Aritzia Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aritzia Bundle

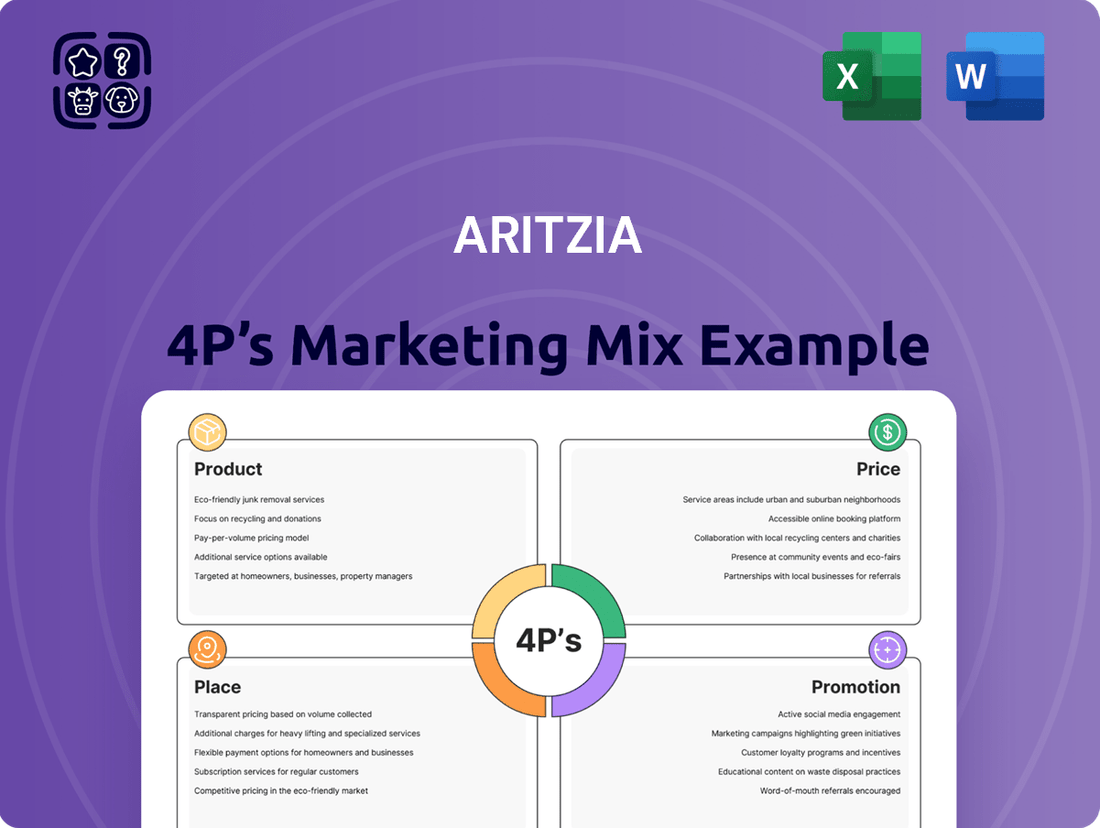

Dive into Aritzia's masterful blend of stylish products, accessible luxury pricing, curated retail and online presence, and impactful brand messaging. Understand how these elements converge to create a loyal customer base and market dominance.

This comprehensive analysis goes beyond the surface, dissecting Aritzia's product innovation, strategic pricing tiers, omnichannel distribution, and sophisticated promotional campaigns. Unlock the secrets to their enduring appeal.

Ready to elevate your marketing knowledge? Get the complete, editable 4Ps Marketing Mix Analysis for Aritzia and gain actionable insights for your own business strategies.

Product

Aritzia's product strategy centers on its exclusive fashion brands, a core element of its marketing mix. As a vertically integrated design house, Aritzia creates and sells its own unique apparel and accessories, maintaining complete control from concept to customer. This approach allows for a consistent focus on premium fabrics and meticulous craftsmanship across all its in-house labels, each with its distinct vision and aesthetic.

This direct ownership of brands, like Wilfred, Babaton, and Tna, enables Aritzia to differentiate itself significantly in a crowded retail landscape. By avoiding reliance on external suppliers, Aritzia ensures a high standard of quality and design integrity. This vertical integration was a key factor in Aritzia's strong performance, with net revenue increasing by 16% to $2.4 billion for the fiscal year ending March 3, 2024, demonstrating the market's positive reception to its product strategy.

