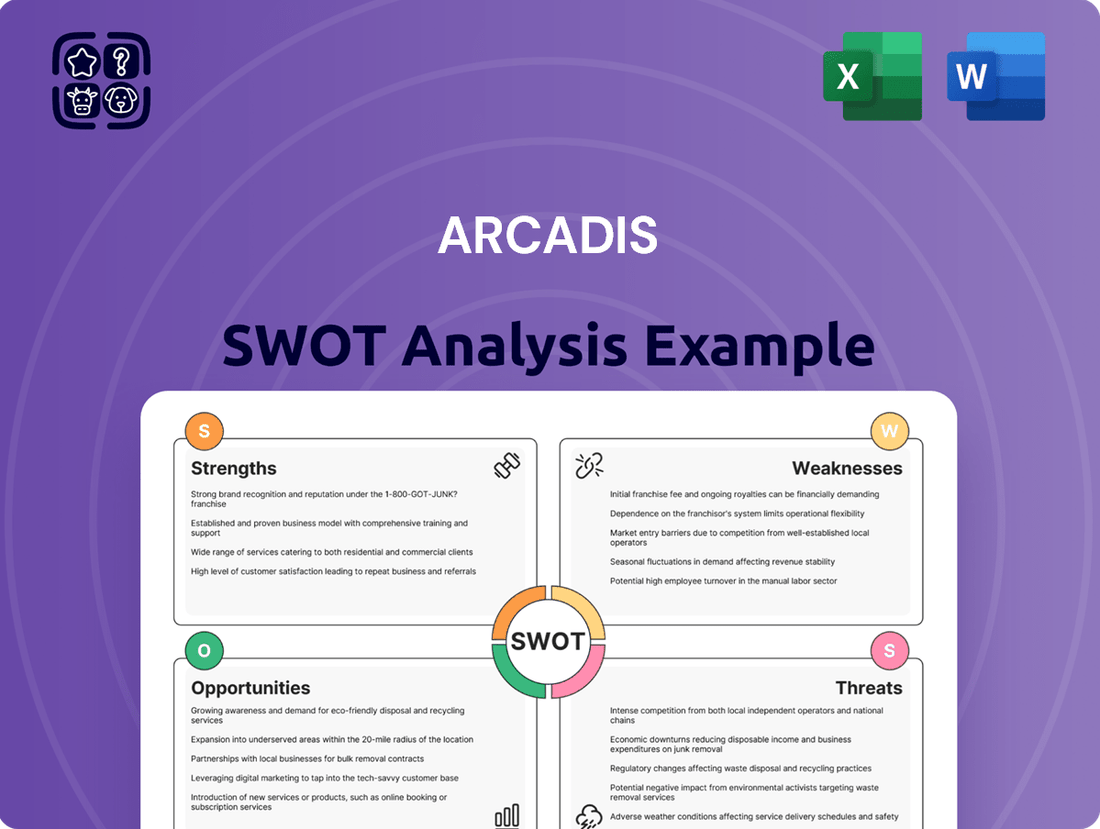

Arcadis SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Arcadis Bundle

Arcadis possesses significant strengths in its global reach and reputation for technical expertise, but faces challenges in navigating evolving market demands and competitive pressures.

Want the full story behind Arcadis's market position, growth drivers, and potential risks? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support your strategic planning and investment decisions.

Strengths

Arcadis boasts a record-high backlog of €3.7 billion, offering substantial visibility into its future financial performance. This impressive figure reflects strong order intake, with a notable 16% organic growth recorded in 2024 and a continued 2.8% organic growth in the first quarter of 2025.

This robust backlog acts as a bedrock for sustained revenue generation and operational steadiness for Arcadis. Furthermore, the company highlights a healthy project pipeline that spans all its Global Business Areas, with particular strength observed in markets experiencing rapid expansion.

Arcadis has demonstrated a strong upward trend in its operating profitability. For the full year 2024, the company achieved an impressive operating EBITA margin of 11.5%. This positive momentum continued into the first quarter of 2025, with the margin expanding further to 10.9%.

This enhanced profitability stems from several key drivers. Arcadis benefits from disciplined project execution, a strategic emphasis on sustainable projects, and growing contributions from its Global Excellence Centers. Furthermore, internal efficiencies gained through standardization and automation are playing a significant role in margin expansion.

