Aritzia PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aritzia Bundle

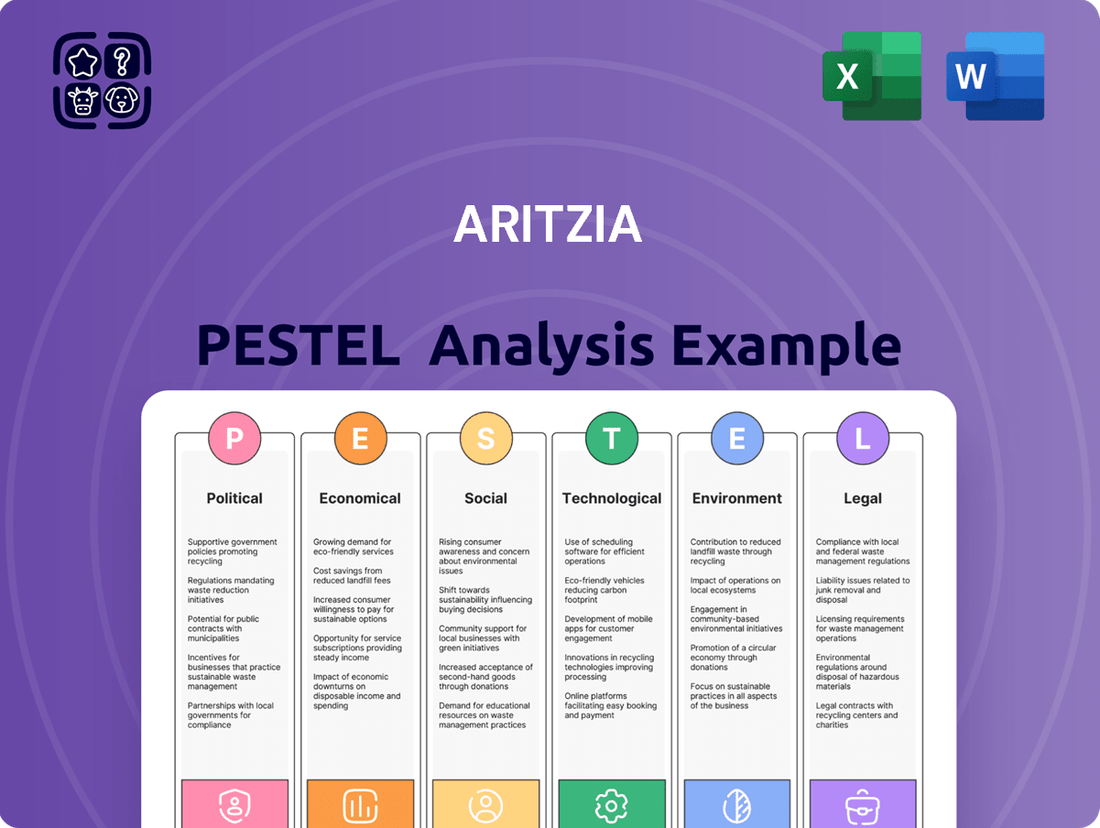

Uncover the critical political, economic, social, technological, legal, and environmental factors shaping Aritzia's trajectory. Our PESTLE analysis dives deep into these external forces, offering a clear view of opportunities and threats. Equip yourself with this vital market intelligence to refine your strategies and gain a competitive edge. Download the full PESTLE analysis now for actionable insights.

Political factors

Changes in international trade policies, such as new tariffs or shifts in trade agreements, directly influence Aritzia's operational costs. For instance, the United States' imposition of tariffs on goods from China, a significant manufacturing hub, could increase Aritzia's sourcing expenses if a portion of its production is affected. In 2023, global trade growth slowed to an estimated 0.9%, reflecting ongoing geopolitical tensions and protectionist measures, a trend that could continue to impact companies like Aritzia that rely on international supply chains.

Variations in labor laws, including minimum wage requirements and employment standards, across Canada and the United States directly impact Aritzia's operational costs and staffing strategies. For instance, in 2024, the federal minimum wage in Canada is not set, but provincial minimum wages range from $13.50 in Saskatchewan to $17.30 in Nunavut, while the US federal minimum wage remains $7.25, with many states and cities having higher rates. Aritzia must navigate these diverse regulations to ensure compliance and manage its workforce effectively.

Compliance with these multifaceted labor regulations is crucial for Aritzia's extensive network of physical boutiques and its corporate workforce. Adhering to fair labor practices not only ensures legal standing, avoiding costly disputes and penalties, but also contributes to employee morale and retention, which is vital for a customer-facing retail business. In 2023, the retail trade sector in Canada employed over 2 million people, highlighting the significant impact of labor laws on such a large segment of the economy.