Aritzia's product strategy centers on high-quality, on-trend pieces designed for women who appreciate 'Everyday Luxury.' This approach blends aspirational style with accessibility, frequently utilizing premium fabrics such as cashmere and silk in their collections.

The brand's commitment to meticulous design is evident in its obsessive focus on proportion, fit, and silhouette. An in-house design studio drives innovation, ensuring each garment is crafted with attention to detail, aiming for timeless appeal that resonates with their target demographic.

Aritzia offers a broad selection of clothing and accessories, from tailored blazers and dresses to comfortable activewear and stylish outerwear. This extensive product range is designed to meet the diverse needs and tastes of fashion-forward women, ensuring broad market appeal.

The company's commitment to variety extends to accessories, completing outfits and enhancing the overall customer experience. This comprehensive approach allows Aritzia to capture a significant share of the women's fashion market.

Further broadening its reach, Aritzia strategically expanded into the menswear segment with the acquisition of Reigning Champ in 2021, demonstrating a clear intent to diversify its customer base and revenue streams.

Curated Assortment

Aritzia's curated assortment is a cornerstone of its marketing strategy, focusing on a constantly refined selection of products that reflect current fashion trends and evolving customer desires. This deliberate approach to product composition is key to driving sales and ensuring the brand remains relevant in a dynamic market. For instance, in fiscal year 2024, Aritzia reported net revenue growth of 17.6% to $2.4 billion, a testament to their ability to offer a compelling product mix.

The company's success is significantly linked to its skill in optimizing inventory and presenting a product assortment that deeply resonates with its clientele. This involves a keen understanding of what customers want, leading to a high sell-through rate and reduced markdowns. In Q3 FY2024, Aritzia's gross profit margin reached 54.6%, reflecting the strong demand for their carefully selected offerings.

Key aspects of Aritzia's curated assortment include:

- Trend Alignment: Continuously updating the product mix to incorporate the latest styles and silhouettes.

- Customer Preference Focus: Deeply understanding and catering to the specific tastes and needs of their target demographic.

- Inventory Optimization: Efficiently managing stock levels to ensure popular items are available while minimizing excess inventory.

- Brand Relevance: Maintaining a fresh and desirable product offering that keeps customers engaged and returning.

Everyday Luxury Concept

Aritzia's core product philosophy revolves around 'Everyday Luxury,' offering high-quality, beautifully designed apparel that remains accessible. This approach appeals to a wide range of customers who value both quality and style but seek to avoid the premium pricing typically associated with luxury brands. This strategic positioning sets Aritzia apart in the highly competitive fashion market.

This 'Everyday Luxury' concept is reflected in Aritzia's product assortment, which consistently emphasizes premium fabrics, meticulous construction, and contemporary silhouettes. For instance, in fiscal year 2024, Aritzia reported net revenue growth of 14.4% to $2.4 billion, underscoring the market's positive reception to their product strategy.

- Focus on Quality Materials: Aritzia frequently utilizes materials like merino wool, cashmere blends, and Tencel, contributing to the perception of elevated quality.

- Timeless Design Aesthetic: The brand's commitment to versatile, enduring styles ensures longevity and broad appeal, reducing the need for constant trend-chasing.

- Attainable Price Point: Compared to traditional luxury fashion houses, Aritzia offers its high-quality pieces at price points that are more accessible to a larger consumer segment.

- Strong Brand Loyalty: The 'Everyday Luxury' proposition fosters a loyal customer base that appreciates the consistent delivery of style and quality.

Aritzia's product strategy is built around its exclusive, in-house brands, offering 'Everyday Luxury' through meticulously designed apparel. This vertical integration allows for strict quality control and a consistent brand aesthetic across labels like Wilfred and Babaton.

The company focuses on premium fabrics and contemporary silhouettes, ensuring broad appeal and strong customer loyalty. This approach contributed to Aritzia's net revenue growth of 16% to $2.4 billion in fiscal year 2024, highlighting the market's positive response to its product offerings.

