ARN Media Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ARN Media Bundle

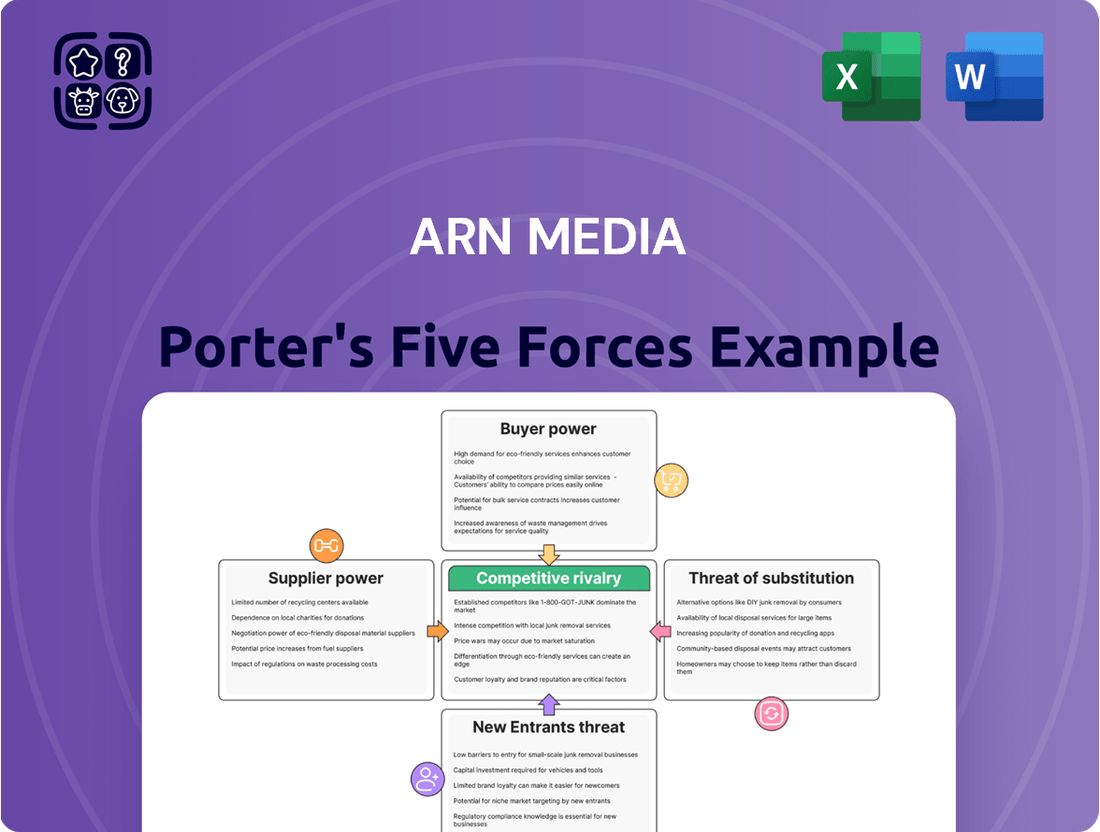

Understanding the competitive landscape of ARN Media is crucial for any strategic decision. Our Porter's Five Forces analysis reveals the intricate interplay of buyer power, supplier leverage, threat of new entrants, substitute products, and industry rivalry that shapes ARN Media's market. This snapshot highlights key pressures, but the full report offers a comprehensive, data-driven deep dive.

The complete report reveals the real forces shaping ARN Media’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Content creators and talent hold significant bargaining power over ARN Media. Popular radio personalities, especially those with proven track records of drawing large audiences, can command higher salaries and more favorable contract terms. For instance, the immense popularity of 'The Kyle & Jackie O Show' for ARN's KIIS network exemplifies this, as their audience draw directly translates to listener retention and advertising revenue.

Music licensing companies wield considerable bargaining power over ARN Media. A significant portion of radio content, the very core of ARN's business, relies on playing music, necessitating licensing agreements with music labels and rights holders. These entities control the essential intellectual property, directly influencing ARN's operational costs and content availability.