Aritzia must navigate evolving consumer protection legislation, particularly concerning product safety, accurate labeling, and truthful advertising claims. For instance, in 2024, Canada’s Competition Bureau continued its focus on combating deceptive marketing practices, which directly impacts how fashion brands like Aritzia communicate value and product attributes to consumers.

Maintaining strict adherence to these regulations is paramount for Aritzia to preserve customer trust and avoid potential penalties. Failure to comply, such as misrepresenting the sustainability of materials or the origin of garments, could lead to significant fines and damage the reputation of its carefully curated fashion lines and marketing campaigns.

Government Support and Incentives

Government initiatives aimed at promoting sustainable manufacturing could offer Aritzia opportunities to enhance its brand image and operational efficiency. For instance, Canada's federal budget in 2024 proposed significant investments in clean technology and green infrastructure, which could translate into incentives for companies like Aritzia adopting more environmentally friendly production methods. Such support might lower the cost of investing in sustainable materials or energy-efficient facilities.

Furthermore, government policies supporting e-commerce development can be a boon for Aritzia's online sales channels. Many governments are actively investing in digital infrastructure and offering grants for small and medium-sized businesses to expand their online presence. This could mean improved logistics networks or tax benefits for digital sales, directly impacting Aritzia's ability to reach a wider customer base and manage its digital operations more effectively.

Policies focused on job creation, particularly in sectors relevant to retail and apparel manufacturing, could also influence Aritzia's operational costs and talent acquisition. For example, provincial governments might offer tax credits or subsidies for companies that create new jobs, potentially reducing Aritzia's labor expenses. However, stringent labor regulations or minimum wage increases, often part of job creation strategies, could also necessitate adjustments to Aritzia's staffing and compensation models.

Aritzia's strategic decisions regarding technology adoption and infrastructure investment will likely be shaped by the prevailing government incentives and regulatory landscape. The Canadian government's commitment to innovation, including support for AI and advanced manufacturing, could provide Aritzia with opportunities to upgrade its supply chain and customer experience technologies, potentially securing a competitive edge.

Political Stability and Geopolitical Tensions

Aritzia's operations are significantly influenced by political stability in its key sourcing and retail markets. For instance, disruptions in major manufacturing hubs due to political unrest could directly impact inventory levels and production timelines. The company's reliance on global supply chains means that geopolitical tensions, such as trade disputes or regional conflicts, can introduce volatility. These external factors necessitate agile risk management to mitigate potential impacts on market access and operational costs.

The ongoing global geopolitical landscape presents a complex operating environment for retailers like Aritzia. For example, in 2024, continued supply chain vulnerabilities stemming from international conflicts, like the ongoing conflict in Eastern Europe, have maintained upward pressure on shipping and logistics costs. These pressures can affect Aritzia's cost of goods sold and, consequently, its pricing strategies and profit margins.

- Supply Chain Vulnerability: Geopolitical events can disrupt the flow of goods from manufacturing countries to Aritzia's distribution centers and retail locations.

- Market Access Risks: Political instability or sanctions in certain regions could limit Aritzia's ability to operate or expand into those markets.

- Cost Inflation: Increased geopolitical tensions often correlate with higher inflation, impacting raw material costs, labor, and transportation expenses for Aritzia.

- Regulatory Changes: Shifting political climates can lead to new trade regulations, tariffs, or labor laws that affect Aritzia's business model and profitability.

Political stability in Aritzia's sourcing and retail markets significantly impacts its operations. Geopolitical tensions and trade disputes can disrupt supply chains, affecting inventory and production timelines, as seen with global trade growth slowing to an estimated 0.9% in 2023 due to such factors.

Government policies and regulations, from labor laws to consumer protection, directly influence Aritzia's operational costs and compliance strategies. For instance, varying minimum wages across Canada and the US require careful navigation, with provincial minimums in Canada ranging from $13.50 to $17.30 in 2024.

Government initiatives promoting sustainability and e-commerce can create opportunities for Aritzia. Canada's 2024 budget proposed investments in clean technology, potentially incentivizing greener manufacturing practices for companies like Aritzia.

Aritzia must adapt to evolving trade policies and geopolitical risks, which can lead to cost inflation and market access challenges. Continued supply chain vulnerabilities in 2024, linked to international conflicts, have maintained upward pressure on logistics costs.

What is included in the product

This PESTLE analysis examines the external macro-environmental factors influencing Aritzia's operations across Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It provides actionable insights for strategic decision-making by highlighting opportunities and threats within Aritzia's specific market context.

A clear, actionable framework that helps Aritzia proactively identify and address external factors, thereby mitigating potential market disruptions and strengthening strategic decision-making.

