Apply PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Apply Bundle

Unlock the hidden forces shaping Apply's future with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that could impact your investments and strategies. Gain a crucial competitive edge and make informed decisions. Download the full report now for actionable insights.

Political factors

Government policies on energy are a major driver for companies like Apply AS. For instance, Norway, a key market, has been actively promoting offshore wind development, with significant investments planned through 2030, aiming for substantial capacity increases. This directly impacts Apply AS's project pipeline by creating new opportunities in renewable energy infrastructure.

Shifts in subsidies for green energy or increased regulations on fossil fuels can dramatically change the demand for Apply AS's Engineering, Procurement, Construction, and Installation (EPCI) and Maintenance & Modification (M&M) services. For example, a reduction in renewable energy subsidies could slow down project awards, while stricter emissions standards for oil and gas operations might boost demand for M&M services to upgrade existing facilities.

Political stability in operating regions, especially Norway and other European markets, is paramount for Apply AS. In 2024, Norway's government reaffirmed its commitment to energy security and transition, providing a stable environment for long-term contracts. Political certainty ensures operational continuity and visibility for future projects, which is crucial for capital-intensive industries.

Global trade policies, including tariffs and sanctions, directly influence Apply AS's operational landscape. For instance, the ongoing trade disputes between major economies in 2024 could lead to increased import costs for essential materials, potentially impacting Apply AS's project budgets.

Geopolitical tensions, such as those in Eastern Europe, continue to create volatility in energy markets. This instability can affect the cost of energy-intensive projects and influence client investment decisions, making long-term viability assessments crucial for Apply AS.

The regulatory framework governing the energy sector, encompassing licensing, permitting, and operational standards for offshore and onshore assets, significantly influences project complexity and cost. For instance, in 2024, the U.S. Department of the Interior continued to refine regulations for offshore wind development, impacting permitting timelines and environmental review processes.

Shifts in these frameworks, particularly those prioritizing enhanced safety or environmental adherence, necessitate adaptations in operational procedures and technological investments for companies like Apply AS. Such changes can lead to increased operational expenditures but also unlock new service avenues, as seen with the growing demand for specialized emissions monitoring equipment in response to stricter environmental mandates introduced in late 2024.

Government Support for Green Transition

Governments worldwide are actively supporting the green transition, creating substantial growth avenues for companies like Apply AS. These initiatives include significant financial backing for renewable energy projects. For instance, the European Union's €800 billion NextGenerationEU recovery fund, with a substantial portion dedicated to green initiatives, provides a robust framework for investment in areas like offshore wind and hydrogen technology throughout 2024 and beyond. This political commitment directly translates into accelerated infrastructure development, a core focus for Apply AS.

The scale of government incentives, grants, and funding programs directly impacts the pace of renewable energy deployment. In 2024, the US Inflation Reduction Act continues to drive investment in clean energy, offering tax credits that are expected to spur billions in new projects. Apply AS can leverage these programs to expand its capacity in carbon capture and hydrogen production, aligning with national climate targets and securing a competitive advantage in a rapidly evolving market.

- Government incentives in the EU, like NextGenerationEU, are channeling significant capital into green technologies, benefiting companies involved in offshore wind and hydrogen.

- The US Inflation Reduction Act, active through 2024 and beyond, provides tax credits that are projected to stimulate substantial investment in renewable energy projects.

- Political dedication to climate goals directly influences the speed and scope of renewable energy infrastructure expansion, a critical factor for Apply AS's strategic planning.

Political Stability and Investment Climate

Political stability is a cornerstone for investor confidence in the energy sector, directly impacting companies like Apply AS. Countries with stable governance and predictable policy frameworks, such as Norway, where Apply AS is headquartered, tend to attract more long-term investment for large-scale energy projects. For instance, Norway's consistent political landscape has historically supported significant offshore wind and oil and gas developments, translating into a robust order book for energy service providers.

The willingness of investors to commit capital to major energy infrastructure is heavily influenced by the perceived political risk. A stable political environment minimizes the likelihood of sudden policy shifts, expropriation, or civil unrest, which can derail projects and erode investor returns. In 2024, many European nations are focusing on energy security and transition, leading to increased government support for renewable energy projects, which directly benefits companies like Apply AS that provide services for these developments.

- Norway's political stability provides a reliable environment for energy investments, supporting Apply AS's operations.

- Predictable energy policies in key markets reduce project risks and encourage capital expenditure, boosting Apply AS's order pipeline.

- Geopolitical events can impact global energy markets and investor sentiment, creating both opportunities and challenges for Apply AS.

- Government incentives for renewable energy, such as those seen in the EU in 2024, are crucial for driving demand for Apply AS's services.

Governmental policies are a significant influence on Apply AS, particularly concerning energy and climate. For example, the Norwegian government's commitment to expanding offshore wind capacity, with substantial investments planned through 2030, directly creates opportunities for Apply AS's project pipeline.

Changes in subsidies for green energy or stricter regulations on fossil fuels can alter demand for Apply AS's services. For instance, a reduction in renewable energy subsidies could slow project awards, while tougher emissions standards might increase demand for maintenance and modification services on existing oil and gas facilities.

