ARN Media Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ARN Media Bundle

Unlock the strategic potential of ARN Media with our comprehensive BCG Matrix analysis. Understand precisely where each product line sits – are they burgeoning Stars, stable Cash Cows, underperforming Dogs, or promising Question Marks? This snapshot is just the beginning of a deeper dive into market share and growth potential.

Don't miss out on the actionable insights that will shape your investment decisions and product portfolio. Purchase the full ARN Media BCG Matrix to receive a detailed breakdown, including data-driven recommendations and a clear roadmap for future success. It's your essential tool for competitive advantage.

Stars

The iHeartRadio platform is a significant player in Australia's digital audio landscape, evidenced by its substantial growth. In 2024, registered users climbed by 10% to exceed 2.9 million, and digital audio revenue saw a robust 28% increase. This performance underscores iHeartRadio's role as a cornerstone of ARN Media's digital expansion strategy.

ARN Media's approach with iHeartRadio is characterized by a low-capital investment model. This allows for efficient utilization of advanced technology in content creation, distribution, and monetization. Such a strategy is designed to foster accelerated and profitable revenue growth, with projections indicating continued strong performance into 2025 and beyond.

ARN Media's digital audio segments achieved a significant milestone by turning EBITDA and cashflow positive in the latter half of 2024. This turnaround demonstrates the successful monetization of their digital audio offerings within a rapidly expanding market.

The company's direct-sold digital revenue saw an impressive 28% year-on-year increase, outperforming the broader market growth by a considerable margin. This robust growth underscores ARN's effective strategies for capturing market share in the digital audio space.

This digital audio segment is a cornerstone of ARN's ambitious three-year transformation plan. The ultimate goal is to transition ARN into a fully digitized audio business, leveraging the strength and growth potential of its digital platforms.

The KIIS Network stands as a dominant force in the Australian audio market, recognized as the number one national network. Its consistent audience engagement and strong market leadership are evident in its significant revenue growth, particularly in major metropolitan areas like Sydney and Melbourne, where it outperformed market averages in 2024.

KIIS reaches an impressive audience of over 10 million listeners weekly. This extensive reach spans broadcast radio, digital streaming, and podcast platforms, cementing its status as a high-market-share leader within the Australian audio landscape.

Hong Kong Outdoor Advertising (Cody)

ARN Media's Hong Kong outdoor advertising business, Cody, has seen a remarkable comeback, significantly boosting the group's revenue in 2024. This resurgence is largely due to two major advertising contracts that have put Cody back on the map.

Cody achieved cash-positive EBITDA in the fourth quarter of 2024 and is on track to be free cash-flow positive by 2025. This turnaround marks a high-growth segment for ARN, creating a vital new income source and reinforcing its market position.

- Significant Revenue Contribution: Cody's performance in 2024 directly fueled ARN Media's overall revenue growth.

- EBITDA Positive: Achieved cash-positive EBITDA in Q4 2024, demonstrating operational profitability.

- Free Cash Flow Target: Aiming for free cash-flow positivity in 2025, signaling strong financial health.

- Market Re-establishment: The business is re-establishing its market presence as a critical new revenue stream for ARN.

Regional Radio Network ('Leaders In Local' Strategy)

ARN Media's 'Leaders In Local' strategy has significantly boosted its regional radio presence. This approach has led to 10 out of 12 regional stations securing top ratings, underscoring their strong local appeal and competitive edge.

The success is further evidenced by a 6% increase in commercial share gains, reflecting advertisers' confidence in ARN's regional reach. ARN now connects with 2 million Australians across its 46 regional stations, a testament to its expanding footprint in these vital markets.

The regional radio segment is proving to be a valuable advertising avenue, consistently growing its share within the non-digital media landscape. This trend highlights the enduring relevance and effectiveness of local radio for advertisers seeking to connect with specific communities.

- 10 out of 12 regional stations achieved #1 ratings.

- 6% increase in commercial share gains.

- Reaches 2 million Australians across 46 stations.

- Regional segment's share of non-digital media advertising continues to grow.