Economic factors

Aritzia's financial performance is closely tied to consumer discretionary spending, as its focus on fashion apparel means its products are not necessities. When the economy faces challenges like inflation or higher interest rates, consumers tend to cut back on non-essential purchases, directly affecting Aritzia's sales and growth prospects.

For instance, in the fiscal year ending March 3, 2024, Aritzia reported net revenue of $2.19 billion, a 10.5% increase year-over-year, demonstrating resilience. However, the discretionary nature of its offerings means that shifts in consumer confidence and disposable income, influenced by macroeconomic trends, are critical to monitor for future demand forecasting.

High inflation in 2024 and projected for 2025 directly impacts Aritzia's cost of goods sold and operational expenses, including wages and utilities. For instance, the US Consumer Price Index (CPI) saw a significant increase in 2024, impacting global supply chains and input costs.

Rising interest rates, a key tool to combat inflation, also present challenges. Higher borrowing costs can affect Aritzia's ability to finance expansion or manage debt. Furthermore, increased rates tend to dampen consumer spending confidence, potentially reducing demand for discretionary items like apparel, a trend observed in consumer sentiment surveys throughout 2024.

Aritzia, being a Canadian company with substantial U.S. and international dealings, is sensitive to shifts in currency values. For instance, the Canadian dollar's value against the U.S. dollar directly influences the cost of goods Aritzia imports from the U.S. and the revenue it earns from sales in U.S. dollar-denominated markets.

In early 2024, the Canadian dollar traded in a range of approximately 0.73 to 0.75 U.S. dollars, meaning a stronger U.S. dollar would increase Aritzia's import costs and reduce the reported value of its U.S. sales when converted back to Canadian dollars. Conversely, a weaker U.S. dollar would have the opposite effect, potentially boosting profitability from its U.S. operations.

Economic Growth and Recessionary Pressures

Aritzia's performance is closely tied to the economic health of North America, its primary market. In 2024, the US economy showed resilience, with GDP growth projected to be around 2.3%, while Canada's GDP growth was anticipated to be around 1.7% for the year. These figures indicate a generally supportive, albeit moderating, economic environment for discretionary spending on fashion.

However, potential recessionary pressures remain a concern. Factors like persistent inflation and rising interest rates could dampen consumer confidence and spending. For instance, if inflation continues to outpace wage growth, consumers may cut back on non-essential purchases like Aritzia's apparel. This necessitates careful inventory management and strategic pricing to navigate potential downturns.

- US GDP Growth (2024 Projection: ~2.3%): Indicates a relatively stable economic backdrop for Aritzia's key market.

- Canadian GDP Growth (2024 Projection: ~1.7%): Suggests moderate economic expansion in Aritzia's home market.

- Inflationary Pressures: A continued concern that could impact consumer discretionary spending power.

- Interest Rate Environment: Higher rates can increase borrowing costs and reduce consumer spending on higher-priced fashion items.

Unemployment Rates and Wage Growth

Unemployment rates and real wage growth are key indicators for Aritzia's sales performance. When unemployment is low and wages are rising, consumers have more disposable income, which typically translates to increased spending on fashion. For instance, in the US, the unemployment rate hovered around 3.9% in early 2024, and real average hourly earnings saw modest growth, suggesting a generally supportive environment for discretionary spending.

Conversely, if unemployment were to climb or wage growth stagnate, Aritzia could face headwinds. A less robust job market can lead consumers to cut back on non-essential purchases like apparel, opting for value or delaying buying decisions. This directly impacts market sizing and the accuracy of sales forecasts, making close monitoring of these economic factors essential.

- US Unemployment Rate (Early 2024): Approximately 3.9%.

- Real Wage Growth Trend: Modest positive growth observed in early 2024, indicating some increase in purchasing power.

- Impact on Disposable Income: Lower unemployment and rising wages generally boost consumer spending power for fashion items.

- Forecasting Relevance: These metrics are critical for Aritzia's market sizing and predicting future sales volumes.

Aritzia's performance is intrinsically linked to consumer discretionary spending, making it susceptible to economic fluctuations. In 2024, while the U.S. economy showed resilience with projected GDP growth around 2.3%, and Canada around 1.7%, persistent inflation and rising interest rates present ongoing challenges. These factors can dampen consumer confidence and purchasing power, directly impacting sales of fashion apparel.

The company's cost of goods sold and operational expenses are also sensitive to inflation, which impacted global supply chains and input costs throughout 2024. Higher interest rates, used to combat inflation, can increase Aritzia's borrowing costs and potentially reduce consumer spending on non-essential items.

