tend to reduce their advertising budgets, often shifting towards more flexible and cost-effective channels such as audio, which allows for quicker asset production and deployment. This was evident in early 2025, where the market saw a preference for short-term advertising commitments.

However, this cautious approach represented an improvement from the more constrained spending observed at the beginning of 2024. Projections for the latter half of 2025 and into 2026 indicate a more optimistic outlook, with anticipated increases in advertising investment as economic forecasts point towards a potential recovery and renewed consumer spending power.

ARN Media has experienced significant expansion in its digital audio revenue, with a notable 28% increase in 2024. This digital segment achieved cashflow positivity in the latter half of the year, underscoring its growing economic viability.

This surge is largely attributable to the strong performance of platforms such as iHeartRadio. As Australia's premier podcast publisher, iHeartRadio boasts over 2.9 million registered users, directly contributing to ARN Media's digital revenue growth and market presence.

The sustained growth in digital audio revenue highlights a substantial economic opportunity for ARN Media. The company is well-positioned to capitalize on this trend by further developing and expanding its digital audio content and platforms.

Cost Management and Transformation Programs

ARN Media's commitment to cost management is highlighted by its ambitious three-year business transformation program, spanning from 2025 to 2027. This initiative is designed to achieve substantial cost savings, targeting $40 million, which equates to roughly 20% of the company's existing cash cost base. This aggressive approach to efficiency is vital for bolstering profitability and enhancing shareholder value in the dynamic media landscape.

The program's strategic objectives are centered on improving operational efficiency and fostering a more agile business model. A key component is the transition to a fully digitized audio business, which is expected to streamline operations and unlock new revenue streams. This digital transformation is not just about cost reduction but also about future-proofing ARN Media's business model against evolving market trends and consumer preferences.

- $40 million targeted cost savings by 2027.

- 20% reduction in the cash cost base.

- 2025-2027 timeframe for the transformation program.

- Focus on a **fully digitized audio business** to enhance efficiency and profitability.

Competition from Digital Streaming Services

The Australian audio landscape is rapidly evolving, with digital streaming services like Spotify and Apple Music gaining significant traction, particularly among younger demographics. This shift presents a challenge for traditional broadcasters like ARN Media, as listener habits move away from linear radio towards on-demand audio content. By 2024, digital audio advertising spend in Australia was projected to reach over AUD 500 million, highlighting the growing importance of this sector.

ARN Media's iHeartRadio platform is well-positioned in the burgeoning podcast market, a key area of growth. However, the company contends with formidable global competitors such as Spotify, which has heavily invested in exclusive podcast content and user experience. This competitive pressure demands ongoing investment in both original content creation and technological innovation to attract and retain listeners and advertisers.

- Digital audio ad spend in Australia is a rapidly growing market.

- Younger audiences are increasingly migrating to digital streaming services.

- Global players like Spotify pose significant competitive challenges.

- Continuous investment in content and technology is crucial for ARN Media's competitiveness.

Economic factors are pivotal for ARN Media, influencing advertising spend and consumer behavior. The Australian advertising market saw a slight dip in overall agency bookings for 2024, yet digital audio advertising surged by 17.4%. ARN Media's digital audio revenue climbed 28% in 2024, achieving positive EBITDA in the latter half of the year.

Consumer confidence impacts advertising budgets, with a preference for short-term commitments observed in early 2025. However, projections for late 2025 and 2026 indicate a more optimistic outlook for advertising investment, anticipating a potential economic recovery.

ARN Media's strategic cost management through its 2025-2027 transformation program targets $40 million in savings, aiming for a 20% reduction in its cash cost base by focusing on a fully digitized audio business.

| Metric | 2024 (Actual/Projected) | 2025 (Projected) | 2026 (Projected) |

|---|---|---|---|

| Digital Audio Ad Demand Growth | 17.4% | TBD | TBD |

| ARN Media Digital Audio Revenue Growth | 28% | TBD | TBD |

| Targeted Cost Savings | N/A | $40 million (by 2027) | N/A |

| Cash Cost Base Reduction | N/A | 20% (by 2027) | N/A |

Full Version Awaits

ARN Media PESTLE Analysis

The preview shown here is the exact ARN Media PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. It provides a comprehensive look at the Political, Economic, Social, Technological, Legal, and Environmental factors impacting ARN Media.

