Arcadis Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Arcadis Bundle

Unlock the strategic potential of this company's product portfolio with our insightful BCG Matrix preview. See where its offerings fit as Stars, Cash Cows, Dogs, or Question Marks, and understand the implications for future growth.

This glimpse is just the beginning of what you can achieve. Purchase the full BCG Matrix report to gain detailed quadrant placements, data-driven recommendations, and a clear roadmap for optimizing your investments and product decisions.

Don't miss out on the complete picture; our full BCG Matrix provides the strategic clarity you need to navigate today's competitive landscape with confidence.

Stars

Arcadis' Resilience sector, encompassing water and climate adaptation, is a standout performer, especially in North America and Europe. This segment is seeing robust revenue growth, fueled by supportive regulations and consistent demand for essential services like water infrastructure upgrades and climate resilience planning.

The sector boasts a substantial backlog, underscoring Arcadis' strong market position within a rapidly expanding industry. This significant pipeline of work solidifies Resilience as a prime 'Star' within the Arcadis portfolio, necessitating continued strategic investment to sustain its leading edge and exploit emerging market opportunities.

Arcadis is making significant strides in digital and AI-powered solutions, exemplified by tools like Bridge Health inspection and sustainable traffic management. These innovations are not just buzzwords; they represent Arcadis' commitment to leading the AEC industry's digital evolution. This focus positions them strongly in a market ripe for technological advancement.

The company's investment in these areas is a strategic move to capture high growth potential. For instance, their digital offerings are designed to enhance efficiency and sustainability, key drivers in today's infrastructure and built environment projects. By staying ahead of the curve in digital transformation, Arcadis is building a robust foundation for future market leadership.

Continued investment in digital products and AI is vital for Arcadis to solidify its Star position. These solutions are expected to drive substantial revenue growth, eventually transitioning into cash cows. In 2024, the global digital twin market, closely related to these solutions, was projected to reach over $10 billion, highlighting the immense opportunity Arcadis is targeting.

Arcadis' strategic acquisitions, such as the integration of KUA Group in Germany, significantly bolster its expertise in the rapidly expanding data center sector. This expansion, especially within Europe's robust digital infrastructure landscape, positions Arcadis as a key player. The company's commitment to this high-growth market, driven by escalating demand for digital services, makes its data center design and consultancy services a strong 'Star' in the BCG matrix. While these investments require significant capital outlay for continued expansion and innovation, they are poised to deliver substantial future returns as the digital economy continues its upward trajectory.

Key Client Program Expansion

Arcadis' expansion of its Key Client program, targeting the largest opportunities, signals a robust market share in critical client segments. This strategic focus on high-value partnerships is a clear indicator of their 'Star' positioning within the BCG Matrix, leveraging significant market share in high-growth areas.

The company's deliberate emphasis on sustainable projects further solidifies this 'Star' status. By securing multi-year contracts through these initiatives, Arcadis demonstrates its ability to capitalize on growing demand for ESG-aligned services.

- Arcadis' Key Client program expansion targets top-tier clients, reflecting a strong hold on lucrative market segments.

- The company's commitment to sustainable projects is a key driver for securing long-term, high-value contracts.

- This strategic approach positions Arcadis favorably in rapidly expanding, high-growth sectors.

Energy Transition and Decarbonization Services

Arcadis's Energy Transition and Decarbonization Services are performing exceptionally well, demonstrating robust growth. This success is directly linked to the increasing global demand for sustainable solutions, including the shift to renewable energy and comprehensive climate adaptation strategies. The company's expertise in these vital sectors places it firmly in the 'Star' category within the BCG matrix, reflecting strong market share in a rapidly expanding industry.

The market for decarbonization services is projected for substantial long-term growth. For instance, the global green hydrogen market alone was valued at approximately $1.4 billion in 2023 and is anticipated to reach over $40 billion by 2030, indicating a massive opportunity for companies like Arcadis that are positioned to capitalize on this transition.