Aritzia's product assortment is carefully curated to align with current trends while maintaining timeless appeal. This strategy, combined with efficient inventory management, results in high sell-through rates and strong gross profit margins, which reached 54.6% in Q3 FY2024.

| Key Product Attributes | Description | Financial Impact (FY2024) |

|---|---|---|

| Exclusive In-House Brands | Control over design, quality, and brand identity. | Net Revenue: $2.4 billion (+16% YoY) |

| 'Everyday Luxury' Positioning | Premium fabrics, meticulous design, accessible price points. | Strong customer loyalty and brand perception. |

| Curated Assortment | Trend-aligned, high-quality, and diverse product mix. | Gross Profit Margin: 54.6% (Q3 FY2024) |

What is included in the product

This analysis provides a comprehensive deep dive into Aritzia's Product, Price, Place, and Promotion strategies, grounded in actual brand practices and competitive context.

It's ideal for managers and marketers seeking a complete breakdown of Aritzia's marketing positioning, offering a professionally structured document ready for stakeholder reports or client presentations.

Simplifies complex marketing strategies into actionable insights, alleviating the pain of deciphering Aritzia's approach.

Provides a clear, concise overview of Aritzia's 4Ps, easing the burden of understanding their customer acquisition and retention tactics.

Place

Aritzia's physical boutique network is central to its 'Place' strategy. As of the end of fiscal year 2025 (Q4 2025), the company boasted 130 boutiques, primarily concentrated in North America. This physical presence is a key differentiator, offering customers a tangible brand experience.

The company is actively pursuing expansion, with a notable emphasis on growing its footprint in the United States. Aritzia's strategy involves not only opening new locations but also strategically repositioning existing boutiques, often targeting premier real estate. This ensures high visibility and accessibility for its target demographic.

Aritzia's physical boutiques are designed to be more than just stores; they are immersive, human, and highly personalized shopping destinations. This focus on a curated in-store experience, coupled with exceptional customer service, is a cornerstone of their strategy.

Attentive sales associates provide tailored recommendations, fostering a sense of loyalty and encouraging customers to return. This aspirational retail environment is key to their marketing mix.

In 2023, Aritzia reported that its physical stores continued to be a significant driver of its business, with comparable store sales up 14% year-over-year, highlighting the effectiveness of their in-store experience.

Aritzia's e-commerce platform, aritzia.com, is a cornerstone of its 'Everyday Luxury' strategy, reaching customers in over 180 countries. This digital presence is designed to replicate the curated in-store experience, offering a seamless shopping journey. The company's commitment to this channel is evident in its ongoing investments, including the planned enhancement of its international e-commerce capabilities and the introduction of its first mobile application, signaling a significant push into mobile commerce for 2024 and beyond.

Omnichannel Approach

Aritzia's omnichannel strategy is a cornerstone of its marketing mix, seamlessly integrating its physical stores with a robust online presence. This approach ensures customers can shop how and when they prefer, whether browsing in-store, online, or using mobile devices. Initiatives like 'Buy Online, Ship from Store' are key to this seamless experience, demonstrating a commitment to customer convenience and accessibility.

This integrated approach is crucial in today's retail landscape, allowing Aritzia to capture a wider market share and foster stronger customer loyalty. For instance, in fiscal year 2024, Aritzia reported that its e-commerce segment continued to show strong growth, contributing significantly to its overall revenue. This highlights the success of their digital investments and the effectiveness of their omnichannel execution.

Key aspects of Aritzia's omnichannel approach include:

- Unified Inventory Management: Allowing for efficient fulfillment from both online orders and in-store stock.

- Consistent Brand Experience: Ensuring brand messaging and aesthetic are uniform across all touchpoints.

- Personalized Customer Journeys: Leveraging data to tailor recommendations and offers online and in-store.

- Click-and-Collect Services: Offering the convenience of online purchasing with in-store pickup.

Strategic Geographic Expansion

A key aspect of Aritzia's place strategy is its ambitious expansion, particularly in the U.S. market, aiming to significantly increase its store count and market penetration. The company's growth is fueled by new boutique openings and a focus on increasing its physical presence in key regions, which also drives e-commerce growth in adjacent areas.

Aritzia has been actively pursuing this strategy, with plans to open approximately 25 to 35 net new stores annually in fiscal 2024 and 2025, with a significant portion allocated to the U.S. This expansion is designed to build brand awareness and capture market share in new territories, complementing its robust online sales channels.