Labor market conditions, such as the U.S. unemployment rate hovering around 3.9% in early 2024 and modest real wage growth, generally support discretionary spending. However, any significant increase in unemployment or stagnation in wage growth could negatively affect demand for Aritzia's products.

| Economic Factor | 2024 Data/Projection | Impact on Aritzia |

|---|---|---|

| US GDP Growth | ~2.3% | Supports discretionary spending in key market. |

| Canadian GDP Growth | ~1.7% | Moderate economic expansion in home market. |

| US Unemployment Rate | ~3.9% (Early 2024) | Low rate generally supports consumer spending. |

| Inflation | Persistent concern | Increases costs, may reduce consumer spending power. |

| Interest Rates | Rising | Increases borrowing costs, can dampen consumer confidence. |

Preview Before You Purchase

Aritzia PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This Aritzia PESTLE analysis provides a comprehensive overview of the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the fashion retailer.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises. Dive into the detailed breakdown of Aritzia's market position and strategic considerations within its operating landscape.

The content and structure shown in the preview is the same document you’ll download after payment. You'll gain actionable insights into Aritzia's opportunities and threats, enabling informed business decisions.

Sociological factors

Aritzia thrives in a fashion landscape where styles and what consumers desire change rapidly. To stay relevant, the company must continuously refresh its designs and inventory to align with the tastes of its core demographic—women looking for stylish, well-made clothing. This agility is crucial, as a lag in adaptation can directly impact brand perception and revenue. For instance, Aritzia's focus on curated collections, like their popular Super Puff jackets, demonstrates an understanding of current trends, contributing to their reported revenue growth. In fiscal year 2024, Aritzia saw net revenue increase by 35% to $2.4 billion, reflecting successful navigation of evolving consumer preferences.

Consumers are increasingly prioritizing sustainability and ethical sourcing in their fashion choices. This trend directly influences purchasing decisions, with many shoppers actively seeking brands that demonstrate environmental and social responsibility. For Aritzia, this means a growing demand for transparency regarding its supply chain and product lifecycle.

Aritzia's efforts in this area are crucial for its brand image and ability to connect with this growing segment of conscious consumers. For instance, the fashion industry as a whole faces scrutiny; a 2023 report indicated that 66% of global consumers are willing to pay more for sustainable products, a significant increase from previous years.

Social media platforms like Instagram and TikTok are crucial for Aritzia, as they heavily influence fashion trends and purchasing decisions for their target demographic. In 2024, brands are increasingly relying on influencer marketing, with a significant portion of Gen Z and Millennial consumers reporting that social media content has directly impacted their recent clothing purchases. Aritzia's success hinges on its ability to maintain its aspirational brand image and connect with its community through these digital channels.

Demographic Shifts and Generational Values

Aritzia's success is increasingly tied to understanding the evolving values of Gen Z and Millennials. These groups, representing significant purchasing power, prioritize authenticity, social responsibility, and unique shopping experiences over traditional brand loyalty. For instance, by Q1 2024, Aritzia reported a 17.7% increase in net revenue, partly driven by continued strong performance in its key demographic segments.

These younger consumers are also driving shifts in how they engage with fashion. They seek brands that align with their personal values, influencing Aritzia's approach to product development and marketing. Aritzia's focus on inclusive sizing and diverse representation in its campaigns resonates with these preferences, aiming to build deeper connections beyond just product sales.

- Gen Z and Millennial Spending Power: These demographics continue to be major drivers of consumer spending, with their preferences shaping retail trends.

- Brand Authenticity: Consumers in these cohorts are more likely to support brands that demonstrate genuine values and transparency.

- Experiential Retail: Aritzia's investment in its store environments and online platforms caters to the desire for engaging customer experiences.

- Digital Natives: Their comfort with and reliance on digital channels means Aritzia must maintain a strong online presence and seamless e-commerce experience.

Lifestyle Changes and Work-from-Home Trends

The ongoing shift towards hybrid and remote work has significantly reshaped consumer demand for apparel. Aritzia must strategically adjust its product offerings to cater to these evolving lifestyles, focusing on versatile pieces that blend comfort with its signature fashion-forward appeal. This necessitates a keen understanding of how consumers integrate work and leisure into their daily routines, impacting the utility and style of their wardrobe choices.

Consumer behavior analysis highlights a growing preference for clothing that transitions seamlessly between home, casual outings, and occasional office visits. For instance, reports from early 2024 indicated a sustained interest in elevated loungewear and comfortable yet stylish separates. Aritzia's ability to anticipate and respond to these nuanced demands, by offering adaptable fashion solutions, will be crucial for maintaining market relevance.

- Increased demand for versatile apparel: Consumers are seeking garments that can be styled for both professional and casual settings.