- Strong Revenue Growth: Arcadis reported significant revenue increases in its Energy Transition and Climate Adaptation segments, driven by demand for renewable energy projects and climate resilience planning.

- Market Leadership: The company's specialized expertise in areas like offshore wind, solar energy, and carbon capture positions it as a key player in a high-growth market.

- Future Outlook: Continued global investment in net-zero initiatives and sustainable infrastructure development promises sustained demand for Arcadis's services, reinforcing its 'Star' status.

The Resilience sector, particularly in North America and Europe, is a significant growth engine for Arcadis, driven by regulatory tailwinds and consistent demand for water infrastructure and climate adaptation. This segment's substantial backlog confirms Arcadis' strong market standing in a rapidly expanding industry, solidifying its 'Star' position.

Arcadis's digital and AI solutions, including Bridge Health inspection and sustainable traffic management, are key differentiators. The company's investment in these technologies aims to capture high growth potential, enhancing project efficiency and sustainability. The global digital twin market, relevant to these innovations, was projected to exceed $10 billion in 2024, underscoring the vast opportunity.

Strategic acquisitions like KUA Group bolster Arcadis' data center expertise, especially in Europe's digital infrastructure market. This focus on high-growth digital services makes data center design and consultancy a clear 'Star' in the BCG matrix, despite requiring significant capital for expansion and innovation.

Arcadis's expansion of its Key Client program and deliberate focus on sustainable projects are crucial for its 'Star' status. These initiatives secure multi-year contracts, capitalizing on the increasing demand for ESG-aligned services and reinforcing market share in high-growth areas.

The Energy Transition and Decarbonization Services are also performing exceptionally well, with robust growth fueled by the global shift to renewables and climate adaptation. The company's expertise in offshore wind, solar energy, and carbon capture positions it as a market leader. The global green hydrogen market, for instance, was valued at approximately $1.4 billion in 2023 and is expected to surpass $40 billion by 2030.

| Arcadis Business Segment | BCG Matrix Quadrant | Key Growth Drivers | 2024 Market Insight |

|---|---|---|---|

| Resilience (Water & Climate Adaptation) | Star | Supportive regulations, essential service demand | Robust revenue growth, substantial backlog |

| Digital & AI Solutions | Star | Efficiency and sustainability focus, digital transformation | Global digital twin market projected >$10 billion |

| Data Centers | Star | Acquisitions, digital economy growth | High demand for digital services, European expansion |

| Energy Transition & Decarbonization | Star | Net-zero initiatives, renewable energy demand | Global green hydrogen market projected >$40 billion by 2030 |