Stars represent high-growth, high-market-share offerings within the ARN Media portfolio. These are typically digital-first platforms that have achieved significant audience engagement and are poised for substantial future revenue growth. Their success is driven by strong market positioning and the ability to capture growing digital advertising spend.

The iHeartRadio platform exemplifies a Star, with registered users growing 10% to over 2.9 million in 2024 and digital audio revenue up 28%. This segment is a cornerstone of ARN's digital transformation, aiming for full digitization of the business.

The KIIS Network, while primarily broadcast, also has a strong digital presence and consistently ranks as the number one national network, reaching over 10 million listeners weekly. Its strong market share and audience engagement place it in a strong growth trajectory, particularly with its direct-sold digital revenue increasing by 28% year-on-year.

| Business Segment | Market Share | Growth Trajectory | Key Metrics (2024) |

|---|---|---|---|

| iHeartRadio | High (Digital Audio) | High (Digital Revenue +28%) | 2.9M+ registered users (+10%) |

| KIIS Network | #1 National Network | High (Audience Engagement, Digital Growth) | 10M+ weekly listeners |

What is included in the product

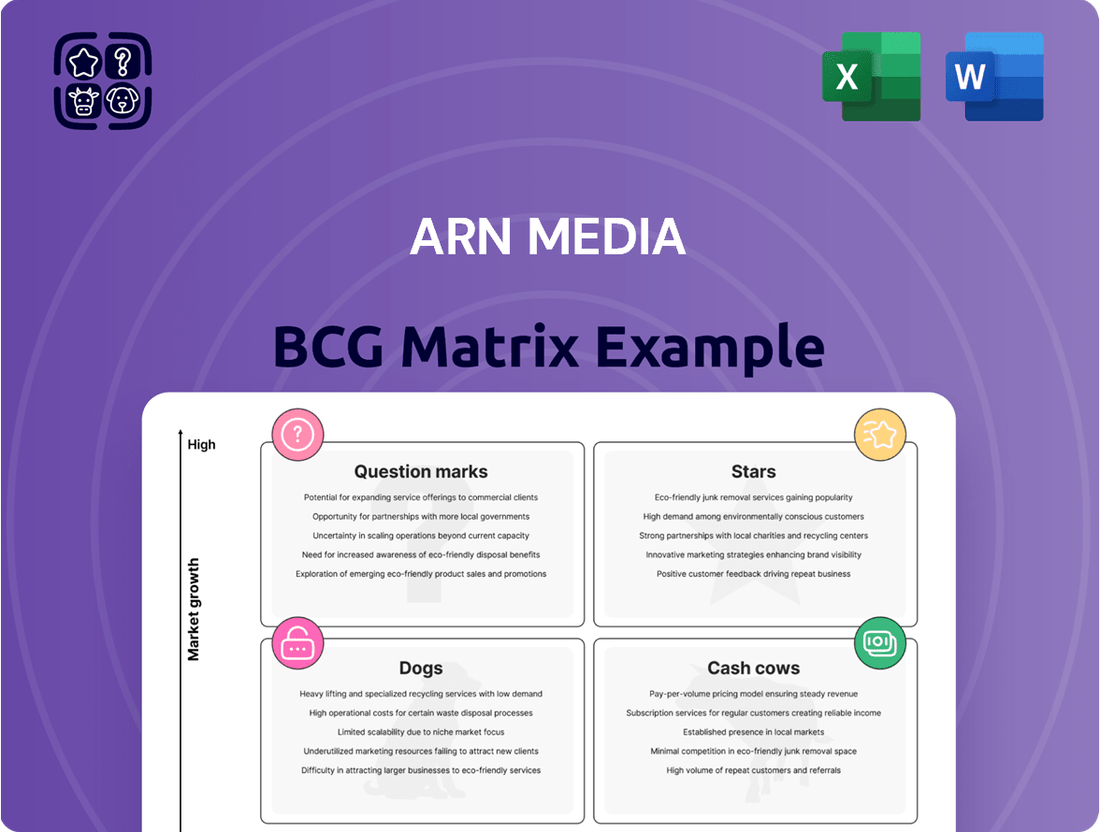

ARN Media BCG Matrix analyzes product portfolio across Stars, Cash Cows, Question Marks, and Dogs.