The terms and fees associated with these music licenses are critical factors in ARN Media's financial performance. For instance, in 2024, the global music licensing market continued to see robust demand, with major labels often dictating terms due to the irreplaceable nature of their catalogs. This can lead to increased royalty payments for broadcasters like ARN, impacting profitability.

ARN Media's reliance on technology and infrastructure providers for both traditional radio and digital audio platforms is a significant factor. For instance, companies providing transmission equipment or specialized streaming software can hold considerable bargaining power if their offerings are unique or critical to ARN's operations. This is particularly true as ARN continues its investment in a fully digitized audio business.

The specialized nature of certain technologies means that ARN might not have a vast array of alternative suppliers readily available. This limited choice can empower those providers, allowing them to command higher prices or more favorable terms. For example, if a particular digital audio platform development software is proprietary and essential for ARN's streaming services, the supplier of that software gains significant leverage.

Advertising Technology (AdTech) Platforms

As ARN Media deepens its investment in digital audio and podcasting, its reliance on Advertising Technology (AdTech) platforms for crucial functions like targeted advertising, performance measurement, and revenue generation becomes more pronounced. The increasing complexity and extensive reach of these platforms, particularly those enabling automated, programmatic ad buying, can significantly amplify their leverage.

The bargaining power of AdTech suppliers is a key consideration for ARN Media. These platforms are essential for ARN's strategy to offer comprehensive 'Total Audio commercial solutions'. For instance, in 2024, the global programmatic advertising market was projected to reach over $100 billion, highlighting the sheer scale and influence of these technologies.

- Dependence on Sophisticated Platforms: ARN's expansion into digital audio and podcasting necessitates advanced AdTech for effective audience targeting and campaign management.

- Programmatic Buying Power: Platforms offering robust programmatic capabilities, which allow for automated ad transactions, hold considerable sway due to their efficiency and reach.

- Market Size and Growth: The significant growth in programmatic advertising, estimated to account for a substantial portion of digital ad spend in 2024, underscores the AdTech sector's market power.

- Essential Monetization Tools: AdTech platforms are critical for ARN to monetize its growing audio inventory, making strong relationships with them vital for revenue.

News and Information Wire Services

News and information wire services hold significant bargaining power over ARN Media, especially when local radio programming incorporates news and current affairs. These services often possess exclusive access to timely information and extensive journalistic networks, making their content indispensable for stations aiming to stay relevant.

The ability of wire services to control the flow and exclusivity of critical news makes them a powerful supplier. For instance, in 2024, major news syndicators continued to be a primary source for broadcast content, with many local newsrooms relying heavily on their feeds for breaking stories and regional updates.

- Exclusive Content Access: Wire services can dictate terms based on their unique access to events and reporters.

- Syndication Fees: The cost of licensing news feeds represents a direct expense where suppliers can exert pricing power.

- Dependence on Timeliness: ARN Media's need for up-to-the-minute news makes it difficult to switch suppliers quickly without compromising content quality.

- Reputational Leverage: Established wire services lend credibility, which suppliers can use to their advantage in negotiations.

Suppliers of essential content, like music licensing companies and news wire services, possess significant bargaining power over ARN Media. Their control over intellectual property and timely information directly impacts ARN's operational costs and content strategy. For instance, the global music licensing market's robust demand in 2024 allowed major labels to dictate terms, potentially increasing royalty payments for broadcasters.

Technology and AdTech platform providers also wield considerable influence, especially as ARN expands its digital audio and podcasting operations. ARN's reliance on these specialized platforms for functions like programmatic advertising, a market projected to exceed $100 billion globally in 2024, empowers these suppliers in negotiations.