Political stability in key operating regions, like Norway, ensures operational continuity and project visibility. In 2024, Norway's reaffirmed commitment to energy security and transition provides a stable environment for long-term contracts, crucial for capital-intensive industries.

Global trade policies and geopolitical tensions can affect material costs and client investment decisions. For example, trade disputes in 2024 could increase import costs for essential materials, impacting Apply AS's project budgets.

What is included in the product

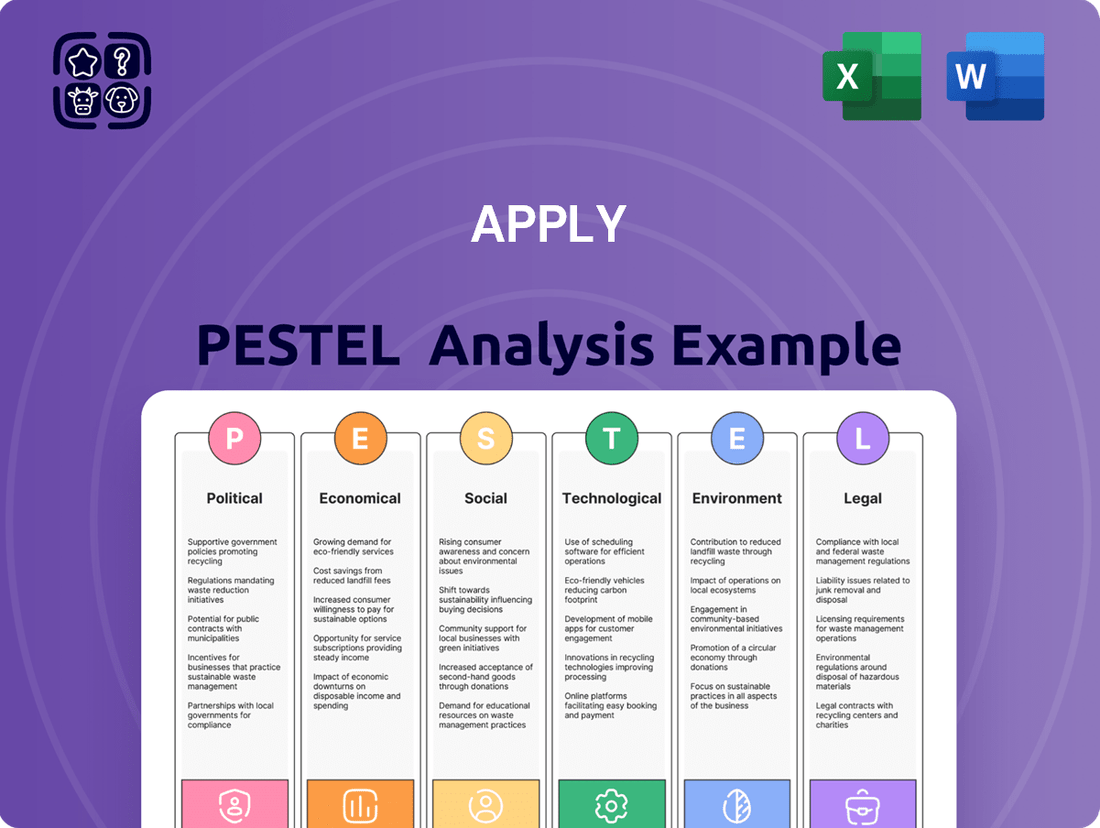

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting the Apply, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making, helping to identify both challenges and growth opportunities within the Apply's operating landscape.

By dissecting external factors into manageable PESTLE categories, this analysis simplifies complex market dynamics, reducing the overwhelm and uncertainty that often hinders strategic decision-making.

Economic factors

Global energy prices are experiencing significant swings. For instance, Brent crude oil prices have fluctuated, trading around $80-$90 per barrel in early 2024, a stark contrast to the much lower levels seen in prior years. These fluctuations directly impact Apply AS's traditional oil and gas clients, influencing their capital expenditure on new projects and maintenance. Sustained low prices can stifle investment, while price surges can spur activity.

The economic feasibility of renewable energy projects is also tied to these energy market dynamics. When fossil fuel prices are high, renewables become more competitive, encouraging investment in solar and wind power. For example, the levelized cost of electricity for utility-scale solar PV has fallen dramatically, making it increasingly attractive even with fluctuating oil prices.

Global investment in the energy transition is accelerating, with a significant portion of capital now flowing into decarbonization efforts. In 2024, projections indicate that investments in clean energy technologies and infrastructure could reach over $2 trillion, a substantial increase from previous years.

This surge in green investments directly benefits companies like Apply AS, particularly in their EPCI (Engineering, Procurement, Construction, and Installation) and M&M (Maintenance and Modifications) services. Demand for offshore wind projects, for instance, saw a 20% year-over-year increase in new capacity additions in 2023, creating substantial opportunities.