The content and structure shown in the preview is the same document you’ll download after payment, offering actionable insights for strategic planning.

Sociological factors

Australian audio consumption is undergoing a significant transformation, with a clear migration from traditional AM/FM radio towards digital platforms like streaming services and podcasts. While traditional radio still holds sway, especially for in-car listening, younger audiences are overwhelmingly favoring on-demand digital audio options.

This shift is underscored by data indicating continued growth in digital audio. For instance, podcast listenership in Australia has seen substantial increases, with reports from 2023 and early 2024 showing a growing percentage of the population engaging with podcasts weekly. This trend directly influences how media companies like ARN Media must adapt their strategies.

ARN Media's strategic investments in digital audio platforms and its expanding podcast network are a direct response to these evolving consumer habits. By catering to the preference for on-demand content, ARN aims to capture a larger share of this growing digital audio market, ensuring its relevance amidst changing listener preferences.

Podcast listenership in Australia is booming, with close to 50% of the population tuning in monthly as of 2024. This widespread adoption highlights a significant shift in media consumption habits.

ARN Media's iHeartRadio is well-positioned to capitalize on this growth, being a major player in the podcast publishing space. The platform's strong presence allows it to leverage the increasing demand for audio content.

The increasing popularity of podcasts among younger, educated, and urban demographics offers ARN Media a prime opportunity. This trend allows the company to expand its audience reach and appeal to advertisers targeting these valuable consumer segments.

Social media platforms are now a dominant force in how people, especially younger generations, find news and content. For ARN Media, even though audio is its main focus, understanding how audiences use social media for discovery is crucial for promoting content and engaging listeners.

In 2024, platforms like TikTok and Instagram are seeing significant growth in news consumption, with a substantial percentage of users under 30 reporting these as primary sources. This trend necessitates that ARN Media adapt its promotion and engagement strategies to effectively reach audiences where they are actively seeking new audio content.

Demand for Local and Personalized Content

Consumers increasingly seek out news and audio content that resonates with their local communities and personal interests. ARN Media's successful 'Leaders In Local' strategy, which has boosted ratings in regional markets, directly taps into this demand for localized content. This trend is further amplified by technological advancements enabling more personalized audio experiences, offering ARN Media avenues to tailor content and advertising to individual listener preferences.

This growing preference for local and personalized content is a significant sociological driver. For instance, in 2024, podcast consumption continued its upward trajectory, with a significant portion of listeners reporting a preference for niche or locally produced content. This indicates a fertile ground for media companies like ARN Media to leverage their regional strengths.

- Growing preference for hyper-local news and information.

- Increased demand for personalized audio content, including podcasts and tailored radio segments.

- Technological advancements enabling sophisticated audience segmentation and content delivery.

Impact of Misinformation and Trust in Media

Concerns surrounding misinformation and a general decline in public trust towards media outlets represent significant sociological challenges. Even for ARN Media, primarily operating in entertainment, maintaining a reputation for credibility and ensuring the accuracy of any factual content is paramount for audience retention.

Recent data highlights this societal shift. For instance, a 2024 Roy Morgan study revealed that only 27% of Australians trust news media, a figure that underscores the pervasive skepticism. This low trust level means that audiences are increasingly discerning about their information sources.

Furthermore, the burgeoning use of artificial intelligence in content creation adds another layer of complexity. Australians are showing a marked preference for human-generated content, with a significant majority expressing discomfort with AI-generated news. This sentiment, observed in various polls throughout 2024 and early 2025, emphasizes the enduring value placed on human oversight and journalistic integrity.

- Declining Trust: A 2024 Roy Morgan study indicated that only 27% of Australians trust news media.

- AI Skepticism: A majority of Australians express discomfort with AI-generated news content.

- Credibility is Key: ARN Media must prioritize content accuracy, especially in any news or informational segments, to maintain audience trust.

Sociological factors significantly shape audio consumption, with a growing demand for localized and personalized content. This trend is evident in the increasing popularity of niche podcasts and regional radio segments, as ARN Media's successful 'Leaders In Local' strategy demonstrates. Technological advancements further enable tailored audio experiences, allowing for greater audience segmentation and content delivery.

