Aritzia Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aritzia Bundle

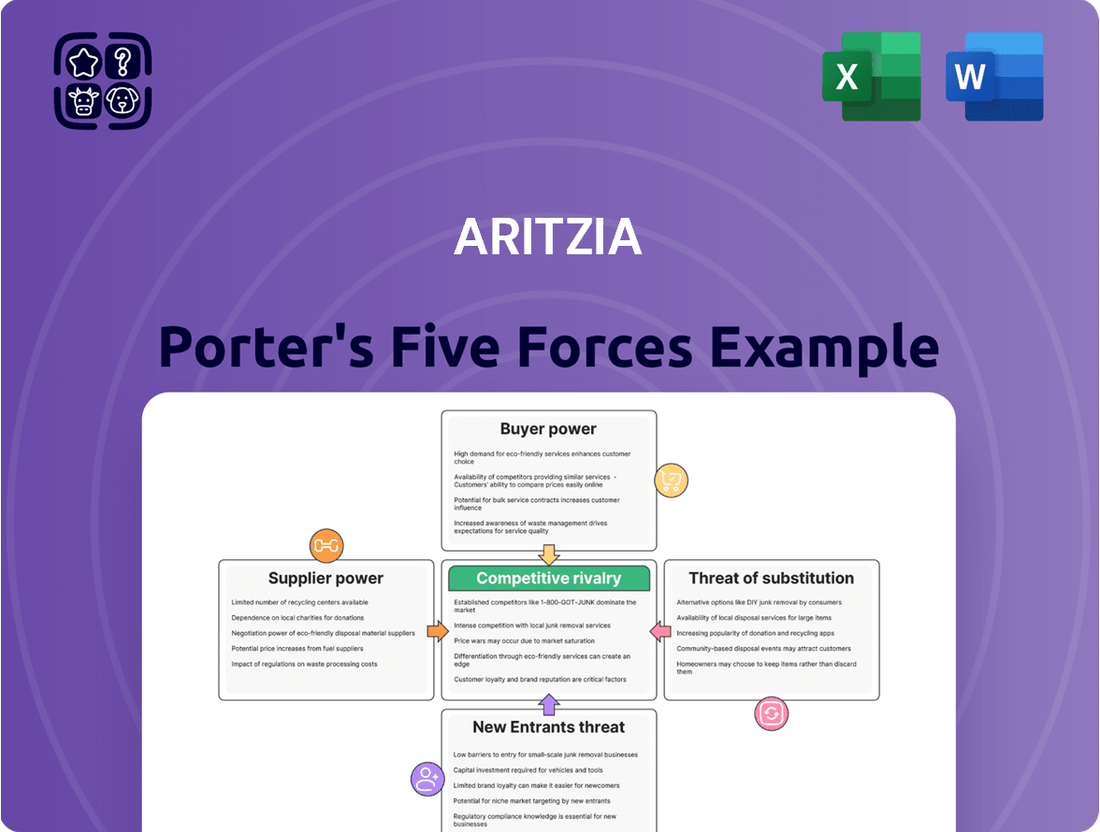

Aritzia navigates a competitive fashion landscape where buyer power is significant due to readily available alternatives and the threat of new entrants is moderate given brand loyalty and capital requirements. Supplier power is relatively low, allowing Aritzia to maintain favorable terms. The intensity of rivalry is high, driven by numerous fashion brands vying for consumer attention.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Aritzia’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Aritzia's vertically integrated model, where it designs and sells its own exclusive fashion brands, significantly strengthens its position against suppliers. This means Aritzia has substantial control over the entire product lifecycle, from initial design to final production, lessening its dependence on outside design firms or contract manufacturers for its core offerings. This control allows Aritzia to set precise product specifications and ensure uniform quality across its collections.

Aritzia's diversified sourcing strategy significantly weakens supplier bargaining power. By actively reducing reliance on any single region, such as its strategic move away from China, the company cultivates alternative sourcing options. This approach directly diminishes the leverage individual suppliers can exert, especially in the face of potential disruptions like tariffs or geopolitical shifts.