- Focus on comfort and style: The blend of comfort suitable for home and fashion-forward aesthetics is a key driver in purchasing decisions.

- Adaptation of product mix: Aritzia's success hinges on its capacity to curate a collection that reflects the new normal of work and social life.

- Consumer behavior analysis: Continuous monitoring of trends like the sustained popularity of elevated loungewear is vital for strategic planning.

Aritzia's success is deeply intertwined with its ability to resonate with the values and preferences of its core demographic, primarily Gen Z and Millennials. These groups, wielding significant purchasing power, increasingly favor brands that demonstrate authenticity, social responsibility, and offer engaging shopping experiences. Aritzia's reported net revenue growth of 17.7% in Q1 2024 partly reflects its strong connection with these key segments.

The rise of social media platforms like Instagram and TikTok continues to be a dominant force in shaping fashion trends and influencing purchasing decisions for Aritzia's target audience. Brands are heavily leveraging influencer marketing, with a substantial portion of Gen Z and Millennial consumers indicating that social media content directly impacts their apparel choices in 2024. Maintaining an aspirational brand image and fostering community engagement through these digital channels is therefore paramount for Aritzia's continued relevance and sales performance.

Consumers are increasingly prioritizing sustainability and ethical practices, with a significant percentage willing to pay more for environmentally and socially responsible products. This trend necessitates greater transparency from Aritzia regarding its supply chain and product lifecycle. As of 2023, approximately 66% of global consumers expressed a willingness to pay a premium for sustainable goods, underscoring the importance of these considerations for brand loyalty and market positioning.

The evolving work landscape, marked by a rise in hybrid and remote arrangements, directly impacts consumer demand for apparel. Aritzia must strategically adapt its product mix to cater to these changing lifestyles, emphasizing versatile pieces that blend comfort with its signature fashion-forward aesthetic. This requires a keen understanding of how consumers integrate work and leisure, influencing their wardrobe choices and the utility expected from their clothing.

| Sociological Factor | Impact on Aritzia | Supporting Data/Trend (2023-2025) |

|---|---|---|

| Demographic Shifts & Spending Power | Dominance of Gen Z & Millennials in consumer spending | Gen Z and Millennials represent a significant portion of Aritzia's customer base, driving demand for trend-aligned and value-driven products. |

| Social Media Influence | Key driver of fashion trends and purchasing decisions | In 2024, a large percentage of Gen Z and Millennial consumers report social media content directly influencing their clothing purchases. |

| Sustainability & Ethical Consumption | Growing consumer demand for responsible brands | Approximately 66% of global consumers were willing to pay more for sustainable products in 2023. |

| Work-Life Integration | Increased demand for versatile and comfortable apparel | Early 2024 reports show sustained interest in elevated loungewear and adaptable separates suitable for hybrid work models. |

Technological factors

Aritzia's commitment to its e-commerce platform is a key driver of its direct-to-consumer success. In fiscal 2024, Aritzia reported that its e-commerce channel represented 40% of its total revenue, a significant increase from previous years, highlighting the importance of continuous investment in mobile optimization and AI-powered personalization to enhance customer engagement and boost online sales.

Aritzia's investment in data analytics and AI is a significant technological driver. For instance, in fiscal year 2024, the company reported a 36% increase in total revenue, partly fueled by enhanced customer understanding derived from these technologies. This allows for highly personalized marketing, as seen in their targeted email campaigns which often boast higher engagement rates than generic outreach.

These advanced tools are crucial for optimizing Aritzia's operations. By analyzing purchasing patterns, they can refine inventory management, reducing stockouts and overstock situations. In 2023, Aritzia noted improvements in inventory turnover, a direct benefit of their data-driven approach to forecasting and allocation, ensuring popular items are available when and where customers want them.

Aritzia is significantly enhancing its supply chain through digitization and automation. Technologies like RFID tracking and automated warehousing are key to this strategy, aiming to boost efficiency and transparency. This focus is crucial for managing its vertically integrated model, ensuring better inventory control and faster delivery times.

In-Store Technology and Omnichannel Integration

Aritzia is actively integrating advanced in-store technologies to elevate the customer experience and strengthen its omnichannel strategy. Innovations like smart mirrors and endless aisle capabilities are designed to provide a seamless and personalized shopping journey, directly supporting the brand's focus on curated service. This technological investment aims to bridge the physical and digital realms, ensuring customers can easily access a wider product selection and receive enhanced assistance regardless of their shopping channel.

These technological advancements are crucial for Aritzia's commitment to exceptional customer service and a cohesive brand experience. For instance, the company's ongoing investment in its digital infrastructure and in-store tech is a key component of its strategy to maintain customer loyalty and drive sales growth. Aritzia reported a 10% increase in comparable store sales for the fiscal year ending March 3, 2024, partly attributed to these enhanced in-store experiences.