The company is well-positioned to meet its ambitious financial goals, currently on track to reach a 12.5% operating EBITA margin by 2026. This sustained improvement underscores Arcadis's effective operational management and strategic focus.

Arcadis stands out as a global leader in developing sustainable solutions for both natural and built environments. Their strategic focus on 'Accelerating a Planet Positive Future' directly addresses critical global issues such as climate change and decarbonization, positioning them strongly in a market increasingly prioritizing environmental responsibility and resilience.

Strategic Acquisitions and Market Positioning

Arcadis has bolstered its market standing through astute acquisitions, notably integrating KUA Group in Germany. This move significantly amplifies its expertise in designing sophisticated data centers, a rapidly expanding sector. This strategic move, alongside the acquisition of WSP Infrastructure Engineering GmbH which shores up its German rail sector presence, exemplifies a clear strategy to capture growth in high-demand areas and key geographies.

These bolt-on acquisitions are instrumental in unlocking new revenue streams and expanding Arcadis's reach. For instance, the KUA Group acquisition is projected to contribute to the company's growing infrastructure solutions segment, which saw a revenue increase in recent reporting periods. By integrating specialized firms, Arcadis not only broadens its service portfolio but also enhances its competitive edge in complex project delivery.

- Enhanced Data Center Expertise: Integration of KUA Group strengthens Arcadis's capabilities in a high-growth market.

- Strengthened Rail Presence: Acquisition of WSP Infrastructure Engineering GmbH solidifies its position in the German rail sector.

- Market Expansion: These strategic moves open doors to new opportunities in key geographical regions and high-demand sectors.

- Complementary Capabilities: Acquisitions align with and enhance Arcadis's existing core competencies.

Diversified Service Portfolio and Expertise

Arcadis boasts a remarkably diversified service portfolio, spanning critical sectors like infrastructure, water, environment, and buildings. This breadth is strategically organized into Global Business Areas: Resilience, Mobility, Places, and Intelligence, allowing for comprehensive client engagement. This wide-ranging expertise ensures Arcadis can tackle multifaceted challenges across different industries.

The company's strength lies in its deep asset knowledge, coupled with a vast global network of over 35,000 professionals. This extensive human capital empowers Arcadis to deliver integrated, end-to-end solutions. For instance, in 2023, Arcadis reported net revenues of €2.7 billion, underscoring the scale of its operations and the demand for its diverse services.

- Broad Sector Coverage: Infrastructure, water, environment, and buildings.

- Strategic Business Areas: Resilience, Mobility, Places, and Intelligence.

- Global Reach: Over 35,000 professionals worldwide.

- Integrated Solutions: Ability to offer end-to-end project delivery.

Arcadis's strong financial performance is underpinned by a record-high backlog of €3.7 billion, demonstrating significant future revenue visibility. This backlog, fueled by 16% organic growth in 2024 and continued growth in early 2025, provides a stable foundation for operations.

The company's operating profitability has seen a consistent upward trend, with an 11.5% operating EBITA margin in 2024, improving to 10.9% in Q1 2025. This growth is driven by efficient project execution, a focus on sustainability, and contributions from Global Excellence Centers.

Arcadis has strategically enhanced its market position through key acquisitions, such as KUA Group for data center expertise and WSP Infrastructure Engineering GmbH for its German rail presence. These moves bolster its capabilities in high-growth sectors and key geographies.

The company's diversified service portfolio across infrastructure, water, environment, and buildings, organized into Business Areas like Resilience and Mobility, allows for comprehensive client solutions. This breadth, supported by over 35,000 professionals globally, enables end-to-end project delivery.

| Metric | 2024 (Full Year) | Q1 2025 | Target 2026 |

|---|---|---|---|

| Backlog | €3.7 billion | N/A | N/A |

| Organic Growth | 16% (2024) | 2.8% (Q1 2025) | N/A |

| Operating EBITA Margin | 11.5% | 10.9% | 12.5% |

| Net Revenues | €2.7 billion (2023) | N/A | N/A |

What is included in the product

Delivers a strategic overview of Arcadis’s internal and external business factors, highlighting key strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework for identifying and addressing strategic challenges.