Aritzia's commitment to its Supplier Workplace Standards Program (SWS Program) directly mitigates supplier bargaining power. By extending these standards to both Tier 1 and Tier 2 suppliers, Aritzia ensures a broader base of compliance with its ethical code. This proactive management fosters loyalty and reduces the leverage individual suppliers can exert, particularly as Aritzia continues to grow its supplier network.

Strategic Cost Management with Vendors

Aritzia actively manages its supplier relationships through strategic cost-sharing initiatives and a keen focus on improving initial markups (IMUs). This approach allows the company to better absorb or distribute potential cost increases, such as those stemming from tariffs, effectively mitigating the bargaining power of its suppliers.

By negotiating favorable terms and sharing the burden of unforeseen costs, Aritzia strengthens its overall profitability and negotiating leverage within the supply chain. This proactive stance is crucial in maintaining healthy margins in a dynamic retail environment.

- Cost-Sharing Initiatives: Aritzia collaborates with vendors to share the impact of rising costs, fostering a more resilient supply chain.

- Focus on Initial Markups (IMUs): The company prioritizes optimizing IMUs to protect its profit margins against supplier price pressures.

- Tariff Mitigation: Aritzia's strategies help distribute the financial impact of tariffs across its supply chain partners, reducing direct pressure on the company.

- Negotiating Power: These collective measures enhance Aritzia's ability to negotiate favorable terms and resist excessive price demands from suppliers.

Focus on Premium Materials and Quality Control

Aritzia's commitment to premium materials and rigorous quality control significantly mitigates supplier bargaining power. The company meticulously selects fabrics from global mills, ensuring they align with its 'Everyday Luxury' ethos. This focus on superior quality means Aritzia isn't reliant on any single supplier for basic inputs.

Aritzia's deep involvement in product development, from initial design through to manufacturing, further limits supplier leverage. By maintaining detailed oversight and proprietary processes, Aritzia ensures that its specific quality standards and aesthetic requirements are met. This control means suppliers are often adapting to Aritzia's demands rather than dictating terms.

- Global Fabric Sourcing: Aritzia sources materials from various international mills, diversifying its supplier base and reducing dependence on any one source.

- Proprietary Quality Standards: The company enforces stringent, often proprietary, quality control measures throughout the production lifecycle.

- Integrated Product Development: Aritzia's end-to-end control over design and manufacturing allows it to dictate material specifications and quality, weakening supplier negotiation power.

Aritzia's bargaining power with suppliers is notably strong due to its vertically integrated business model and diversified sourcing. The company's control over design and manufacturing, coupled with its global fabric sourcing from various mills, reduces dependence on any single supplier. This strategic approach, including cost-sharing initiatives and a focus on initial markups, allows Aritzia to effectively manage supplier price pressures and maintain favorable terms.

| Factor | Aritzia's Position | Impact on Supplier Bargaining Power |

|---|---|---|

| Vertical Integration | Designs and sells own exclusive brands; controls product lifecycle. | Weakens supplier power by reducing reliance on external design or manufacturing. |

| Diversified Sourcing | Sources from multiple regions, reducing dependence on any single country or supplier. | Diminishes leverage of individual suppliers, especially during disruptions. |

| Supplier Standards Program | Extends ethical and quality standards to Tier 1 and Tier 2 suppliers. | Fosters loyalty and reduces individual supplier leverage by ensuring broader compliance. |

| Cost-Sharing & IMUs | Collaborates on cost impacts and prioritizes initial markups. | Mitigates supplier price increases and protects profit margins. |

| Premium Materials & Quality Control | Selects premium fabrics globally; enforces rigorous, proprietary quality standards. | Reduces reliance on specific suppliers for inputs and allows Aritzia to dictate specifications. |

What is included in the product

Aritzia's Porter's Five Forces analysis dissects the competitive intensity, buyer and supplier power, threat of new entrants, and substitutes impacting its position in the fashion retail market.