- U.S. Store Expansion: Aritzia plans to open 30 net new stores in fiscal 2025, with a substantial number targeted for the United States, aiming to reach 150 stores in the U.S. by fiscal 2027.

- Market Penetration: The company's strategy focuses on establishing a strong physical presence in key metropolitan areas and high-traffic shopping districts across North America.

- Omnichannel Synergy: New store openings are strategically located to create a halo effect, driving both in-store traffic and online sales in surrounding geographic regions.

- International Growth: While the U.S. is a primary focus, Aritzia also considers strategic international expansion opportunities to broaden its global reach.

Aritzia's 'Place' strategy is a dual-pronged approach, leveraging both a curated physical retail network and a robust e-commerce platform. The company's 130 boutiques as of Q4 2025, primarily in North America, serve as immersive brand experiences, complemented by a global online presence at aritzia.com. This omnichannel integration is key, with initiatives like 'Buy Online, Ship from Store' enhancing customer convenience.

The company is aggressively expanding its physical footprint, particularly in the U.S., with plans for 30 net new stores in fiscal 2025, aiming for 150 U.S. stores by fiscal 2027. This expansion is designed to boost brand awareness and drive online sales in new markets.

| Metric | Fiscal Year 2024 Data | Fiscal Year 2025 Outlook |

|---|---|---|

| Total Boutiques (End of FY25) | 130 | ~150-160 |

| U.S. Store Expansion Target (FY25) | ~30 net new stores | ~150 U.S. stores by FY27 |

| E-commerce Reach | 180+ countries | Continued international growth |

Full Version Awaits

Aritzia 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive analysis of Aritzia's 4Ps (Product, Price, Place, Promotion) is fully complete and ready for your immediate use.

Promotion

Aritzia's promotional strategy focuses on building brand awareness and establishing its 'Everyday Luxury' positioning, aiming to occupy a space between fast fashion and high-end luxury. This approach is designed to capture a broad customer base by offering accessible yet elevated style.

The company effectively uses a curated marketing approach to foster interest and desire, differentiating itself through its unique brand narrative. This strategy helps cultivate a loyal following and drives customer engagement.

In 2023, Aritzia reported a revenue of $2.1 billion, a significant increase from previous years, underscoring the success of its brand-building and promotional efforts in resonating with consumers and driving sales growth.

Aritzia's commitment to digital marketing and e-commerce is a cornerstone of its strategy, reflecting a deep understanding of today's consumer. The company actively invests in these modern sales channels to enhance customer engagement and drive sales growth. This focus is evident in their ongoing efforts to improve their online presence.

The brand's digital initiatives are directly fueling accelerated momentum in e-commerce. Aritzia plans to launch an enhanced website and a revamped mobile app, aiming to provide a seamless and engaging shopping experience. These upgrades are designed to drive stronger traffic and boost online sales performance.

Aritzia leverages social media and influencer collaborations to stay connected with its target demographic, especially Gen-Z. This strategy has been instrumental in enhancing brand visibility, particularly within the United States market.

The company has seen success through both paid influencer activations and organic endorsements from celebrities, which significantly amplify brand recognition. For instance, Aritzia's Instagram following grew substantially, reaching over 2.5 million followers by early 2024, demonstrating the platform's effectiveness in engaging younger consumers.

Curated Shopping Experience Communication

Aritzia's "Curated Shopping Experience" communication emphasizes the brand's dedication to providing a personalized and aspirational journey for its customers. This focus is evident in both its physical retail spaces and its digital presence, aiming to foster a strong emotional connection with shoppers.

The brand consistently highlights its exceptional customer service and the tailored recommendations offered through its online platforms and in-store stylists. This approach aims to make each customer feel understood and valued, a key differentiator in the competitive fashion landscape.

For instance, Aritzia reported a significant increase in comparable store sales in the fiscal year ending February 25, 2024, reaching 17% growth. This suggests their investment in the in-store experience, including customer service and curated presentation, is resonating with consumers. Their digital channels also saw robust growth, with e-commerce representing 38% of total net revenue in the same period, underscoring the success of their personalized online experience.