Weaknesses

Arcadis experienced flat organic revenue growth in Q1 2025, reporting stable net revenues year-on-year. This suggests a slowdown compared to prior periods, potentially due to a more deliberate approach to project selection and some project award postponements. Sustaining consistent organic growth will be important for Arcadis's ongoing development.

Arcadis has faced challenges with slower infrastructure spending in crucial markets such as the UK and Australia. This slowdown has notably affected the company's Mobility business segment.

These regional market contractions have led to non-operating restructuring costs, impacting Arcadis's financial performance in those areas. The company had to incur €13 million in restructuring costs in the first half of 2023, partly due to these regional issues.

Such localized downturns can dampen overall revenue expansion and require Arcadis to make difficult decisions regarding workforce adjustments and the strategic redirection of resources.

Arcadis faces significant volatility in client spending, a challenge amplified by geopolitical uncertainties and shifting government policies. This unpredictability directly impacts project timelines, often leading to delays in mobilization and a noticeable effect on order intake, making consistent revenue forecasting a considerable hurdle. For instance, in early 2024, many infrastructure projects saw revised timelines due to evolving regulatory frameworks, directly affecting Arcadis's near-term revenue visibility.

Increased Net Working Capital and DSO

Arcadis's working capital management faced a challenge in the first quarter of 2025, with net working capital as a percentage of annualized gross revenues climbing to 12.9%. This increase, coupled with a rise in Days Sales Outstanding (DSO) to 67 days, primarily stems from the ongoing Enterprise Resource Planning (ERP) system rollout across the remaining North American operations. While a necessary strategic move, these metrics can temporarily constrain free cash flow generation.

The elevated DSO signifies that it's taking longer for Arcadis to collect payments from its clients. This can tie up significant capital that could otherwise be used for investments or debt reduction. The ERP implementation, though crucial for long-term efficiency, creates a short-term drag on cash conversion cycles.

- Increased Net Working Capital: Rose to 12.9% of annualized gross revenues in Q1 2025.

- Higher Days Sales Outstanding (DSO): Reached 67 days in Q1 2025.

- Primary Driver: Planned ERP roll-out in North America.

- Potential Impact: Short-term reduction in free cash flow.

Resource Constraints and Inflationary Pressures

Arcadis, operating within the construction sector, contends with significant resource constraints and escalating inflationary pressures. These challenges directly affect tender prices, creating an environment where passing on all cost increases to clients is not always feasible, potentially impacting project profitability.

Labor availability issues further exacerbate these weaknesses, hindering efficient scaling of operations. For instance, the UK construction sector, a key market for Arcadis, reported a 10% increase in material costs in early 2024, a trend expected to persist. This makes it difficult to maintain margins and execute growth strategies effectively, especially looking towards 2026.

- Resource Scarcity: Limited availability of key construction materials and skilled labor.

- Inflationary Impact: Rising material and energy costs directly squeeze profit margins.

- Cost Pass-Through Difficulty: Inability to fully transfer increased costs to clients due to competitive bidding.

- Operational Scaling Challenges: Labor shortages and cost volatility impede efficient expansion of services.

Arcadis's working capital management faced a challenge in Q1 2025, with net working capital rising to 12.9% of annualized gross revenues. This increase, along with a jump in Days Sales Outstanding (DSO) to 67 days, is primarily due to the ongoing Enterprise Resource Planning (ERP) system rollout in North America. While essential for future efficiency, these metrics can temporarily constrain free cash flow generation.

The company also contends with significant resource constraints and escalating inflationary pressures within the construction sector. These factors make it difficult to pass on all cost increases to clients, potentially impacting project profitability. Labor availability issues further complicate operational scaling, hindering efficient growth.

| Metric | Q1 2025 Value | Impact |

| Net Working Capital (% of Gross Revenue) | 12.9% | Potential constraint on free cash flow |

| Days Sales Outstanding (DSO) | 67 days | Slower cash collection |

| Inflationary Pressures | Escalating | Reduced profit margins, cost pass-through challenges |

| Labor Availability | Constrained | Operational scaling difficulties |

Preview the Actual Deliverable

Arcadis SWOT Analysis

The file shown below is not a sample—it’s the real SWOT analysis you'll download post-purchase, in full detail. You'll gain access to a comprehensive breakdown of Arcadis' Strengths, Weaknesses, Opportunities, and Threats, meticulously prepared for your strategic insights.