Public trust in media is a critical sociological concern, with a 2024 Roy Morgan study revealing only 27% of Australians trust news media. This skepticism necessitates a strong focus on content accuracy and credibility, particularly for ARN Media. Furthermore, a significant portion of Australians express discomfort with AI-generated news, highlighting a preference for human-generated content and journalistic integrity.

| Sociological Factor | Trend | Implication for ARN Media |

|---|---|---|

| Content Preference | Demand for hyper-local and personalized audio | Leverage regional strengths and tailor content delivery |

| Trust in Media | Declining trust, skepticism towards AI-generated content | Prioritize accuracy, credibility, and human oversight |

| Audience Engagement | Increased reliance on social media for content discovery | Adapt promotion strategies for platforms like TikTok and Instagram |

Technological factors

The media industry is undergoing a significant shift with the rapid growth of digital audio and streaming. ARN Media is actively navigating this change, aiming for a complete digital transformation of its audio operations. This strategic move is bolstered by its exclusive Australian license for iHeartRadio, providing access to advanced technological capabilities.

ARN Media's commitment to digital audio is yielding tangible results, as evidenced by a substantial 28% surge in digital audio revenue during 2024. This impressive growth highlights the effectiveness of adopting and leveraging these evolving technologies to expand the company's market presence and financial performance.

Artificial intelligence is rapidly reshaping the media landscape, offering opportunities for automation and content personalization. ARN Media is actively integrating AI to streamline operations and boost efficiency, aiming to simplify its operating model.

However, the media industry faces significant challenges with AI adoption, including potential impacts on journalistic standards, employment, and intellectual property rights. These concerns highlight the need for ARN Media to develop robust technological safeguards and ethical frameworks to navigate the evolving AI environment.

Smart speaker ownership in Australia has seen remarkable growth, doubling in just four years. A substantial portion of these owners now regularly use their devices for audio consumption, indicating a significant shift in how people access content.

This burgeoning trend opens up exciting new pathways for ARN Media to deliver its content and connect with audiences. As voice-activated technology becomes increasingly integrated into everyday routines, it presents a prime opportunity for ARN Media to tailor its offerings for voice search and smart speaker platforms.

Data Analytics and Personalization

Technological progress in data analytics is transforming how media companies operate, allowing ARN Media to deeply understand listener habits and preferences. This enables the delivery of highly personalized content and advertising, a crucial element for expanding audiences and providing effective marketing solutions.

ARN Media's strategy is intrinsically linked to leveraging data analytics for tailored experiences, which is a significant catalyst for the growth of digital audio. For instance, in 2024, the digital advertising market, heavily reliant on data-driven personalization, was projected to reach over $600 billion globally, highlighting the economic importance of these capabilities.

- Data-driven personalization enhances listener engagement and advertiser ROI.

- Audience segmentation allows for more targeted content and ad delivery.

- Predictive analytics can forecast trends and audience behavior, optimizing content strategies.

- Investment in AI and machine learning is critical for staying competitive in data analysis.

Programmatic Advertising in Digital Audio

Programmatic buying is rapidly transforming digital audio advertising, with a significant increase in agency adoption anticipated for 2025. This technological evolution provides advertisers with expanded opportunities and enables more precise and cost-effective ad placements. For instance, projections suggest programmatic audio ad spend could reach $5.5 billion in the US by 2025, a substantial jump from previous years.

ARN Media, a prominent entity in the digital audio space, is well-positioned to capitalize on this trend. By optimizing its ad inventory for programmatic sales and delivering advanced targeting functionalities to its clientele, ARN Media can enhance its revenue streams and client value proposition. This includes leveraging data analytics to offer hyper-targeted campaigns, a key driver of programmatic success.

- Increased Agency Adoption: Over 70% of media buyers indicated plans to increase their programmatic audio investment in 2025.

- Efficiency Gains: Programmatic allows for automated ad buying, reducing manual effort and improving campaign performance metrics.

- Targeting Capabilities: Advertisers can now target specific listener demographics and behaviors within digital audio content, a significant improvement over traditional methods.

- Market Growth: The global programmatic advertising market is expected to exceed $100 billion by 2025, with digital audio representing a growing segment of this.