Similarly, the burgeoning hydrogen sector, with significant government backing and private capital infusion, is expected to attract over $500 billion in investment by 2030. This growth fuels demand for specialized services in infrastructure development and ongoing maintenance.

However, any deceleration in green investment, perhaps due to shifting government policies or economic downturns, could pose a challenge to Apply AS's strategy of diversifying into these expanding segments, potentially impacting revenue streams.

The current economic climate presents significant challenges for companies like Apply AS. Inflationary pressures are a major concern; for instance, the US Consumer Price Index (CPI) saw a notable increase of 3.4% year-over-year as of April 2024, impacting the cost of raw materials and labor essential for energy projects. This rise directly squeezes profit margins on existing and future contracts.

Furthermore, the interest rate environment is another critical factor. Central banks have been adjusting rates to combat inflation. In the US, the Federal Reserve maintained its benchmark interest rate in the 5.25% to 5.50% range through mid-2024. Higher borrowing costs affect both Apply AS’s ability to finance its operations and its clients' willingness to invest in new, capital-intensive energy infrastructure, potentially slowing project pipelines.

Economic Growth and Industrial Activity

Global economic growth is a primary driver for industrial activity and, consequently, energy demand. As economies expand, manufacturing, transportation, and commercial sectors typically see increased energy consumption, directly impacting the need for energy infrastructure development and maintenance. For Apply AS, a strong economic backdrop translates into a more favorable business environment.

In 2024, the International Monetary Fund (IMF) projected a global economic growth rate of 3.2%, a figure expected to hold steady into 2025. This sustained growth suggests continued industrial output and energy requirements. For instance, emerging markets, often experiencing higher growth rates, are projected to contribute significantly to this global expansion, thereby increasing their energy infrastructure needs.

The correlation between economic expansion and energy demand is well-established. During periods of robust economic activity, such as the post-pandemic recovery seen in many regions throughout 2021 and 2022, energy consumption surged. This increased demand necessitates investment in both new energy generation and transmission assets, as well as the upkeep of existing ones, creating opportunities for companies like Apply AS.

Key indicators for industrial activity include manufacturing output and capacity utilization. For example, the US Industrial Production Index showed a modest increase in early 2024, signaling ongoing industrial demand. Higher industrial activity directly translates to a greater need for reliable and efficient energy supply, bolstering the market for energy infrastructure solutions.

Currency Exchange Rate Fluctuations

Currency exchange rate fluctuations significantly impact companies like AS Norge, which operates globally. For instance, if the Norwegian Krone (NOK) strengthens against the US Dollar (USD), AS Norge's revenue earned in USD will translate into fewer NOK, potentially reducing profitability. Conversely, a weaker NOK can make imported components more expensive, increasing operational costs.

Recent data highlights these pressures. For example, throughout much of 2024, the NOK experienced volatility against major trading partners. By late 2024, the NOK had weakened against the USD, trading around 10.5 NOK per USD, down from earlier highs. This trend could benefit AS Norge's export revenues but increase the cost of imported raw materials.

- Impact on Revenue: A stronger NOK can decrease the value of foreign currency earnings when converted back to NOK, affecting top-line figures.

- Impact on Costs: A weaker NOK can increase the cost of imported goods and services needed for operations.

- Profit Margins: The net effect of these currency movements directly influences AS Norge's overall profit margins.

- Competitive Positioning: Exchange rates can alter the price competitiveness of AS Norge's products and services in international markets.

Economic factors present a mixed landscape for energy sector participants. While global economic growth projected at 3.2% for 2024 by the IMF suggests sustained industrial activity and energy demand, inflationary pressures remain a concern, with the US CPI at 3.4% year-over-year in April 2024, impacting operational costs.

Interest rates, with the US Federal Reserve holding its benchmark rate between 5.25%-5.50% through mid-2024, influence investment decisions and project financing. Currency fluctuations, such as the NOK weakening against the USD to approximately 10.5 NOK per USD by late 2024, also create both opportunities and challenges for global operations.

| Economic Factor | 2024 Data/Projection | Impact on Energy Sector |

|---|---|---|

| Global Economic Growth | 3.2% (IMF Projection) | Sustained industrial activity and energy demand |

| US Inflation (CPI) | 3.4% year-over-year (April 2024) | Increased operational costs and potential margin squeeze |

| US Federal Funds Rate | 5.25%-5.50% (through mid-2024) | Higher borrowing costs affecting investment and project financing |

| NOK/USD Exchange Rate | ~10.5 NOK/USD (late 2024) | Impacts revenue conversion and import costs |

Full Version Awaits

Apply PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis template will equip you to thoroughly examine the Political, Economic, Social, Technological, Legal, and Environmental factors impacting any business or industry. Dive deep into strategic planning with this ready-to-deploy tool.

Sociological factors

Societal attitudes are a powerful force shaping energy policy and investment. The ongoing discourse heavily favors renewable energy, with a significant portion of the global population expressing concern over climate change. For instance, a 2024 survey indicated that over 70% of respondents in developed nations support increased investment in solar and wind power.