ARN Media BCG Matrix provides a clear, visual snapshot of your portfolio's health, alleviating the pain of strategic uncertainty.

Cash Cows

The Kyle & Jackie O Show on Sydney's KIIS1065 is a prime example of a cash cow for ARN Media. This program has consistently held the top spot as the number one FM breakfast show in Sydney, showcasing strong audience loyalty and a significant market share in a well-established radio market.

This enduring popularity translates directly into substantial advertising revenue. In 2024, the show continued its dominance, remaining Australia's most listened-to radio program nationwide, reinforcing its status as a reliable and significant cash flow generator for ARN Media.

Sydney's WSFM, a cornerstone of ARN Media's portfolio, exemplifies a classic cash cow. It consistently commands strong ratings in the Sydney market, frequently achieving the number one overall position. This enduring popularity, bolstered by its well-loved breakfast program, translates into a predictable and substantial stream of advertising revenue, solidifying its status as a mature, high-market-share asset.

GOLD 104.3 in Melbourne is a significant player for ARN Media, fitting the profile of a Cash Cow. It boasts a strong, consistent market share, with recent ratings showing incremental growth, indicating stability and audience loyalty.

This station is a reliable revenue generator, benefiting from its established presence in a major metropolitan market. Its primary demographic appeal lies within the 40-54 age group, a valuable segment for advertisers.

GOLD 104.3 plays a crucial supporting role within ARN's KIIS network, contributing to the overall strength of the brand. In the first half of 2024, ARN Media reported a 10.6% growth in revenue, with its regional radio segment, which includes stations like GOLD 104.3, showing particular resilience.

Established National Radio Advertising Sales

Established National Radio Advertising Sales, representing ARN Media's core Australian radio operations, demonstrated robust performance in 2024. Despite a dynamic market, this segment generated a substantial cash flow of $27.5 million. This revenue is a direct result of ARN's established national advertising sales, a testament to the enduring strength of its extensive commercial radio network across Australia.

This foundational revenue stream remains a critical and reliable contributor to ARN Media's overall financial stability. The resilience of these operations is noteworthy, providing the essential capital required to fuel other strategic initiatives and investments within the company.

- 2024 Cash Flow: $27.5 million generated by established national radio advertising sales.

- Key Driver: Leverages ARN's extensive network of commercial radio stations.

- Financial Contribution: A significant and consistent contributor to ARN Media's financial health.

- Operational Resilience: Provides necessary capital for strategic investments.

Overall Australian Radio Operations

ARN's overall Australian radio operations, a significant Cash Cow, represent the bedrock of the company's financial stability. This segment, encompassing both its metro and regional networks, continued to exhibit robust financial performance and strong cash generation throughout 2024.

Despite a challenging overall radio market, ARN's diverse portfolio of radio brands has proven resilient. The company successfully maintained its strong market position, highlighting its adaptability and effective strategy in navigating industry headwinds. For instance, in the first half of 2024, ARN reported a 5% increase in revenue to $162.1 million, underscoring the consistent performance of these established assets.

- Strong Cash Generation: The established metro and regional networks consistently provide substantial and reliable cash flow.

- Market Resilience: ARN's radio operations have demonstrated an ability to withstand and adapt to broader market challenges.

- Stable Income Source: This segment acts as the company's primary engine for stable income and cash generation.

- Market Leadership: ARN maintains a leading market share across its diverse radio brand portfolio, contributing to its Cash Cow status.

Cash Cows for ARN Media are its mature, high-market-share radio stations that consistently generate significant and predictable revenue. These assets, like The Kyle & Jackie O Show and WSFM, benefit from established listener loyalty and strong advertising demand.

In 2024, ARN's established national radio advertising sales, representing these core operations, generated a substantial cash flow of $27.5 million. This segment's resilience and market leadership across metro and regional networks underscore its role as a primary engine for stable income.