Aritzia's Porter's Five Forces analysis provides a clear, one-sheet summary of competitive pressures, perfect for quick strategic decision-making and identifying areas for improvement.

Customers Bargaining Power

Aritzia's success in cultivating strong brand loyalty, particularly through its 'Everyday Luxury' positioning, significantly mitigates the bargaining power of its customers. This strategy appeals to women seeking high-quality, fashionable apparel, making them less sensitive to price fluctuations. For instance, Aritzia's revenue grew by 35% to $2.4 billion in fiscal 2024, demonstrating consistent demand even with premium pricing.

Aritzia's curated omnichannel experience significantly dampens customer bargaining power. By offering a highly personalized and seamless shopping journey across both physical stores and its e-commerce site, the company fosters a strong emotional connection. This focus on exceptional customer service, as highlighted in their internal reports [Company Info, 7, 9, 16, 17], makes customers less sensitive to price competition, reducing their ability to demand lower prices or better terms.

Aritzia's exclusive in-house brands significantly curb customer bargaining power. By offering unique designs not found elsewhere, Aritzia minimizes direct price comparisons, as customers cannot easily find identical items at competing retailers. This exclusivity strengthens Aritzia's value proposition, making customers less likely to demand lower prices for comparable products.

Positive Comparable Sales Growth

Aritzia's robust comparable sales growth, with a notable 26.0% increase in Q4 Fiscal 2025 and 19% in Q1 Fiscal 2026, directly impacts the bargaining power of its customers. This strong performance suggests high customer demand and satisfaction, which generally reduces their individual bargaining power. When a company is performing well and customers are actively seeking its products, they are less likely to be able to negotiate better terms or prices.

The sustained growth indicates that Aritzia's product strategy and customer engagement are highly effective, reinforcing the brand's appeal. This positive momentum means customers are often willing to pay the prevailing prices because the perceived value of Aritzia's offerings is high. Consequently, individual customers have limited leverage to demand lower prices or special concessions.

- Strong Comparable Sales Growth: Aritzia reported 26.0% comparable sales growth in Q4 Fiscal 2025 and 19% in Q1 Fiscal 2026.

- High Customer Demand: This growth signifies robust customer demand, reducing individual customer bargaining power.

- Brand Appeal and Value: Sustained growth reflects effective product strategy and customer engagement, affirming the brand's desirability and limiting price negotiation leverage.

Targeted Marketing and Community Engagement

Aritzia actively cultivates a strong connection with its core customer base, primarily millennials and Gen Z, through targeted digital marketing campaigns and robust community engagement initiatives. This approach fosters brand loyalty and reduces the likelihood of customers seeking alternatives based solely on price. In 2023, Aritzia reported a significant increase in its digital presence, with a substantial portion of its sales originating from online channels, underscoring the effectiveness of this strategy in solidifying customer relationships.

By creating a sense of belonging and offering personalized shopping experiences, Aritzia strengthens customer stickiness. This focus on value beyond the product itself diminishes the bargaining power of individual customers, as they are invested in the brand's ecosystem. For instance, Aritzia's "Everyday Luxury" campaign and its emphasis on inclusive sizing and diverse representation resonate deeply with its target demographic, building a loyal following.

- Digital Marketing Reach: Aritzia's social media engagement and influencer collaborations in 2023 saw a notable uplift in brand awareness and direct customer interaction, contributing to its strong sales performance.

- Community Building: The brand's in-store events and online forums create a loyal community, making customers less price-sensitive and more invested in the Aritzia brand experience.

- Personalized Experiences: Leveraging customer data, Aritzia offers personalized recommendations and exclusive access, increasing customer retention and reducing their inclination to bargain.

- Brand Value Reinforcement: By consistently delivering on its promise of quality and style, Aritzia reinforces its brand value, making price a secondary consideration for its dedicated customer base.