Talent, particularly popular radio personalities, can command higher salaries and favorable terms due to their direct impact on audience engagement and advertising revenue. The immense popularity of shows like 'The Kyle & Jackie O Show' for ARN's KIIS network underscores this leverage.

| Supplier Type | Bargaining Power Factor | Impact on ARN Media | Example/Data Point (2024) |

|---|---|---|---|

| Music Licensing Companies | Control of Intellectual Property | Increased royalty payments, content availability | Robust global music licensing market demand |

| News Wire Services | Exclusive Access to Timely Information | Indispensable for programming, pricing power | Primary source for broadcast content in 2024 |

| AdTech Platforms | Essential for Digital Monetization | Leverage in negotiations for programmatic advertising | Programmatic ad market projected over $100 billion in 2024 |

| Talent/Content Creators | Audience Draw and Revenue Generation | Higher salaries, favorable contract terms | Popularity of 'The Kyle & Jackie O Show' |

What is included in the product

This analysis applies Porter's Five Forces to ARN Media, examining the intensity of rivalry, threat of new entrants, bargaining power of buyers and suppliers, and the threat of substitutes within the media industry.

Instantly identify and quantify competitive pressures, allowing for proactive strategy adjustments and pain point mitigation.

Customers Bargaining Power

Advertisers, including businesses and agencies, represent ARN Media's core revenue stream through the purchase of airtime and digital ad space. Their influence is particularly pronounced with large national advertisers or media agencies managing significant advertising budgets.

In today's competitive advertising landscape, these clients can negotiate for favorable pricing, precise audience targeting, and measurable return on investment (ROI), directly affecting ARN Media's revenue and pricing strategies. For instance, digital audio ad spend saw a notable increase in 2023, projected to continue growing, offering advertisers a wider array of platforms and choices, thereby amplifying their bargaining power.

While ARN Media doesn't directly charge audiences, their listenership is paramount as it fuels advertiser demand. In 2024, the average Australian spent over 10 hours per week listening to radio, a significant but increasingly diversified metric.

The proliferation of audio platforms, from traditional FM/AM to digital streaming services and podcasts, grants listeners unprecedented choice. This fragmentation empowers audiences, as they can easily shift their attention, diminishing ARN's inherent bargaining power.

To counter this, ARN Media must continually innovate, focusing on compelling content and a seamless user experience to retain its audience base. Failing to do so risks a decline in listener engagement, directly impacting the company's attractiveness to advertisers.

Users of ARN's digital audio platforms, such as iHeartRadio, face an ever-expanding universe of audio content, both free and paid. This abundance of choice significantly amplifies their bargaining power, as they can readily migrate between different apps and services. For instance, in 2024, the global digital audio advertising market was projected to reach over $11 billion, highlighting the competitive landscape ARN operates within.

The ease with which listeners can switch platforms is a key driver of their influence. This means ARN must consistently deliver a superior user experience, offer exclusive or highly desirable content, and ensure effortless access to its services. Failure to do so risks losing these valuable digital listeners, directly impacting ARN's ability to grow its digital audio revenue streams.

Regional Businesses and Local Advertisers

Regional businesses and local advertisers form a significant customer base for ARN Media's network of radio stations. Their collective bargaining power, while individually limited, can be substantial depending on the competitive landscape of local markets and their dependence on radio for effective local outreach. For instance, in 2024, local advertising spend across Australian radio remained a crucial component of media budgets for many SMEs.

The leverage these customers hold is directly tied to their alternatives and the importance of ARN's stations to their marketing objectives. If local advertisers have numerous other cost-effective channels to reach their target demographics, their ability to negotiate lower rates with ARN increases. Conversely, if ARN's stations offer unparalleled local reach and engagement, their bargaining power diminishes.

- Local advertising spend in Australia for radio in 2024 is projected to contribute significantly to the overall media market, highlighting its importance to regional businesses.

- ARN Media's 'Leaders In Local' strategy is designed to mitigate this bargaining power by fostering stronger, more integrated relationships with these advertisers.

- The reliance of regional businesses on radio for localized marketing efforts directly influences their negotiating position with ARN.

Content Consumers of Podcasts

The bargaining power of podcast listeners is significant for ARN Media. With millions of podcasts available globally, listeners have an extensive selection and can easily switch between platforms and content providers. This abundance means ARN must consistently deliver compelling and high-quality audio experiences to maintain listener engagement and loyalty.

Listeners wield considerable power due to the widespread availability of free podcast content. They can access a vast array of shows without direct payment, placing pressure on ARN to differentiate its offerings through unique value propositions, such as exclusive content or superior production quality. In 2024, the podcast advertising market was projected to reach over $2 billion in the US alone, highlighting the importance of audience size and engagement for revenue generation.