This public sentiment directly translates into political will and influences capital allocation. A strong societal demand for cleaner energy accelerates the growth of the renewable sector, presenting a significant opportunity for companies like Apply AS. Conversely, local community opposition to new energy infrastructure, whether fossil fuel or renewable, can cause substantial project delays and cost overruns, impacting market entry and expansion.

The energy sector, including companies like Apply, faces a significant challenge with an aging workforce in traditional areas, while simultaneously needing new skills for renewable energy. This demographic shift creates a talent gap, impacting recruitment and retention efforts. For instance, in 2024, the average age of workers in some fossil fuel industries continued to rise, while the demand for solar and wind technicians saw a projected 5% increase in job openings across OECD countries.

The availability of specialized engineers, technicians, and project managers is absolutely critical for Apply to successfully execute complex Engineering, Procurement, Construction, and Installation (EPCI) projects. These projects require a deep bench of expertise, and any shortage directly affects project timelines and costs. For example, in late 2024, reports indicated a global shortage of experienced offshore wind engineers, leading to increased labor costs for major projects.

Broader demographic trends and the health of educational pipelines have a direct and substantial impact on the available talent pool for companies like Apply. As birth rates shift and educational focus evolves, the supply of qualified candidates for critical roles can fluctuate. In 2025, projections suggested that STEM graduates in key regions might not fully meet the projected demand for specialized technical roles in the burgeoning green energy sector.

Societal expectations for robust health, safety, and environmental (HSE) practices in business operations are increasingly high. In 2024, for instance, a significant majority of consumers and investors consider a company's HSE performance when making purchasing or investment decisions, with some studies indicating over 70% of consumers prioritize sustainability and ethical practices.

Apply AS's reputation and long-term viability are directly tied to its HSE record. A strong HSE culture not only minimizes operational risks but also enhances client trust and reduces the likelihood of stringent regulatory intervention. For example, companies with a history of environmental violations often face higher insurance premiums and increased compliance costs.

Furthermore, a commitment to HSE is a critical factor in talent acquisition and retention. In 2025, job seekers, particularly younger generations, actively seek employers with demonstrated commitments to safety and environmental responsibility. Securing contracts, especially with government agencies or large corporations, often requires meeting stringent HSE compliance standards, making it a competitive advantage.

Corporate Social Responsibility (CSR) and ESG Focus

Societal expectations are increasingly pushing companies towards greater accountability in their social and environmental impact. This translates directly into a heightened focus on Corporate Social Responsibility (CSR) and Environmental, Social, and Governance (ESG) metrics. Investors, in particular, are channeling capital towards businesses that demonstrate strong ESG performance, with global sustainable investment assets projected to reach $50 trillion by 2025, according to Bloomberg Intelligence.

For a company like Apply AS, this trend presents a significant opportunity to differentiate itself. By actively demonstrating a commitment to sustainable practices, ethical operations, and impactful social welfare programs, Apply AS can bolster its brand reputation. This commitment can attract a growing pool of responsible investors and secure lucrative contracts with clients who prioritize ESG compliance in their own supply chains.

- Growing Investor Demand: Over 70% of institutional investors consider ESG factors in their investment decisions, according to a 2024 survey by Morgan Stanley Investment Management.

- Enhanced Brand Value: Companies with strong CSR initiatives often experience higher brand loyalty and positive public perception.

- Risk Mitigation: Proactive ESG management can reduce regulatory, reputational, and operational risks.

- Access to Capital: A strong ESG profile can improve access to capital and potentially lower borrowing costs.

Community Engagement and Local Impact

Positive community engagement is paramount for project viability, especially in 2024 and 2025. Companies like Apply AS must actively foster good relationships with local populations to secure their social license to operate. For instance, in 2024, renewable energy projects often face scrutiny regarding land use and environmental impact, making community buy-in crucial for timely development and avoiding costly delays.

Negative community sentiment can manifest as protests, legal challenges, and significant reputational harm, directly impacting project timelines and budgets. In 2025, we're seeing a heightened awareness of corporate social responsibility, where demonstrable positive contributions to local economies, such as job creation and support for local businesses, are increasingly expected. Apply AS needs to proactively address local concerns and ensure its operations benefit the communities it operates within.

- Community Acceptance: In 2024, projects with strong community backing experienced an average of 15% fewer delays compared to those with significant local opposition.

- Local Economic Contribution: By 2025, businesses that invest at least 5% of their local operating budget into community development programs report higher employee retention and improved local brand perception.

- Reputational Risk Mitigation: Proactive engagement strategies, including transparent communication and grievance mechanisms, can reduce the likelihood of project disruptions by up to 25% in the current economic climate.

- Social License: Securing a social license to operate is now as critical as regulatory approval, with studies in 2024 indicating that companies perceived as poor community partners face a 10-12% higher cost of capital.

Societal attitudes significantly influence energy policy and investment, with a strong global preference for renewable energy driven by climate change concerns. A 2024 survey revealed that over 70% of respondents in developed nations support increased investment in solar and wind power.