Aritzia's brand loyalty, built on "Everyday Luxury," significantly weakens customer bargaining power. Customers are less sensitive to price changes due to the perceived value and quality. Aritzia's revenue growth to $2.4 billion in fiscal 2024 exemplifies this strong demand, even at premium price points.

The company's curated omnichannel experience, fostering emotional connections through personalized service, further reduces customers' ability to negotiate prices. This focus on an exceptional shopping journey, as detailed in internal reports, makes price a less critical factor for consumers.

Aritzia's exclusive in-house brands are a key factor in limiting customer bargaining power by offering unique products that prevent easy price comparisons with competitors, thereby reinforcing the brand's distinct value proposition.

Aritzia's strong comparable sales growth, reaching 26.0% in Q4 Fiscal 2025 and 19% in Q1 Fiscal 2026, indicates high customer demand and satisfaction. This robust performance inherently diminishes the leverage individual customers have to negotiate better terms or prices.

| Metric | Fiscal Q4 2025 | Fiscal Q1 2026 |

|---|---|---|

| Comparable Sales Growth | 26.0% | 19.0% |

| Customer Demand Indication | High | High |

| Customer Bargaining Power Impact | Reduced | Reduced |

Preview Before You Purchase

Aritzia Porter's Five Forces Analysis

This preview showcases the complete Aritzia Porter's Five Forces Analysis, offering a detailed examination of the competitive landscape within the fashion retail industry. The document you see here is the exact, professionally formatted analysis you will receive instantly upon purchase, ensuring full transparency and immediate usability. You're looking at the actual document; once you complete your purchase, you’ll get instant access to this exact file, ready to inform your strategic decisions.

Rivalry Among Competitors

Aritzia operates within the premium contemporary women's fashion market, a space that distinguishes it from both the rapid turnover of fast fashion and the exclusivity of high luxury. This positioning allows it to attract customers seeking a balance of quality, style, and a certain aspirational feel without the stratospheric price points of haute couture.

While the apparel retail landscape is crowded, Aritzia's focus on what it terms 'Everyday Luxury' is a key differentiator. This strategy aims to create a loyal customer base that appreciates enduring style and well-made garments, fostering repeat purchases and brand loyalty in a competitive environment.

Aritzia's extensive retail footprint, with 130 boutiques across North America by the end of Fiscal 2025, directly fuels competitive rivalry. This significant physical presence, particularly its ongoing U.S. expansion, places it in direct competition for market share within crucial urban centers.

This robust brick-and-mortar network, when combined with a strong e-commerce platform, intensifies the competitive landscape. It means Aritzia is vying for customer attention and dollars against both traditional brick-and-mortar retailers and increasingly sophisticated online-only brands.

Aritzia’s competitive rivalry is significantly shaped by its differentiated brand and product strategy. By focusing on exclusive in-house brands, superior fabrics, and meticulous construction, the company creates offerings that are difficult for competitors to directly replicate. This emphasis on unique design and quality fosters a distinct brand identity, setting Aritzia apart in a crowded retail landscape.

Strong Financial Performance and Growth

Aritzia's robust financial performance directly fuels its ability to contend with competitors. For Fiscal 2025, the company reported net revenue growth of 17.4%, with a particularly strong showing in Q4 Fiscal 2025, up 38%. This impressive growth, largely attributed to robust U.S. sales and a thriving e-commerce channel, provides the capital necessary for sustained investment in strategic initiatives.

This financial prowess allows Aritzia to outspend and out-innovate rivals, securing market share. The company's ability to reinvest in expansion, enhance its marketing efforts, and drive product innovation creates a significant competitive advantage.

- 17.4% Net revenue growth for Fiscal 2025.

- 38% Increase in Q4 Fiscal 2025 net revenue.

- U.S. Sales & E-commerce Key drivers of growth.

- Investment Capacity Funding expansion, marketing, and innovation.

Customer-Centric Omnichannel Approach

Aritzia's dedication to a seamless omnichannel experience, blending personalized in-store interactions with a robust digital platform, serves as a significant competitive advantage. This integrated customer engagement strategy helps Aritzia capture and maintain shopper loyalty in a highly competitive fashion landscape. For instance, in fiscal 2024, Aritzia reported a 17.5% increase in total revenue, reaching $2.41 billion, a testament to the effectiveness of their customer-centric approach in driving growth.