ARN's overall Australian radio operations, including stations like GOLD 104.3, demonstrated robust performance in the first half of 2024, with revenue increasing by 5% to $162.1 million. This growth highlights the enduring strength and consistent cash generation from these established assets.

| ARN Media Radio Segment | 2024 Performance Metric | Financial Impact | Key Characteristic |

|---|---|---|---|

| National Radio Advertising Sales | $27.5 million cash flow | Significant and consistent contributor to financial stability | Leverages extensive commercial radio network |

| Overall Australian Radio Operations | 5% revenue increase (H1 2024) to $162.1 million | Primary engine for stable income and cash generation | Market leadership and resilience across diverse portfolio |

| The Kyle & Jackie O Show (KIIS1065) | Australia's most listened-to radio program nationwide | Substantial advertising revenue | Strong audience loyalty and market share dominance |

| WSFM | Consistent number one overall position in Sydney | Predictable and substantial advertising revenue stream | Mature, high-market-share asset with popular breakfast program |

What You See Is What You Get

ARN Media BCG Matrix

The ARN Media BCG Matrix preview you are currently viewing is the exact, fully formatted document you will receive upon purchase. This means no watermarks, no demo content, and no surprises – just the complete, analysis-ready report designed for immediate strategic application. You can be confident that the professional layout and comprehensive data presented here are precisely what will be delivered to you, ready for integration into your business planning and decision-making processes.

Dogs

Within ARN Media's portfolio, certain legacy radio formats and individual stations operating outside the prominent KIIS, Gold, and Pure Gold networks likely face challenges. These stations, not benefiting from the strong brand recognition of the leading networks, may be experiencing a decline in listener engagement and advertising income.

The Australian radio broadcasting industry itself is projected to see a revenue decrease. For instance, industry-wide revenue experienced a dip in recent periods, and with a general trend of some businesses within the sector declining, less competitive or niche traditional radio offerings are particularly vulnerable to losing market share and relevance.

ARN Media's ongoing three-year business transformation program, targeting $40 million in cost savings, highlights significant inefficiencies within its operational processes. These areas, while not traditional products, function as 'Dogs' in the BCG matrix by consuming resources without generating adequate returns.

The company's strategic focus on leveraging technology and AI to streamline its operating model directly addresses these inefficiencies. This initiative aims to unlock value by reducing the cash drain associated with outdated or poorly performing operational structures.

ARN Media's strategic decision to pull out of acquiring SCA's Regional TV business in May 2024, citing its deteriorating performance and the general outlook for regional TV, clearly signals a 'Dog' category asset. This move demonstrates ARN's commitment to avoiding or divesting from segments that could become cash drains, aligning with a disciplined approach to portfolio management.

Certain Niche DAB+ Stations with Low Traction

Certain niche DAB+ stations within ARN Media's portfolio, particularly those that haven't captured substantial audience interest, could be categorized as Dogs in the BCG Matrix. This classification stems from their limited market share and potentially low growth prospects within the evolving digital audio landscape.

For example, while ARN Media is actively investing in digital audio, some of its DAB+ stations may not be meeting expectations. CADA, despite initial strong DAB+ listening in Sydney, saw a dip in audience engagement with its AI DJ 'Thy' by Survey 3 2025. This suggests that even innovative features might not guarantee sustained listener interest if the core offering doesn't resonate broadly.

- Low Market Share: Stations failing to build a significant listener base on DAB+ possess a low share of this specific market.

- Limited Growth Potential: If these niche stations consistently struggle to attract new listeners or generate revenue, their growth prospects are considered poor.

- Investment Reassessment: ARN Media may need to reassess the ongoing investment in these underperforming DAB+ assets, especially as digital audio strategies evolve.

- Strategic Divestment Consideration: In scenarios where traction remains minimal and revenue generation is negligible, these stations could become candidates for divestment to reallocate resources to more promising ventures.