- Smart Mirrors: Enabling customers to view different sizes, colors, and styling suggestions without leaving the fitting room.

- Endless Aisle: Providing access to the full online inventory from within the physical store, fulfilling out-of-stock items via home delivery or in-store pickup.

- Augmented Reality (AR): Exploring AR try-on features to offer virtual product visualization and reduce fitting room friction.

- Clienteling Tools: Equipping store associates with technology to access customer purchase history and preferences for personalized recommendations.

Cybersecurity and Data Privacy Protection

Aritzia's reliance on its e-commerce platform and loyalty programs means it handles substantial customer data. Therefore, strong cybersecurity is not just important, it's essential for protecting this sensitive information. This includes safeguarding against potential data breaches that could compromise customer trust and Aritzia's reputation.

Compliance with evolving data privacy regulations, such as GDPR and CCPA, is a significant technological factor. Failure to adhere to these rules can result in substantial legal penalties and damage brand image. For instance, in 2023, the global average cost of a data breach reached $4.45 million, highlighting the financial risks involved.

Continuous investment in security infrastructure is vital for Aritzia. This involves staying ahead of sophisticated cyber threats and ensuring data integrity. Companies in the retail sector are increasingly allocating budgets to cybersecurity, with global spending projected to reach over $200 billion by 2024, demonstrating the industry's focus on this area.

- Customer Data Protection: Aritzia must implement advanced encryption and access controls to secure customer information collected online and through its loyalty programs.

- Regulatory Compliance: Staying abreast of and adhering to global data privacy laws like GDPR and CCPA is critical to avoid significant fines.

- Investment in Security: Ongoing investment in updated security software, employee training, and threat detection systems is necessary to mitigate risks.

- Reputation Management: Proactive cybersecurity measures are key to maintaining customer trust and protecting Aritzia's brand reputation from data-related incidents.

Aritzia's technological strategy heavily emphasizes its e-commerce platform, which accounted for 40% of its revenue in fiscal 2024. This digital focus is supported by significant investments in data analytics and AI, contributing to a 36% revenue increase in fiscal 2024 through personalized marketing. The company is also enhancing its supply chain with digitization and automation, aiming for improved inventory control and faster deliveries.

In-store technology is a key component of Aritzia's omnichannel approach, with innovations like smart mirrors and endless aisle capabilities improving the customer experience. This is reflected in a 10% increase in comparable store sales for fiscal 2024. Cybersecurity is also paramount, given the substantial customer data handled, with global data breach costs averaging $4.45 million in 2023, underscoring the need for robust protection and compliance with privacy regulations.

| Technology Area | Fiscal 2024 Impact/Focus | Key Initiatives |

| E-commerce Platform | 40% of total revenue | Mobile optimization, AI personalization |

| Data Analytics & AI | 36% revenue increase | Personalized marketing, customer insights |

| Supply Chain Digitization | Efficiency and transparency | RFID tracking, automated warehousing |

| In-Store Technology | 10% comparable store sales increase | Smart mirrors, endless aisle, AR try-on |

| Cybersecurity | Customer data protection | Encryption, access controls, regulatory compliance |

Legal factors

Aritzia must navigate a complex web of data privacy laws, including Canada's Personal Information Protection and Electronic Documents Act (PIPEDA) and US state regulations like the California Consumer Privacy Act (CCPA). These laws dictate how Aritzia handles customer information, affecting everything from online sales to its popular loyalty program.

Staying compliant is paramount, as violations can result in substantial financial penalties and harm Aritzia's brand image. For instance, in 2023, companies faced increasing scrutiny and potential fines under these evolving frameworks, underscoring the need for robust data protection practices.

Aritzia's reliance on exclusive, in-house designed brands necessitates robust intellectual property (IP) protection. This includes safeguarding designs, trademarks, and copyrights against infringement. Legal frameworks are vital for preventing counterfeiting and unauthorized replication, thereby protecting Aritzia's unique product offerings and brand equity in the highly competitive fashion industry.

Aritzia navigates a patchwork of labor and employment laws in Canada and the United States, dictating everything from minimum wage and overtime to workplace safety and anti-discrimination policies. For instance, in 2024, the federal minimum wage in the US remained at $7.25 per hour, while many states and cities have established significantly higher rates, impacting Aritzia's hourly workforce costs. Compliance ensures fair treatment of employees, mitigating risks of costly lawsuits and reputational damage.