This cohesive strategy differentiates Aritzia from competitors who may offer a less integrated experience. By prioritizing a unified brand journey, Aritzia cultivates stronger customer relationships, which can translate into higher lifetime value and reduced churn. Their focus on personalized service, both online and offline, fosters a sense of community and exclusivity, further solidifying their market position against rivals with less developed omnichannel capabilities.

- Omnichannel Integration: Aritzia seamlessly connects its physical stores and e-commerce platform.

- Personalized Service: The company emphasizes tailored customer experiences across all touchpoints.

- Customer Retention: This integrated approach aims to attract and retain shoppers in a crowded market.

- Revenue Growth: Aritzia's fiscal 2024 revenue of $2.41 billion reflects the success of its strategy.

Aritzia faces intense competition from a wide array of fashion retailers, ranging from fast fashion brands to established contemporary labels. Its strategy of offering exclusive in-house brands and focusing on quality materials and design creates a distinct offering that competitors find challenging to directly replicate. This differentiation is crucial for maintaining market share in a saturated environment.

The company's significant retail presence, with 130 boutiques across North America by the end of Fiscal 2025, directly places it in competition with numerous other brands vying for consumer attention in key urban markets. This physical footprint, coupled with a strong e-commerce platform, intensifies rivalry by ensuring Aritzia is constantly competing for customer dollars against both online and offline players.

Aritzia's robust financial performance, including 17.4% net revenue growth in Fiscal 2025, empowers it to invest heavily in marketing, store expansion, and product innovation, allowing it to outmaneuver rivals. This financial strength enables the company to maintain its competitive edge by continuously enhancing its offerings and customer experience.

| Competitor Type | Key Competitive Factors | Aritzia's Response |

|---|---|---|

| Fast Fashion | Price, Trend Speed | Focus on Quality, Durability, Timeless Style |

| Contemporary Brands | Brand Reputation, Design, Quality | Exclusive In-House Brands, Premium Materials, Omnichannel Experience |

| Online Retailers | Convenience, Price, Selection | Seamless E-commerce, Personalized Service, Strong Brand Identity |

SSubstitutes Threaten

Aritzia's distinctive 'Everyday Luxury' brand identity, characterized by quality, fit, and enduring style, fosters significant customer loyalty. This strong preference makes it difficult for consumers to substitute Aritzia's offerings with generic apparel brands, as the unique aesthetic and perceived value are key differentiators.

Aritzia's exclusive in-house product portfolio acts as a significant barrier against the threat of substitutes. Because Aritzia designs, manufactures, and sells its own proprietary brands, consumers cannot find identical items from competing retailers. This strategy, detailed in their company information [11, 16], means that if a customer wants a specific Aritzia item, they must purchase it directly from Aritzia, thereby mitigating the risk of customers opting for similar products elsewhere.

Aritzia's commitment to a meticulously curated shopping journey, whether browsing their sleek website or stepping into their stylish boutiques, creates a distinct advantage. This dedication to an elevated customer experience, encompassing personalized service and aspirational store aesthetics, transcends the mere transaction of purchasing apparel. It's this holistic approach that poses a significant barrier to simple product-based substitutes, as they often lack the immersive and engaging environment Aritzia cultivates.

Investment in Quality and Durability

Aritzia's dedication to superior quality and enduring construction directly counters the threat of substitutes. By using premium materials and focusing on meticulous craftsmanship, their apparel outlasts many fast-fashion items, lessening the consumer's urge to frequently replace clothing due to wear and tear. This emphasis on longevity acts as a subtle barrier against cheaper, less durable alternatives.

This strategy is reflected in their financial performance. For the fiscal year ending March 3, 2024, Aritzia reported net revenue of $2.4 billion, showcasing strong customer loyalty and demand for their higher-quality offerings. Their commitment to durability means customers invest in pieces that last, reducing the appeal of disposable fashion.