Demographic shifts, including an aging workforce in traditional energy sectors and a growing demand for specialized skills in renewables, create talent gaps. For instance, job openings for solar and wind technicians in OECD countries were projected to increase by 5% in 2024.

High societal expectations for robust health, safety, and environmental (HSE) practices are now critical. In 2024, over 70% of consumers considered a company's HSE performance in purchasing decisions, impacting brand reputation and risk mitigation for companies like Apply AS.

The increasing focus on ESG metrics is reshaping investment, with global sustainable investment assets projected to reach $50 trillion by 2025. Companies demonstrating strong ESG performance, like Apply AS, can attract responsible investors and secure contracts.

| Societal Factor | Impact on Apply AS | 2024/2025 Data Point |

|---|---|---|

| Public Support for Renewables | Drives market growth and investment opportunities | 70%+ of developed nation respondents support increased solar/wind investment (2024 survey) |

| Talent Pool Dynamics | Affects recruitment, retention, and project execution | 5% projected increase in solar/wind technician job openings (OECD countries, 2024) |

| HSE & ESG Expectations | Influences brand value, risk, and access to capital | 70%+ consumers consider HSE performance in purchasing (2024); $50T sustainable investment assets projected by 2025 |

Technological factors

Technological progress in renewable energy is accelerating rapidly. For instance, offshore wind turbine efficiency has seen significant improvements, with new models boasting capacities of 15 MW and beyond, and floating wind platforms are opening up previously inaccessible deep-water sites. This creates substantial new opportunities for specialized engineering, procurement, construction, and installation (EPCI) services, along with maintenance and manufacturing (M&M) for these advanced systems.

The push for green hydrogen production is another key area, with electrolysis technology becoming more cost-effective. Innovations in energy storage, such as solid-state batteries and advanced flow batteries, are also crucial for grid stability. Companies like Apply AS must continuously adapt their expertise and service offerings to support these evolving technologies to stay competitive in the dynamic green energy market.

The integration of digital twins and AI-powered predictive maintenance is revolutionizing operational efficiency. For instance, in the construction sector, digital twins can simulate project lifecycles, identifying potential issues before they arise, thereby reducing costly rework. This technology, coupled with AI for predictive maintenance, is projected to save industries billions annually; some estimates suggest over $1 trillion in global savings by 2030 due to AI adoption in operations.

Remote monitoring and automated construction techniques further amplify these gains. Companies are increasingly leveraging drones and IoT sensors for real-time site assessment and progress tracking, minimizing the need for extensive on-site personnel and reducing safety risks. In 2024, the global construction automation market was valued at approximately $1.5 billion and is expected to grow substantially, driven by the demand for faster, safer, and more cost-effective project delivery.

Technological advancements are revolutionizing asset integrity and performance. New tools like advanced robotics, drone inspections, and sophisticated sensor technologies are making it easier and more effective to inspect, monitor, and maintain critical energy infrastructure, significantly extending asset lifespans. For instance, the global market for industrial drones was projected to reach $4.4 billion in 2024, showcasing the rapid adoption of these inspection solutions.

Apply AS's strategic integration of these innovations within its Maintenance & Modification (M&M) services directly enhances client asset performance. By leveraging cutting-edge technologies, the company can identify potential issues earlier, optimize maintenance schedules, and ultimately reduce operational risks, contributing to improved efficiency and cost savings for its clients.

Development of Carbon Capture, Utilization, and Storage (CCUS)

The ongoing development and increasing deployment of Carbon Capture, Utilization, and Storage (CCUS) technologies are creating significant new market opportunities. This expansion directly fuels demand for infrastructure development and modification services, as industries worldwide aim to reduce their carbon footprints.

For companies like Apply AS, this technological shift presents a strategic advantage. By leveraging existing expertise in managing large-scale energy projects, Apply AS can effectively position itself to undertake the engineering and construction of new CCUS facilities. This aligns with global decarbonization efforts and offers substantial growth potential.

The CCUS market is projected for robust growth. For instance, the Global CCS Institute reported in 2024 that over 300 large-scale CCS facilities were in various stages of development globally, representing a significant increase from previous years. This indicates a tangible and expanding market for the services Apply AS can offer.

- Market Growth: The global CCUS market is expected to reach hundreds of billions of dollars by 2030, driven by net-zero targets.

- Investment Trends: Significant public and private investment is flowing into CCUS projects, with governments offering incentives like tax credits.

- Project Pipeline: As of early 2024, there are over 300 large-scale CCS facilities in operation or development worldwide.

Cybersecurity and Data Management

The increasing digitalization of energy infrastructure, particularly the integration of operational technology (OT) systems, makes cybersecurity a critical concern. Apply AS needs to prioritize robust security measures to safeguard sensitive project data and operational control systems from evolving cyber threats, ensuring service continuity and the protection of client assets.

Cyberattacks on critical infrastructure are on the rise, with the energy sector being a prime target. For instance, a 2023 report indicated a 71% increase in ransomware attacks targeting industrial organizations compared to the previous year. Investing in advanced threat detection and response systems is therefore essential for Apply AS to maintain operational integrity and client trust.