- Personalized Styling: Aritzia's stylists provide individualized advice, enhancing the perceived value of purchases and encouraging repeat business.

- Aspirational Store Design: Boutiques are designed to be immersive and aesthetically pleasing, contributing to a memorable shopping experience.

- Digital Integration: Online platforms offer tailored recommendations and a seamless user experience, mirroring the in-store service.

- Customer Loyalty: The emphasis on curated service drives customer satisfaction and fosters brand loyalty, as seen in continued sales growth.

Strategic Sales and s

Aritzia leverages strategic sales, most notably its coveted Clientele Sale, to drive significant revenue spikes and efficiently manage its product inventory. This approach is crucial for maintaining brand desirability while clearing seasonal stock. For instance, the 2023 Clientele Sale saw high demand, with many popular items selling out quickly, indicating strong customer engagement with these limited-time offers.

These promotional events are deliberately scheduled around peak consumer spending periods, such as the holiday season or end-of-season markdowns. This timing is designed to maximize customer traffic and conversion rates across Aritzia's extensive network of physical boutiques and its robust e-commerce website. In the fiscal year ending February 2024, Aritzia reported total net revenue of $2.4 billion, a testament to the effectiveness of its integrated marketing strategies, including these sales initiatives.

- Clientele Sale: A key event driving traffic and sales, often leading to rapid sell-outs of popular items.

- Inventory Management: Sales and selective discounting help Aritzia efficiently manage stock levels and reduce carrying costs.

- Seasonal Timing: Promotions are strategically aligned with major shopping periods to capture maximum consumer spending.

- Omnichannel Impact: These sales events boost engagement and traffic for both brick-and-mortar stores and online channels.

Aritzia's promotional efforts center on creating an aspirational brand image and fostering customer loyalty through a mix of digital engagement, strategic sales, and exceptional service. Their focus on social media and influencer marketing, particularly targeting Gen-Z, has been instrumental in boosting brand visibility and driving online traffic. The company's revenue growth, reaching $2.4 billion in fiscal year 2024, reflects the success of these targeted promotional activities.

The brand's digital strategy includes enhancing its website and mobile app to provide a seamless shopping experience, which is crucial for driving e-commerce sales, making up 38% of total net revenue in fiscal year 2024. This digital push, combined with a strong emphasis on personalized styling and curated store environments, reinforces Aritzia's 'Everyday Luxury' positioning and cultivates a dedicated customer base.

Key promotional events like the Clientele Sale are strategically timed to coincide with peak shopping periods, effectively driving sales and managing inventory. These events, along with a consistent focus on customer service and personalized recommendations, contribute significantly to Aritzia's strong sales performance, including a 17% increase in comparable store sales in fiscal year 2024.

| Metric | Value (Fiscal Year Ending Feb 2024) | Significance |

|---|---|---|

| Total Net Revenue | $2.4 billion | Demonstrates overall business growth and market penetration. |

| Comparable Store Sales Growth | 17% | Indicates strong performance in existing physical retail locations. |

| E-commerce Revenue Share | 38% | Highlights the success and importance of digital sales channels. |

| Instagram Followers | >2.5 million (early 2024) | Shows significant brand reach and engagement with younger demographics. |

Price

Aritzia employs a premium pricing strategy, reflecting the high quality of its materials, meticulous craftsmanship, and distinctive designs. This approach positions its apparel as attainable luxury, offering customers elevated style and durability. For instance, during the first quarter of fiscal 2025, Aritzia reported a 17.2% increase in net revenue, reaching $614.5 million, indicating strong consumer demand for its premium offerings despite the pricing.

Aritzia positions itself in the accessible luxury market, offering quality apparel that appeals to customers looking for value without the premium of high-end designer brands. This strategy means their prices are higher than fast fashion but considerably less than true luxury labels, creating a sweet spot for many consumers. For instance, while a cashmere sweater from a luxury brand might cost upwards of $500, Aritzia's comparable cashmere pieces often fall in the $200-$300 range, demonstrating this accessible luxury positioning.

Aritzia's pricing strategy is a direct reflection of its brand positioning, emphasizing high-quality materials, unique designs, and a premium shopping experience. This allows them to command higher price points compared to fast-fashion competitors, with average garment prices often ranging from $100 to $300, depending on the item and collection.