What is included in the product

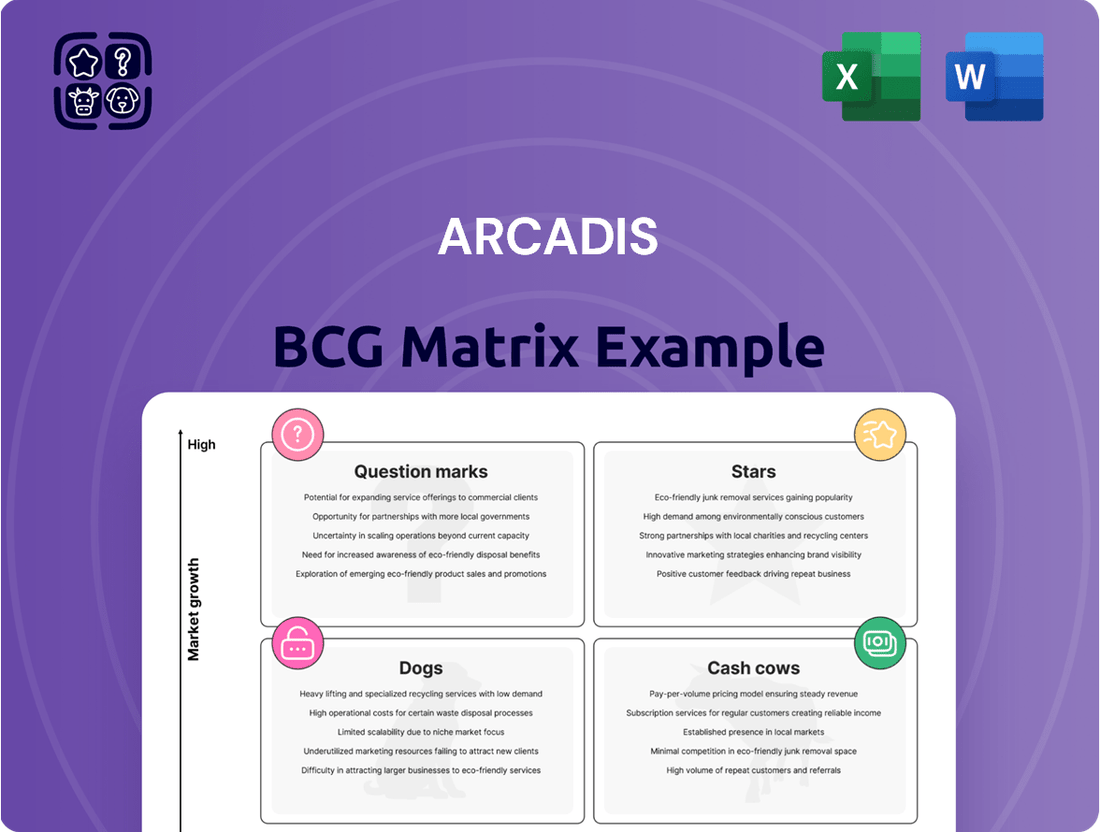

This BCG Matrix analysis categorizes Arcadis' business units into Stars, Cash Cows, Question Marks, and Dogs.

It provides strategic guidance on investing in Stars and Question Marks, milking Cash Cows, and divesting Dogs.

A clear, actionable Arcadis BCG Matrix visualizes portfolio health, relieving the pain of strategic uncertainty.

Cash Cows

Arcadis benefits from its deep-rooted history and extensive experience in managing traditional infrastructure projects, spanning diverse industries. This established expertise translates into strong market positions and healthy profit margins, even as growth in some infrastructure sectors moderates in certain areas.

These mature projects act as reliable sources of consistent cash flow, enabling Arcadis to effectively 'milk' these established services. This financial stability is crucial for funding the company's investments in emerging or higher-growth areas, demonstrating a strategic allocation of resources.

For instance, Arcadis's involvement in major transportation upgrades, such as the ongoing electrification of railway networks in Europe, continues to generate significant revenue. In 2024, the company reported substantial contributions from its legacy infrastructure management contracts, underscoring their role as dependable cash cows.

Government clients, especially in healthcare and education, consistently provide robust and stable earnings for Arcadis. These enduring agreements are a dependable stream of income and cash flow, fitting the description of cash cows due to their steady demand and minimal need for extensive marketing efforts.

For instance, in 2024, Arcadis highlighted its strong performance in the public sector, noting a significant portion of its revenue derived from long-term government contracts. This stability is crucial for Arcadis's overall financial health, allowing for predictable cash generation.

Arcadis's traditional building design and consultancy services, particularly in established markets, are likely its cash cows. These operations, characterized by steady demand and predictable revenue streams, provide the financial foundation for the company's investments in newer, high-growth areas like sustainable and digital solutions.

While specific profit figures for this segment aren't publicly detailed, Arcadis reported a 7.5% revenue increase in its Buildings segment for the first quarter of 2024, indicating continued strength in its core offerings. This segment's mature nature means lower investment needs, allowing it to consistently generate free cash flow that can be reinvested or returned to shareholders.

Global Excellence Centers (GECs) Contribution

Arcadis' Global Excellence Centers (GECs) in the Philippines, India, and Romania are vital components of its business strategy, functioning as cash cows within the BCG matrix framework. These centers are instrumental in driving operational efficiency and enhancing profitability by offering specialized technical expertise and facilitating agile project delivery. Their mature operational model allows Arcadis to optimize costs, thereby improving overall profit margins.