Traditional Radio Segments Facing Stiff Digital Competition

Traditional radio segments are indeed facing significant headwinds from the digital revolution. The broader trend sees listeners flocking to streaming platforms, which offer on-demand content and personalized experiences that traditional radio struggles to match. This shift in listener preference directly impacts advertising revenue, as marketing budgets increasingly follow audiences to digital channels.

For ARN Media, this translates into a potential challenge for any traditional radio segments that haven't effectively integrated digital strategies or developed truly unique, compelling content. While ARN's established brands provide a buffer, segments within their traditional radio portfolio that are demonstrably losing market share in this evolving landscape could be categorized as .

- Listener Migration: In 2024, digital audio consumption continues to grow, with platforms like Spotify and Apple Music capturing a larger share of listening hours, particularly among younger demographics.

- Advertising Shift: Advertising spend is increasingly allocated to digital platforms, with traditional radio's share of the total advertising market facing pressure. For instance, digital advertising spending in Australia was projected to reach over AUD 12 billion in 2024.

- Content Differentiation: Segments that rely on generic programming without a strong digital presence or unique talent are more vulnerable to audience erosion.

- ARN's Position: ARN's strength lies in its portfolio of strong brands, which can help mitigate the impact on individual segments. However, underperforming traditional segments without a clear digital strategy would be a concern.

ARN Media's legacy radio formats and niche DAB+ stations that are not gaining significant traction are likely considered 'Dogs'. These segments exhibit low market share and limited growth potential in the rapidly evolving digital audio landscape. For instance, CADA experienced a dip in audience engagement with its AI DJ by Survey 3 2025, indicating that even innovative features may not guarantee sustained listener interest if the core offering doesn't resonate broadly.

ARN Media's operational inefficiencies, highlighted by its three-year transformation program targeting $40 million in cost savings, also represent 'Dogs'. These areas consume resources without generating adequate returns. Furthermore, the strategic decision to withdraw from acquiring SCA's Regional TV business in May 2024, citing its deteriorating performance, clearly signals a divestment from a 'Dog' category asset.

Traditional radio segments that haven't effectively integrated digital strategies or developed unique content are vulnerable. With digital audio consumption growing and advertising spend shifting to digital platforms, these segments face audience erosion. For example, digital advertising spending in Australia was projected to exceed AUD 12 billion in 2024, underscoring the migration of ad revenue away from traditional media.

| Category | Characteristics | ARN Media Examples | Market Trend Impact | Strategic Implication |

|---|---|---|---|---|

| Dogs | Low Market Share, Low Growth Potential | Underperforming legacy radio formats, niche DAB+ stations (e.g., CADA's engagement dip), operational inefficiencies | Listener migration to digital platforms, advertising spend shift to digital | Reassess investment, consider divestment, focus on efficiency gains |

Question Marks

The expansion of The Kyle & Jackie O Show to Melbourne in April 2024 positions it as a Question Mark within ARN Media's BCG Matrix. This move signals a substantial investment with the aim of capturing a new market, mirroring its strong performance in Sydney.

Initial survey results in Melbourne have shown a lower market share than anticipated, with some fluctuations, characteristic of a Question Mark. This necessitates ongoing, significant investment to cultivate audience engagement and transform casual listeners into loyal ones.

The show’s success in Melbourne is not yet guaranteed, but if it can overcome these early challenges and build a robust listener base, it has the potential to ascend to the Star category, driving significant revenue for ARN Media.

ARN Media is strategically developing genre-specific sub-brands on platforms like iHeartRadio. This move targets the rapidly expanding digital audio sector, a market projected to reach $36.8 billion globally by 2027, according to Statista. While these new ventures are positioned in a high-growth area, their current market share is minimal, reflecting their status as nascent products.

These emerging digital audio sub-brands, like ARN's planned iHeartRadio expansions, necessitate substantial investment in both marketing and content creation to achieve significant audience traction and scalability. Their potential lies in becoming Stars within the BCG matrix if they can successfully capture a substantial portion of the digital audio listener base, which saw podcast advertising revenue alone exceed $2 billion in the US in 2023.