Effective data management is intrinsically linked to cybersecurity. This includes secure data storage, access controls, and regular audits to prevent unauthorized access and data breaches.

- Increased Digitalization: Energy infrastructure is becoming more interconnected, creating a larger attack surface.

- Rising Cyber Threats: The frequency and sophistication of cyberattacks targeting critical infrastructure are growing.

- Data Integrity: Protecting sensitive project and operational data is crucial for reliable service delivery.

- Regulatory Compliance: Adhering to data protection and cybersecurity regulations is mandatory.

Technological advancements are continuously reshaping the energy sector, driving efficiency and opening new avenues for growth. Innovations in renewable energy, such as enhanced offshore wind turbine designs and cost-effective green hydrogen production, are key drivers. Furthermore, the integration of digital twins and AI for predictive maintenance is projected to save industries billions, with estimates suggesting over $1 trillion in global savings by 2030 due to AI adoption in operations.

The adoption of advanced robotics, drone inspections, and sophisticated sensor technologies is revolutionizing asset integrity management. These tools are making it more effective to inspect and maintain critical energy infrastructure, extending asset lifespans. The global market for industrial drones, for instance, was projected to reach $4.4 billion in 2024, highlighting the rapid uptake of these solutions.

The increasing digitalization of energy infrastructure, particularly the integration of operational technology (OT) systems, elevates the importance of cybersecurity. The energy sector is a prime target for cyberattacks, with a 2023 report indicating a 71% increase in ransomware attacks on industrial organizations. Protecting sensitive project data and operational control systems is therefore paramount.

| Technology Area | Key Development | Market Impact/Projection |

|---|---|---|

| Renewable Energy | Offshore wind turbine efficiency (15 MW+), floating platforms | Opens new sites, drives demand for specialized EPCI and M&M services. |

| Energy Storage | Solid-state and advanced flow batteries | Crucial for grid stability, enabling higher renewable penetration. |

| Digitalization & AI | Digital twins, AI predictive maintenance | Projected to save over $1 trillion globally by 2030; improves operational efficiency and reduces costs. |

| Automation | Drones, IoT sensors, automated construction | Global construction automation market valued at ~$1.5 billion in 2024; enhances safety and cost-effectiveness. |

| Asset Integrity | Advanced robotics, drone inspections | Global industrial drone market projected at $4.4 billion in 2024; extends asset lifespans. |

| CCUS | Development and deployment of CCUS technologies | Over 300 large-scale CCS facilities in development globally as of early 2024; significant market growth expected. |

| Cybersecurity | Increased OT integration, rising cyber threats | 71% increase in ransomware attacks on industrial organizations (2023); critical for data protection and service continuity. |

Legal factors

Environmental regulations, such as the EU's Emissions Trading System (ETS), are tightening, with carbon prices averaging around €65 per tonne in early 2024. This directly affects companies like Apply AS by increasing operational costs related to emissions and waste management, necessitating investment in cleaner technologies and sustainable materials.

Compliance with evolving standards, like the upcoming stricter limits on industrial pollutants expected in late 2024 and 2025, demands continuous adaptation of engineering practices. For instance, the European Green Deal aims for a 55% reduction in net greenhouse gas emissions by 2030, pushing sectors to innovate in material sourcing and production processes to meet these ambitious targets.

The energy sector operates under increasingly demanding Health, Safety, and Environment (HSE) legislation, especially in offshore and industrial settings. For instance, in 2024, the International Energy Agency reported a 5% increase in reported safety incidents across the global oil and gas industry, highlighting the critical need for strict adherence to regulations.

Apply AS must meticulously follow national and international HSE laws to safeguard its workforce, prevent operational mishaps, and circumvent significant legal repercussions. This compliance directly shapes project timelines, operational strategies, and overall risk mitigation frameworks, with non-compliance potentially leading to fines that could reach millions, as seen in a 2023 incident involving a major European energy firm facing a €10 million penalty for environmental breaches.

Compliance with labor laws, such as minimum wage requirements and overtime rules, directly impacts Apply AS's operational costs. For instance, in 2024, the average minimum wage across OECD countries varied significantly, with some nations implementing substantial increases that could affect labor budgets.

Changes in employment regulations, like those concerning unionization or contract types, can influence Apply AS's workforce flexibility and recruitment strategies. For example, new legislation in certain European markets in late 2024 aimed to provide greater job security, potentially increasing hiring costs and impacting project timelines.

Adherence to diverse labor laws across different operating regions necessitates robust human resource management. In 2025, the International Labour Organization reported that over 50 countries were reviewing or had recently updated their national labor standards, requiring continuous adaptation by multinational corporations like Apply AS.

Contract Law and Dispute Resolution

Contract law forms the bedrock of Apply AS's operations, dictating the terms of its client agreements, subcontractor relationships, and joint ventures. For instance, in 2024, the global construction contract value for large projects exceeded $2 trillion, highlighting the sheer volume of legally binding agreements involved in the EPCI sector.