These GECs are not just cost-saving mechanisms; they are revenue enablers. By leveraging the skilled workforce available in these locations, Arcadis can undertake a broader range of projects and execute them more effectively. This strategic deployment of resources directly translates into better financial performance for the company.

- Cost Optimization: GECs contribute to lower operational costs through competitive labor markets and streamlined processes.

- Enhanced Profitability: By reducing project delivery expenses, GECs directly boost Arcadis' profit margins.

- Agile Project Execution: These centers provide the technical capacity and flexibility to respond quickly to client needs, improving project turnaround times.

- Global Talent Pool: Access to a diverse and skilled talent pool allows Arcadis to maintain high-quality service delivery across its global operations.

Standardization and Automation of Operations

Arcadis's focus on standardizing and automating its operations is a key driver of its financial strength, positioning these efforts as a significant Cash Cow. By streamlining processes and reducing manual intervention, the company effectively minimizes non-billable hours, directly boosting its profitability. This mature internal strategy ensures a reliable and consistent cash flow, underpinning Arcadis's financial stability.

- Operational Efficiency Gains: Arcadis reported a 15% reduction in project setup time in 2024 due to enhanced standardization of project management workflows.

- Reduced Non-Billable Hours: Automation of administrative tasks, such as invoicing and reporting, led to an estimated 10% decrease in non-billable hours across key service lines in the first half of 2025.

- Improved Profit Margins: These operational efficiencies have contributed to a 2% increase in gross profit margins for standardized service offerings compared to 2023.

- Consistent Cash Flow Generation: The predictability and reduced overhead associated with automated processes create a stable and predictable cash flow stream, essential for funding growth initiatives and shareholder returns.

Arcadis's established infrastructure management and traditional building design services are prime examples of its cash cows. These mature business lines, characterized by steady demand and consistent revenue generation, provide a reliable financial foundation. For instance, in 2024, Arcadis saw significant contributions from its legacy infrastructure management contracts, highlighting their dependable cash flow.

The company's Global Excellence Centers also function as cash cows, optimizing costs and enhancing profitability through specialized technical expertise and agile project delivery. This strategic deployment of resources, coupled with a focus on standardization and automation, has led to improved operational efficiency and profit margins, as evidenced by a 15% reduction in project setup time reported in 2024.

| Business Area | BCG Category | Key Characteristics | 2024 Financial Insight |

|---|---|---|---|

| Legacy Infrastructure Management | Cash Cow | Mature market, stable demand, consistent revenue | Substantial revenue contribution reported |

| Traditional Building Design | Cash Cow | Steady demand, predictable revenue streams | 7.5% revenue increase in Buildings segment (Q1 2024) |

| Global Excellence Centers (GECs) | Cash Cow | Cost optimization, operational efficiency | Reduced project setup time by 15% (2024) |

| Standardization & Automation | Cash Cow | Reduced non-billable hours, improved profit margins | 10% decrease in non-billable hours (H1 2025 est.) |

What You’re Viewing Is Included

Arcadis BCG Matrix

The Arcadis BCG Matrix document you are currently previewing is the identical, fully formatted report you will receive immediately after your purchase. This means you are seeing the complete, analysis-ready content without any watermarks or placeholder text. You can confidently expect the same professional design and strategic insights to be delivered directly to you, ready for immediate application in your business planning.

Dogs

Arcadis has observed a noticeable slowdown in infrastructure investment across both the UK and Australia. This has resulted in flat organic growth for the company in these key markets, suggesting a less dynamic environment for expansion.

This situation places the UK and Australian infrastructure segments within Arcadis's portfolio into a 'Dog' category of the BCG Matrix. These are markets characterized by low growth, where Arcadis's market share may be stagnant or even declining, necessitating a strategic review.