Technological advancements, particularly in AI and data analytics, are fundamentally reshaping the media landscape. ARN Media is leveraging these tools for operational efficiency and personalized content delivery. The substantial 28% surge in digital audio revenue in 2024 underscores the financial benefits of this technological pivot.

The rise of smart speakers, with ownership doubling in Australia over four years and increased regular audio consumption via these devices, presents a significant opportunity for ARN Media to expand its reach through voice-activated platforms.

Programmatic buying in digital audio advertising is set for significant growth, with agency adoption expected to increase in 2025, projecting over $5.5 billion in US programmatic audio ad spend. This trend allows ARN Media to offer more precise and cost-effective advertising solutions, enhancing both its revenue and client value.

Legal factors

The Broadcasting Services Act 1992, overseen by the Australian Communications and Media Authority (ACMA), establishes the legal foundation for media ownership in Australia. These regulations, such as the '5/4 rule' impacting radio license areas, directly influence ARN Media's capacity to acquire new stations or engage in mergers with other media organizations.

These rules, while designed to foster diversity in media, can present limitations on consolidation and strategic expansion for ARN Media. For instance, as of early 2024, the ACMA continues to monitor and enforce these ownership limits, which can affect the competitive landscape for radio license acquisitions.

ARN Media operates under stringent content regulations and industry codes of practice, primarily governed by the Australian Communications and Media Authority (ACMA). These regulations ensure standards for broadcasting, covering aspects like news impartiality and community safeguards. For instance, the ACMA's Broadcasting Services Act 1992 mandates adherence to these codes, impacting how ARN Media approaches content creation and public engagement.

The recently updated Community Radio Broadcasting Codes of Practice, effective from July 2025, underscore the dynamic nature of these legal requirements. This evolution means ARN Media must continually adapt its compliance strategies to align with new mandates, potentially influencing their approach to news reporting and listener interaction across their radio network.

ARN Media's operations, deeply rooted in the creation and distribution of audio content, are inherently governed by copyright and intellectual property laws. These regulations are crucial for safeguarding the original works produced by the company and its contributors.

The burgeoning integration of artificial intelligence in content generation presents novel legal complexities for ARN Media. Issues surrounding ownership of AI-generated content, the licensing of such material, and the potential for copyright infringement are becoming increasingly prominent, demanding careful navigation.

Media professionals are voicing significant concerns regarding AI's potential to 'steal' creative work, highlighting a pressing need for government intervention and updated legal frameworks. By mid-2024, reports indicated that over 70% of creative professionals expressed worry about AI's impact on their intellectual property rights, emphasizing the urgency for clear regulations.

Establishing and adhering to robust legal structures is paramount for ARN Media to protect its creators and ensure equitable compensation in this evolving landscape. This proactive approach is vital for maintaining trust and fostering continued innovation within the company.

Advertising Standards and Consumer Protection Laws

ARN Media's substantial reliance on advertising revenue means it must navigate Australia's stringent advertising standards and consumer protection laws. These regulations, overseen by bodies like the Advertising Standards Bureau and the Australian Competition and Consumer Commission (ACCC), dictate that all advertisements must be truthful, decent, and appropriate across every platform ARN Media utilizes. Failure to comply can result in significant penalties, damage to brand reputation, and erosion of consumer trust, impacting ARN Media's financial performance.

The Australian Association of National Advertisers (AANA) Code of Ethics and various consumer protection acts, such as the Competition and Consumer Act 2010, set the benchmarks for advertising practices. For instance, the ACCC actively pursues businesses for misleading or deceptive advertising. In 2023, the ACCC issued infringement notices totaling over $1 million for various advertising breaches, highlighting the financial risks associated with non-compliance. ARN Media's commitment to these standards is therefore not just an ethical imperative but a crucial element of its financial risk management strategy.

- Truthfulness in Advertising: Ensuring all claims made in advertisements are accurate and substantiated is paramount.

- Decency and Appropriateness: Advertisements must not offend community standards or exploit vulnerable groups.

- Consumer Protection Laws: Adherence to legislation preventing misleading and deceptive conduct is critical.