The company's commitment to adhering to these legal frameworks is crucial for fostering a stable and productive workforce. This includes managing unionization efforts, as seen in various retail sectors where employee advocacy for collective bargaining has increased. Staying abreast of evolving legislation, such as potential changes to overtime eligibility or paid leave mandates in 2025, is paramount for operational continuity and employee morale across Aritzia's diverse retail and corporate settings.

Advertising and Marketing Regulations

Aritzia must navigate a complex web of advertising and marketing regulations to ensure its promotional activities are truthful and transparent. This includes adhering to consumer protection laws that govern advertising claims, endorsements, and digital marketing practices. For instance, in 2024, regulators continued to scrutinize influencer marketing, emphasizing clear disclosure of paid partnerships to avoid misleading consumers.

Failure to comply can result in significant penalties and damage to brand credibility. Aritzia's marketing strategies, especially those involving social media and influencer collaborations, must therefore prioritize clear and conspicuous disclosures. This ensures that consumers are fully aware of any sponsored content, maintaining trust and avoiding potential legal repercussions.

Key considerations for Aritzia include:

- Truthfulness in Advertising: Ensuring all claims made in marketing materials are substantiated and not misleading.

- Endorsement Guidelines: Complying with regulations around influencer and celebrity endorsements, including proper disclosure of material connections.

- Digital Marketing Compliance: Adhering to rules governing online advertising, data privacy, and email marketing practices.

- Consumer Protection: Upholding consumer rights by providing clear information and avoiding deceptive practices across all marketing channels.

Product Safety and Labeling Standards

Aritzia must comply with stringent product safety and labeling regulations in its key markets, Canada and the United States. These rules dictate requirements for apparel, including accurate material composition disclosures, clear care instructions, and adherence to flammability standards. For instance, the U.S. Federal Trade Commission's Textile Fiber Products Identification Act mandates specific labeling for all clothing sold in the U.S.

Ensuring compliance is critical for Aritzia to maintain consumer trust and avoid costly product recalls or import/export disruptions. In 2023, recalls for apparel due to safety concerns or mislabeling remained a significant issue across the retail sector, highlighting the importance of rigorous quality assurance processes. Aritzia's commitment to these standards directly supports its brand image as a provider of high-quality, reliable fashion.

- Mandatory Labeling: Compliance with the Textile Fiber Products Identification Act (USA) and the Consumer Chemicals and Containers Regulations (Canada) for fiber content and origin.

- Safety Standards: Adherence to flammability standards, such as those set by the Consumer Product Safety Commission (CPSC) in the U.S., for specific garment types.

- Recall Prevention: Robust quality control measures to prevent product recalls, which can damage brand reputation and incur significant financial losses.

- International Trade: Meeting the varying labeling and safety requirements of both Canada and the U.S. to facilitate seamless cross-border sales and inventory management.

Aritzia's operations are heavily influenced by evolving data privacy laws, such as Canada's PIPEDA and US state regulations like the CCPA. Compliance is critical to avoid substantial fines and protect its brand reputation, especially as scrutiny of data handling practices intensified in 2023.

Protecting its intellectual property is a legal necessity for Aritzia, given its focus on exclusive, in-house designed brands. Safeguarding designs and trademarks against infringement is vital to prevent counterfeiting and maintain brand equity in a competitive market.

Navigating labor laws across Canada and the US is paramount, covering minimum wage, workplace safety, and anti-discrimination. For instance, the disparity in minimum wages, with the US federal rate at $7.25 in 2024 and many states having higher rates, directly impacts Aritzia's labor costs.

Adherence to advertising and marketing regulations ensures truthful promotions and consumer protection. In 2024, influencer marketing disclosures faced increased regulatory attention, emphasizing the need for transparency in sponsored content to maintain consumer trust.

Environmental factors

Governments worldwide are tightening environmental regulations, impacting fashion retailers like Aritzia. For instance, the European Union's proposed regulations on textile waste and extended producer responsibility aim to curb landfill waste and promote circularity. These shifts necessitate significant adjustments in supply chain management and material sourcing for brands to ensure compliance and avoid penalties.

Aritzia, like many global apparel companies, faces increasing pressure to adopt more sustainable practices, including reducing carbon emissions and improving waste management. Mandatory sustainability reporting, which is becoming more common, will require detailed disclosures on environmental performance. In 2023, the fashion industry was estimated to be responsible for 4-10% of global carbon emissions, highlighting the urgency for companies like Aritzia to implement greener strategies and transparent reporting to meet evolving stakeholder expectations.

Consumers increasingly favor eco-friendly and ethically sourced fashion, directly influencing Aritzia's product design and marketing. For instance, a 2024 report indicated that 60% of Gen Z consumers consider sustainability a key factor in their apparel purchases.