ARN is actively pushing to commercialize live radio streaming, seeing digital audio as a significant and growing source of revenue. This move acknowledges the increasing mainstream adoption of audio streaming platforms.

While listener numbers for streaming are strong, the actual revenue generation and market dominance for live radio streaming are still in their early stages of development. The industry is working to fully unlock this potential.

This segment offers substantial growth opportunities, but it necessitates strategic investment to achieve optimal returns and secure a leading position in the market. For instance, digital audio advertising revenue in the US was projected to reach $7.1 billion in 2024, highlighting the commercial viability.

AI-driven Operational Enhancements

ARN Media's focus on AI-driven operational enhancements positions it as a 'Question Mark' within the BCG Matrix. The company's strategic intent is to build a digitized audio business, using technology and AI to streamline operations and boost efficiency.

While AI promises significant potential for internal improvements and future innovation, its immediate impact on market share or revenue is still developing. This necessitates continued investment in AI development and integration to realize its full market potential.

- AI Implementation Costs: In 2024, companies across various sectors are allocating substantial budgets to AI integration, with estimates suggesting the global AI market will reach over $2 trillion by 2030, indicating significant upfront investment is typical for such initiatives.

- Efficiency Gains: Early adopters of AI in operations have reported efficiency improvements ranging from 15% to 30% in areas like content moderation and ad placement, showcasing the tangible benefits AI can bring.

- Market Impact Uncertainty: Despite the internal efficiencies, the direct translation of these AI enhancements into increased market share or revenue remains to be seen, making it a high-potential but unproven area for ARN Media.

- Research and Development Focus: ARN Media's commitment to AI development in 2024 reflects a broader industry trend where significant R&D spending is crucial for staying competitive in the rapidly evolving digital landscape.

CADA

CADA, ARN Media's youth-focused brand, is positioned within the digital audio sector, a market experiencing significant expansion. Its presence is particularly noted in DAB+ listening within Sydney, indicating a targeted reach.

While CADA operates in a high-growth segment, its current market share does not rival ARN's established brands. Audience engagement metrics have shown some variability, suggesting a need for sustained strategic focus to solidify its position.

- Market Position: CADA targets the youth demographic in the expanding digital audio market, with a notable presence in Sydney's DAB+ listenership.

- Growth Potential: The digital audio space offers significant growth opportunities, aligning with CADA's strategic focus.

- Challenges: CADA faces the challenge of increasing its market share against ARN's dominant brands and managing fluctuating audience interest to avoid a 'Dog' classification.

- Strategic Imperative: Continued investment and strategic development are crucial for CADA to capitalize on its potential and secure a stronger market foothold.

Question Marks represent new ventures or products with low market share in high-growth industries. ARN Media's expansion of The Kyle & Jackie O Show into Melbourne and its investment in new digital audio sub-brands exemplify this category. These initiatives require significant investment to build audience and market presence, with the potential to become Stars if successful.

| ARN Media Initiative | BCG Category | Market Context | Investment Rationale | Potential Outcome |

|---|---|---|---|---|

| The Kyle & Jackie O Show (Melbourne) | Question Mark | Expansion into a new, competitive radio market. | Leverage existing show success to capture new audience share. | Potential to become a Star if market penetration is achieved. |

| Digital Audio Sub-brands (iHeartRadio) | Question Mark | High-growth digital audio sector, low initial market share. | Targeting evolving listener habits and digital advertising revenue. | Opportunity to become Stars in the digital audio landscape. |

| AI-Driven Operational Enhancements | Question Mark | Rapidly evolving technology with unproven market impact. | Streamline operations and boost efficiency for future growth. | Potential to drive competitive advantage and revenue if successful. |

| CADA (Youth-Focused Brand) | Question Mark | Expanding digital audio market, targeting youth demographic. | Establish a presence in a high-growth segment with specific audience. | Can become a Star by capturing youth market share and loyalty. |

BCG Matrix Data Sources

Our BCG Matrix is constructed using a robust blend of proprietary market research, financial statements, and industry trend analysis to provide a comprehensive view of business unit performance.