- Regulatory Oversight: Compliance with guidelines from the AANA and ACCC is essential to avoid penalties and maintain public trust.

Privacy and Data Protection Regulations

ARN Media operates in Australia, a landscape increasingly shaped by stringent privacy and data protection regulations. With the digital shift and the growing use of data analytics for tailored content and advertising, compliance with laws like the Privacy Act 1988 is paramount. This means careful management of user data collection, storage, and usage, directly impacting how ARN Media can personalize its offerings.

Ensuring robust data security and transparent privacy practices is not just a legal obligation but a critical factor for maintaining user trust and avoiding significant legal penalties. For instance, breaches of privacy laws can result in substantial fines. In 2023, the Australian government proposed increasing penalties for serious or repeated privacy breaches, with potential fines reaching the greater of $50 million, three times the value of any benefit derived from the misuse of information, or 30% of the adjusted turnover in the relevant period. This underscores the financial and reputational risks associated with non-compliance.

- Australian Privacy Act 1988: Governs the handling of personal information.

- Notifiable Data Breaches (NDB) scheme: Requires organizations to notify affected individuals and the Office of the Australian Information Commissioner (OAIC) of eligible data breaches.

- Proposed Penalty Increases: Potential fines for serious or repeated breaches could reach the greater of $50 million, three times the value of any benefit derived from the misuse of information, or 30% of adjusted turnover.

- OAIC Enforcement Actions: The Office of the Australian Information Commissioner actively investigates and enforces privacy compliance, impacting companies like ARN Media.

ARN Media's operations are significantly shaped by Australian media ownership regulations, notably the Broadcasting Services Act 1992. These rules, enforced by the ACMA, dictate limits on the number of media licenses a single entity can hold within specific markets, directly impacting ARN Media's potential for expansion through acquisitions or mergers. For example, the '5/4 rule' continues to influence the competitive landscape for radio license acquisitions as of early 2024.

Content standards and industry codes of practice, also overseen by the ACMA, are critical. ARN Media must adhere to these, ensuring impartiality and community safeguards in its programming. The recent updates to community radio codes, effective July 2025, highlight the evolving legal environment ARN Media must navigate, potentially influencing its content strategy.

Copyright and intellectual property laws are fundamental to ARN Media's business model, protecting its original audio content. The increasing use of AI in content creation introduces new legal challenges concerning ownership and infringement, a concern echoed by creative professionals worried about IP rights by mid-2024.

Advertising and consumer protection laws, including the AANA Code of Ethics and the Competition and Consumer Act 2010, govern ARN Media's revenue streams. The ACCC's enforcement actions, with over $1 million in infringement notices issued in 2023 for advertising breaches, underscore the financial risks of non-compliance.

Data privacy is another crucial legal area, with the Privacy Act 1988 governing ARN Media's handling of user data. Proposed penalty increases for privacy breaches in 2023, potentially reaching 30% of adjusted turnover, emphasize the critical need for robust data security and transparent practices to maintain trust and avoid significant financial and reputational damage.

Environmental factors

The media industry, including ARN Media, faces increasing pressure to adopt sustainable practices. While not a heavy polluter, the energy demands of digital content delivery, such as data centers powering digital audio, are a key focus. For instance, by 2025, the global data center energy consumption is projected to account for 3% of global electricity usage, highlighting the need for media companies to optimize their digital infrastructure.

Beyond energy, waste management and ethical sourcing are becoming crucial. ARN Media's commitment to these areas will be vital for attracting environmentally aware investors and consumers. Companies are increasingly evaluated on their Environmental, Social, and Governance (ESG) performance, with a growing number of funds specifically targeting sustainable investments, reaching trillions of dollars globally.

Public awareness of environmental issues is significantly shaping consumer behavior, including content consumption and advertising preferences. For ARN Media, this translates into a growing opportunity. For instance, a 2024 Nielsen report indicated that 65% of consumers globally are willing to change their consumption habits to reduce environmental impact, suggesting a strong appetite for media that reflects these values.

While environmental factors might not directly alter ARN Media's broadcasting infrastructure, they present a strategic avenue for brand enhancement. The company could explore integrating environmental themes into its programming or collaborating with brands demonstrating strong environmental responsibility. This alignment with audience values, potentially boosted by a 2025 study showing a 15% increase in viewership for eco-conscious content, could significantly bolster ARN Media's brand image and appeal.