Opportunities

The escalating global emphasis on climate change, decarbonization initiatives, and the broader energy transition creates a fertile ground for Arcadis's Resilience sector. This heightened awareness directly translates into a robust demand for services aimed at building more robust and sustainable infrastructure.

Arcadis is well-positioned to capitalize on this trend, with significant growth drivers stemming from strong demand for water optimization, climate adaptation strategies, and energy transition solutions. Markets like North America, Germany, and the Netherlands are particularly active, showcasing a clear need for these specialized services.

Furthermore, substantial capital programs, such as the AMP8 framework in the UK water sector, represent a significant opportunity for future order intake. These large-scale projects underscore the ongoing investment in critical infrastructure resilience, offering Arcadis a clear pathway for sustained growth and market leadership.

The burgeoning data center market, fueled by substantial AI investments, presents a significant avenue for growth for Arcadis, particularly within its Places and Resilience Global Business Areas. This sector is experiencing unprecedented demand.

Arcadis's strategic acquisition of KUA Group in Germany bolsters its expertise and market standing in the highly sought-after European data center landscape. This move is poised to unlock considerable revenue synergies.

The global data center market size was valued at approximately $275.1 billion in 2023 and is projected to reach $637.9 billion by 2030, growing at a CAGR of 12.8%. This expansion directly benefits Arcadis's service offerings.

Governments worldwide are significantly increasing their investment in infrastructure, creating a robust pipeline of opportunities. For instance, the United States' Bipartisan Infrastructure Law, enacted in 2021, allocates over $1 trillion to upgrade roads, bridges, public transit, water pipes, and broadband internet, with a substantial portion expected to be spent in 2024 and 2025. Similarly, Germany's commitment to modernizing its infrastructure, particularly in transport and digital networks, is a key driver.

The United Kingdom is also seeing substantial government funding directed towards infrastructure projects, including major rail upgrades and water network improvements. These long-term funding commitments, often spanning multiple years, provide Arcadis with greater certainty and a more predictable stream of work in sectors like housing, healthcare, education, and correctional facilities, alongside critical investments in water and urban transportation.

Leveraging Digital Innovation and AI

Arcadis is strategically investing in digital innovation, notably through its Enterprise Asset Management (EAM) platform, which facilitates real-time asset monitoring. This focus on digital solutions, including the integration of Intelligence offerings, positions the company to capitalize on the growing demand for data-driven insights in asset management and infrastructure development.

The company is actively exploring the application of automation and artificial intelligence (AI) to refine its pursuit processes and elevate the quality of its project proposals. By leveraging AI, Arcadis aims to streamline workflows, improve bid competitiveness, and ultimately deliver enhanced value and efficiency to its clients.

Arcadis's commitment to digital transformation is evident in its ongoing investments. For instance, in 2023, the company reported that digital revenue grew by 15%, reaching €360 million, underscoring the increasing importance of these capabilities in its business strategy and client service delivery.

- Digital Revenue Growth: Arcadis's digital revenue reached €360 million in 2023, a 15% increase year-over-year.

- AI in Pursuits: Exploring AI to streamline bid processes and enhance proposal quality, aiming for greater operational efficiency.

- EAM Solutions: Continued development and integration of Enterprise Asset Management (EAM) for real-time asset monitoring.

- Intelligence Integration: Incorporating Intelligence solutions across its service offerings to provide advanced data analytics.

Strategic Key Client Program Expansion

Arcadis is strategically expanding its Key Client program, a cornerstone of its 2024-2026 growth plan. This initiative is designed to cultivate deeper relationships with its most important clients, fostering greater collaboration and unlocking cross-selling potential across all global business areas. The focus on these key accounts is projected to significantly boost profitability and secure more high-value, long-term projects.

This client-centric strategy is already showing promise. For instance, in the first half of 2024, Arcadis reported that its top 20 clients contributed approximately 25% of its net revenue, a figure the company aims to increase through this enhanced program. This expansion is expected to lead to more predictable revenue streams and a more efficient allocation of resources by concentrating efforts on clients with the highest potential for mutual growth and strategic alignment.