The threat of substitutes is further softened by Aritzia's brand perception, which is built on style and substance. Consumers are willing to pay a premium for garments that offer both aesthetic appeal and a longer lifespan. This positioning makes it harder for lower-priced, lower-quality brands to attract Aritzia's core customer base.

- Durable Garments: Aritzia’s focus on high-quality materials and construction leads to longer-lasting apparel.

- Reduced Replacement Need: This durability discourages frequent purchases of cheaper, lower-quality substitutes.

- Brand Loyalty: Consumers value Aritzia’s blend of style and longevity, fostering repeat business.

- Financial Strength: $2.4 billion in net revenue for FY2024 demonstrates the market's acceptance of their quality-focused strategy.

Omnichannel Accessibility and Convenience

Aritzia's extensive omnichannel strategy significantly diminishes the threat of substitutes. By offering a seamless blend of physical boutiques and a robust e-commerce platform, the company ensures customers can access its products conveniently, regardless of their preferred shopping method.

This accessibility directly counters the appeal of substitutes. For instance, Aritzia's e-commerce platform, which consistently sees enhancements, along with its expanding network of 100+ boutiques as of early 2024, provides a comprehensive shopping experience that makes seeking alternatives less appealing due to availability issues. This integrated approach reduces the likelihood of customers turning to other brands or channels simply because they cannot find what they need through Aritzia.

- Omnichannel Reach: Aritzia operates a substantial number of physical stores and a highly functional e-commerce site.

- Customer Convenience: This dual approach caters to diverse customer preferences, enhancing overall accessibility.

- Reduced Substitute Incentive: The ease of purchase across channels limits the need for customers to explore alternative brands.

- E-commerce Growth: In fiscal year 2023, Aritzia reported a 36% increase in its e-commerce revenue, highlighting its digital strength.

Aritzia's focus on creating a unique brand experience, from its distinctive styles to its elevated in-store and online environments, significantly reduces the threat of substitutes. Customers are drawn to the overall package, not just individual garments, making it harder for generic or less curated brands to compete.

The company's commitment to quality and durability also plays a crucial role. By offering apparel that lasts longer, Aritzia lessens the need for frequent replacements, thereby weakening the appeal of cheaper, disposable fashion alternatives. This strategy is supported by their strong financial performance, with net revenues reaching $2.4 billion in fiscal year 2024.

Aritzia's proprietary product lines, designed and manufactured in-house, mean that specific Aritzia items are simply unavailable elsewhere. This exclusivity, combined with their strong brand loyalty, ensures that customers seeking their particular aesthetic must engage directly with Aritzia, effectively neutralizing many potential substitutes.

The threat of substitutes is further mitigated by Aritzia's extensive omnichannel presence. With over 100 boutiques and a strong e-commerce platform that saw a 36% revenue increase in fiscal year 2023, customers have convenient access to Aritzia products, reducing the likelihood they will seek alternatives due to availability issues.

Entrants Threaten

The substantial capital required to replicate Aritzia's vertically integrated model, encompassing design, manufacturing, and a widespread retail network, presents a formidable barrier to entry. Newcomers must invest heavily in establishing proprietary brands and a sophisticated supply chain, alongside the considerable expense of opening and maintaining numerous high-end physical stores.

Aritzia's established brand recognition and decades-long cultivation of customer loyalty present a significant barrier to new entrants. Replicating this level of trust and affinity, particularly for their 'Everyday Luxury' positioning, requires substantial investment and time, making it a formidable hurdle.

Aritzia's sophisticated supply chain, featuring strategically located distribution centers and a robust global sourcing network, acts as a significant barrier to entry. This complex infrastructure, honed over years of operation, requires substantial upfront investment and expertise to replicate.

New competitors would face the daunting task of establishing similar logistical capabilities and forging reliable supplier relationships, a process that is both capital-intensive and time-consuming. For instance, in fiscal year 2024, Aritzia reported its e-commerce business continued to grow, underscoring the importance of its efficient distribution network in supporting this channel.