- Vast Content Choice: Listeners can choose from over 5 million podcasts globally, offering immense variety.

- Free Accessibility: The majority of podcasts are free to consume, increasing listener leverage.

- Platform Agnosticism: Listeners often use multiple apps and platforms, reducing lock-in to a single provider.

- Demand for Quality: High listener expectations for engaging content and production drive ARN's need for excellence.

ARN Media's advertisers possess substantial bargaining power, particularly national clients and agencies managing large budgets. They can negotiate for better pricing and precise audience targeting, influencing ARN's revenue strategies. In 2023, digital audio ad spend saw significant growth, expanding advertiser options and their leverage.

Listeners, while not direct customers, are crucial as they drive advertiser demand. In 2024, Australians spent over 10 hours weekly on radio, but the proliferation of audio platforms like streaming services and podcasts gives listeners more choices. This fragmentation empowers them, allowing easy shifts in attention and reducing ARN's influence.

ARN Media must continually innovate with compelling content and user experience to retain listeners. The digital audio market, projected to exceed $11 billion globally in 2024, is highly competitive, forcing ARN to offer superior value to keep digital listeners engaged and growing its revenue.

| Customer Segment | Bargaining Power Drivers | Impact on ARN Media |

|---|---|---|

| National Advertisers & Agencies | Large budget control, alternative media options, demand for ROI | Price negotiation, demand for specific targeting, pressure on ad rates |

| Digital Audio Listeners | Abundance of free content, platform agnosticism, low switching costs | Need for superior content and UX, potential audience fragmentation |

| Regional Businesses | Local market dependence, availability of local marketing alternatives | Negotiation leverage on local ad rates, importance of 'Leaders In Local' strategy |

Same Document Delivered

ARN Media Porter's Five Forces Analysis

This preview showcases the exact ARN Media Porter's Five Forces Analysis you will receive immediately after purchase, offering a comprehensive examination of the competitive landscape. You're looking at the actual, fully formatted document, ensuring no surprises and immediate usability. Once you complete your purchase, you’ll get instant access to this same detailed analysis, ready to inform your strategic decisions.

Rivalry Among Competitors

The Australian radio landscape is intensely competitive, with ARN Media facing strong rivalry from major players like Southern Cross Austereo (SCA) and Nova Entertainment. This competition spans across securing listener attention and capturing advertising dollars in both metropolitan and regional markets.

The battle for dominance isn't limited to audience share; it also involves a fierce contest for top on-air talent and compelling content. This dynamic directly impacts ARN's ability to maintain and grow its market position.

Recent market performance highlights this rivalry, with SCA notably surpassing ARN in market capitalization as of early 2024, underscoring the shifting competitive dynamics within the industry.

Global music streaming giants like Spotify and Apple Music present a formidable competitive challenge, especially for capturing the attention of younger demographics. These platforms vie for listener engagement and advertising revenue, directly impacting ARN Media's market share.

In 2023, Spotify reported over 600 million monthly active users, highlighting the sheer scale of its reach. This intense competition necessitates ARN Media's substantial investment in its own digital audio strategy, notably through its iHeartRadio platform, to remain competitive in the evolving audio landscape.

The podcasting industry is incredibly crowded, with thousands of creators and platforms all trying to capture listener attention and advertising dollars. This intense competition means that established players like ARN Media, which operates iHeartRadio in Australia, must constantly innovate to secure popular content and attract advertisers in a fast-expanding market.

Traditional Media Outlets (TV, Print, Outdoor)

ARN Media faces intense competition for advertising dollars from established traditional media like television, newspapers, and billboards. Advertisers frequently spread their budgets across various channels, necessitating ARN to consistently prove the value and return on investment of its radio offerings.

The battle for ad spend is fierce, with traditional media holding significant market share. For instance, in 2023, Australian television advertising revenue reached approximately $3.7 billion, while the print sector, though declining, still commanded a notable portion of the market. Outdoor advertising also continues to be a strong contender, attracting significant investment due to its visibility.