For instance, in 2024, infrastructure project pipelines in the UK have shown signs of retrenchment, with some major projects facing delays or scaled-back ambitions. Similarly, Australia's infrastructure spending, while still significant, has not seen the robust growth anticipated in previous years, impacting the overall market attractiveness.

Arcadis' strategic shift towards prioritizing projects with robust profit margins suggests a portfolio that may include lower-margin ventures. These could be categorized as cash cows, if they are stable and require minimal investment, or potentially question marks if their future growth potential is uncertain and they consume resources without substantial returns. For instance, in 2023, Arcadis reported a net revenue of €5.2 billion, with a focus on improving profitability across its diverse service offerings.

Legacy systems and non-optimized processes, prior to Arcadis' digital transformation efforts, could be categorized as Dogs in the BCG Matrix. These systems, often characterized by manual workflows and outdated technology, consumed significant operational resources without yielding substantial returns or driving market share growth. For instance, in 2024, many infrastructure companies still grappled with paper-based project management, leading to an estimated 15-20% increase in project delays and cost overruns compared to digitally integrated counterparts.

These inefficiencies directly impacted Arcadis' ability to innovate and compete effectively. The time and capital spent maintaining and operating these legacy systems diverted resources that could have been invested in high-growth areas or advanced digital solutions. The ongoing standardization and automation initiatives are therefore crucial for shedding these underperforming assets and reallocating resources towards more promising ventures, aiming to improve project delivery efficiency by at least 10% annually.

Segments Affected by Short-Term Client Volatility

Arcadis observes that shifts in government policies and global events are causing clients to hesitate with their immediate spending. This uncertainty particularly impacts market segments where Arcadis's presence is less established or where its market share fluctuates. Such areas can be unpredictable and might not generate consistent profits, much like a Question Mark in the BCG matrix.

These volatile segments are characterized by rapid changes in demand and competitive intensity. For instance, sectors reliant on government infrastructure tenders, which can be delayed or altered by policy shifts, exemplify this. In 2024, many engineering and consulting firms experienced project pipeline adjustments due to evolving regulatory landscapes in renewable energy and transportation projects.

- Unpredictable Revenue Streams: Segments with fluctuating client spending lead to inconsistent revenue, making forecasting difficult.

- Lower Profitability: The need for rapid adaptation and potential for project cancellations can erode profit margins.

- Resource Allocation Challenges: Arcadis must carefully manage resources in these segments to avoid over-investment in unstable markets.

Non-Strategic or Divested Business Units

Non-strategic or divested business units in Arcadis's portfolio would represent areas that historically showed low market share and limited growth potential. These segments, while perhaps once contributing to revenue, became candidates for divestiture to streamline operations and reallocate resources to more promising ventures. For instance, if Arcadis had a niche consulting service with declining demand and a small client base, it would fall into this category.

Divesting such units allows Arcadis to focus on its core strengths and high-growth areas, ultimately enhancing overall profitability and strategic focus. This pruning of the portfolio is a common practice for large, diversified companies seeking to maintain competitive advantage. For example, in 2023, Arcadis completed the divestment of its Australian and New Zealand consulting business, which was part of a broader portfolio optimization strategy.

- Divested Businesses: Units with low market share and low growth prospects, often sold to improve financial performance.

- Portfolio Optimization: Arcadis's strategy to shed non-core or underperforming assets.

- Resource Allocation: Freeing up capital and management attention for more strategic investments.

- Historical Examples: Past business lines that no longer align with current market opportunities or company strategy.

The UK and Australian infrastructure markets, experiencing a noticeable slowdown in investment, place Arcadis's segments in these regions into the 'Dog' category of the BCG Matrix. These are markets with low growth where Arcadis's market share is stagnant or declining, necessitating a strategic review. For instance, in 2024, UK infrastructure project pipelines saw retrenchment, with some major projects delayed or scaled back, impacting overall market attractiveness.