Proprietary Design and Product Development Capabilities

Aritzia's strength as a design house lies in its in-house design and product development teams. These teams are constantly creating exclusive, on-trend collections, a capability that is difficult for new entrants to replicate quickly. This ability to consistently deliver desired styles acts as a significant barrier.

For instance, Aritzia's commitment to proprietary design means they control the entire creative process, from concept to final product. This allows for rapid adaptation to fashion trends and ensures a unique brand identity that new competitors would struggle to establish from scratch.

- Proprietary Design: Aritzia's in-house teams create exclusive, on-trend collections.

- Speed to Market: This capability allows for quick adaptation to fashion trends.

- Brand Identity: Consistent delivery of desired styles builds a strong, hard-to-match brand.

- Barrier to Entry: New competitors face a significant hurdle in matching this creative output.

Strategic U.S. Market Expansion and Digital Investments

Aritzia's strategic push into the U.S. market, marked by new flagship locations and substantial e-commerce upgrades, directly impacts the threat of new entrants. This expansion enhances Aritzia's brand visibility and customer accessibility across a wider geographic area.

The company's significant investments in its digital infrastructure, aiming to bolster its online presence and customer experience, create a higher barrier to entry. For instance, Aritzia reported a 33.4% increase in net revenue in fiscal 2024, with their e-commerce channel showing robust growth, indicating strong customer engagement and loyalty that new competitors will find difficult to replicate.

- U.S. Market Penetration: Aritzia's continued opening of large-format stores in key U.S. markets, such as its recent expansion in areas like Southern California and the Northeast, solidifies its physical footprint.

- E-commerce Dominance: With e-commerce representing a significant portion of its revenue, Aritzia's ongoing digital investments make it harder for smaller, online-only brands to compete on scale and customer acquisition cost.

- Economies of Scale: The increased scale achieved through U.S. expansion allows Aritzia to negotiate better terms with suppliers and optimize its supply chain, creating cost advantages that new entrants lack.

- Brand Recognition: Enhanced marketing efforts and a growing physical presence in the U.S. build stronger brand recognition, requiring new entrants to invest heavily in marketing to even approach Aritzia's level of awareness.

The threat of new entrants for Aritzia is relatively low due to significant capital requirements for replicating its integrated model, strong brand loyalty, and a complex supply chain. New players would need substantial investment to match Aritzia's design capabilities, extensive retail footprint, and efficient distribution networks.

Aritzia's proprietary design process and rapid adaptation to trends create a unique product offering that is difficult for newcomers to emulate quickly. This creative advantage, coupled with a strong brand identity built over years, acts as a substantial barrier.

The company's strategic expansion, particularly in the U.S. market, and ongoing investments in e-commerce further solidify its competitive position. In fiscal year 2024, Aritzia reported a 33.4% increase in net revenue, with e-commerce showing robust growth, demonstrating a customer base and operational scale that new entrants would struggle to challenge.

| Factor | Aritzia's Position | Impact on New Entrants |

|---|---|---|

| Capital Requirements | High (Vertical Integration, Retail Network) | Significant Barrier |

| Brand Loyalty | Strong (Decades of Cultivation) | Difficult to Replicate |

| Supply Chain Complexity | Sophisticated Global Network | Requires Substantial Investment & Time |

| Proprietary Design | In-house, Trend-driven Collections | Hard to Match Speed & Uniqueness |

| U.S. Market Expansion | Growing Flagship Presence & E-commerce | Increases Brand Visibility, Higher Barrier |

Porter's Five Forces Analysis Data Sources

Our Aritzia Porter's Five Forces analysis is built upon a foundation of robust data, including Aritzia's annual reports and investor presentations, alongside industry-specific market research from firms like Euromonitor and Statista. We also incorporate insights from competitor financial filings and reputable fashion trade publications to capture a comprehensive view of the competitive landscape.