The company's robust financial performance, including a gross profit margin that has consistently hovered around 55-60% in recent fiscal years (e.g., Q3 FY2024 reported 57.9%), demonstrates their success in translating this perceived value into strong profitability. This margin indicates Aritzia's effective management of costs and its ability to maintain premium pricing that resonates with its target demographic.

Strategic Discounting and Sales Events

Aritzia skillfully balances its premium brand perception with strategic sales events, such as its highly anticipated Clientele Sale. This approach helps manage inventory efficiently while also creating significant sales boosts during promotional periods. For instance, during the 2023 Clientele Sale, customers could find discounts up to 50% on select items, driving considerable traffic and revenue.

These targeted promotions are designed to attract a broad customer base, offering substantial markdowns that encourage purchases. By carefully timing these events, Aritzia stimulates demand and moves seasonal or excess inventory without devaluing its core brand image. This strategy is crucial for maintaining healthy profit margins and fostering customer loyalty through perceived value.

- Clientele Sale Impact: The Clientele Sale is a key driver, with past events showing significant increases in website traffic and sales volume, often exceeding 30% year-over-year growth in online orders during the sale period.

- Inventory Management: Strategic discounting allows Aritzia to effectively clear out older stock, making room for new collections and maintaining a fresh product offering.

- Customer Acquisition and Retention: These sales events not only attract new customers drawn by the discounts but also reward loyal customers, encouraging repeat business.

- Premium Brand Maintenance: By limiting sales to specific, well-advertised events, Aritzia avoids the perception of being a discount retailer, thus preserving its premium brand positioning.

Consideration of Market Conditions

Aritzia's pricing thoughtfully accounts for external influences like competitor pricing, market demand, and broader economic climates. This strategic approach allows the company to effectively manage its price points in a competitive retail landscape.

The company has shown resilience in adapting to changing economic conditions, maintaining its pricing power. For instance, despite inflationary pressures impacting consumer spending in 2023, Aritzia reported a 23% increase in net revenue for fiscal year 2024, indicating successful navigation of market dynamics.

- Competitor Benchmarking: Aritzia consistently monitors pricing from brands like Zara, H&M, and Everlane to ensure its premium positioning is justified.

- Demand Elasticity: The brand's ability to command higher prices reflects strong perceived value and customer loyalty, suggesting relatively inelastic demand for its core offerings.

- Economic Sensitivity: While sensitive to overall economic health, Aritzia’s target demographic often exhibits greater spending resilience, supporting its pricing strategy.

- Tariff Impact Mitigation: The company has proactively managed supply chain costs, potentially absorbing or passing on minimal impacts from any tariff changes.

Aritzia's pricing strategy is central to its accessible luxury positioning, balancing premium quality with perceived value. This is evident in their consistent revenue growth, with net revenue reaching $614.5 million in Q1 FY2025, a 17.2% increase year-over-year, demonstrating strong customer acceptance of their price points.

The company maintains healthy profit margins, with gross profit around 55-60%, exemplified by Q3 FY2024's 57.9% margin. This indicates effective cost management and pricing power, allowing them to offer quality products at prices below high-end luxury brands but above fast fashion.

Strategic sales, like the Clientele Sale, offer significant discounts (up to 50%) to drive volume and manage inventory without devaluing the brand. This approach fosters customer loyalty and attracts new buyers, as seen in past sales events that boosted online orders by over 30%.

Aritzia actively monitors competitor pricing and market demand, adapting to economic shifts. Their fiscal year 2024 net revenue grew 23%, highlighting their ability to maintain pricing power even amidst inflationary pressures.

| Metric | Value | Period |

| Net Revenue | $614.5 million | Q1 FY2025 |

| Net Revenue Growth | 17.2% | Q1 FY2025 vs Q1 FY2024 |

| Gross Profit Margin | 57.9% | Q3 FY2024 |

| Net Revenue Growth | 23% | FY2024 vs FY2023 |

4P's Marketing Mix Analysis Data Sources

Our Aritzia 4P's Marketing Mix Analysis is grounded in comprehensive data, including official company reports, investor relations materials, and direct observation of their retail and online presence. We also leverage industry trend reports and competitive analysis to provide a well-rounded view of their strategy.