- Television: Remains a dominant force in advertising, offering broad reach but often at a higher cost.

- Print Media: While facing digital disruption, print still appeals to specific demographics and offers a tangible advertising experience.

- Outdoor Advertising: Provides high impact and localized targeting, making it attractive for certain campaigns.

Emerging Digital Content Platforms

The competitive rivalry within the digital content space is intensifying, significantly impacting traditional media like ARN Media. Platforms such as TikTok, Instagram Reels, and YouTube Shorts are capturing substantial audience attention, particularly among younger demographics. In 2024, TikTok continued its dominance, with reports indicating over 1 billion monthly active users globally, a significant portion of whom spend considerable time on the platform daily. This diversion of eyeballs directly competes for advertising dollars that might otherwise flow to radio.

These emerging digital platforms, while not always direct audio competitors, create a highly fragmented media landscape. They offer diverse and engaging content formats, from short-form videos to interactive audio experiences, forcing traditional media to adapt or risk losing market share. For instance, the rise of podcasting and audio-first social media features on platforms like X (formerly Twitter) and Spotify further dilutes the traditional radio audience. In 2023, the global podcasting market was valued at over $20 billion, demonstrating a significant shift in audio consumption habits.

The indirect competition for advertising spend is a crucial aspect of this rivalry. Advertisers are increasingly allocating budgets to digital channels that offer precise targeting capabilities and measurable ROI, often at a lower cost per impression than traditional radio. This trend is expected to continue, with digital advertising spend projected to grow year-on-year. For ARN Media, this means facing pressure to demonstrate the unique value proposition of radio in an increasingly crowded and dynamic digital ecosystem.

- Digital platforms like TikTok and Instagram Reels are siphoning audience attention and advertising revenue from traditional media.

- In 2024, TikTok maintained over 1 billion monthly active users, highlighting its significant reach.

- The growth of podcasting, valued at over $20 billion in 2023, signifies a major shift in audio consumption habits.

- Advertisers are increasingly favoring digital channels due to better targeting and measurable returns on investment.

Competitive rivalry is a significant factor for ARN Media, with major players like Southern Cross Austereo and Nova Entertainment vying for listeners and advertising revenue. This intense competition extends to securing top talent and engaging content, directly influencing ARN's market standing. Notably, SCA surpassed ARN in market capitalization by early 2024, illustrating the dynamic shifts in the industry.

The rise of global music streaming services like Spotify, which boasted over 600 million monthly active users in 2023, presents a formidable challenge, especially for younger demographics. This necessitates ARN's investment in its digital audio strategy, including its iHeartRadio platform, to remain competitive.

Furthermore, the crowded podcasting market and the increasing popularity of digital content platforms like TikTok, with over 1 billion monthly active users in 2024, fragment audience attention and advertising spend. Advertisers are increasingly shifting budgets to digital channels offering precise targeting and measurable ROI, putting pressure on traditional media like ARN to demonstrate radio's unique value proposition.

SSubstitutes Threaten

Dedicated music streaming services like Spotify and Apple Music present a strong substitute for traditional radio. These platforms offer extensive on-demand music libraries, personalized listening experiences, and ad-free options for subscribers, directly challenging radio's reach, especially with younger audiences.

In 2024, Spotify reported over 600 million monthly active users, with a significant portion being premium subscribers, underscoring the shift towards curated, on-demand audio content. This trend directly erodes radio's traditional listenership base.

The rise of podcasts and on-demand audio content presents a significant threat of substitutes to traditional radio. Listeners now have access to a vast library of specialized content, from news and comedy to niche hobbies, all available at their convenience. This flexibility allows audiences to curate their listening experience, bypassing the need to tune into scheduled radio broadcasts.

For instance, the podcast industry experienced substantial growth, with projections indicating continued expansion. In 2024, the global podcasting market was valued at over $20 billion, with listener numbers steadily increasing. This readily available and diverse audio alternative directly competes with the reach and engagement of radio stations like ARN Media.

ARN's strategic move to invest in podcasting platforms, such as iHeartRadio, is a clear acknowledgment of this evolving media landscape. By offering its own on-demand audio content, ARN aims to retain audience attention and capture a share of the growing digital audio market, mitigating the threat posed by these readily accessible substitutes.