Legacy systems and non-optimized processes, prior to Arcadis's digital transformation efforts, also fit the 'Dog' profile. These systems consumed significant operational resources without substantial returns or market share growth. In 2024, many infrastructure companies still struggled with paper-based project management, leading to an estimated 15-20% increase in project delays and cost overruns compared to digitally integrated counterparts.

These inefficiencies directly impacted Arcadis's ability to innovate and compete. The ongoing standardization and automation initiatives are crucial for shedding these underperforming assets and reallocating resources towards more promising ventures, aiming to improve project delivery efficiency by at least 10% annually.

Non-strategic or divested business units, like Arcadis's former Australian and New Zealand consulting business divested in 2023, represent areas with historically low market share and limited growth potential, fitting the 'Dog' category. Divesting such units allows Arcadis to focus on core strengths and high-growth areas, enhancing profitability and strategic focus.

| BCG Category | Market Growth | Arcadis Market Share | Examples | Strategic Implication |

|---|---|---|---|---|

| Dogs | Low | Low / Stagnant | UK & Australia Infrastructure (2024), Legacy Systems, Divested Units | Divest, Harvest, or Turnaround |

Question Marks

Arcadis is actively investing in emerging digital products and platforms, particularly those incorporating AI and data analytics. These initiatives are designed to offer enhanced value and innovative solutions to their clientele. For instance, Arcadis's 2024 strategy emphasizes digital transformation, with a significant portion of their R&D budget allocated to these areas.

These digital ventures are currently positioned as question marks within the Arcadis BCG Matrix. They operate in high-growth technological markets, showing immense potential. However, their current market share and the breadth of their adoption are still in nascent stages, reflecting the early lifecycle of these innovations.

Substantial investment is crucial to nurture these question marks into stars. Arcadis's commitment to this transformation is evident in their planned capital expenditures for 2024-2025, which are earmarked for scaling these digital offerings and driving wider market penetration. This strategic focus aims to solidify their competitive advantage in the digital landscape.

Expansion into new geographical markets for Arcadis would place them in the 'Question Marks' category of the BCG matrix. These are markets where Arcadis might have a relatively small market share but where the market itself is growing rapidly. For example, emerging economies in Southeast Asia or parts of Africa present significant opportunities for infrastructure and environmental consulting services, areas where Arcadis has established expertise.

While Arcadis has a strong presence in established markets like the US and Germany, venturing into these nascent regions necessitates considerable capital outlay and strategic planning to cultivate a meaningful market presence. For instance, Arcadis's 2023 revenue was €4.7 billion, and a portion of this would need to be allocated to market research, establishing local operations, and building brand recognition in these new territories to compete effectively against established local players or other international firms.

Arcadis significantly broadened its sustainability services in 2024, introducing key offerings like Sustainability Advisory for ESG and Net Zero strategies, comprehensive Energy and Life Cycle Analysis, and robust Carbon Accounting. This strategic expansion moves beyond the company's established expertise in green building certifications.

These new, more encompassing sustainability solutions are positioned to capitalize on a rapidly expanding market. For instance, the global ESG consulting market was valued at approximately $1.7 billion in 2023 and is projected to grow substantially, indicating a strong demand for the expertise Arcadis is now offering more broadly.

To effectively capture market share in this dynamic environment, Arcadis will need to make strategic investments in talent, technology, and market outreach for these expanded services. The increasing regulatory focus on climate disclosures and corporate net-zero commitments, as seen in new SEC proposals and EU directives, underscores the urgency and opportunity for such integrated sustainability advisory.

Advanced Industrial Facilities and Reshoring Projects

Arcadis is well-positioned to support the reshoring of advanced industrial facilities, a growing trend fueled by shifting global supply chains. This segment is a prime example of a 'Question Mark' in the BCG matrix for Arcadis. It offers substantial growth prospects, but Arcadis's current market share in this specific niche might be developing, requiring strategic focus and investment to capture leadership.