Aritzia's ability to integrate sustainable materials, ensure responsible production, and maintain supply chain transparency can significantly boost its brand image and attract environmentally conscious shoppers. This alignment with consumer values is crucial for market penetration and loyalty.

Aritzia's global supply chain, from sourcing cotton to shipping finished garments, carries a significant environmental footprint. This includes water consumption, chemical use in dyeing, and emissions from manufacturing and transport. For instance, the fashion industry globally accounts for an estimated 10% of global carbon emissions, a figure Aritzia, like other apparel companies, must address.

To manage these impacts, Aritzia focuses on strategic supplier partnerships and investing in more sustainable production. This involves working with suppliers to reduce water usage and chemical waste, and exploring more eco-friendly materials. By 2023, Aritzia reported progress in reducing its Scope 1 and 2 greenhouse gas emissions, though specific supply chain (Scope 3) data is still being developed.

Waste Management and Circular Economy Initiatives

The fashion industry faces significant environmental pressure regarding textile waste, from manufacturing scraps to discarded clothing. Aritzia's proactive engagement in waste reduction, including enhanced recycling programs and the exploration of circular economy principles like resale and repair, directly addresses this challenge. Such initiatives are crucial for improving the company's environmental footprint and meeting growing consumer and regulatory demands for sustainability.

By focusing on reducing packaging waste and investing in circular models, Aritzia can enhance its brand reputation and potentially unlock new revenue streams. For instance, the global second-hand apparel market was valued at approximately $100 billion in 2023 and is projected to grow significantly, indicating a strong consumer appetite for sustainable fashion options.

- Textile Waste Challenge: The fashion industry generates vast amounts of textile waste, with estimates suggesting that over 90% of discarded clothing ends up in landfills or incinerated globally.

- Circular Economy Potential: Aritzia's adoption of resale, repair, and upcycling models can mitigate waste and align with a growing market for pre-owned fashion, which is expected to double in the next five years.

- Packaging Reduction: Efforts to minimize packaging waste, such as using recycled materials or reducing overall packaging volume, contribute to operational efficiency and environmental responsibility.

- Consumer Demand: A significant portion of consumers, particularly Gen Z and Millennials, express a preference for brands demonstrating strong environmental and ethical commitments, influencing purchasing decisions.

Climate Change Impacts on Operations

Climate change presents tangible threats to Aritzia's operational continuity. Extreme weather events, a growing concern in 2024 and projected to intensify, can severely disrupt the company's intricate supply chain. This disruption can manifest as shortages of crucial raw materials, delays in manufacturing processes, and increased logistical challenges, impacting product availability and delivery timelines.

Furthermore, the evolving regulatory landscape surrounding climate change is poised to affect Aritzia's cost structure. As governments worldwide implement stricter environmental mandates and carbon pricing mechanisms, such as potential carbon taxes or emissions trading schemes, the company may face increased operational expenses. For instance, in Canada, the federal carbon pricing system is gradually increasing, impacting industries that rely on energy-intensive operations.

- Supply Chain Vulnerability: Extreme weather events in key sourcing regions could impact textile production and transportation.

- Regulatory Cost Increases: Potential carbon pricing or emissions regulations could raise operational expenses for manufacturing and logistics.

- Adaptation Imperative: Investing in resilient supply chain planning and pursuing emissions reduction strategies are critical for mitigating these environmental risks and ensuring long-term operational stability.

Governments are increasingly implementing environmental regulations, such as the EU's proposed rules on textile waste and extended producer responsibility, which directly affect fashion retailers like Aritzia by necessitating adjustments in their supply chains and material sourcing to ensure compliance and avoid penalties.

Aritzia, like other global apparel companies, faces pressure to adopt sustainable practices and reduce its environmental footprint, with mandatory sustainability reporting becoming more prevalent. The fashion industry's estimated 4-10% contribution to global carbon emissions in 2023 underscores the need for greener strategies and transparent reporting.

Consumer preference for eco-friendly fashion is a significant driver, with a 2024 report indicating that 60% of Gen Z consumers consider sustainability in their apparel purchases, making Aritzia's integration of sustainable materials and transparent production crucial for brand image and market appeal.

The fashion industry's substantial environmental impact, including textile waste, is being addressed by Aritzia through waste reduction initiatives like enhanced recycling programs and the exploration of circular economy principles, such as resale and repair, which are vital for improving the company's environmental footprint and meeting growing demands.

PESTLE Analysis Data Sources

Our Aritzia PESTLE analysis is built on a robust foundation of data from reputable sources including fashion industry market research firms, government economic reports, and global sustainability initiatives. We ensure every insight into political, economic, social, technological, legal, and environmental factors is grounded in current, verifiable information.