Online video platforms like YouTube and TikTok are increasingly encroaching on traditional audio consumption. These platforms offer a vast library of music, podcasts, and spoken-word content, directly competing with dedicated audio services. For instance, in 2024, TikTok continued its dominance in short-form video, with user engagement metrics suggesting a significant portion of time spent on the platform could otherwise be allocated to audio-only experiences.

Personalized Playlists and Digital Music Libraries

Consumers are increasingly crafting their own audio experiences. This shift directly challenges traditional radio by offering a personalized alternative that bypasses advertisements and fixed schedules.

The rise of streaming services and digital music libraries means listeners can access virtually any song, anytime. This deep customization presents a significant threat, as it caters precisely to individual tastes, a level of personalization often difficult for broadcast radio to match.

- Personalization: Platforms like Spotify and Apple Music allow users to create and share playlists, offering a highly tailored listening experience.

- Accessibility: Digital libraries provide on-demand access to vast catalogs of music, unlike the limited selections and broadcast times of radio.

- Ad-Free Options: Many digital services offer ad-free tiers, directly competing with radio's revenue model and listener experience.

- Growth in Streaming: By 2024, global music streaming revenue was projected to exceed $30 billion, highlighting the significant shift in consumer preference away from traditional broadcast media.

Other Forms of Entertainment and Information

The threat of substitutes for ARN Media is significant, as virtually any activity consuming a consumer's time and attention can be considered a rival. This encompasses a wide array of options, from streaming services and social media platforms to online news outlets and video games.

In 2024, the average person globally spends over 6.5 hours per day online, with a substantial portion dedicated to entertainment and information consumption outside traditional media. This constant competition for audience engagement directly impacts ARN Media's ability to capture and retain viewers and listeners, thereby affecting its advertising revenue potential.

- Digital Entertainment Dominance: Platforms like Netflix, YouTube, and TikTok continue to capture a massive share of leisure time, offering on-demand content that often surpasses traditional broadcast schedules.

- Social Media as a Time Sink: Social media platforms are not just for connecting; they are major hubs for news consumption and entertainment, directly competing for eyeballs that might otherwise land on ARN's offerings.

- Gaming's Growing Appeal: The global gaming market is projected to reach over $320 billion by 2026, indicating a substantial diversion of consumer attention and disposable income away from traditional media.

- Fragmented Information Sources: Consumers now have access to an unprecedented volume of information from diverse sources, making it challenging for any single media entity to maintain a dominant share of mind.

The threat of substitutes for ARN Media is substantial, as consumers have a vast array of entertainment and information options beyond traditional radio. Streaming services, podcasts, and even social media platforms offer personalized, on-demand content that directly competes for audience attention and time.

In 2024, the average global internet user spent nearly 7 hours online daily, with a significant portion allocated to digital entertainment and social media. This intense competition for consumer engagement means ARN Media must constantly innovate to retain its audience share.

The shift towards digital audio platforms is evident in market growth figures. For instance, the global music streaming market was expected to surpass $30 billion in revenue by 2024, demonstrating a clear preference for on-demand listening over broadcast radio.

| Substitute Category | Key Characteristics | Impact on Traditional Radio | 2024 Data/Projections |

|---|---|---|---|

| Music Streaming Services | On-demand access, personalization, ad-free options | Erodes listenership, particularly among younger demographics | Spotify had over 600 million monthly active users in 2024. |

| Podcasts | Niche content, convenience, diverse topics | Captures time previously spent on radio | Global podcasting market valued at over $20 billion in 2024. |

| Online Video Platforms | Music, spoken word, short-form content | Diverts attention from audio-only experiences | TikTok's high engagement suggests significant time allocation away from traditional media. |

| Social Media & Gaming | Entertainment, news, leisure activities | General competition for consumer attention and time | Global gaming market projected to exceed $320 billion by 2026. |

Entrants Threaten

The digital audio landscape, especially podcasting, presents very low hurdles for aspiring creators. Anyone with a microphone and an internet connection can start producing and distributing content, meaning new voices and niche interests can easily enter the market. This accessibility allows for a constant influx of new podcasts, potentially fragmenting audience attention.