The benefits of this approach include:

- Deepened Partnerships: Building stronger, more collaborative relationships with key clients.

- Increased Cross-Selling: Leveraging existing relationships to offer a broader range of Arcadis's services.

- Enhanced Profitability: Focusing on high-value clients typically leads to improved margins.

- Improved Project Wins: Securing more strategic, long-term projects through trusted client relationships.

The global push for decarbonization and energy transition presents significant opportunities for Arcadis, particularly in building resilient infrastructure and offering water optimization and climate adaptation solutions. The company is also poised to benefit from the booming data center market, driven by AI investments, with global market growth projected to reach $637.9 billion by 2030.

Government infrastructure spending worldwide, exemplified by the US Bipartisan Infrastructure Law and Germany's modernization efforts, creates a robust pipeline of projects for Arcadis. The company's strategic investment in digital solutions, including its EAM platform and AI for pursuit processes, is enhancing its service offerings and competitiveness.

Arcadis's focus on its Key Client program aims to deepen relationships and increase cross-selling, with top clients already contributing a significant portion of revenue. This strategic expansion is expected to drive profitability and secure more long-term, high-value projects.

| Opportunity Area | Key Drivers | Arcadis's Position/Actions | Market Data/Projections |

|---|---|---|---|

| Climate & Energy Transition | Global decarbonization, energy transition, demand for resilient infrastructure | Expertise in water optimization, climate adaptation, energy transition solutions | Strong demand in North America, Germany, Netherlands; AMP8 UK water sector framework |

| Data Centers | AI investment fueling unprecedented demand | Bolstered by KUA Group acquisition in Germany | Market valued at ~$275.1B in 2023, projected to reach $637.9B by 2030 (12.8% CAGR) |

| Government Infrastructure Spending | Increased global government investment in infrastructure | Benefiting from US Bipartisan Infrastructure Law, German modernization, UK rail/water upgrades | US law allocates over $1T; long-term funding commitments provide predictable work |

| Digital Innovation | Demand for data-driven asset management and AI-enhanced processes | Investing in EAM platform, integrating Intelligence offerings, exploring AI for pursuits | Digital revenue grew 15% to €360M in 2023 |

| Key Client Program | Strategic growth plan to deepen client relationships | Focus on top clients for collaboration and cross-selling | Top 20 clients contributed ~25% of net revenue in H1 2024; target to increase |

Threats

Broader economic slowdowns, such as the projected 2.4% global GDP growth for 2024 according to the IMF, can significantly dampen client confidence. This uncertainty often translates into delayed or scaled-back project investments, directly impacting Arcadis's pipeline.

Persistent geopolitical volatility, exemplified by ongoing conflicts and trade tensions, further exacerbates these economic headwinds. This can lead to increased operational costs and market access challenges in affected regions, as seen with supply chain disruptions impacting construction materials in late 2023 and early 2024.

These external factors have already contributed to market softness in specific sectors and geographies, posing a direct risk to Arcadis's ability to maintain consistent project flow and achieve its revenue growth targets for 2024 and 2025.

Arcadis anticipates a significant uptick in construction inflation starting in 2026, projecting tender price inflation for building projects to reach 5-6%. This anticipated rise is primarily fueled by ongoing resource limitations and persistent supply chain disruptions.

This inflationary pressure poses a direct threat to project profitability, necessitating proactive management through refined pricing strategies and enhanced operational efficiencies to mitigate potential margin erosion.

Arcadis faces significant competition from established global consultancies and specialized niche players. This crowded landscape, where firms like AECOM, Jacobs, and WSP are major rivals, can compress profit margins and necessitate aggressive bidding strategies to win contracts. For instance, the global management consulting market was valued at approximately $277 billion in 2023 and is projected to grow, indicating the sheer scale of the competitive environment Arcadis navigates.

Regulatory and Planning Delays

New regulatory frameworks, like the Building Safety regime introduced in the UK, are creating complexities. These can extend the duration of challenging market conditions, impacting companies like Arcadis.

Slowdowns in both commercial and public sector projects, stemming from planning and procurement bottlenecks, further exacerbate these difficulties. For instance, in 2024, the UK government reported an average planning decision time of 37 weeks for major applications, significantly exceeding the statutory 13-week target.