The reshoring trend is significant, with many companies re-evaluating their manufacturing footprints. For instance, a 2024 report indicated that over 60% of manufacturers were considering or actively pursuing reshoring initiatives to mitigate risks and improve supply chain resilience. This presents a clear opportunity for Arcadis to leverage its expertise in facility design, construction, and project management.

- High Growth Potential: The reshoring of advanced manufacturing, particularly in sectors like semiconductors and electric vehicle battery production, is projected to see double-digit annual growth through 2030.

- Nascent Market Share: While Arcadis has broad capabilities, its established market share specifically within the advanced industrial facility reshoring segment may still be building, necessitating focused business development.

- Strategic Investment: To capitalize on this trend, Arcadis needs to direct resources towards specialized services, talent acquisition, and targeted marketing to establish a dominant presence.

- Competitive Landscape: The sector is attracting attention from various engineering and construction firms, underscoring the need for Arcadis to differentiate its offerings and secure early wins.

Specialized Solutions in Smart Mobility and Intelligent Highways

Arcadis is strategically positioning its intelligent highway solutions and smart mobility services as question marks within the BCG Matrix. These specialized areas are characterized by high growth potential, driven by the burgeoning smart city development sector. For instance, the global smart transportation market was valued at approximately $165.8 billion in 2023 and is projected to reach $435.4 billion by 2030, exhibiting a compound annual growth rate (CAGR) of 14.7%.

Despite this robust market expansion, Arcadis's market share in these niche segments is still in its formative stages, necessitating ongoing investment to capture a significant portion of the opportunity. The integration of engineering expertise with advanced data analytics and cutting-edge technology is key to differentiating Arcadis’s offerings in this competitive landscape. This focus allows them to address complex transportation challenges, from traffic management to sustainable transit integration.

- High Growth Potential: The smart mobility and intelligent highways sector is experiencing rapid expansion, fueled by urbanization and the demand for efficient, sustainable transportation.

- Evolving Market Share: Arcadis is building its presence in these specialized segments, requiring continued investment to establish a stronger competitive position.

- Integration of Technology: The company leverages data, engineering, and technology to create innovative solutions for modern transportation systems.

- Strategic Investment Focus: These areas represent a significant future opportunity, justifying the allocation of resources for growth and market penetration.

Question Marks in Arcadis's BCG Matrix represent business areas with high market growth potential but currently low market share. These ventures require significant investment to grow and potentially become market leaders. Arcadis's strategic focus on emerging digital products, particularly those leveraging AI and data analytics, places them squarely in this category. These initiatives, while promising, are still in their early stages of adoption and market penetration.

Arcadis's expansion into new geographical markets, such as Southeast Asia and Africa, also fits the Question Mark profile. These regions offer substantial growth opportunities for infrastructure and environmental consulting, but Arcadis's market share is still developing. The company's 2023 revenue of €4.7 billion highlights the financial commitment needed to establish a strong presence in these nascent territories.

Furthermore, Arcadis's broadened sustainability services, including ESG and Net Zero strategies, are considered Question Marks. The global ESG consulting market, valued at approximately $1.7 billion in 2023, is rapidly expanding, but Arcadis's share in this enhanced service offering is still being cultivated. Strategic investments in talent and technology are crucial for capturing market share in this dynamic sector.

The reshoring of advanced industrial facilities is another key Question Mark for Arcadis. With over 60% of manufacturers considering reshoring in 2024, the market growth is significant. However, Arcadis's established market share in this specific niche is still building, necessitating focused business development and specialized service offerings.

| Business Area | Market Growth | Market Share | Investment Need | Potential |

| Digital Products (AI/Data) | High | Low | High | Star |

| New Geographical Markets | High | Low | High | Star |

| Expanded Sustainability Services | High | Low | High | Star |

| Advanced Industrial Reshoring | High | Low | High | Star |

BCG Matrix Data Sources

Our BCG Matrix leverages a blend of internal financial data, comprehensive market research reports, and publicly available company disclosures to provide a robust strategic overview.