Established media companies, with their vast content libraries and existing advertiser relationships, are increasingly venturing into the audio space. For instance, in 2023, major media groups continued to invest heavily in podcasting and digital radio, seeking to diversify their revenue streams and capture a larger share of the growing audio advertising market. This expansion poses a direct threat to ARN Media by introducing well-funded competitors who can leverage their established brand recognition and cross-promotional capabilities to quickly gain traction.

Global technology giants like Google and Amazon, with their vast financial reserves and extensive user networks, represent a significant threat. These companies could easily expand their audio services, either by developing entirely new platforms or by acquiring established audio businesses. For instance, Amazon's Alexa ecosystem already integrates audio content, and further investment in this area could challenge existing players. In 2024, tech companies continued to pour billions into AI and content development, directly impacting the competitive landscape for audio services.

Independent Content Networks and Aggregators

The emergence of new, independent content networks and aggregators poses a threat to ARN Media. These entities could specialize in niche genres or cater to specific audience segments, potentially siphoning off listeners and advertisers. Their agility and focused approach might allow them to capture valuable market share.

For instance, in 2024, the podcast advertising market continued its robust growth, projected to reach approximately $2.7 billion in the US alone. This expansion signifies a fertile ground for new entrants to carve out their own revenue streams by offering specialized content and targeted advertising opportunities that larger, more generalized platforms might overlook.

- Niche Specialization: New networks can attract dedicated audiences by focusing on underserved genres, offering a competitive edge against broader platforms.

- Agility and Innovation: Smaller, independent players often demonstrate greater flexibility in adopting new technologies and content formats.

- Listener Fragmentation: The increasing variety of audio content available can lead to a more fragmented listener base, making it easier for new aggregators to gain traction.

- Advertiser Demand for Targeted Reach: Advertisers are increasingly seeking highly specific audience segments, which niche networks are well-positioned to provide.

Changes in Regulatory Landscape

Changes in the regulatory landscape can significantly alter the threat of new entrants in the Australian audio market. Historically, stringent broadcasting licenses acted as a substantial barrier. However, ongoing reviews and potential shifts in media regulation, particularly concerning digital content, could lower these entry barriers.

For instance, if licensing becomes more accessible or digital content rules are relaxed, it could open doors for innovative new players. These new entrants might leverage novel business models that traditional broadcasters find harder to replicate. The Australian media regulatory environment is dynamic, with continuous evaluation of its effectiveness and impact on competition.

- Regulatory Evolution: Australian media regulations are under constant review, potentially easing entry for new audio businesses.

- Digital Content Rules: Changes in rules governing digital audio content could reduce barriers for new market participants.

- Licensing Accessibility: A more accessible licensing framework could invite new companies to enter the Australian audio sector.

The threat of new entrants in the audio market remains significant, driven by low barriers to entry for digital content creation and the strategic expansion of established media and tech giants. New independent networks also pose a challenge by specializing in niche areas. Regulatory changes in Australia could further lower these barriers, inviting more competition.

| Factor | Impact on ARN Media | 2024 Data/Trend |

|---|---|---|

| Low Digital Entry Barriers | Increased competition from new creators and platforms. | Podcast advertising market projected to reach $2.7 billion in the US in 2024. |

| Established Media Expansion | Competition for audience and advertising revenue from well-funded players. | Major media groups continued significant investment in audio in 2023-2024. |

| Tech Giant Influence | Potential disruption through new platforms or acquisitions. | Tech companies invested billions in AI and content in 2024, impacting audio services. |

| Niche Networks & Aggregators | Siphoning of listeners and advertisers through specialized offerings. | Growth in niche podcasting caters to specific advertiser demands for targeted reach. |

| Regulatory Environment (Australia) | Potential for reduced barriers if regulations ease. | Ongoing reviews of Australian media regulations could impact entry requirements. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a foundation of verified data, including company annual reports, industry-specific market research, and publicly available financial filings. This ensures a comprehensive understanding of competitive dynamics.