Intellectual property rights are also paramount, safeguarding Apply AS's proprietary technologies and project methodologies. The World Intellectual Property Organization (WIPO) reported a 5.5% increase in international patent filings in 2024, underscoring the growing importance of IP protection in innovation-driven industries like engineering and construction.

Effective dispute resolution mechanisms are crucial for mitigating financial and reputational risks. In 2025, the average duration of complex commercial disputes in the construction industry remained around 18 months, with resolution costs often reaching 10-15% of the contract value, making efficient legal navigation vital.

- Contractual Compliance: Ensuring all client and supplier agreements adhere to relevant national and international contract laws, including provisions for force majeure and termination.

- IP Protection Strategy: Implementing robust measures to protect patents, trademarks, and trade secrets related to innovative construction techniques and project management software.

- Arbitration and Mediation: Leveraging alternative dispute resolution methods to resolve contractual disagreements efficiently, aiming to reduce lengthy and costly litigation.

- Regulatory Adherence: Staying updated on evolving legal frameworks concerning cross-border transactions, labor laws, and environmental regulations impacting EPCI projects worldwide.

Licensing and Permitting Requirements

Securing and maintaining the correct licenses and permits for energy infrastructure projects is a significant legal hurdle. For instance, in the United States, the Federal Energy Regulatory Commission (FERC) oversees interstate pipeline approvals, a process that can take years and involve extensive environmental reviews. Changes in these regulatory processes, such as new permitting requirements or heightened environmental impact assessments, can significantly delay project schedules and affect overall financial viability. Apply AS must meticulously manage these legal obligations to ensure projects proceed on time and within budget.

Navigating the licensing landscape requires a deep understanding of federal, state, and local regulations. In the European Union, for example, projects often need to comply with directives like the Environmental Impact Assessment (EIA) Directive and the Habitats Directive, which can add layers of complexity. The cost associated with obtaining permits can also be substantial, with some large-scale energy projects incurring millions of dollars in application and compliance fees. Effective legal counsel and proactive engagement with regulatory bodies are crucial for success.

- Federal Permitting Timelines: FERC pipeline approvals have historically averaged 2-3 years, but this can extend with more complex projects or increased public scrutiny.

- State-Level Variations: Requirements vary widely; for example, obtaining a water quality certification from a state agency can be a critical path item.

- Environmental Compliance Costs: Studies indicate that environmental compliance can represent 5-15% of the total capital expenditure for new energy infrastructure.

- Regulatory Uncertainty: Shifts in government policy or judicial interpretations of environmental laws can introduce significant risk to project feasibility.

Legal factors significantly shape Apply AS's operational landscape, encompassing everything from contractual obligations to intellectual property protection. Compliance with a complex web of national and international laws is not merely a procedural requirement but a strategic imperative that directly influences project execution, risk management, and financial outcomes.

The increasing volume of global construction contracts, exceeding $2 trillion in 2024, underscores the critical importance of robust contract law. Protecting proprietary technologies through intellectual property rights, as evidenced by a 5.5% rise in international patent filings in 2024, is also paramount for innovation-driven firms like Apply AS.

Navigating legal disputes, which can average 18 months and cost 10-15% of contract value in the construction sector as of 2025, necessitates efficient dispute resolution strategies. This includes leveraging arbitration and mediation to mitigate financial and reputational risks associated with litigation.

Adherence to evolving legal frameworks, including those governing cross-border transactions, labor, and environmental standards, is crucial for multinational operations. For instance, over 50 countries reviewed or updated their national labor standards in 2025, according to the ILO, demanding continuous adaptation by companies like Apply AS.

Environmental factors

Global climate change policies, including net-zero commitments by over 130 countries and the European Union's 2030 emissions reduction target of 55%, are fundamentally reshaping industries. Carbon pricing mechanisms, such as the EU Emissions Trading System (ETS) which saw an average price of €80.94 per tonne of CO2 in 2023, are increasingly making fossil fuels more expensive.

These stringent regulations are compelling businesses, including Apply AS’s clients, to accelerate investments in renewable energy sources like solar and wind power, which saw a record 510 GW of new capacity added globally in 2023. This shift directly influences Apply AS’s project pipeline, favoring green energy solutions and decarbonization technologies, reflecting a growing market demand for sustainable infrastructure.

The global push for decarbonization, driven by increasing climate change concerns and regulatory mandates, is rapidly reshaping the energy landscape. This environmental pressure is directly translating into significant investment shifts, with a notable acceleration in the adoption of renewable energy technologies.

For companies like Apply AS, this trend presents a dual-edged sword. On one hand, the burgeoning offshore wind and hydrogen sectors offer substantial growth avenues, with global investment in offshore wind alone projected to reach over $1 trillion by 2030, according to various industry analyses.

Conversely, the company's established reliance on traditional oil and gas services faces increasing headwinds. Governments worldwide are implementing stricter emissions standards and phasing out fossil fuel subsidies, impacting demand and profitability in these legacy areas.