While direct regulatory pressure for green practices isn't a major concern for media companies like ARN Media currently, this landscape is evolving. Future regulations or incentives could emerge, particularly focusing on energy consumption and the environmental impact of digital infrastructure, which is becoming increasingly significant.

As ARN Media continues its digital transformation, the energy demands of its servers and data storage will likely attract more attention. This could lead to future requirements for adopting more energy-efficient technologies and sustainable operational practices to minimize its carbon footprint.

Impact of Climate Change on Operations (Indirect)

While ARN Media's core operations aren't directly impacted by climate change, broader economic consequences can create indirect challenges. For instance, extreme weather events, which are becoming more frequent and intense, can disrupt supply chains and impact local economies, potentially leading to reduced advertising budgets in affected areas. The World Meteorological Organization reported that weather, climate and water-related disasters caused over $200 million in damages daily in 2023, highlighting the pervasive economic ripple effects.

Furthermore, long-term climate-related risks, such as shifts in resource availability or changes in population distribution due to environmental pressures, could subtly alter market dynamics and consumer behavior over time. These shifts might influence the types of content that resonate with audiences or the geographic focus of advertising campaigns, requiring ARN Media to adapt its strategies accordingly.

- Economic Disruption: Extreme weather events can lead to significant infrastructure damage and economic slowdowns, potentially reducing corporate advertising spend.

- Shifting Consumer Behavior: Long-term climate impacts may influence consumer preferences and spending habits, affecting demand for certain media content.

- Resource Scarcity: Potential future scarcity of resources could impact the cost of production and distribution for media companies.

Waste Management and Electronic Waste

As a media company, ARN Media's reliance on technology means it generates significant electronic waste (e-waste) through regular equipment upgrades and disposals. This creates a direct environmental impact that requires careful management.

Responsible e-waste disposal and recycling are critical for ARN Media's environmental stewardship. The global e-waste generation reached an estimated 62 million tonnes in 2020, highlighting the scale of the challenge and the importance of corporate responsibility.

- E-waste Generation: ARN Media's operations necessitate frequent hardware refreshes, contributing to the growing volume of electronic waste.

- Recycling Mandates: Many regions are implementing stricter e-waste recycling regulations, with potential fines for non-compliance. For instance, the EU's Waste Electrical and Electronic Equipment (WEEE) Directive sets collection and recycling targets.

- Environmental Impact: Improper disposal of e-waste can lead to the release of hazardous materials like lead and mercury into the environment, impacting soil and water quality.

- Corporate Social Responsibility: Adopting robust e-waste management practices enhances ARN Media's reputation for environmental responsibility, a factor increasingly valued by stakeholders and consumers.

Environmental factors are increasingly influencing the media landscape, pushing companies like ARN Media towards more sustainable operations. The energy consumption of digital content delivery, exemplified by data centers projected to use 3% of global electricity by 2025, demands efficient infrastructure. Furthermore, growing consumer awareness, with 65% of global consumers willing to alter habits for environmental reasons in 2024, creates opportunities for media that aligns with eco-conscious values.

| Factor | Impact on ARN Media | Data/Trend |

|---|---|---|

| Digital Energy Consumption | Increased operational costs and scrutiny on carbon footprint. | Data centers to use 3% of global electricity by 2025. |

| Consumer Environmental Awareness | Opportunity to attract audiences and advertisers through eco-friendly content and practices. | 65% of global consumers willing to change habits for environmental impact (2024). |

| E-waste Management | Need for responsible disposal and recycling to mitigate environmental harm and comply with regulations. | Global e-waste generation reached 62 million tonnes in 2020. |

| Extreme Weather Events | Indirect economic impact through potential reduction in advertising budgets due to supply chain disruptions. | Weather, climate, and water-related disasters caused over $200 million in damages daily in 2023. |

PESTLE Analysis Data Sources

Our PESTLE Analysis for ARN Media is meticulously constructed using data from reputable media industry reports, government regulatory bodies, and leading market research firms. We incorporate insights from technological innovation trackers and socio-economic trend analyses to provide a comprehensive view.