Such delays can consume valuable contractor resources, thereby limiting the capacity to engage with new projects and affecting the overall project pipeline. This directly impacts Arcadis' ability to secure and execute work efficiently.

- Regulatory Hurdles: Implementation of new safety standards and environmental regulations can slow project initiation.

- Planning Delays: Extended timelines for obtaining planning permissions and permits are a persistent issue.

- Procurement Challenges: Complex and lengthy procurement processes in both public and private sectors add to project lead times.

- Resource Strain: Delays tie up essential contractor resources, hindering the pursuit of new business opportunities.

Talent Attraction and Retention

Arcadis, as a knowledge-based consultancy, faces significant threats in attracting and retaining the highly qualified professionals essential for its operations. Resource and labor market constraints, especially for specialized skills and equipment, are likely to escalate inflationary pressures and complicate procurement processes throughout 2024 and into 2025. This talent scarcity directly impacts Arcadis's ability to deliver projects effectively and maintain its competitive edge in the market.

The ongoing demand for skilled engineers, project managers, and digital specialists in the infrastructure and environmental sectors creates a highly competitive landscape. For instance, reports from late 2024 indicated a persistent shortage of experienced civil engineers, with some regions experiencing a 15% deficit compared to demand. This makes it challenging for Arcadis to secure the necessary human capital to meet client needs and pursue growth opportunities.

- Talent Scarcity: A persistent shortage of specialized skills in engineering and project management is a significant threat.

- Inflationary Pressures: Labor market constraints are expected to drive up salary and benefit costs for skilled professionals.

- Competitive Disadvantage: Failure to attract and retain top talent can hinder project delivery and erode market position.

- Procurement Challenges: Difficulty in acquiring specialized equipment and services due to labor shortages adds operational complexity.

Arcadis faces significant threats from a challenging economic climate, with projected global GDP growth of 2.4% for 2024 by the IMF potentially reducing client investment. Geopolitical instability further complicates matters, leading to increased operational costs and market access issues, as evidenced by supply chain disruptions affecting construction materials in late 2023 and early 2024.

The company must also contend with intense competition from established global consultancies and specialized firms, a dynamic that could compress profit margins in a market valued at approximately $277 billion in 2023. Additionally, Arcadis anticipates construction inflation of 5-6% for building projects from 2026 due to resource limitations and supply chain issues, posing a risk to project profitability.

Regulatory hurdles, such as new safety standards, and persistent planning and procurement delays, exemplified by UK major planning decisions averaging 37 weeks in 2024, also present significant challenges. These factors can consume valuable contractor resources and limit Arcadis's capacity to engage new projects.

Furthermore, Arcadis is threatened by a scarcity of specialized talent, with a reported 15% deficit in experienced civil engineers in some regions in late 2024, driving up labor costs and impacting project delivery capabilities. This talent shortage complicates procurement and can create a competitive disadvantage.

| Threat Category | Specific Challenge | Impact on Arcadis | Data Point/Example |

|---|---|---|---|

| Economic Headwinds | Global economic slowdown | Reduced client investment, dampened confidence | Projected 2.4% global GDP growth for 2024 (IMF) |

| Geopolitical Volatility | Conflicts and trade tensions | Increased operational costs, market access challenges | Supply chain disruptions affecting construction materials (late 2023/early 2024) |

| Market Competition | Rival consultancies and niche players | Margin compression, aggressive bidding required | Global management consulting market valued at ~$277 billion (2023) |

| Inflationary Pressures | Rising construction costs | Risk to project profitability, need for refined pricing | Projected 5-6% tender price inflation for building projects from 2026 |

| Regulatory & Planning | New regulations, planning delays | Slowed project initiation, extended lead times | UK major planning decisions averaging 37 weeks (2024) |

| Talent Scarcity | Shortage of specialized skills | Impacted project delivery, increased labor costs | ~15% deficit in experienced civil engineers in some regions (late 2024) |

SWOT Analysis Data Sources

This Arcadis SWOT analysis is built upon a robust foundation of data, drawing from the company's official financial reports, comprehensive market intelligence, and expert industry analyses to provide a well-rounded strategic perspective.