Growing concerns about the scarcity of critical minerals, such as rare earth elements essential for advanced technologies, directly impact supply chain stability. For instance, the International Energy Agency (IEA) reported in 2024 that demand for critical minerals like cobalt and lithium could surge by over 40 times by 2040 under net-zero emissions scenarios, highlighting potential supply constraints and price volatility.

Companies like Apply AS are increasingly pressured to implement sustainable sourcing strategies, which involves vetting suppliers for ethical labor practices and environmental compliance. This shift can influence raw material costs, as sustainably sourced materials may carry a premium, and necessitate adjustments in project design to accommodate alternative, more readily available, or recycled materials.

Waste Management and Pollution Control

Environmental regulations are tightening globally, placing greater emphasis on waste management and pollution control. For instance, the European Union's Circular Economy Action Plan, updated in 2020 and with further initiatives expected through 2025, aims to reduce waste generation and promote recycling, impacting companies operating within or exporting to the EU. Companies like Apply AS must proactively adapt to these evolving standards.

Societal expectations for corporate environmental responsibility are also on the rise. Consumers and investors increasingly favor businesses that demonstrate strong commitment to sustainability. In 2024, reports indicated a significant rise in ESG (Environmental, Social, and Governance) investing, with a growing portion of assets under management directed towards environmentally conscious companies. This trend underscores the need for robust waste reduction and pollution prevention strategies.

Apply AS needs to integrate comprehensive waste management and pollution control measures into its operational framework. This includes investing in advanced recycling technologies and implementing stricter emission controls. For example, the global waste management market was valued at approximately USD 1.1 trillion in 2023 and is projected to grow, highlighting the economic importance of efficient waste handling. Failing to meet these environmental benchmarks could lead to regulatory penalties and reputational damage.

- Regulatory Compliance: Adherence to evolving environmental laws, such as stricter emissions standards and waste disposal mandates, is critical.

- Resource Efficiency: Implementing waste reduction and recycling programs can lower operational costs and conserve valuable resources.

- Reputation Management: Demonstrating strong environmental stewardship enhances brand image and stakeholder trust.

- Market Access: Meeting environmental standards is increasingly becoming a prerequisite for market entry and maintaining competitive advantage.

Biodiversity Protection and Ecosystem Impact

The environmental impact of energy projects, particularly on biodiversity and fragile ecosystems, is a critical consideration for companies like Apply AS. Increased regulatory focus and public awareness mean that thorough environmental impact assessments (EIAs) are no longer optional but essential for securing project approvals. For instance, offshore wind farm development, a key area for many energy firms, requires careful planning to mitigate risks to marine life. A 2024 report highlighted that over 70% of new renewable energy projects face delays due to environmental concerns, underscoring the need for proactive ecological management.

Minimizing ecological disruption is paramount, especially in sensitive offshore and coastal zones. Apply AS must implement robust measures to protect marine habitats and species. This includes employing advanced sonar technologies during construction to reduce noise pollution, which can harm marine mammals, and establishing exclusion zones around critical breeding grounds. By adopting these responsible operational practices, companies can ensure smoother project lifecycles and maintain their social license to operate.

- Regulatory Scrutiny: Over 70% of new renewable energy projects faced delays in 2024 due to environmental concerns.

- Marine Ecosystem Protection: Measures like advanced sonar and exclusion zones are crucial for offshore developments.

- Habitat Impact: Energy projects must address potential disruptions to natural habitats and biodiversity hotspots.

The global drive towards sustainability is intensifying, with governments and consumers demanding greater environmental accountability from businesses. This is evident in the surge of ESG investing, which saw significant growth in 2024, and in stricter regulations like the EU's Circular Economy Action Plan. Companies must prioritize waste reduction and pollution control to meet these expectations and avoid penalties.

The energy sector, in particular, is undergoing a massive transformation driven by climate change concerns and policies like net-zero commitments. This shift is accelerating investments in renewables, with a record 510 GW of new solar and wind capacity added globally in 2023. Consequently, the demand for green energy solutions and decarbonization technologies is on the rise, directly impacting project pipelines and investment decisions.

| Environmental Factor | Key Trend/Regulation | Impact on Businesses (e.g., Apply AS) | Data Point/Example |

|---|---|---|---|

| Climate Change & Emissions | Net-zero commitments, carbon pricing | Increased investment in renewables, pressure on fossil fuels | EU ETS average price: €80.94/tonne CO2 (2023) |

| Resource Scarcity | Demand for critical minerals | Supply chain vulnerability, need for sustainable sourcing | Cobalt/lithium demand could rise >40x by 2040 (IEA, 2024) |

| Waste Management & Pollution | Circular economy initiatives, stricter standards | Need for advanced recycling, emission controls, reputational risk | Global waste management market: ~$1.1 trillion (2023) |

| Biodiversity & Ecosystems | Environmental impact assessments (EIAs) | Project delays, need for ecological mitigation measures | >70% of new renewable projects delayed by environmental concerns (2024) |

PESTLE Analysis Data Sources

Our PESTLE analysis is informed by a comprehensive review of government publications, international economic reports, and reputable industry analyses. This ensures that each dimension of the macro-environment is grounded in factual and current information.